Top 3 Growth Stocks to Watch for 2024💎

Top growth investment picks for 2024 🧠

Hi investor!👋

In this article, we will provide 3 growth business ideas for you.

Build a high-quality stock portfolio of compounders in 2024💎

A growth company is a business that is expected to (and has the track record of) beat the market average for revenue and earnings.

The S&P 500 is expected to continue its long-term growth trajectory of ~10% annual earnings growth.

This means that the companies in this article are expected to grow faster than 10% annually for revenue and earnings.

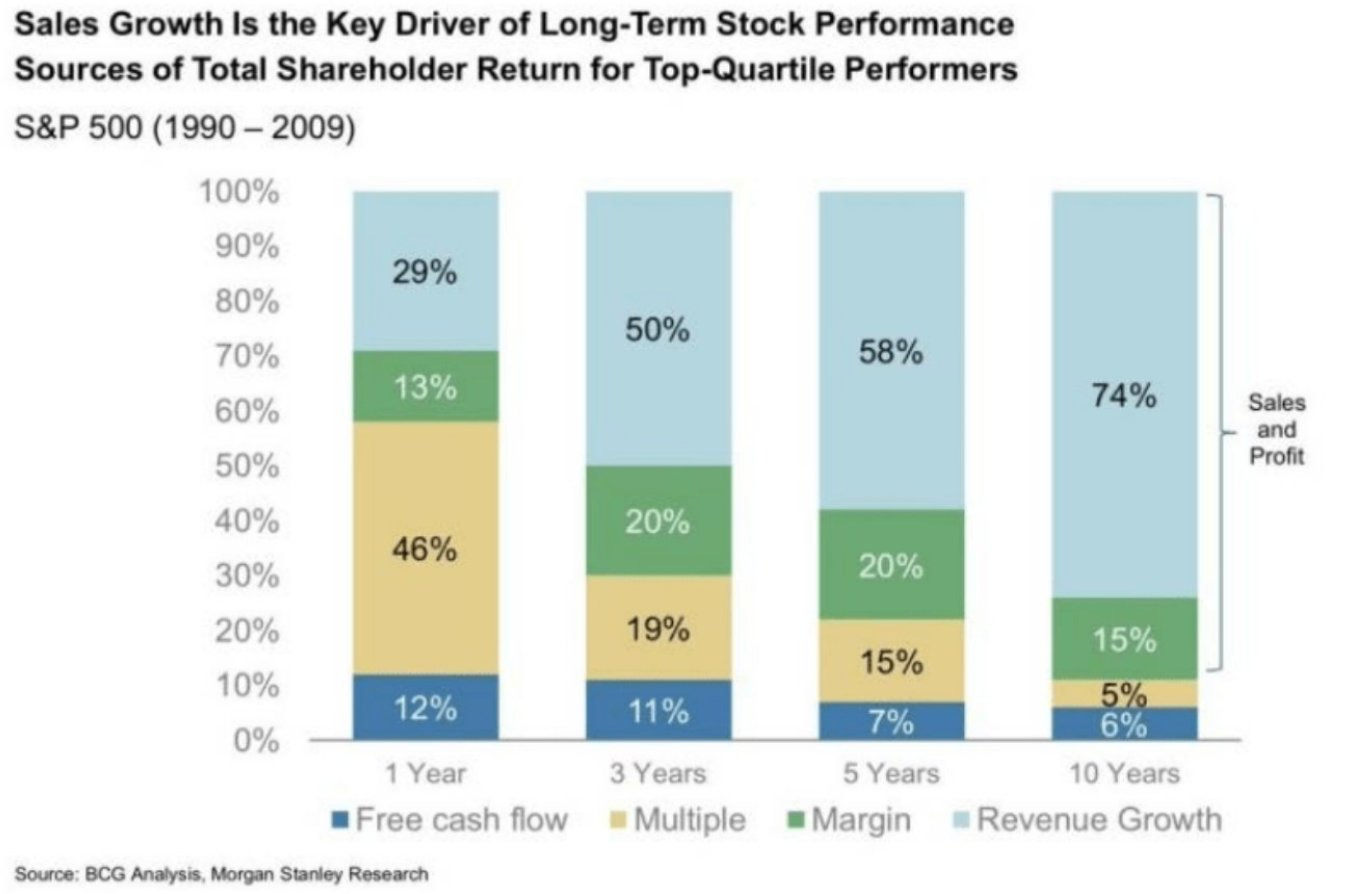

Revenue growth is the single most important factor for long-term shareholder returns:

Let’s get into it 👇🏻

Kinsale Capital KNSL 0.00%↑ 💰

Kinsale Capital is an E&S insurance company that is growing rapidly in a niche segment of the insurance market. Their combined ratio is unmatched in the market and their data solutions and experienced management make this an interesting investment case.

Revenue forward 2 years: 23.27%

Long-term EPS growth: +15%

Unmatched combined ratio with emphasis on the expense ratio:

Significant per-share growth & ROE expansion

Revenue per share +32.46% (10Y CAGR)

EPS diluted +36.21%

FCFPS +23.53%

ROE 16.2% → 33.6%

Fundamentals Overview

Kinsale Capital is consolidating a fragmented market and has about 2% market share. This has been a major growth lever for the business in the past growing revenues by 40.38% over the last 5 years, and EPS by 50.31% in the same period.

The business has low debt levels and an interest cover of 51.56x, indicating that Kinsale with not have issues handling its obligations.

Kinsale stock is trading at a 0.99 PEG (Price-to-growth ratio), which indicates that the expected growth rate is higher than the current PE ratio.

Forward Price-to-earnings ratio

Kinsale is trading at 25.33x NTM earnings, this is below its 10-year median of 29.7x and well below its 2021 high of 70x.

Read our full analysis of Kinsale Capital here:

Dino Polska DNP 0.00%↑ 🛒

Dino Polska is an extraordinary investment case in Poland. The company operates retail stores with an emphasis on fresh foods. Their business model revolves around creating standardized stores that make their operations easy to execute with the same playbook for each store. The business has grown rapidly and expanded all over Poland. Poland is also one of the most interesting economies to invest in as its GDP is growing rapidly.

Revenue forward 2 years +17.54%

EPS long-term growth +22.27%

Key Performance Indicators

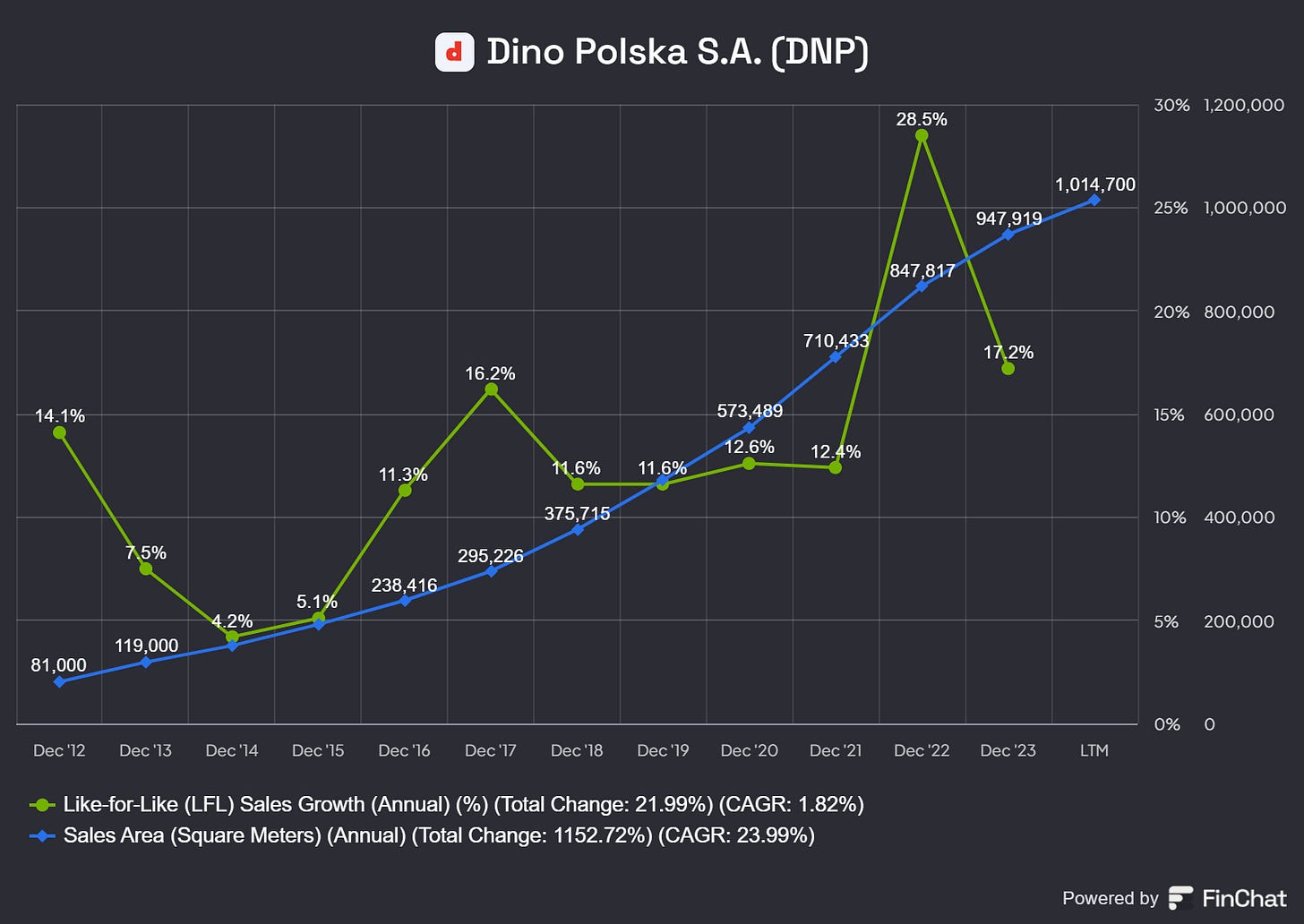

Total sales area measured in square meters has compounded by 23.99% annually since 2012.

In addition, LFL sales have increased over time, from a low of 4.2% to a high of 28.5%. The recent dip in LFL reflects increased competition in Poland and has some investors concerned about the future growth and profitability of Dino Polska.

Per-share compounding

Revenue per share +31.02%

EPS diluted +38.14%

Operating cash flow per share +27.12%

ROIC 13.9% → 19.7%

Note: We use OCF per share instead of FCF per share for Dino Polska because they invest in new stores through their Capex budget, leaving little free cash flow. This can be considered “growth capex”.

Forward Price-to-Earnings ratio

Dino trades at 19.65x NTM earnings, this is well below its median of 27.19x.

Read our full analysis of Dino Polska here:

Novo Nordisk NVO 0.00%↑ 💊

Novo Nordisk is a Danish pharmaceutical company with important medicines and treatments for obesity and diabetes. Both of these human problems are unfortunately expanding. This creates a growing demand for Novo Nordisk’s products and has supported fantastic growth over the last 5 years.

Revenue forward 2 years +21.88%

EPS long-term growth +20.66%

Per share compounding (10Y)

Revenue per share +13.78%

EPS diluted +15.67%

FCFPS +13.89%

Note: Novo Nordisk's growth was mediocre up until 2020, from that point the growth has been significant, much thanks to their new and revolutionizing obesity treatment, Ozempic.

Key Performance Indicators

The diabetes and obesity segment has significantly increased since 2020 with massive YoY growth rates for the obesity segment.

Obesity was 5.5% of the total revenue in 2020, in the last twelve months obesity represented 25% of the total revenue.

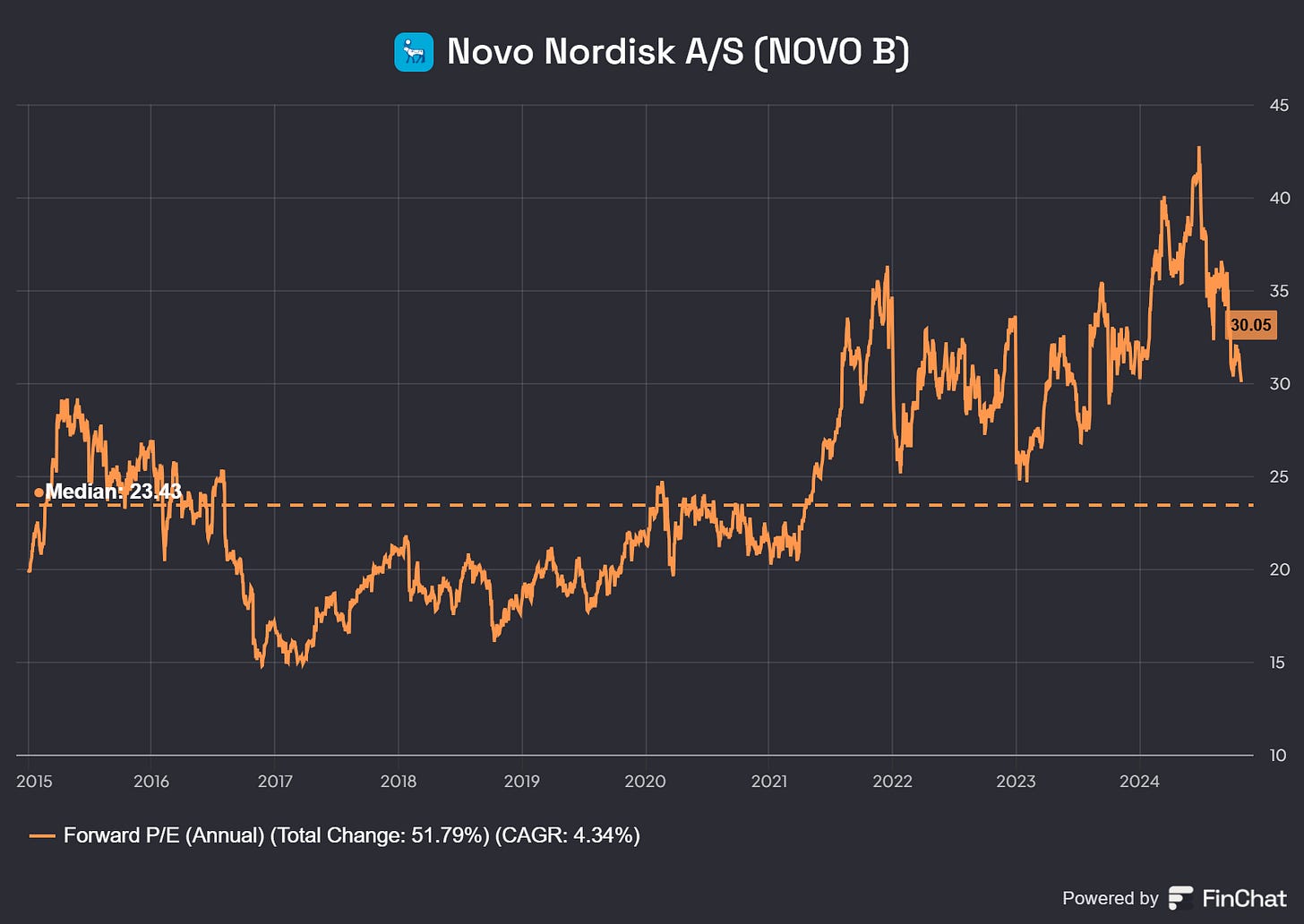

Forward Price-to-Earnings ratio

Novo Nordisk is trading at 30.05x NTM earnings. The median is at 23.43x.

However, this does not provide a clear picture in our opinion. Novo Nordisk is a far better business with incredible growth opportunities in its two main segments. This deserves a higher premium than their pre-2020 growth profile.

Read our analysis of Novo Nordisk here:

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +14.000 stock market investors (42% open rate) — Contact us via: investinassets20@gmail.com

All quality compounders. I did a deep dive on Dino not so long ago but haven’t followed as much recently. Distracted by the likes of $SOFI $HIMS $PLTR.

Incredible long term hold though I think.

Anyway it’s very difficult to rely too much on PEG in this moment. The worldwide scenario is unstable and the projections could be fallacious