Portfolio Reveal & New Service👑

Follow my Quality Growth Portfolio💎

Hello Invest In Quality Subscribers!

Get 50% off Essentials of Quality Growth Investing for the next 24 hours: https://investinassets.gumroad.com/l/wgkrip/CUVDLRA

I’ve received countless requests from subscribers to be able to follow my portfolio. I’m vocal about my strategy and what kind of businesses I want to invest in, and this strategy resonates with many of you. So I will start to share my full portfolio and all my buys and sells with my paid newsletter subscribers.

The newsletter will be priced at $12 per month or $100 per year, and you will get the following value:

💎Full access to my quality growth portfolio where I invest 80% of my net worth

📈Monthly factsheets of the portfolio, performance, buys and sells.

🎯Notification in advance, or the same day I buy or sell a position.

🧾Upcoming courses on financial statement analysis and valuations

🏰All my research (Investable universe, ranking, valuations, quality)

👑Weekly breakdowns of quality compounders and valuations

🤵Access to me: I will be available to answer all the questions and concerns my paid subscribers might have about investing

Get a 20% discount forever if you accept this offer in the next 24 hours:

And don’t worry… Free subscribers still get 1 e-mail per week where I break down businesses in the quality universe, write about the great investors, and educate on important investing concepts.

Now, for those of you who are interested in following my portfolio and its performance, it’s time to show it off. But first, let me share my strategy and principles:

Principles & Strategy for the Quality Growth Portfolio

I want to buy great businesses 🏰

I don’t want to overpay for those businesses 📈

And ideally, I’d never sell a position 👑

Buying Companies of High Fundamental Quality

High-quality means:

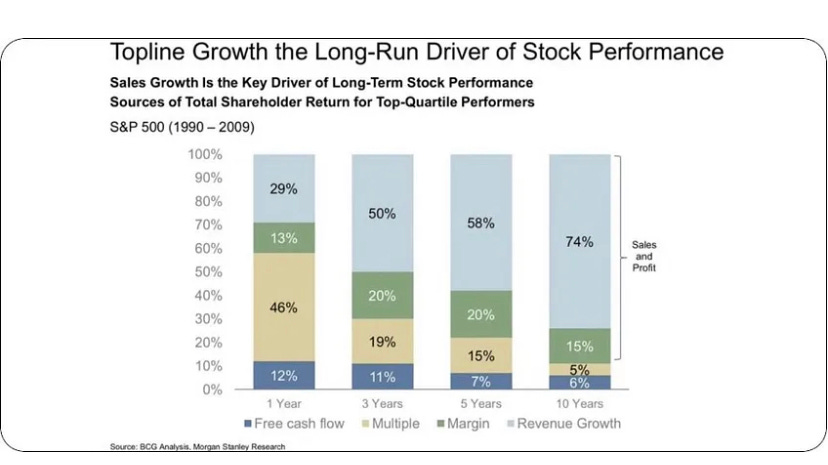

Revenue, earnings, and cash flow growth of more than 10% for the last 5 and 10 years. As we know, revenue growth is the greatest predictor of long-term returns in the stock market:

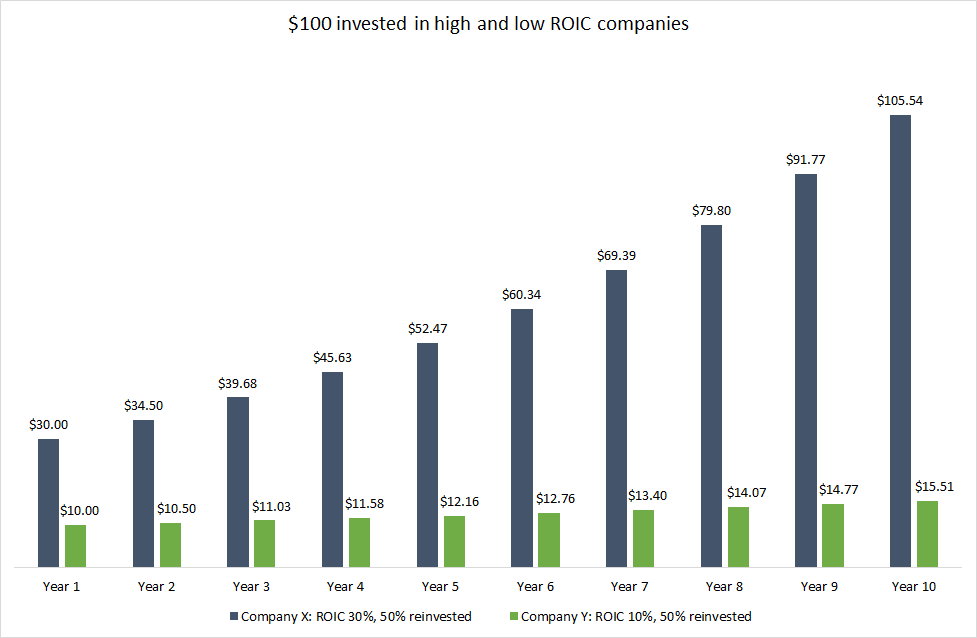

Consistent returns on capital employed above 15%:

Reinvestment rates above 50%

Industry-leading margins, ideally above:

Gross margins: +50%

Operating margins: +15%

Converts most of its earnings into cash, with a +75% FCF conversion (FCF/Net Income)

Interest coverage above 10x

Net debt to FCF below 3

Free cash flow yield above or close to the risk-free rate

Market leaders in attractive industries

I look for businesses that are well-positioned in industries that will grow above average. I want to own the market leader or the market gainer of that industry:

Widening Moat

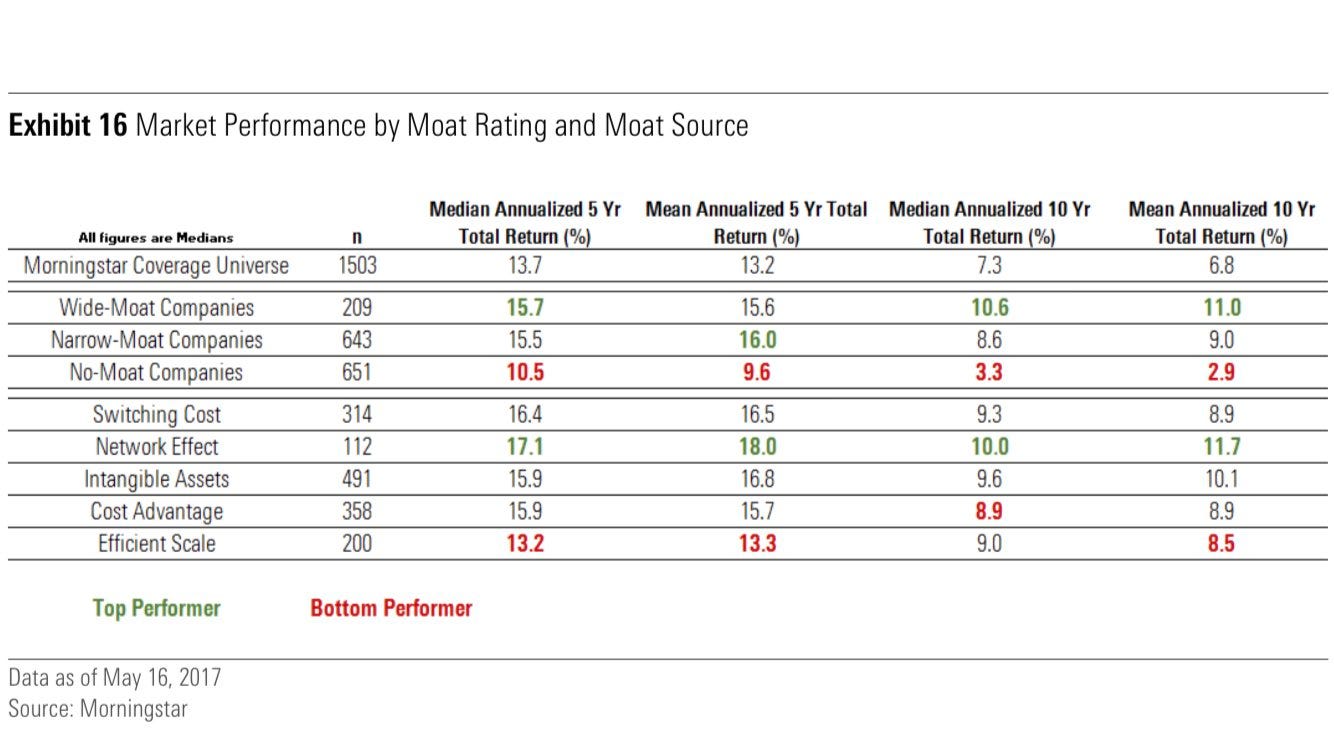

I want the business I own to have a moat that is strong and can withstand competitors for decades. As we know, a company with an economic moat outperforms over the long term:

Capital-light Business Model

I focus on asset-light companies. The kinds of businesses that don’t need a ton of cash reinvested every year just to keep their business running. I stay away from asset-heavy industries.

Competent & Committed Management

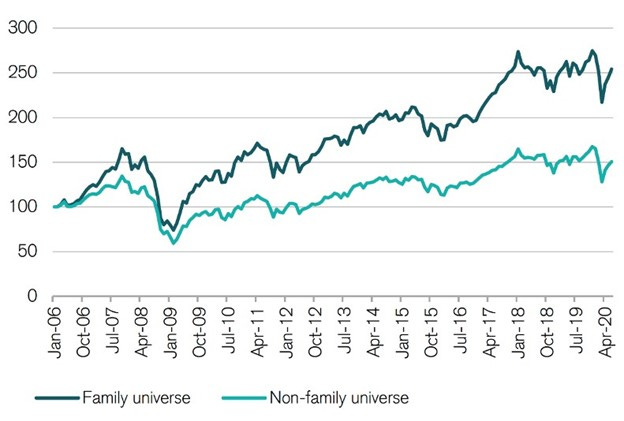

I want competent management with skin in the game. Skin in the game ensures that the management team’s and shareholder’s interests are aligned. Ideally, we get a founder-led business:

If not, we might get a family-owned business where the key management members have deep investments in the company:

Happy employees

I look at how satisfied the workforce is with the company they work for. This can be a good indicator of a good long-term performer:

I also look at the qualitative factors below:

Mission-driven business - Is the vision and mission of the business something that will inspire the employees and set the tone for the corporate culture?

Optionality - Companies that test new ideas out to fulfill their mission. Most may not work, but if only a few do, they will move the needle.

Low Cyclicality - All businesses are cyclical to some degree. But I steer away from businesses that only make their money in “good times”. I want sticky revenue sources, strong brands, and intellectual property that secures cash flows even in bad times.

If you want to learn more about the quality growth investing style, check out my guide: Essentials of Quality Growth — Join more than 200 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

Now, let’s dive into my portfolio, the businesses I own and my performance since the inception of the quality growth portfolio: