Top 5 Buys for January 📊

<5 min read 🧠

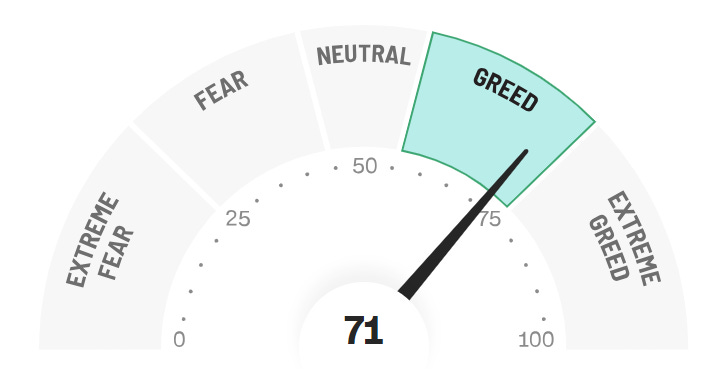

The market is hovering between greed & extreme greed

As of this writing, the Fear & Greed index has hit “Greed”. This indicates that market participants are taking risks to achieve better returns. In my view, this is not the best time to be investing in the market. I’d rather wait for temporary fear to set in before investing.

The S&P 500 is close to its all-time high after a rapid run over the last few months. I’m not trying to time the market, but I do realize that the market is volatile, and I’d rather take advantage of volatility to the downside than force an investment after a huge run-up (especially if the run-up is not backed by fundamentals).

That said, there are always opportunities in the market. When some stocks rise quickly, others lag behind or even decline due to temporary issues or a range of different factors.

This provides possible entry points for us as investors.

I have previously shared with you my investable universe:

And my watchlist contains 20 companies I follow closer:

Top 5 Buys

Based on this research I will share with you every month what quality companies I believe are priced fairly for that specific month. I will try to not use the same examples each month. However, you must understand that even if I believe the price is fair at the moment, I will not initiate positions at these levels unless you as a premium subscriber are notified of it. This should not be considered investing advice, but inspiration to do further due diligence into the stocks mentioned.

What is a good buy?

I have outlined in my book and my valuation cheat sheet how I value businesses. There are several methods one can use, but I like to keep it simple. First I want to understand the business, how it makes money, the different business segments, and the growth potential for each segment or product/service. Then I look at historical values for PE, PS, PB, PFCF to get an idea of what the company has traded at, as well as the development of margins and capital efficiencies over time. I then use a discounted cash flow analysis and a reverse DCF analysis to determine what I believe the company will return.

Here are the top 5 buys for January from the Quality Growth universe:

If you want more information about the paid investing service, read here:

Google GOOGL 0.00%↑

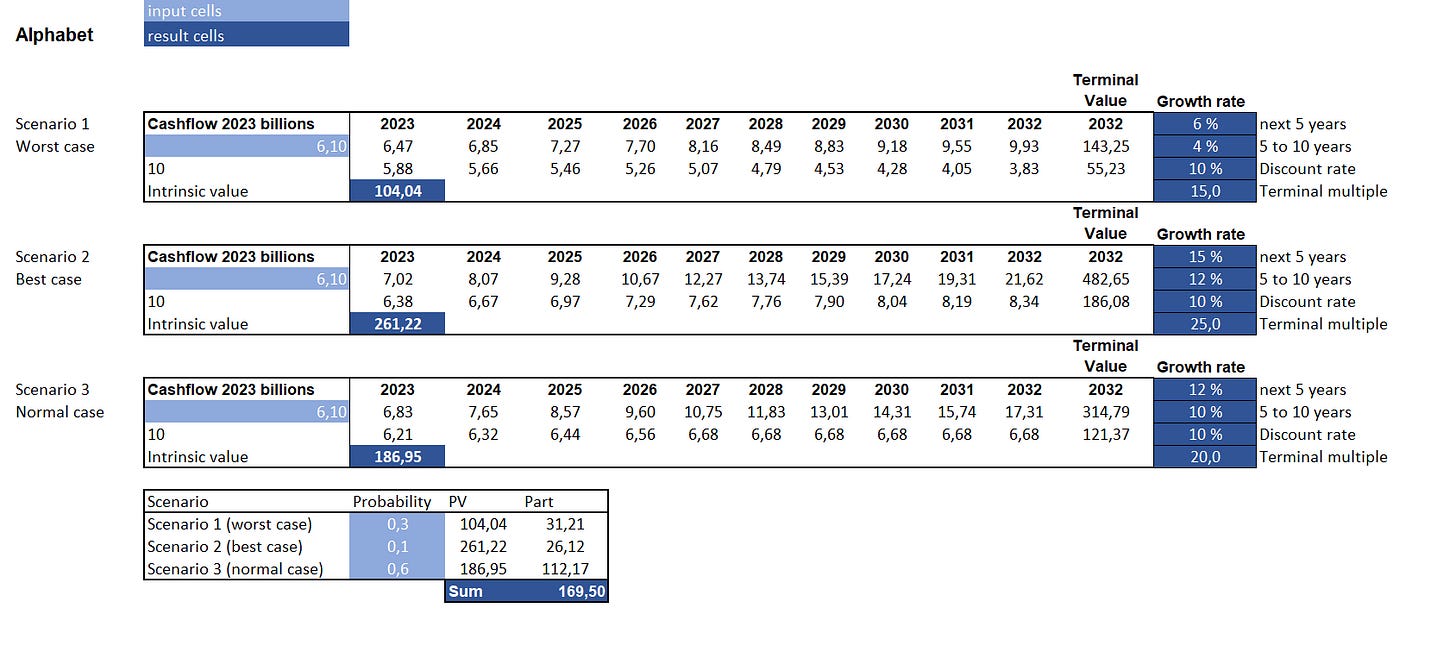

Google is a market leader in web search & video content. The founders are still involved, have competent management, and solid fundamentals, and are currently trading at a fair price. The fundamentals:

I use the TTM free cash flow per share of $6.1 as an input.

Using 3 different scenarios for our discounted cash flow analysis:

Worst case: 6% growth for the next 5 years, and 4% growth the following 5 years, with an exit multiple of 15 times free cash flow per share

Best case: 15% growth for the next 5 years, and 12% growth the following 5 years, with an exit multiple of 25 times free cash flow per share

Normal case: 12% growth for the next 5 years, and 10% growth the following 5 years, with an exit multiple of 20 times free cash flow per share

Intrinsic value estimate of $169.5 per share, versus today’s (as of this writing) price of $138.8. This suggests a 22.12% upside in the stock from current levels. Keep in mind, that a DCF analysis is only as good as its inputs. My inputs might be too conservative, but I’d rather keep conservative inputs to create a margin of safety than overestimate the growth potential of an investment.

At the current price, we can expect a 14% annual return from Google. Which is a solid return for a wide-moat business.

Fortinet FTNT 0.00%↑

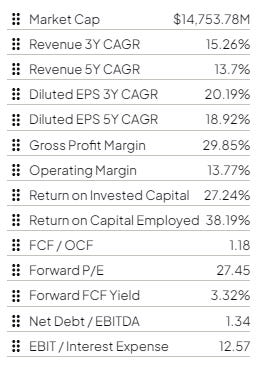

Fortinet is a market leader in the cybersecurity space. The business is founder-led, has fantastic fundamentals, and is currently trading at attractive levels. The fundamentals:

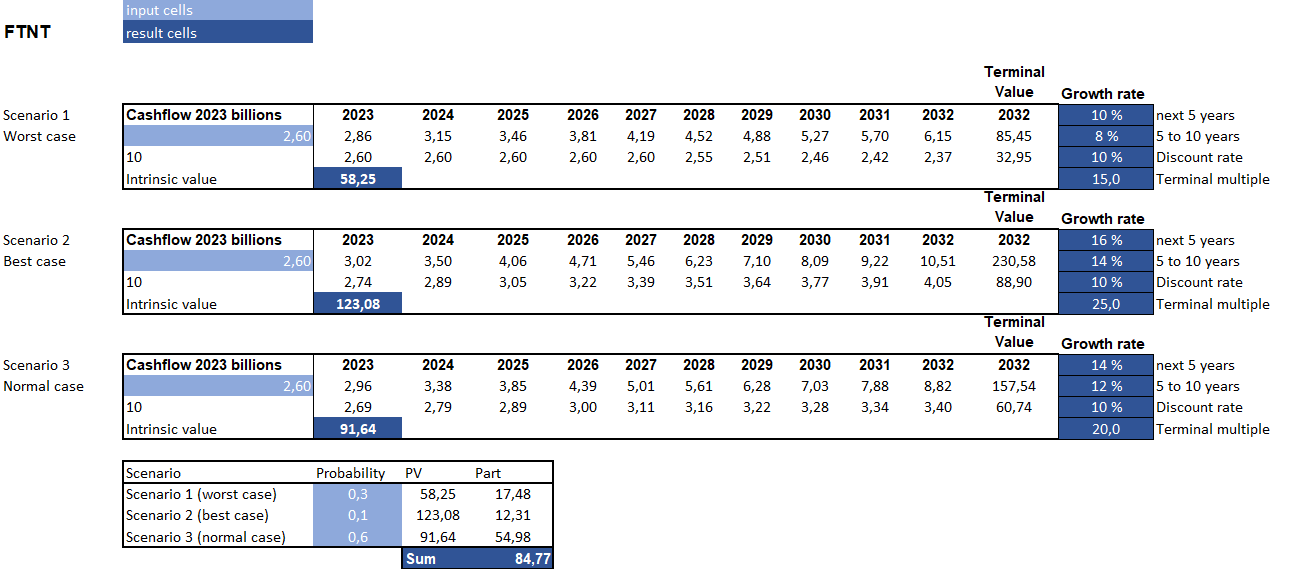

I use the TTM free cash flow per share of $2.6 as an input.

Using 3 different scenarios for our discounted cash flow analysis:

Worst case: 10% growth for 5 years, then 8% for the next 5 years, and an exit multiple of 15.

Best case: 16% growth for 5 years, then 14% for the next 5 years, and an exit multiple of 25.

Normal case: 14% growth for 5 years, then 12% for the next 5 years, and an exit multiple of 20.

Our estimate of the per-share value is $84.77 given the inputs above. The current market capitalization is $62.25 suggesting a 36% upside in the stock if it can continue to grow.

At the current valuation, Fortinet looks attractive. For the Normal scenario, we can expect an above 15% annual return given the growth rates of 14% for the next 5 years.