🎯Top 5 Buys February 2024

🧠5 ideas in 5 min

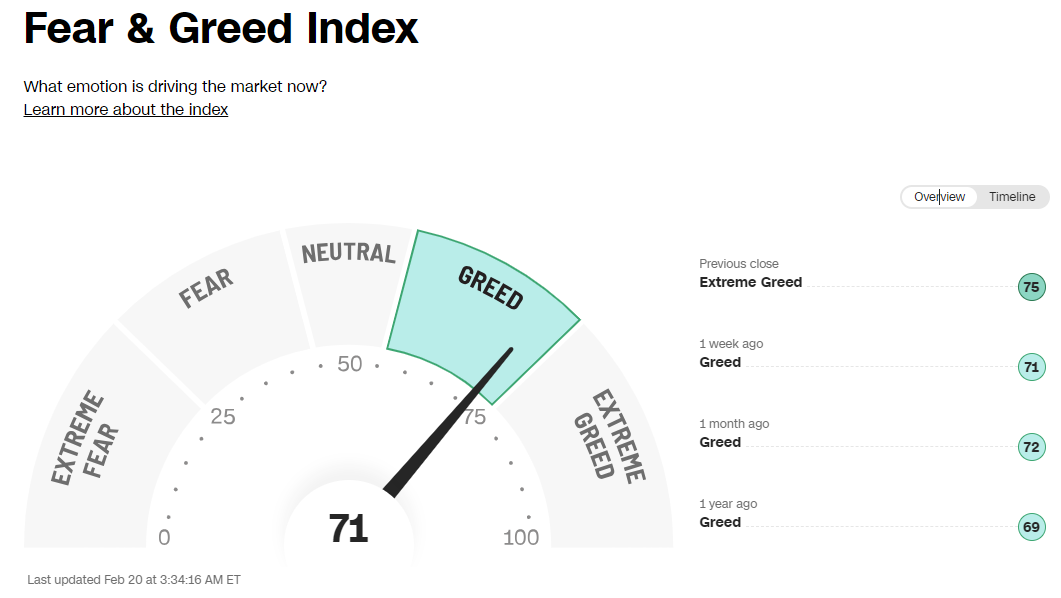

The market is hovering between greed & extreme greed

As of this writing, the Fear & Greed index has hit “Greed” just bouncing out of “Extreme Greed”. This indicates that market participants are taking risks to achieve better returns. In my view, this is not the best time to be investing in the market. I’d rather wait for temporary fear to set in before investing. That said, the market will always present us with decent opportunities if we look in the right places.

Market Run-Up

The S&P 500 has reached an all-time high after a rapid run over the last few months. I’m not trying to time the market, but I do realize that the market is volatile, and I’d rather take advantage of volatility to the downside than force an investment after a huge run-up (especially if the run-up is not backed by fundamentals).

Mr. Market Offers Us Deals

That said, there are always opportunities in the market. When some stocks rise quickly, others lag behind or even decline due to temporary issues or a range of different factors.

This provides possible entry points for us as investors.

I have previously shared with you my investable universe that contains +200 quality businesses:

My watchlist contains 20 companies I follow closer and would like to invest in given the right price:

Top 5 Buys February 2024

Based on this research I will share with you every month what quality companies I believe are priced fairly for that specific month. I will try to not use the same examples each month.

You must understand that even if I believe the price is fair at the moment, I will not initiate positions at these levels unless you as a premium subscriber are notified of it. This should not be considered investing advice, but inspiration to do further due diligence into the stocks mentioned.

What is a good buy?

I have outlined in my book and my valuation cheat sheet how I value businesses. There are several methods one can use, but I like to keep it simple. First I want to understand the business, how it makes money, the different business segments, and the growth potential for each segment or product/service. Then I look at historical multiples for PE, PS, PB, PFCF, FCF yield to get an idea of what the company has traded at, as well as the development of margins and capital efficiencies over time. I then use a discounted cash flow analysis and a reverse DCF analysis to determine what I believe the company will return.

Here are the top 5 buys for January from the Quality Growth universe:

Check out the top 5 buys for January 2024 here:

Mettler-Toledo International MTD 0.00%↑

A Terry Smith favorite business. Mettler-Toledo supplies weighing and precision instruments to customers in the life sciences, industrial, and food retail industries. Its products include laboratory and retail scales, pipettes, pH meters, thermal analysis equipment, titrators, metal detectors, and X-ray analyzers. Mettler leads the market for weighing instrumentation and controls more than 50% of the market for lab balances.

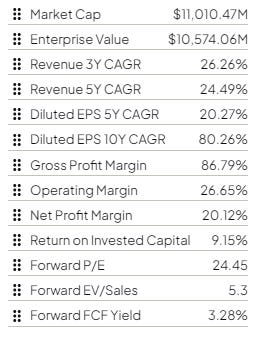

Fundamentals:

Free cash flow per share has been growing by ~15% annually for the last 10 years. The stability of its per-share compounding is impressive.

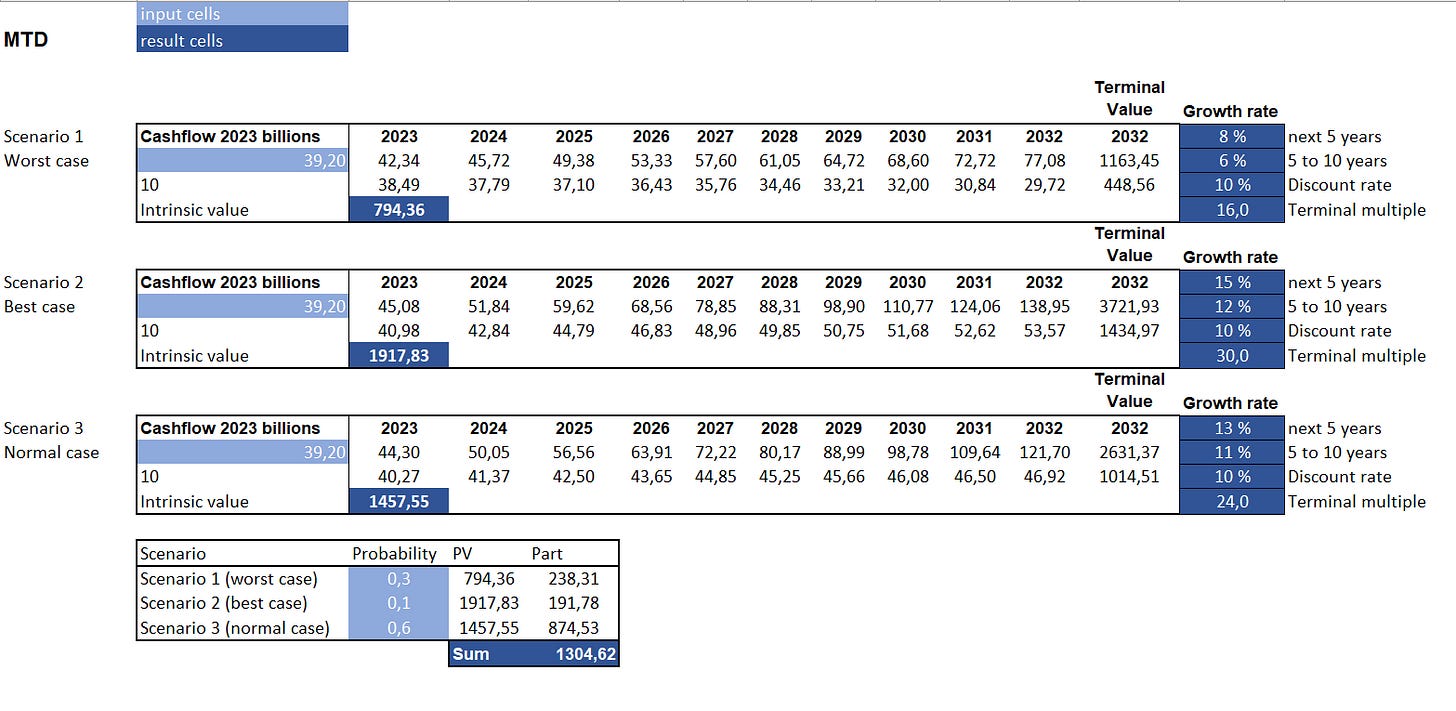

Fair value estimate

We estimate that MTD’s fair value is $1304, and the current share price is $1187, suggesting a 10% upside.

At current valuations, we can expect a 13% annual return with our growth and multiple inputs:

Mettler-Toledo is a stable and consistent compounder

It is expected that their product will be in growing demand over the next 10 years, and they are the clear market leader with a +50% market share. Being able to secure shares in this compounder at decent prices can be a solid long-term investment.

Paycom PAYC 0.00%↑

Paycom is a fast-growing provider of payroll and human capital management, or HCM, software primarily targeting small business clients in the United States. Paycom was established in 1998 and services about 19,500 clients as of 2023. Paycom also offers various add-on modules which include time management, talent management, and administration software.

The stock has been beaten down due to a slowdown in growth, guiding with a mere 12-14% revenue growth vs. historical growth rates of 25%. However, the CEO is focused on making the right long-term decisions as he owns a significant stake in the business.

Fundamentals:

Paycom has stellar fundamentals and growth rates. The market fears that it will become an ex-growth business, but this is not visible on the free cash flow per share chart at all. Additionally, their margins are well above competitors, indicating that they have something unique going on.

Free cash flow has been growing like crazy, and shares outstanding have not gone up in the last 10 years. This is a great sign.

Fair value estimate

We estimate that Paycom is worth $206,67 given the growth & multiple inputs below (Dark blue). The market is expecting Paycom to grow ~10% for the long term. If this would be the case, there is a downside in the stock at current prices.

However, we believe that Paycom will do better than 10% annually and that Mr. Market is providing a decent entry into a founder-led software business that has fantastic fundamentals.

Current prices suggest an 11.5% annual return for the next 5-10 years if they can keep growing at a decent rate.

Note: The price for the Premium service will increase on March 1. Make sure you purchase a subscription before this to keep the current price of $12/m or $100/yr.

I will never raise the prices for my existing subscribers.