From Yoga Mats to Market Share: Lululemon Investment Case 💡

Solid Fundamentals & Growth + Strong Brand

Thank you for subscribing to Invest In Quality.

We deeply value your feedback, and would love for you to take this 3-minute survey to help us improve our service to you:

Hello, dear subscriber!

This is a free article, leave a ❤ if you enjoy it.

What you’ve missed in recent times if you don’t subscribe to the Premium service:

Lululemon Athletica

Lululemon is an athletic apparel company founded in Canada. Its commitment to quality, innovation, and community has positioned Lululemon as a unique brand with loyal customers in the high end of the market. Their products typically sell for $90-$130 and are considered high quality in terms of their fabric, functionality, and perceived quality.

Lulu’s success comes from their first-mover advantage in the athleisure market. Athleisure is a hybrid that can be worn for athletic activities and casually. Lulu created a new category, where you can wear your training apparel everywhere. This path has proven to provide an advantage over traditional appeal makers such as Adidas, Nike, and Under Armour.

Additionally, Lululemon differentiates itself from other athletic/sports brands as it cultivates a lifestyle brand that transcends the gym or yoga studio. In this article we will detail Lululemon as a business and whether the investment case is attractive.

What Lululemon Does

The Lululemon brand empowers individuals and communities to lead active and mindful lives through its premium apparel and accessories. Lulu offers a wide range of products tailored for athletic activities such as yoga, running, and working out at the gym. Lululemon has successfully created a community around its brand by utilizing social media marketing and leveraging influencers in niche communities, such as Yoga, CrossFit, and running. Their values promote wellness, self-improvement, and a healthy, mindful lifestyle.

Lululemon’s product lifecycle:

How Lululemon Makes Money

Lululemon makes money by selling athletic apparel. Their product is sold through its brick-and-mortar stores globally, as well as direct-to-consumer through an e-commerce platform and mobile application.

Since 2020, the direct-to-consumer revenue has compounded by almost 40% annually. While the “company-operated stores revenue” has compounded at ~15%. This showcases a shift in consumer preference to shopping online instead of going to the stores.

Lifestyle Brand

Lululemons unique combination of design and cutting-edge performance has captured the hearts of mindful fitness & fashion enthusiasts.

Lululemon offers free yoga classes and running clubs. These are just a few examples of initiatives Lulu does to connect with their customers. Each time a customer participates in these events, they form unique, personal connections with the brand. This positive experience gives the customers a positive association with the brand years after the experience.

Utilizing Scarcity to Drive Impulse Purchases

Lululemon’s clothing sells out fast. The selected product is re-stocked every Tuesday on their website. Fans of Lululemon know this, which drives customers to make more impulsive purchases due to fear of them selling out.

Many clothing brands have to discount their clothes to sell out inventory. With this strategy, Lululemon can always sell their product close to full price. This is beneficial for Lulu, as they earn better margins, but it is also good for their brand perception — discounted products signal that the product is less valuable (Consumers will often perceive that the more expensive option is of higher quality just because the price is higher).

Another benefit of scarcity is that it generates significantly higher website traffic than most apparel online stores. According to Kenjo at Lululemon, Lulu’s customers visit the website on average 15 times per year, 4X higher than the average appeal online store.

Customer Loyalty

Lululemon has a Net Promoter Score of 43, with 63% promoters of the brand. This is a strong NPS score in line with some of the top brands in the world.

Additionally, customer loyalty is very high, at 84%:

And customer satisfaction is at 86/100:

These statistics indicate a high loyalty and satisfaction with the brand.

Drivers for Growth

Relentless focus on innovation

Innovation & Lulu’s focus on fashion & functionality is the underlying driver for their products. Innovation triggers their ambassadors to purchase more products and spread the word through word of mouth.

Building a loyal community through brand ambassadors

Increasing customer satisfaction, loyalty, and the number of ambassadors is a well-known marketing strategy that is cost-efficient and not easy to pull off. Lululemon’s DNA is built on the notion of creating a community by arranging events, work outs, meet ups to create fans (as opposed to transactional customers). This creates an emotional relationship with the brand.

International expansion

Although Lulu’s growth has slowed down in North America, the international market is providing significant potential for Lulu. Lulu’s internationalization is firing on all cylinders with immense growth coming from Asia and Europe. The athleisure trend is on the rise in Asia and can be a growth driver for Lulu in the next 5-10 years.

Diversification of Sales

Lululemon has diversified its sales from offering wearable athletic apparel, to footwear, accessories, and personal care products. This enables Lulu to take a larger share of their customer’s wallets. Lulu does not disclose revenue or EBIT from each product segment (Yet). But they do offer 3 product segments:

Women’s products: $6.1 billion growing at 22% CAGR since 2020.

Men’s product: $2.25 billion growing at 25% CAGR since 2020.

Other product categories: $1.2 billion growing at 44% CAGR since 2020.

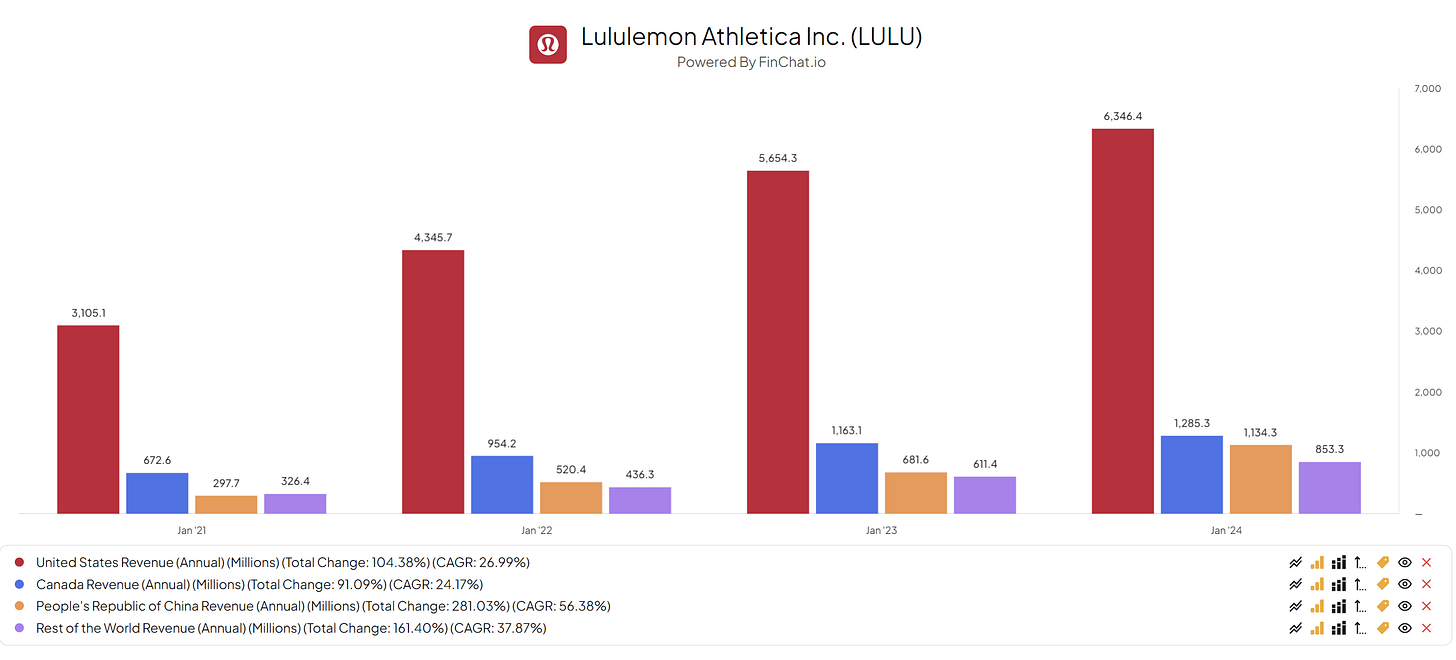

Geographic sales

United States poses the largest segment by far with $6.3 billion in revenue as of Jan 2024. Although it is the largest segment, it still grew revenues by 27% annualized since 2021. Canada is the second largest at $1.28 billion with 24% CAGR growth since 2021. However, China is likely to surpass Canada this year, with a growth from $681 million in 2022, and $1.13 billion in 2023, China is a growth engine for Lulu. The annualized growth of China since 2021 is 56% (!). The rest of the world is also growing rapidly with ~38% annualized growth since 2021, and a total revenue in 2023 of $853 million.

Company-operated stores can be seen as a leading indicator for Lululemon, as more stores opened in a region or country are likely to stimulate more direct-to-consumer purchases as well due to their presence and event-driven marketing strategy.

As we can see, the opening of new stores is rapidly expanding in China (35% CAGR), South Korea (40% CAGR), and “All Other” (20% CAGR):

The Market

The global sportswear market is projected to grow from $193.89 billion in 2023 to $305.67 billion by 2030, at a CAGR of 6.72% during the forecast period according to Fortune Business Insight.

Health consciousness

The upcoming generations are much more health-conscious than their predecessors. They focus on physical and mental health and utilize gyms, sporting activities, and events to a large degree. The science in the last decades points towards the physical and mental benefits of working out and living a healthy lifestyle that is reflected in millennials & Gen Z’s values & attitudes.

From a study by the American Heart Association: “… millennials are more likely to engage in healthy behaviors, such as regular exercise and maintaining a healthy diet, than in previous generations.

Like millennials, Gen Z (born between 1997 and 2012), are more likely to prioritize eating healthy and getting regular exercise, however, they also prioritize their mental health and managing stress.” Fortune Business Insight.

Urbanization

The secular trend of engaging in fitness activities driven by global population urbanization is likely to drive the demand for sports and athleisure apparel in the years ahead. As more developing countries are creating a larger middle-class base, they are likely to engage in sporting activities, driving sportswear & athleisure sales.

Female Participation in Sports

More females are participating in sports worldwide. This can primarily be seen as the number of female sporting events increasing, and participation in competitive events, such as the Olympic games. A few supporting statistics:

In the U.S., girls' participation in high school sports has increased from 295,000 in 1971 to 3.4 million in 2015-16.

At the 2018 Winter Olympic Games, women made up 41% of the competitors.

ESPN's share of televising women's sports grew by 275% between 1993 and 2011. (Gitnux)

Counterfeits

The rising number of counterfeit products may hamper the market growth in the years ahead. The surge from cheap counterfeit footwear, clothing, and leather goods from Asian countries can contribute to slowing sales for many quality brands such as Lulu. According to the Organization for Economic Co-operation and Development, trade of counterfeit goods stands for 3.3% of world trade (Sportswear is included but just a small % of this trade).

The Stock

Lululemon has recently pulled back quite a bit from its all-time highs, still, it has a 10-year CAGR of 21.1% over that period. Since its inception in 2008, it has compounded its total return by 21.4%. And in the last 5 years, the CAGR has been 16.1%.

The Growth 10-Year CAGR

Revenue: 22.5%

Gross Profit: 22.3%

Earnings per share: 24.8%

Free cash flow per share: 28.6%

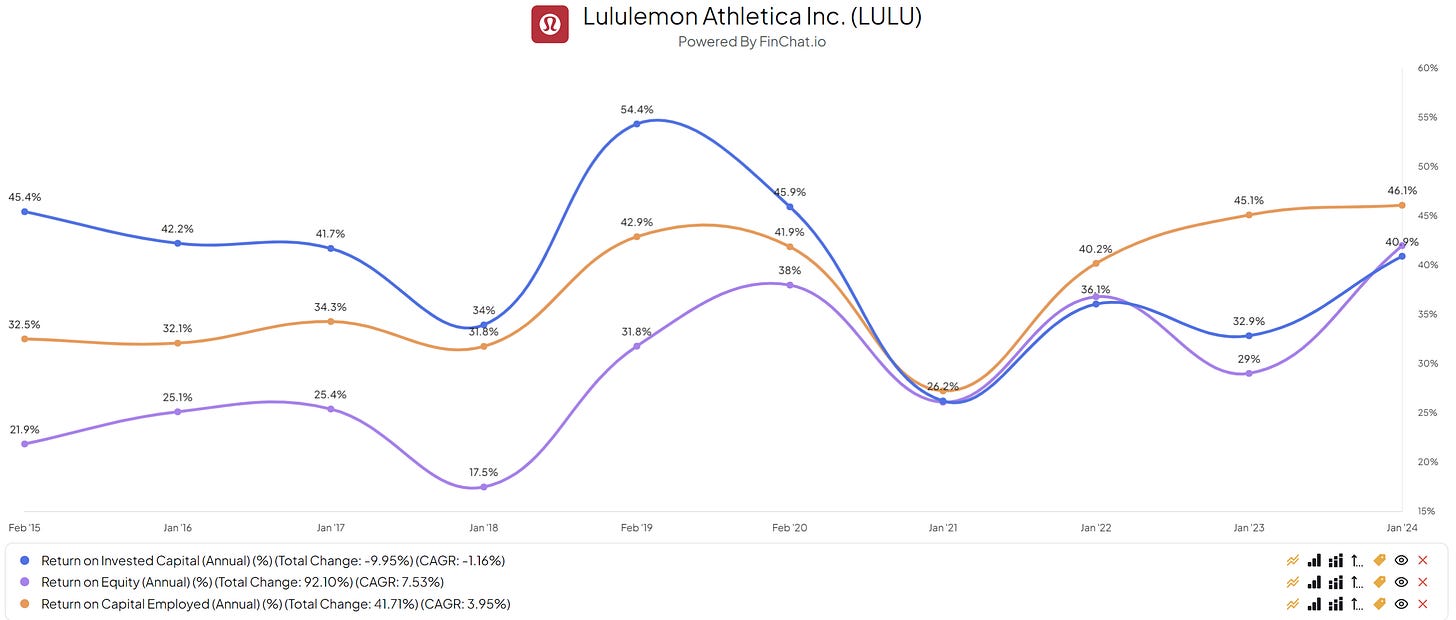

Lululemon has seen strong growth over the last decade with impressive margins and returns on invested capital. The CAGR rates are between 20-30% annually, and the ROIC has consistently been above 30% and even 40%.

Lululemon repurchases its own shares every year (as opposed to paying a dividend). This helps to boost their per-share earnings and can be a good use of excess capital when the business is trading at a fair price.

Lululemon’s per share growth has been nothing but amazing over the last decade:

Management

The executive management of Lululemon:

Lululemon's management team has demonstrated a solid track record of navigating the company through various challenges while capitalizing on growth opportunities. Under the leadership of CEO Calvin McDonald, who assumed the role in 2018, Lululemon has experienced sustained revenue growth, expanded its global footprint, and enhanced brand relevance in the competitive athletic apparel market.

“Mr. McDonald is a growth-oriented leader who has a proven track record helping large organizations scale by integrating how brands engage with customers where they shop – in stores, across digital channels, and from their home. Prior to joining lululemon in August 2018, Mr. McDonald served for five years as president and CEO of Sephora America’s, a division of the LVMH group of luxury brands, during a period of double-digit growth.”

McDonald holds an impressive track record and relevant experience within premium clothing brands. He has been the Lulu for 6 years and provided solid results in his tenure.

According to GuruFocus, McDonald holds 73.793 shares in Lululemon, which at today’s price of $357 is valued at $26.3 million. This is a lot of money for most people, however, McDonald receives a compensation of ~$20 million every year for his role as CEO of Lululemon:

The good thing is that McDonald receives a lot of his compensation in shares of the company, providing a long-term incentive alignment with shareholders.

What we don’t like to see is that McDonald sells a lot of the shares he gets as compensation. He owns about 0.07% of the business in total, but here are some recent sales and dates from McDonald:

Now, there might be personal reasons for selling the stock, such as diversification, the purchase of a new home, or other assets, so it is not necessarily a bad sign. However, the large sale 18th of December at $497.5 indicates (in my opinion) that he believed the business was richly priced.

I’d love to see more commitment to the business from the CEO, but it is not a deal breaker.

Sustainable competitive advantage

Business/Distribution model

A structural advantage of Lululemon is that they don’t rely on retailers selling their product, like Nike does. They sell directly from their stores, or via their website. This provides higher margins as they cut out the middleman (retail shops). In addition, their ability to sell directly from their website is a large advantage. Direct-to-consumer is only achievable for strong brands. You have to specifically want “Lululemon” as a consumer, if not, you will go to the closest retail store and look for discounts on a random brand.

Additionally, the strategy of only selling its product in its stores, is that it can create scarcity and make Lululemon an exclusive high-end product which stimulates demand and allows Lulu to charge premium prices.

Brand Power

Lululemon has a strong brand with loyal customers as previously discussed. There are blogs dedicated to updating customers when Lululemon updates their website with “We made too much” where Lulu offers discount prices on specific items. Customers are more attached to Lululemon than other brands that don’t evoke the same excitement and community.

Innovation & Differentiation

Innovation is the front and center of Lululemon’s brand. New products and iterations keeps the brand fresh and recruits new loyal customers that wants a piece of the newest products. Creating new products that are differentiated from the main competitors is not easy, and it is therefore also hard for new entrants or competitors to create this culture of innovation, making it a competitive edge.

Lulu’s differentiation strategy entails building a community by hosting events, such as Yoga classes & running sessions, having a strong social media presence with endorsements from key influencers in the fitness community, and creating a unique experience for customers in their dedicated stores.

Margins

Lululemon has been improving its Gross profit margins over the last decade, indicating that it has pricing power over its customers. Additionally, the operating margin is consistently above 20% - also slightly expanding over the last decade.

Capital Efficiencies

Returns on capital have generally been high (+40%), indicating a superior business. Since the pandemic, Lululemon has recovered from ROIC of 25% to almost 40%.

Why own Lululemon?

Strong future growth prospects (Est. 15% long-term EPS growth)

Strong competitive position & advantage

Doesn’t need debt to achieve superior returns

Growing demand for sports & athleisure clothing

Proven ability to innovate & expand globally

High return on capital

Highly profitable

History of strategic execution

Decent valuation

The Risk

Market Saturation: Lululemon faces risks of market saturation as competition increases in the athletic apparel industry, potentially impacting sales growth.

Supply Chain Disruptions: Any disruptions in the supply chain, such as manufacturing delays or logistics issues, could lead to inventory shortages and hinder revenue generation.

Fashion Trends: Changes in consumer preferences and fashion trends may affect demand for Lululemon's products, leading to inventory write-offs and reduced margins.

Geopolitical Factors: Economic uncertainties, trade tensions, and geopolitical events could disrupt operations, increase costs, and impact profitability, especially in international markets such as China.

Economic Downturns: During economic downturns, consumer spending on discretionary items like athletic apparel may decline, leading to reduced sales and financial performance.

Valuation

Historical Multiple comparisons

The forward PE ratio is currently at 24.7, which is far from its top levels of +70 (which is excessive, to say the least). Lululemon is currently trading close to its 10-year low of 20.5.

The forward FCF yield is 3.2% vs. its historical highs in 2017-2018 of ~4%, and 2022 of 4.2%. The low point in FCF yield is around 1.2%-1.5% which we saw in 2020-2021 when I believe Lulu was overpriced. A 3.2% FCF yield seems fair if Lulu can continue to expand and grow its earnings for the next +5 years.

If you subtract the growth capex from the free cash flow calculation you get a FCF yield of:

Free Cash Flow Yield Ex. Growth Capex

= Operating cash flow - (Capex - Growth capex) / Market Cap

= $2296.2 - ($652.3 - $349) / $44.130 = 4.5%

Discounted Cash Flow Analysis

Using conservative growth estimates suggests an intrinsic value per share of $437.27. This suggest an upside of 22.5% upside.

Worst case scenario (30% weight): 10% growth for 5 years, followed by 8% growth, with an exit multiple of 18x FCF per share.

Best case scenario (10% weight): 15% growth for 5 years, followed by 13% growth, with an exit multiple of 30x FCF per share.

Normal case scenario (60% weight): 12% growth for 5 years, followed by 10% growth, with an exit multiple of 25x FCF per share.

The current price of $357 per share suggest a 12%-13% annual return from the Normal case scenario. This scenario suggests growth of 12% for the next 5 years, and 10% for the following 5, with an exit multiple of 25. We believe this is achievable for Lululemon, and that current headwinds are temporary. The long-term EPS estimate for Lululemon is +15% annually:

Disclaimer: The author has a position in the security discussed.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +6.500 stock market investors (45% open rate) — Contact us via: investinassets20@gmail.com

It seems this stock is everywhere - so many analyzing and writing about it.

Nice edition, thank you.