Why Investors Are Eyeing This Fast Growing Quality Business 🧠

Growing profitably at a high rate with fantastic fundamentals

Hi friend👋

In case you missed it:

If you are enjoying the articles we produce, subscribe so you don’t miss out:

Finchat is sponsoring this article.

Finchat is easily my favorite investing tool.

The ease of visualizing data + accuracy of KPI numbers is unmatched

Kinsale Capital: Extraordinary fundamentals

Kinsale Capital is one of the fastest-growing quality companies in the world.

The stock has compounded by 48% (!) since its inception in 2016.

Let’s take a closer look at this fast-growing niche insurance business.

Business Model

Kinsale Capital Group was founded in 2009. It specializes in excess and surplus lines insurance, also known as E&S, a sub-market in the insurance industry.

The company underwrites risks that standard carriers find difficult to insure. Insurance that is easy to insure can be viewed as a commodity (cars, houses, travel insurance). What Kinsale insures is much harder to calculate a risk/reward for. This naturally creates higher barriers to entry than for the insurance business as a whole.

Value proposition: Kinsale offers customized insurance solutions to underserved markets, providing tailored policies that cater to unique risks.

Examples of E&S insurance: Data breaches, cyber security risk, insuring body parts (Think Tom Brady’s throwing arm), art collections, and historical artifacts.

These are hard to analyze with limited data.

Kinsale targets small to medium-sized businesses with unique or hard-to-place risks. The company’s diverse portfolio includes construction, manufacturing, and professional services.

The E&S insurance market

Kinsale operates in the attractive, yet competitive, specialty insurance market. The growing complexity of risks and increasing regulatory requirements make this sector vital.

E&S represents a specialized insurance market that fills the gaps where standard carriers hesitate. Kinsale addresses challenging and often high-risk cases from mobile homes to multinational oil companies and everything in between.

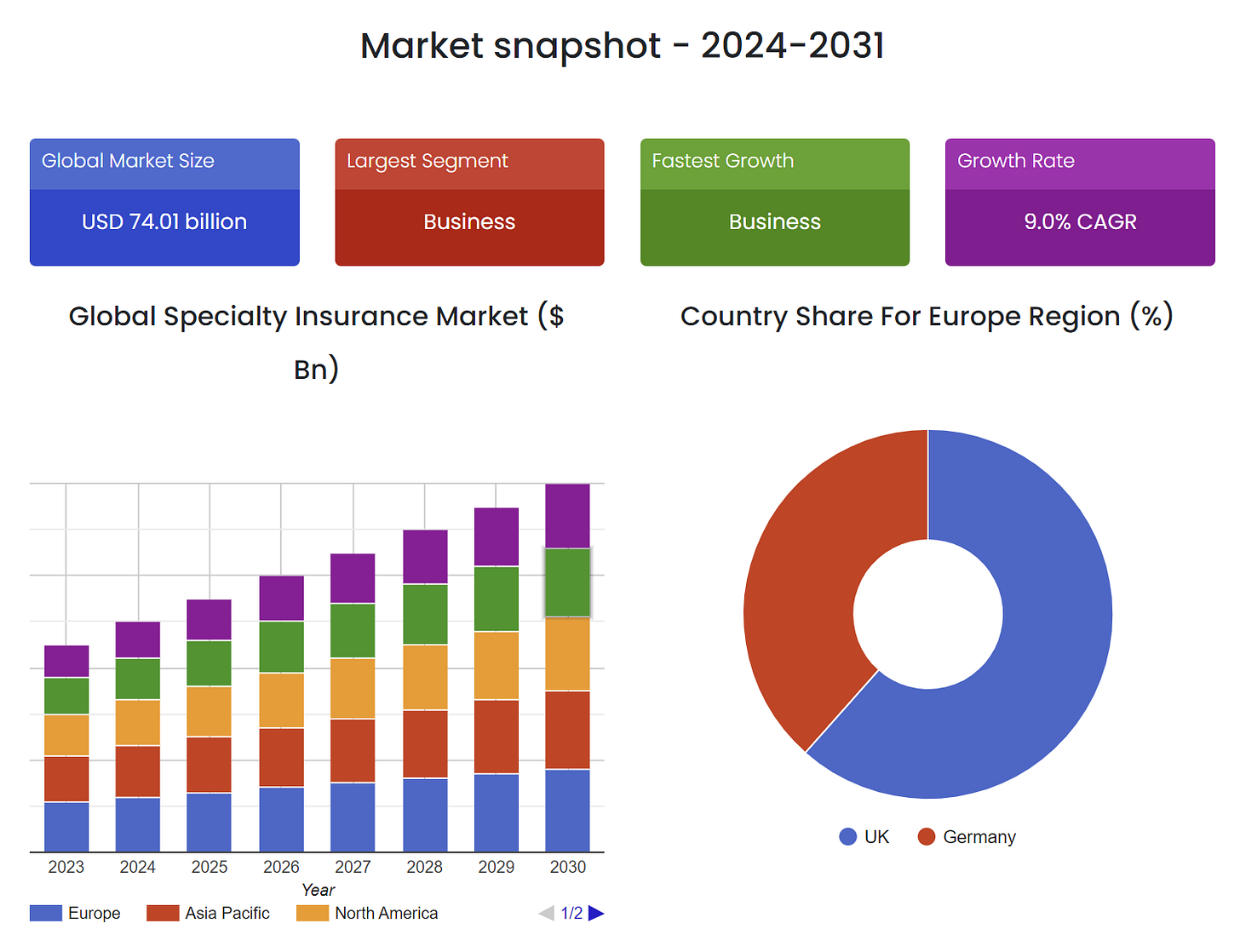

Market potential: The specialty insurance market is expected to grow at a CAGR of 9% until 2030, driven by the rising demand for customized insurance solutions.

Changing industry dynamics

The insurance industry is expected to go through a transformation in the coming decade. The main drivers for this change:

Increase of viruses/disease

Armed conflicts (Up significantly since 2010)

Global warming as a catalyst for extreme weather

The ability to adapt to the changing risk environment will be vital for insurers to make sure their underwriting is effective.

Kinsale is in a position where they can pick their spots, they are relatively small and can pick and choose what they believe will yield the best returns.

Revenue Streams

Revenues are generated via premiums and investment income. This provides Kinsale with predictable cash flows.

Premiums (85.8% of revenue): Income from policyholders’ payments for insurance coverage. This represents $1,144.9M in the last twelve months.

Investment income (14.2% of revenue): Returns from investing the premiums collected. This represents $189.3M in the last twelve months, where:

60.5% comes from total interest and dividend income

23.4% comes from gain (loss) on the sale of investments

16% comes from “other revenues

Capital light business model

Ideally, we want to own capital-light businesses that require little capital to grow.

Let’s take a look at Kinsale. We judge the capital lightness by comparing Capital Expenditure (Investments the business needs to keep operating) with its revenues and operating cash flows:

Revenues TTM: 1144.9M

Operating Cash Flow TTM: $872.6M

Capital Expenditure TTM: $7.5M

CAPEX/Sales: 0.56% (7.5 / 1334.1) ✅

CAPEX/Operating Cash Flow: 0.86% (7.5 / 872.6) ✅

The capital intensity of Kinsale is low, which is favorable.

Management

Kinsale was co-founded by Michael Kehoe (CEO) and Brian Haney (COO). The founders lead the company with extensive experience in the insurance industry.

Leadership alignment: Directors and executive officers own 6.5% of shares in Kinsale, aligning their interests with those of shareholders.

Michael Kehoe owns 3.85% of the business.

Track record: Under Michael Kehoe’s (CEO) and Brian Haney’s (COO) leadership, Kinsale has demonstrated excellent growth, prudent risk management, and strong financial performance.

The management team has seen its EPS compound by 36.25% annually since 2014, and book value compound by 25.52% annually:

Michael Kehoe and Brian Haney left James River (a larger E&S insurance company) in 2008 to found Kinsale Capital.

Most likely, the duo saw the flaws in James River’s business model and applied the lessons to create an ideal business model for the E&S insurance market.

Capital Allocation

We know from the book “The Outsiders”, that the best CEOs are extraordinary capital allocators.

Looking at returns on capital can give us an idea of how effective management can allocate capital to new projects:

Return on Equity 5-year average: 23.01%

Return on Invested Capital 5-year average: 7.38%

Return on Capital Employed 5-year average: 25.42%

The issue when looking at ROIC for an insurance business like Kinsale Capital, is that ~78% of its assets are investments from the float received from clients.

If you exclude investments from the ROIC calculation, you get a number closer to the ROE/ROCE of +20%.

A high-level comparison between Kinsale and its peers from a profitability standpoint, shows a superior operating margin (33.10%), return on equity (35.36%), and return on total capital (23.33%).

Based on Kinsale’s historic return on capital, it is clear that the management team understands how to deploy capital in the E&S insurance market effectively.

Stock-base compensation & dilution

Kinsale’s stock-based compensation in the trailing twelve months is $9.4M.

Compared to their operating cash flows of 872.6, this represents 1.077% of the OCF. This is a very low level.

Since 2016, Kinsale’s total outstanding shares have increased by 1.45% annually driven by common stock issuance in 2016 (72.8M), 2019 (68.6M), 2020 (60.3M), and 2022 (48.6M).

This is within reason for a fast-growing company like Kinsale. Management appears to be skilled capital allocators, so the capital raised from common stock issuance has been well spent.

Sustainable competitive advantage

Kinsale holds a competitive advantage in the specialty insurance market.

Factors contributing to their advantage:

Market Leadership: Kinsale is the market leader in E&S insurance in the US. The market is fragmented, and Kinsale is still gaining market share over its competitors.

Kinsale’s combined ratio (Loss ratio + Expense ratio) is very impressive, especially when we compare it to other businesses in their industry and the rapid growth of Kinsale:

Niche-focused: Kinsale focuses on the E&S part of insurance, in this niche market, the competition is less fierce, and not commoditized. The market requires unique expertise to evaluate different unique risks and price them correctly. In addition, Kinsale focuses on small accounts. The part of the market they target is much more attractive than the overall insurance market.

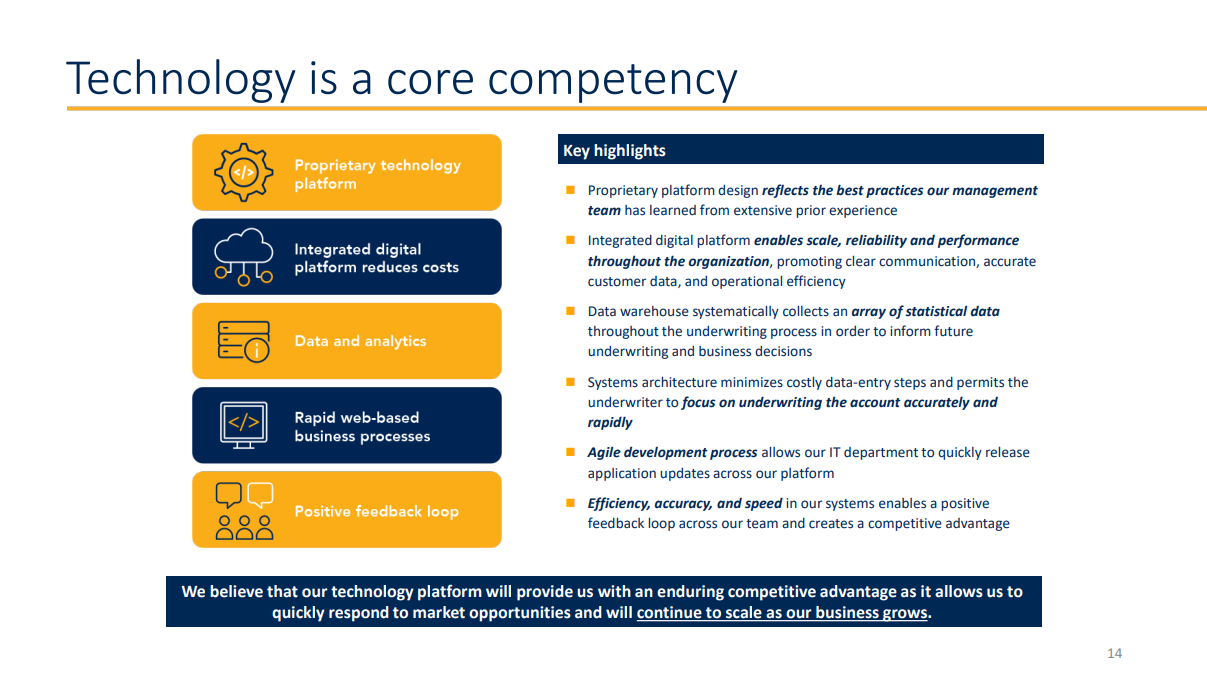

Technology Platform: Kinsale has built an extensive integrated technology platform that increases the efficiency and accuracy of the underwriting process. The data obtained in E&S is not available anywhere else, so this serves as a competitive advantage for newcomers who will have a much harder time assessing risk/pricing compared to Kinsale.

Margin expansion

Net profit margins and free cash flow margins is steadily expanding, suggesting a strong competitive position. From a net margin low in 2017 of 13.3% to its LTM highs of 26.3%, this expansion is impressive.

Return on Capital

Return on capital has also been steadily increasing over time, as 78% of Kinsale’s assets are investments, we want to look at the return on capital employed or return on equity to determine how efficient the management team is at allocating capital.

Kinsale’s trailing twelve-month ROCE is 36.9%. The return on capital and expansion suggest that Kinsale has a competitive advantage.

Combined ratio (Insurance specific KPI)

A lower combined ratio is better, as it indicates more profitability in the company’s underwriting process.

Therefore, going from 84.7% in 2019 to 75.4% is like margins/return on capital expanding — it tells us that the business is expanding its competitive position.

Kinsale seems to have a competitive advantage that allows them to grow profitably.

Historic growth rates

Kinsale Capital has expanded its business from $63.7M in 2014, to $1,334.1M in the last twelve months. That is a CAGR of 38.92% over the period.

Per-share compounding

Earnings per share 10-year CAGR is 36.25%, book value per share is 25.52%, and free cash flows per share is 23.56%. This is a high growth rate from a small base.

Future expected growth

2 year forward revenues are expected to grow 23.78% annually

2-year forward EPS is expected to grow by 18.59%

Long-term EPS is expected to grow 15% annually

The Stock

Kinsale has compounded by 48% annually (!) since its inception.

5-year total returns is 36% annually.

3-year total returns are 33.8% annually.

Kinsale is currently on one of its largest drawdowns since inception of -29.57%:

Risks

Competitive pressures: Intense competition from other specialty insurers. Kinsale is in an attractive niche that might attract other insurers, competing away their outperformance over time.

Regulatory risks: Changes in insurance regulations could impact operations.

Economic conditions: A downturn could affect premium collections and investment income.

Catastrophic events: Natural disasters or large-scale claims could impact profitability.

Valuation risk: Looking in the rearview mirror, Kinsale looks fantastic. However, the future is expected to provide slower growth rates, which in turn can mean a re-rating of Kinsale’s multiple if they are not able to keep their position in the E&S market.

Valuation

Historical multiple comparison — Price to earnings ratio

Kinsale is trading at its lowest PE ratio since inception of 25.63x earnings.

It should be mentioned that forward PE has increased by 52.12% since 2016, a 5.49% CAGR.

Free cash flow Yield is 9.63%. This is the highest yield since 2018. Historically, this has been a good entry point (To be fair, you could have entered Kinsale at any point since its inception and done exceptionally well).

Important: If we compare Kinsale to other insurance companies, their PE looks high. Markel trades at ~18x earnings, and James River Group at ~4x earnings.

Now, Kinsale is a much higher quality business and should not be directly compared to a company like River Group. However, it is important that we understand that there is a downside risk if we see a re-rating of Kinsale in the future (to a lower PE multiple).

Discounted cash flow analysis

We want to be conservative in our estimates to create a margin of safety.

Using the EPS from the last twelve months (LTM) as a proxy for earnings.

With 3 different scenarios for growth between 10%-15% EPS growth in the next 5 years.

+15% long-term EPS growth is what analysts expect.

Fair value estimate for Kinsale Capital: $418.19

Current share price: $385

Upside: +9.2%

If Kinsale can grow at 15% or above in the next 5-10 years, we assume that Kinsale will return +15% annually for its shareholders.

Note: If Kinsale’s growth slows down, combined with a lower combined ratio and return on equity due to higher competition, we could easily see the multiple contracts to something closer to its peers ~10-15x earnings. This is a risk we must have in the back of our minds.

Conclusion

Kinsale is an interesting investment case. It operates in a profitable niche, where it has built up an expertise and technology platform to increase barriers to enter.

The business is founder-led and both founders are still on board as CEO and COO. They both own significant stakes in the company and are aligned with the shareholders.

The growth in per-share earnings and book value is extraordinary. However, the growth is expected to be lower moving forward (+15% pa.).

The valuation looks somewhat attractive, but it depends on how well Kinsale will be able to keep its competitive position. Lower growth can lead to lower multiples closer to its industry peers at 10-15 times earnings.

Kinsale has proven the bears wrong and compounded its share price by an incredible 48% pa. The share price has been steadily moving up since its inception in 2016.

Kinsale is a business we want to keep following to learn more & potentially take a position if the right opportunity presents itself.

That’s it for today! Like & Share if you found this article valuable.

Feel free to share it with your friends:

Leave a like and a comment so more people can discover our newsletter! 💎

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +8.000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

It is my 2nd largest position at an average price of 370$. Management has always been cautious and they said 30-40% growth rates won't last forever. However, I think they can achieve at least 15% EPS growth in the next few years and beat the market. Multiple contraction is indeed a risk, and that is why I don't add more to my already large position at this price. For those you don't have a position, I think this is a good starting point. But if Kinsale falls to the range of 22-23 PE, I would add even more, because it is a high quality business with great, down to earth management. I think it deserves a premium.