Evolution Gaming: An Asset Light Compounder Trading at a Discount 🎰

A high-quality business trading at a 5.2% forward free cash flow yield 🧠

Evolution is looking attractive at current levels, suggesting a 71% upside

Evolution has an excellent business model and a strong competitive position

Strong growth prospects, pristine balance sheet, & a cash-generating machine

Our friend Compounding Quality’s new service is sponsoring this article.

A Premium Subscription gives you access to his portfolio, investment courses, company deep dives, weekly stock dives and much more.

The business

What Evolution does

Evolution Gaming AB is a pioneer in the online casino industry. Evolution had the idea in 2006, to replicate the land-based casino experience online. Evolution wanted to deliver a live casino experience from the comfort of your own home. The business model was a success, reducing the overhead required to operate the business substantially compared to land-based casinos, and making it globally available through the internet. Evolution has close to 100 different games in two business segments, i) live casino, and ii) RNG (Random number generation). It sells its services B2B to partners like Betfair, Betsson, and 888, and gets a commission fee of ~10% of the profits their games are generating.

Drivers for growth

Number of innovative games

Evolution is continuously improving its games and is innovating to appeal to a wider audience and attract more engaged customers. In 2017, Evo launched an in-house developed game that mixed the best of live casinos and RNG combined with augmented reality. Evo is set to cross the 100-game mark by the end of 2023.

Growing & untapped market

Evolution has been expanding into new geographies to tap into potential markets in the US, Canada, and Asia. In many states in the US online gambling is illegal. A catalyst for growth is if these states start to legalize online gambling.

Scalable business model

Evolution’s business model allows one “game presenter” to have up to many more customers at the same time than a land-based casino ever could. The unit economics for this model is stellar. Evolution only has to pay one game presenter, but can make a significant amount of profit from just one table (This does not apply for all games, as some games are limited).

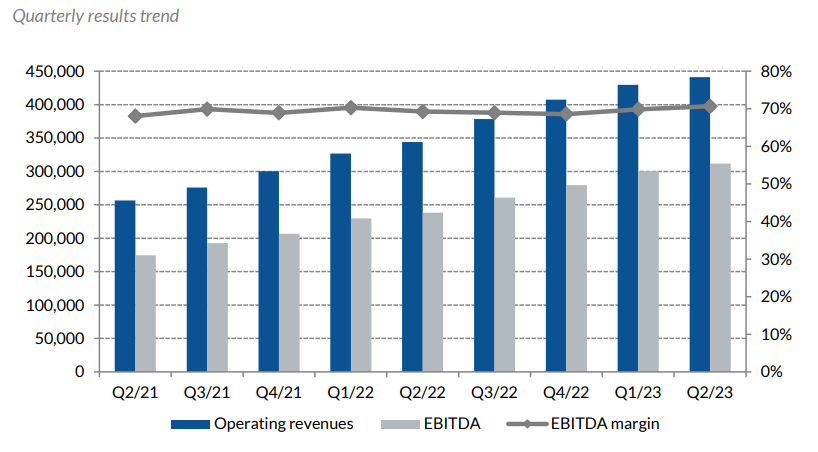

Evolution financials since 2021 are a thing of beauty:

Diversification of sales

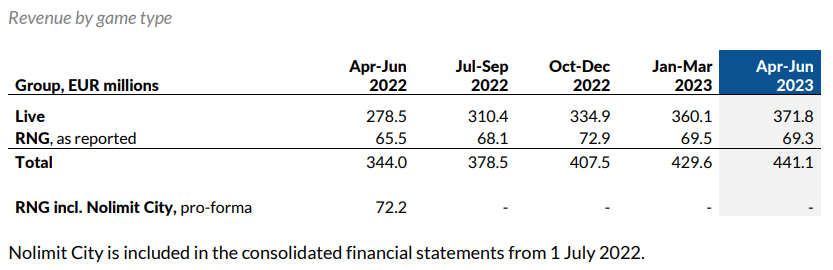

Evolution divides their sales into two categories, Live and RNG. Live has been a stellar growth story, growing by 33.5% YoY as demand is strong.

RNG on the other hand has been struggling and has been growing slower than expected, with a YoY growth of 5.8%. The management wants this to be in the low to mid-teens.

Evolution provides its services in 40 different regulated markets, which include 10 in Europe, 5 in the US, 2 in Canada, and 2 in Latin America.

Diversification of sales:

EU: 39%

Asia: 31%

NA: 12.5%

Latin America: 7%

Europe is a mature market that is still growing at +15% annually, while other emerging markets like Asia, North America, and Latin America are growing at a significantly higher rate:

The business model

Evolution offers its services to other online and land-based casino operators. The business makes a commission of ~10% on the winnings of their RNG and live games. This creates a win-win relationship with its partners, as the partners still keep 90% of their profits, while Evolution can focus on getting and maintaining attention from the end user. Additionally, they offer customizable services for VIPs. The fees are paid monthly to Evo, which allows them to have a steady and growing cash flow.

By focusing on creating superior games that the customers love, and letting the casinos take most of the risk, Evo has found a profitable position in the market. Evo is able to gush out cash while taking on limited risk. This allows Evo’s business model to be asset-light, which is a sign of a superior business.

Evolution has more than 700 clients to whom they deliver their games, including Draft Kings, Leo Vegas, Pokerstars.com, Unibet, Betsson, and 888.

The main expenses for Evolution are personnel costs, amounting to 53%. Of this, 87% of the cost is for the game presenters, 7% for IT developers, 3% on admin, 2% on studio developments, and 1% on sales.

The big advantage of Evolution is its ability to keep scaling, as the live games can take on many customers without any marginal cost, providing the potential for very good unit economics per table and per game presenter.

Additionally, the scalability and operating leverage of the business model are showcased in the operating margins that have increased from 30% in 2016 to +62% in 2022.

The Fundamentals

Operations:

ROIC: 28.75%

Operating Margin: 63%

Free cash flow Margin: 52%

FCF/Net Income 5Y: 90%

Interest coverage: 197x

Growth 3Y / 5Y CAGR

Revenue: 55% / 51.5%

EBIT: 67% / 67%

Net Income: 65% / 68%

EPS (Diluted): 56.5% / 62%

Levered Free cash flow: 69.5% / 91.9%

Valuation metrics

FCF Yield: 3.1%

Fwd. FCF Yield: 5.5%

PE: 21.5

Fwd. PE: 17

The market

According to H2GC the total gaming market (including land-based and online) has an estimated value of £438 billion in 2022 and is expected to grow by 11% annually for the next 5 years. Although land-based casinos have been the most normal form of gaming in the past, online is growing at a significantly higher clip. The Global Online Gaming market grew by 19% annually from 2018 to 2022 and is expected to grow by more than 12% annually until 2030.

Additionally, the U.S. online Gambling market is expected to grow 12% annually until 2030. Many states in the US do not allow online gambling, which might change in the coming years, creating a potential upside & catalyst for Evolution.

Future Growth in Evolution

The company has grown at a rapid rate, outpacing the overall gaming market by a wide margin. Can this growth continue?

Evolution is expecting growth in RNG in the “mid-teens”, and the live casino segment by +10-20% annually. This is a conservative estimate for a live casino, as it has shown strength in the past, growing above 30% annually. RNG, however, has lagged in its performance and might continue to disappoint shareholders.

Europe, where Evo is most dominant is a mature market in the gaming industry. Nonetheless, it is expected to grow 15% annually. While the other markets are expected to grow significantly faster as showcased earlier in this article. Asia for example, is benefitting from an increasing middle class and more people accessing the internet.

Evolution’s business model, combined with its competitive position in its niche market, sets it up well to take a profitable piece of the growing gaming market globally. We expect Evolution to grow by 15% annually for the next 5 years.

What if operators start taking Evolution’s services in-house?

You would think that this is a good idea, as the Evolution margins are stellar, it must be a fantastic business segment for operators, right?

This interview where an iGaming executive is asked why no operator in-house the services of Evolution sheds light on why it is not so easy to replicate what Evolution is doing as you might think:

Additionally, the economics of in-housing this service does not make sense, as you need scale for it to be profitable. If you want to read more about this I highly recommend this article on Evolution by Fundasy.

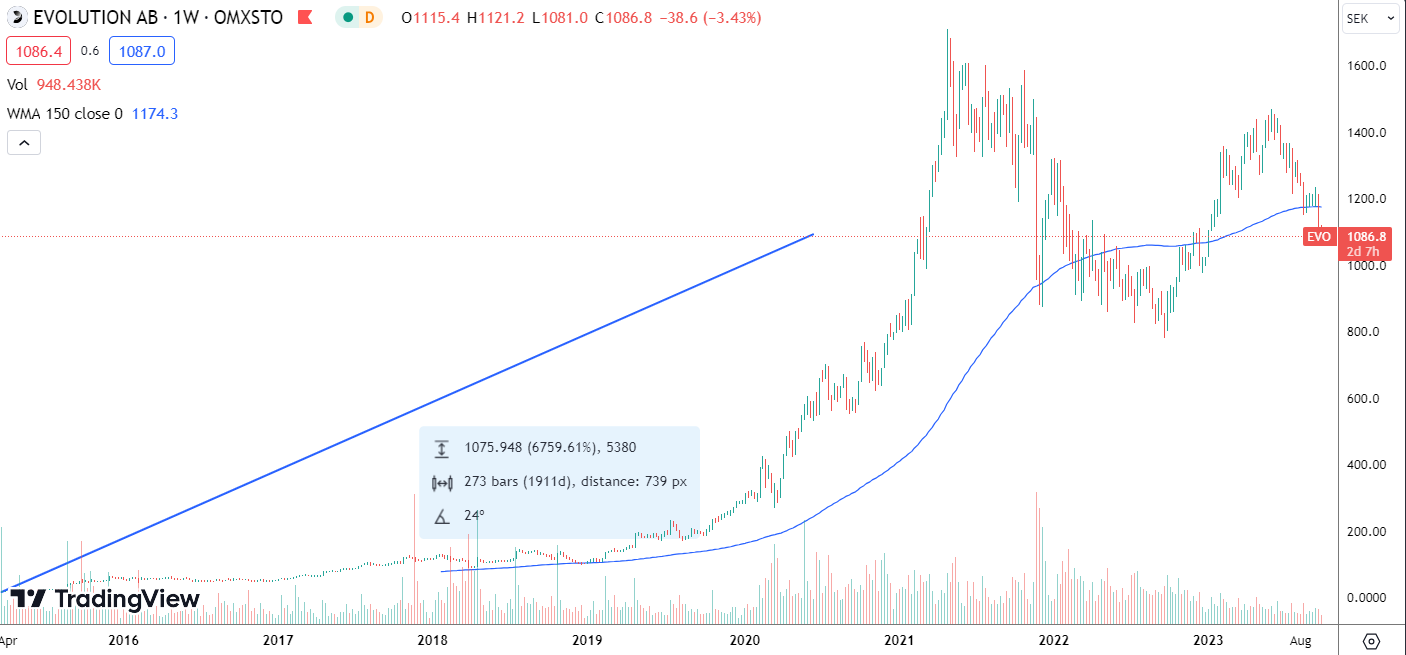

The Stock

Evolution went public in 2015, and since its IPO it has returned 6760% for its shareholders. That is a ~69% compounded annual growth rate since inception. The stock became overpriced in 2021 along with other growth names in the post-pandemic bubble. Evo is yet to claim a new all-time high. However, the fundamentals have been growing and the business is doing excellent.

The Market Position & Competitive Advantage

Market Position

Evolution is the clear market leader in the industry. They dominate in terms of the most played games and have limited competition in the live casino segment. The RNG segment is more competitive, and Evolution’s position is weaker. Evolution is a one-stop shop for operators. This makes it easier for operators to stay with Evolution than to hire several smaller suppliers to deliver bits and pieces.

Playtech is the main competitor, although the business model is not the same. This can be seen in the margins of Playtech vs. Evolution. Playtech has a more diluted business with several low-margin segments that drag down the overall business quality.

Although Playtech provides services to game operators, Evolution is the clear leader in terms of creating new, exciting, and innovative games for the end-user. Which is a high-margin quality business. This gives operators an incentive to go with Evolution, as more customers and attention equals more money for the casinos.

Efficient scale

As previously discussed, the more customers Evolution attracts, the more money they make. This puts a great emphasis on continuously making new and exciting games. Taking Evolutions service in-house does not make sense from an economic standpoint because the operators will lack the scale needed for the tables to run profitably. This serves as a competitive advantage for Evolution, as they have efficient scale to benefit from the upside of this model.

The scale and quality of the service allow Evolution to take prices in the 10-12% range. Even if a competitor offered a smaller commission, it would not make sense for the operators to pick the competitor if they are not able to attract the same amount of customers and profits as Evolution.

Recurring revenue

Evolution is paid on a monthly basis from its partners with ~10% of the profits their games generate. This revenue model is excellent, as it incentivizes Evolution to make the best games that the customers engage with. Conversely, if no one plays their games, their revenue will suffer as a consequence. Right now, Evolution is delivering fantastic products. However, if the tides turn, it can create a larger downside than if the business had a license-based model or a more traditional SaaS revenue model.

Intellectual property

There are 3 elements to Evolutions IP:

Data: Evolution is the clear leader in its niche market, and its games are by far the most popular with many of the largest gambling companies globally. This provides Evolution with unique data on consumer trends and needs, which in turn Evolution has been effective in turning into new cash-generating games.

Industry-specific expertise: The CPO Todd Haushalter is a key resource for Evolutions’ continued growth. He of course gets the credit, but there is an entire department behind him that is identifying trends in the data, developing new game concepts, and executing at a high level on new and profitable games.

Culture of innovation: Evolution has a leading position, but will not become complacent and allow competitors to catch up. They are continuously releasing new, innovative games. One example is Funky Time which was released in Q1 23, which combines RNG and live in a new and complex manner that has not been done in the industry before. Additionally, they are aiming to have more than 100 games in total by the end of 2023.

Evolution’s unique position, combined with its efficient scale, the problems of in-housing their services, and its specific expertise, and innovative culture, creates a narrow moat for Evolution.

Management

The founders of Evolution are still active in the business. Jens Von Bahr, and Fredrik Österberg are leaders and members of the board. They own a combined 5.2% of the business.

The CEO, Martin Carlesund, has been leading the business since 2015 and owns 585k shares valued at ~638 SEK Million. Carlesund has bought shares in the open market, the last time this happened was in September of 2022.

The CPO, Todd Haushalter, has been leading the product innovation for Evolution since 2015 and is responsible for its high-quality games and strong position in the market. Haushalter has extensive experience in the gaming industry and is an important asset for Evolution. Hasuhalter owns 0.04% of Evolution and added to the open market alongside the CEO in September 2022.

The management team is competent and has a track record of successful execution and operations, as well as capital allocation. Additionally, the management’s incentives are aligned with the shareholders as they own a piece of Evolution themselves. Which is a sign of a superior business.

As a bonus, the original founders are still involved in the business as leaders of the board and board members. The data suggests that founder-led businesses outperform significantly.

Capital Allocation

Evolution has made significant efforts to get a foothold in the RNG segment. It bought NetEnt in 2020 for £1.9 billion to strengthen this segment. Still, RNG continues to underperform in Evolution. This also brings a question to the management’s capital allocation skills, the funds used for acquisitions to strengthen RNG could have been used more efficiently by repurchasing shares at a discount.

Why own Evolution Gaming AB?

Strong growth prospects

A strong competitive position with a narrow moat

No strong competitors in the Live segment

Doesn’t need debt to achieve superior returns

A superior business model

High return on capital

Plenty of future reinvestment opportunities

Cash generating machine

Management with skin in the game

The Risk

Competition: New entrants into the market that start competing with Evolution, hence reducing their potential earnings and margins in the future.

Regulatory: There is an underlying risk of making online gambling illegal. 60% of Evolution’s revenue is from unregulated markets.

Customer concentration: The top 5 largest customers of Evo, represents ~30% of its revenues. If one of these decided to take this in-house, it would be a significant cut in Evo’s revenues.

Risk/reward for investors: There is also a risk of paying too much for a company with risks that might severely impact future earnings. Additionally, investors should be cautious about investing in companies that have an enterprise value to sales of more than 10, as this has historically provided poor results.

Our friend Compounding Quality’s new service is sponsoring this article.

A Premium Subscription gives you access to his portfolio, investment courses, company deep dives, weekly stock dives and much more.

Valuation: Evolution AB Appears Attractive

Evolution’s forward FCF yield is currently 5.2%, well above the risk-free rate of 4.5%:

The forward PE is 14-17 (depending on the source), which is historically low for the company:

Discounted cash flow analysis

Using Evo’s TTM Net Income with the following 3 scenarios:

Worst case: 10% growth for the next 5 years, followed by 8% growth for the next 5 years, valued at 15 times net income at the end of the period.

Best case: 18% growth for the next 5 years, followed by 15% growth for the next 5 years, valued at 25 times net income at the end of the period.

Normal case: 15% growth for the next 5 years, followed by 13% growth for the next 5 years, valued at 20 times net income at the end of the period.

Our fair value estimate for Evolution based on a conservative growth profile and weighing is $36.14Bn. The company is currently valued at $21.08Bn. This represents a 71% upside from today’s level and a significant margin of safety.

If our normal case scenario plays out with a growth of 13-15%, we can expect an 18.5% annual growth rate. This is well above our hurdle rate of 15%.

Conclusion

Evolution AB is a stellar business with a superior business model, diversified revenue streams, a strong competitive position, and a narrow moat. The business is trading 71% below our fair estimate and is looking attractive in terms of risk and reward.

The upside is substantial as the online and land-based gambling market is set to grow by +12% annually until 2030. As there are no real competitors, Evolution is likely to continue to get a big and profitable piece of the pie in the years ahead.

There are significant risks that investors should be aware of, such as the regulatory risks concerning unregulated markets.

Overall, the investment case for Evolution AB is strong, and we think this is an attractive price to enter the stock.

Disclaimer: Invest In Quality holds a position in the security discussed in this article.

Get $100 off your subscription to Compounding Quality’s new service

When you are read, check out Essentials of Quality Growth Investing (Book)

Marvelous!! Thanks my friend