7 Biases to Make you a Better Investor 🧠

How to stop making fatal mistakes in the stock market

Hi investor! 👋

In this article, we will discuss 7 psychological biases that affect your decision-making process when you invest in the stock market.

“Charlie Munger has the best 30-second mind in the world”

— Warren Buffett

Munger was able to out-think his competitors by understanding cognitive biases.

In his famous speech “The Psychology of Human Misjudgement”, Charlie outlined why smart people make dumb decisions.

If you haven’t read or listened to this speech, you are missing out.

Download his full speech here:

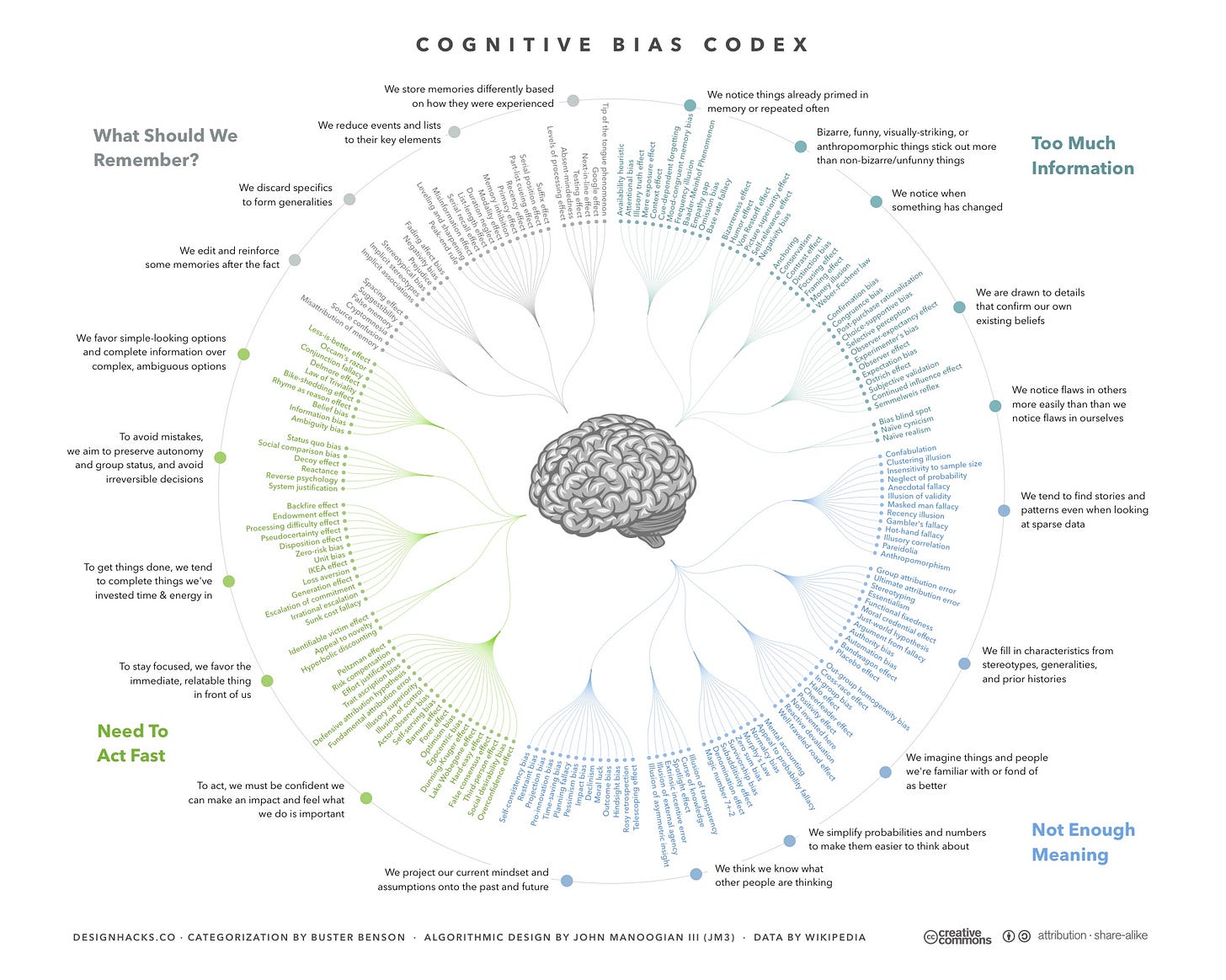

What is a psychological bias?

