13 Lessons from Peter Lynch💎

<5 min read 🧠

Hi there! 👋

Today you are getting 13 lessons from the legendary investor, Peter Lynch.

In case you missed our latest articles:

All public writing from Peter Lynch in one handy PDF for you 🧠

Peter Lynch has one of the most impressive track records in fund manager history.

He achieved an annual compounded growth rate of 29.2% for 13 years.

$1.000 invested with Peter Lynch would have turned into $28.140.

$1.000 invested in the S&P 500 would have turned into $6.600.

13 Lessons from Peter Lynch that will make you a better investor:

Lesson #1: You want to understand a company's DNA and why you hold a specific stock. Buying a stock because the price has gone up 100% is a bad idea. Buying based on a deep understanding of the business is much smarter.

Read our Nick Sleep articles on the “deep realities of compounders” to learn more:

Lesson #2: A solid balance sheet is always essential. A business with low/no debt and a lot of cash on its balance sheet will not go bankrupt. Some companies fuel their growth using debt but are unable to grow without it. This is where retail investors lose a lot of money.

Lesson #3: Invest in boring companies—keywords: low analyst coverage, mundane, currently unpopular. Dull companies with no hype are likely to yield better investing opportunities than anything you will find in financial news.

Read “6 Boring Quality Companies”

Lesson #4: Professional investors are a herd because they are formed and restricted by their funds' policies and their fears of keeping their jobs. Retail investors can gain an edge by ignoring this herd and doing independent research based on one’s unique knowledge

Lesson #5: Never invest in a stock based on a tip. No matter how smart the person that gave you this tip is, do your own work. You have no idea if this person has a small or big position. And you don't know if he is hedged or doing some other advanced play.

Lesson #6: Think about products and services you love or can't live without Now, research the companies. But keep in mind, if the product you love only represents a small % of the total sales, the product won't be enough for it to be a good investment.

Lesson #7: Retail investors should not have more than 10-12 stocks at any given time This is because "Owning stocks is like having children - don't get involved with more than you can handle". As a part-time investor, keeping up with more than 10-12 companies can be a challenge.

Lesson #8: If a business decides to enter into a "new strategic direction", be cautious This could be a new business segment or an acquisition. Companies often end up worse off after this, what Lynch refers to as "diworsefication".

Lesson #9: Lynch encourages investors to use the edge they have over institutional investors We all have 9-5s, hobbies, interests, and other domains where we know more than 95% of the population. Leverage this knowledge into investment ideas.

Lesson #10: Never invest the same day/week of discovering a new stock. You are likely to be affected by FOMO and greed. Instead, let it digest for at least 2 weeks, and see how you feel about the investment then. This will provide you with a much clearer mind when deciding.

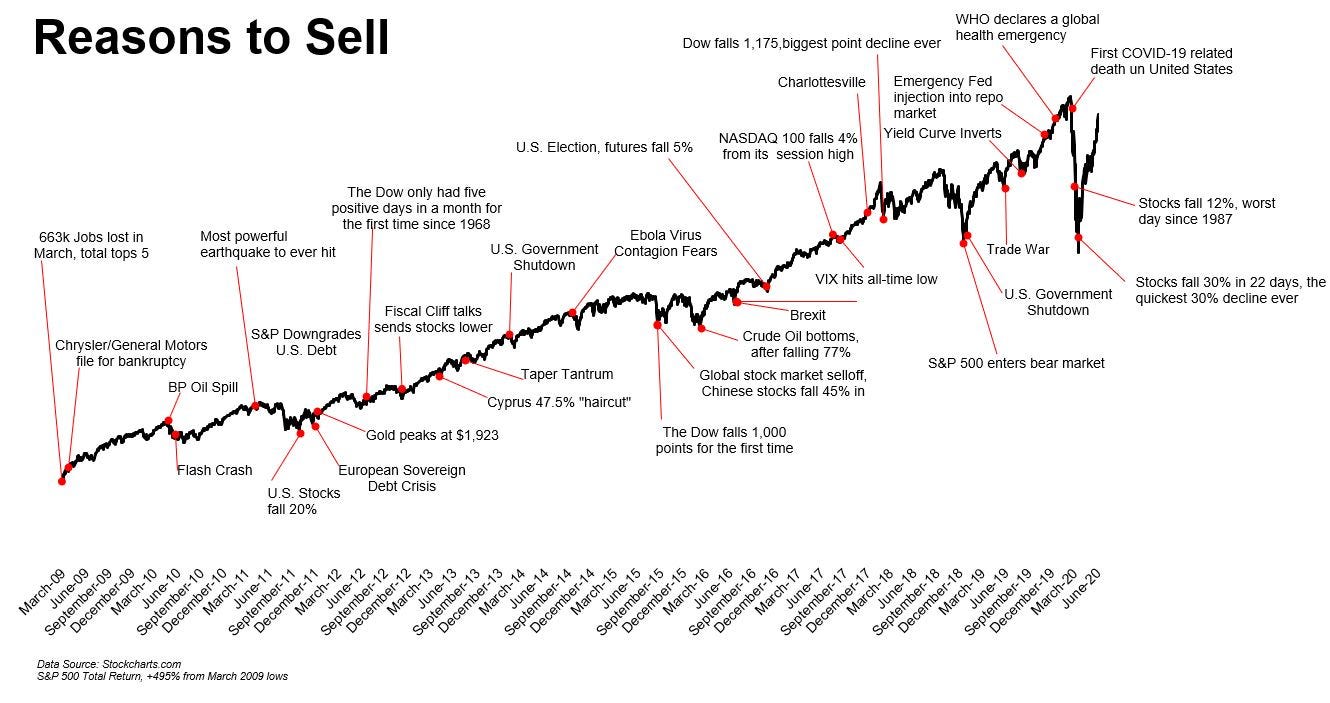

Lesson #11: For retail investors, stock market declines are opportunities This is an essential mind-shift change. Stocks declining means that you will get a better future return on the stocks you want to buy at bargain prices.

Lesson #12: Never invest in companies without understanding their finances. Know how the business makes money Know which products drive growth and earnings. Know how much cash the business is generating Know how much debt they have and need.

Download our free mini-course on how to analyze the financial statements:

Lesson #13: Peter Lynch famously did not waste any time studying macroeconomics. He had a bottom-up approach focused on business performance. He believed that the time investors used trying to predict the interest rate was a complete waste.

That’s it for today, leave a like and a comment if you liked it!

Read more valuable articles at www.investinassets.net

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +8.000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

🏈 Touchdown!

A recent example is enough, last Friday (6/21) an unusual amount of PUTS in SPX/SPXW and not exactly for collecting premiums

OI: 16,563,572