Premium 💎

💎Build a Market-Beating Portfolio of Quality Compounders

Join Invest in Quality: Trusted by 30,000+ Investors

Invest smarter. Save time. Own great businesses.

You’re a busy professional.

You want your money to work as hard as you do.

But markets move fast, information is overwhelming, and time is limited.

That’s why I built Invest in Quality Premium — a unique membership for investors who want clarity, conviction, and results without spending 20 hours a week researching stocks.

🧩 Why Invest in Quality Premium Exists

I built Invest in Quality because I was tired of noisy and fraudulent financial media and surface-level stock tips from financial influencers.

There’s no shortage of opinions, but very few frameworks that actually work.

So I created a transparent, data-driven system — and I share it all publicly:

every company I own, every move I make, and the full reasoning behind it.

📈 The Results

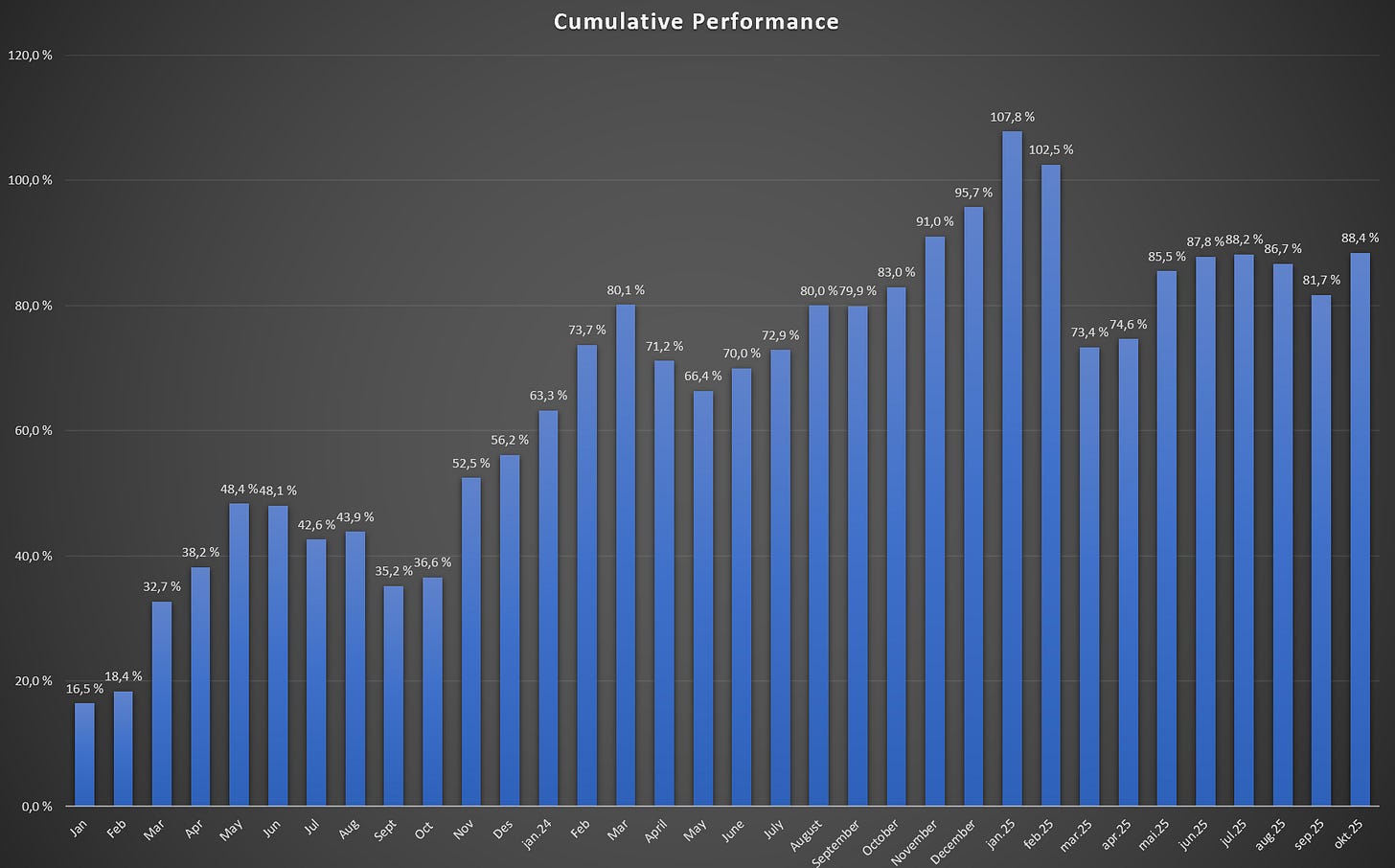

Since launching the Quality Growth Portfolio on January 1, 2023 (And sharing every move online), the performance has been exceptional:

The quality growth portfolio: +88.4% since inception (As of 31.10.2025)

Compounded annual growth rate: +25.1%

I’m not promising +25% annual returns forever.

But I am promising a disciplined, transparent, long-term process that compounds over time.

Start compounding smarter today 👇

🔍 What You Get as a Premium Member

💎 My Full Portfolio: See exactly what I own (80% of my net worth)

📢 Buy & Sell Alerts: Real-time notifications of portfolio changes

📊 Monthly Factsheets: Performance, weights, and commentary

🏰 1–2 Deep Dives Monthly: Actionable breakdowns of world-class businesses

📘 Member Archive: Every past analysis, instantly accessible

🤝 Direct Access: Ask questions, get clarity, stay informed

🎓 Early Access to Courses: Coming soon: The Quality Growth System

All delivered with zero hype & noise, just logic, transparency, and consistency.

🧠 The Quality Growth System

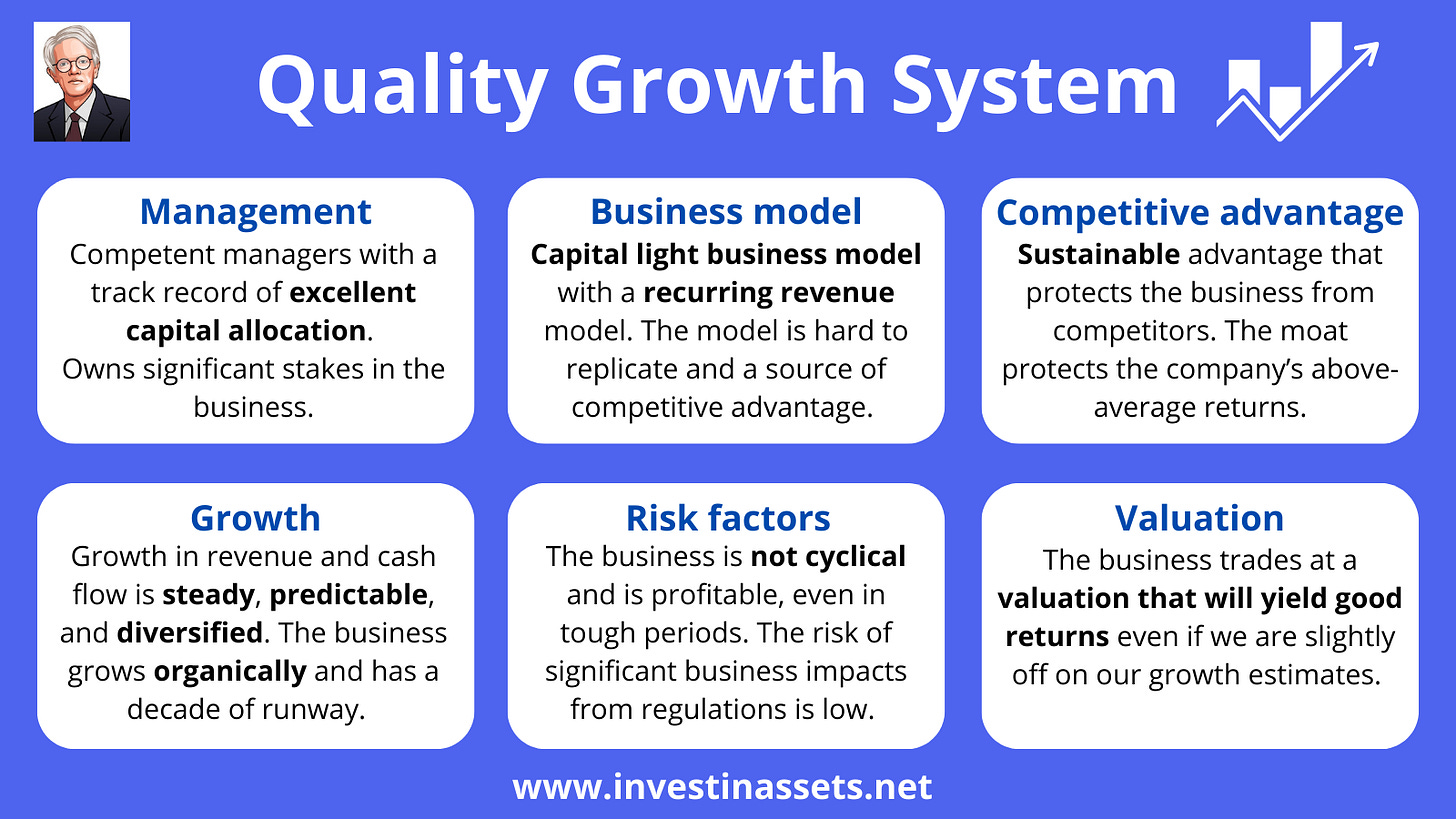

Every stock I own must pass six tests:

Management. Business Model. Moat. Growth. Risk. Valuation.

This framework helps me identify durable compounders that can outperform for decades, and it’s the same framework I share with members.

👉 Read the full guide here → 6 Pillars of Quality Growth Investing

👤 The Founder: Marius

I’m an independent investor — not a fund manager, not a financial influencer.

I’ve been investing my own money in the stock market for more than a decade, applying a consistent quality-growth strategy to my own portfolio.

The quality growth strategy has helped me build a significant amount of wealth in a stable and consistent manner.

I built Invest in Quality to help other busy professionals invest smarter and with more confidence — using data, discipline, and common sense.

Everything I share is backed by real money and real transparency.

💬 What Members Say

What customers are saying about our Premium service:

+30,000 investors trust Invest In Quality as a source of data-driven, rational, and independent stock market research.

💰 Your Membership

$20/month or $200/year (save 2 months)

Join us now 👇

✅ Secure checkout via Substack

✅ Cancel anytime

✅ 30,000+ readers trust Invest in Assets

Note: The price will soon increase.

Join today and get:

✅ Real-time portfolio access

✅ Monthly deep dives

✅ Monthly performance updates

✅ Early access to future courses

✅ Direct access for questions

⚖️ Why Join Now

Every smart decision in the market compounds into future freedom.

Every bad one costs you time — sometimes years of it.

Losing out on compounding is the most expensive mistake an investor can make.

The goal of Invest in Quality is simple:

Help you make better portfolio decisions in less time, with more clarity and confidence.

The time you save can be invested where it matters most, with family, friends, or doing what you love.

👉 Join 30,000+ investors learning to invest smarter and compound wealth the right way. 👇

Hope to see you soon!

All the best,

Marius