6 Cognitive Biases to Make You a More Effective Thinker 💎

The best 30-second mind 🧠

Hi investor! 👋

In this article, we will discuss 6 psychological biases that affect your decision-making process when you invest in the stock market.

Want to learn a systematic approach to quality investing to create wealth over time?

Sign up for the waitlist for the “Quality Growth System” digital course:

“Charlie Munger has the best 30-second mind in the world”

— Warren Buffett

Charlie Munger was able to out-think most people by understanding cognitive biases.

In his famous speech “The Psychology of Human Misjudgement”, Charlie outlined why smart people make dumb decisions.

Download his full speech here:

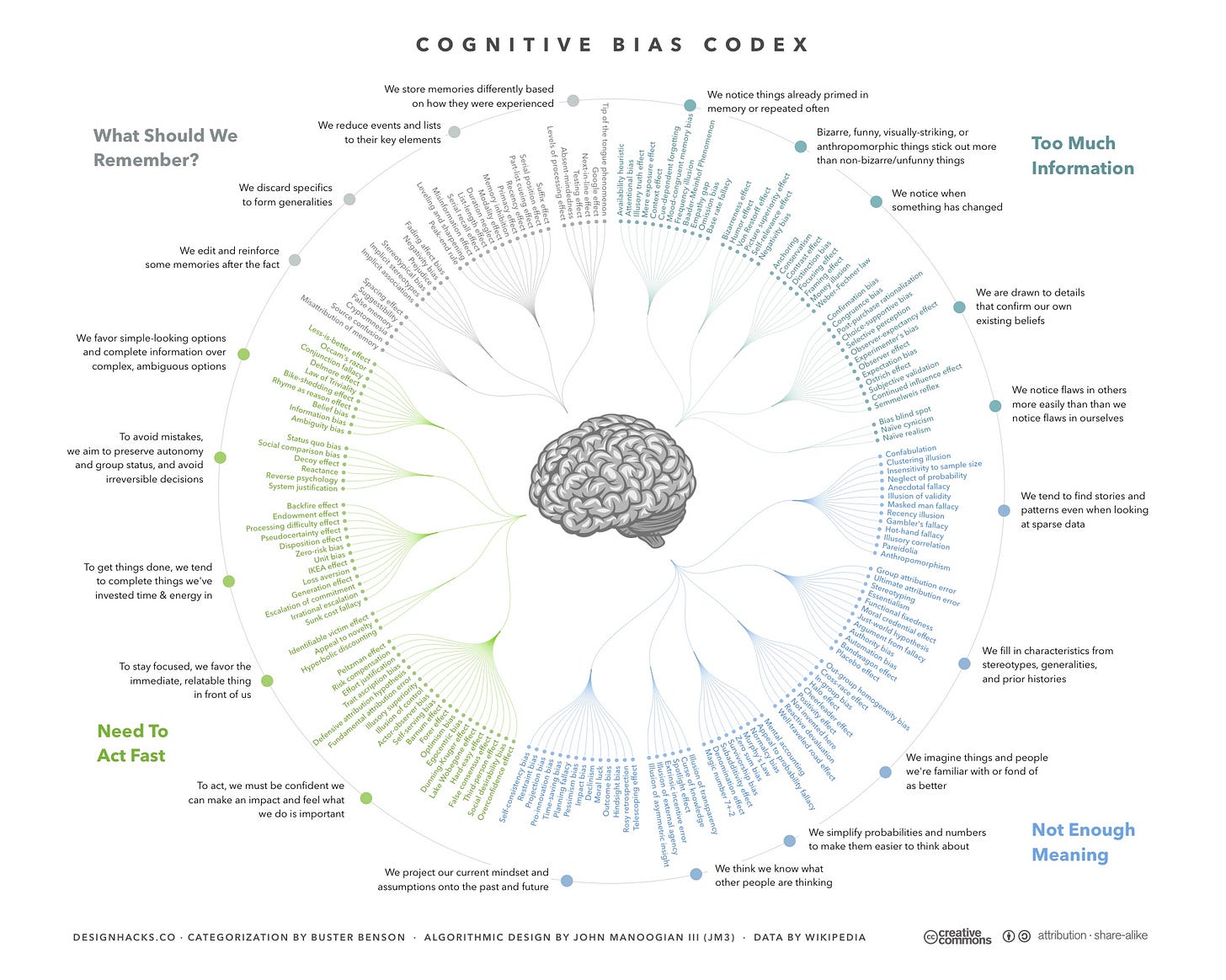

What is a psychological bias?

Also known as a “cognitive bias” it can be defined as a pattern of deviation from rational judgment.

In other words, why do we (human beings) sometimes act and think like morons.

Most investors have been caught in one of these scenarios:

A stock keeps increasing, all your friends are making money, and you want to get in too! (FOMO)

A stock keeps falling in price, the pain gets worse every day, and you sell at the point of maximum pain (only to realize it was the bottom). (Appeal to fear)

You think you know more about a certain stock or industry than you do, you agree with all articles and reports that confirm your thesis, and neglect those that oppose your thesis (Confirmation bias).

6 Psychological Biases to Sharpen Your Thinking

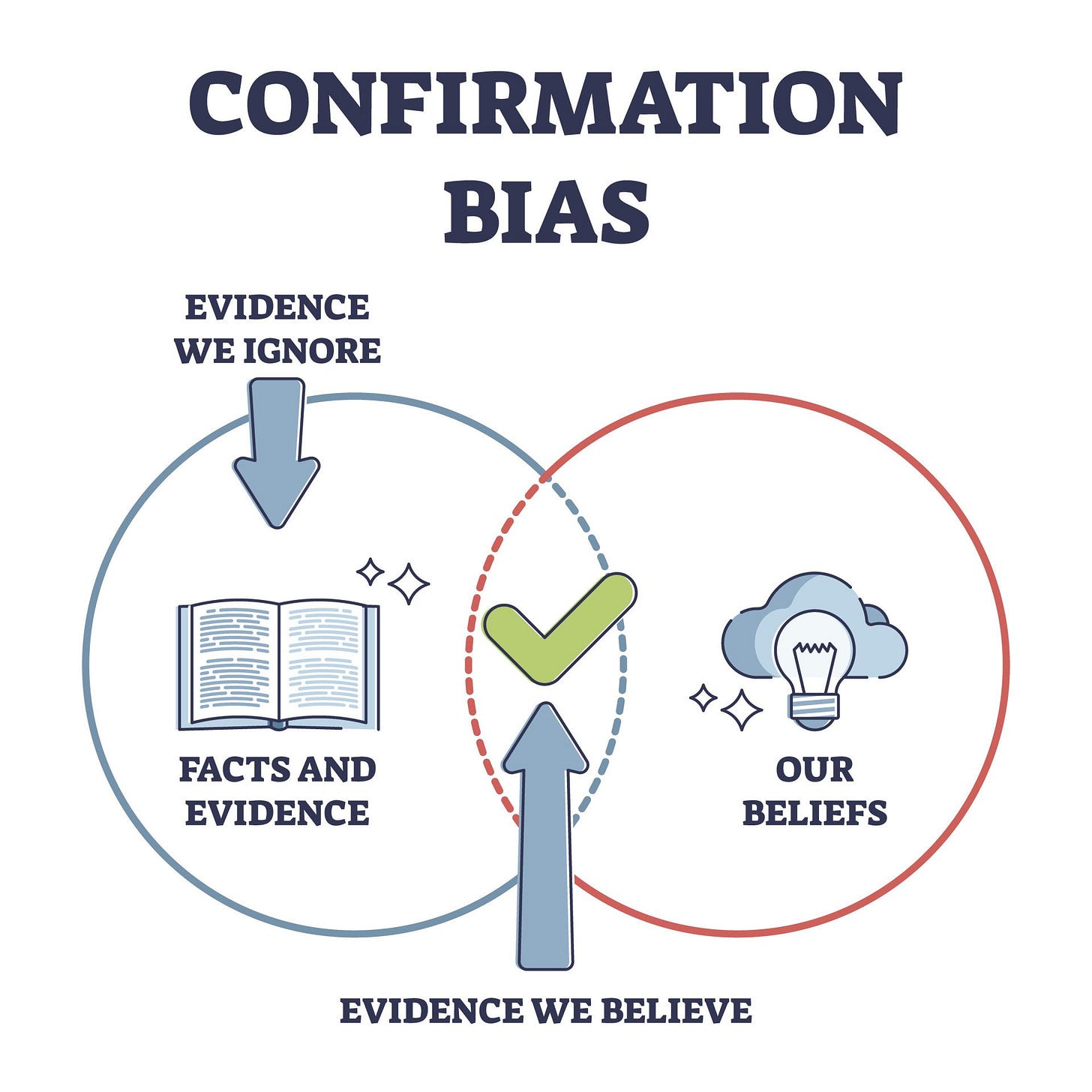

#1 Confirmation Bias

Refers to the tendency of individuals to search for, interpret, and remember information in a way that confirms their preexisting beliefs or hypotheses.

This cognitive bias leads people to favor information that aligns with their views while disregarding or minimizing evidence that contradicts them.

Confirmation bias can reinforce existing beliefs and attitudes, making it difficult to change one's perspective even in the face of contrary evidence.

Example: You evaluate all the sources that confirm that Bitcoin will go to the moon while disregarding all the sources claiming it is rat poison squared.

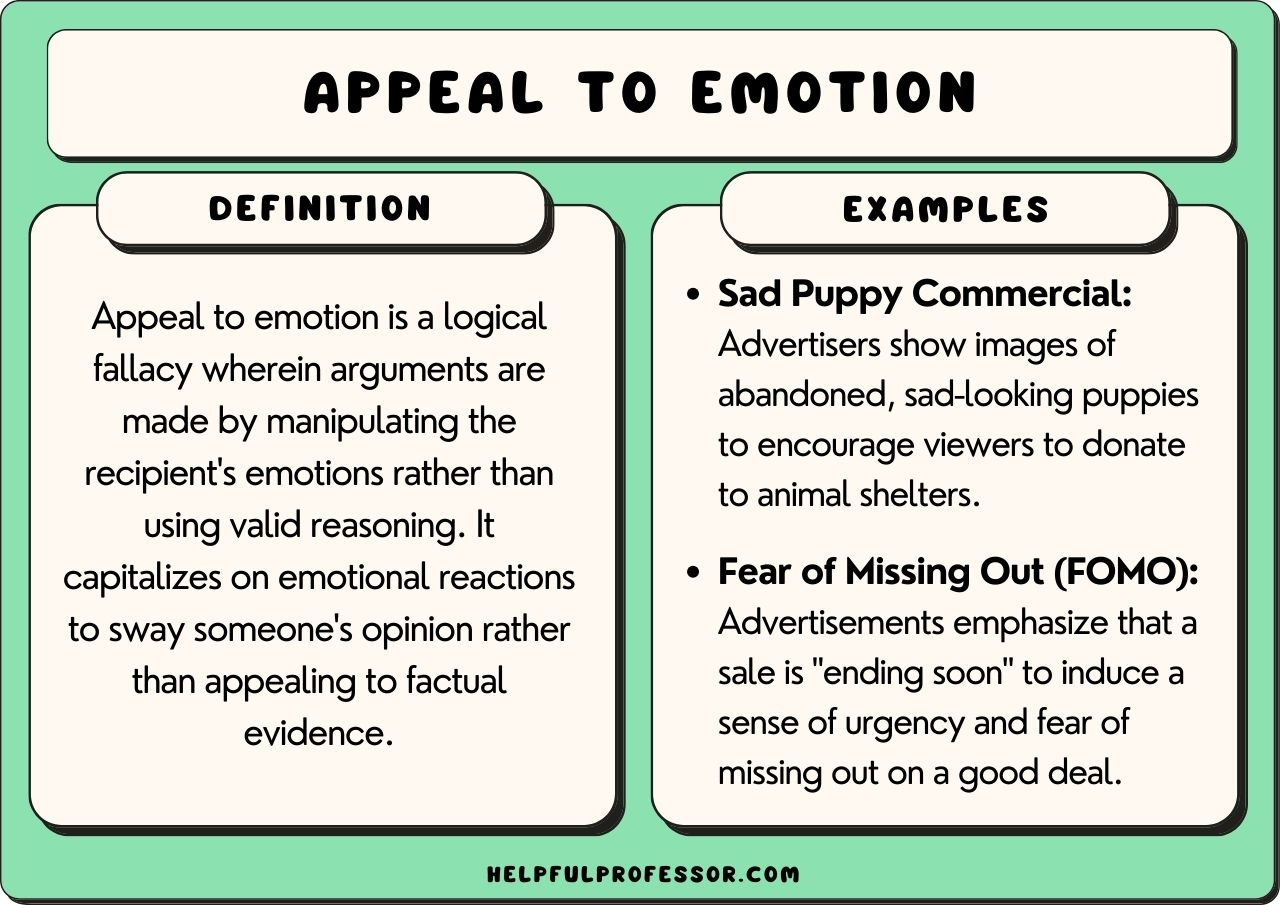

#2 Appeal to Emotion (Fear)

A logical fallacy where fear, rather than evidence or reason, is used to persuade an audience to accept a conclusion.

This tactic involves presenting a scenario or potential threat that instills fear to influence people's attitudes or behaviors.

The aim is to create a sense of urgency or danger, prompting individuals to take action or adopt a belief to avoid the feared outcome, often bypassing rational analysis.

Example: Financial media headlines like “You should get out of the market NOW” or “S&P to crash 50% expert says”.

#3 Slippery Slope Fallacy

Occurs when a relatively minor first step is assumed to lead to a chain of related events culminating in a significant and usually negative effect.

This fallacy suggests that taking one action will inevitably lead to a series of other actions that result in a dramatic and undesirable outcome, without providing evidence for such a progression.

It often relies on speculative reasoning rather than concrete evidence.

Example: “If interest rates go up by 2%, the stock market will crash leading to the real estate bubble bursting”

#4 Guilty by Association

A fallacy that occurs when an individual is judged negatively based on their association with another person or group rather than on their actions or character.

This reasoning implies that because someone is connected to a person or group with negative connotations, they must share the same negative qualities, regardless of their behavior or beliefs.

This fallacy undermines individual accountability and can lead to unfair judgments.

Example: An event triggers a sell-off in a certain sector. Even businesses not affected by the event will be dragged down due to this bias.

#5 Narrative Fallacy

A fallacy or bias that leads investors to base their investment decisions on compelling stories.

When an investor connects with the narrative of an investment, they tend to prioritize the story over the factual and rational aspects.

This preference for storytelling over objective analysis can result in irrational decisions, potentially leading to poor investment outcomes.

Example: Nikola’s electric trucks that weren’t even driving (Great story, but no real product). The former CEO is now in jail, and the investors lost most of their money.

