💎Asset-light businesses are superior

<5 min read

Love this infographic?

Carbon Finance sends out a weekly newsletter with the most important investing infographics, insights, and insider trades.

It’s completely free and only takes 5 minutes to read.

Join thousands of investors and automatically subscribe with the button below 👇

Asset-Light Businesses Models are Superior 👑

Lawrence Cunningham (The Author of Quality Investing & Quality Shareholders) once said: "Asset-light industries are attractive since they require less capital to be deployed in order to generate sales growth"

This means that asset-light businesses can grow without large investments. As an example, if you run a telecom business, you have to build out costly infrastructure to get access to customers and build cash flow. This requires a lot of capital upfront, and you might not see a return on that capital before 5-10 years.

An asset-light business lets you acquire more customers, and sell more to your existing customers without large capital investments. This is why SaaS (Software as a service) businesses are so attractive investments. The incremental cost of a new customer is very low. It does not require huge upfront investments. This also allows these businesses to use more capital to develop their products and utilize smart marketing strategies to attract more customers.

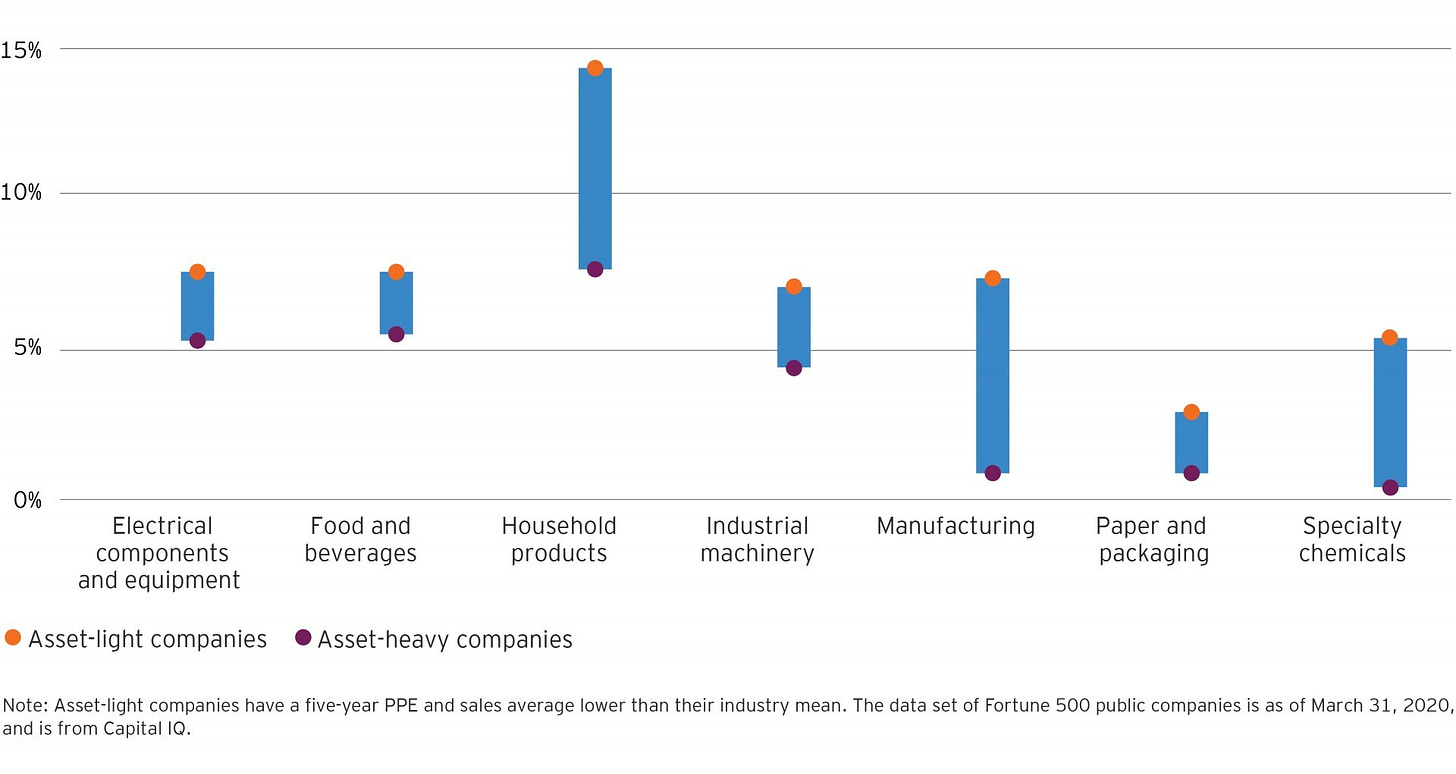

EY did a study comparing the total shareholder return of asset-light businesses to their asset-heavy counterparts in different sectors:

As you can see, the asset-light business models did significantly better than the asset-heavy ones. The return comparison is total shareholder return (TSR).

Note: There are many examples where an asset-heavy business model can be superior. It creates a natural barrier to entry. If you need billions invested to even get into the game, way fewer competitors will be attracted to compete with you. This is why we must understand the business model and competitive advantage in-depth before making decisions.

Why do capital-light business models promote better returns?

The more of the total business you want to keep in-house, the more work it takes to maintain and develop the different systems and functions. By outsourcing elements of the business that is not part of the “core business”, companies are able to focus their time and attention on elements that are important for TSR:

Market/Customer opportunities for increased sales

Innovation through collaboration and increased go-to-market speed

Less capital is tied up in the business, which increases margins and provides more cash that can be used to reinvest into promising projects

Companies utilize asset leverage to get a better return on capital employed (ROCE)

How to identify an asset-light business model

For our example, we will use two ratios to determine if a business is capital-light:

Capital Expenditure/Sales should be lower than 10%

Capital Expenditure/Operating Cash flow should be lower than 20%

Note: The lower these numbers, the better.

Capital Expenditure / Sales

Let’s use Fortinet as an example: First, we find Fortinet’s revenue for 2023 in the Income Statement (Yahoo Finance). Revenue for 2023 = $5.3 billion

Next, we need to find the capital expenditure figure, located in the Cash Flow Statement:

Capital Expenditure for 2023 = $204 million or $0,2 billion.

Now that we have both figures, we put them together:

Capex/Sales = 0.2 (CapEx) / 5.3 (Revenue) x 100 = 3.77%

Capex/Sales of 3.77% is well below 10% and within our range for a capital-light business.

Capital Expenditure / Operating Cash Flow

Now let’s look at the next ratio. Capex / Operating Cash Flow. Here you can find both in the Cash Flow Statement:

Fortinet’s 2023 operating cash flow = $1.935 billion. Now, let’s put it together:

Capex / OCF = 0.2 (CapEx) / 1.935 (OCF) x 100 = 10.33%

Fortinet is below our requirement for both sales (<10%) and operating cash flow (<20%, which means it is considered a capital-light business.

8 Examples of capital-light business models:

Adobe

Paycom

Fortinet

Admicom

Mastercard

Novo Nordisk

Meta Platforms

Constellation Software

All this and more is covered in Essentials of Quality Growth.

Winter Sale: Get -25% off Essentials of Quality Growth Investing!

The book is studied by +250 investors worldwide.

Read more here.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

Promote yourself to +6,000 stock market investors (46% open rate) — Contact us via: investinassets20@gmail.com

Asset light business can be good providing they are available in the market and are trading at a reasonable valuation. See Candies acquired by Berkshire Hathaway in the mid 1970s was a classic example. Buffett and Munger paid about $25mn for it and over the last five decades it has generated up to $ 1bn in capital returned back to Omaha. However, as size of assets increased, asset light businesses which would move the needle for BRK were not available at a fair price. BRK invested in capital intensive businesses such as Utilities and Railways,