Meta Platforms: A Good Investment for 2024? 💎

Founder-led, high quality market leader 🧠

Hi there investor! 👋

In case you missed our recent articles:

Let’s get into it 👇

Meta Platforms META 0.00%↑

Introduction

Meta Platforms is a multinational technology company based in Menlo Park, California.

The original company names were Facebook, and TheFacebook before they rebranded to Meta Platforms in 2021.

This American conglomerate owns and manages several products and services, notably Facebook, Instagram, and WhatsApp. It is one of America’s largest IT companies and one of the Big Five alongside Google, Apple, Amazon, and Microsoft.

3 Interesting facts about Meta:

Meta Platforms has provided a substantial return of 23.9% CAGR since its IPO in May 2012. That is a 1280% return in 12 years.

From 2015 to 2023, Meta’s revenue has grown from $17.9 billion to over $134.9 billion. A CAGR of 28.35%. This growth highlights Meta's dominant position in digital advertising and expanding user base.

As of April 2024, Meta Platforms operates the largest social media network globally, with over 3 billion monthly active users across Facebook, Instagram, WhatsApp, and Messenger (Statista). This massive user base underscores its global influence and reach.

Let’s take a closer look at why Meta Platforms could prove a quality investment option 👇

The Business Model of Meta 📊

Meta generates revenue primarily by selling demographic-tailored advertisements, such as display ads, video ads, or sponsored content, across its social media platforms.

The business can be divided into two main segments:

Family of Apps (FoA): Meta’s FoA primarily generates advertising revenue.

Reality Labs (RL): This segment of Meta focuses on new AR and VR technologies, selling products like the Meta Quest virtual reality headset.

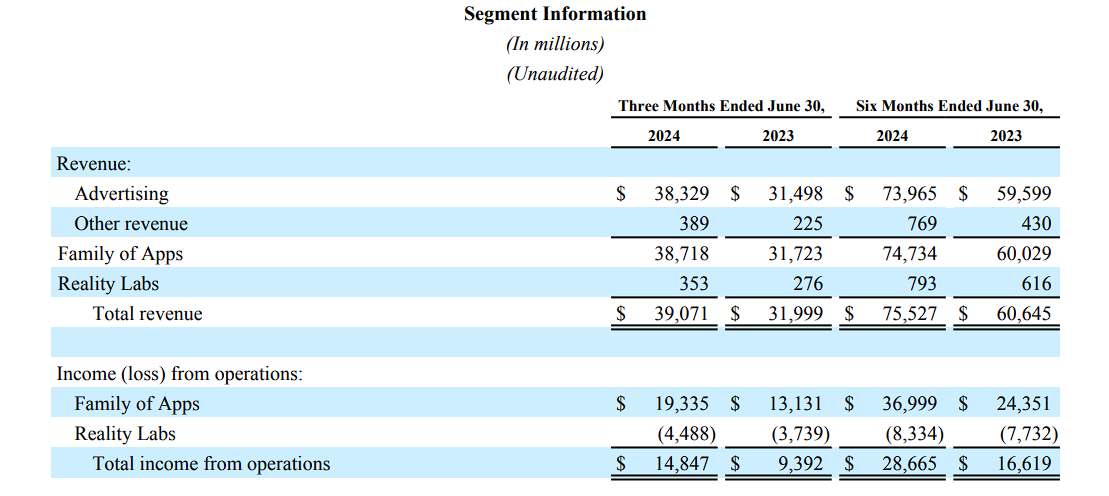

Meta's revenue increased by 22% in the most recent quarter. The company’s FoA division is the primary reason for the growth.

As of Q2 2024, Meta Platforms has approximately a 20% market share of the U.S. digital advertising market. That puts the company behind Microsoft and Google (Alphabet Inc) at the current time.

That performance is strongly linked to the strong performance of Meta’s Family of Apps, as its Reality Labs segment is still operating at a loss.

Family of Apps (Facebook, Instagram, WhatsApp)

Meta’s FoA is its Facebook, WhatsApp, Instagram, and Messenger social media apps.

Meta Platforms' revenue continues to increase thanks to its platforms, such as Facebook and Instagram.

It increased 22% year-over-year in the second quarter of 2024, leading to a net income of $13.45 billion.

Reality Labs

Reality Labs is a division of Meta that focuses on the research, development, and sales of Virtual and Augmented reality technology.

Meta’s Reality Labs division reported losses of $4.48 billion for the second quarter of 2024.

However, as the technology is still relatively new and expensive, this is as expected. As tech evolves, prices become more affordable, and adoption increases, there is a strong belief this segment will contribute more positively toward Meta’s financial results.

Meta heavily relies on the robust business model of its family of apps. Facebook, in particular, has enjoyed monumental growth in the last decade, and the company expects this growth to continue.

Growth Drivers 📈

Several growth drivers contribute to Meta Platform’s continued expansion. Let’s get into each:

Advertising Revenue:

Facebook generated $134.9 billion in revenue during 2023, with its mobile app bringing in around $71 billion (Business of Apps).

Ad impressions delivered across Meta’s FoA increased by 10% year-over-year in the second quarter of 2024 (Meta).

The average price per ad also increased by 10% year-over-year (Meta).

User Base Expansion:

The Family Daily Active People (DAP) across those platforms for the period reached 3.27 billion, up 7%.

According to Statista, as of April 2024, Meta’s FoA has 8 billion active users, including Facebook (3,5 billion), Instagram (2.5 billion), WhatsApp (2 billion), and Messenger (1 billion).

To compare, YouTube has 2,504 billion active users, while TikTok and Twitter stats show 1,582 billion and 611 million, respectively.

E-commerce Integration:

Meta has created additional revenue streams from its FoA by integrating e-commerce features across many platforms. Businesses use these platforms to sell products and services directly to users.

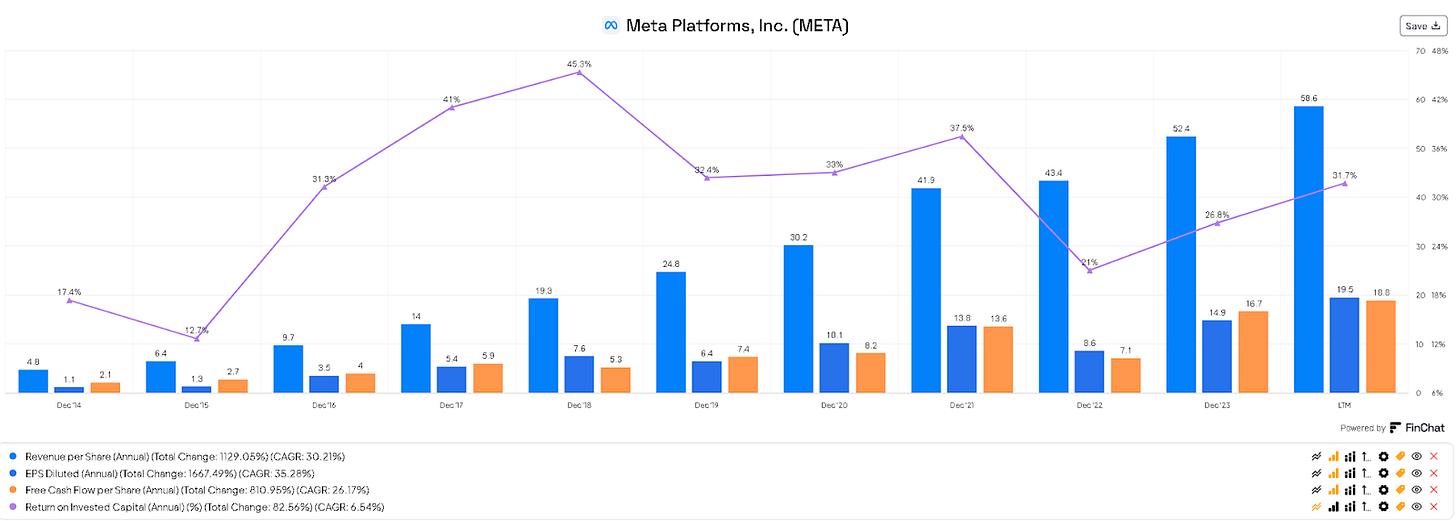

10-Year Growth Rates

As the popularity of Meta’s social media platforms has increased over the past decade, so has its revenue. In 2014, the company reported an approximate revenue of $12.47 billion. Fast-forward 10 years to 2024, and the conglomerate’s revenue is predicted to be around $150 billion.

Meta Platforms' revenue has compounded by 30.21% in the last decade. Earnings Per Share have grown 35.28% CAGR, free cash flow per share has grown 26.17%, and return on invested capital (ROIC) has averaged above 30%, indicating a formidable business model at Meta.

Competitive advantage (Moat) 🏰

Meta Platforms have a wide economic moat, with intangible assets and network effects being their moat sources.

Network Effects

Meta benefits from network effects due to its large and popular user base across several social media platforms and apps.

User Growth: As Meta’s social media platforms attract more users, the network's value increases, making it more attractive for future sign-ups. As of 2024, the Daily Active People (DAP) using Meta's apps increased to 3.27 billion, 200 million more than the previous year.

Data Accumulation: As more users join Meta’s platforms, more data is collected, improving the accuracy and effectiveness of its advertising services.

Barriers to Entry: Meta’s social media platforms' sheer size and popularity make it increasingly difficult for competitors to enter the market. Replicating such a successful and extensive network is difficult and expensive.

Intangible Assets

Meta Platforms boasts a strong portfolio of intangible assets, primarily driven by its brand recognition and the user data it has collected.

User Data: The company has collected vast user data across its FoA. That data appeals to advertisers, allowing them to create highly personalized advertising campaigns targeting specific demographics with their products and services.

Brand Recognition: Facebook is one of the world’s most recognizable brands. As of March 2024, it had a 45.5% market share based on the share of social media website visits (Statista).

Technology and algorithms: Meta has invested in and continues to invest in artificial intelligence and machine learning technologies. These improve user experience and further increase the effectiveness of their advertising services.

Meta Platforms’ intangible assets and network effects are its strongest competitive advantages.

Those moat sources allow Meta to maintain a competitive edge over its competitors in the social media, marketing, and digital advertising sectors.

Management 🕴🏻

Key executives and their insider holdings:

Mark Elliot Zuckerberg

Title: Co-founder, Chairman, CEO, and Member of the Board of Directors of Meta Platforms, Inc.

Ownership: 344.52M shares

Market Value of Shares: $168.74B

Tenure: 20 years (since 2004)

CEO Since: 2004

Track Record: Led Meta from the beginning and through all significant growth phases, such as the acquisitions of Instagram and WhatsApp.

Sheryl Kara Sandberg

Title: Former Chief Operating Officer (COO) of Meta Platforms, Inc.

Ownership: 1.27M shares

Market Value of Shares: $621.99M

Tenure: 14 years at Meta (2008–2022).

COO Since: 2008 to 2022

Track Record: Sandberg is lauded for her pivotal role in scaling Facebook’s advertising business.

Christopher K. Cox

Title: Chief Product Officer of Meta Platforms, Inc.

Ownership: 397.98K shares

Market Value of Shares: $194.93M

Tenure: Joined in 2005, with a brief departure in 2019, and returned in 2020.

Track Record: Cox played a leading role in developing Facebook’s News Feed.

Facebook has marked its 20th birthday, and what stands out is that most of its key executives have worked with the company for at least half that time. They each also hold significant shares in the business, although the others pale in comparison to Zuckerberg’s 344.52M.

Of course, as one of the company's founders, Zuckerberg has remained a key figure since its founding.

In the Second Quarter 2024 Results Conference Call hosted by Kenneth Dorell, a Director of Meta, Zuckerberg stated that what's pleased him most is the increase in young adults using Facebook and the steady growth of a new platform, Threads.

This focus on young adults via Facebook and a trendy new solution should help Meta maintain a competitive edge despite the rapid rise of competitor platforms.

Risk Factors ❌

The main risks for Meta Platforms:

Regulatory and Legal Challenges: Meta has consistently faced backlash from regulators and consumers for several reasons. Data privacy, content moderation, and antitrust issues are the common causes of complaints.

These challenges could eventually lead to regulatory fines or restrictions or potentially forced changes to Meta’s business practices.

Dependence on Advertising Revenue: Another risk is the company’s reliance on an advertising revenue model. Significant economic downturns could result in businesses spending less on advertising.

Furthermore, the continued rise of competitors, specifically TikTok in recent years, could also threaten that ad revenue.

Technological Disruption: The rate of technological advances is another risk to the long-term success of Meta’s social media platforms. Trends constantly shift, and the company could struggle to stay relevant.

The rapid rise of TikTok is a prime example. The social media platform has experienced a meteoric rise in users and is proving increasingly popular with Gen Z and the Alpha generation.

Valuation Risk

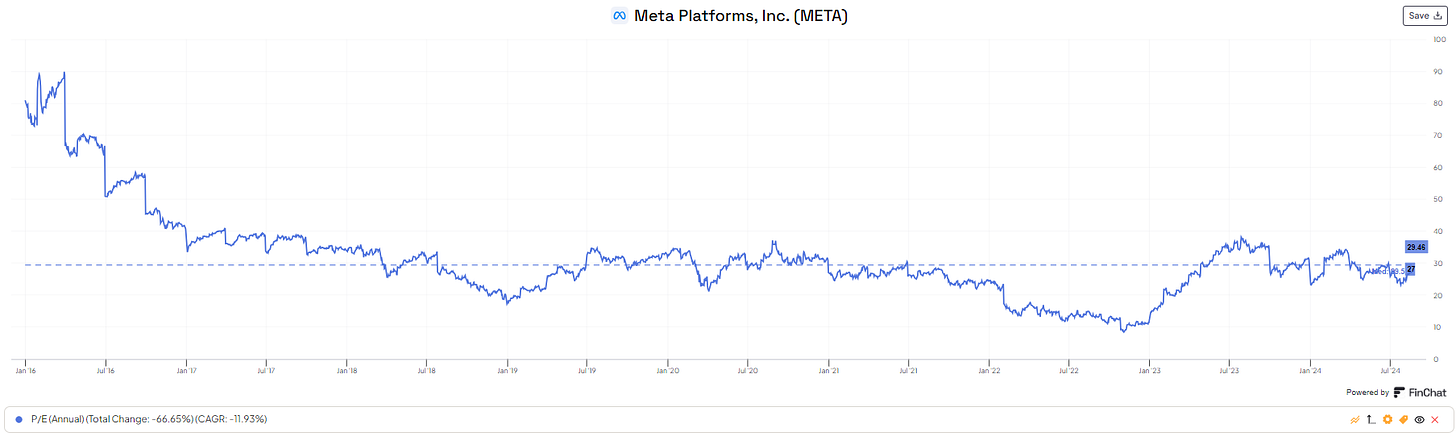

Relative Valuation: Meta is trading at a P/E ratio of approximately 27, below its median of 29.46. Although the median PE is high, we saw Meta Platforms trade at 8.5 times earnings in 2022.

Furthermore, Meta faces ongoing regulatory scrutiny concerning privacy practices, which could impact its ability to maintain high growth rates.

Tired of boring, text-heavy investing newsletters?

My good friend Carbon Finance sends out a weekly visual newsletter with the most important infographics, insights, and insider trades.

It’s completely free and only takes 5 minutes to read.

Join 16,500+ investors! Click the button below to subscribe now

Valuation ⚖️

Multiple Comparisons

Meta Platforms is trading at a PE of 27x earnings, lower than its median of 29.46 and considerably lower than its highest PE range of 109.4 times.

These figures indicate that the current P/E ratio is close to its 10-year median P/E.

The Free Cash Flow Yield is 3.72% vs. its historical median of 3.32%.

This indicates Meta generates significant free cash flow relative to its stock price. If cash flow generation is a metric you look for when investing, Meta Platforms is undoubtedly an appealing investment opportunity.

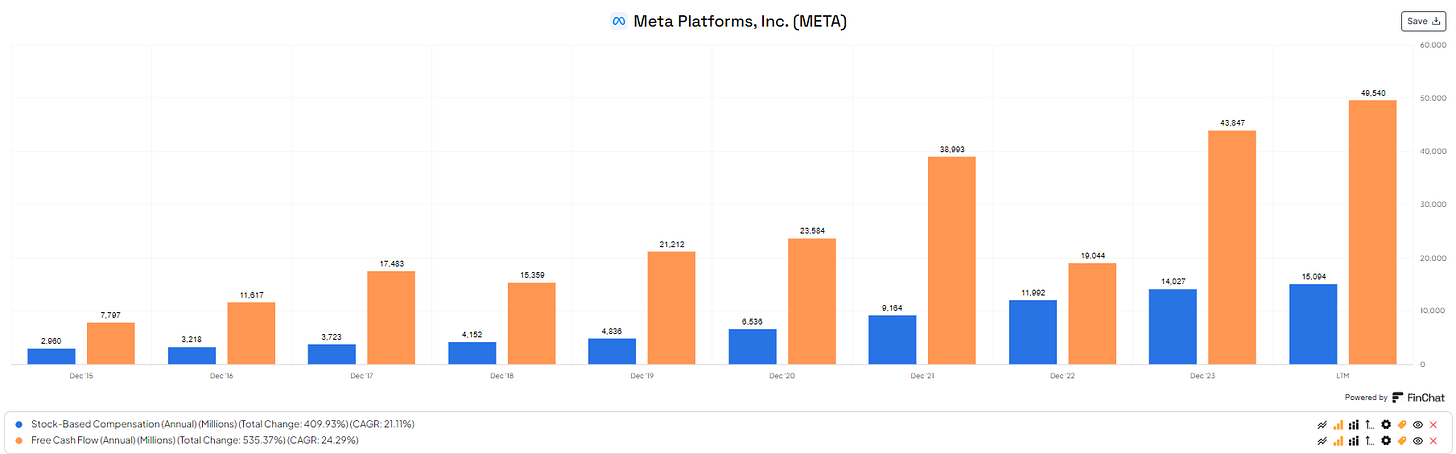

Stock-based compensation

Meta uses stock-based compensation to attract top talent. This can be a good strategy to pay the best people to stick around. However, for us as investors, we want to subtract the SBC from the free cash flow, as it is a cost for shareholders (dilution).

LTM FCF: $49.54 billion

LTM SBC: $15.09 billion

LTM FCF - SBC: $49.54 - $15.09 = $34.45 billion

The real free cash flow yield: $34.45 / $1.332,5 x 100 = 2.58%

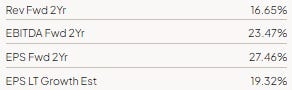

Below are the analyst estimates for the next 2 years and the long term:

Discounted cash flow analysis

Using the free cash flow per share - SBC per share as a proxy.

Free cash flow less SBC = $34.45 billion / 2533 million shares

FCF less SBC per share = $13.6

3 different scenarios for growth:

Fair Value Estimate: $423

Current Share Price: $529

Downside: 20%

While our DCF analysis determines a 20% downside, the same growth scenarios would provide a positive fair value estimate and an upside of 10-15% had we used the free cash flow without subtracting SBC.

Conclusion

Meta Platforms remains at the forefront of the global tech industry and has continuously shown that it has the innovation and product offerings to stay relevant for the foreseeable future. The company indeed represents an exciting investment opportunity, primarily due to healthy competitive advantages and lucrative growth drivers. That said, no investment should be taken lightly, so we implore you to conduct thorough due diligence while considering the associated risks such an investment would carry.

The company’s social media platforms have become a necessity for billions worldwide, but there is no cast-iron guarantee that Meta will not face hurdles in the future.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +10.000 stock market investors (45% open rate) — Contact us via: investinassets20@gmail.com

I wouldn't buy stocks until the Federal Reserve's September 17 meeting