Also known as a “cognitive bias” it can be defined as a pattern of deviation from rational judgment.

In other words, why do we (human beings) sometimes act and think like morons.

7 Psychological Biases to Sharpen Your Thinking

Let’s get into it 👇🏻

#1 Risk-Aversion Bias

This bias causes investors to prefer safety and avoid risks, especially during uncertain times.

This bias leads them to invest in lower-return instruments with predictable risks rather than pursuing higher returns that come with unexpected risks.

Consequently, investors may choose guaranteed, smaller returns over potentially larger, but uncertain, gains.

Example: Investors will rebalance their portfolio during recessions to more bond exposure and less stock exposure. In reality, this is often the worst time to do this.

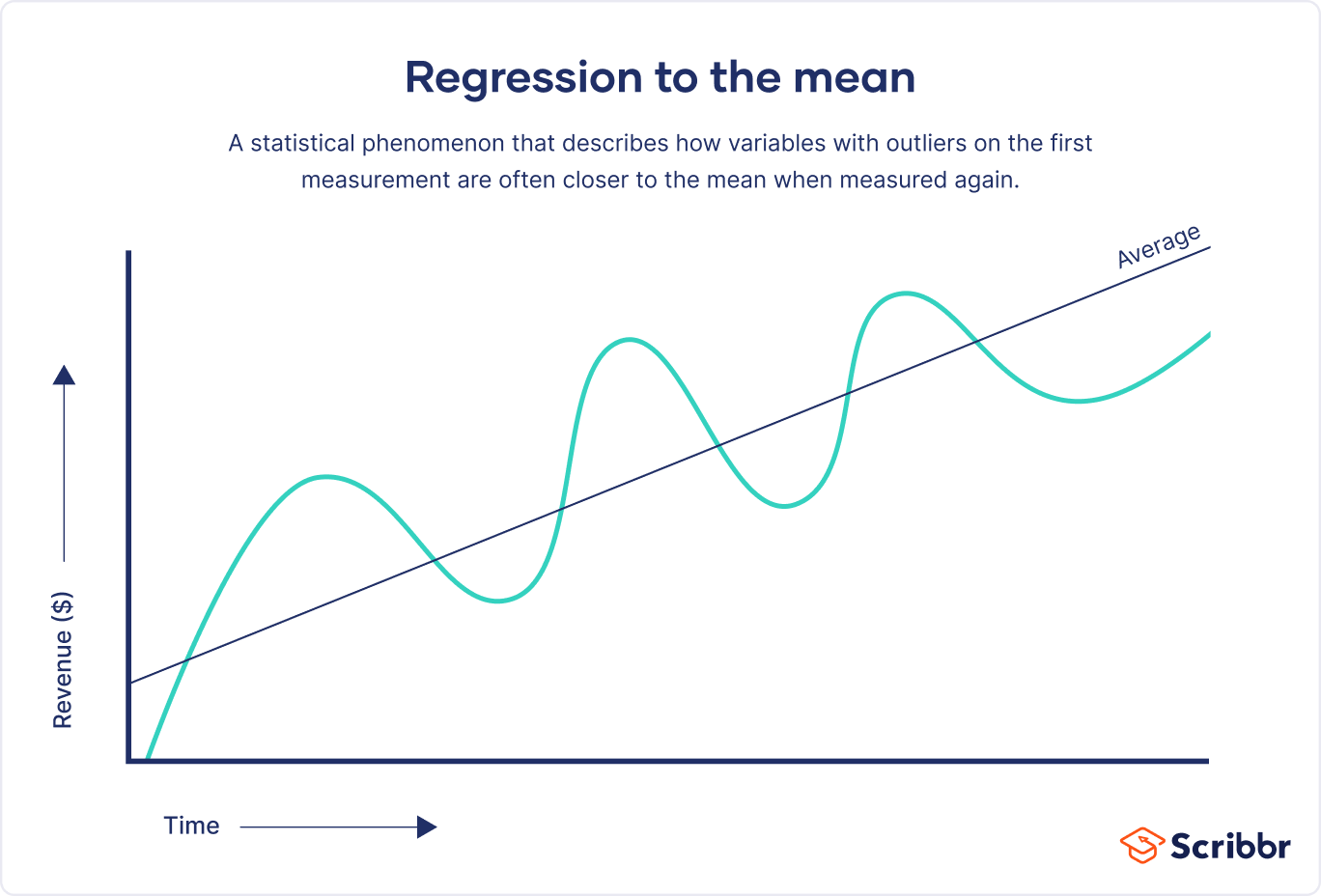

#2 Regression to the mean

We are always seeking patterns and cause-and-effect relationships. Our brains are hard-wired to look for this, and it often results in us attributing a cause-and-effect relationship to something that is just a random correlation.

One common mistake investors make with this bias is to believe that a company’s performance will revert to the mean. This can be the company’s stock performance, earnings, revenues, or cash flows. We assume that overperforming businesses will revert back to an average return, and we assume that underperforming businesses will revert back to their former glory.

The two mistakes can be equally damaging to your returns:

Assuming an above-average business will revert back to the average. Without looking at the facts we can assume that this will happen because it happens to most companies. However, the best businesses defy mean reversion and continue to deliver above-average returns for decades. These are the businesses we are looking for.

Assuming a below-average business will revert back to the average. If the facts do not support this thesis, the business can just as easily continue to fall in quality, growth, and market share until it goes out of business. Sometimes, these businesses will be misunderstood, and great turnaround opportunities, but never assume that a business will get back to its former glory without substantial proof.

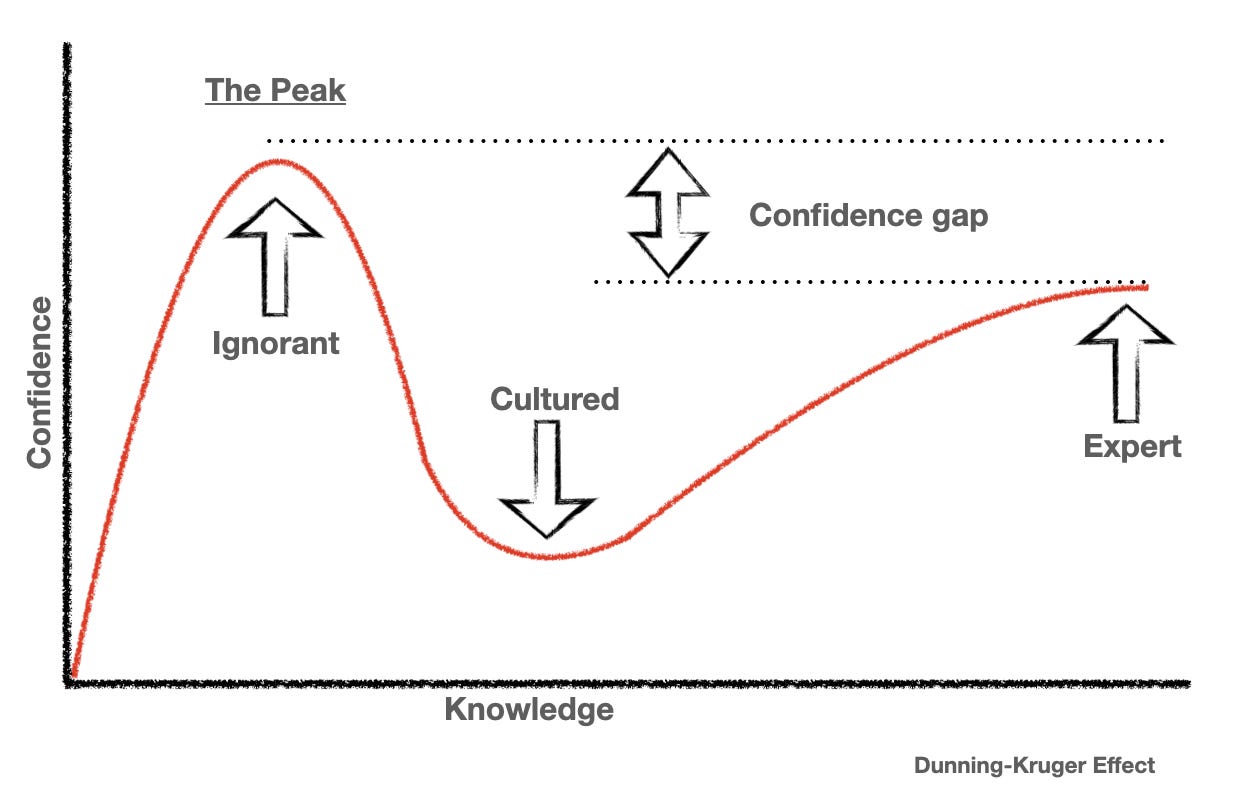

#3 The illusion of skill

The illusion of skill is a cognitive bias that is connected to a concept called “Mental filtering”. We tend to attribute our successful investments to our skill as stock pickers while attributing disastrous investments to randomness or being unlucky.

This creates the illusion of skill, we believe that we are far better investors than we actually are. This lack of intellectual humility can lead to disaster in investing.

The truth is that randomness plays a huge role in the outcome of our investments. We need rational rules and investing processes in place to achieve superior returns.

Example: New investors make 1 successful investment in the stock market, then proceed with way too much confidence, believing that “beating the market is easy”.

The Dunning-Kruger effect applies:

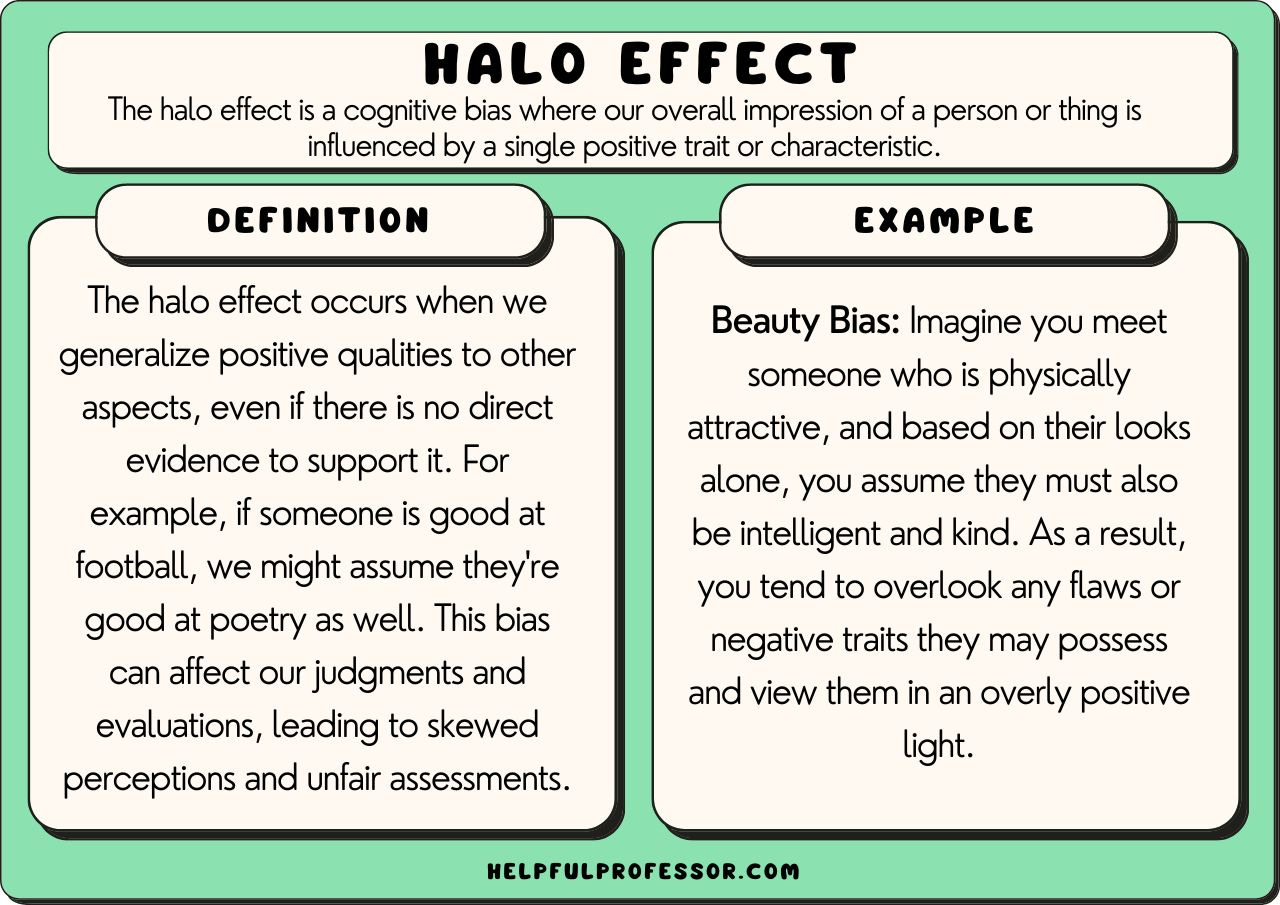

#4 Halo Effect

The halo effect describes how we might like everything or nothing about something. If we look at a company, and we don’t like the CEO, this can cloud our judgment and write the company off, even if there are several positive signals from the business.

It is challenging for our brain to not think in absolutes, or in black or white. We have to be disciplined in how we research stocks so as not to get misguided by our own cognition.

A common mistake is religiously following a charismatic leader without looking at the underlying business. This effect has caused huge losses for investors in the past.

Example: “Sam Bankman-Fried is a genius and I will invest in his company without doing thorough due diligence!” — Many Smart Venture Capitalists

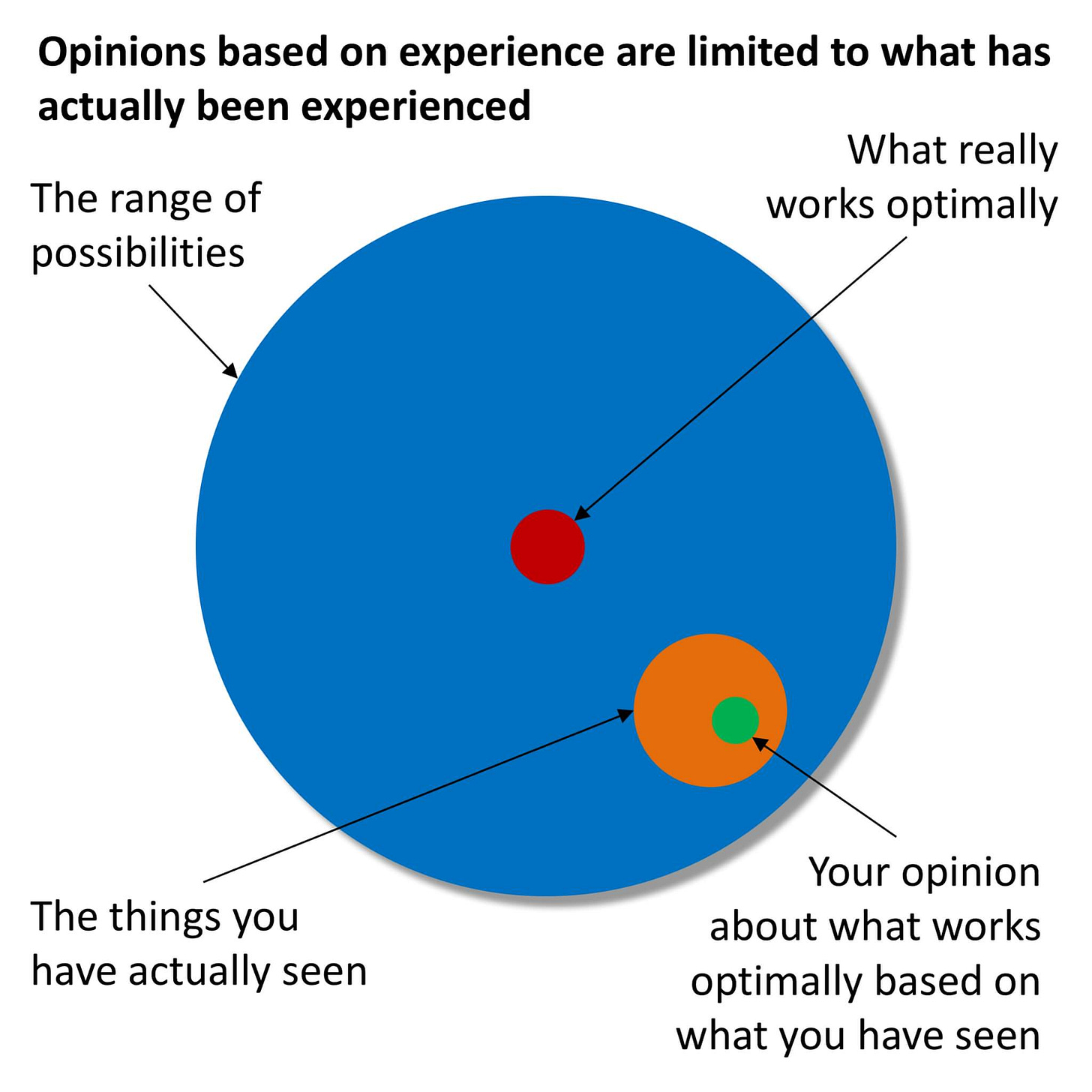

#5 WYSIATI

“What you see is all there is” is a cognitive bias. We all have blind spots. We seldom hold all the relevant information when making investing decisions, and it can be hard to challenge our assumptions.

The danger from this bias comes as our confidence increases as we only hear one side of the story. Our so-called “conviction” can simply be that we have only allowed our brains to absorb the “bull-case”, and not the “bear-case” to get a more nuanced view of an investment.

Remember that for most investment cases, your knowledge of the company’s situation is only a small percentage of the overall context.

Example: Investors looking at a company’s revenue growth, while neglecting HOW they are achieving that growth (E.g. from excessive spending on marketing & sales that is unsustainable).

