Top 5 Quality Buys April 🚀

5 Fairly priced Quality Businesses 💎

Hi partner! 👋🏻

Welcome to the April edition of Top 5 Buys ✅

You can access our Top 15 Buys for 2025 list as a premium member here.

In this article, we will discuss our top stock picks for April 2025.

Let’s get into it 👇

The Market Sentiment: Extreme Fear

We are in an “Extreme Fear” environment, with the Fear to Greed index pointing towards a 17. This indicates that investors are fearful of taking excess stock market risk. We have seen this in the last few weeks with volatility we’ve not seen since 2020.

For long-term investors, fear in the market is synonymous with opportunities.

I ask you to turn your mindset from fear and wanting to sell all your stocks, to that of opportunity hunting. It is in these uncertain times we receive the best opportunities.

Lower prices in quality assets are often long-term opportunities for savvy investors.

The fear to greed index is at an all time low level due to the market uncertainty:

Disclaimer: This is not investment advice. Always conduct your due diligence and make your own investment decisions.

Now, let's get into it 👇🏻

Top 5 Quality Buys April 2025 🚀

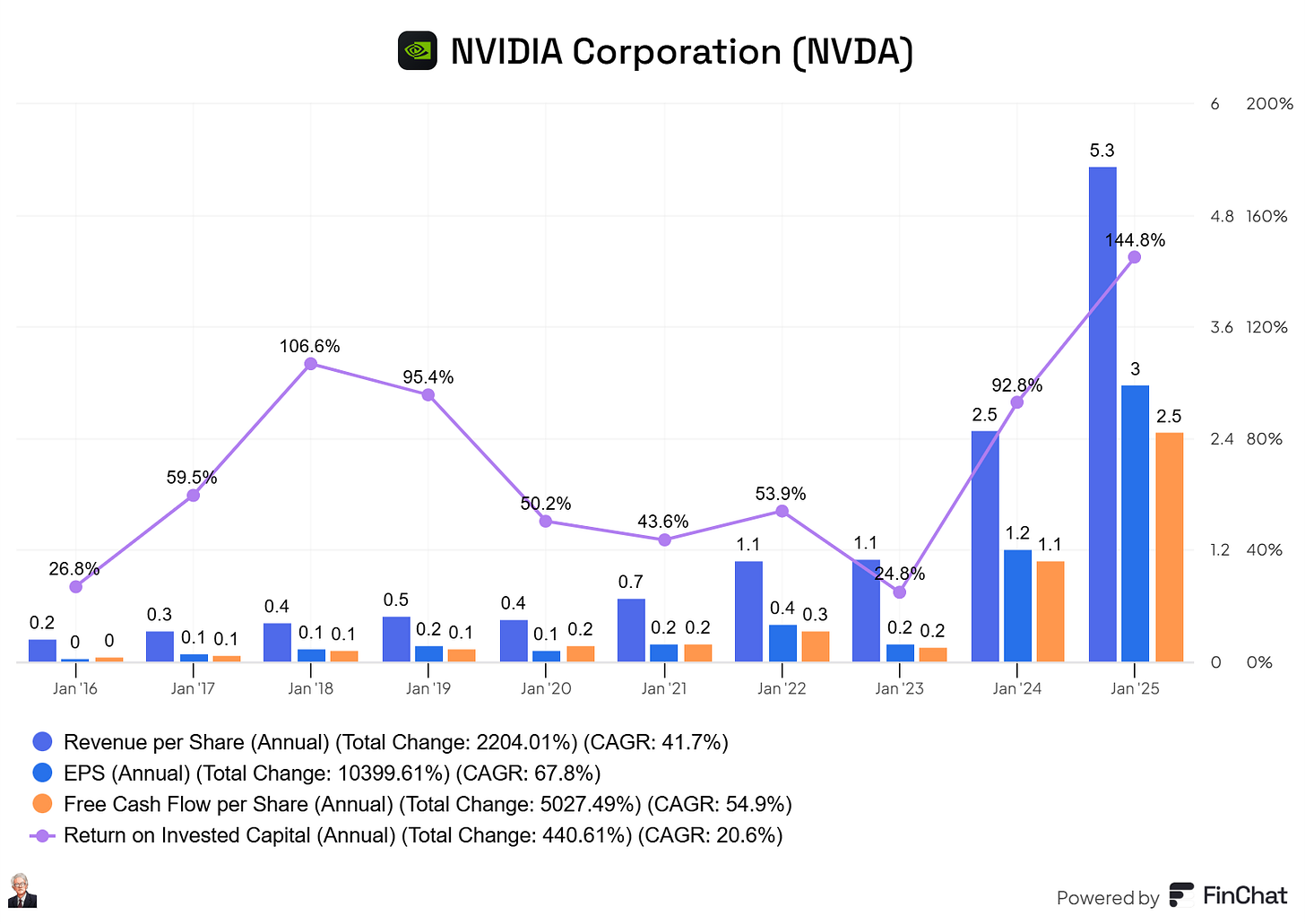

Nvidia Corporation NVDA 0.00%↑ 💻⚡

Nvidia is a global leader in graphics processing technology and AI computing. Best known for its powerful GPUs used in gaming, data centers, and AI workloads, Nvidia has positioned itself at the forefront of transformative technology trends, including artificial intelligence, autonomous vehicles, and high-performance computing.

Nvidia’s dominance in GPU architecture, combined with its expanding software and platform ecosystem (CUDA, Omniverse, DGX), widens its moat. As demand for AI infrastructure accelerates across industries, Nvidia continues to be a critical enabler of the AI revolution.

Key fundamentals:

Gross Margin: 75%

Operating Margin: 62.4%

Return on Equity (ROE): 61.7%

Revenue Growth (3Y): 69.3%

EPS Growth (3Y): 96.9%

Forward PE: 22.5x

Why we like Nvidia:

AI & Data Center – Nvidia is the market leader in AI infrastructure, with its GPUs powering the majority of machine learning and generative AI workloads worldwide. Demand for Nvidia’s data center products, including the H100 and upcoming B100 chips, continues to increase as the AI arms race is booming for big tech.

Superior Margins & Scalable Platform – Beyond hardware, Nvidia’s software stack (CUDA, cuDNN, TensorRT) creates a high-margin, recurring revenue stream and fosters higher switching costs for its clients. This vertical integration increase margins and enables scalable monetization across different industries.

Strong Financial Performance & Free Cash Flow – Nvidia consistently delivers high margins and return on capital. Its free cash flow (~Fwd. FCF yield of 4.3%) supports shareholder returns through growth initiatives, buybacks and acquisitions. With nearly $60B in annual free cash flow, Nvidia is well-positioned to reinvest in growth and reward investors.

Simple Discounted Cash Flow Analysis

Nvidia is expected to grow long term EPS by 35.4% (!).

It is also expected to grow EPS and revenue in the next 2 years by ~40%.

Our DCF inputs are conservative, but Nvidia looks attractive at the current valuation.

Fair value estimate: $128.30

Current price: $94.31

Upside: +36%

Expected CAGR: +14%

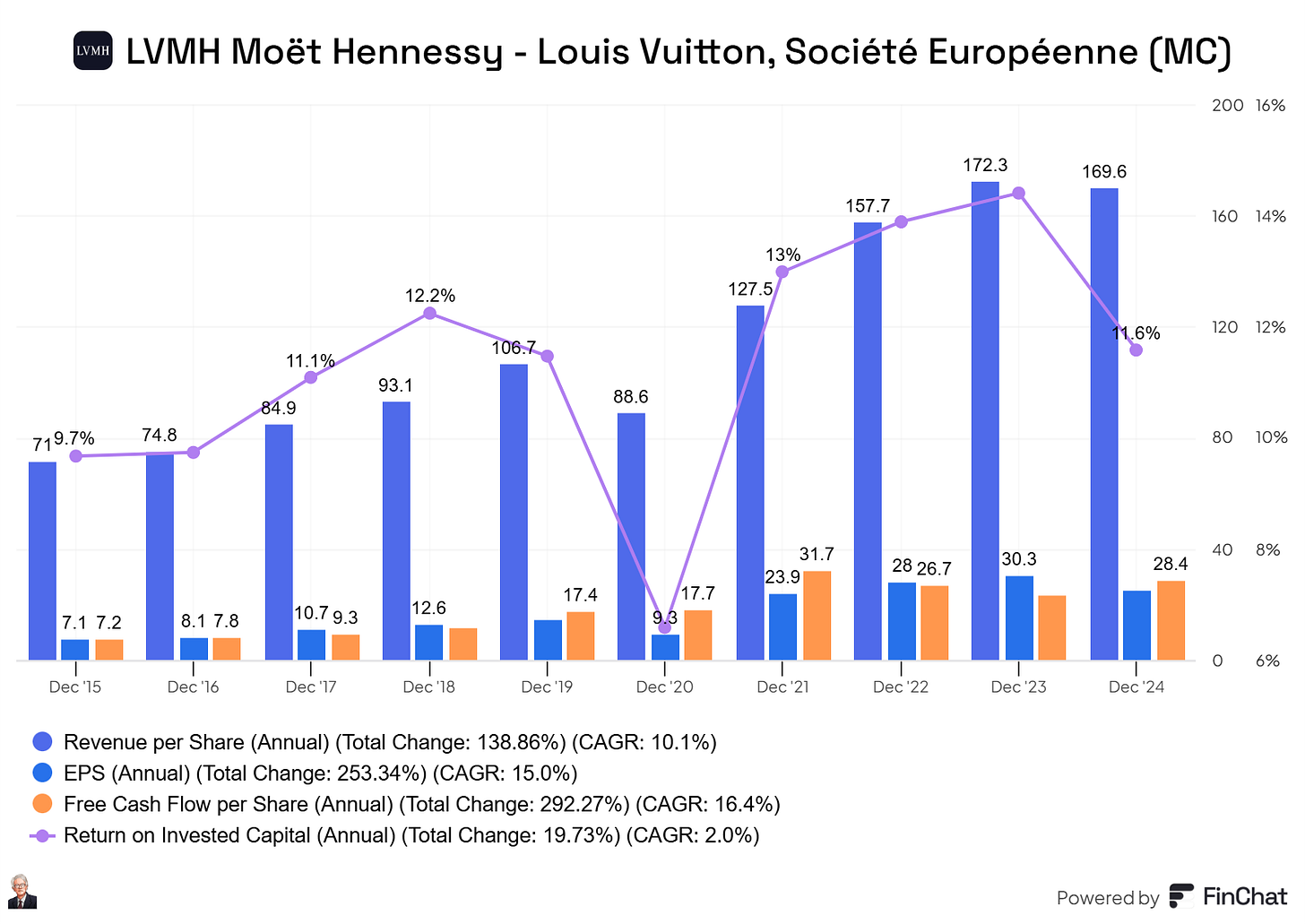

LVMH Moët Hennessy Louis Vuitton $MC.PA 👜🍷🕰️

LVMH is the world’s largest luxury goods conglomerate, with an unique portfolio of fashion, leather goods, watches, jewelry, perfumes, cosmetics, wines, and spirits brands. Its iconic brands include Louis Vuitton, Dior, Fendi, TAG Heuer, Hennessy, Moët & Chandon, and Tiffany & Co., each with deep brand equity and heritage.

LVMH’s unique mix of creativity, craftsmanship, and strategic brand management has enabled it to maintain pricing power, high margins, and global demand—even in times of economic uncertainty. With a multi-brand, multi-category approach and strong exposure to high-growth regions like Asia and the U.S., LVMH is well-positioned for long-term, secular growth in the luxury space.

Key fundamentals:

Gross Margin: 67.0%

Operating Margin: 23.1%

Return on Equity (ROE): 24.5%

Revenue Growth (3Y): 9.7%

EPS Growth (3Y): 1.7%

Forward PE: 19.9x

Why we like LVMH:

Luxuary Brand Portfolio – LVMH owns 75+ prestigious brands across multiple luxury segments, many of which hold dominant positions globally. The brands have strong pricing power, and its target segment is not as effected by economic downturns as the average consumer.

Emerging Segment of “Aspirational Consumption” – With a strong presence in key luxury markets, LVMH benefits from secular trends in premiumization, growing global affluence, and increasing demand for exclusivity, especially among younger consumers.

High Margins and Free Cash Flow – LVMH’s vertically integrated model, combined with brand pricing power, delivers strong margins and returns. Free cash flow yield sits around ~5.2%, supporting consistent dividends and reinvestment into growth initiatives and selective acquisitions.

Simple Discounted Cash Flow Analysis

LVMH is expected to grow its long term EPS by 9.6%.

However, in the next 2 years, EPS and revenue is expected to be around ~6%.

We think the aspirational consumption will drive growth and that the upside can be a bit larger than the expectations.

Fair value estimate: EUR 857.65

Current price: EUR 530

Upside: +61.8%

Expected CAGR: +17%

The rest of the article is for premium subscriber, join us and read more here: