The selection process

Having a good radar to collect good ideas is essential in investing. The best investment ideas often come from other great investors who share their ideas openly. We can get investing ideas from fund managers, skilled retail investors, and our screeners. In this article, we will break down 3 primary methods of collecting investing ideas, and I will share with you the quality growth universe.

3 Primary Methods of collecting ideas:

1. Screeners

I use two primary screeners for getting new investing ideas:

The Terry Smith screener focuses on high-quality businesses.

Using a +15% 5Y average for ROCE eliminates the cyclical businesses and ensures that we get the higher quality businesses into our screeners. Smith likes high-margin businesses as this often indicates that the business is doing something special. Lowering the operating margin to 10% can be fair to do, not all great businesses have a high operating margin.

It focuses on sustainable growth by using the 10-year average of earnings per share CAGR of +7%, and the 5-year average of free cash flow CAGR of +5%. We want profitable businesses that keep growing their earnings and cash flows over long periods. This growth does not necessarily need to be high, but it depends on the predictability of the earnings.

Finally, interest coverage above 10x ensures that the business is generating enough earnings to pay off its short-term debt & obligations. This lets us know that the business is not overly leveraged and most likely does not need debt to fund its superior returns on capital.

10 Examples from the screen:

Apple

Microsoft

Google

Nvidia

Visa

Novo Nordisk

LVMH

Adobe

ASML

Hermes

My second screener is the quality growth screener. It is similar to the Terry Smith screener, but it emphasizes growth above margins.

We still want businesses that produce +15% ROCE on a 5-year basis. However, in this screener, we want to see a 5-year sales CAGR of +15%, and a 5-year FCF CAGR of 10% to find the “fast growers”.

The operating margins need to be positive, but no more than 0%. Of course, we still want to buy profitable businesses, but sometimes you can find great businesses that are very profitable but that are currently spending a lot on for example marketing & sales to grab market share. I don’t want to exclude these businesses as they can be major long-term winners if you understand them correctly.

It is however still important that these businesses don’t use excessive levels of leverage, as this greatly increases the chance of a devastating result for us as investors. Therefore we use filters of Net Gearing and Interest coverage.

10 Examples from the screen:

Vertex Pharmaceuticals

Regeneron Pharmaceuticals

Copart

Nucor

Fortinet

Adyen

Monolithic Power Systems

ASM International

Evolution

Paycom Software

2. Twitter / X.com

I use a list of 25 of the best investors I know on X, where I get a lot of ideas. This includes fund managers, private investors, and analysts. I would highly recommend the “List” function on X, as this eliminates most of the “noise” on Twitter, and allows you to focus on a few quality accounts that are providing you with investing value and ideas.

5 Accounts I love to follow:

3. Looking at the greats

Dataroma.com and whalewisdom.com are great places to start looking at top fund managers and what they buy and hold. You can seek out the managers you have a similar investing style to and see what purchases they are making each quarter, this is a fantastic source of ideas. A few fund managers I follow:

Thomas Nielsen of First Funds (Scandinavian Quality)

Dev Kantesaria of Valley Forge Capital (Focused Global Quality)

Chris Hohn of TCI Funds (Focused Global Quality)

Terry Smith of Fundsmith (Focused Global Quality)

Chuck Akre of Akre Capital (Focused US Quality)

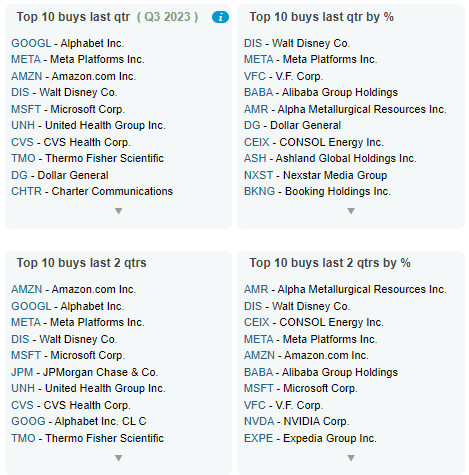

Dataroma tracks many of these investors, plus many more. It provides data that can be useful, like the top 10 buys for the last quarter:

You might find a few new ideas here, or at the very least get an understanding of what the super investors are buying on an aggregated level.

After using these 3 methods to get ideas, I vet the businesses by looking at a few simple points:

The fundamentals (E.g. return on capital, growth, and margins over time)

The industry it operates in and its position (Market leader or gainer)

The linearity of the stock price (Can be a good indicator of a business that keeps creating value for shareholders)

If the business passes, I add it to my investable universe.

To get to the short-list I have to dig deeper into:

The business model

Management

Unit economics

Competitive advantage

Quality and predictability of the revenue streams

I will disclose my short list in an article coming soon.

Without further ado, here is the investable universe for Quality Growth with the following information for each company:

If you want more information about the paid service, read the following article: