Admicom: Highly profitable SaaS Business Offering an Attractive Risk/Reward (Part 1/2) 📈

6 min read 🧠

This article is sponsored by my Investing Service, this is what you get:

💎Full access to my quality growth portfolio where I invest 80% of my net worth

📈Monthly factsheets of the portfolio, performance, buys, and sells.

🎯Notification in advance, or the same day I buy or sell a position.

🧾Upcoming courses on financial statement analysis and valuations

🏰All my research (Investable universe, ranking, valuations, quality)

👑Breakdowns of quality compounders and valuations

🤵Access to me: I will be available to answer all the questions and concerns my paid subscribers might have about investing

Get a special holiday offer of 20% off:

Introduction

Today we will discuss the Finnish ERP system company, Admicom. Admicom has been a growth story over the past decade, growing rapidly with impressive margins. Admicom has a scalable and profitable business model and is well-positioned in the construction SME and microcap niche in Finland. The stock has been on a significant pullback from its 2021 top levels as growth has slowed due to a slowdown in the Nordic construction market. Admicom has set a new growth strategy for the next 5-10 years which will take Admicom outside of Finland and into Europe for its international expansion.

A brief overview of Admicom’s history and financial performance:

Investment Thesis

The investment thesis for Admicom: As the construction sector gets into an upcycle, it has to digitalize to reduce costs and increase efficiencies. When this happens the Nordic SMEs and microcaps will look to Admicom to solve their ERP and accounting challenges. It is unlikely that larger ERP providers such as SAP, Microsoft, and Nemetschek will try to take these SMEs and microcaps as the business is just too small for them to move the needle. This leaves a potentially profitable niche for Admicom.

The image below describes what market trends drive the need for SaaS solutions in the construction sector:

Admicom: The Business Financials

Admicom Oyj was founded in 2004 and is headquartered in Jyväskylä, Finland. In terms of business fundamentals, Admicom Oyj has a market cap of €217.41M and a total enterprise value of €216.38M. The company has shown strong profitability with a gross profit margin of 57%, an operating margin of 37.6%, and an FCF margin of 32.3%.

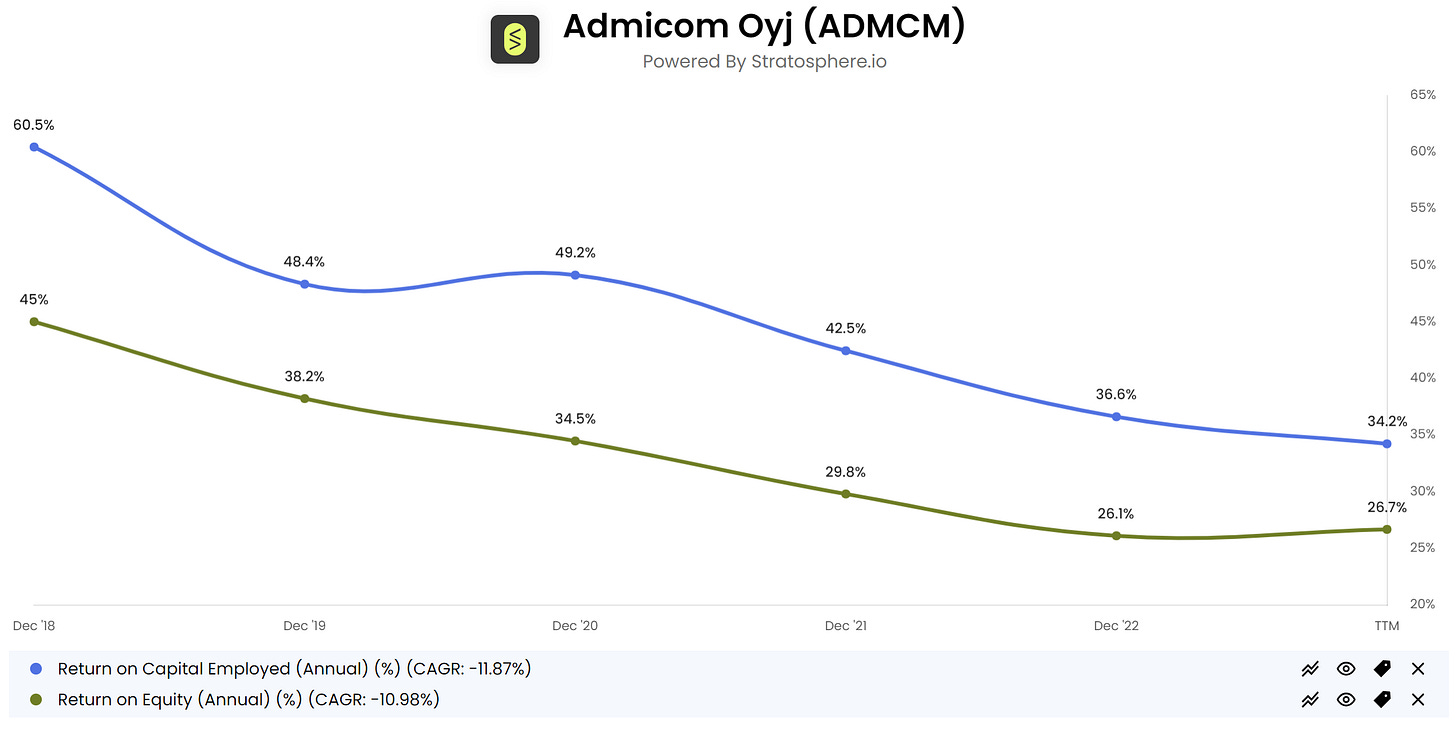

Additionally, Admicom Oyj has demonstrated solid capital efficiency with a return on equity (ROE) of 26.7% and a return on capital employed of 34.2%.

Looking at the company's valuation, the forward P/E ratio is 22.65, and the forward free cash flow yield is 4.6%.

In terms of organic revenue growth, Admicom Oyj has shown a 12.1% growth for the fiscal year 2022 and a 6% growth for the quarter ending 2023-09-30.

These numbers indicate that the business is fundamentally strong, with i) high margins, ii) high returns on capital, iii) decent growth numbers, iv) a modest valuation compared to other SaaS businesses.

