Steady Growth: European Diabetes and Obesity Giant💊

High quality European healthcare giant with multiple growth levers🧠

Hi friend! 👋

In this article, we’re breaking down Novo Nordisk, a European healthcare giant with attractive growth prospects.

In case you missed our latest articles:

Got any feedback for us? Please reply to this email!

Tired of boring, text-heavy investing newsletters?

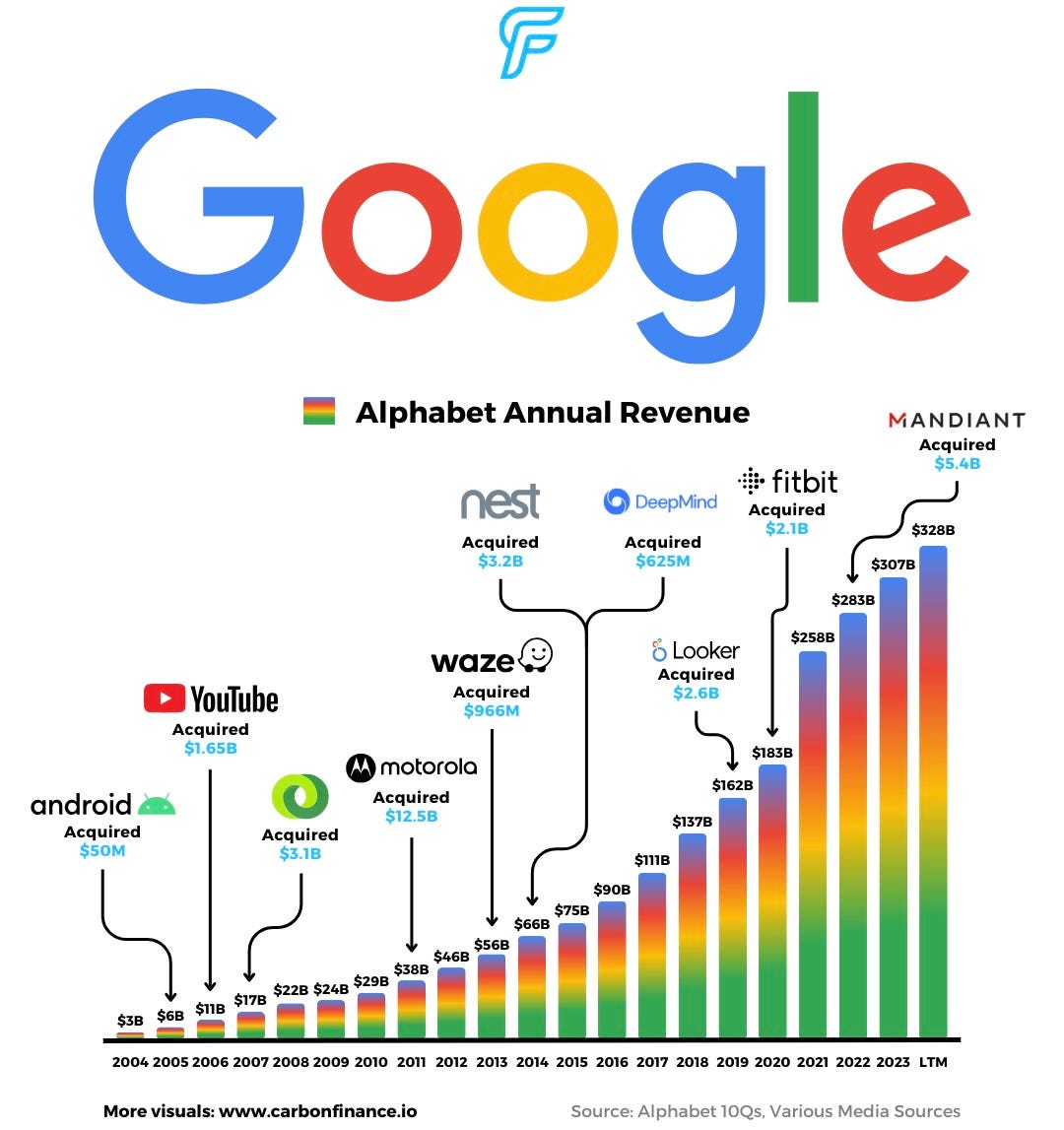

My good friend Carbon Finance sends out a weekly visual newsletter with the most important infographics, insights, and insider trades.

