📝Invest In Quality: Owner's Manual

🧠 Inspired by the imphamys Fundsmith's owner's manual

Why This Manual Exists

This manual exists to explain how I invest, why I invest this way, and what you — as a reader, supporter, or limited partner — can expect from me. It serves as a guidepost for decision-making and a filter for long-term alignment.

Mission & Investment Philosophy

🧭 Mission:

To compound the capital I manage at +15% compounded annual growth rates for the long-term, by investing in high-quality, wide moat businesses with strong management teams, favorable business models, and a structural demand for the product or service they sell - and to do this with clarity, discipline, and decisiveness.

🔍 Philosophy (Core Tenets):

Business > stock: I invest in businesses, not tickers or trends.

Long-term lens: I aim to hold companies for 5–10+ years. Turnover is a cost to performance.

Valuation discipline: Even great businesses have prices I won’t pay.

Skin in the game: I invest ~80% of my wealth in the Quality Growth Portfolio, and I’m 100% transparent about the moves — alignment matters.

Quality first: High returns on capital, attractive business model, strong moats, organic growth, and predictable economics are non-negotiable.

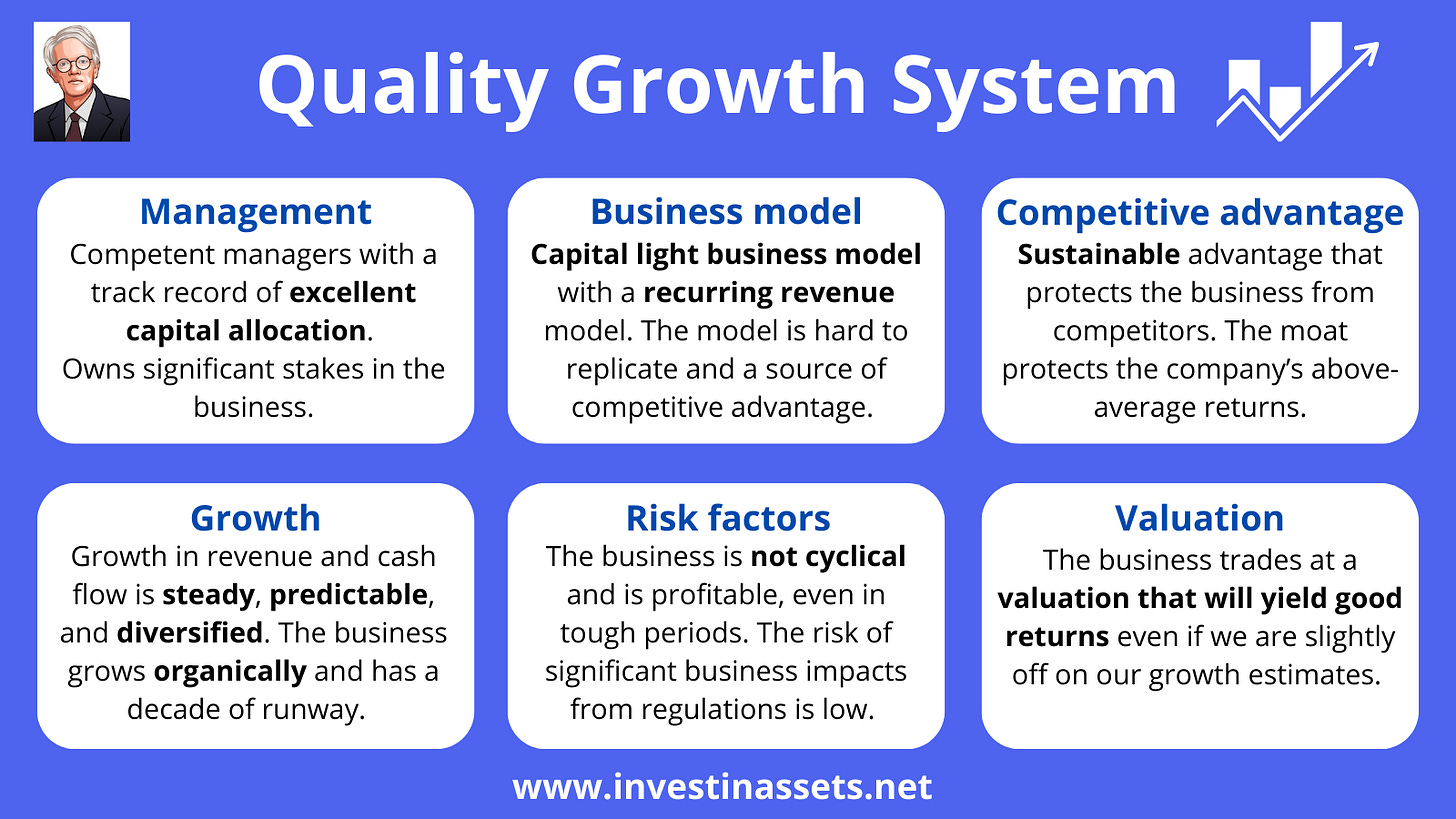

Here is the system we follow to identify great businesses:

