When to Sell a Quality Stock 💎

The hardest question in investing

When To Sell

Reflections on lessons from Peter Lynch

Having a framework of when to buy, hold, and sell a stock is key to long-term investing success.

The largest stock market losses comes from being too stubborn about deteriorating stocks.

One of the clearest frameworks on selling comes from Peter Lynch. His key insight is simple and powerful:

You don’t sell because the stock went up. You sell because the reason you bought it no longer holds.

-Peter Lynch

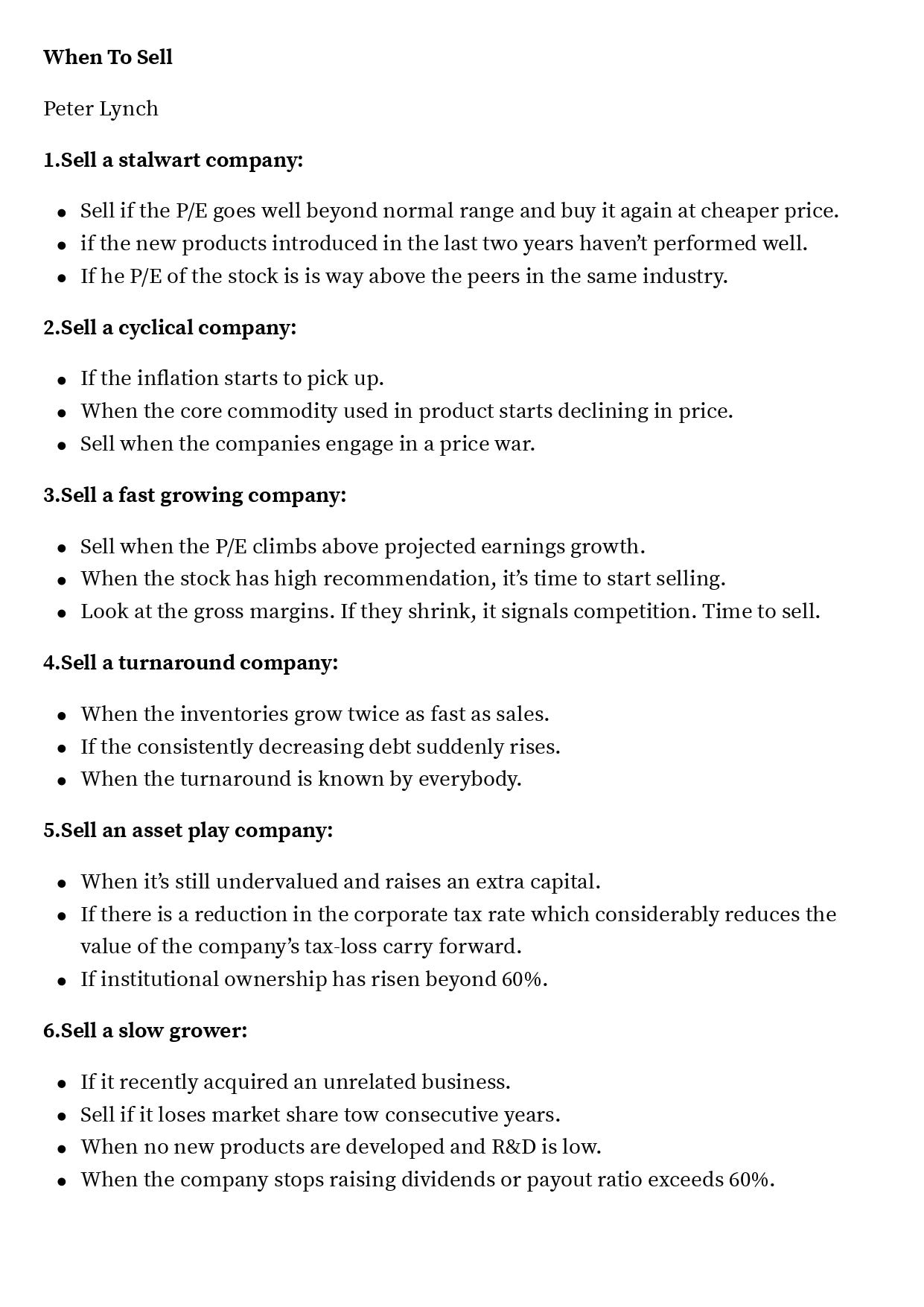

Here is the short version of Peter Lynch’s framework:

Generally, I’d like to own a business for the long-term, but realistically, it’s often better to sell stocks at some point. To have better framework for selling its important to think through when its time to sell different types of stocks.

I’ve adapted the lessons from Peter Lynch’s framework of when to sell to a Quality Growth-based perspective. Let’s get into it 👇

1️⃣ When to sell a Stalwart (steady compounders)

Stalwarts are large, established businesses growing earnings at ~8–12% annually.

Examples:

Procter & Gamble

Coca-Cola

Nestlé

Unilever

Johnson & Johnson

Sell signals:

Valuation disconnect

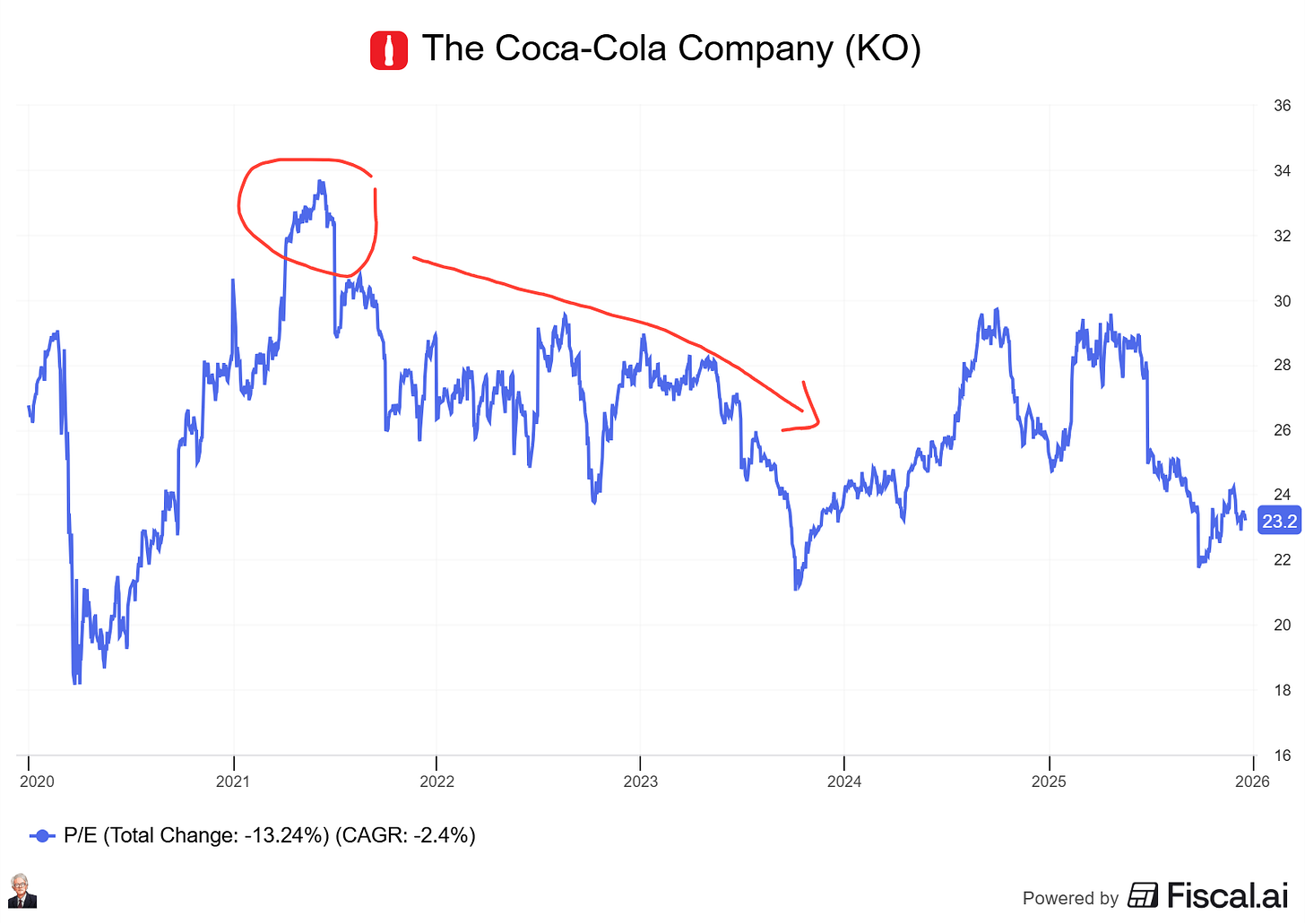

It happens all the time that a stalwart trades well above its historical average, without any change to the business quality. Typically, the PE gets to a top level before decending down to the historical average.

Coca Cola was trading near 34x earnings in 2021, before reaching a bottom level of 21x earnings in 2024. If you’d bought, or held through this period, you’d hold for a 38% reduction in PE - it takes a lot of growth in earnings per share to sustain the stock price when the multiple compress like that. Coca Cola stayed flat through this 3 year period.

Product portfolio stagnation

New products or services that have been launched over the past 1-2 years have failed to gain traction and move revenue or profits in a meaningful way.

This might be an early indication that the business is losing its touch and that earnings and revenues will stagnate along with innovation.

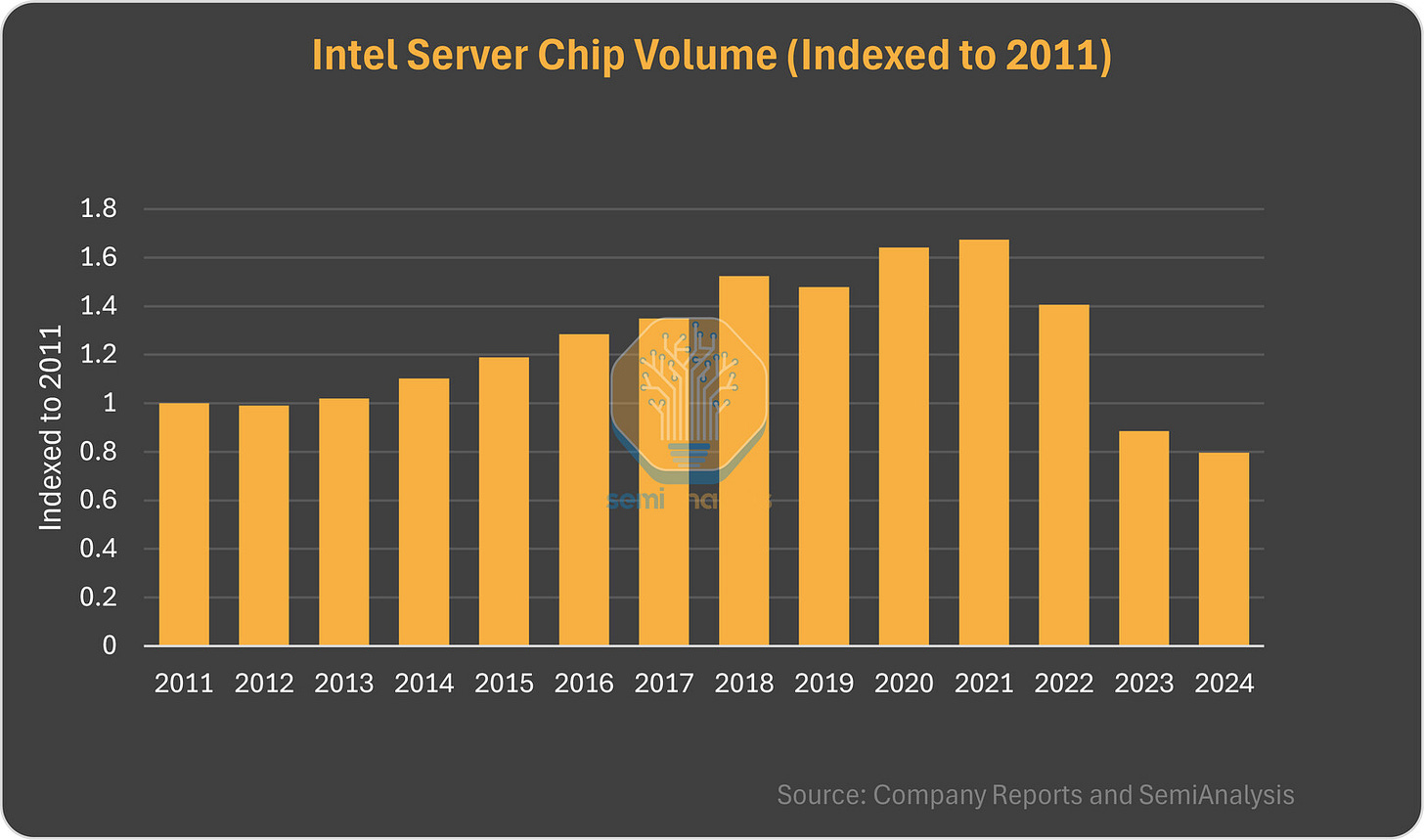

Intel is a prime example of a business that didn’t keep up with product innovation, and paid the price:

Relative Overvaluation

If a stalwart trades well above its peers with similar growth and margins, it could be time to sell the stock. This happens from time to time, where a business gets overhyped due to some narrative, for example AI optionality, or moving into crypto. These initiatives tend to get overvalued by the market, giving the stock a premium valuation compared to its peers - but for savy investors, this is the time to take profits and not double down. The main reason for this is because the risk is elevated due to higher valuation, and there is also usually significant execution risk for the initiative that has gained traction by the market.

Same valuation with worsening fundamentals

If we start to see a Stalwart slow down on growt, lets say from 10% to 5% without a re-rating of the PE, it should be something to consider. Stalwarts can often keep their premiums (e.g. 35x earnings) for many quarters, even when the fundamentals are worsening. This can be:

Margin compression (Gross margins and operating margins)

Lower Returns on capital

Slowing top-line growth

Increased costs without being able to transfer pricing to its customers

Piling up debt on the balance sheet (increases risk)

Higher capital expenditure demands reduce free cash flows and reinvestment opportunities

Slowing dividend growth or even cuts in dividends

These are all signals to watch quarterly for Stalwarts, if the PE or PFCF stays the same even with worsening fundamentals, it’s usually a sign to exit the position, as the stock price is likely to fall or stagnate in the coming period.

2️⃣ When to sell a Fast Grower

Fast growers can create immense wealth in a short period of time, but only as long as they can keep the growth premium and durable.

Examples:

Nvidia

Mercado Libre

ASML

Palantir

Shopify

Sell signals:

