Top 15 Buys 2025 🚀

The best quality stocks to own in 2025 💎

Hi Partner 👋

Today, we are providing a top 15 list for 2025.

The Top 15 List for 2025 🏆

Certain companies in our investable universe stand out due to their high quality, steady cash flows, competitive advantages, and attractive valuations.

From e-commerce giants and luxury brands to cybersecurity and tech conglomerates, these 15 companies are shaping the way we live, shop, and interact with the world.

To get a better understanding of the different factors that go into scoring the business, we will use our Quality Growth system to score the different companies:

Let’s get into it 👇

#15 Qualys: Securing the Digital Realm🦠

Qualys stands out in the cybersecurity domain with its cloud-based solutions that help businesses protect their IT infrastructures. Their integrated approach to security offers real-time insights and automated updates, ensuring robust protection against cyber threats in an increasingly digital world.

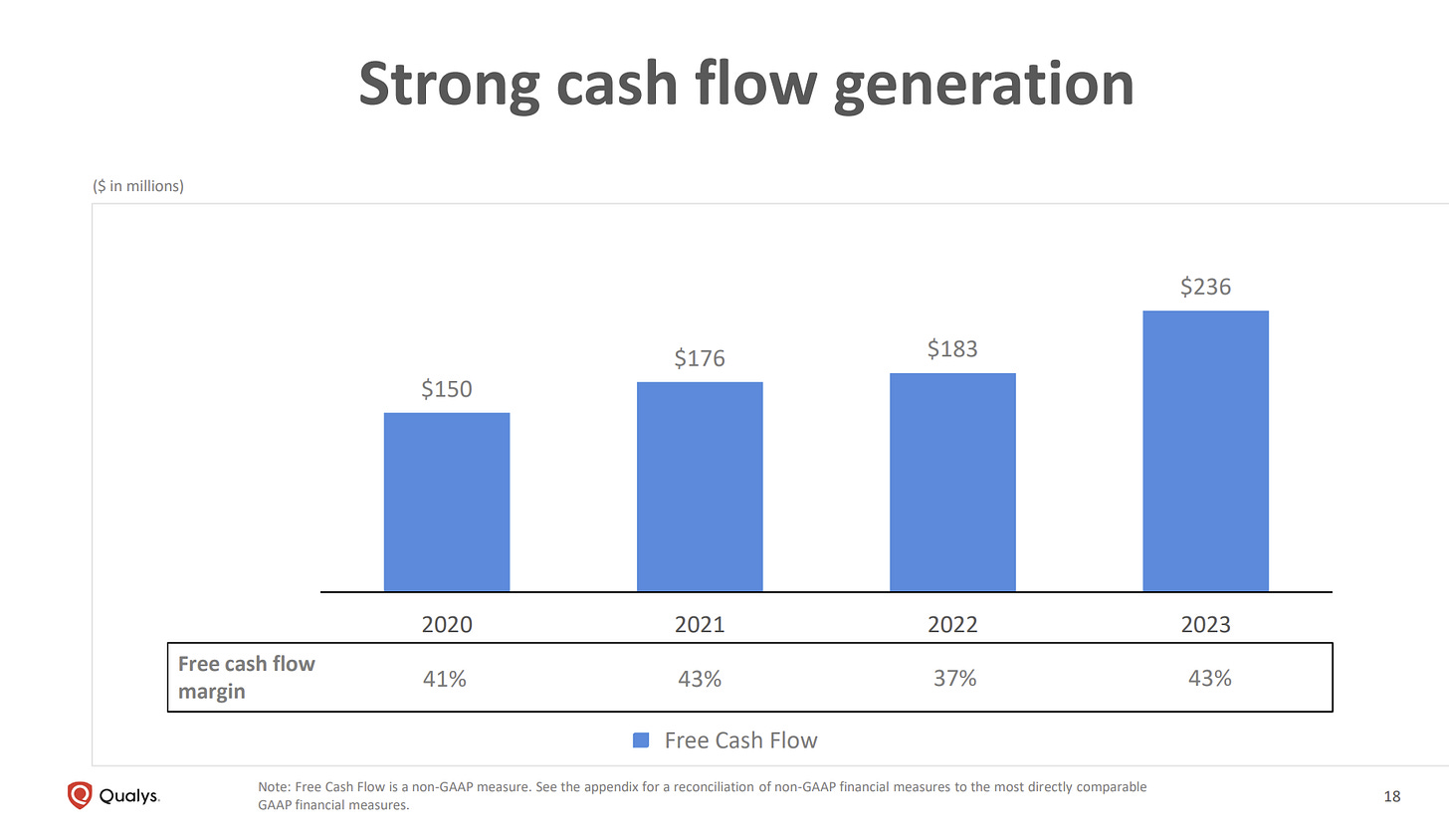

The business boasts superior margins and cash flow generation, with an attractive ROIC and growth rates.

Qualys have contracted quite a bit from its all-time highs. It is now trading at 23.8x NTM earnings vs. its 2022 high of 46x.

Valuation and my buy area

The current price of Qualys is $143

Qualys is expected to grow its long-term EPS by 4.6% annually. Considering the demand for Qualys’ products and its value proposition of combining multiple must-have services in one platform, we believe this estimate is very modest.

Using the free cash flow per share of $5.9 as a proxy for the DCF below.

Current price per share: $143

Intrinsic value estimate per share: $172.48

Suggested upside: +20.6%

CAGR from normal scenario: 13%

Quality scoring:

Management: 7/10

Business Model: 7/10

Competitive advantage: 7/10

Growth: 6/10

Risk Factors: 6/10

Valuation: 7/10

Total score: 40

#14 OTC Markets: Democratizing Access to Financial Markets📈

OTC Markets Group operates financial markets for over 11,000 U.S. and global securities. By providing a marketplace that connects a diverse network of broker-dealers, OTC Markets facilitates easier access to trading and improves liquidity for traditionally underserved securities.

OTC Markets trade at 23.6x LTM earnings, a fair price for a high-quality, founder-led business like OTCM. After the post-pandemic stock boom, OTC is still finding its footing. We believe the business will continue to grow as more investors want to trade “Over-the-counter” stocks in emerging markets.

Valuation and my buy area

The current price of OTC Markets is $53.

Analysts expect OTCM to grow its long-term EPS by 9% annually.

We use OTCM’s LTM free cash flow per share as a proxy for the discounted cash flow analysis below.

Current price per share: $53

Intrinsic value estimate per share: $61.62

Suggested upside: +28%

Suggested CAGR from normal scenario: 13%

Quality scoring:

Management: 8/10

Business Model: 7/10

Competitive advantage: 6/10

Growth: 6/10

Risk Factors: 6/10

Valuation: 7/10

Total score: 40

#13 Lululemon: Redefining Athletic Wear & Branding 🧘🏻

Lululemon has carved a niche for itself in the competitive athletic apparel industry by focusing on high-quality products tailored for yoga enthusiasts and other active consumers. Their commitment to innovation in fabric and design has allowed them to build a loyal community and expand their product line to include a variety of athletic and leisure wear.

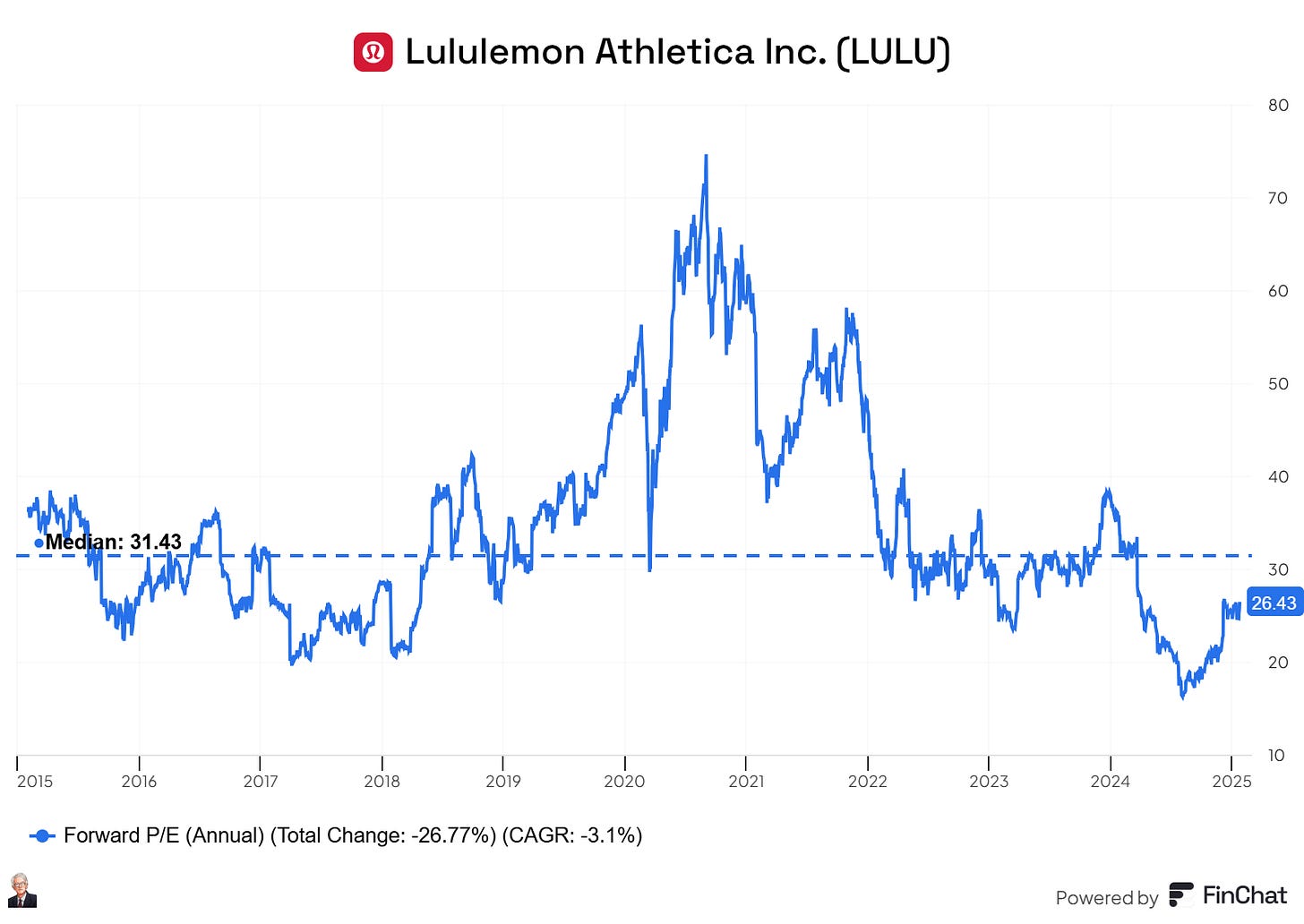

Lululemon has somewhat recovered from its 2024 lows, but the stock still trades well below its 10-year median PE.

The NTM PE is 26.43 vs. its median of 31.43x.

Valuation and my buy area

The current price of Lululemon is $400.

Using Lulu’s EPS of $13.9 as a proxy for the DCF.

Lululemon is expected to grow its long-term EPS by 12.3% annually.

Current price per share: $400

Intrinsic value estimate per share: $434.98

Suggested upside: +8.7%

CAGR from normal scenario: 11.5%

Quality scoring:

Management: 7/10

Business Model: 7/10

Competitive advantage: 7/10

Growth: 8/10

Risk Factors: 7/10

Valuation: 5/10

Total score: 41

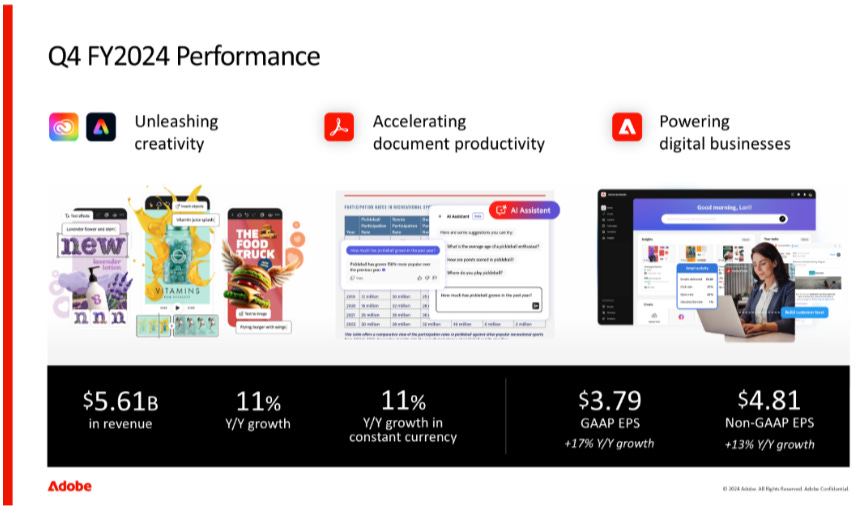

#12 Adobe: Market-leading SaaS business 📸

Adobe is a global leader in digital media and marketing solutions.

The business is best known for its flagship software, including Photoshop, Acrobat, and Premiere Pro, empowering creators in photography, design, video editing, and document management.

Adobe’s Creative Cloud subscription service has become a cornerstone for professionals, offering access to innovative tools.

Adobe also excels in digital marketing through its Experience Cloud platform, which leverages AI-driven analytics to optimize customer engagement and marketing campaigns.

Valuation and Buy Area

Adobe is trading at a decade-low with a forward PE of 21.31x NTM.

The forward PE is currently 21.31x vs. 31.31x for its 10-year median.

Simple discounted cash flow analysis

We want to be conservative in our estimates to create a margin of safety.

Using the free cash flow per share of $17.50 as a proxy for our DCF.

+15% long-term EPS growth is what analysts expect.

Fair value estimate: $550.80

Current share price: $435.38

Upside: +20.95%

CAGR from normal scenario: +13.5%

Quality Scoring:

Management: 7/10

Business Model: 8/10

Competitive advantage: 7/10

Growth: 6/10

Risk Factors: 6/10

Valuation: 7/10

Total Quality score: 41

#11 Dino Polska: The Polish King of Retailing 🛒

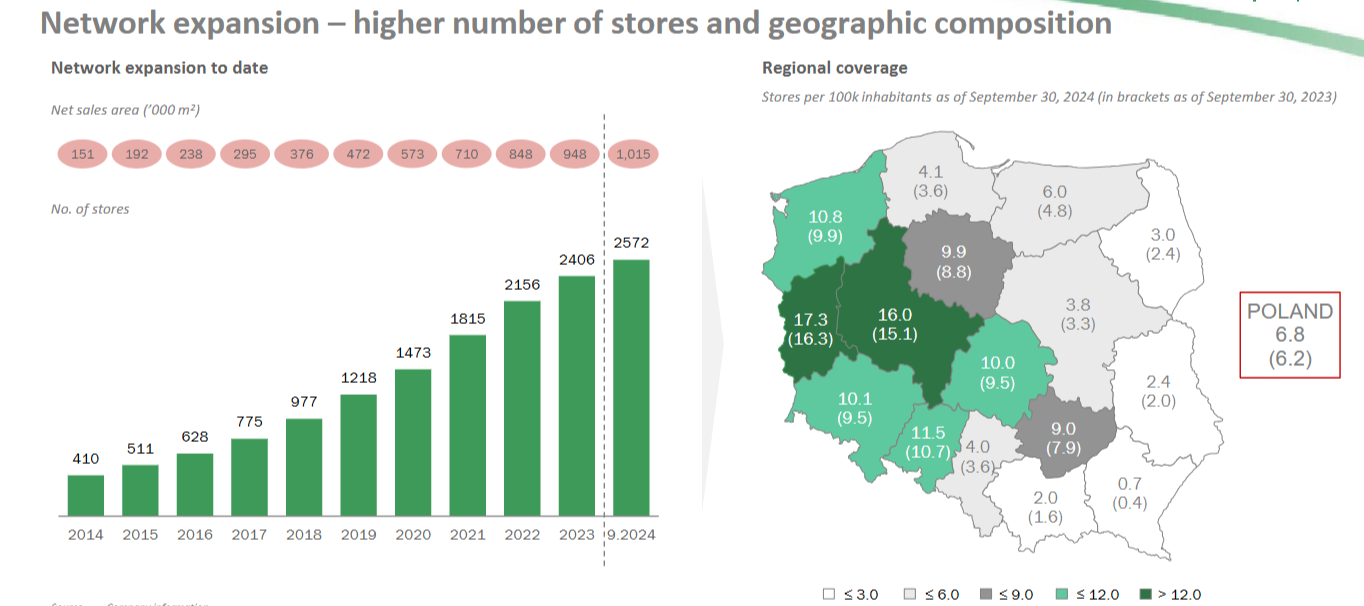

Dino is one of Poland’s fastest-growing retail chains. It focuses on smaller, conveniently located stores. Its business model, centered on fresh produce and essential goods, effectively caters to local shopping habits, driving its expansion across the country.

