3 Mid Cap Stocks to Buy 🏆

3 Premium Mid Cap Picks🧠

Hi dear investor 👋

In this article, we’re exploring 3 high-quality mid-caps that might be of interest to you.

You might want to become a premium subscriber

Here’s why:

💎 Save time by leveraging our research and stock picks. Follow our market-beating quality growth portfolio.

🏆 Get high-quality ideas from our Top 5 Buys of the Month, Top 10 buys for 2024, Investable Universe, and continuous updates on the most promising investments.

🏰 Detailed business breakdowns of top-performing compounders and their valuations.

Introduction

The idea is that small & mid-cap stocks have a lot of room to grow. If you can pick a few great small caps before the large institutions buy them, you can do well over time. As the small businesses become large enough to interest larger funds & institutional players, the stock price surges and we retire with a healthy nest egg.

Definition: A mid-capitalization stock is a business that is worth between $2 billion - $10 billion. However, this is sometimes stretched to $20 billion.

Mid-caps sorted by Return on Capital Employed 5Y average $2B-$10B

Mid-caps sorted by Return on Capital Employed 5Y average $10B-$20B

Sample from our Investable Universe

The list above contains some of the top-quality mid-cap names from our investable universe. The list is sorted by ROCE as we believe this is the purest measure of profitability and competitive positioning in the respective markets.

Growth on a 5-year basis is not necessarily the best proxy to understand the quality of a business. Many businesses will underperform their 5-year above-average compounded annual growth rate in the coming 5-year period. While those with a low growth might have easier comps.

These are our 3 favorite midcaps ($2B-$10B) currently…

3 Quality Mid Caps 💎

These mid-caps are not household names just yet. They have great fundamentals and ride secular trends that can support their growth for many years to come.

Let’s dive in 👇

Reply SpA $REY

Market capitalization: $4.9 billion

Free cash flow per share CAGR 5-Year: +19.8%

Earnings per share CAGR 5-Year: +13.4%

ROIC: 15%

Gross Margin: 17%

Operating margin: 13%

Interest Cover: 30x

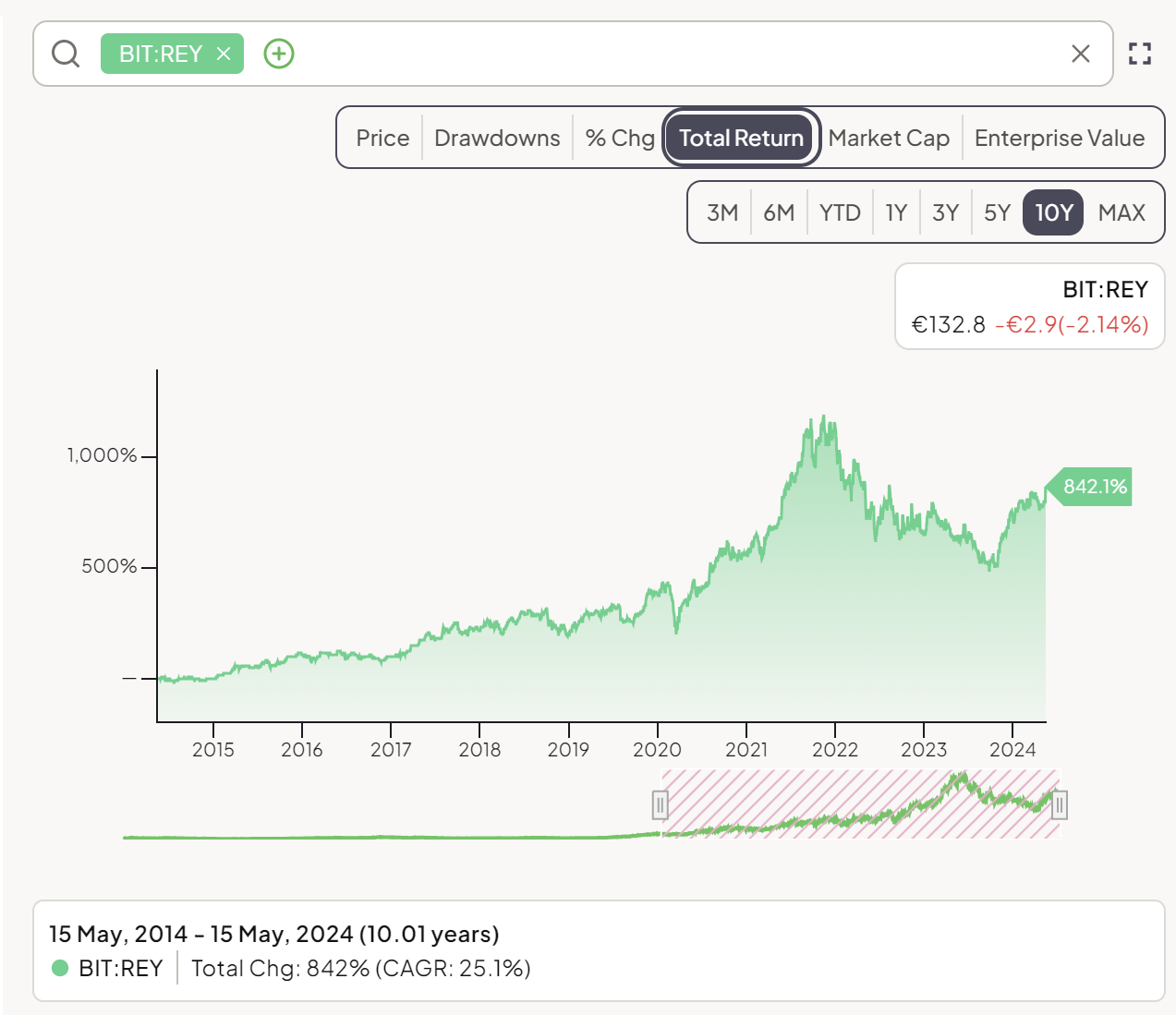

10 Year Price CARG: 25.1%

Introduction

Reply SpA is a leading provider of consulting, system integration, and digital services in Italy. Since its inception in 1996, Reply has specialized in designing and implementing solutions based on new communication networks and digital media.

The company serves a diverse range of industries, including telecommunications, finance, manufacturing, and public sectors, Reply helps organizations optimize their operations and enhance technological capabilities.

Its network of specialized companies allows for deep expertise and agility, adapting quickly to technological advancements and market demands.

3 Reasons why Reply is interesting:

Innovation and New Technologies: Reply’s continuous investment in cutting-edge technologies such as artificial intelligence, big data, cloud computing, and the Internet of Things positions it as the go-to consultant company in Italy.

Diversified revenue clientele: The company serves a wide array of industries, with 33.7% coming from automotive, manufacturing, logistics & retail, while 30% comes from Financial. Additionally, the company operates in multiple regions, and through multiple business lines.

Strong Financial Performance and Market Position: Reply has demonstrated solid financial growth, driven by long-term client relationships and a reputation for delivering advanced technology solutions. This is reflected in the stock price over the past 10 years:

These factors collectively position Reply SpA as a promising company with significant potential for sustained growth and success in the IT services and digital transformation industry.

Financial history

Reply’s 10-year financial history is impressive. Free cash flow per share CAGR 10-year is 20.94%, EPS is 16.36%, and revenue per share is 14.22%. The business has also maintained a high return on capital employed between 24.4% and 19.1% in the last decade, indicating a strong competitive position.

Qualys QLYS 0.00%↑

Market capitalization: $5.5 billion

Free cash flow per share CAGR 5-Year: +20.6%

Earnings per share CAGR 5-Year: +24%

ROIC: 19%

Gross Margin: 81%

Operating margin: 30%

Interest Cover: No interest expenses in the last 3 years

10 Year Price CARG: 21.1%

Introduction

Qualys is a pioneering provider of cloud-based security and compliance solutions that help organizations protect their data and ensure compliance with relevant regulations.

The company offers an integrated suite of solutions that automate the various aspects of IT security and compliance management, including vulnerability management, policy compliance, web application scanning, malware detection, and much more.

3 Reasons Why Qualys is Interesting:

Robust Technology Platform: Qualys Cloud Platform utilizes a powerful combination of software-as-a-service (SaaS) architecture and an integrated suite of security and compliance solutions. This scalable platform enables customers to conduct thorough security scans and compliance checks with ease and efficiency, significantly reducing the complexities and costs associated with traditional IT security.

Large & Expanding Market: With increasing cyber threats and strict regulatory requirements, businesses are prioritizing IT security and compliance, driving demand for Qualys’ services. Qualys’ comprehensive offerings are well-suited to meet these growing needs, positioning it favorably in a rapidly expanding market.

Strong margins & Cash flows: Qualys post industry-leading margins with 47% EBITDA margins:

In addition, their cash flow is growing at a steady and high pace. Since 2021, their free cash flow has increased 16% CAGR with a 57% FCF margin in Q1 2024.

Financial history

Qualys showcase steady growth and profitability over the last decade. Revenue per share has grown (10-year CAGR) at 15.7%, EPS by 19.5%, and Free cash flow per share by 26.8%. In addition, Qualys has expanded its return on capital employed almost every year, from a low of 6.8% in 2014, to 42.2% in 2023.

Games Workshop

Market capitalization: $3.3 billion

Free cash flow per share CAGR 5-Year: +26%

Earnings per share CAGR 5-Year: +17.7%

ROIC: +67%

Gross Margin: 70%

Operating margin: 37%

Interest Cover: 190x

10-Year Price CAGR: 40.6%

Introduction

Games Workshop is a British manufacturer of miniature wargames, notably Warhammer 40,000 and Warhammer Age of Sigmar.

Games Workshop operates a unique business model that encompasses the development, production, and sale of its game systems and related products through company-owned retail stores, independent retailers, and its own direct sales channels, including websites and mail orders.

3 Reasons Why Games Workshop is Interesting:

Strong Brand and Loyal Community: Games Workshop has cultivated a dedicated and passionate fan base around its richly detailed game universes. This loyal community not only purchases products but also actively participates in events and forums, providing a stable demand and a robust market for both new and existing products.

Vertical Integration: By controlling the entire process from design to retail, Games Workshop ensures high-quality products and experiences for its customers. This vertical integration allows the company to maintain strong profit margins and better manage its operational risks than companies relying on external suppliers.

Expanding Online: Recognizing the shift towards digital media, Games Workshop has expanded its digital offerings, including digital versions of its games and a growing presence in multimedia entertainment. This expansion into digital and media ventures opens new revenue streams and markets, potentially boosting its long-term growth prospects.

Financial History

Games Workshop has grown at an impressive rate over the last decade. Revenue per share has grown (10-year CAGR) at 15.6%, EPS by 36.4%, and Free cash flow per share by 31.6%. Additionally, Games Workshop has expanded its return on capital employed almost every year, from a low of 31.5% in 2014, to 61.6% in 2023.

That’s it for today. If you made it all the way to the end, here are some more reading material you might find interesting:

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

Promote yourself to +6,000 stock market investors (46% open rate) — Contact us via: investinassets20@gmail.com

Any ideas on valuetion?reply was growing a lot last ten years(I hold ot for more than 5 years since 2011) but the hrowth was related to FCA and telecommunication,not now great customers.Qualys was hit a lot lately (why?) amd gameshop was hit hard some years ago,note to consider

Qualys is quality! I think is undervalued right now.