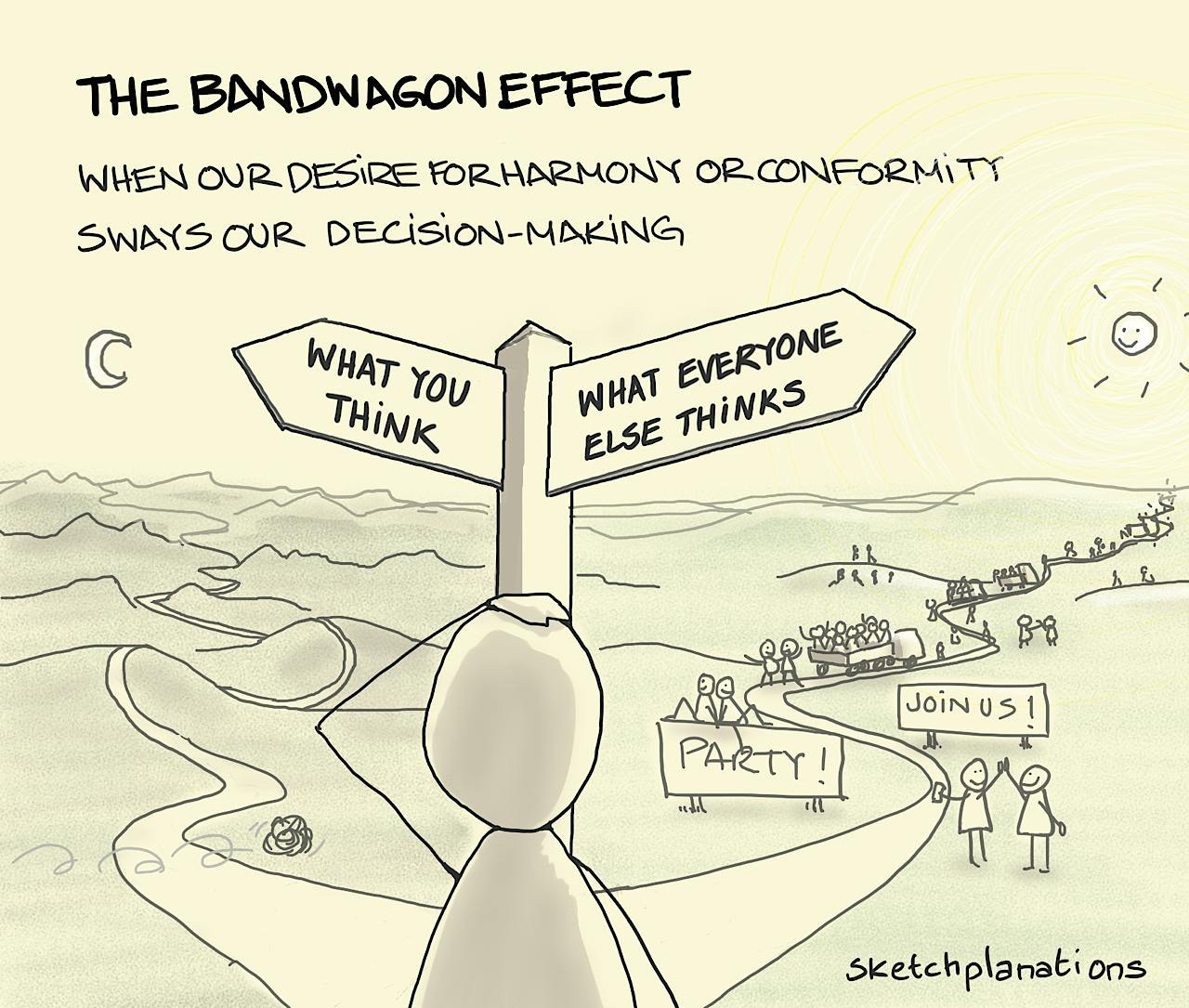

#6 Bandwagon effect

This bias refers to the tendency to find comfort in believing what the majority believes, regardless of whether it is right or wrong.

Investors influenced by this bias often forego independent analysis and judgment, avoiding unconventional paths even if they might be more profitable.

This herd mentality can contribute to speculative bubbles. To overcome this bias, investors should conduct thorough research, leading to more informed decisions and potentially greater profitability.

Example: “I will invest heavily in the Mag-7s because all my portfolio manager peers do that, and I don’t want to risk being wrong”

Conclusion

To become a great investor, you need to study the different cognitive biases that make most investors poor at this game. If you are unaware of these biases, you will be a slave to them. If you are aware, and create systems and investing processes to counter them, you have a higher probability of being successful in investing.

The art of becoming a more effective thinker will not only make you a better investor, but it is translatable to other parts of your life. Your 9-5, personal finances, and networking will all benefit from this skill.

A great place to start is to listen to Charlie Munger’s “Psychology of Human Misjudgement” and internalize the lessons from that talk.

If you liked this article, please leave a like and a comment telling me what you enjoyed.

All the best,

Invest In Assets

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 300 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +10.000 stock market investors (45% open rate) — Contact us via: investinassets20@gmail.com

Marius, thank you for yet another insightful post!

It's crucial for everyone, whether an investor or not, to recognize the presence of cognitive biases. More importantly, we must have the honesty to acknowledge when these biases influence our decisions. However, our egos and pride often lead us to ignore the facts, allowing us to continue on our paths unchanged. Perhaps this is why the saying goes, 'History may not repeat itself, but it often rhymes.'

I appreciate the link to Charlie's speech—undoubtedly, he was one of the brightest minds of our time. Lastly, with your example about BTC, you might have kicked the hornet's nest! Lol

I look forward to speaking with you tomorrow.

Thanks for the article, very helpful.