PE and PFCF goes astronomic

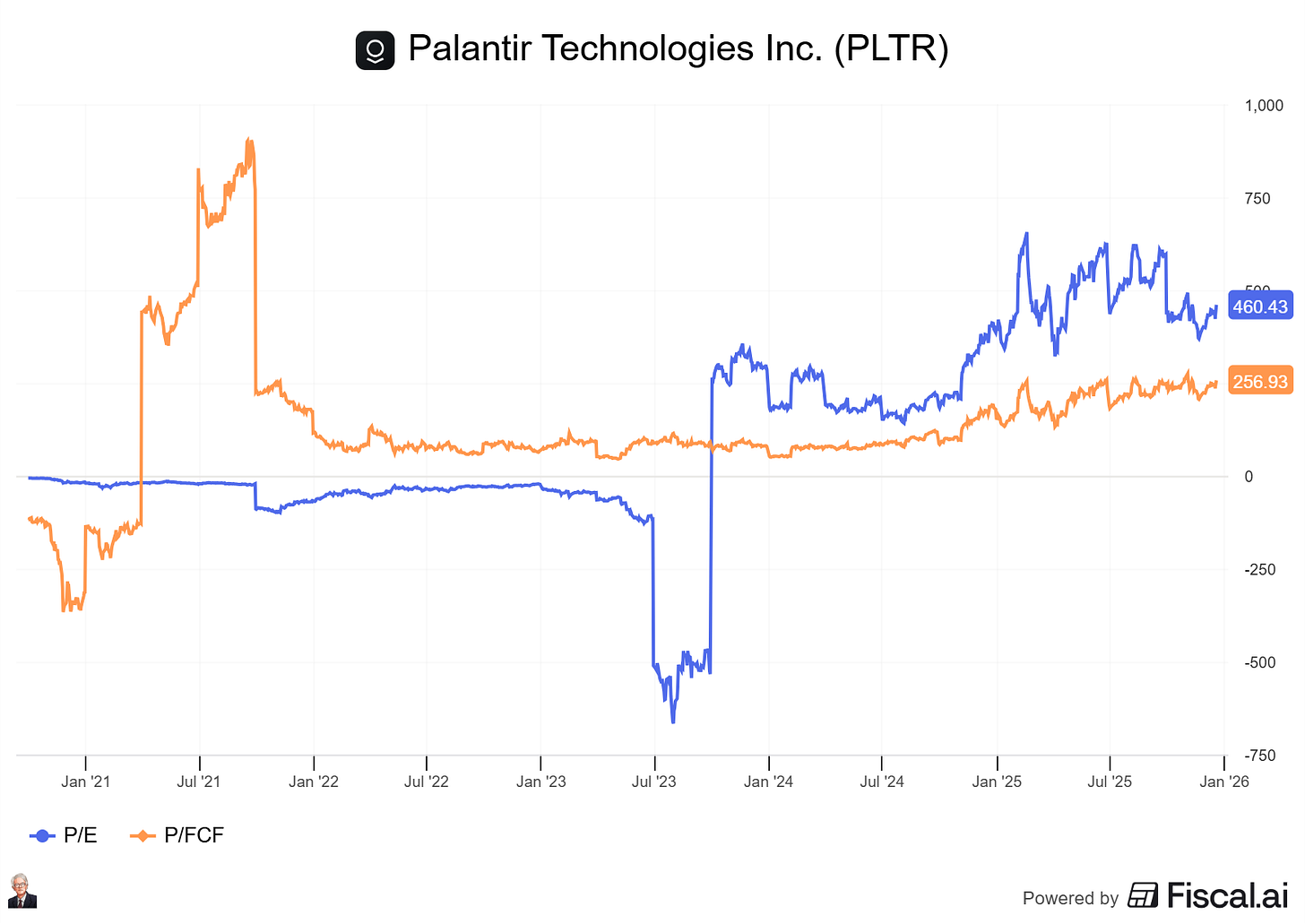

We see fast growing stocks (Often defined as stocks growing +20% annually) have astronomic multiples in the 50-150x range (Even 460x PE multiples if you look at Palantir).

The problem is not a high PE, for example, a fast growing business can justify a 30-50x earnings multiple if the expectation is that it will grow +30% per year. The problem is when the disconnect becomes too large.

