💎 The Quality Growth Strategy

<5 min read

Hi there.

If you are a free subscriber, this is what you missed this month:

In this article, we will explore the Quality Growth Investing strategy:

The Quality Growth investing strategy summarized 🧠

Buy high-quality companies:

Growth in revenues +10% pa.

Growth in FCF per share +10%

ROIC/ROCE +15% 5-year avg.

Healthy margins above industry

FCF/Net Income +75%

Interest coverage +10x

FCF yield > Risk-Free Rate

Low/no dilution

We want to find high-quality investments at a reasonable price:

“The investment game always involves considering both quality and price, and the trick is to get more quality than you pay for in price. It’s just that simple.”

Charlie Munger

Want to follow the Quality Growth Portfolio? Read about our premium service here.

Buying Companies of High Fundamental Quality

High-quality means:

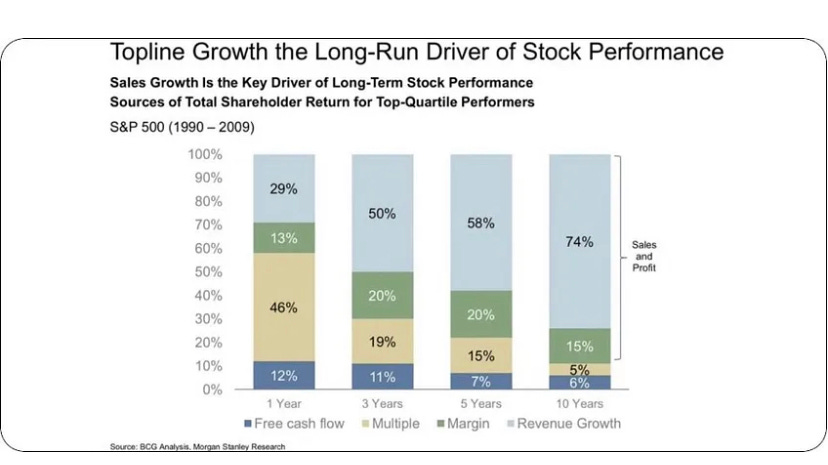

Revenue, earnings, and cash flow growth of more than 10% for the last 5 and 10 years. As we know, revenue growth is the greatest predictor of long-term returns in the stock market:

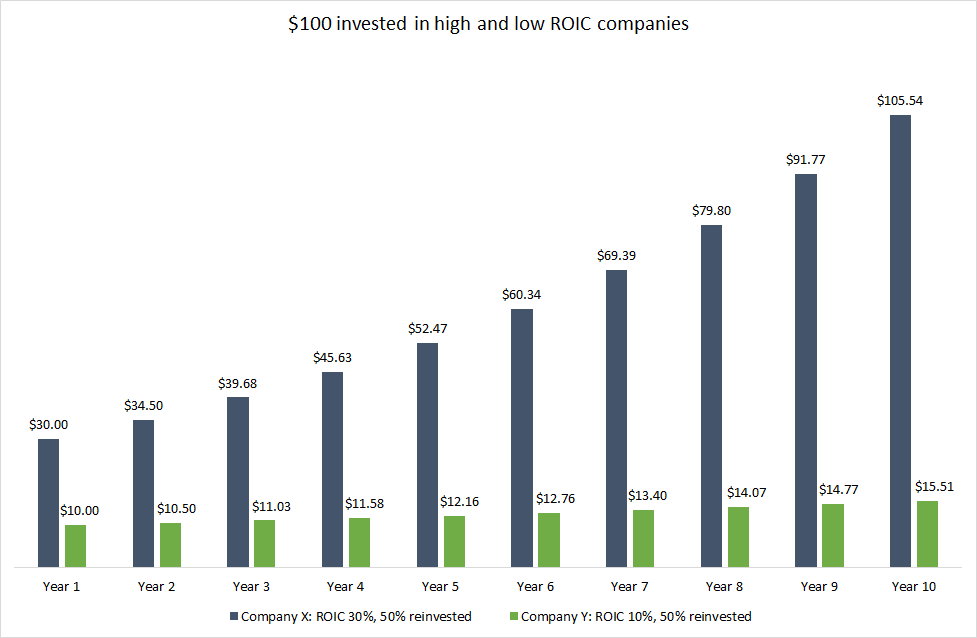

Consistent returns on capital above 15%:

Reinvestment rates above 50%

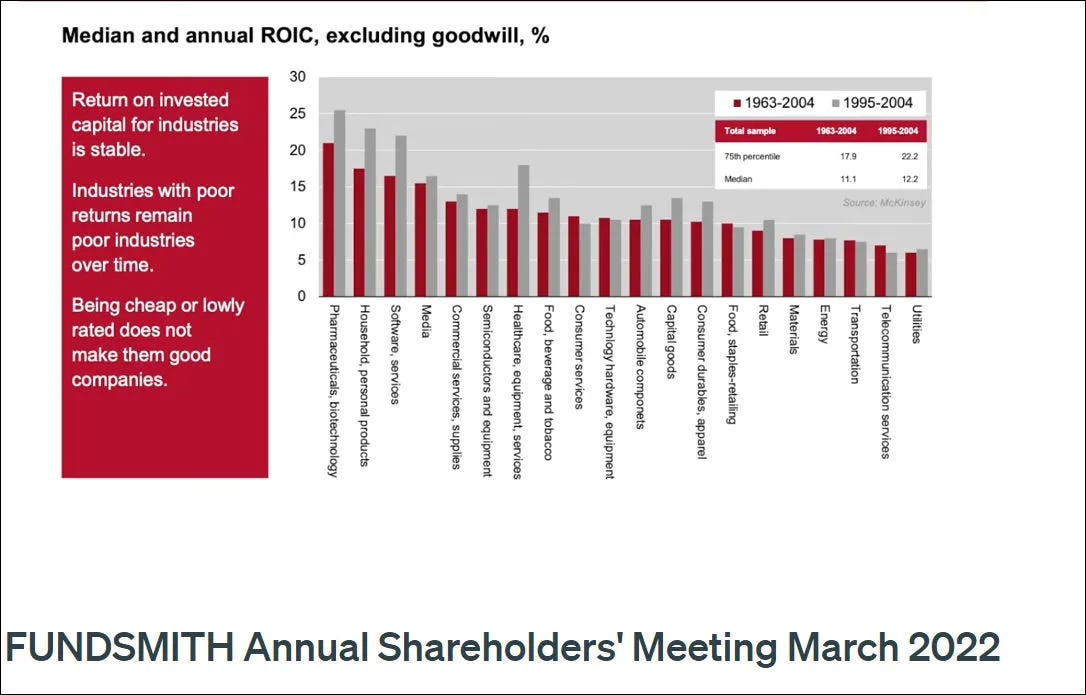

Invest in industries with favorable economics:

We want to explore industries where the ROIC is naturally high. This indicates high profitability and investing returns. Low ROIC industries are much more likely to destroy shareholder value over time.

Three great industries to consider:

Consumer products (Household)

Software/Tech (Software as a service)

Healthcare

The average ROIC of these industries is 20-25%:

Capital-light Business Model

I focus on asset-light companies. The kinds of businesses that don’t need a ton of cash reinvested annually to keep their business running. I stay away from asset-heavy industries.

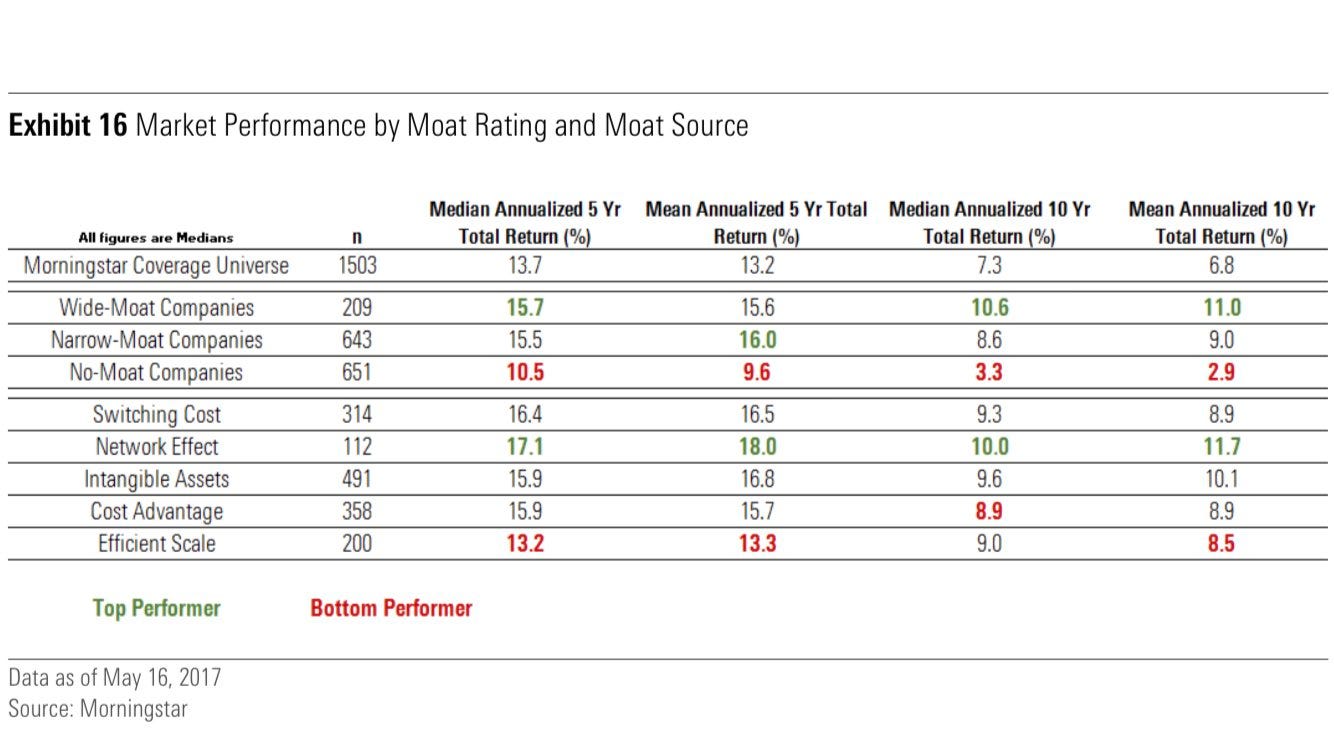

The company must have a moat

Low-Cost Production: Offer something for a cheaper

Network Effect: Each user makes the product better

Efficient scale: Uses scale to gain an advantage

Switching Costs: Hard to stop using

Intangibles: Patent, Brand, recipe

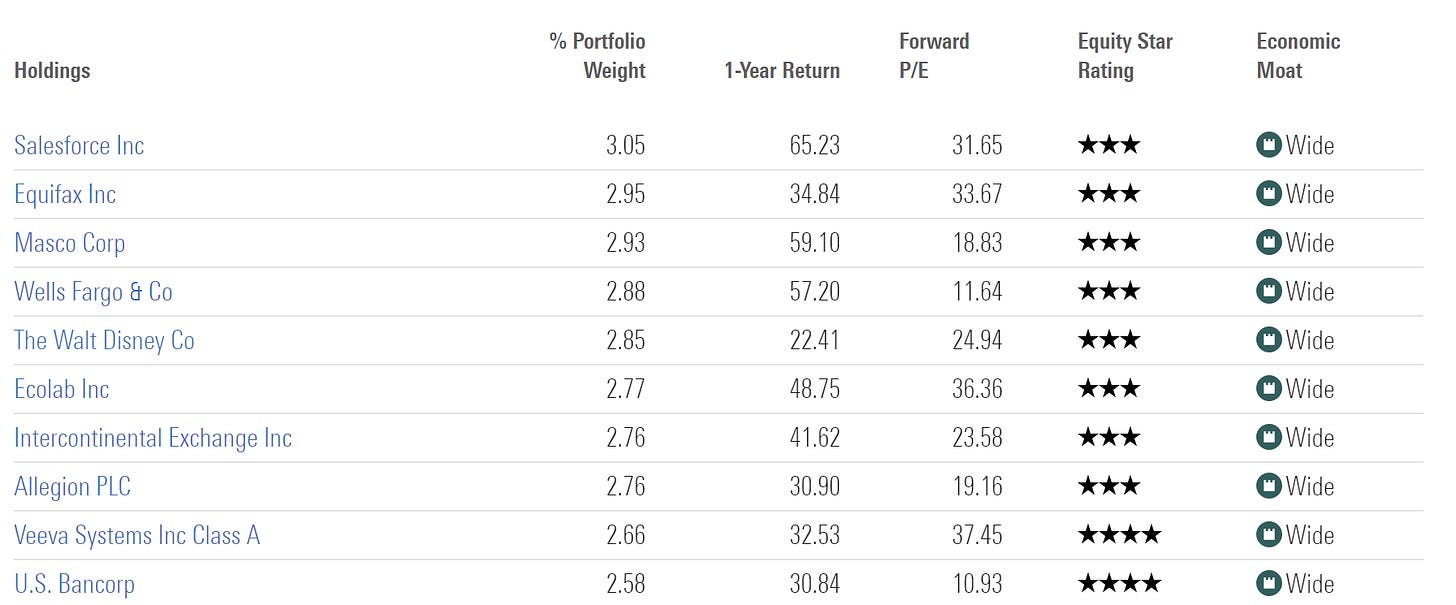

A list of wide moat businesses according to Morningstar:

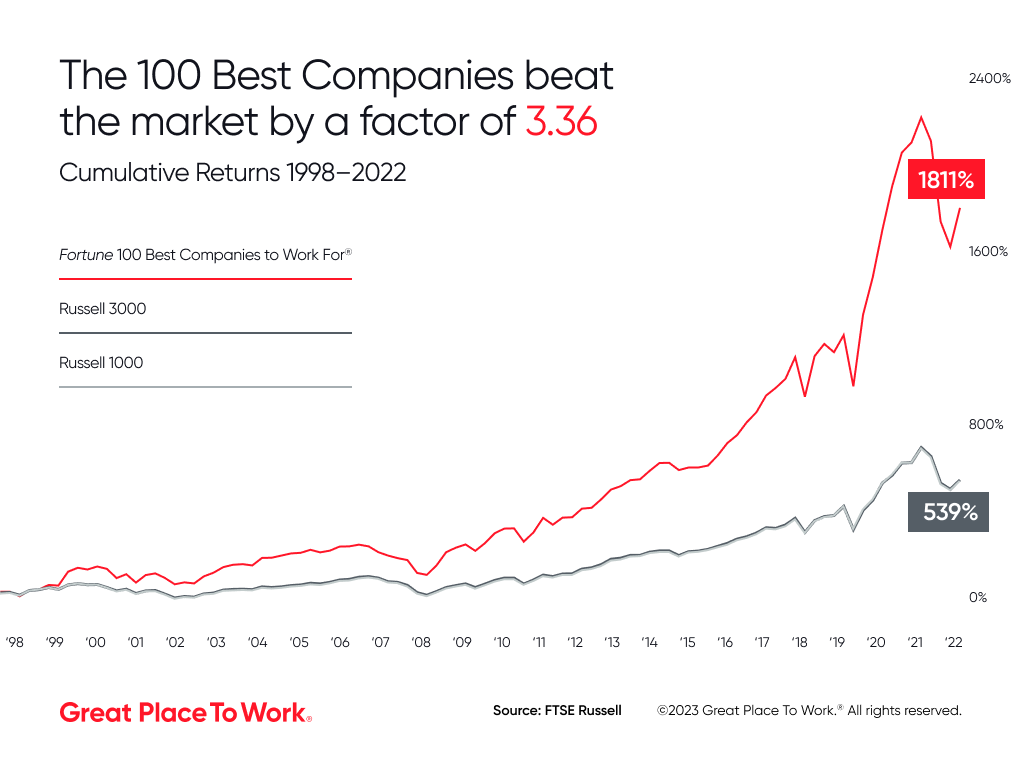

Happy employees

I look at how satisfied the workforce is with the company they work for. This can be a good indicator of a good long-term performer:

Competent & Committed Management

I want competent management with skin in the game. Skin in the game ensures that the management team’s and shareholder’s interests are aligned. Ideally, we get a founder-led business:

Great management and capital allocators is measured by:

Tenure

Track record

ROIC over time

Skin in the game

Incentive program

Accomplishments

Acquisitions and use of excess cash

Company characteristics to look for:

Mission-driven (great mission statement)

Owner-operators (Founder led)

High insider ownership

Low Debt levels

Low Cyclicality

Optionality

Valuation

An easy method of determining if a business is of decent value is to look at its FCF Yield in relation to the Risk-Free Rate (10-year treasury bill). Right now, the risk-free rate is 4.1%. If we find a great quality business with an FCF yield close to or higher than the risk-free rate, we might have a good deal.

Additionally, I like to use a simple valuation method explained in my free Valuation Cheat Sheet and a discounted cash flow analysis. You can view an example here:

Want more details? Grab a 25% discount on Essentials of Quality Growth Investing.

The book breaks the entire quality growth process down in detail with many examples and case studies that will make you a better investor.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +6.500 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

How do you get the re-investment rate?