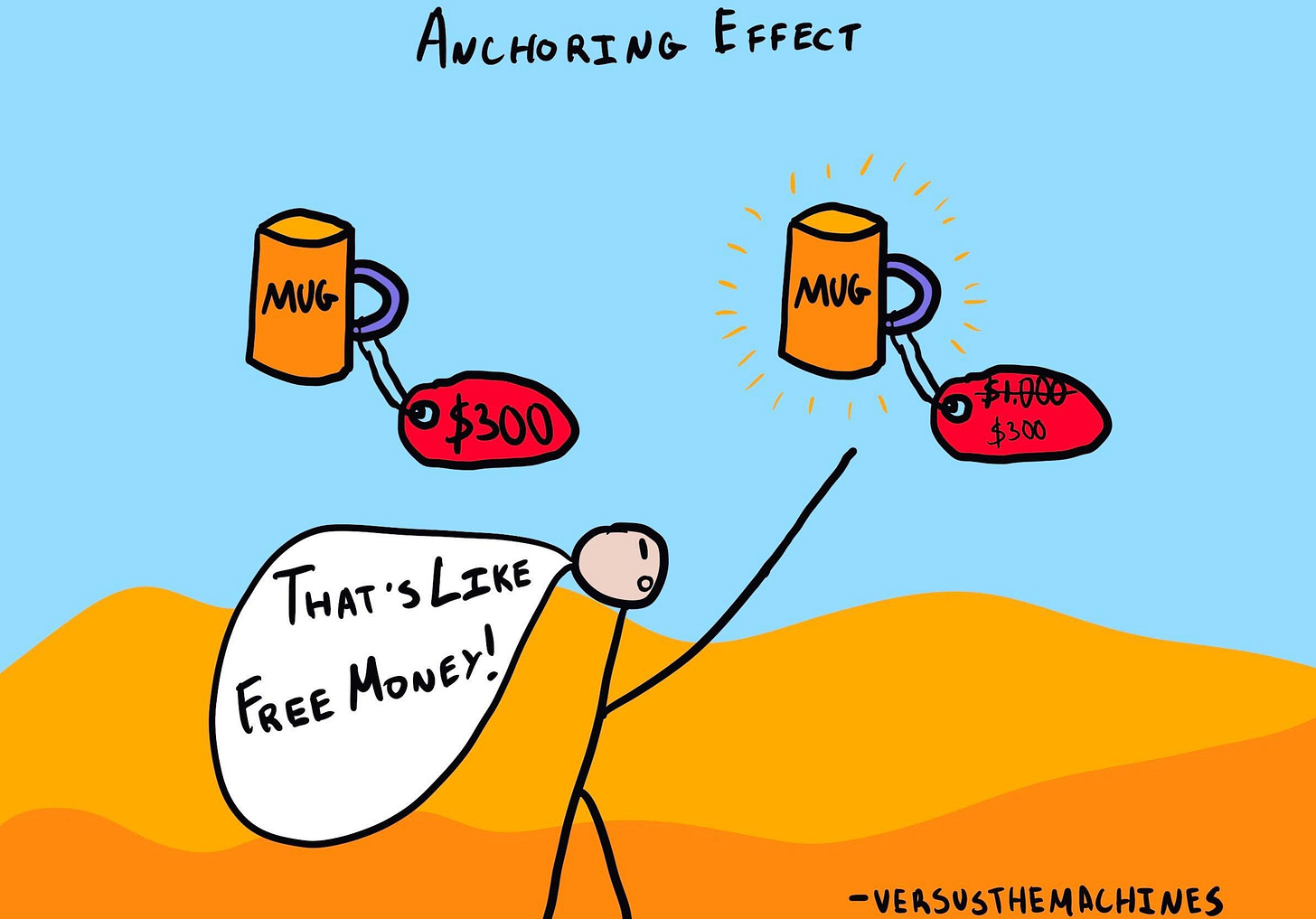

#6 Anchoring

The first information about a subject that enters our minds is the information and opinion we are most likely to stick with. In investing, anchoring stock prices is a normal phenomenon. We know that PayPal used to trade at +$300 per share and that it is now $70 per share. Therefore, we think the probability of PayPal getting back to the anchored price is higher than it continuing to trend down.

This can be true, but we should base that assumption on facts, not anchoring. This is why investors should always look at the intrinsic value of a business, and try to determine the probability of a high-return outcome, vs. the risk of a low-return outcome.

Example: “Asos stock traded at £40 in 2021, it is now trading at £3.50, it’s a steal!”

#7 Hindsight Bias

In hindsight, everyone is a genius. We see a lot of this on social media, investors make a post about PayPal, or Enphase Energy, where they claim that the decline was obvious. And yes, everything is obvious when you have the facts in front of you.

The risk from this bias comes, as we believe we will be able to predict the next recession, the next big turnaround (Like for Meta Platforms), or the next bull run. We won’t. If you were able to do this with any form of certainty, we would quickly become very rich.

Instead of being geniuses in hindsight, let’s focus on building investment cases on rational objective facts and assign a probability to the outcome. Being a hindsight genius is an ego game, not one that we should play if we want to achieve riches in the market.

Example: “I knew that Lululemon would crash, it was obvious” (It wasn’t).

Conclusion

To become a great investor, you need to study the different cognitive biases that make most investors poor at this game. If you are unaware of these biases, you will be a slave to them. If you are aware, and create systems and investing processes to counter them, you have a higher probability of being successful in investing.

The art of becoming a more effective thinker will not only make you a better investor, but it is translatable to other parts of your life. Your 9-5, personal finances, and networking will all benefit from this skill.

A great place to start is to listen to Charlie Munger’s “Psychology of Human Misjudgement” and internalize the lessons from that talk.

If you liked this article, please leave a like and a comment telling me what you enjoyed.

All the best,

Invest In Assets

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +10.000 stock market investors (45% open rate) — Contact us via: investinassets20@gmail.com

Thank you. I'm going to create a cognitive bias checklist for my trading.

I loved your post, a lot of lessons for becoming a better investor