Hi investor! 👋

Today we will learn the importance of revenue growth and diversified revenue streams for a business.

This is part of an upcoming digital course on quality growth investing, where we will disclose our full investing system — sound interesting?

Sign up for the waiting list:

How to analyze the revenue stream & growth of a business

The ideal business meets the following criteria:

The importance of revenue growth

Morgan Stanley’s research concluded that sales growth amounted to 74% of the shareholder return after 10 years. Profits only amounted to 15%, multiple expansion for 5% (increasing price to earnings ratio), and 6% for free cash flow.

The conclusion to draw from this study is that revenue growth is the most important factor to consider for long-term investors.

After 1 year, the multiple expansion is what matters the most. However, in the other periods, namely 3 years, 5 years, and 10 years, revenue growth is the most significant contributor.

We are doing some market research for a new product we’re creating.

I’m looking to talk to investors who want to learn how to build a winning portfolio of quality stocks.

If this is you, email me at investinassets20@gmail.com, and I’ll follow up with you to schedule a 15-minute session. Looking forward to it!

Organic growth is the preferred growth

Organic growth comes from the business selling more of its products, increasing its product offering (by introducing new products), or increasing the price of the product or service it sells. This type of growth is by far the preferred growth method as it signals high demand for the product. Ideally, we want to demand that rides a secular trend wave (Like urbanization or an aging population) to support growth for the next decade.

Companies can also grow from inorganic sources, this is primarily from acquisitions. Various studies show that between 70 - 90% of acquisitions end up destroying shareholder value. This means that only a very fine selection of businesses can pull off this strategy to benefit shareholders and not the executive team (Think Constellation Software, Lifco AB, and LVMH).

Lululemon is an example of a business that has produced high organic growth rates for more than a decade. They sell directly to the consumer, showcasing their brand strength. Despite the recent fall in Lulu, the business has still been a fantastic performer since its inception.

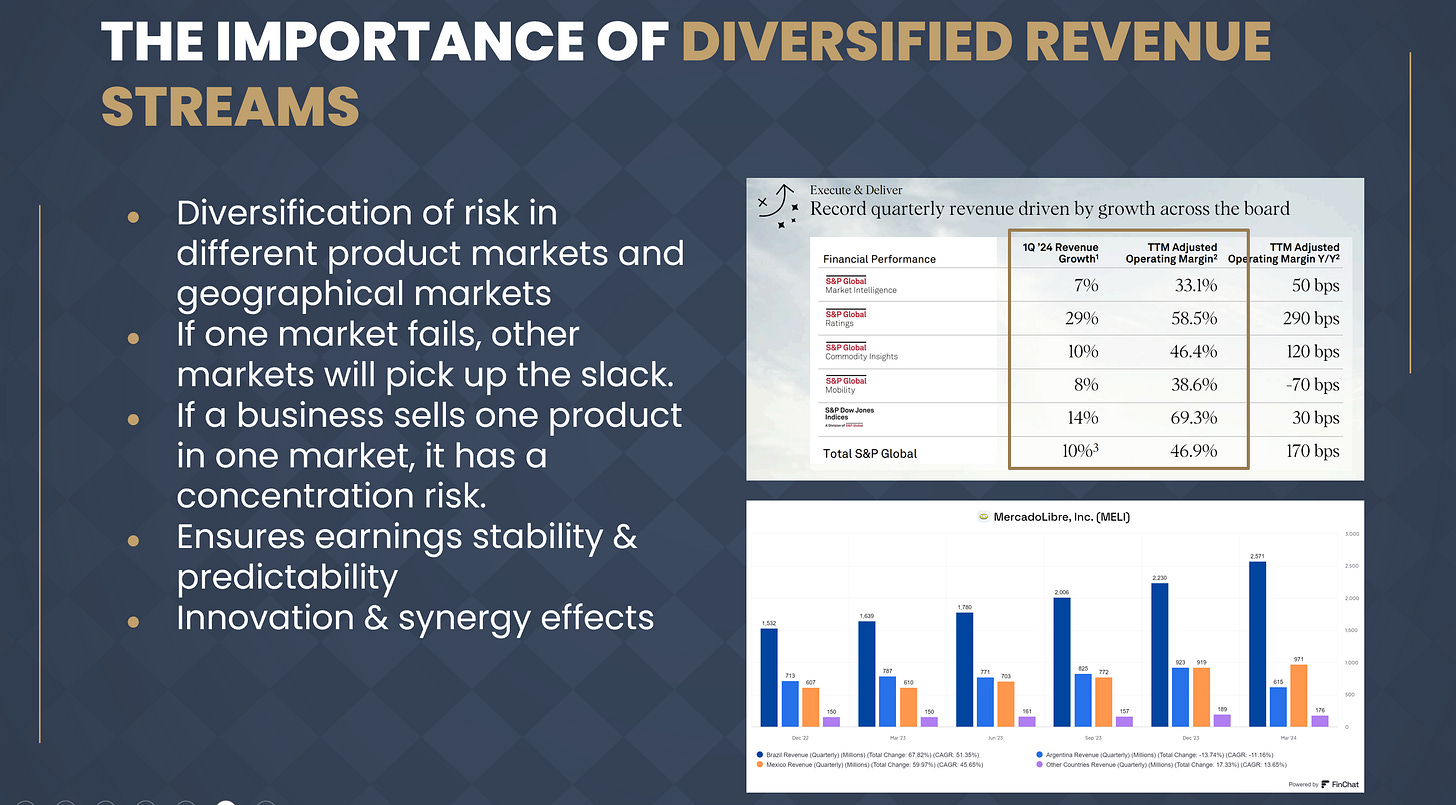

The importance of diversified revenue streams

We want to invest in companies that have a diversified revenue stream. This has multiple levels:

Diversified customer groups - We don’t want to invest in a business with a single point of failure, where 50% of revenue is tied up to one client.

Diversified business segments - Businesses with multiple strong segments will reduce risk significantly because if one segment is going through a tough period, the others can sustain revenue growth.

Diversified by product - Within each business segment, the company can offer multiple products. Think about the products within Apple’s “Service” segment: Apple TV, Apple Music, Books, and Podcasts.

Diversified by geographies - When one market is showing weakness, others will pick up the slack. Relying on one geographic market can be a large risk. Just look at what happened with Mercadolibre in Argentina last quarter!

Business segments

Amazon is a prime example of the potential of multiple business segments.

Starting, there was only the “Online Store” segment. Bezos spent more than a decade to build this asset up.

As the years went on, segments like AWS (Amazon Web Services), Advertising, and 3rd Party sellers have become massive businesses in and of themselves.

Some investors have gone as far as to say that Amazon’s entire market capitalization is justified by just the AWS segment alone (I don’t agree with this but it sounds good).

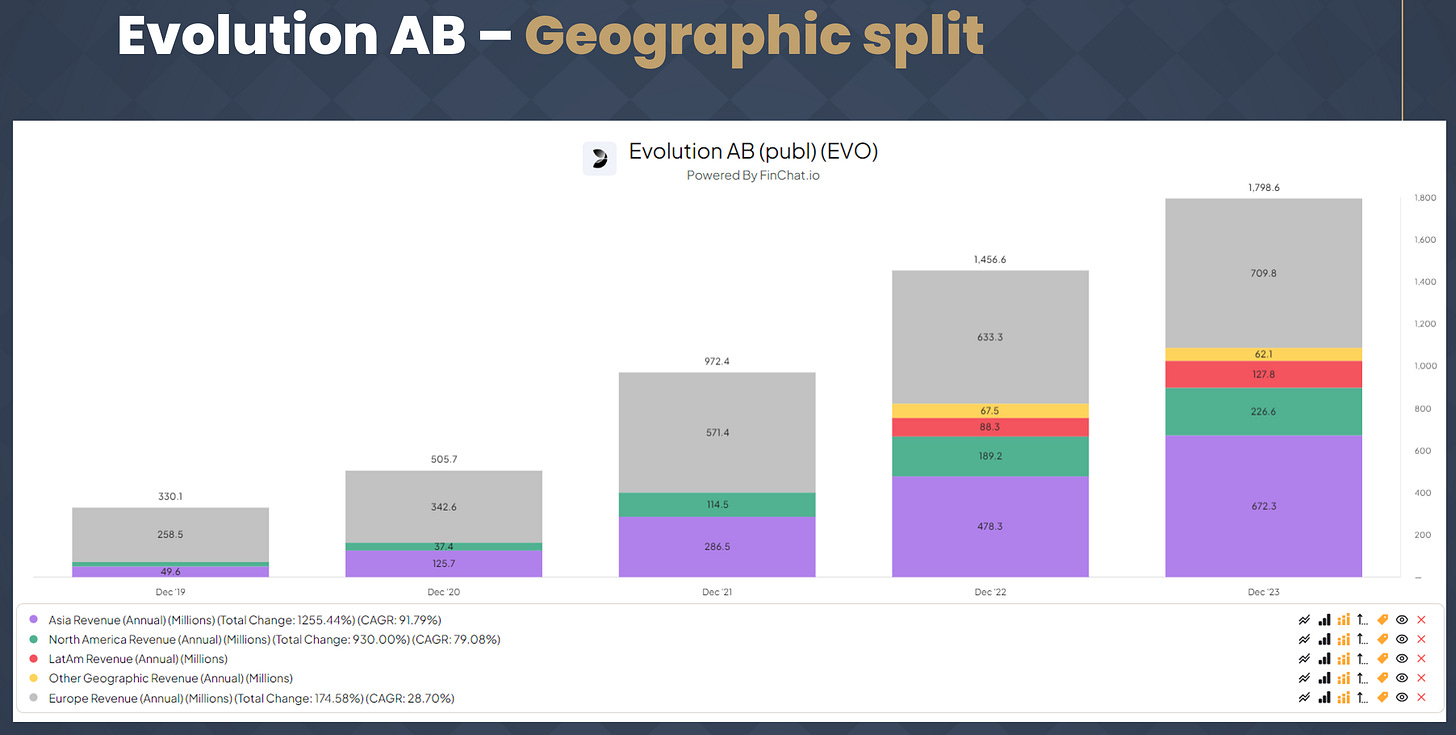

Geographic Revenue Split

Evolution AB (A well-known online casino operator from Sweden) had a significant portion of its revenue coming from Europe in 2019.

As the years went on, Asia kept growing, North America kept growing, and LatAm kept growing. In 2023 the business has a geographically diversified business with multiple growing markets (Primarily Asia, NA, and LatAm)

Recurring Revenue

Getting repeat purchases is much easier than one-off selling. Great businesses utilize a recurring revenue model. These models come in many sizes and forms. You might think of software as a service (SaaS), but strong consumer brands also utilize a recurring revenue model (The consumer must purchase their product every week or month on an ongoing basis).

Otis’ Recurring Service Revenue

Otis collects a significant portion of its revenue from recurring service revenue streams. Clients of Otis have to maintain & repair their elevators regularly. This creates predictable and recurring revenue for Otis - a great model.

This is part of an upcoming digital course on quality growth investing, where we will disclose our full investing system — sounds interesting?

Sign up for the waiting list:

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +9.000 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

Nice article. I’d be curious to read the original Morgan Stanley research you mentioned. Do you have a link to it?

Revenue growth is probably the #1 determinant of investment success over an extended period of time (ex- special sit.). Thanks for sharing!