👑5 Founder-Led Businesses

Founders outperform the rest 🧠

Summer Deal on Essentials of Quality Growth Investing for the next 10 purchases (-40%)

A multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders. The book covers:

- How to find quality compounders 📈

- How to value quality companies ⚖

- The importance of return on capital and free cash flow 👑

- Portfolio management with a comprehensive checklist 🧾

Hi there! 👋

Ever wondered why we are so obsessed with founders and founder-led businesses in the business world?

In this article, we will tell you what you need to know about founders and give 5 examples of founder-led businesses.

3 primary terms that somewhat intertviens:

Founder-led (The founder is still the CEO with a large stake in the business)

Family-led (A family owns the business with multiple generations of executives being from that family)

Owner-operator (The majority owner of the business runs the business - this person does not need to be the founder)

Let’s start with the data… 📊

Founder led businesses

Ruediger Fahlenbrach (That is a mouthful) researched founder-led CEOs in 2009.

He found that the founders’ primary aim was to create shareholder value rather than destroy value through acquisitions.

His research shows that founder-led businesses outpaced “other companies” by a wide margin:

The same result is extracted from the Australian market (With a shorter time frame):

Family-owned businesses 👨👩👦👦

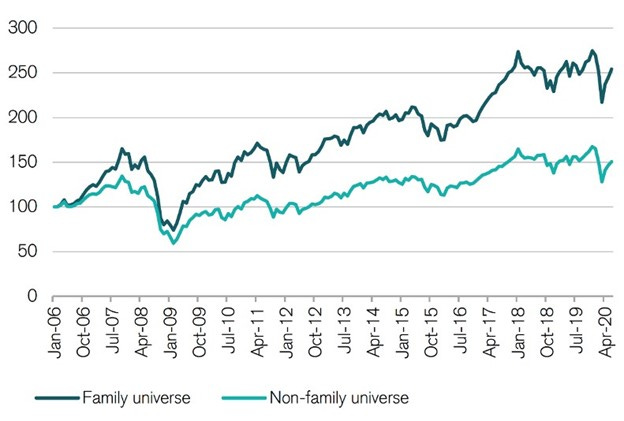

Henry McVey looked at family-owned businesses in 2005.

He found that family-owned businesses ignored short-term quarterly numbers to focus on the long-term value creation.

This led to a major outperformance because of I) lower risk-taking in the short term, II) greater vision and investment for the long term:

Owner-operator 👴🏽

The closest we get to a valid study on owner-operators is an interesting study by Joel Shulman (2012).

The study looked at the stock performance of companies managed by billionaires (Think Jeff Bezos, Elon Musk, Reid Hoffman, Mark Pincus).

This study overlaps with the founder-led study discussed earlier, but in this case, we only look at the successful ones (billionaires).

The study showed that businesses managed by billionaires outperformed the market by 7% annually from 1996 to 2011.

I guess the billionaires know what they’re doing…

Now, let’s dig deeper, WHY do founders, owners, and billionaires outperform the rest?

Factors that support outperformance 📈

Incentive alignment

“Show me the incentive, and I will show you the result” - Charlie Munger.

Founders and owners often have their life savings invested in the shares of the business.

This allows them to think long-term and make decisions that are friendly to the shareholder (because they are a large shareholder themselves).

Decisive decision making

Bureaucracy is something that reduces business performance.

The more middle managers, board approvals, and overall steps a business needs to take to make a decision, the slower the business will move.

Bureaucratic businesses will almost never make a radical shift, because the business is run by “politicians” who care more about their job title than the long-term prospects of the business.

Founders on the other hand are able to make radical decisions and overrule the bureaucracy.

Just think about Mark Zuckerberg’s decision to invest billions into the Metaverse.

And Elon Musk’s decision to create the cyber truck (and all the giga factories globally).

Usually, these decisions would not happen because the bureaucracy would shut it down for some “logical” reason.

Founders can take the business in a direction to fulfill their long-term vision.

Founders (& billionaires) are often exceptional at what they do

Think about Steve Jobs, Bill Gates, Elon Musk, Warren Buffett, and Marcos Galperin.

These founders are (or were) exceptional at their craft.

These are special individuals molded by the pressures of creating a business from scratch.

This is not something Business Schools will teach you, this is something you possess (most likely from childhood or adolescence).

Having these exceptional people run the business you invest in, is a major advantage.

They will not only outsmart the competitors, but they will allocate capital to the highest-performing projects to grow the business over time.

The names mentioned are definitely “Outsider CEOs”, but it is also true for smaller founders.

If you manage to successfully grow a business to millions of dollars per year, you have something special (usually).

Now, let’s jump into the 5 business examples 👇

5 Founder-led Businesses 💡

MercadoLibre MELI 0.00%↑

Founded in 1999, by Marcos Galperin (CEO), Mercadolibre is the dominant e-commerce and fintech giant of Latin America.

Growth 5Y CAGR:

Revenue +57.88%

Free cash flow per share: +91.72%

Earnings per share: 124.12%

Quality:

ROIC: 14.3%

ROE: 41.6%

Gross margin: 56.5%

Operating margin: 14.6%

Valuation

Forward PE: 43.9

Forward free cash flow yield: 3.2%

Adyen $ADYEY

Adyen was founded in 2006 by Pieter van der Does and Arnout Schuijff, now the CEO and CTO, respectively.

Adyen is a Dutch payment company with the status of an acquiring bank that allows businesses to accept e-commerce, mobile, and point-of-sale payments.

Growth 5Y CAGR:

Revenue +36.05%

Free cash flow per share: +36.55%

Earnings per share: +39.19%

Quality:

ROIC: +8.4%

ROE: +25.1%

Gross margin: 61.9%

Operating margin: 41.9%

Valuation

Forward PE: 43.88

Forward free cash flow yield: 2.2%

Fortinet FTNT 0.00%↑

Founded by Ken Xie (CEO) — Fortinet is a market leader in the Cyber security sector.

Growth 5Y CAGR:

Revenue +23.54%

Free cash flow per share: +25.7%

Earnings per share: +30.88%

Quality:

ROIC: +20.4%

ROCE: +34.6%

Gross margin: +77.1%

Operating margin: +23.8%

Valuation

Forward PE: 33.4

Forward free cash flow yield: 4%

Intercontinental Exchange ICE 0.00%↑

Founded and CEO Jeff Sprecher — ICE operates global financial exchanges and clearing houses.

Growth 5Y CAGR:

Revenue +10.78%

Free cash flow per share: +9.24%

Earnings per share: +4.52%

Quality:

ROIC: +2.5%

ROCE: +8.4%

Gross margin: +100%

Operating margin: +48.6%

Valuation

Forward PE: 21.9

Forward free cash flow yield: 5.1%

Paycom PAYC 0.00%↑

Founder and CEO Chad Richison — Paycom is an online payroll service business (SaaS) from the US.

Growth 5Y CAGR

Revenue +23.52%

Free cash flow per share: +20.65%

Earnings per share: +27.15%

Quality

ROIC: +11.6%

ROCE: +33.3%

Gross margin: +86.6%

Operating margin: +33.1%

Valuation

Forward PE: 18.2

Forward free cash flow yield: 3.7%

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +8.000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

Gates gets a lot of credit, but Paul Allen was no slouch either.

The Bollore family is also often overlooked.

Where would the Mars family be if they traded publicly?

The Campbell Soup clan on the other hand can’t seem to get out of their own way.

Thanks for an interesting post. Additionally, I think there is an ETF (I know, surprising) that holds founder/family run companies.

Thanks for introducing me to ICE. Excellent business characteristics and management.