6 Pillars of Quality Investing

When building a durable portfolio that can compound for decades, investors need a framework that goes beyond chasing the next trend or reacting to quarterly noise. At Invest in Quality, we believe in a systematic approach — one rooted in six timeless pillars that define true quality growth businesses.

These pillars are the foundation of our Quality Growth System and the reason why certain companies can deliver above-average returns while others struggle. Let’s break them down.

1. Management – Capital Allocation Above All

The starting point for any quality investment is management. Competent leaders with a proven history of excellent capital allocation can make or break a business.

We look for:

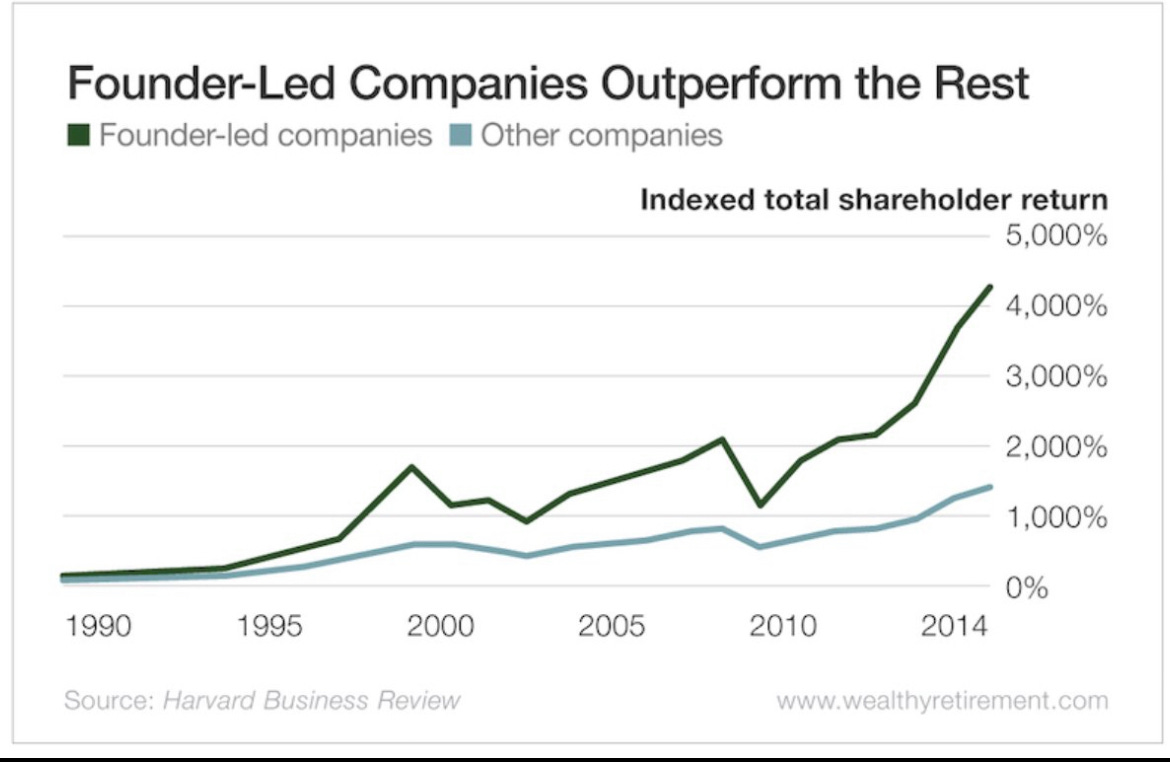

Executives who own significant stakes in their own companies ensure alignment with shareholders. We prefer founder-led companies because they have an incentive to make their vision come true, and not just a monetary incentive. This power has consistently outperformed “hired gun CEOs”.

A track record of deploying capital wisely — whether that means reinvesting in the business, making value-accretive acquisitions, or returning excess cash through buybacks and dividends.

Discipline during downturns. The best managers know when not to pursue growth for growth’s sake.

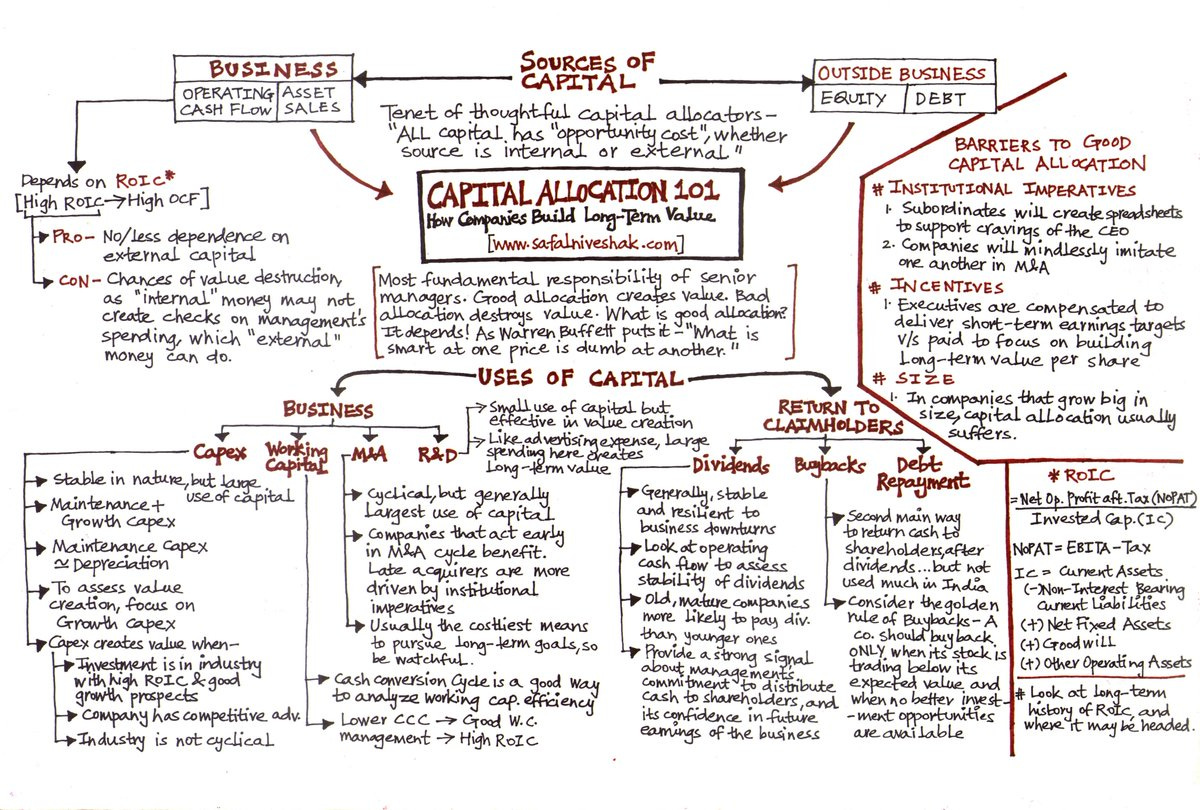

History shows that capital allocation is the single most important driver of shareholder returns over the long run.

While capital allocation can be complicated, the best managers understand that how they allocate each dollar from the business will affect the long-term returns of the shareholders that own the business.

Capital allocation 101:

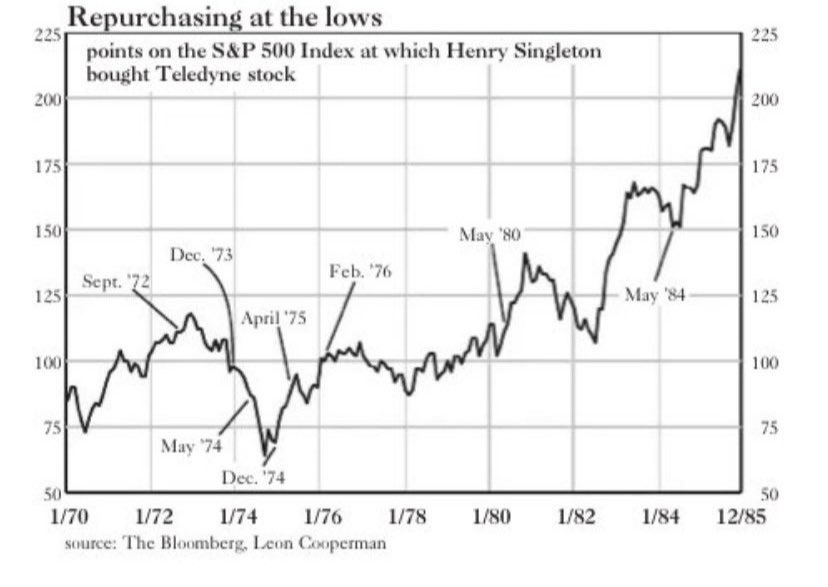

Henry Singleton showed great capital discipline in the 70s, when he repurchased stocks in his company, Teledyne, at record low levels. He seized the opportunity to make a logical bet when others were fearful and was rewarded handsomely for his moves.

Founders I admire:

Sam Walton of Walmart.

Warren Buffett of Berkshire Hathaway.

Ingvar Kamprad of IKEA.

Ray Kroc of McDonald’s.

Steve Jobs of Apple.

Jeff Bezos of Amazon.

Reed Hastings of Netflix.

Mark Leonard of Constellation Software.

Marcos Galperin of Mercadolibre.

Read more about founder-led businesses here:

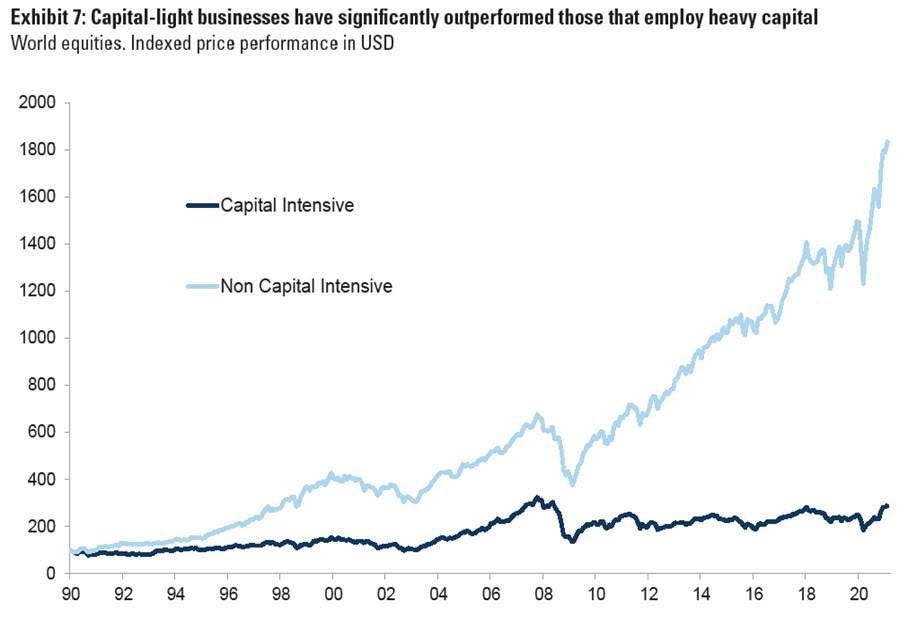

2. Business Model – Capital-Light and Recurring

A great business is defined by its model. We prefer capital-light structures that don’t require heavy reinvestment to sustain growth.

The hallmarks of a quality model:

Recurring revenues that provide predictability and resilience. Subscription-based SaaS, transaction-based platforms, and sticky ecosystems fall into this category.

Scalability without proportionate increases in cost. Digital-first businesses are compelling in this regard.

Models that are hard to replicate. If competitors can copy it easily, the advantage evaporates.

Simply put: the less a company has to spend to grow, and the more predictable its revenues, the better.

While some capital-heavy businesses can have deep moats, we prefer capital-light, or “non-capital-intensive” businesses.

These types of businesses have also significantly outperformed over time:

Read more about how we identify capital-light businesses here:

3. Competitive Advantage – The Moat

No matter how compelling the business model, it must be defended. A sustainable competitive advantage — or moat — protects a company’s above-average returns from erosion.

Examples include:

Network effects (Visa, Meta)

Switching costs (Microsoft, Adobe)

Brand power (Apple, LVMH)

Regulatory or structural barriers (Moody’s, S&P Global)

A true moat allows a business to withstand attacks, raise prices, and compound shareholder wealth over time.