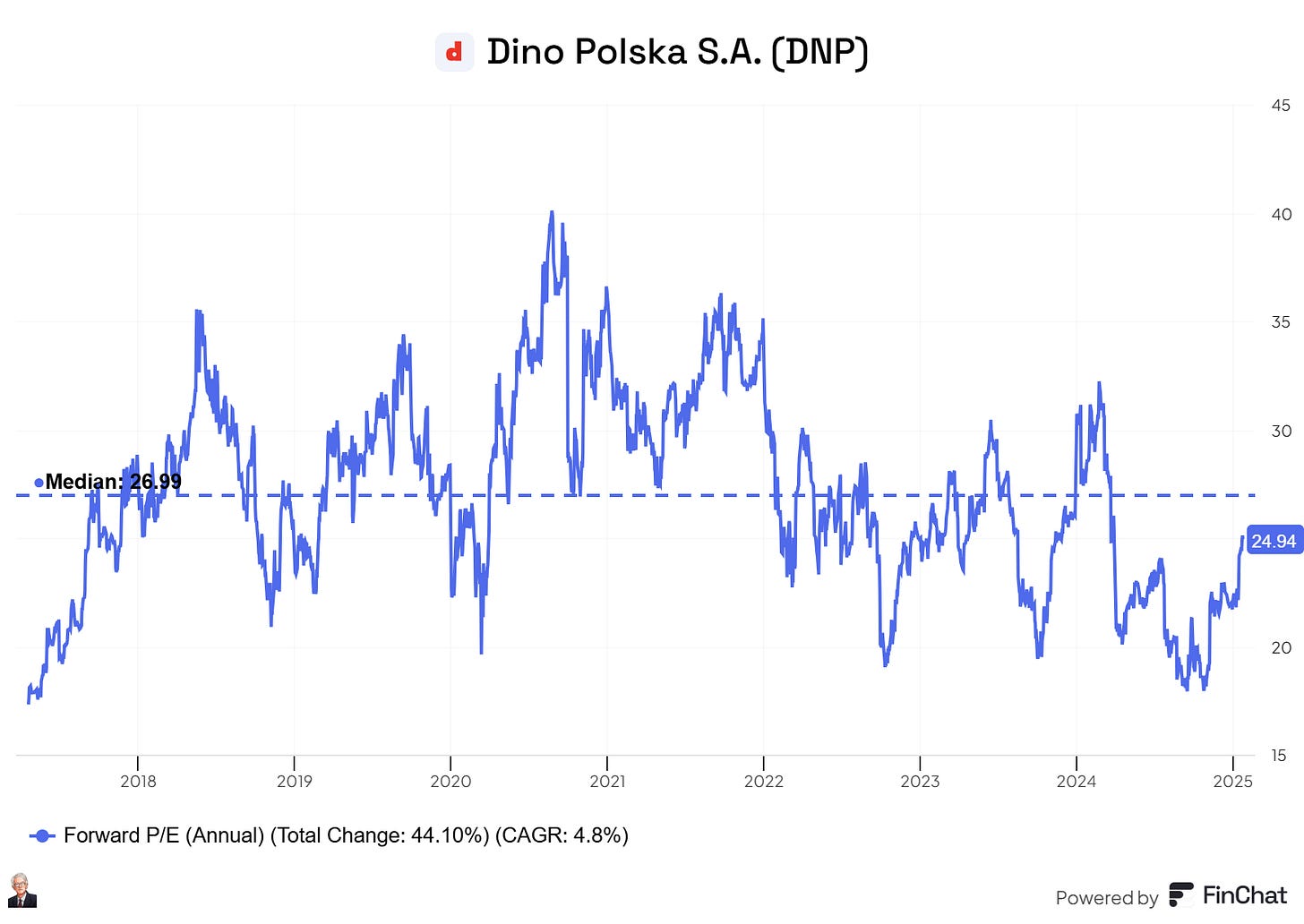

Dino Polska's revenue CAGR for the last five years is 31.6%, while EPS has compounded 30.3% annually during the same period. Dino trades at 25x NTM earnings, which historically is below its 10-year median of 26.99x and well below its 2020/2021 highs of +40x.

Valuation and my buy area

The current price of Dino Polska is PLN 448 per share.

Using Dino’s EPS of $14.6 as a proxy for the DCF below.

Dino Polska is expected to grow its long-term EPS by 21.8% annually.

Current price per share: PLN448

Intrinsic value estimate per share: PLN511

Suggested upside: +14%

Quality scoring:

Management: 9/10

Business Model: 7/10

Competitive advantage: 6/10

Growth: 8/10

Risk Factors: 6/10

Valuation: 6/10

Total score: 42

Now we move into the top 10 Buys of 2025 🏆

The rest of the article is for Premium Subscribers, join us, and read more: