ASML: A Bargain after its recent fall?

Wide moat with great growth prospects 🧠

Hi investor!👋🏻

Today we’re breaking down ASML, a European juggurnaut with a machine so complex, no one is able to replicate it. Let’s get into it!

ASML Holdings N.V (Nasdaq: ASML 0.00%↑)

Investment thesis

ASML has a deep economic moat reinforced by its deep ties in the semiconductor industry with more than 800 suppliers and partners. They have a monopolistic position in the EUV lithography market. High switching costs and barriers to entering the industry make ASML a high-quality business that deserves a premium.

Short-term bearish concerns are led by the cyclicality of the semiconductor business. In our view, you can’t escape this, but ASML is well-positioned to make money regardless of temporary downturns.

We see significant technology drivers for growth: 5G build-out, AI integration, and cloud computing.

The Business

ASML is a company from the Netherlands that produces photolithography which is an important step when producing semiconductors. ASML sells its products to major semi-producers and is considered one of the most important companies in the world.

The drivers for continued growth in the semiconductor market are essentially every technological category: smartphones, cloud computing, computing, 5G, AI/MR, and autonomous vehicles.

ASML sells most of its products to Asian countries like South Korea, Taiwan, and China. Only $3.1B of sales came from the US, while $1.2B came from Europe in 2023. This creates a concentration risk, and political factors might affect ASML’s future earnings.

The Fundamentals

The company’s return on invested capital is 19.5% and has been consistently high for years, ranging from 15-29%.

Gross margins and operating margins have been steady and expanding over the last decade, indicating that ASML has a strong competitive position and a unique product.

The stock

The stock has been a big winner over the last 10 years, with a total return of 868%. This is a compounded annual growth rate of 25.5%.

ASML has outperformed the S&P500 by a mile in the last decade.

The Growth

ASML has compounded revenue, cash flows, earnings, and dividends at a rapid rate for the last 10 years.

10-year CAGR:

Revenue per share: 17.89%

Earnings per share: 18.97%

Free cash flow per share: 12.50%

Dividends: 11.11%

Book Value: 8.04%

Sustainable Competitive Advantage

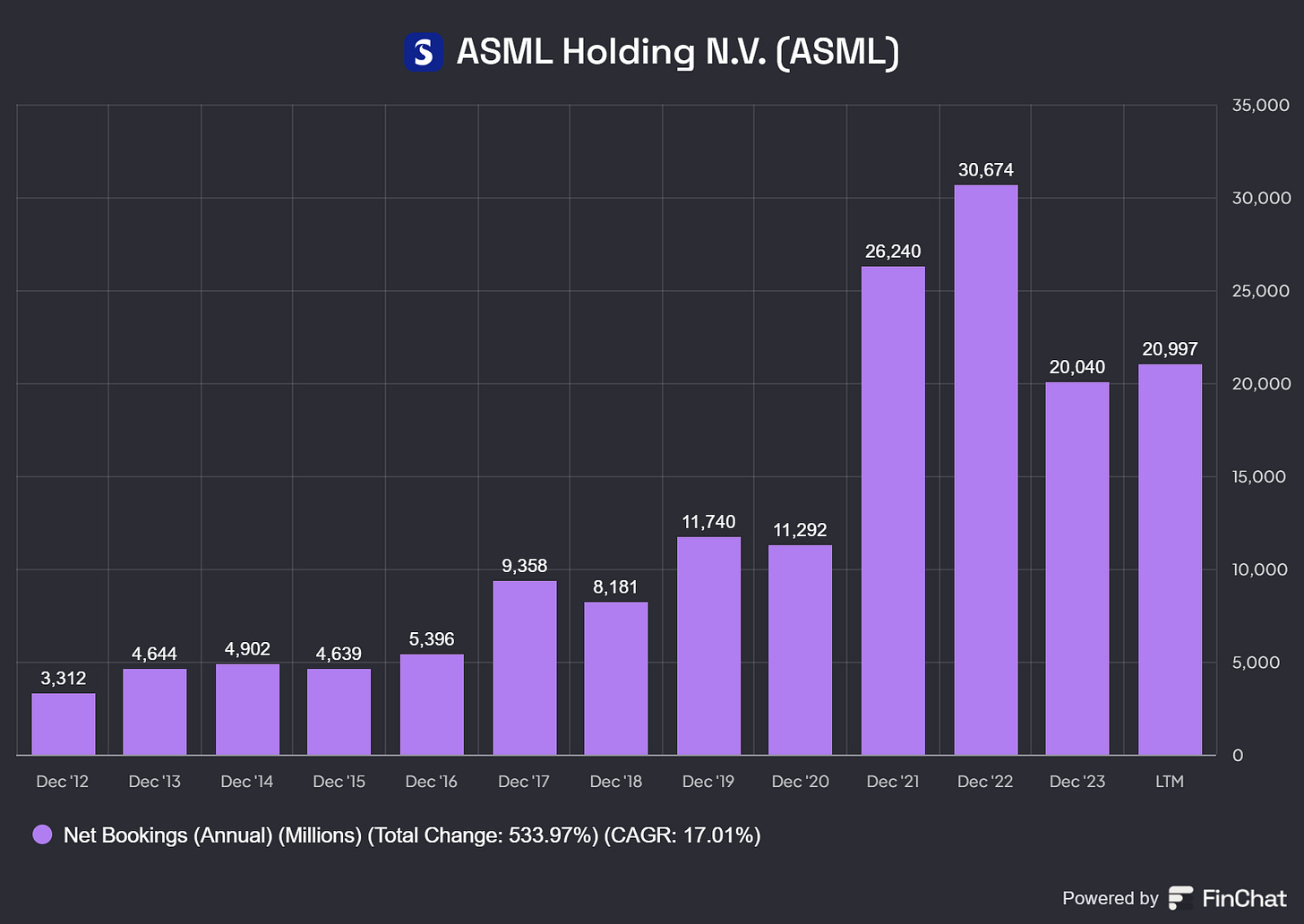

ASML’s EUV machines are so complex and effective in making microchips, that they have a hard time keeping up with the demand. Even with a semiconductor “bear market” after 2022, ASML has Net Bookings of $20.997B in the last twelve months:

Their booking secures earnings even in a recessionary environment. We saw an example of this in 2023, EPS went from $19.9 to $17.6 which is a small dip compared to the change in year-over-year net bookings.

Market dominance

ASML holds more than 90% of the EUW market and about 60% of the total lithography market:

Market growth

The market for EUW machines is growing rapidly, and ASML’s technology is and will continue to be in high demand.

The market is expected to grow by 17.3% until 2030.

ASML is part of a deep semiconductor Ecosystem

Lollapalooza moat

Charlie Munger talks about the Lollapalooza moat, here are a few more points for ASML’s moat:

Complexity of their EUV machine (Very hard to replicate)

Capital intensive for new entrants creates a naturally high barrier to entry

Customer/client relationships, ASML has a tight relationship with its clients that has helped them financially to develop the EUV machine

ASML has more than 800 suppliers that all help support the creation of the EUV machine. This can’t be replicated in a few years, it would take years of building up a supplier network.

If you want to go deeper into the EUV machines and ASML’s competitive advantage I recommend this video:

Their VP of technology famously said that even with all the resources in the world, and 10,000 of the best engineers, you would not be able to recreate the EUV machine.

Why own ASML?

Strong future growth prospects

Wide (Lollapoloza) moat

Large backlog (High demand for their EUV machine)

High return on capital

Expanding margins

Exposure to a uniquely positioned semiconductor business

Main Risk

The main risks I see for ASML

Disruption: New technology, substitutes, and competitors using e-beam lithography

Supplier dependency: ASML has supplier dependencies for the material required to make the EUV Machine

Political risk: ASML has the majority of its revenue from Asia, trade wars or political tensions could affect future earnings

Concentration on customer base: A few large companies make up almost all of ASML’s sales

Valuation risk: For investors, there is also a risk of paying too much for a company with high concentration and risks that might impact future earnings

Valuation

ASML is trading below its median forward PE and significantly lower than its 2021 and 2024 highs of ~50x.

Discounted cash flow analysis

ASML is guiding for 7% - 25% growth in 2025 with some margin increases. That is the low range from what has been guided earlier in 2024. Given this, we need to account for lower growth scenarios in our analysis.

Fair intrinsic value: EUR 646.68

Current price: EUR 661.3

Downside: -2.2%

Best case scenario upside: +45%

Conclusion

ASML is an interesting semiconductor business with one of the widest economic moats out there. The growth and prospects for the business look attractive, and short-term headwinds are scaring investors, making a possible entry point for long-term investors who believe ASML growth will continue.

ASML’s earnings stability is riskier than other quality companies. This is due to concentration risk to a few large Asian businesses. It is also not clear whether technological changes could disrupt the need for their EUV machines. Their EUV machines look like a strong asset that is protected by patents and the ecosystem - but technological advancements could disrupt the uniqueness of the EUV machines and affect their market position over time.

Fantastic business, trading at an OK price.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +10.000 stock market investors (45% open rate) — Contact us via: investinassets20@gmail.com

This is insightful. Very well presented.

Thanks for the awesome breakdowns! How can i share your Substack to gain some referral points? I can't find the link to your leaderboard to find my unique referral link.