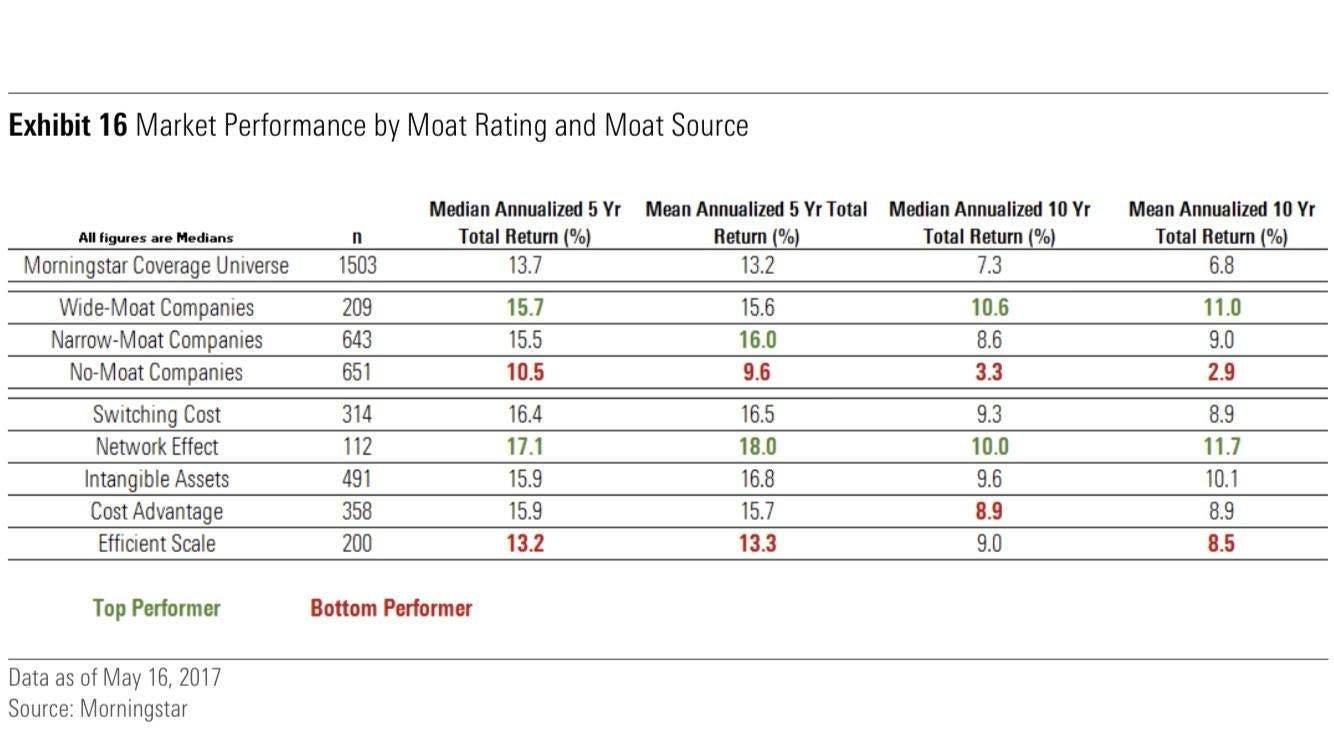

While value and quality can be found even without a deep moat, our philosophy is based on strong businesses that are built to last. We don’t want to own a business for 1-2 years just due to undervaluation; we want to own businesses that can sustain high organic growth and high returns on invested capital for decades. This is only obtainable for businesses with wide moats.

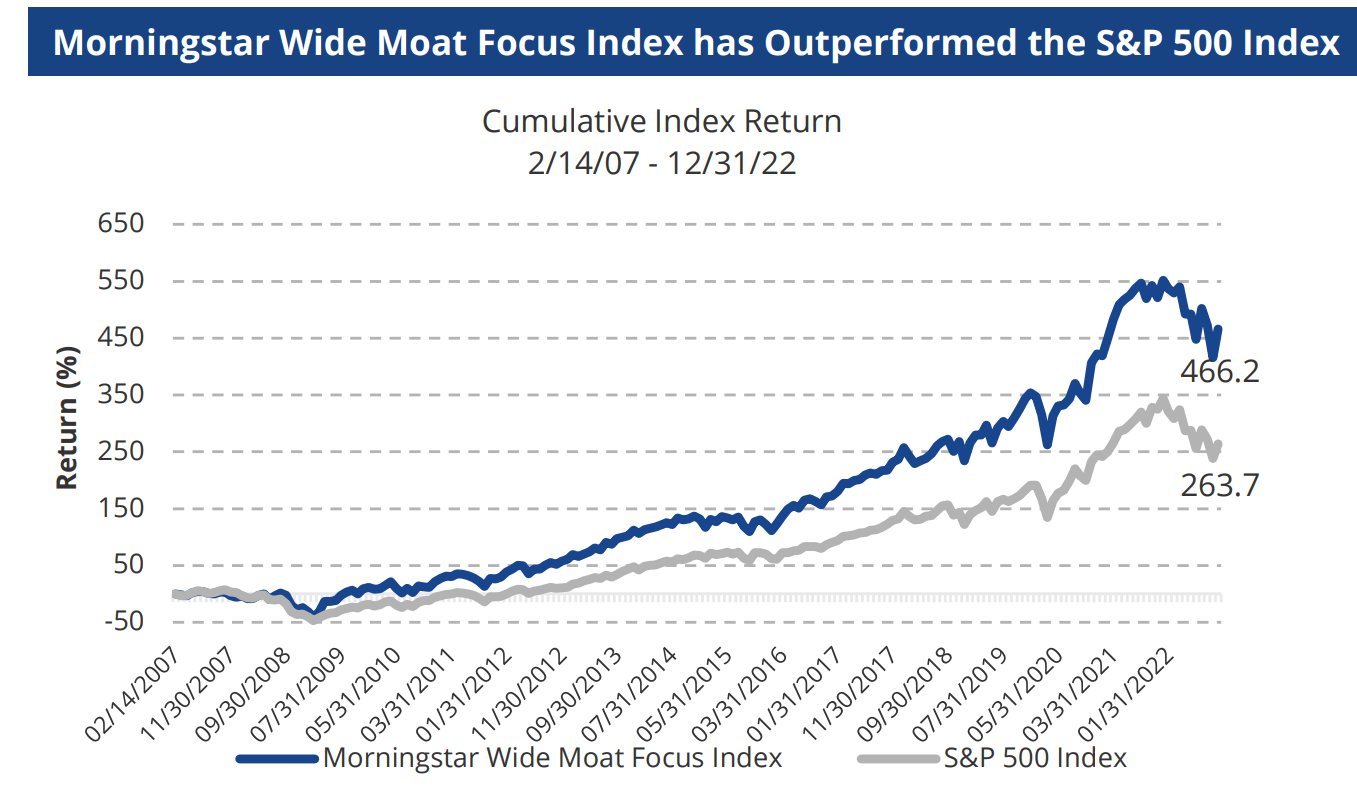

This is the performance of Morningstar’s Wide Moat Focus index vs. the S&P 500 from 2007 to 2022—significantly outperforming.

The width of the moat also matters. In the short term, the difference between a wide and narrow moat business is not that large. However, when you look at a 10-year annualized time horizon, the wide moat companies outperform the narrow moats more significantly.

What becomes more evident the longer the time horizon is, is that No-Moat companies perform poorly. As a result, we do not invest in companies that don’t have any form of moat.

Want a deeper breakdown of the framework we use for analyzing a company’s moat? Read our full article here:

4. Growth – Predictable, Diversified, Durable

Without growth, even the best businesses stagnate. But not all growth is created equal.

We focus on companies where growth is:

Steady and predictable rather than volatile.

Diversified, coming from multiple revenue streams, geographies, or customer segments.

Organic, showing that demand exists without relying solely on acquisitions.

Backed by a long runway, ideally a decade or more of market opportunity.

Durable growth compounds both earnings and investor confidence.

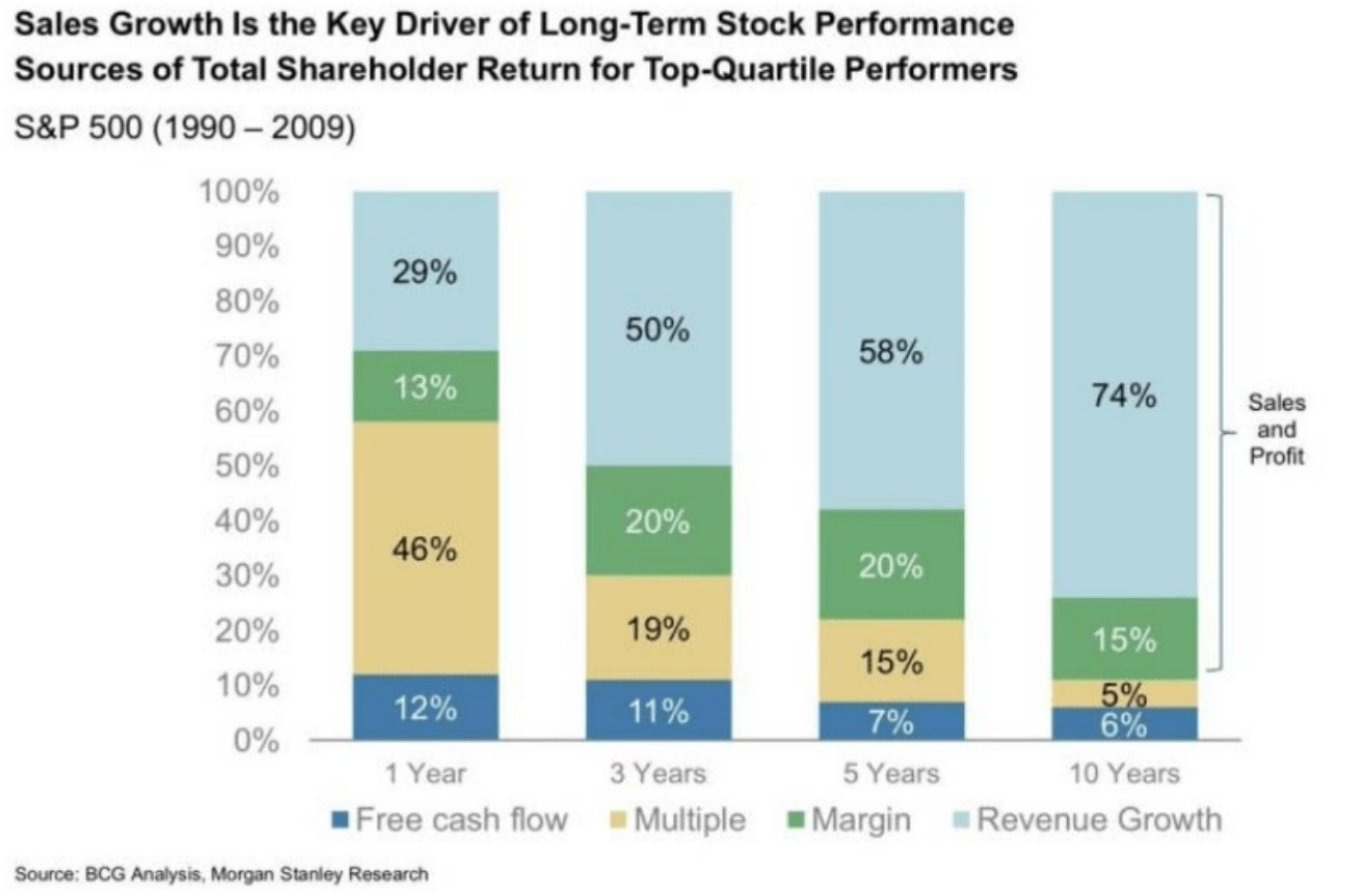

In a study conducted by BCG and Morgan Stanley, growth was the number one driver of long-term (10-year) stock market returns. Revenue growth is the single most important factor. This is why we prefer fast-growing quality over slow growers.

Read more about what growth you should look for in a business:

5. Risk Factors – Resiliency Over Cyclicality

Investors often underestimate risk. Quality investing means selecting businesses that remain profitable through tough times.

Our ideal profile:

Companies that are not highly cyclical and don’t collapse when economic conditions tighten.

Low exposure to disruptive regulation or technological obsolescence.

Healthy balance sheets with manageable debt, strong cash flow, and solid liquidity.

When recessions hit, resilient businesses not only survive but often emerge stronger. This is because when other companies have to negotiate with the bank due to insolvency, these kinds of businesses can invest in growth. This can be taking advantage of a competitor losing ground, or cheap acquisitions available due to no one else having the capital to invest during these hard times.

You can’t eliminate risk when investing in businesses, but you can have a strategy that minimizes the risk of permanent capital loss.

6. Valuation – Paying a Fair Price for Quality

Even the best business can be a poor investment if bought at the wrong price. Valuation is the final filter.

We aim for:

Entry prices that provide a margin of safety, even if growth assumptions are slightly off.

Businesses trading at a valuation that allows compounding of shareholder returns of +15% annually, not just great stories.

Patience: waiting for pullbacks or market overreactions to buy into long-term winners.

As Warren Buffett said,

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Buying a business at 10 times earnings is better than buying a business at 30 times earnings, all else equal (It is basic logic).

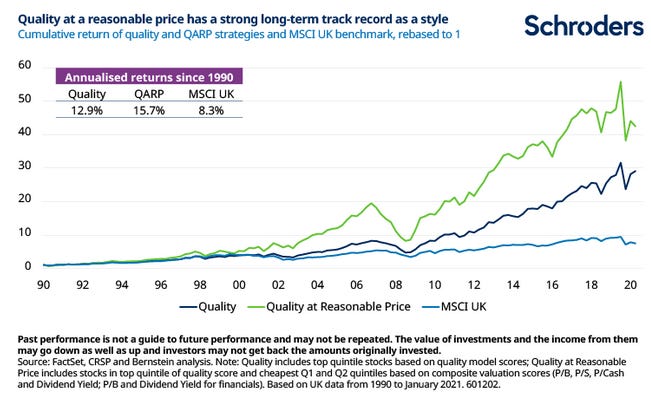

From a quality lens, we have specific data from Scroders on a pure Quality-based investment style vs. a Quality at a reasonable price (QARP) investing style.

As you can see from the chart below, the difference is significant over 30 years:

Quality style: 12.9%

QARP style: 15.7%

Therefore, we focus on buying growing quality businesses when they trade at reasonable valuation levels.

Learn more about when to pay up for quality companies here:

Closing Thoughts

The 6 Pillars of Quality Investing — Management, Business Model, Competitive Advantage, Growth, Risk Factors, and Valuation — form the backbone of our portfolio construction.

By filtering every potential investment through these lenses, we maximize our chances of owning the rare companies that can compound wealth steadily over the next decade.

That’s the essence of durable, quality growth investing.

How I Allocate Capital

“We don't diversify for the sake of it. We concentrate where we have the highest conviction.”

Portfolio Construction Principles:

Concentration: Typically 5–15 core holdings

Position Size: One position max 15% of portfolio (Can grow beyond this organically, but I won’t add more after this point)

Sector-agnostic: But biased toward capital-light compounders in technology, consumer products, and healthcare.

Cash as optionality: I will hold cash when I can’t find quality at a fair price

No derivatives or leverage

When will I sell a stock?

A sale of a stock will be triggered by:

Material deterioration in the investment thesis

Valuation excess (Well above reasonable levels)

Superior alternatives with +3% expected CAGR.

When will I buy a stock?

A purchase of a new position can be triggered by:

An event that temporarily sends the stock price down due to fear and uncertainty.

Overall market drawdowns that drive fear and hence provide attractive entries into quality compounders.

When the current valuation does not match the quality of the business and the future growth prospects.

📈 My View on Valuation

Valuation work is a tool to reduce the risk of overpaying for a great business.

I use multiple lenses:

Current Price-to-Earnings (PE) vs. Historical levels

Free Cash Flow yield (FCF Yield) vs. history

Discounted Cash Flow ranges (3 scenarios for growth)

Owner earnings and payback time

I’m willing to pay up for quality, but I won’t overpay.

⚖️ Risk Management

I don’t define risk as volatility — I define it as permanent capital loss

I avoid leverage, speculative business models, and binary outcomes (high-risk bets).

I focus on business quality and downside protection

🧠My Edge

My edge is:

I combine product management insight, business leader operating intuition, and deep business analysis to pick my companies

I write to think clearly, and I invest publicly to stay accountable

I’m not optimizing for AUM or marketing. I’m optimizing for returns and alignment (I invest 80% of my net worth in the Quality Growth Portfolio)

I only invest in companies I’d be happy to own for the long term

What You Can Expect From Me

Monthly fact sheets for the portfolio—discussing performance and recent activity.

Portfolio updates when I decide to buy or sell a company in the portfolio.

Investment cases as high conviction ideas emerge.

Transparency—I share the good, the bad, and the ugly. Investing is a tough game to be in; there will be periods of decline.

📚Influences & Intellectual DNA

Fundsmith / Terry Smith – Focus on ROCE and quality discipline

Chuck Akre – The compounding “three-legged stool”

Pat Dorsey – Moats as central to long-term returns

Nick Sleep – Patience, customer obsession, long-termism

Howard Marks / Buffett / Munger – Margin of safety, temperament, rationality

Final Word

This manual is a compass. It’s here to protect us — from noise, from fads, from our own impatience. It’s what I’ll return to when the market is panicked, euphoric, or irrational.

I invite you to judge me not by short-term performance, but by consistency in applying these principles over the next 10+ years.

I share my full portfolio and moves with premium subscribers only. Join us here:

Ready to take the next step? Here’s how I can help you grow your investing journey:

Go Premium — Unlock exclusive content and follow our market-beating Quality Growth portfolio. Learn more here.

Essentials of Quality Growth — Join over 300 investors who have built winning portfolios with this step-by-step guide to identifying top-quality compounders. Get the guide.

Free Valuation Cheat Sheet — Discover a simple, reliable way to value businesses and set your margin of safety. Download now.

Free Guide: How to Identify a Compounder — Learn the key traits of companies worth holding for the long term. Access it here.

Free Guide: How to Analyze Financial Statements — Master reading balance sheets, income statements, and cash flows. Start learning.

Get Featured — Promote yourself to over 15,000 active stock market investors with a 42% open rate. Reach out: investinassets20@gmail.com

https://open.substack.com/pub/buysidealpha/p/welcome-to-my-substack?utm_source=share&utm_medium=android&r=69w6c1

Just WHO is this going to help? Be honest given the current market and party capture.