It’s completely free and only takes 5 minutes to read.

Join nearly 16,000+ investors! Click the button below to subscribe now 👇

Table of content

Introduction

The business model

Growth drivers

Competitive advantage

Management

Risk Factors

Valuation

Novo Nordisk NVO 0.00%↑

Introduction

Novo Nordisk is a global healthcare company headquartered in Denmark.

Novo is known for its leadership in diabetes care. With a century-long history, Novo Nordisk has established itself as a pioneer in biopharmaceuticals, particularly in diabetes, obesity, and rare blood disorders.

3 Interesting facts about Novo:

The total return for shareholders has been 21.2% CAGR since its inception in 1992 (52.294.3% in total).

From 2020 to the last twelve months (LTM) Novo’s earnings per share have grown 27.66% annually, led by their massive success with their weight loss drug Wegovy

Obesity is a major global health concern. One in eight people globally are obese (+1 billion people). Obesity has doubled since 1990 for adults (WHO). Wegovy leans into this unfortunate global trend.

Let’s take a closer look at why Novo Nordisk might be an interesting quality business 👇

The Business Model of Novo Nordisk

Novo Nordisk makes money from selling products related to treating diabetes and obesity.

The business can be divided into 3 main segments

Diabetes (GLP-1, Insulin, Other diabetes)

Obesity Care (Wegovy)

Rare disease

In the most recent quarter, Novo grew its sales by 24%, led by diabetes & obesity care (especially in North America):

Novo Nordisk holds a market leader status in the diabetes market with a total market share of 55.3% in the GLP-1 segment.

The business is taking market share in its international operations and NA segment.

Novo Nordisk has a strong position in two growing markets (Diabetes and Obesity).

This is a secular trend that will not vanish in a few years. As the global population consumes more fast food & processed foods, we will likely see the trend of Obesity and type 2 diabetes increase over the next decade.

This is good news for Novo Nordisk (but poor news for mankind).

Ozempic and Wegovy

Ozempic is a diabetes medication that regulates blood sugar.

However, doctors are prescribing it for weight loss as this is one of its “side effects”.

Novo Nordisk’s obesity care product is Wegovy, which has recently been approved for sale in China.

Ozempic leads sales

Ozempic is Novo’s leading treatment - bringing in 41% of its revenue in 2023.

Wegovy is bringing in 13.5% of the total revenue.

The diabetes & obesity segment together brings in 93% of Novo’s revenue.

Novo Nordisk has a strong business model with high margins and returns on capital. Their primary treatments, Ozempic and Wegovy have seen explosive growth over the last few years. The company expects this growth to continue.

Growth Drivers

The key growth drivers for Novo Nordisk are centered around their GLP-1-based treatments for diabetes and obesity care. Here are the main points:

Diabetes & Obesity treatments:

Ozempic, Wegovy, and Rybelsus are the main growth drivers, with significant sales growth in Q1 of 2024.

GLP-1 saw a 32% growth in diabetes and a 42% growth in obesity.

Sales of GLP-1-based products grew 30% at constant exchange rates (CER).

Expansion into Obesity Care:

Wegovy sales grew 107% at CER, and the company has launched Wegovy in 10 countries.

Wegovy was just approved in China. This is a growth lever for Novo as the Chinese market can be lucrative for these kinds of treatments.

Market Share in Diabetes:

Novo Nordisk continues to gain market share in total diabetes, now at 33%.

GLP-1 diabetes sales in North America grew 37% at CER, making Novo Nordisk the market leader in GLP-1 diabetes in NA.

Expansion into New Therapy Areas:

The company is expanding into cardiovascular and emerging therapy areas, including initiating a phase 3 trial with Ziltivekimab in heart failure and acquiring Cardior Pharmaceuticals.

10 Years of Compounding

Novo Nordisk has been compounding its revenue by 13.48% in the last decade. Earnings per share has grown 16% CAGR, free cash flow per share has grown 11.34% and the ROIC has constantly been above 25% indicating that Novo has an attractive and profitable business model.

FinChat.io is The Complete Stock Research Platform for fundamental investors and a sponsor of Invest In Quality.

They have complete financial data on more than 100,000 stocks, including company-specific metrics.

Want to see Nvidia’s data center revenue? FinChat’s got it.

Like to track Spotify’s premium subscribers? FinChat's got that too.

