Dino Polska - A Fast Growing Retail Store Chain in Polen with a Strong Business Model and a natural Competitive Advantage

High insider ownership, High returns on capital, fantastic growth, decent margins and low debt levels. Dino Polska looks like a great business that I consider a potential multi-bagger.

The Business

Dino Polska is a Polish retail store chain that is rapidly expanding in Polen. The retailer was founded in 1999 by Tomasz Biernacki and the stores were in the early days located in smaller places outside the cities. What separates Dino Polska from its competitors is that it owns all the premises and land where its stores operate, unlike most competitors who rent the premises.

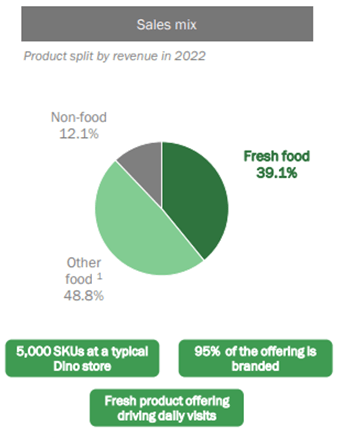

The specialty of Dino Polska is its fresh food, representing 39,1% of sales. Every Dino store has a fresh foods section with an emphasis on meats like chicken and pork. Dino previously acquired Agro-Rydzyna, a meat manufacturer, which makes it more cost-efficient to offer high-quality products to its customers.

Company History

In 2010 a private equity fund bought 49% of Dino’s shares for ~200 million PLN. In 2010 Dino had 111 stores, by 2017 they had 775 stores across Polen, much thanks to the aggressive expansion strategy of the PE fund. The fund sold its stake in Dino in 2017. At this time Dino was valued at 3.4 billion PLN, about 8.5X more than what they paid for it, 7 years prior. This represents a 35,8% CAGR for the PE fund.

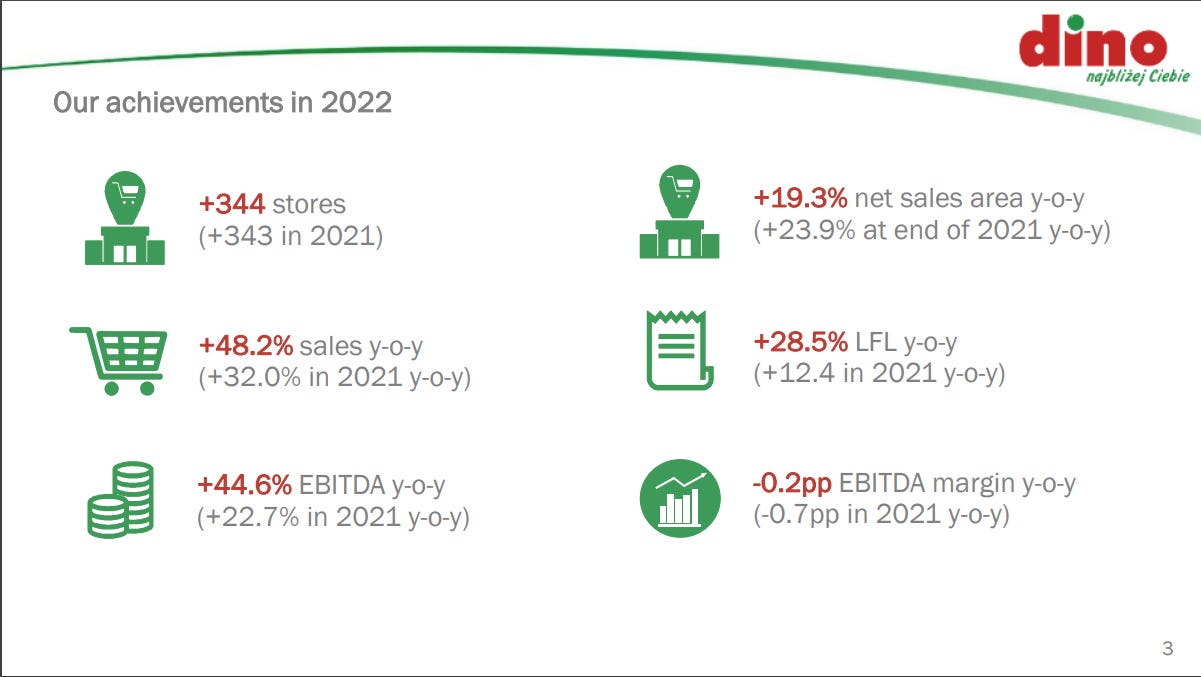

In 2018 Dino Polska was allowed to go into the petrol stations market in Polen under their brand name. Dino has the potential to execute this opportunity as well to further expand their business. In 2020 Dino opened 278 new stores, in 2021 they opened 343 stores, and in 2022 they opened 344 stores, a rapid expansion illustrated in the image above.

Dino Polska is a growth story

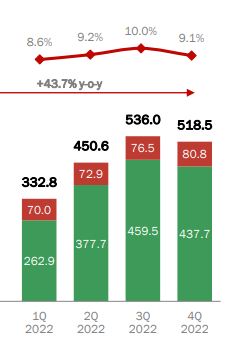

Dino has rapidly grown their top line while keeping steady EBITDA margins between 8-10%. Dino’s continuous expansion in Polen supports this growth.

Growth 5-year CAGR (Source: SeekingAlpha):

Revenue: 34.72%

EBITDA: 35.43%

Net Income: 39.59%

EPS: 39.59% (No dilution)

Total Assets: 38.31%

Dino Polska still has plenty of room to grow in Polen. The image below shows the density of stores across Polen. Their presence in West Polen is strong, while East and South still have plenty of room to grow.

Healthy balance sheet and debt levels

Dino’s net debt is $320 million. The Ebit in 2022 was ~$366 million. They would have no problem paying down their debt if they needed to or if that was the smartest capital allocation move. Their cash levels are currently $87.2 million.

Note that their interest coverage ratio went from 21.9X to 10.9X in 2022, this is something to keep an eye on. However, increased debt levels from 21-22, and increasing interest rates explain this change. Also, interest coverage of 10.9X is more than satisfactory.

Profitability

Dino Polska’s EBITDA is growing at a high clip. From 2021 to 2022 their EBITDA increased by +44,6%. They have a gross margin of 24% and an operating margin of ~8%. These margins are better than their competitors, the reason for this is most likely that (i) they own their own premises, (ii) identical stores reduce complexity, and (iii) synergy and cost optimization by owning a meat manufacturer.

Competitive advantage

Dino Polska’s business model makes it resilient and not easy to compete with:

Pricing Power - Dino’s LFL sales are consistently above food inflation, this suggests that the company has pricing power in the Polish market. Hopefully, Dino would be able to leverage this advantage to keep their margins high during high inflationary environments like we’re seeing now.

Economics of scale - Dino is able to grow their earnings more rapidly than their variable cost. They pay a cost upfront to acquire the land and premises, but after the fixed costs are paid for they are able to gain operating leverage and increase their margins.

Dino is also able to leverage their size and growth in cooperation with their suppliers to achieve competitive prices while keeping their margins attractive.

Buying the real estate for their stores - One of Dino Polska’s advantages is that they buy the land for their stores. This provides a variable cost advantage to competitors and is similar to what Copart CPRT 0.00%↑ is doing in their market. A few reasons why this is important:

Flexibility: Dino is able to choose the most attractive sites

Accessibility: Dino can set up stores in smaller villages

Consistency: All Dino stores have the same format/design, which is great for logistics, planning, and efficient distribution.

Cost control: Lower costs in the development and building of the stores, and lower maintenance costs

Real estate appreciation: An added bonus of owning real estate is that you also get appreciation if the land increases in value. Their locations are often in popular and growing areas which may give Dino the added bonus of increasing value.

Dino Polska seems to have a competitive advantage. Whether this advantage is sustainable is hard to say, but I do think their emphasis on building their stores in an identical manner creates natural advantages in terms of resources used for planning logistics, distribution, building, and maintenance costs.

Additionally, they do not have to pay a lease on the land, they own it. This decreases their variable cost per store, allowing the stores to compete with a cost advantage over competing retailers. Moreover, owning real estate in attractive metropolitan areas in one of the fastest-growing economies can be a lucrative investment. As mentioned this reminds me of how Copart owns the land where they build their scrapyards.

Ownership - High insider ownership

The founder, Tomasz Biernacki, owns 51.07% of the shares in the business. Tomasz is also the chairman of the board.

The management team

Izabela Biadala - Director of Operations and Administration. Tenure: 21 years

Michal Krauze - Chief Financial Officer. Tenure: 21 years

Piotr Scigala - Director of the Control Department. Tenure: 20 years

The management team has been with the company for more than 20 years and has been an essential part of its growth story.

Valuation

Market capitalization: $9.34 BN

EBIT 2022: 1537,8MPLN:

The current exchange rate is 1 PLN = 0,24 USD

EBIT in USD 22: $365,97 Million

Ebit/Mcap: 25.5

Using Dino’s $365,97M for our discounted cash flow analysis:

If Dino can keep up their growth in EBIT at a 20% growth rate for the next 5 years, and then reduce growth to 16%, we can expect a 19% annual return, given a multiple of 20 at the end of 10 years.

The questions will be, can Dino continue their expansion in Polen, and will it be able to expand beyond Polen’s borders? There is still room to grow in Polen, but at some point, Polen will be a saturated market for Dino. If they want to keep growing, they have to enter new geographies OR new business areas like petrol stations.

Keep in mind, a discounted cash flow analysis has several weaknesses, it’s entirely based on our assumption about the future. We tend to think in a linear manner, but growth won’t happen like projected in our DCFA above. Just like the stock market, we can expect to see ups and downs in growth.

A DCFA should be used as a high-level guide. We aim to be approximately right, rather than precisely wrong.

A DCFA of course does not take risks into account, risks include:

Recession

International and local competition

Increased rates

Inflation

Conclusion

Dino Polska is a fantastic growth story in Polen. Their concept of identical stores and the fact that they own a meat manufacturer to produce fresh foods create some natural advantages in the market. Additionally, the fact that they own their real estate can be seen as a sustainable competitive advantage.

If Dino is able to keep expanding in Polen, we will likely see solid growth (+20% p.a.) for the next few years. But there are concerns as to how Dino will continue to grow after Polen is saturated.

The valuation looks fair given their potential for growth. Dino is currently investing all their Operating cash flows into new stores, which means that its FCF is low/negative. This will of course change once they go from growth mode to cash cow mode.

I’m adding Dino to my watchlist to investigate further. Before an investment, I need to know a few key elements: Where will Dino be in 10 years? What will management do to make sure Dino reaches that destination? What may hinder Dino from reaching that destination?

Congratulations. I like your analyse. Dino is also in my watchlist. thanks