Admicom: Highly profitable SaaS Business offering a good risk reward (Part 2/2) 📈

5 min read 🧠

Welcome to Invest In Quality! The newsletter for aspiring investors. We break down businesses, super investors, and economic psychology.

This is part 2 of the Admicom analysis, see part 1 here:

Part 2 contains:

Competition

Competitive advantage

Management

Acquisitions

Valuation

Risk

Conclusion

Competition

Admicom operates in 4 different product segments: i) Planning & Scheduling, ii) Construction & Renovation, iii) Management & Admin, and iv) Maintenance & Real Estate maintenance. Admicom operates in the low end of the large companies segments while spending most of its time and resources around the SMEs and Microcap companies.

If Admicom is to enter the European Large cap market, it will compete with large enterprises such as Nemetschek, Trimble, RIB, SAP, and Microsoft Dynamics. However, if they pursue the Microcaps & SMEs, they are more likely to enter a blue ocean with less competition, as the large enterprises won’t find it profitable to chase small companies.

Admicom does compete directly with a few small players such as; Visma, Ecom, Jydacom, and Oscar Software. None of these do however offer a complete suite of products and services like Admicom does, this gives them an edge, as they can deliver more services that the customers need. It can be cost-efficient and convenient for an SME to have one supplier for many different software services, as it simplifies the system side, billing, support, and more.

Want to learn more about what we invest in, our investable universe, our watchlist and much more? Join us as a premium subscriber, read more here:

Competitive Advantage

Admicom has several competitive advantages that make it hard to compete with them:

Intangible assets: Their product suite is hard to replicate, and is based on deep knowledge of the different market segments they are present in.

Switching costs: Switching IT systems can be a huge hassle for SMEs that want to focus on their operations. This creates a natural barrier for clients to switch to a competitor. As long as customers remain happy and the prices are fair, they are likely to keep paying their suppliers.

Scalability & profitability: Their business model is highly scalable and profitable, this provides an advantage to further increase the desirability and usability of their existing services while adding new services that their main business segments demand.

Network effects: I would also argue that Admicom can utilize data from all their local clients to make the product better, and hence have a competitive edge from its network of clients using their software solutions. It is however unclear to what degree Admicom does this currently.

Looking at the margins of Admicom, there has been a significant expansion from 2016 to 2021. From 2021 to the TTM, we have seen a slight reduction. This is expected as the business has entered a new stage and will focus more on acquisitions moving forward. It is however something we investors need to keep an eye on.

There has also been a slight reduction in capital efficiencies, is it due to a deteriorating competitive advantage, or due to the change in strategy? I’m arguing that the latter is true, but there are some concerning data points we will discuss in the risk section that might indicate that Admicom is losing its touch.

Management

The CEO, Petri Kairinen, joined Admicom in 2022. Previous to joining Admicom, he spent almost 16 years at Nixu Corp. Nixu corp. is a cybersecurity company that has operations in Finland, Sweden, Netherlands, Denmark, and Romania. While Mr. Kairinen was CEO, the revenue went from £10m to £50m taking the business from a consultancy-based business to a service-based business. Mr. Kairinenhas a sales-based background as he has held several different sales & marketing positions before becoming CEO.

The management team is a mix of newcomers and experienced players who have been with Admicom for several years.

Insider Ownership

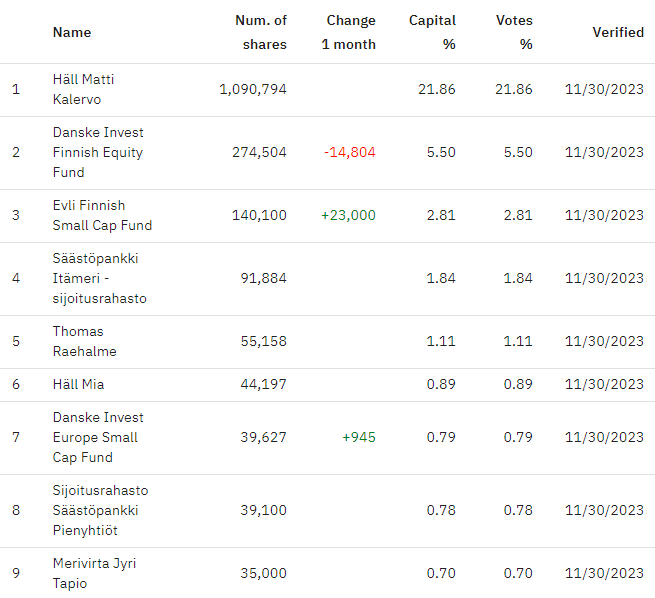

Häll Matti is the founder of Admicom but is now working as an Account Manager in the company. He still owns 21.86% of Admicom and has plenty of skin in the game.

Thomas Reahalme is the CTO of Admicom and owns 1.11% of the company.

Häll Mia is the Branch Director and has worked for Admicom for more than 9 years, and owns 0.89% of the company.

Petri Kairinen is the CEO of Admicom. Since joining in 2022, he has added about £81k worth of Admicom stock, putting his holding at 0.04%.

Director dealings

In 2020, most insiders were selling the stock. There are many reasons why executives sell, but we can assume that it had to do with the bloated multiples and soft outlooks for the stock. In 2022 and 2023 this has turned around, and there are almost exclusively buys being made by executives. Mr. Kairinen has made several purchases, Mr Aho, and Mr Järvi. This is a good sign for investors, indicating that the stock is currently attractive.

Acquisitions

Admicom has made several acquisitions in recent years:

Tocoman (2020): Cost accounting, data modeling & scheduling

Hilava (2021): Task management for mobile maintenance & installation work

PlanMan (2022): Schedule management

Kotopro (2022): documentation and information management

These acquisitions fit well into Admicom’s offering as discussed earlier, and are in line with their strategy of growing with acquisitions as an integral part of accelerating overall growth:

Acquisitions are never easy, as investors we will track how well Admicom can unlock synergies in the acquired businesses, as well as how good these businesses are in terms of competitive advantages, return on capital employed, and more.

Valuation

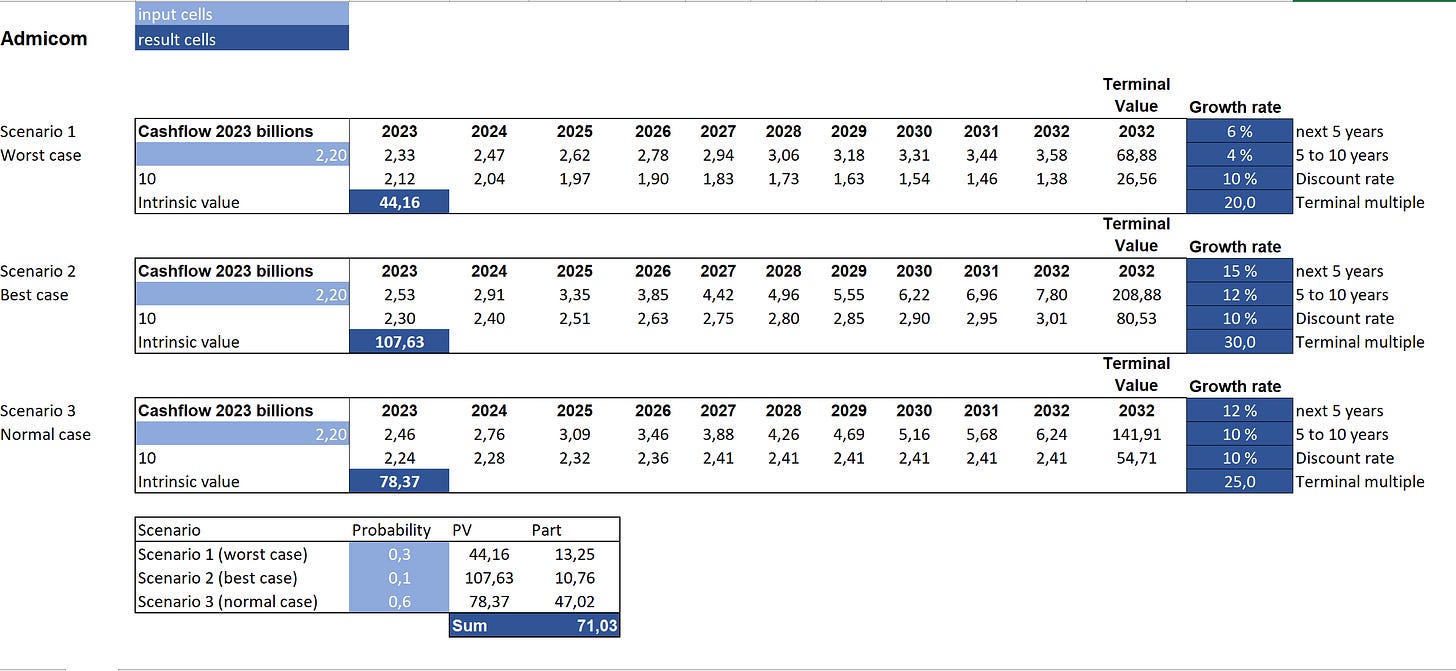

Using the trailing twelve-month free cash flow per share of £2.2, we’ll use a discounted cash flow analysis with 3 scenarios to determine the intrinsic value.

Normal case: 12% growth for the next 5 years, then 10% for the next 5 years, with an exit multiple of 25 reflecting the high margins.

Best case: 15% growth for the next 5 years, then 12% for the next 5 years, with an exit multiple of 30.

Worst case: 6% growth for the next 5 years, then 4% for the next 5 years, with an exit multiple of 20.

The fair value estimate for Admicom is £71 per share, a 67.8% upside from current levels of £42.3. The worst-case scenario of 6% and 4% growth is providing a fair value of £44 per share, which reflects the market’s current expectations from Admicom.

As I see it, the downside is limited for Admicom, even if they don’t grow at the top end of their estimate, their current valuation is a hedge against significant downside. On the other hand, the upside is large. If Admicom can take advantage of the turning tides in the construction sector to grow both organically and inorganically over the next 5 years, investors might be paid handsomely.

The normal scenario of 12% and 10% growth gives us an estimated annual return of 18%. This is of course given that Admicom can grow significantly while holding their margins at the upper end of their estimate (~42-44%).

The risk-reward in Admicom is currently attractive in my opinion.

Risks

There are some concerns for the Finnish Software business:

Cyclical clientele

Admicom has a profitable, scalable, and low-risk business model. However, their client base is cyclical and very sensitive to the economic environment such as interest rates and inflation. The benefit of downcycles is that Admicom might be able to get great acquisitions on the cheap, but as we have seen over the last few quarters, their churn rates have been respectively 7.7% and 10.6% in the last 2 quarters. The CEO told investors in their last earnings call that part of the churn was due to bankruptcies in the construction sector in Finland, and that he thought it would persist for the start of 2024.

Competition & Substitutes

SaaS businesses are attractive, and Admicom’s margins will attract competitors. Right now they have an advantage for SMEs in Finland, if they can extend this advantage to the Nordic countries, such as Sweden it will further widen their advantage in the construction sector.

It is also worrisome that microcaps and SMEs can use substitutes to achieve the same result as Admicom’s services. This includes basic tools like Excel and other low-cost software systems.

Strategic execution

Admicom has made a big shift in its strategy, going from a Finnish ERP systems provider in the construction sector to an internationalization strategy to enter other markets in Europe. There have been significant changes in the executive management, and although their new CEO looks impressive, he has not proven his worth just yet in terms of executing their growth strategy. Additionally, M&A’s will be a large part of the growth story, how are the management group’s capital allocation skills? Only the future will show.

Conclusion

Admicom is a great SaaS business with 93% recurring revenue, high insider ownership, high returns on capital, and a lot of market potential to grow into, and is well positioned in the construction sector. The company provides valuable services that increase productivity and cut costs for its clients. In addition, construction is set to make a huge shift towards digitalization as it comes out of the down cycle. Admicom has no significant debt and is creating a lot of cash. The business is growing organically even with a soft construction market with many bankruptcies.

I think RedEye sums it up pretty accurately with the statement “Although its operational performance has softened in recent years following the plummeting share price, Admicom’s EV/EBIT valuation is among the lowest in the Nordic SaaS space, making it a rather attractive risk/reward”: