🏰 The Quality Growth System

How I pick the best compounders for the next decade

The 6 Pillars of Quality Growth Investing

How to identify durable compounders that build wealth over decades

At InvestInAssets.net, we believe wealth is built through owning extraordinary businesses for long periods of time.

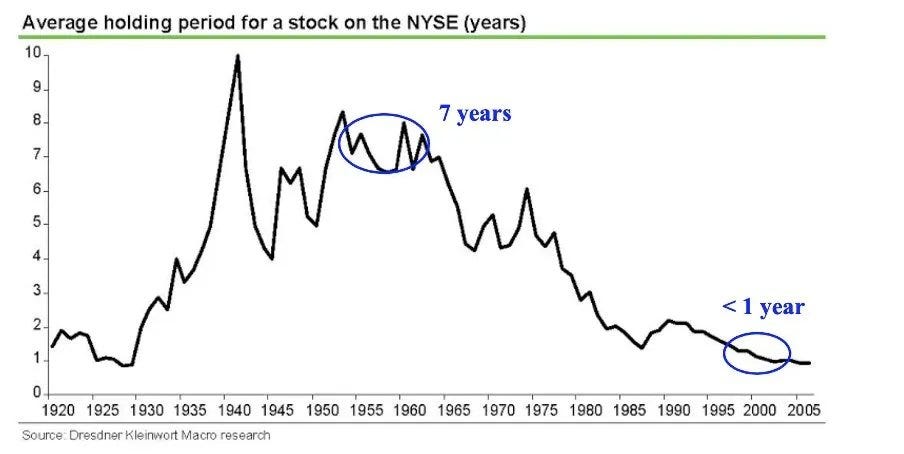

The average holding period for retail investors has dropped significantly since the 1960s:

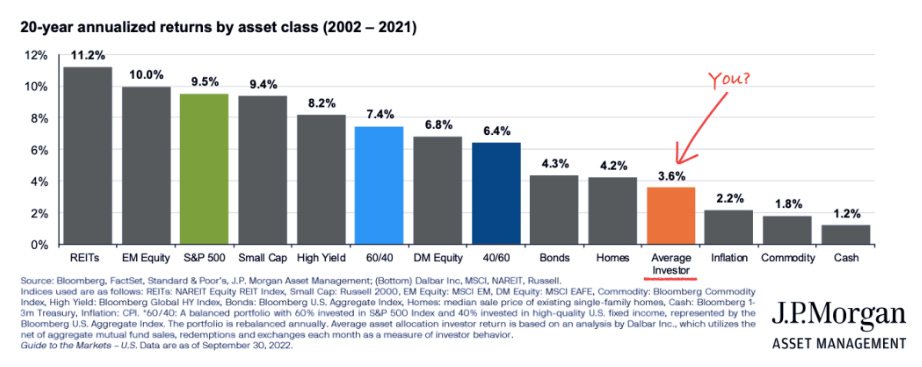

But the returns for individual investors have plummeted at the same time:

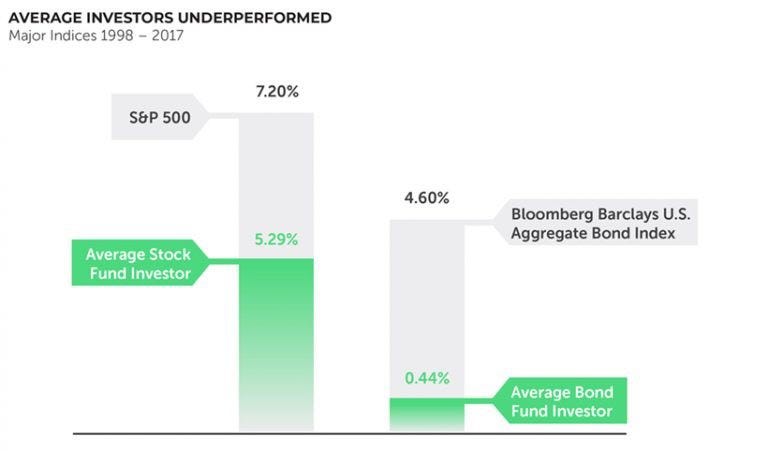

This is not only true for individual stock pickers, but it is also true for fund and bond holders.

The average stock fund investor has a return of 5.29% vs. the S&P 500’s return of 7.20%.

For bond fund investors, it’s even worse: 0.44% for the average investor, while the index returned 4.60% in the same period:

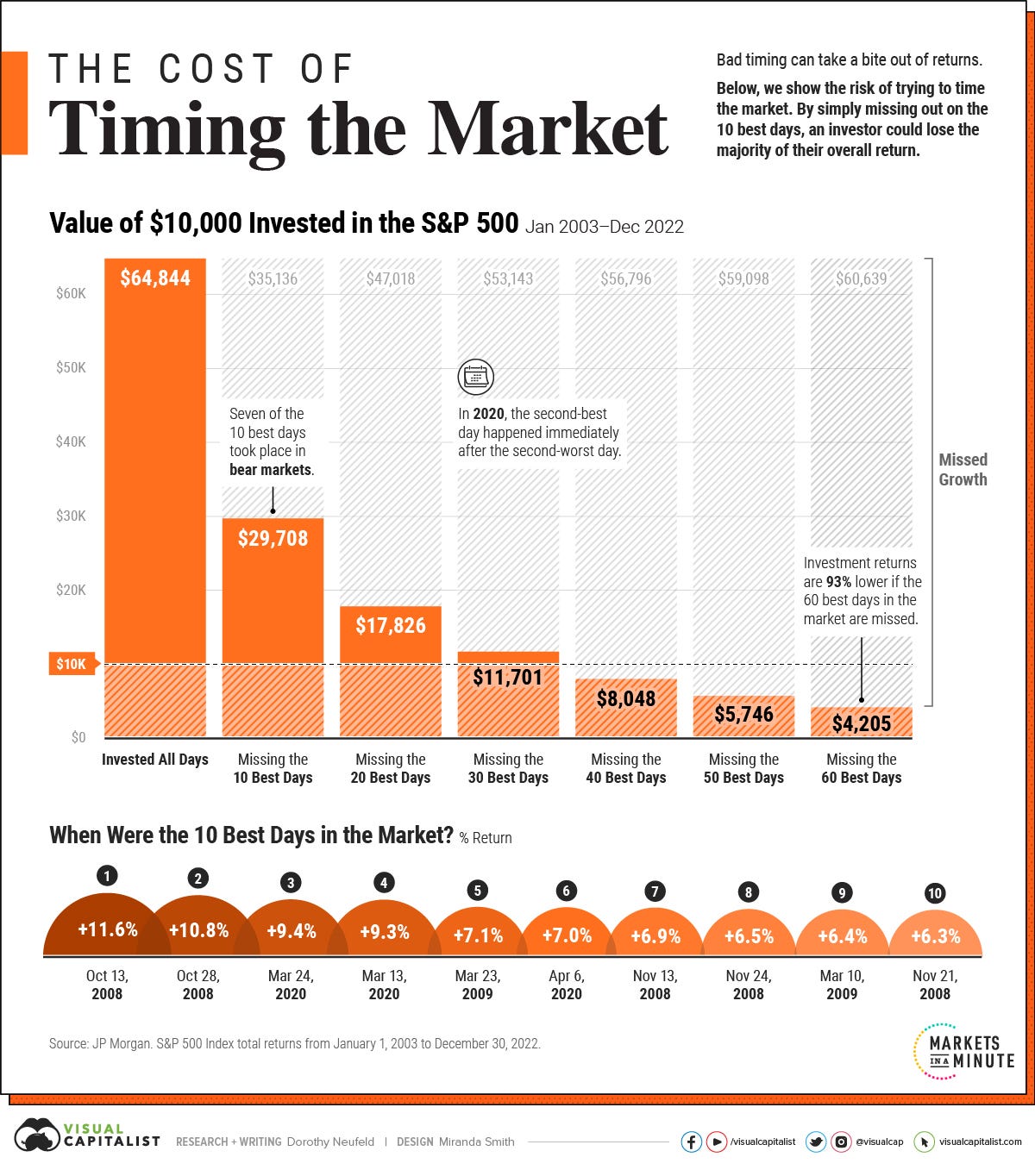

Why do we underperform so much? The answer is simple: Fear.

Most investors will sell low and buy high.

Sell when there is market turbulence; buy back in when things stabilize.

The flipside here is that you often lose the best days in the market by trying to time the market:

This is why we focus on Long-term Quality Growth Investing.

We want to hold great compounding businesses at fair valuations for the long-term. This saves transaction costs, capital tax requirements, and unnecessary headaches.

Why Quality Growth investing?

We’ll get more into this when we look at the 6 pillars, but let’s just say, the data on quality-based investing is overwhelmingly good.

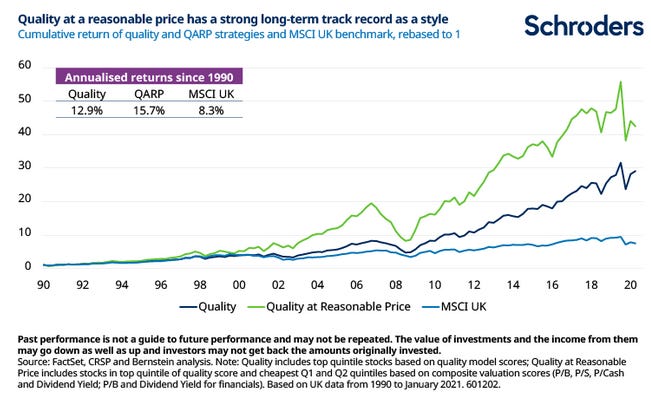

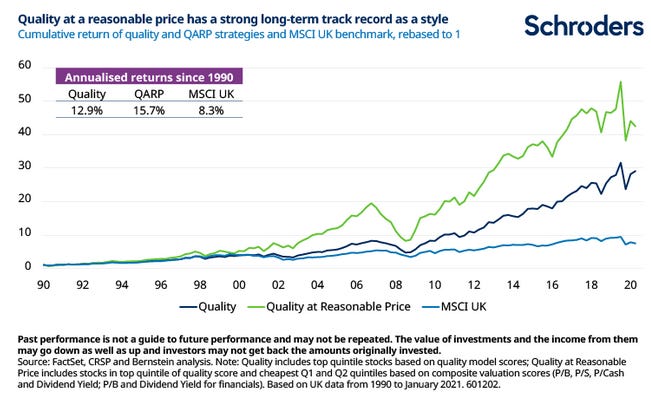

This report from Schroders looks at MSCI UK, versus “Quality”, versus “Quality at a reasonable price”, where the two quality-based approaches significantly outperformed from 1990 to 2020:

But how do we find companies to invest in?

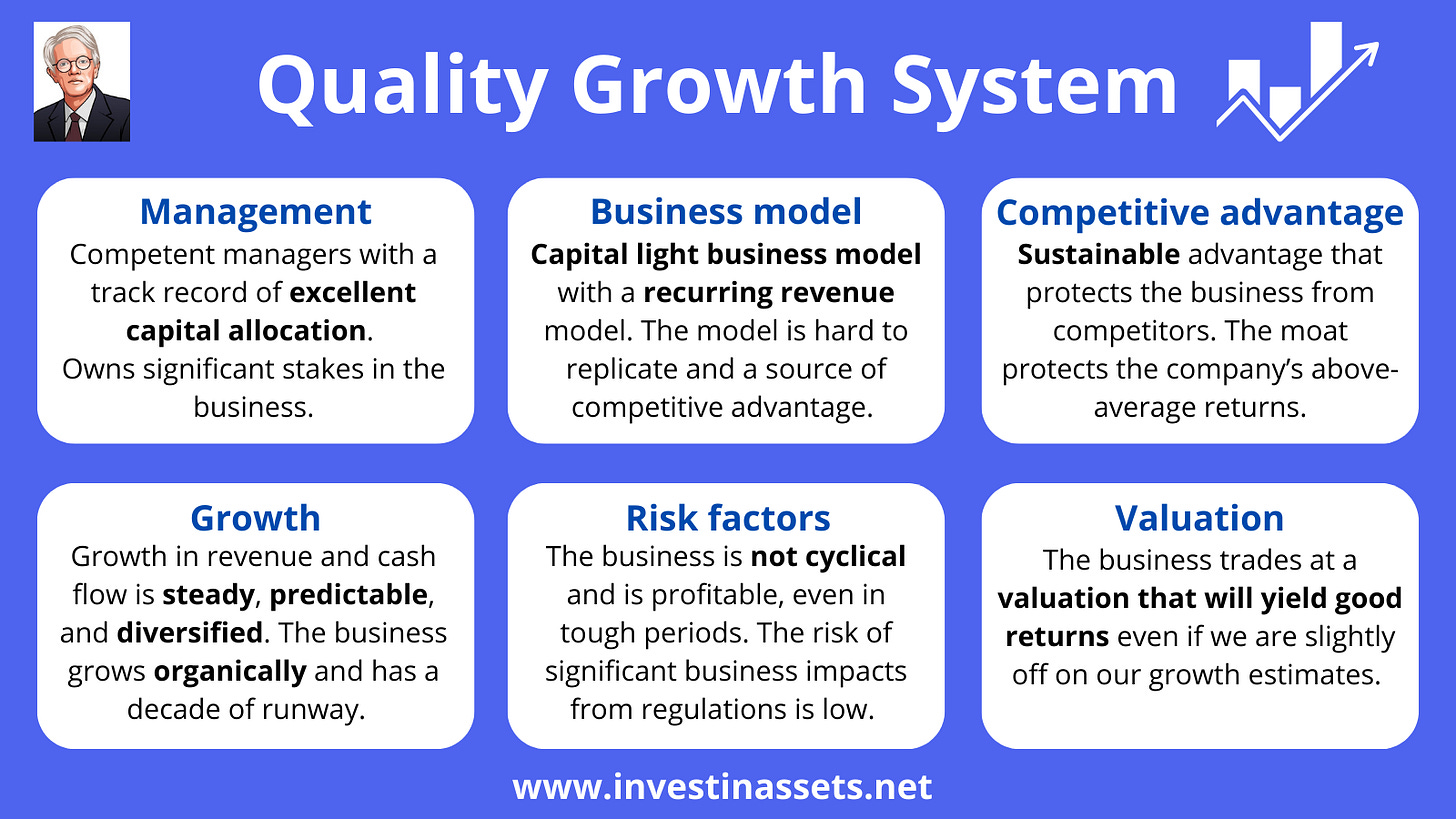

Over the years, our framework has evolved into what we call The 6 Pillars of Quality Growth Investing: a simple, repeatable system for evaluating long-term compounders.

The framework is based on data, strategies from superinvestors like Buffett & Munger, Terry Smith, and Francois Rochon, and our own decade-long experience investing in the stock market.

Let’s get into the pillars 👇

1. Management

Capital allocators first, operators second.

The best businesses are led by owner-operators who think like investors.

They allocate capital with discipline, avoid dilution, and reinvest in high-return opportunities rather than chasing growth for growth’s sake.

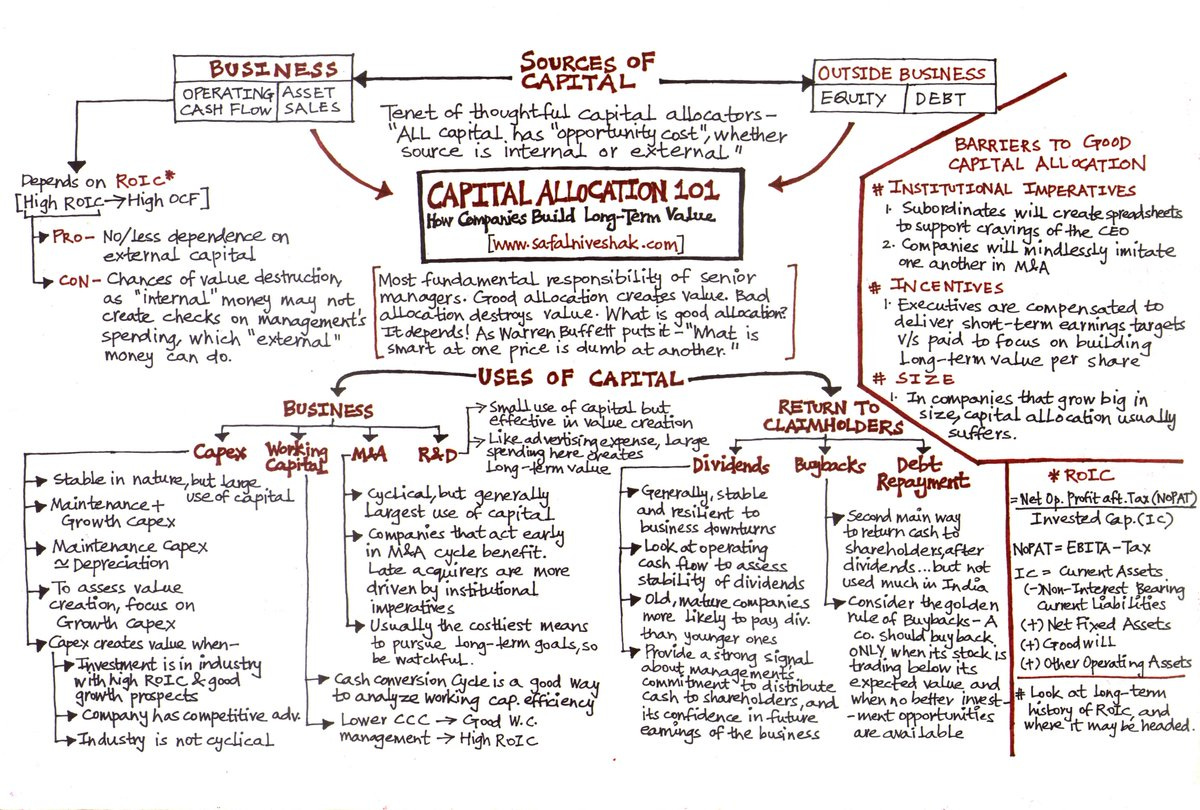

Good capital allocation means that management makes the correct, high-return on investment decision with the excess capital a business has. This is a comprehensive explanation of capital allocation from Safal:

We can see how well management allocates capital by looking at the return on invested capital (ROIC).

Great businesses will have a ROIC of +15%, poor businesses will have a ROIC of >5%.

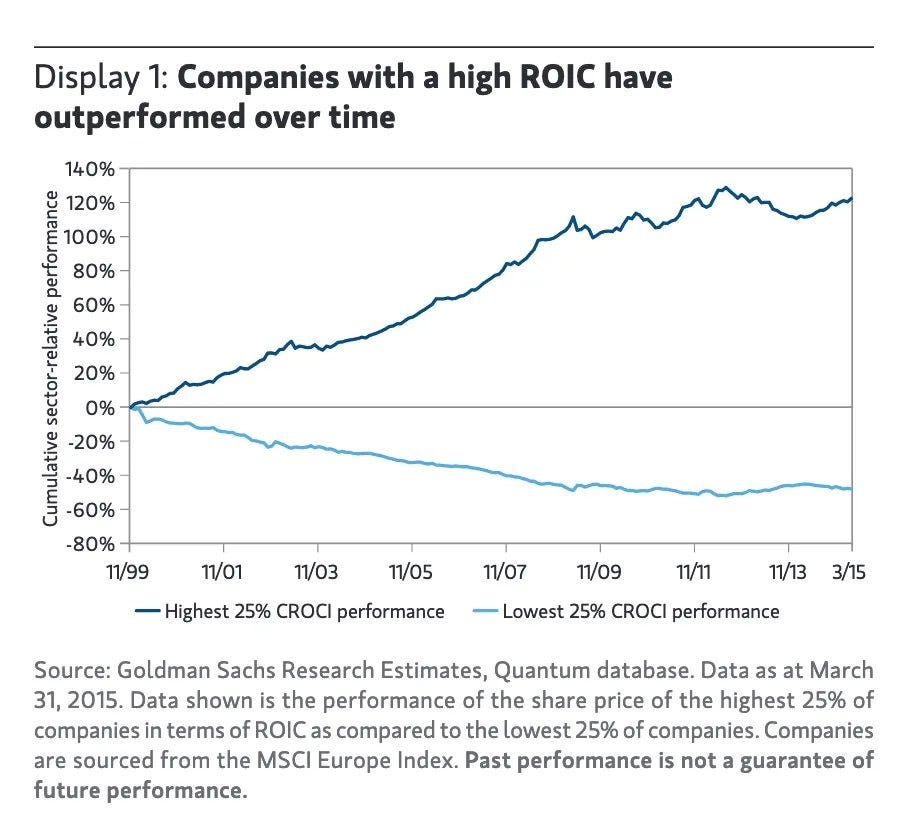

This is the difference in returns for high and low ROIC businesses according to Goldman Sachs:

The difference is staggering, and that is why ROIC is one of the most important metrics we look at for quality growth businesses.

And who makes the decisions that drive ROIC? The management team.

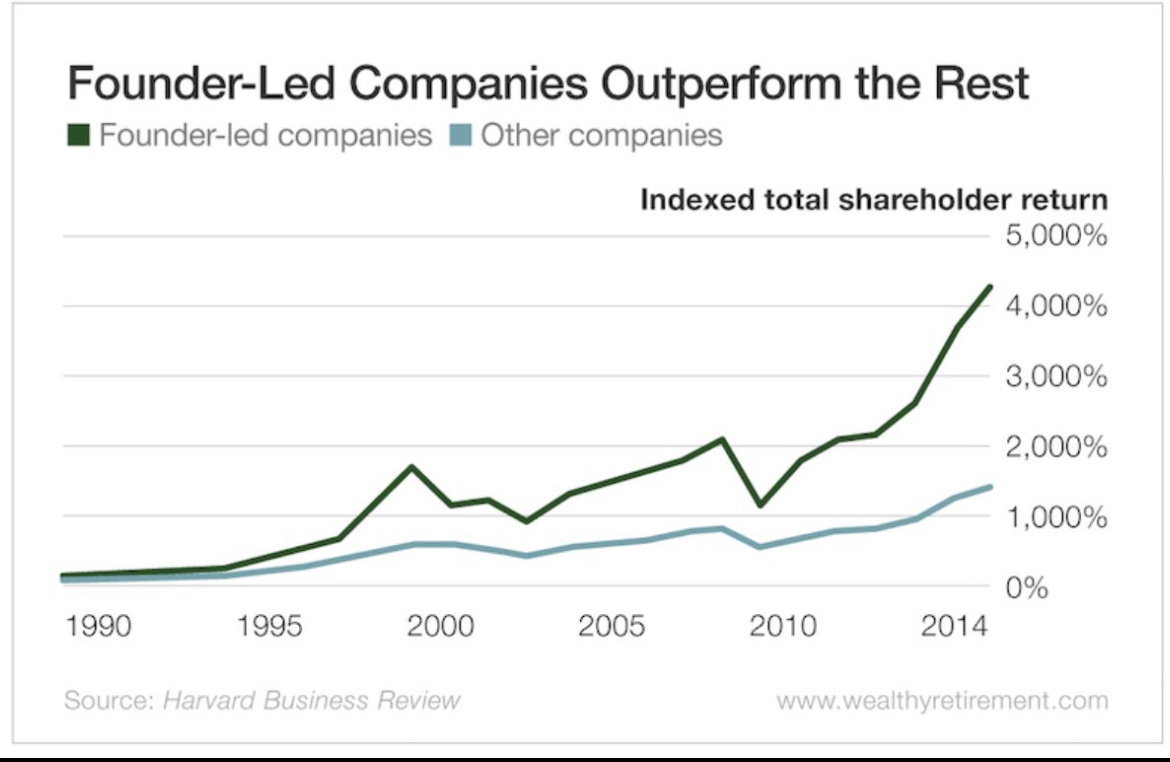

Another important factor when looking at management is whether or not the business is “founder-led” or “owner-operated”.

Founder-led businesses tend to outperform significantly.

Founders combine deep product intuition with shareholder alignment. They own a meaningful stake in the business and care about compounding per-share value, not quarterly optics.

Think of Constellation Software, MercadoLibre, or Apple, all examples where culture and capital allocation drive sustainable business success.

Look for:

Insider ownership and long-term vision

High return on invested capital (ROIC) sustained over time

Rational decision-making during downturns

Read our article to learn more about founder-led businesses:

2. Business Model

Capital-light, recurring, and hard to replicate.

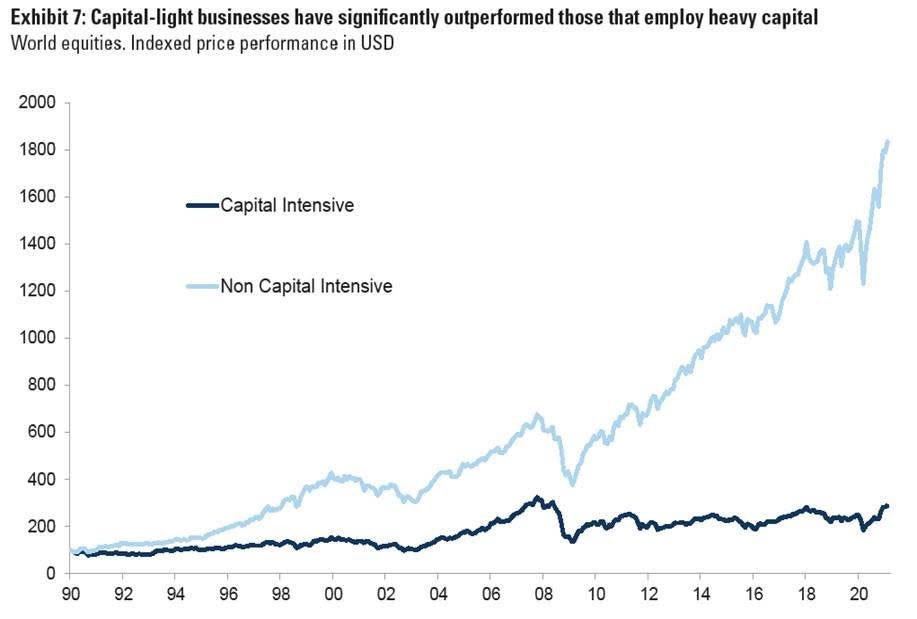

A great business converts revenue into cash without requiring heavy reinvestment.

The holy grail is a capital-light model with recurring or re-occurring revenue streams.

The data suggest that, on average, capital-light businesses outperform capital-intensive businesses by a wide margin:

Examples include:

SaaS: Salesforce, Constellation Software, Adobe.

Payments: Adyen, Visa, Mastercard.

Marketplaces: Booking Holding, Amazon.com, Mercadolibre.

Data Networks: Alphabet, Apple, Tesla.

These models scale without proportionate cost increases.

Once the infrastructure is built, incremental margins expand dramatically.

Look for:

Recurring or subscription-based revenue

High gross margins and operating leverage, where operating income increases more than revenue over time

Network or ecosystem effects that deepen over time

3. Competitive Advantage

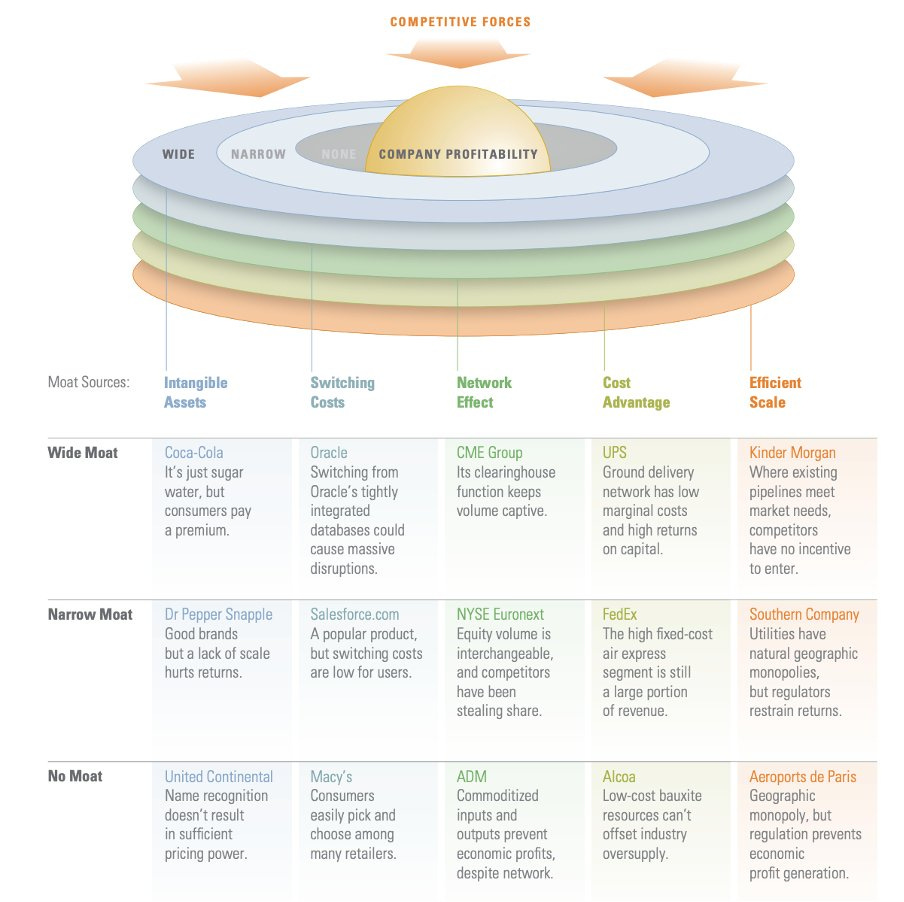

The moat is what protects compounding.

Every great compounder has a moat. This is a structural advantage that protects returns from competitors.

Morningstar’s framework for moats:

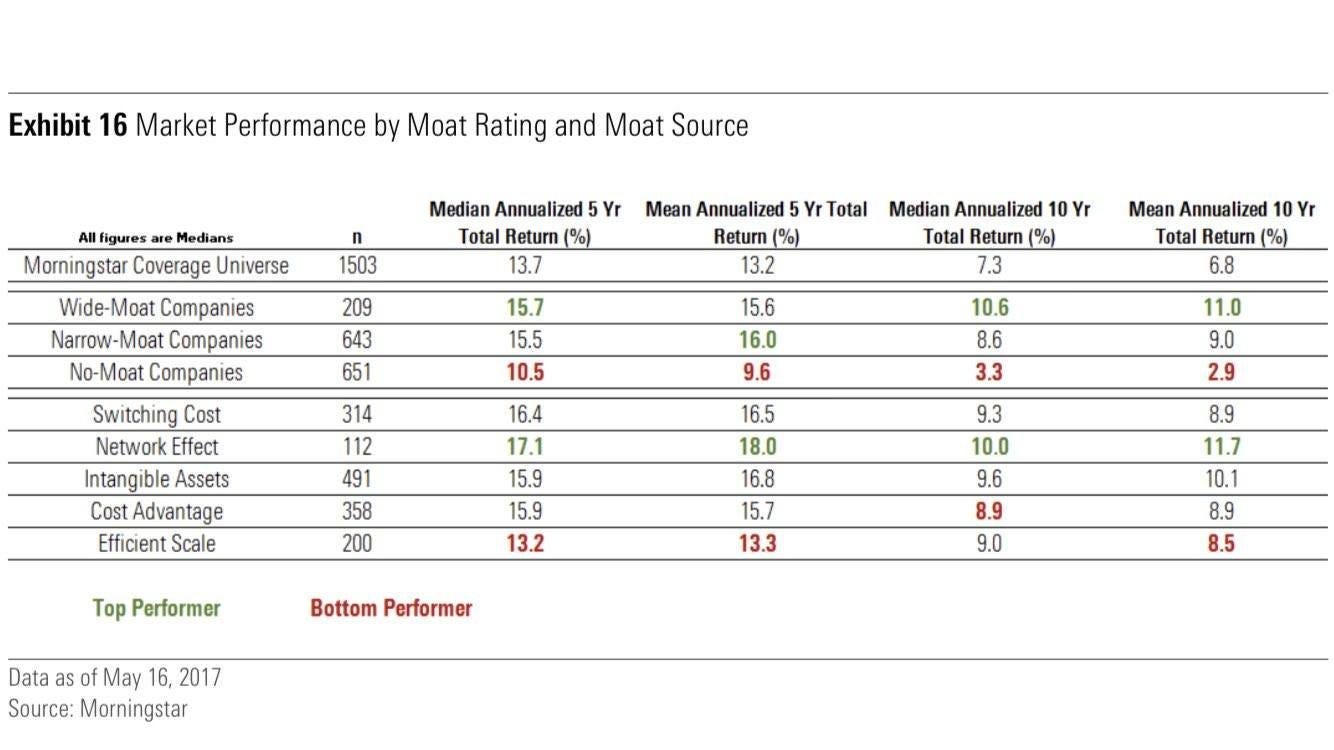

The strongest moat sources, according to Morningstar, are (10-Yr annualized return):

Network Effects (+11.7%)

Intangible Assets (+10.1%)

Switching Costs (+8.9%)

Cost Advantage (+8.9%)

Efficient Scale (+8.5%)

The data suggest that wide moat businesses tend to outperform those businesses with a narrow or no moat.

Especially weak is the “no-moat” category with the lowest levels of reported returns on all time frames.

The key is sustainability. Temporary edges (like marketing budgets or first-mover advantage) tend to fade.

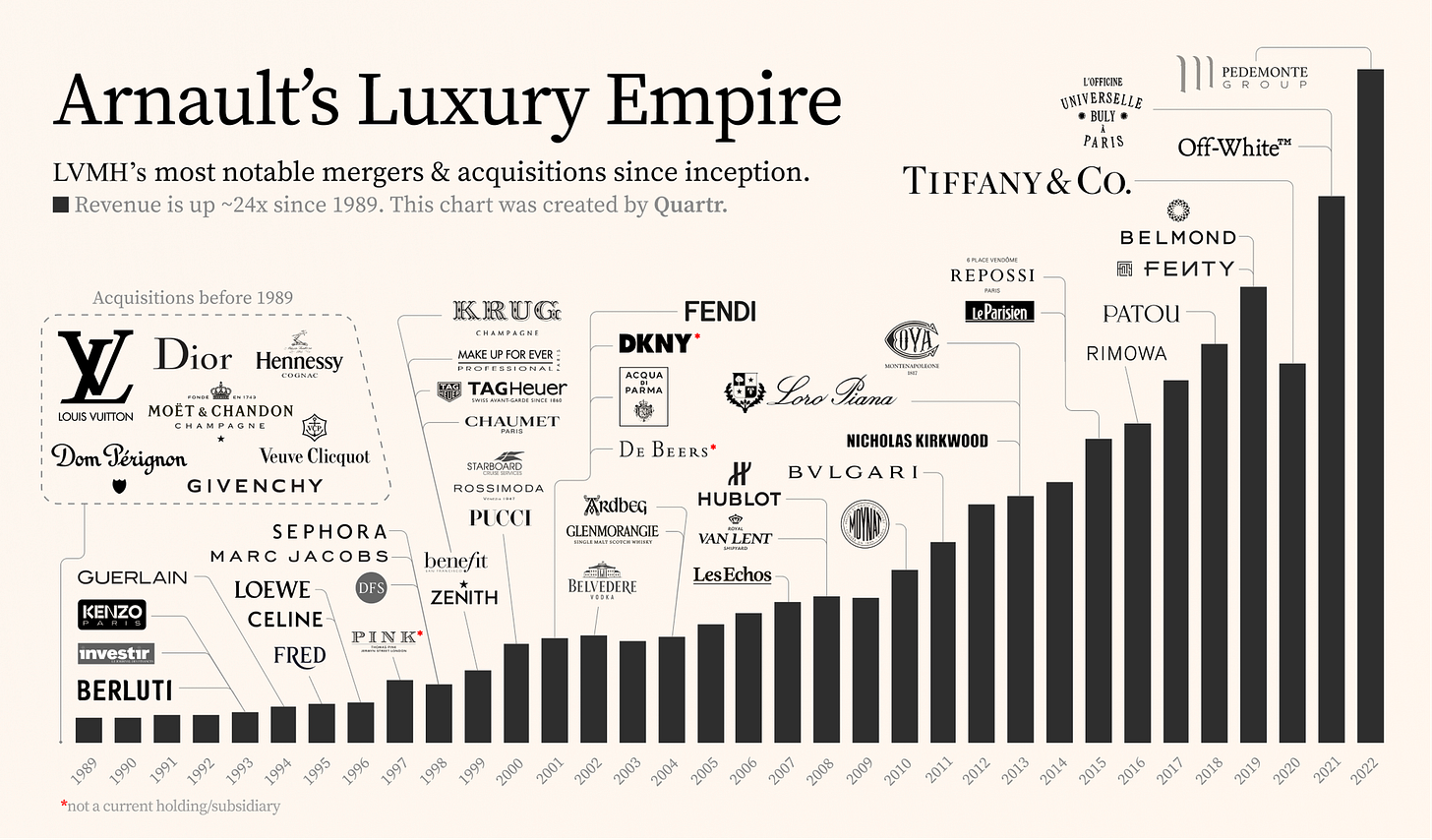

Durable moats strengthen with time. As in the case of Visa’s network effects, ASML’s technological monopoly, or LVMH’s brand equity.

Look for:

Rising returns on capital, gross margins, and operating margins.

Pricing power over time (Where competitors cannot increase prices)

Moats that expand as the business scales (This is what makes “Network Effects” so strong).

Read our article to learn more about moats:

4. Growth

Predictable, diversified, and durable.

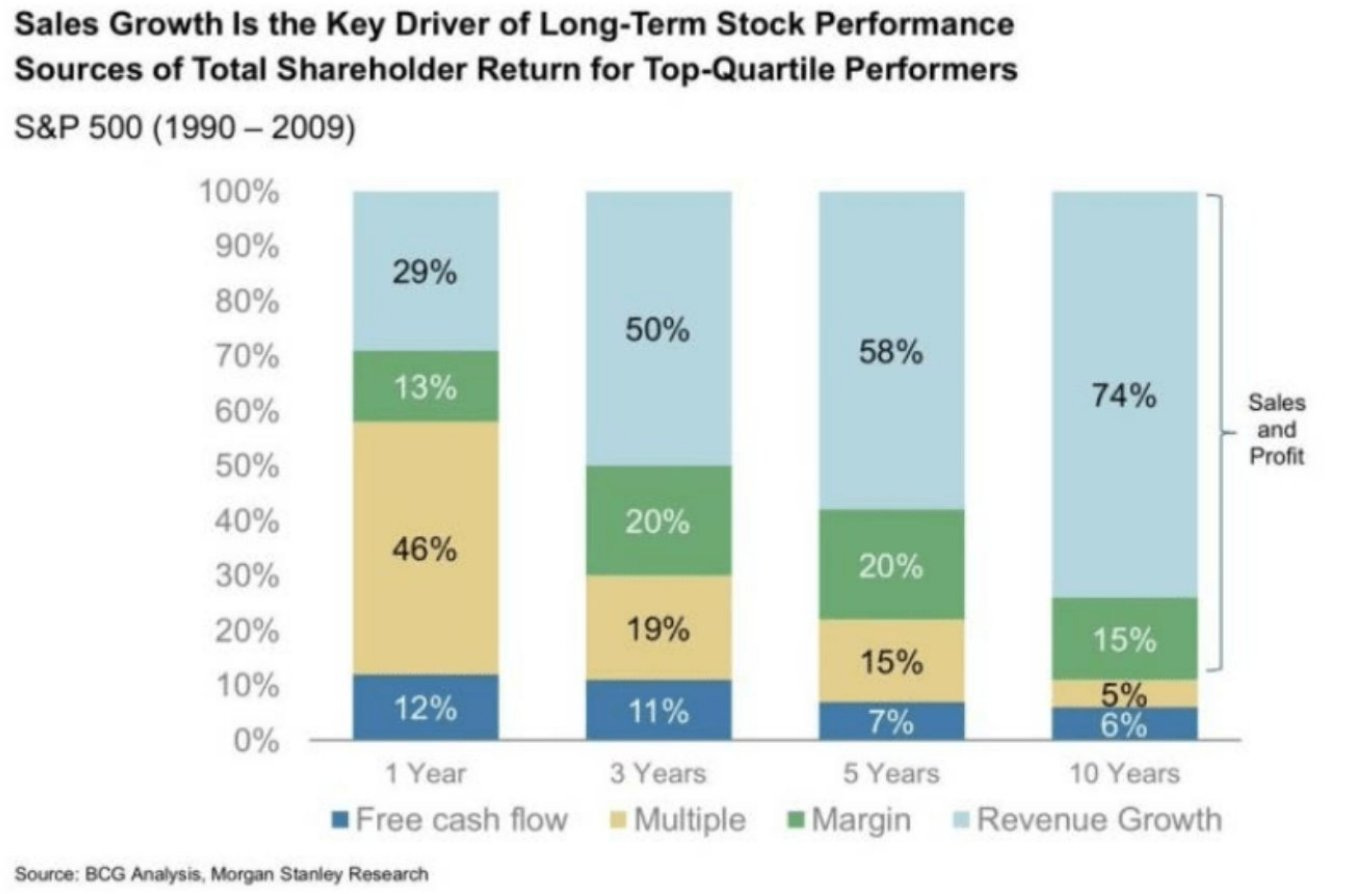

Growth is the single most important factor for shareholder returns:

However, growth alone doesn’t make a great investment.

We want profitable, predictable, and organic growth, ideally from multiple engines (geography, products, customer segments) that reduce concentration risk.

Organic growth is worth far more than acquisition-fueled expansion. The best companies compound from within, powered by strong unit economics and customer retention.

We all know the most famous examples:

Apple: Customers lined up to get the new iPhone or MacBook.

Amazon.com: Customers pay an annual subscription to get their orders quicker and more conveniently.

Tesla: Electric cars so good they turn uninterested consumers into evangelists.

Look for:

Consistent revenue and free cash flow growth over years, not quarters

Expanding TAM with a visible runway

Low customer churn and high net retention

Optionality to move into new business segments

Read more on the importance of growth here:

5. Risk Factors

Avoiding the permanent loss of capital.

A true quality business remains resilient even in recessions.

Companies like LVMH have low cyclicality and remain strong through tough periods, like the dot.com crash, the great financial crisis, and even the pandemic.

Businesses that are low in cyclicality, not over-levered, and not dependent on regulation or a single client.

Volatility in the stock price is not what we consider risk; the fragility of the business is. We want to own anti-fragile businesses (That get stronger during tough times).

LVMH is a financial fortress that can buy competitors at discounted prices during downturns.

We want companies that stay profitable in bad times and grow stronger when others retreat.

Look for:

Consistent profitability across cycles

Low debt and high cash conversion

Limited exposure to binary regulatory or geopolitical events

6. Valuation

Even the best business can be a poor investment at the wrong price.

Quality without discipline leads to overpaying.

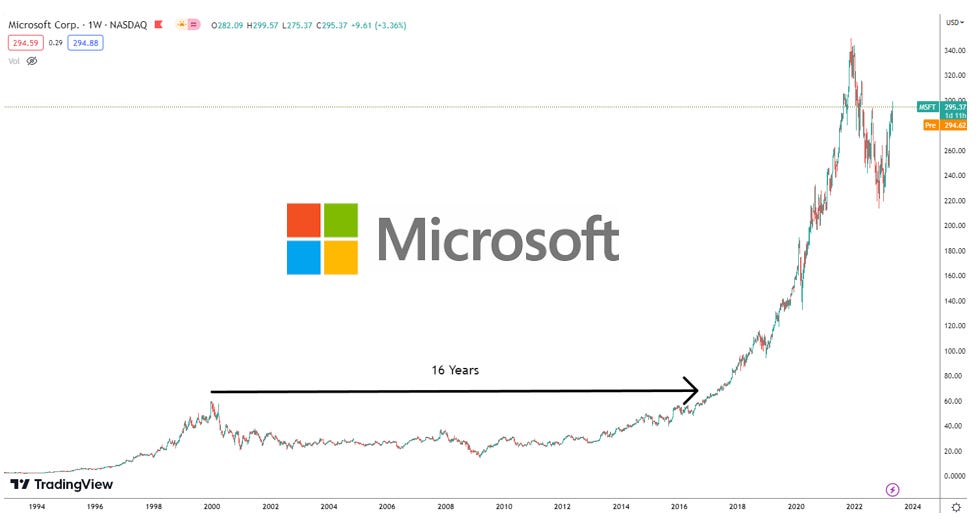

The classic example? Microsoft 2000 to 2016 (It took the stock 16 years to make new highs):

Before we invest, we want to determine if a business has what Buffett calls a margin of safety, even if our growth assumptions are off.

The true valuation of a business is its future earnings power. The free cash flows and earnings the business can produce in 5 or 10 years will ultimately determine if your investment is successful or not.

The relation that this earnings number has to valuation also matters a lot.

The cheaper we can get a business (compared to what we believe it will grow at), the better the investment outcome will be.

If we get the dual engine of growth: EPS growth + Multiple expansion, we’ll perform well over time.

This is why we prefer to buy quality businesses when they are reasonably priced (Supported by Schroders’ data):

Look for:

Reasonable multiples relative to growth and ROIC

Conservative assumptions still yield 10–15% expected returns

Alignment between market expectations and business reality

Free Valuation Cheat Sheet — Discover a simple, reliable way to value businesses and set your margin of safety. Download now.

Concluding thoughts

The 6 Pillars framework filters out noise and focuses on what truly matters:

ownership mindset, scalable economics, durable moats, predictable growth, low fragility, and rational valuation.

It’s not a shortcut to “get rich quick”; it is the long and disciplined journey of capital compounding.

📈 This is the Quality Growth System we use at InvestInAssets.net — a practical roadmap for building a portfolio of durable compounders for the next decade.

Ready to take the next step? Here’s how I can help you grow your investing journey:

Go Premium — Unlock exclusive content and follow our market-beating Quality Growth portfolio. Learn more here.

Essentials of Quality Growth — Join over 300 investors who have built winning portfolios with this step-by-step guide to identifying top-quality compounders. Get the guide.

Free Valuation Cheat Sheet — Discover a simple, reliable way to value businesses and set your margin of safety. Download now.

Free Guide: How to Identify a Compounder — Learn the key traits of companies worth holding for the long term. Access it here.

Free Guide: How to Analyze Financial Statements — Master reading balance sheets, income statements, and cash flows. Start learning.

Get Featured — Promote yourself to over 24,000 active stock market investors with a 42% open rate. Reach out: investinassets20@gmail.com