Identifying Quality Compounders

7 Financial metrics to identify quality compounders

Essentials of Quality Growth Investing contains much more information like this, learn more here.

Investing in high-quality companies is the key to superior long-term returns in the stock market. In this article series, we will discuss the characteristics that define high-quality companies and how to identify them.

In this article, we will explore the financial performance metrics

Identifying Quality Companies

Identifying quality companies requires a thorough understanding of the company's financial performance

Quality companies typically have a history of consistent earnings growth, high return on capital, and strong cash flow. They also have a competitive advantage that enables them to maintain their market position and generate above-average returns. In addition, quality companies have competent management teams that have a track record of making sound business decisions.

Let’s break down the first part of this series:

Financial Performance Metrics

Financial performance metrics are essential indicators of the health, stability, and quality of a company. Quality companies typically have a high return on capital employed which is a measure of how much profit a company generates relative to the amount of all capital employed in the business. They also have stable and growing earnings, revenue, and cash flows. They often (not always) have high margins, and do not require debt to grow. Above industry numbers on these metrics indicate that a company has a sound business model and is generating positive returns for its shareholders.

1. Return on capital is essential

Return on capital is important because it gives us an idea of what returns we can expect from a business moving forward. After 20 years, it's hard for a business that has a return on capital of 6% to deliver anything better than 6% annually to shareholders, the same goes for a 20% return on capital business.

Return on capital can be calculated in several ways:

Return on Equity (ROE): Net income/shareholder’s equity

Return on invested capital (ROIC): Net operating profit after taxes / Total invested Capital

Return on capital employed (ROCE): Earnings before interest & Taxes/Total assets - Current liabilities

Like Terry Smith, I prefer to use ROCE as this profitability metric is broader and considers all capital employed, and not just operating assets like ROIC does. ROE can too easily be manipulated with debt to make the numbers look better.

Let’s use a real-life example of Microsoft, and calculate its return on capital employed (ROCE):

Earnings before Interest & Taxes can be found on the company’s Income Statement. From their 2022 Income statement, I can find $83.577 Billion in Microsoft’s 2022 Income statement.

Total assets can be found on the company’s balance sheet. The total assets for Microsoft in 2022 is $364.840 Billion.

Current Liabilities can also be found on the balance sheet within “Total liabilities Net minority Interest”. The current liabilities for Microsoft in 2022 are $95.082 billion.

Microsoft’s return on capital employed for 2022 is: 83,577 / (364,84-95,082) x 100 = 30,98%

A return on capital employed of ~31% is way above the S&P average of about 15%.

Microsoft has passed the first requirement to determine whether it’s a quality business because it produces high returns on capital.

2. Sustainable and high growth, ideally above 7% annually and mostly organic

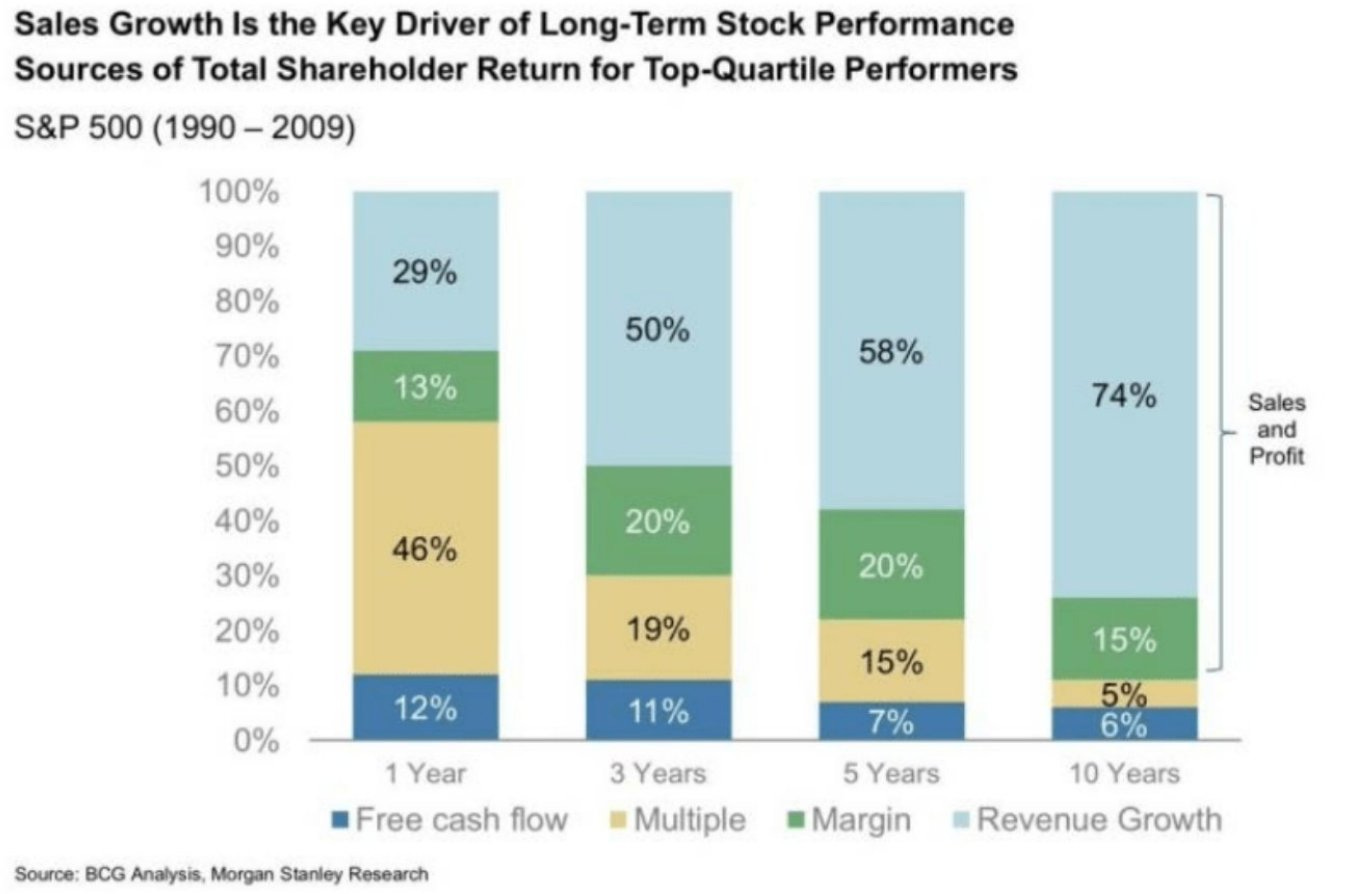

The business we look for is still growing organically. Growing from acquisitions can also be fine, but organic growth is preferable. For Microsoft organic growth can be selling more of their Azure cloud solutions than the previous year. Growth is the primary driver of stock returns, if you grow organically, this will reflect on the company’s revenues, and then on its earnings and cash flows. A study from Boston Consulting Group and Morgan Stanley Research found that top-line growth explained 74% of 10-year returns:

Source: BCG, Morgan Stanley

Worth noting: The longer the time period, the less the “multiple” factors in on returns. A quality business that is growing organically can be worth paying up for.

There are many ways to determine a company’s growth, but the easiest is to look at its history. You can find 10-30 year financials on websites like roic.ai to calculate the growth rate of different companies.

Whether the growth is organic or inorganic can be found in the company’s quarterly and annual reports. A few examples of high organic growth businesses: Lululemon, Tesla, and ASML.

Source: Roic.Ai

As an example, Lululemon has grown its free cash flows per share by 23,8% annually from 2017 to 2022.

Price follows growth as illustrated by Lululemon, and businesses with high organic growth have an appealing product where the demand for the product is growing.

Other elements to consider for growth:

Is the management focused on growing? How will they grow the business? Global expansion? New distribution channels?

How effective is the company’s R&D? Are they coming out with many new products that are catching on?

Is the business in a secular trend? Is the underlying market growing at a high rate?

Why will customers choose this business instead of their competitors?

3. High and expanding margins above the industry average

This includes Gross margins, operating margins, and free cash flow margins

High margins indicate that there is something special going on at the company. If a company has a gross margin of 80%, it means that they are buying stuff for $20 and selling it for $100. The value they are attributing to the goods and services they purchase is 80% of the sales price. This also creates a natural protection against inflation. Margins can decrease, but if your gross margins are 80%, they can fall way more than if they are 20%.

There are 3 types of margins you should know:

Gross margins: Revenue - Cost of goods and service (COGS)

Operating margins: Operating income / Revenue

FCF Margin: Free cash flow / Revenue

What we are looking for are businesses with margins above their industry. We want to see stable margins, and ideally expanding margins. If the margins of a business are expanding, it means that they are able to increase their prices or lower their costs, this often means the business has a sustainable competitive advantage.

Now, let me explain why we look at all 3 margins

Gross margins are great to see if the business is providing value, it lets us know that there is a big cushion between what the business is buying its COGS for and what it sells its finished product for. Studies have shown that businesses with a high gross margin, tend to keep their high margins for sustained periods of time. It was also a point in 100-baggers, that businesses with high gross margins were better performers than those with low.

Operating margins tell us how good the operations of the business are compared to competitors. It does not help to have a high gross margin if your operating margin is low. When looking at the operating margin, we detract amortization and depreciation, plus operating expenses such as sales and administrative costs. A business that is overspending on marketing and sales initiatives will run a bad balance and reduce its operating margin.

Free cash flow margins are vital, as free cash flow is the amount of cash a business is left with at the end of a period. “EBITDA is an opinion, free cash flow is a fact” is a saying. And for good reason. EBITDA doesn’t pay the bills, cash does. There are plenty of account shenanigans to manipulate both EBITDA and EBIT. That is why it's important to view the % of revenue that is turned into cash.

One example of a business that has expanded its gross margins in the last few years, is Appe. In 2019 their gross margins were 38%, in 2022 it was 43,3%. This indicates an increase in value added to the goods and services they purchase. Apple has grown its services segment by a lot over the last few years. The services segment is a very high-margin segment, this has affected the business in a positive way, boosting overall gross margins and strengthening Apple’s business

Source: Finbox

4. Cash conversion should be above 75% on a 5-year average

Cash conversions refer to the business’s ability to transfer earnings into cash that the business can deploy.

Cash Conversion: Free cash flow / EBITDA

A business with a high cash conversion will be able to transfer most of its earnings (EBITDA) into cash that can be deployed. This is important because you need cash to reinvest into the business by buying new factories or investing in R&D. Also, to pay down debt, and pay a dividend. In other words, you need cash to create shareholder value. By tracking how effective the business is at this conversion, we can set a higher quality mark on that it.

If a company has a below 50% average cash conversion for a 5-year average, I see red flags. The company might not be of high quality, and the management might be deceitful, as earnings are what you show investors. If you can keep track of the FCF of a business, it will seldom lie to you. FCF can also be manipulated short-term, but over 3-5 years it’s very hard to manipulate how much cash your operations are providing.

As an example, Adobe has a cash conversion of 91% as of 2022 earnings. This is very good, a 75% cash conversion for more than 5 years is what I look for. All companies can have a good year, but only the best businesses will be consistent in this metric.

5. The free cash flow yield should ideally be close to the risk-free rate

The risk-free rate is the rate you can get without taking any risk. Usually, the 10-year treasury bond is considered to be risk-free, as it would take the US government to collapse for you not to be paid. The risk of the US collapsing is lower than for most companies. We have to evaluate our investments, so seeing what we yield we can get elsewhere is important as a comparison.

Of course, the US treasury yield will not grow. A business can grow its free cash flows by 10, 15, or 20 percent annually. This also has to be factored in. I like to use 5-year growth rates. So let’s say that company X has $100 in free cash flows, and the market cap is $2000.

100 divided by 2000 = 5% free cash flow yield

If we estimate that a business can grow its free cash flows by 15% annually for the next 5 years, we will get:

$100*1,15^5 = $201,13

Company X will produce $201,13 in 5 years. This means that the FCF yield based on their future earnings will be $201,13 divided by $2000 = 10,06%

Now, let's say that the risk-free rate is 7,5%, meaning that a 10-year treasury bond will yield 7,5% on your investment in it. Company X will in year 0 give you an FCF yield of 5%, which is 2,5% lower than the risk-free rate. But, if they can manage to grow their free cash flows by 15% annually, their current valuation can easily be justified.

Given the chance to invest between company X and the treasury yield, I would always pick the productive growing assets. Company X can also get their multiples expanded, going from a price to FCF of 20, to 30 for example. This would give us a price in 5 years of:

$201,13 * 30 = $6033,9 would be the market cap of company X. That is more than a 3X or a 300% return.

If you invested $2000 in treasury bonds, you would have:

$2000 * 0,075^5 = $750 after 5 years. A mere 37.5% gain in the same period.

This illustrates the importance of growth and why investors often pay up for it. Although, paying much for both growth and quality can turn out to be a horrible investment. Microsoft in 1999 is one example where it took you ~15 years to get back your money investing in a great business. However, it must be said that the PE was ~100, indicating a payback period of 100 years.

I like to see my businesses equal to the risk-free rate, if I do, it’s often in bargain territory. If the FCF yield is way lower, but the growth is stellar, this might weigh up for it, but of course, in the cases where you rely on future growth to make money, you are taking on more risk. Nobody knows what will happen in the future, just look at the great SaaS companies of 2021. Almost all fell by 70-90% (Even if they were good businesses!).

An example of a quality business with a high FCF yield is the Finish ERP system provider, Admicom. Their FCF yield is as of this writing 5.2%, and they have been growing their FCF by 24% CAGR for the last 5 years.

6. Net debt to free cash flow should be below 5

We do not want to own businesses with a lot of debt, because it increases our risk of permanent loss. We do not want businesses that rely on leverage to make money. That is also why most quality investors will not purchase bank stocks, because they heavily rely on leverage to turn a small profit, into a sizable one.

Net debt to free cash flow measures the amount of net debt a business has:

Total debt - Cash & equivalents

And divides it by the free cash flows

Operating Cash Flows - Capital Expenditure

Let's say business X has the following:

Total debt: $100

Cash: $20

Net debt: 100-20 = $80

Free cash flows: $20

The net debt to cash flows:

80 divided by 20 = 4

This means that business X could pay down ALL its debt in 4 years (or less given FCF growth).

Even if interest rates are rising, businesses with a low net debt to FCF will manage just fine.

An example of a quality business with a low net debt to FCF is Visa. Visa can pay down all its debts in just over 2 years (2,26) if it wanted to.

7. Interest coverage should be 10x or more

Interest coverage is another metric to look at in terms of leverage. A business should have no problem paying off its interest payments, if this metric is below 10, and even worse, below 5, the business is susceptible to rate hikes and a few bad years with reduced earnings.

Interest coverage is calculated as:

EBIT divided by interest payment

This tells us how many times a business can pay off its interest payments for one year. The higher this number is, the better it is. EBIT is found in the income statement, and so is interest payment.

Let’s use Evolution Gaming as an example here. Using Evolution Gaming’s TTM numbers outlined in the picture below, we get the following numbers:

Interest coverage: 838,886 / 4,610 = 181,97

Evo can pay off their interest expenses 181,97 times using their earnings before interest & taxes. This shows us two things:

Evolution has a low debt level compared to their earnings potential

Evolution does not need debt to fund its growth. If they did, this ratio would be much lower.

A business that can grow organically, despite low debt levels, is a sign of a quality business.

Source: Yahoo.Finance.com

Concluding comments

The financial metrics outlined in this chapter are all important. One could argue that return on capital is the most important thing, but it has to be seen in combination with other metrics like growth and debt levels. What good is a high return on equity, if the business is piling on debt to keep this ratio artificially high? (Which some companies do). What good is a high return on capital if the business is unable to grow and reinvest the profits into the business? What good is a high growth rate, if the business is burning cash?

These questions are meant to be thought-provoking for the reader. A combination and evaluation of these different metrics must be used combined with sound rational thought. Some businesses will have a low cash conversion ratio for example, this does not necessarily mean that the business is of low quality, they might just reinvest all their free cash flows into the business. One example of such a company is the Polish retail chain Dino Polska. Dino reinvests all their cash into new stores to expand in Polen, which they have done with great success over the last 5 years, rewarding shareholders with a 1000% return since its inception in 2017.

You have to think independently to be a great investor, financial metrics are just tools to simplify the financial analysis process and help you build an investment case.

Want to learn more?

Join the Premium newsletter to follow our market-beating Quality Growth Portfolio—be notified of all our moves and the opportunities we see in the market.

Thanks for your kind reply, appreciate it!

Well done! Thanks!