Nick Sleep: The Deep Realities Behind Compounders 👑

6 min read 🧠

Nick Sleep beat the market by a mile for 13 years

His fund returned 921% vs. 117% for the MSCI world index, which is almost a 8X better result than the index. Sleep compounded shareholders' capital by 20.8% annually (18.4% net of fees) while running Nomad Capital. This is a spectacular result. Let’s dive into what we can learn from Nick Sleep’s investing approach.

Nick Sleep’s strategy and leading principles

Compounders that turned into multi-baggers

Nick Sleep is known for having an immense eye for detail and quality and going deep into the information with the longest shelf life. He wanted to understand the DNA of the business, the “deep realities” that made one business successful. By going a mile deep into understanding the businesses, he achieved an edge over other managers who would go a mile wide and only an inch deep. He got to know these compounders at their deepest levels; the culture, the unit economics, the business model, the deep-seated competitive advantage and so much more.

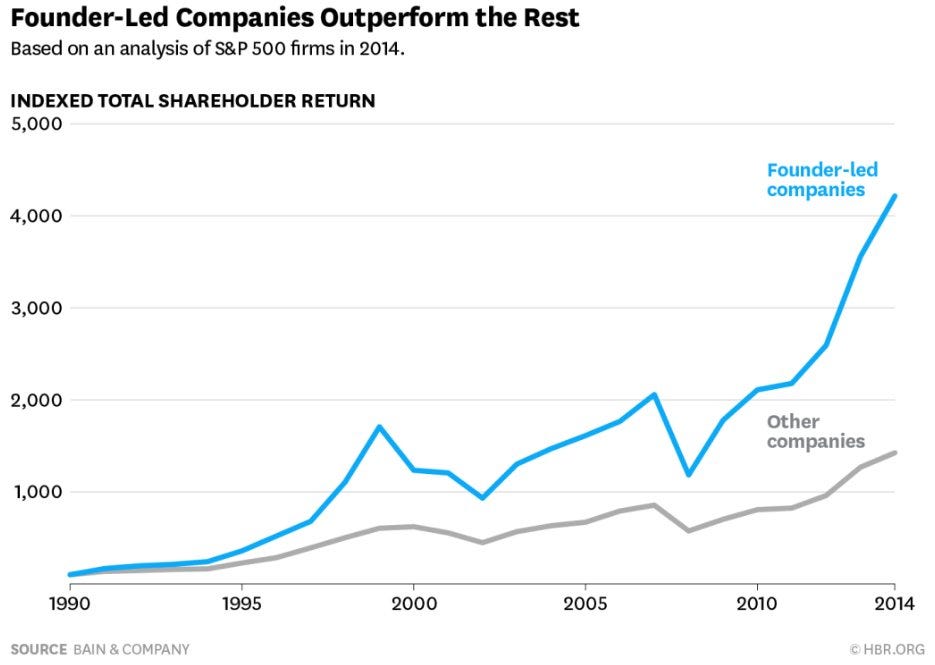

Founders & Managers

Nick Sleep understood the importance of incentive alignment. Therefore, he paid close attention to founder-les businesses, and managers with significant ownership stakes. He realized that the best entrepreneurs did not care about their salary. So-called “hired guns” often care more about their interest, than that of the shareholder. This can be dangerous as it means that the manager might make acquisitions or other capital allocation moves that dilute the shareholders and ruin the business’ quality.

As an example, Buffett, Bezos, and Mark Leonard have all waivered their salaries at some point. Just the type of managers Sleep was looking for.

Destination Analysis

Sleep did not focus on the next few quarters, he often discounted quarterly reports. He wanted to know where the business was going in 10-20 years. He wanted to know the destination so that he could make an educated guess about the potential returns he would receive from jumping on board.

To help him get this information when he talked to management, he used the 3 following questions:

Where will the business be in 10-20 years?

What must management do now to reach that destination?

What circumstances could prevent the business from reaching its destination?

Sleep would know quickly if a management team had thought of these questions beforehand. It would indicate a long-term mindset, and a management team that Sleep was looking to invest with if these questions were answered thoughtfully.

Long-term oriented

Sleep understood compounding, and that the interruption of compounding was the biggest threat to his returns. Therefore, he wanted to keep the compounding effect rolling and stuck to his winners. After determining the business’ destination and that the management team was competent and had a clear and realistic plan to reach the destination, Nick Sleep let the business run.

He is notorious for ignoring short-term noise. News and quarterly earnings will not make Sleep change his mind on a specific business. The elements he looks for and analyzes unfold themselves on a much longer time scale than 3 months.

Financial news sources are incentivized to make you click their articles, as this provides them with more ad revenue. Therefore, they are likely to sensationalize small and insignificant events, even if the effect on the business is almost 0. Sleep would avoid this kind of news like the plague.

Scale Economics Shared

This is a concept that Sleep came up with to explain some of the best business models in the world. Take Costco as an example, they offer products for the cheapest price in the market. They can do this because they buy at scale from suppliers. When they buy at scale, they can negotiate better prices from suppliers – most companies will take this cost savings and add it to their profit margin, but Costco transfers this cost saving directly to their customers. Costco’s business model is to only take ~14% margin on the products they sell, and if they get better prices, they share it with their customers. This has proven to create a deep-seated loyalty in Costco customers, and it creates a natural moat around Costco.

Sleep recognized that companies that had a business model that was centered around the customer, where the customer got the better deal from a structural part of the business (its scale), were superior businesses.

Sleep released a write-up on Costco in 2005, that is pure brilliance, a highly recommended read: https://aksjefokus.no/wp-content/uploads/2020/08/Nick-Sleep-Costco.pdf

Price Giveback

Another strategy that Sleep looked for in the businesses he invested in was what he called “Price Giveback”. These businesses would give back 2%-10% of what the customers bought to the customer. Sleep thought that this was a powerful tactic that would build customers’ habits and loyalty, providing an incentive to come back again and again.

The strategy would give the customers positive associations with the brand, which in turn became a widening moat.

Today, it feels like almost every retail store has adopted this tactic (Guess it works). However, it can be argued that if everyone is doing the same thing, it is no longer a unique tactic that can provide an edge.

Lollapalooza moat

Companies that do one thing well and rely heavily on that one thing can pose a huge risk. What if that one thing starts to deteriorate? This is why Sleep preferred companies that did many things well. It is almost impossible to replicate the success of some companies – Both Ikea and Costco are great examples: A competitor must do 1 million small things just right or better to get an edge. From Costco’s $1 hot dogs to the strategic way Ikea stores are set up to make us feel good & buy more. https://medium.com/choice-hacking/the-gruen-effect-how-ikeas-store-design-makes-you-buy-more-27316f330385

Lollapalooza moat can be seen in several dimensions, for example, the culture of a company will play into this. The distribution network, their hiring processes, how they keep talent on board, how they give compensation, how they create alignment in the organization, how they make sure strategic initiatives are executed, and so on.

This type of moat requires deep insights into the business to determine, it is not enough to read the 10K and expect to get a deeper understanding of the “deeper realities” of a business.

Do nothing

Sleep was a fan of portfolio inactivity. He realized that humans are predisposed to “take action”, but action from a portfolio perspective often leads to sub-optimal returns. Humans need to feel productive, and like we are making progress towards a goal, but this is often counterproductive when it comes to long-term investing in “compounders”.

Sleep wanted to benefit from the compounding effect, and realized that by using an immense amount of time to analyze what kinds of companies he let into his portfolio, he could hold them for longer periods and therefore extract the big returns that come from holding fantastic companies over 10+ years. He held Berkshire Hathaway, Costco Wholesale, and Amazon.com for a long time which represents a lot of the results for his fund.

Don’t pick the flowers and water the weeds.

Volatility is inevitable for investors. It can be physically painful to watch your portfolio and certain positions go down by more than 50%, but if you want to invest in individual stocks over a long time frame, it will happen at some point.

One of the drivers of Sleep’s success is that he managed to identify truly fantastic businesses and hold on to them. He owned Costco for 18 years, through ups and downs, and he held onto Amazon and Berkshire Hathaway for more than 10 years. Just these 3 investments provided one hell of a result. Imagine if he had sold Amazon early due to a temporary high valuation without the foresight to see what Amazon could become down the line.

The 3 stock portfolio

At the end of nomad capital’s existence, the portfolio had concentrated into 3 main positions as mentioned:

Amazon.com

Berkshire Hathaway

Costco Wholesale

What can we learn from Nick Sleep?

Sleep built his strategy on the same ideas as Buffett & Munger:

Find strong businesses with enduring moats

Buy these businesses at fair prices

Hold & verify to get the compounding effect

Sleep taught us 3 key concepts to look for:

Scale economies shared

Price giveback

Lollapalooza moats

Whenever you are ready, this is how I can help you:

Essentials of Quality Growth — Join more than 200 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

Promote yourself to +5,000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

He also bet on Asos?

My favorite investor. I think he still holds Amazon and Costco. Thanks for the write-up!