🚀What Super Investors are Buying

Stock ideas from the best in the business 💎

Hi there investor!👋🏻

In this article, we will review what the top global quality investors did in the previous quarter.

This is a good exercise to spark ideas and get inspiration from some of the best to do it.

Let’s get into it 👇🏻

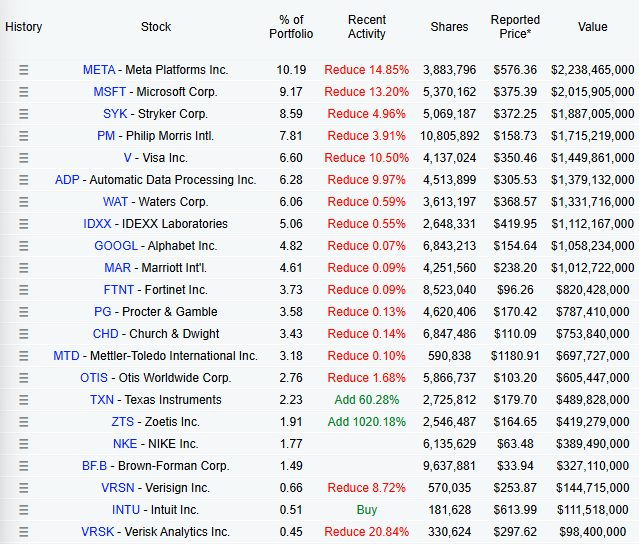

Terry Smith’s Fundsmith

Terry Smith is one of the UK’s most respected fund managers, following a "buy good companies, don’t overpay, do nothing" philosophy.

His fund, Fundsmith, invests in high-quality, capital-efficient businesses with strong pricing power and sustainable growth.

Smith avoids overtrading, preferring to let great companies compound over time. His approach is often compared to Warren Buffett and Nick Train.

After a few years of underperformance, money is likely flowing out of Fundsmith. The most notable moves:

Meta Platforms was reduced by 14.85%, to 10.19% of the portfolio

Microsoft was reduced by 13.20%, to 9.17% of the portfolio.

Visa was reduced by 10.50%, to 6.60% of the portfolio.

Stryker Corp. was reduced by 4.96%, to 8.59% of the portfolio.

Adding 60.28% to Texas Instruments, now 2.23% of the portfolio.

Adding 1020.18% to Zoetis, now 1.91% of the portfolio.

Starting a new position in Intuit of 0.51% of the portfolio.

Smith is trimming large, multi-year winners, like Meta Platforms, Microsoft, and Visa. While making small adds in 3 positions. The large overall sell-off in the fund indicates that investors are pulling money out of the fund after a few years of underperformance from the fund.

Bill Ackman’s Pershing Square Capital Management

Bill Ackman is a high-profile activist investor known for bold, high-conviction bets.

Through Pershing Square, he takes large, concentrated positions in undervalued companies and pushes for strategic changes to unlock value.

His approach focuses on deep fundamental research with activist pressure, often involving public campaigns to drive corporate changes.

His past plays include Canadian Pacific, Chipotle, and Howard Hughes Corporation, along with a famous (and costly) short on Herbalife.

Notable changes:

New massive position in Uber, becoming the #1 position at 18.50%

Ackman increased his position in Brookfield by +17.52%, now at 18.01%.

Chipotle Mexican Grill was reduced by -12.62%, to 9.07% of the portfolio.

GOOG (Class C) was reduced by 16.21% to 8.28% of the portfolio.

GOOGL was increased by 11.33%, to 5.75% of the portfolio (A small net sale for his Alphabet positions in total).

Hilton Worldwide was reduced by -44.84%, to 5.72% of the portfolio.

Bill Ackman made bold moves this quarter, adding 18.50% to Uber, from not existing in the portfolio, to the #1 position. In addition, he continues to add to Brookfield, while reducing in Alphabet (net), Chipotle Mexican Grill, and Hilton Worldwide.

Ackman sees a massive opportunity in Uber, praising the CEO Dara Khosrowshahi for turning Uber into a “highly profitable and cash-generative growth machine”:

Valley Forge Capital Management

Valley Forge Capital is a fundamentals-driven investment firm focused on owning high-quality businesses with strong competitive advantages.

It prioritizes capital preservation, long-term compounding, and disciplined valuation.

Its strategy revolves around buying companies with durable cash flows, exceptional management, and consistent profitability, aiming for superior risk-adjusted returns.

Notable changes:

Trimming Intuit by 26.08%, to 4.16% of the portfolio.

Trimming Fair Isaac by 2% to 32.29% of the portfolio.

An uneventful quarter for VFCM with only one notable reduction in Intuit.

Dev Kantesaria (Portfolio manager) likes to watch paint dry — a great trait for an investor.

Christopher Bloomstran’s Semper Augustus

Christopher Bloomstran is a deep-value investor who emphasizes intrinsic value, capital allocation, and long-term compounding.

His firm, Semper Augustus, takes a research-intensive approach, investing in businesses with strong competitive positions, excellent management, and durable financials.

He is a known admirer of Berkshire Hathaway and applies similar principles of patience and compounding wealth over decades.

Notable changes:

Dollar Tree increased by 48.35%, to 12.86% of the portfolio.

Dollar General was reduced by 37.05%, to 5.97% of the portfolio.

Paramount Global increased by 38.35%, to 3.15% of the portfolio.

Olin Corp was increased by 19.98%, to 2.75% of the portfolio.

The most interesting move from Bloomstran this quarter is his increase in Dollar Tree and reduction in Dollar General. To me, this clearly indicates that he prefers Dollar Tree and believes the opportunity here is larger than in Dollar General.

Dollar Tree has fallen from a high of +$170 in 2022 to the current share price of $74. Bloodstran obviously sees some mispricing in this asset.

Dollar Tree is up 56% from its 2024 lows (when Bloomstran bought most of his position).

Dollar General is up 61% from its 2024 lows.

Chris Hohn’s TCI Fund Management

Chris Hohn runs TCI, a hedge fund that follows an activist, high-conviction strategy.

He seeks undervalued companies with the potential for operational improvement, often pressuring management to enhance efficiency, governance, and shareholder value.

Hohn’s fund is long-term oriented with a concentrated portfolio, and he has been a strong advocate for climate-conscious investing.

Notable changes:

Adding +23.63% to his Microsoft position, now 14.97% of the portfolio.

Trimming 16.21% to his Canadian National railway, now 9.41% of the portfolio.

Trimming 16.06% to his GOOG position, now 4.99% of the portfolio.

Trimming 32.22% to his GOOGL position, now 1.46% of the portfolio.

Hohn appears to favor Microsoft over Google, diverging from the positioning of many prominent investors. This preference may stem from the growing disruption in the search landscape, where AI-powered tools like ChatGPT are increasingly replacing traditional search engines as the go-to source for information.

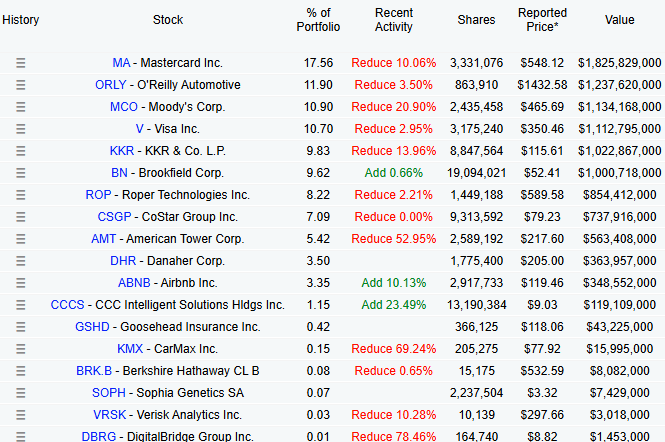

Chuck Akre’s Akre Capital Management

Chuck Akre’s investment style is centered around the "three-legged stool" approach—focusing on a business’s exceptional economics, great management, and reinvestment opportunities.

Akre Capital specializes in finding compounding machines, companies that can grow intrinsic value over long periods. His portfolio is concentrated, long-term, and high-conviction, with holdings such as Mastercard, Moody’s, and American Tower.

Notable changes:

Trimming multiple key holdings:

Mastercard by 10.06%.

KKR & Co. by 13.96%

Moody’s Corp by 20.90%

American Tower Corp by 52.95%

Carmax by 69.24%

DigitalBridge by 78.46%

Notable adds:

Airbnb by 10.13%

CCC Intelligent solutions by 23.49%

Akre Capital notably sold a lot of their core holdings this quarter, among them Mastercard, Moody’s, and KKR. The only adds were rather small, indicating that investors might be pulling out capital from the fund. The only notable purchase this quarter was Airbnb with a 10.13% add.

Francois Rochon’s Giverny Capital

Francois Rochon follows a quality-focused value investing approach, inspired by Warren Buffett and Peter Lynch.

He looks for businesses with strong competitive advantages, outstanding management, and high returns on capital, aiming to hold them for decades.

His philosophy combines art and investing, valuing patience and emotional discipline in building long-term wealth.

Notable changes:

Massive add of +87.27% to his Kinsale Capital position, now 3.05% of the portfolio.

Adding 7.53% to his Medpace holdings position, now 2.83% of the portfolio.

Adding +13.67% to his Arista Network position, now 1.33% of the portfolio.

Trimming +15.10% to his Five Below position, now 1.72% of the portfolio.

The most interesting move made by Rochon in the quarter was his massive add to Kinsale Capital. This is a stock not owned by many other super investors, but a fantastic business that we have written about in the past:

Rochon usually adds on weakness because he is very focused on valuation. Kinsale has had some short periods of weakness in the last year, where Rochon most likely has added to the stock. The aggressive add indicates to me that he is very bullish on this business.

Do you want to follow our market-beating quality growth portfolio?

We follow a Quality Growth-based investing style to provide a great risk-adjusted return.

You should join the premium newsletter where we provide detailed valuation breakdowns of high-quality stocks:

Read more about premium here.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 300 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +13.000 stock market investors (42% open rate) — Contact us via: investinassets20@gmail.com

Hohn has called Google his riskiest investment. He also owns some fantastic stocks outside of the U.S., which you can't see on the list 🙌

Good ideas highlighted here. Thanks for producing.