Capital-Light Swedish Compounder 💎

High quality business with stellar fundamentals and growth 🚀

Hi there investor!

Today we’re breaking down the Swedish quality business, Fortnox AB.

Let’s get into it 👇🏻

Business Breakdowns: Fortnox AB

Stock Ticker: $FNOX.ST

Introduction

Fortnox is transforming from a niche accounting software provider into a financial ecosystem for SMEs in Sweden.

With over 400 development partners, Fortnox addresses small and medium-sized enterprises (SMEs) financial and administrative needs—from accounting and invoicing to financing and employee management.

Its ability to deliver strong customer growth, consistent revenue per user expansion, and robust profitability positions Fortnox as a compelling quality compounder in the SaaS space.

We will break down Fortnox and look at the 6 most important factors for a quality business:

The Business Model 💎

Fortnox provides cloud-based financial and administrative solutions for SMEs, sports clubs, and tenant-owner associations.

Their platform covers accounting, invoicing, financing, payroll, and employee management needs, allowing customers to streamline business workflows.

Revenue Streams:

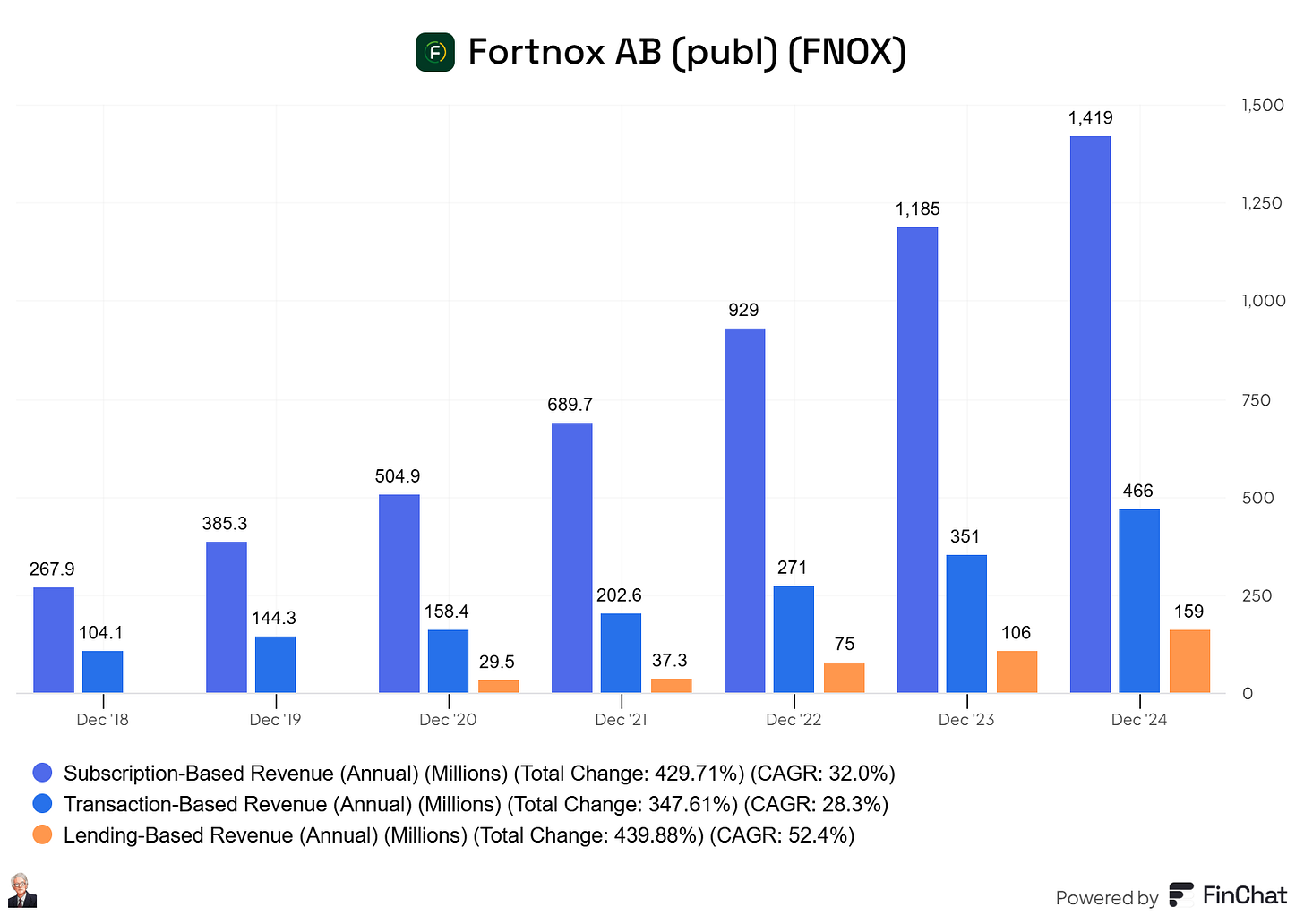

Subscription revenue (Growing 32% CAGR since ‘18): Core SaaS services are sold directly or through accounting firms.

Transaction-based fees (Growing 28.3% CAGR): Generated from payment processing and lending services.

Lending income (Growing 52.4% CAGR): Through Fortnox Finance, customers can access financing options.

Fortnox operates as a scalable ERP platform enhanced by its ecosystem of over 400 development partners, allowing customers to tailor their own business systems. The modular product suite and network of integrations foster high customer retention and revenue expansion.

Growth Drivers 📈

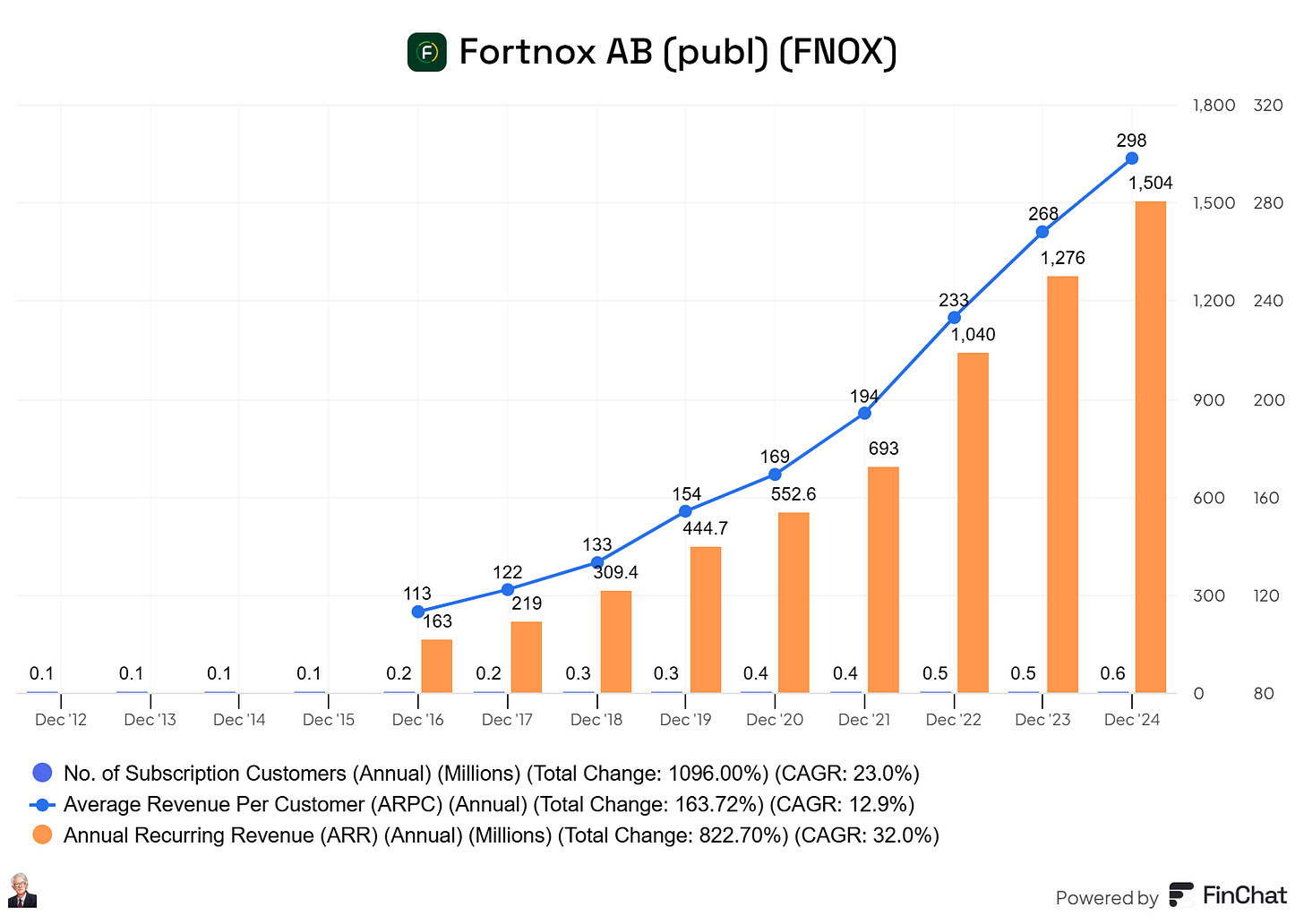

Platform expansion & ARPC growth: Fortnox consistently grows Average Revenue Per Customer (ARPC) through new features, like AI-driven insights and Payroll (launching in 2025).

Nordic expansion: While currently Sweden-based, Fortnox could scale across Nordic countries, tapping into broader SME markets.

SME digitalization: Rising demand for cloud-based, efficient tools among SMEs drives organic customer growth.

Fortnox’ number of subscribers has compounded by 23% annually since 2012. In the same period, their average revenue per customer (ARPC) increased 12.9% CAGR. This has led to a CAGR of 32% in annual recurring revenue (ARR).

Highlights from Q4 2024 earning results

Revenue Growth: Net sales reached SEK 540 million, a 20% increase YoY, driven by a 25% organic growth rate.

Customer Acquisition: The company added approximately 30,000 new customers during the quarter, slightly below the previous year's figures. This was partly due to the divestment of Offerta and slower growth among accounting firm clients.

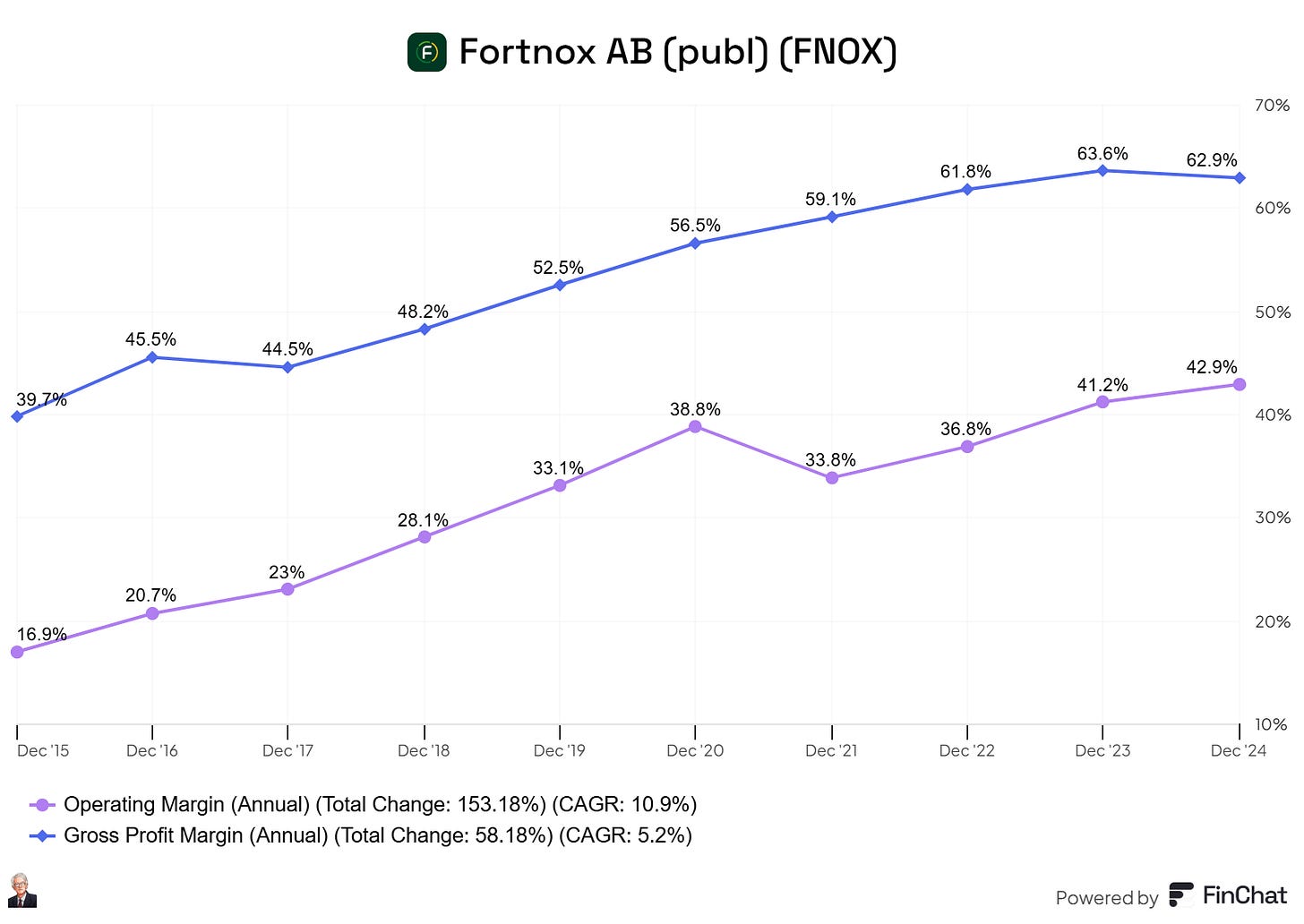

Profitability: Fortnox maintained a strong operating margin of 42.9%, reflecting effective cost management alongside its revenue growth.

The strong margin development over time indicates a strong competitive position:

Competitive Advantage 🏰

Network Effects

With over 400 integrated apps and solutions, each new customer and partner enhances the platform's value. Fortnox’s network effect makes it increasingly difficult for SMEs to switch providers, especially as automated workflows (e.g., 8.6 million vouchers recorded automatically in Q3 2024) embed Fortnox deeper into business operations.

Cost Advantage & Operating Leverage

Fortnox achieves industry-leading margins by spreading fixed costs over a growing user base. EBIT margins reached 42.9% in Q4 2024, demonstrating scale economics at play. This enables consistent reinvestment into product development and value-added services.

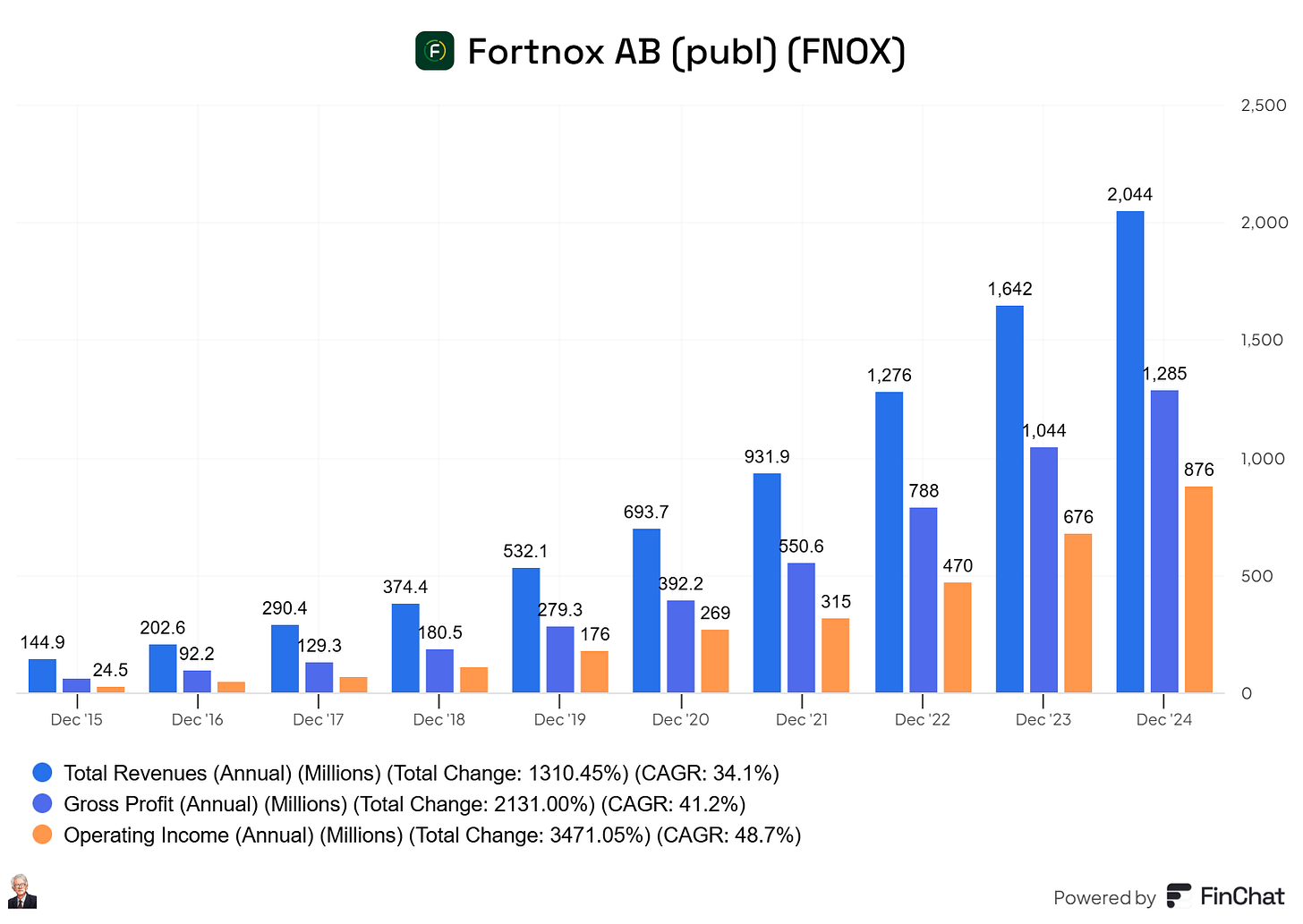

This advantage is visible in the gross- and operating margin. As you can see from the image below, Fortnox’ gross profits and operating income is growing faster than the revenues. This indicates that there is a disconnect between revenue and Cost of Goods sold (COGS) and operating expenses. This effect is often referred to as operating leverage.

5 factors that strengthen Fortnox’ competitive position

Cloud-based service that is highly scalable (Low variable cost)

Large Swedish customer base growing rapidly (Plenty of reinvestment opportunities).

Integration with 3rd party apps such as banks, tax authorities, and payroll services creates an ecosystem where Fortnox is the “hub”.

Freemium with a tiered pricing model allows Fortnox to attract small customers for free and upsell premium services over time (As the business grows).

AI possibilities and focus—Fortnox invests in AI to improve their services.

Management 👨🏻💼

CEO: Since 2020, Tommy Eklund has led Fortnox’s transformation into a comprehensive SaaS ecosystem. Under his leadership, Fortnox has expanded its user base, increased ARPC, and introduced innovative features like AI-driven financial insights.

Track Record:

Revenue Growth: Under his leadership, Fortnox's annual revenue has compounded by 28.42%, EPS by 35.8%, and Free cash flow per share by 30.39%.

Workforce Expansion: Fortnox’ workforce expanded substantially, growing from ~300 employees to ~900 across four locations, indicating robust organizational growth and capacity building.

Product Development and Integration: Eklund has a product-first approach and oversaw the launch of new products and services, including initiatives in areas like Insights, Connect, and Integration Services, enhancing the company's offerings and customer value proposition.

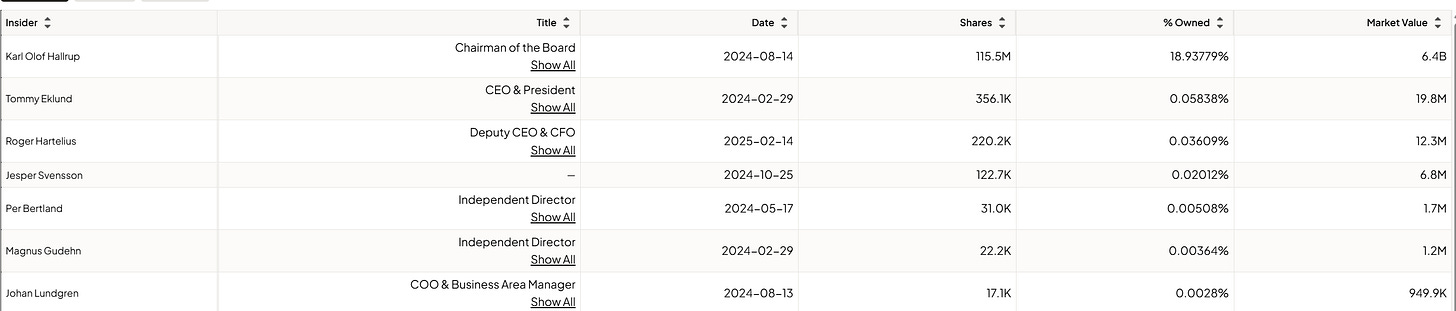

Insider Ownership: While not founder-led, management holds meaningful equity, and recent insider purchases reflect long-term alignment. Eklund holds 356.1k shares valued at 19.8MSEK.

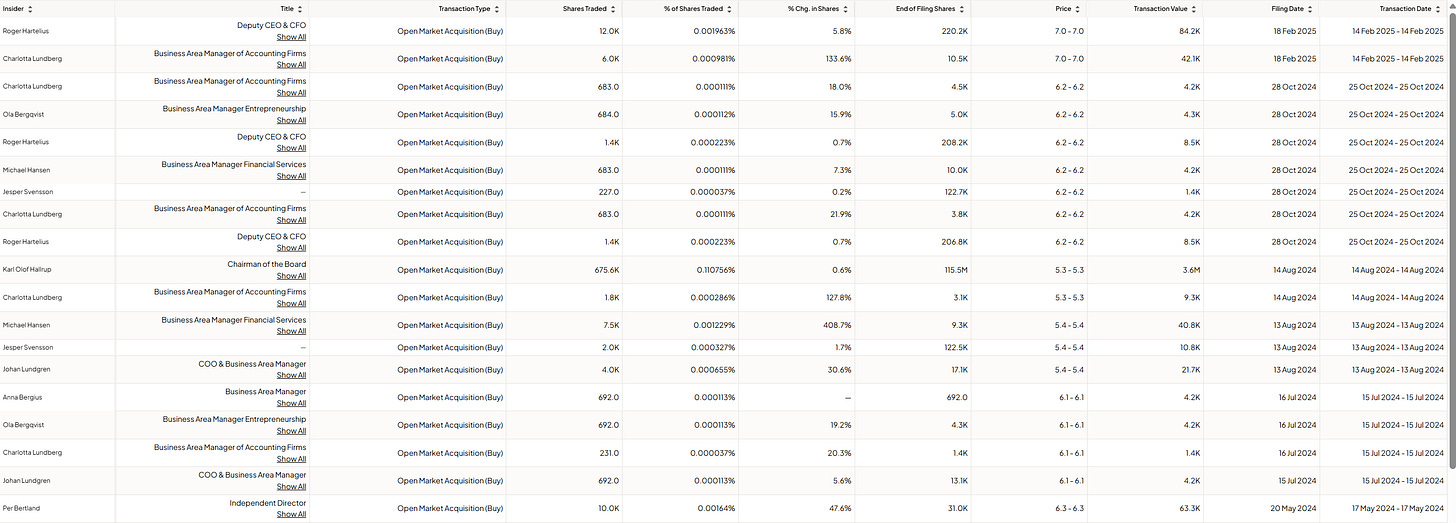

Insiders have been buying the stock since May of 2024. This tends to be a good sign, indicating that the management believes the business is undervalued compared to its future expectations.

Main Risk Factors ❌

Limited geographic footprint: Fortnox operates solely in Sweden. Delays in Nordic expansion could constrain growth.

Competitive threats: Global SaaS players like Visma and Xero could target the Nordic SME space, pressuring margins.

Economic downturn: Slower economic activity could lead SMEs to reduce software spending, impacting growth.

High valuation: A repricing in multiple could make the stock price fall significantly in a short period.

Valuation ⚖️

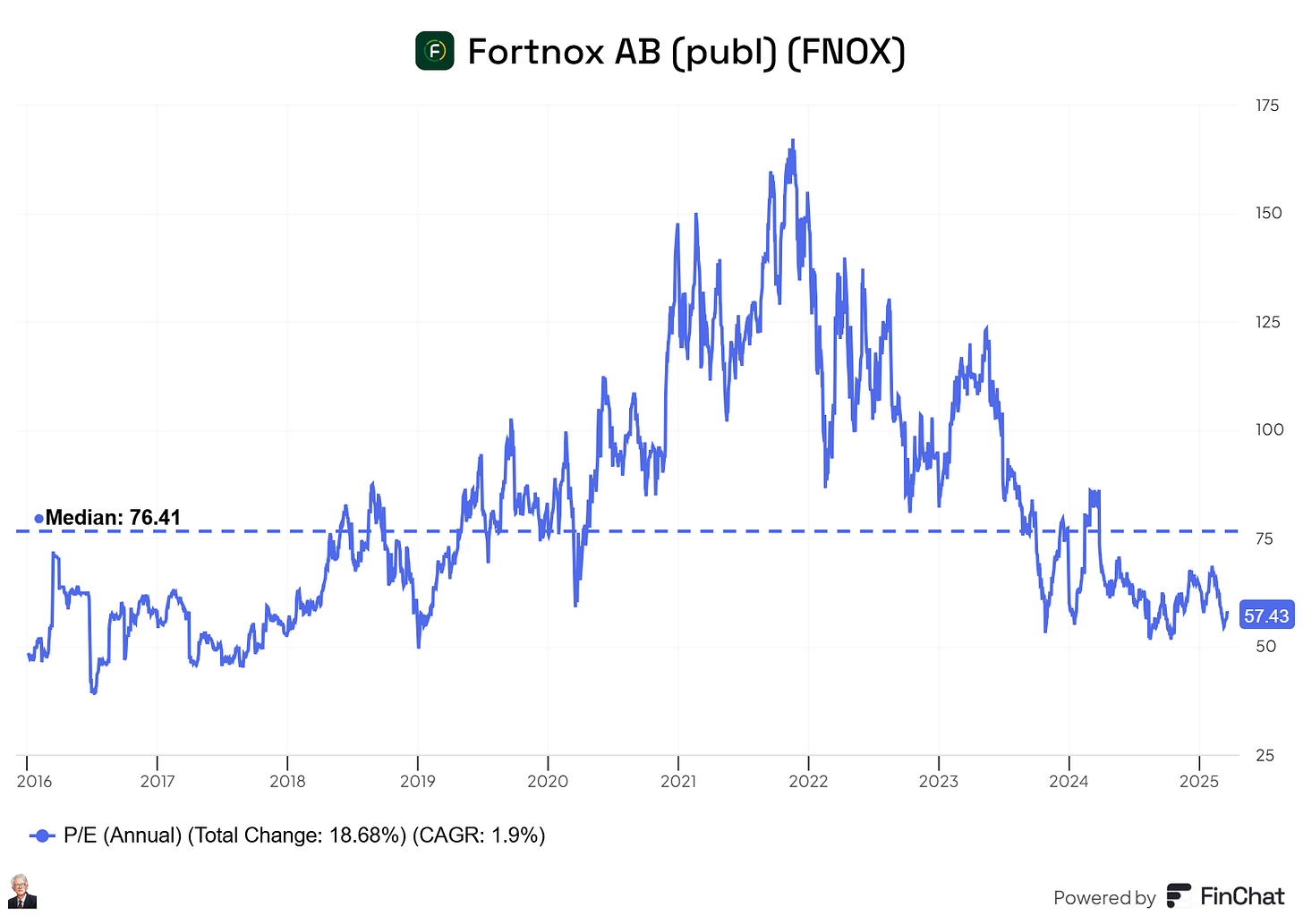

PE Ratio: ~57x | Historical median PE: ~76x

P/FCF: ~57x | Historical median P/FCF: ~61x

Valuation sits slightly below historical averages, but the stock is trading at a high premium to other capital-light quality businesses.

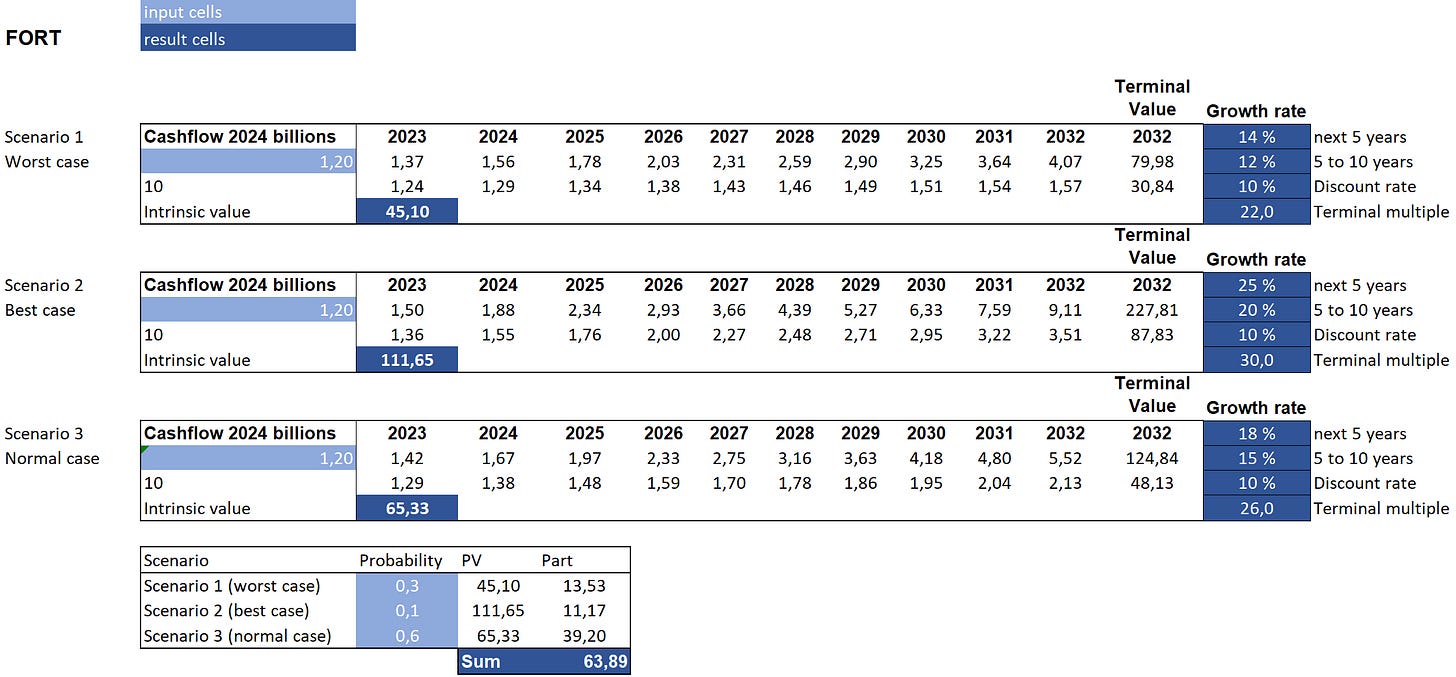

Discounted Cash Flow Analysis

3 different scenarios:

Worst: Growth 12% → 14% with an exit multiple of 22x.

Best: Growth 20% → 25% with an exit multiple of 30x.

Normal: Growth 15% → 18% with an exit multiple of 26x.

Current price: SEK 66

Fair value: SEK 63.89

Upside: -3%

Expected CAGR from normal scenario: 10% CAGR

Note: The risk for estimating growth levels of +25% and future multiples of +30 bakes in a lot of risk to the analysis. It is better to be conservative.

Conclusion

Fortnox offers a unique blend of growth, profitability, and competitive strength. With its transformation into a financial ecosystem, the company is positioned to continue expanding its ARPC and user base, especially with innovations like AI-driven insights and Payroll in 2025. Though geographic expansion remains a future growth lever, Fortnox's capital-light model and strong moat make it a top-tier compounder for long-term investors.

In our view, the current price is too high to provide a great long-term return, but if the stock falls further, it might become a potential purchase for our portfolio.

As a premium member, you can access our Top 15 Buys for 2025:

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 300 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +13.000 stock market investors (42% open rate) — Contact us via: investinassets20@gmail.com

FPR (FORTNOX AB TTM)

= 3.62÷∛(2.14×0.874×0.770)

= 3.205555202

FORTNOX's Capital Intensity is not light, but moderate.

***

FPR (Finance Pressure Ratio, by ATC)

= Total Assets ÷ ∛(Revenue × Gross Profit × Net Profit)

= Equivalent to Capital Intensity enhanced version

= Inverse of CompROA

= 1 ÷ CompROA

ii.

If FPR ≥ 4.743

= It implies Weak Competitive Advantage with Weak Profitability & High Finance Pressure

= Not a Compounder(equivalent to Low Capital Intensity)

iii.

If FPR ≤ 2.371

= It implies Strong Competitive Advantage with Strong Profitability & Low Finance Pressure (equivalent to Low Capital Intensity)

= Poised to be a Multi-bagger Compounder, the magnitude depends on the synergy between the ROIC & Gnp

= Having a long compounding runway time horizon

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e