3 Quality Growth Stocks to Own 2025 🏆

Quality Growth stocks to own in 2025 🏆

Hello, Investor! 👋

Looking for growth stocks to buy in 2025?

You have come to the right place.

In this article, we’re sharing three exciting growth business opportunities to consider for your portfolio.

Building a Portfolio of High-Quality Stocks 💎

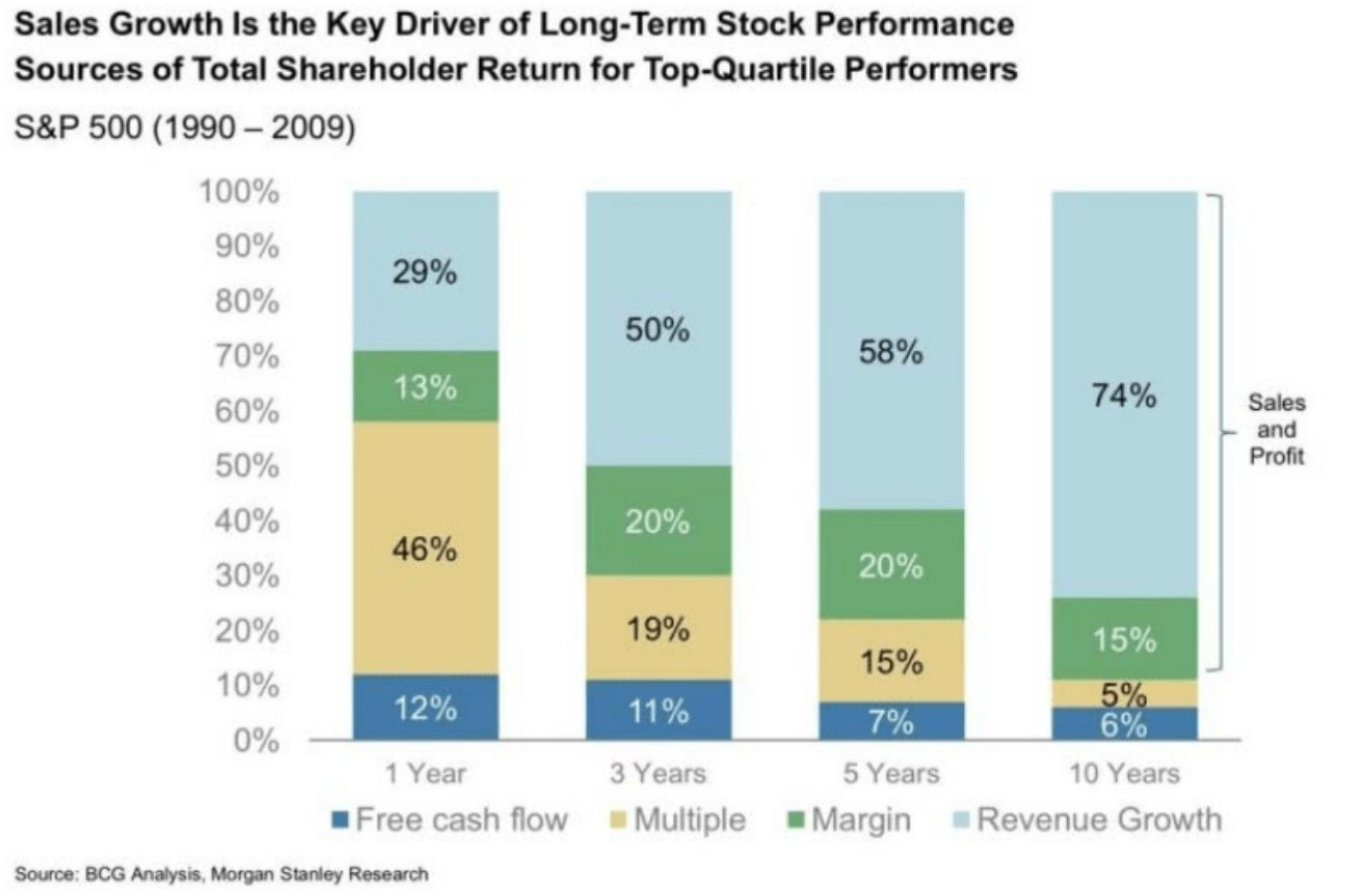

We know that revenue growth is the most crucial factor when it comes to long-term stock gains:

So, the logical thing to do is to find businesses that are growing their top line by more than the S&P 500.

The S&P 500 (Or “the market”), as it is often referred to, has historically been growing its top line by 10.13% (6.37% adjusted for inflation). However, the S&P 500 is expected to grow its top line by 3% - 6%.

So, in this article, we will present 3 great options of quality businesses that are projected to grow their top line by more than 10% in the foreseeable future.

Let’s get into it 👇

1. Evolution AB $EVVTY 🎮

Forward Revenue Growth (2 Years): +12-15%

Long-Term EPS Growth: +13-16%

Why Invest in Evolution AB?

Evolution AB is the market leader in the online gaming and live casino markets.

The company is known for its product innovation and market dominance. Evolution creates higher engagement than any other competitor.

This makes Evolution very attractive for large casinos as it means more revenue in their pockets. It also allows Evolution to take a higher take-rate than competitors.

Evolution has a strong track record, great unit economics for their tables in the live casino category, and a strong client base. They benefit from the global growth of online casinoes with particular growth markets being North America and Latin America.

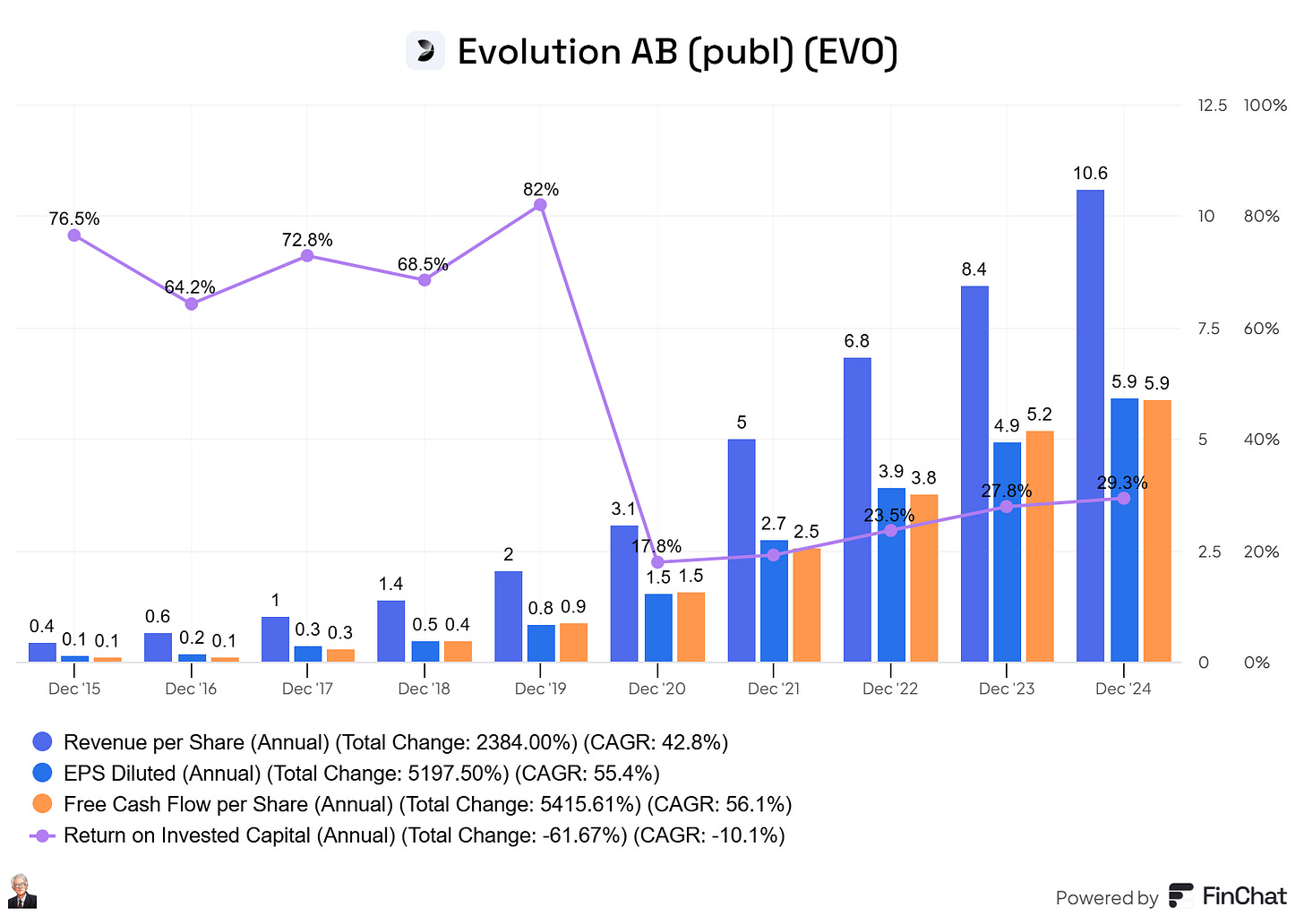

Evolutions’ profitability and growth have been nothing but amazing:

Key Financials:

Revenue per share (10-year CAGR): +42.8%

EPS Diluted (10-year CAGR): +55.4%

Free Cash Flow per Share (10-year CAGR): +56.1%

Return on Invested Capital (ROIC): 17.8% → 29.3%

Valuation

Not only is Evolution set to grow above 10% annually in the foreseeable future, but it is also trading at all-time low multiples of 12.67x forward earnings:

Want to read more about Evolution AB? Check out our analysis here:

2. MercadoLibre MELI 0.00%↑ 🛒

Forward Revenue Growth (2 Years): +23-25%

Long-Term EPS Growth: +25-30%

Why Invest in MercadoLibre?

MercadoLibre is the Amazon of Latin America. The business is dominating multiple digital markets in Latin America: E-commerce, fintech, and logistics solutions.

The e-commerce platform and its financial services (MercadoPago) are experiencing significant growth. Mercadolibre is well-positioned to capitalize on increased internet penetration and digitalization for the middle class in Latin America.

Despite heavy FX-headwinds, Mercadolibre keeps delivering impressive growth:

Key Financials:

Revenue per share (10-year CAGR): +44.6%

EPS Diluted (10-year CAGR): +35.8%

Free Cash Flow per Share (10-year CAGR): +50.1%

Return on Invested Capital (ROIC): -12.8% → +15.5%

Valuation

Mercadolibre is set to grow at more than twice the rate of the S&P 500. A fast grower for sure.

When we look at Mercadolibre’s price-to-sales ratio, it is well below its historical median of 9.55x sales and currently at 6.85x sales.

This is close to its all-time low levels of ~6x.

Want to read more about Mercadolibre? Check out our analysis here:

3. Constellation Software (CSU) 💻

Forward Revenue Growth (2 Years): +18-20%

Long-Term EPS Growth: +16-18%

Why Invest in Constellation Software?

Constellation Software is a conglomerate that invests in mission-critical software companies with high stickiness to the businesses they serve.

This ensures that the businesses they acquire have a moat (despite being small) and that they often can buy these at a fair price to free cash flow compared to fast-growing software companies.

Constellation acquires and optimizes these businesses to create value over time. They famously have a high hurdle rate, only allowing investments with a +20% IRR into their portfolio.

The portfolio includes multiple small and medium businesses in vertical markets, providing software solutions to industries like healthcare, finance, and retail.

The business generates organic growth while strategically acquiring high-quality software firms.

This makes Constellation a prime candidate for long-term investors looking for a reliable compounder.

The stock has compounded by 36.4% since its inception:

Key Financials:

Revenue per share (10-year CAGR): +20.8%

EPS Diluted (10-year CAGR): +17%

Free Cash Flow per Share (10-year CAGR): +21%

Return on Capital Employed (ROCE): 35.2% → 21.7%

Valuation

Constellation software is set to grow significantly faster than the S&P 500.

Constellations forward price to free cash flow is at 27.54x. This is in its historic high range. This turns out to be a FCF yield of 3.63% (The current “risk-free” rate of the US 10-year treasury bond is at 4.3%).

Constellation is not a cheap stock, but it is a fast grower with many great quality characteristics.

Want to read more about Constellation Software? Check out our analysis here:

Building a Winning Portfolio in 2025

Investing is one of the hardest and most intellectually challenging exercises one can do.

Most of us will fail to beat the market.

Even worse, most of us will lose money in the market (Even if we spend hours every week trying to make money).

Some of us will lose money because we’re unlucky, and others will lose money because of ignorance.

There are just so many information sources out there, how do you know what is good information and what is just noise?

Here at Invest In Quality, we focus on a “no-nonsense” approach to investing.

We focus on fundamentals and look at business performance over the long term. Not in a single quarter or two like the rest of the financial world.

We know how hard the journey can be for investors, and we want to be your helping hand in making hard investing decisions that set you up for financial freedom in the future.

Many investors already trust us to provide high-quality, actionable information:

The Quality Growth Portfolio, the portfolio has returned 102.5% in a little over 2 years. That is a compounded annual growth rate of ~33%.

As a bonus, you will get access to the Top 15 Buys Report.

See you on the other side!

Still not convinced? That’s OK. The service is not for everyone. You can read more in-depth about the service here:

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +14.000 stock market investors (42% open rate) — Contact us via: investinassets20@gmail.com

I own everyone except EVO. How do you compare Evo to betsson?

In my view they are pretty the same but betssons valuation is cheaper.