How about tracking Amazon's AWS profits? Yep, FinChat's got it.

The breadth of FinChat’s data is truly one-of-a-kind.

Competitive Advantage

Novo Nordisk has a wide economic moat with Intangible assets and Cost advantage being their moat sources.

Intangible Assets

Novo Nordisk has a strong portfolio of intangible assets, primarily driven by its innovation pipeline and R&D:

Innovation Pipeline and R&D Execution: Novo Nordisk's "innovation machine" delivers important clinical data and advances key trials like SELECT and FLOW.

Market Leadership: Novo Nordisk is the global market leader in the GLP-1 segment with a 55.3% value market share and in the branded obesity market with an 85.4% volume market share.

Cost Advantage

Novo Nordisk's cost advantage is reflected in its high gross margins and efficient manufacturing:

Gross Margin: The company maintains a high gross profit margin, with the most recent data showing 84.83% for Q1 2024.

Capacity Expansion: Novo Nordisk is investing significantly in expanding its manufacturing capacity, allowing it to scale supply and meet growing demand efficiently. Both R&D and CapEX have been ramped up in the last few years to meet the growing demand in the market:

Novo Nordisk has a sustained high return on invested capital (ROIC)

The high ROIC reflects attractive reinvestment opportunities and that Novo Nordisk does not have to use a large percentage of its profits to grow. Hence, more of the profits or free cash flow can be returned to the shareholders through buybacks and dividends.

The total shareholder yield is currently 1.83%, the dividend yield is 1.08%, and the buyback yield is 0.71%.

In summary, Novo Nordisk's competitive advantages are driven by its strong intangible assets and cost advantage.

These moat sources contribute to Novo Nordisk’s wide moat and leadership in the diabetes and obesity market.

Management

Key executives and their insider holdings:

Lars Fruergaard Jorgensen (CEO)

Title: President, CEO & Member of Management Board, Director

Ownership: 92.8K shares

Market Value of Shares: DKK 75.15M

Tenure: 33 years (1991)

CEO since: 2017

Track record: Multiple previous positions in Novo Nordisk, including Economist, senior vice president for IT & Corporate Development, executive vice president, and CIO.

Maziar Mike Doustdar (VP of International Operations)

Title: Executive VP of International Operations & Member of the Management Board, Independent Director

Ownership: 50.26K shares

Market Value of Shares: DKK 40.7M

Tenure: 32 years (1992)

Tenure as VP: Since 2015 (9 years)

Track record: General manager of Novo Nordisk Near East department, VP of Business Area Near East, senior VP of International Operations.

Karsten Munk Knudsen

Title: Executive VP, CFO & Member of the Management Board, Chairman of the Board, Director

Ownership: 611 shares

Market Value of Shares: DKK 494.79K

Tenure: 25 years (1999)

Tenure as CFO: Since 2018 (6 years)

Track record: Various finance positions and business analyst positions. Corporate VP for Finance & IT.

Key executives in Novo Nordisk have been with the business for more than 25 years, this is a good sign, as it may reflect that the executive team knows the business on a deep level.

The executives also hold significant stakes in the business, especially the CEO (DKK 75M), and the VP IO (DKK 40.7M).

Since Mr Jorgensen took over as CEO in 2017, Novo has produced great results. With significant gains in revenue, earnings per share, and free cash flow per share:

On a podcast with Nicolai Tangen (CEO of NBIM), Mr Jorgensen discussed the R&D development process. He was quick to point out that the success Novo Nordisk is experiencing now is not the result of his brilliant leadership, but of R&D investments made 10+ years ago.

These long timelines make it hard to predict whether Novo Nordisk will continue to explore breakthroughs in treatments and drugs in the future. However, the CEO remains confident in the capabilities built in the Danish healthcare giant over the last 20 years.

Risk Factors

The main risks for Novo Nordisk:

Health risks associated with treatments: Ozempic and Wegovy are under fire as 7-9% of users report eye disorders after using their treatments (Reuters). There will always be risks associated with treatment like this, but 7-9% is unacceptably high (if this is true).

Price pressure from Biden in the US: Both Novo Nordisk and Eli Lilly have received criticism for their pricing in the US by President Biden. Prices in the US can be up to 6 times higher than in Denmark, Germany, or Canada. This might pressure the giants to reduce prices in the US market.

Research and Development Risks. Project Delays or Failures - Delays or failures in research and development projects can hinder the company's ability to bring new products to market.

Significant investments: Depending on the results of future R&D efforts, Novo might see a lower ROI on its investment than in this period.

Market and Competitive Risks: Government-mandated or market-driven price decreases for Novo Nordisk's products can impact profitability. Competing Products - The introduction of competing products can impact market share and revenue.

Valuation Risk

High relative valuation: Novo Nordisk is trading at a price-to-earnings ratio of 44.14 vs. its historical median of 26.25x. Recent boosts in obesity sales have boosted the growth and expanded the PE. However, this can pose a downside risk for investors if growth slows down again.

However, there are rising challenges too. These include health risks from its treatments, criticism from Biden on high prices in the US along with greater competition down the line.

Valuation

Multiple comparisons

Novo Nordisk is trading at its highest PE range ever at 44.14x earnings. The median is 26.25 times earnings.

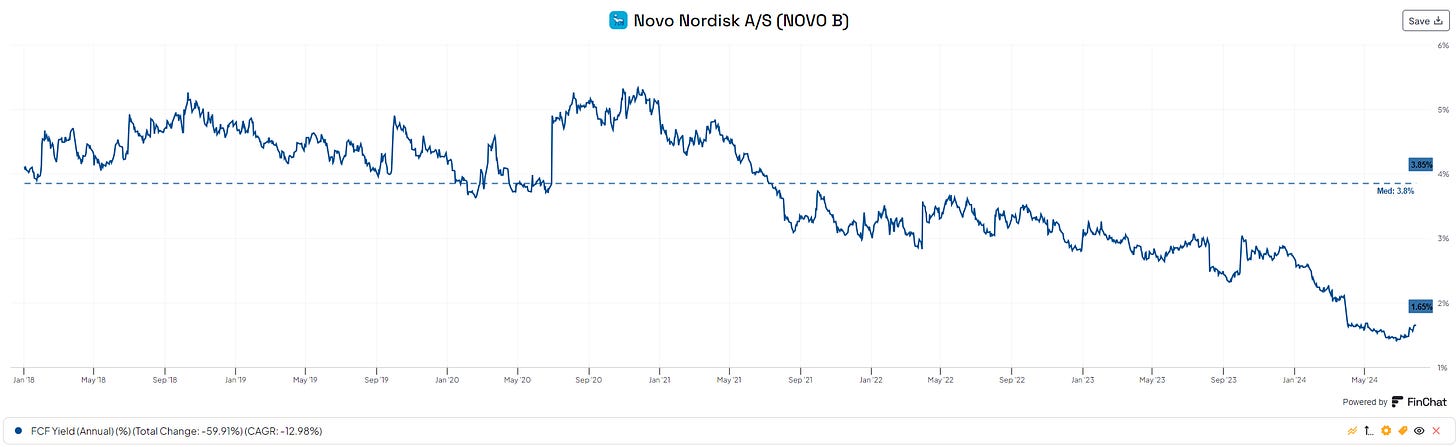

The Free Cash Flow Yield is 1.65% vs. its historical median of 3.85%.

The multiple expansion reflects the opportunity Novo Nordisk has in the years to come. There are high expectations built into the current stock price. Here are analysts estimates for the next 2 years and the long term:

Discounted cash flow analysis

Using the diluted EPS of DKK 19.90 as a proxy for earnings, and 3 different scenarios for growth:

Fair value estimate: DKK 758.08

Current share price: DKK 882.1

Downside: -14.06%

Although our DCF analysis finds a downside of -14%, Novo is likely to continue to expand its share price as the stock is in a strong uptrend. However, some risks can affect the high growth estimates for the future, and if they occur the stock can correct severely to the downside.

We do not believe now is a particularly good time to buy Novo Nordisk on a fundamental basis.

Conclusion

Novo Nordisk stands out as a leader in diabetes care with a promising outlook. Its strong business model, robust growth drivers, and competitive advantages make it a compelling investment opportunity. However, potential investors should be mindful of the associated risks and conduct thorough due diligence. As the global health landscape continues to evolve, Novo Nordisk's commitment to innovation and patient care positions it well for sustained growth and value creation.

Investing in Novo Nordisk offers the potential for steady returns, backed by a century of expertise and a clear vision for the future.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +8.000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

Great article! How did you determine the terminal values of 16, 22 and 25 in your DCF analysis?

Excellent article, my friend!

Thanks for sharing!