The Business: The Products and Services

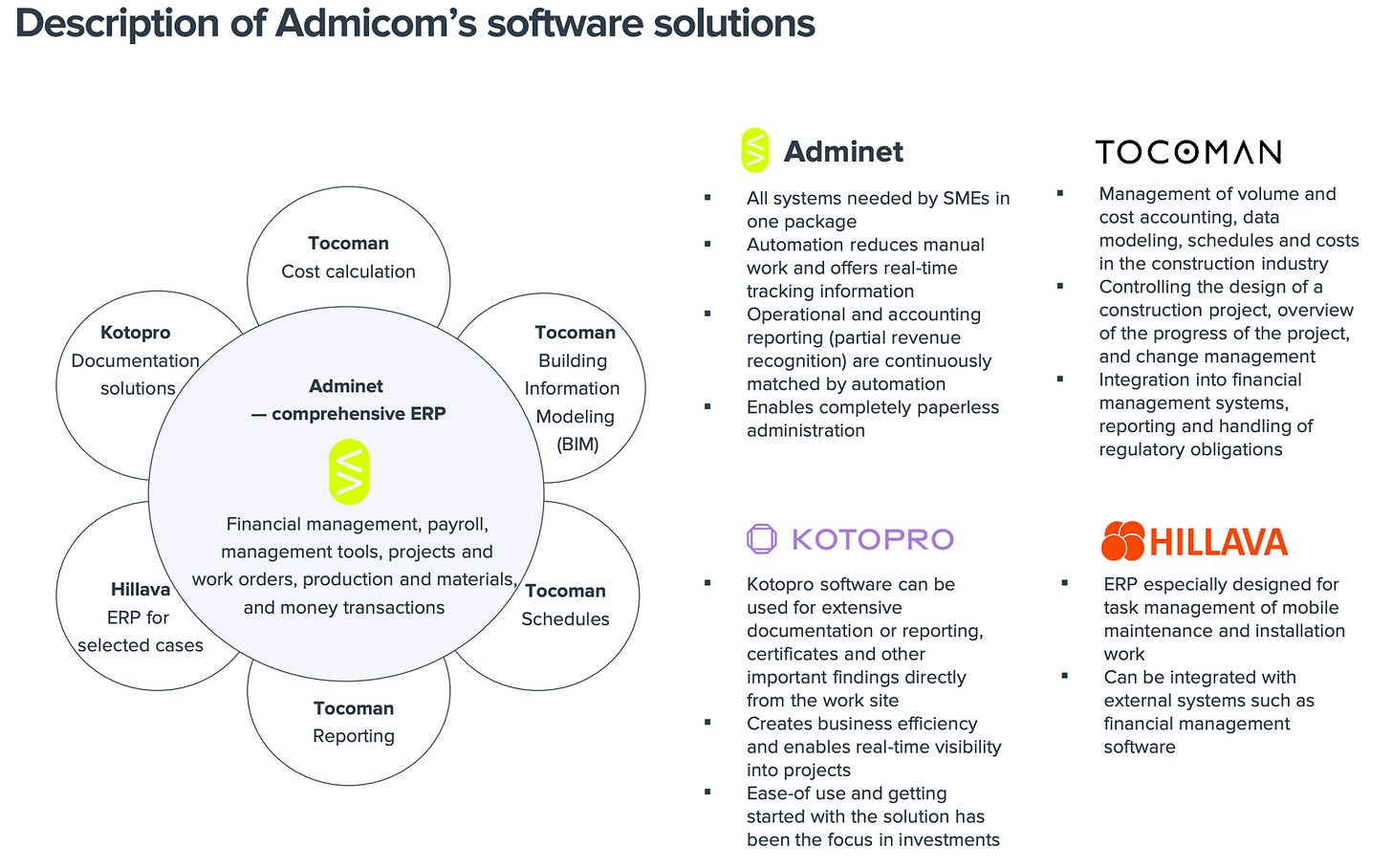

Admicom offers a suite of services to its clients in the construction industry. They started with simple ERP services but have now built out a suite of SaaS products such as cost estimation tools, building information models, reporting & scheduling. Admicom’s products are scalable, sticky, recurring revenue-based, and specifically made for the extended construction market. Here is an overview of their suite:

According to Admicom, their customers are 25% more productive than their competitors due to the value of their product suite. They have a focus on utilizing data to produce results for their clients as they want to deliver a superior "customer experience".

Looking ahead, the prospects for Admicom seem promising. With an ever-expanding global construction market and an increasing reliance on technological solutions, the company is well-positioned to capitalize on these opportunities. Continual innovation, strategic partnerships, and a keen eye on emerging trends will likely drive Admicom's future growth.

The Business model

Admicom sells software as a service (SaaS) to construction companies in the Nordics with 93% of its revenues coming from recurring service agreements. Admicom offers comprehensive tools that are tailored to the unique needs of the construction industry, such as steamlining its operations, enhancing productivity, and increasing transparency and communication internally.

Here is an extensive look at their products (Tocoman, Kotopro, and Hillava are previous acquisitions):

As Admicom is able to offer a comprehensive suite of products and services to their clients, this means that they have the potential to up- and cross-sell their solutions. A client might start with the standard Adminet package, but add on Tocoman’s cost calculations, or Kotopro’s documentation solution if this is something the client demands. Getting several business needs met from the same supplier increases the importance of their relationship and in theory, creates higher switching costs for the clients.

The different products owned by Admicom fill different market needs, below is an overview of what the different software solutions cover in the market:

Core Offerings:

Financial Management: Admicom's software facilitates precise financial management, encompassing invoicing, budgeting, cost tracking, and reporting. This feature empowers construction firms to maintain a tight grip on their finances, ensuring projects remain profitable.

Project Management: The platform integrates project planning, resource allocation, task scheduling, and progress monitoring. It provides real-time insights into project status, optimizing workflows and promoting on-time project completion.

Document Management: A key aspect of the platform involves document storage, sharing, and version control, ensuring stakeholders have access to the most updated information, thus minimizing errors and delays.

Payroll & Management tools: Adminet offers an extensive service that lets clients stay on top of their payroll to their employees.

Cost calculations: Tocoman has extensive products for managing volumes and accounting for the client’s operations

Scheduling & Reporting: Tocoman’s software covers easy-to-use scheduling and reporting tools that increase efficiencies for their clients.

Admicom is continuously developing new tools and improving existing software to cater to the needs of the overall industry. By utilizing data and client feedback they are able to calibrate their products to become even more effective, hence increasing the profitability of their clients.

Key Growth Drivers

Admicom is targeting a cyclical industry by focusing on the extended construction sector in Finland. Let’s look at the key drivers for growth that may take Admicom to the next level:

The construction industry is set for digital adaptation. This represents a huge untapped market that will materialize in the coming 5-10 years. The need for software solutions to increase productivity and reduce cost is prevalent and will likely materialize in the next upcycle.

No strong competition - Blue Ocean. Industry-specific software for SMEs is a niche that is not currently filled by much competition. Admicom tailor their solution to the needs of the construction industry, this allows them to understand the nuances and develop products that cater to its client’s needs. Additionally, small to medium-sized businesses care much more about getting the correct attention from their suppliers, this level of attention is not likely to happen from a large player like Microsoft.

Scalable platform with a suite of products that can be offered to new clients with low addition in variable cost for Admicom. SaaS businesses hold many advantages, one of them is the ability to grow earnings faster than revenues, as an additional customer doesn’t cost Admicom that much in variable cost. Admicom’s products are highly scalable, the growth story will largely depend on Admicom’s ability to continue to grow through new clients and M&As.

Taking market share: Admicom has plenty of room to grow in its existing markets, this is clearly shown by its ability to grow organically, even in a soft construction market.

Price hikes: The CEO stated in their Q3 call that Admicom hiked prices by 5% in the summer without much churn as a direct consequence of the price hike. The churn was explained to be primarily bankruptcies. Anyhow, if Admicom is able to hike prices in the future, this shows pricing power and is a good sign that their product is sticky. This is also a reasonable way to grow its earnings.

Up & Cross-selling: Introducing more modules to their platform will make it easier for Admicom to cross & up-sell their services to their existing customers. Adminet as an example can be used to simply lock up clients from which Admicom can offer more services to further benefit their clients.

International expansion: International expansion is hard, but the potential for Admicom is large if they can manage to enter the Nordic markets. The number of enterprises in the broad construction sector in Finland totaled 82.470 in 2016. However, Sweden totaled 213.434, which is more than double that of Finland. This means that expanding abroad will enlarge Admicom’s TAM. This is part of their new strategy with their new CEO.

Mergers & Acquisitions: Admicom acquired Tocoman in 2020 to increase its product offering and strengthen its position. M&As will be a larger part of the growth story moving forward for Admicom. We can expect Admicom to grow inorganically by acquiring companies that will i) strengthen their existing position in the Finnish market, ii) enhance their product portfolio, and iii) international expansion into Sweden and/or Norway.

The Stock

Admicom went public in 2018, and already in 2021, the stock had returned ~1200%. The company was firing on all cylinders, and the future expectations were high in terms of growth and profitability. Investors gradually modified those expectations as the margins compressed, and growth stagnated due to softer-than-expected markets. The stock is up ~350% since 2018, with a CAGR of 29.3%. Still a fantastic result, but the stock is on a significant decline from its 2021 highs.

It’s important to understand that the pullback has come from sky-high expectations not being met, and not necessarily due to the business fundamentals deteriorating. Admicom still has solid fundamentals, decent organic growth, and high margins and capital efficiencies.

The Growth

Admicom’s growth has been nothing but impressive since 2015, growing revenues at a compounded annual growth rate of 30%, gross profits at 31.43%, and net income at 36.81%. The growth has stagnated in recent years as the construction industry has shown weakness, but it illustrates the growth potential in Admicom.

The per-share figures are impressive as well, since 2017, the revenue per share has grown by 24.31% (CAGR), EPS diluted by 39.9%, and free cash flow per share by 24.51 (since 2018). The high per-share growth tells us that Admicom has not been using excessive amounts of share issuance to fund its growth.

The last 5 quarters

Growth has slowed significantly since the 30% YoY growth in Q3 of 2022. However, as we can see from previous quarters, most of the growth came from acquisitions. 18% of revenue growth in Q3 and Q4 of 2022 was from acquisitions. If we look at organic growth, it has gone from 12% (if you include fees) to 6% in the most recent quarter. It is impressive that Admicom is able to grow organically despite the sector backdrop it finds itself in. It is also worth mentioning that they managed to boost EBITDA margins to 44%, up from 38% in the previous quarter.

Admicom will survive for the next 1-2 years, as the construction sector recovers, I’m expecting Admicom to benefit and regain their growth targets of 8-15% annually.

In the next part of this article, we will look at Admicom’s competitive position and advantage, management, acquisitions, valuation, and risk factors. The article will be released on 30.12.23.