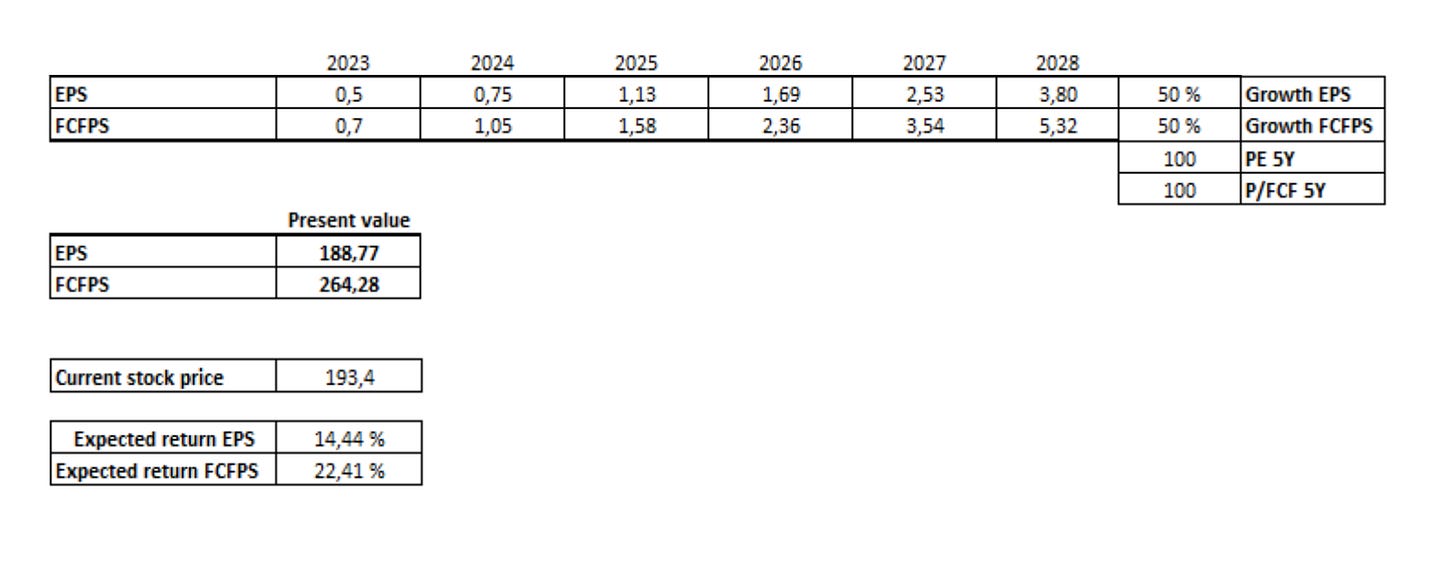

Palantir is expected to grow revenues and earnings at ~48% annually for the two next years. The PE is 460x. In other words, the 48% growth is not enough to justify the valuation.

Even if Palantir keeps growing at 50% (EPS and FCFPS) in the next 5 years, and is valued at 100 times earnings and free cash flow in 5 years, your returns in that period is expected to be 14-22% total (2.66% to 4.06% CAGR).

Now, making assumptions like that is also high risk. There is a lot of things that can go wrong for Palantir that will hinder it from growing this fast.

Lesson: When a fast growers valuation becomes too disconnected from the growth expectations, its time to sell. There is a reason why Peter Lynch liked businesses with a PEG (Price to earnings / Growth) to be below 1.

Shrinking Gross Margins & Returns on capital

Shrinking gross margins or ROIC is a sign of increased competition or loss of pricing power. In most cases this is a negative sign for a fast grower. If gross margins keep declining over 2-3 quarters and competitors are taking market share, its only a matter of time before the growth slows down. And for a fast-grower, slowing growth can reduce the stock price by ~50% in a very short amount of time. This is because we often get a re-rating. Let’s use Palantir as an example. If we see growth stagnate in the coming 1-2 years, Palantir might go from 460x earnings, to 200x earnings - is it cheap now? No, so it could easily drop way lower than this as well.

Lesson: Keep an eye on Gross margins and ROIC, sell a fast grower if these drop signficantly without good reason.

Expanding growth without expanding moat

Growth is fantastic and the single most important factor for long-term shareholder returns. But if the business is outscaling its moat, the growth will not be sustainable. Competitors will enter the market and limited growth and create pricing competition. More pressure on prices means lower margins. Lower margins means less reinvestments into new products, marketing and innovation.

Lesson: We want to buy fast-growers with expanding moats

Zoom is an example of a business that scaled and grew rapidly in the covid era, but didn’t have the moat to sustain growth and keep growing:

3️⃣ When to sell a Turnaround

Turnarounds are usually going from poor business performance to better, or even great business performance. We might beleive that a company is unfairly valued by the market, and invest in it, expecting things to turn around for the better.

Examples:

Meta Platforms (After its Reality Labs fail)

Netflix (When subscribers stagnated)

Novo Nordisk (US fail)

Lululemon (Growth stagnation)

Disney (Growth stagnation)

Sell signals:

Thesis breakdown

When we buy quality businesses as a turnaround play, it is often because we:

Believe that the market is wrong, and that the business doesn’t need a turnaround (It’s just narrative driven)

Believe that the business quality has become lower, but that the management team will manage to turn the business around.

Meta Platforms started falling signifcantly in 2022, and reached a low of $90 per share (Now $658). The fall was somewhat justified, because Meta was pouring billions into Reality labs and the metaverse, a side quest with no clear business model. In addition, the company showed poor capital allocation skills by making record level buy backs at all time high stock prices. This led to a -74% decline in stock price by 2022 (Trading around 8 times earnings)

Now, if we’d expect 1) the business doesnt need a turnaround, despite poor decisions from management, the underlying business is too valuable to be trading at sub 10x earnings, we would’ve been right (In hindsight).

This is the best kind of turnaround play for quality investors, because it doesn’t really require the business to make fundamental changes to rebound.

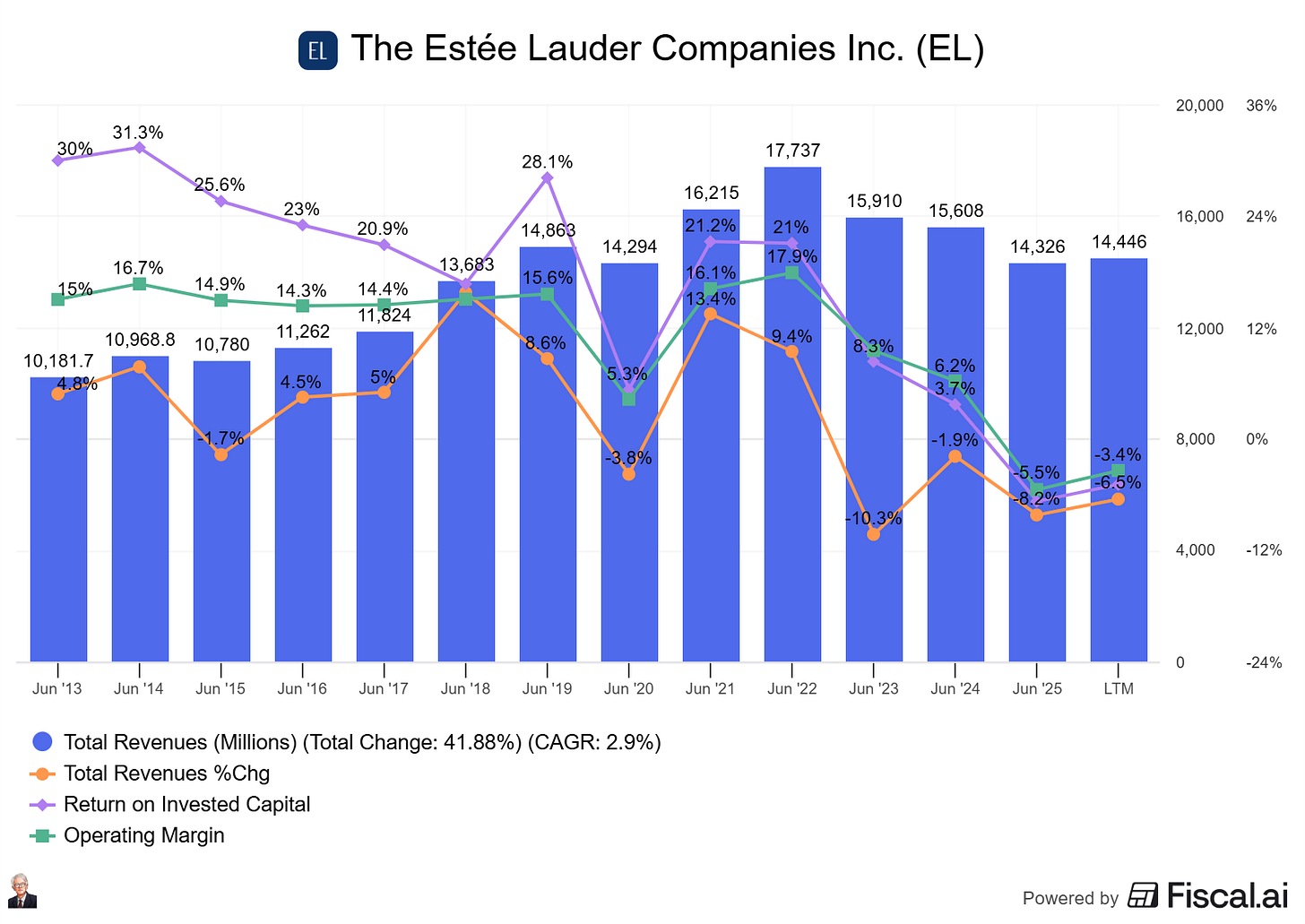

On the other hand, 2) is more demanding. We’ve seen a business like Este Lauder (A former Quality darling) struggle for years. It now has 4 years straight of declining revenues, and even negative operating profits. These kinds of structural turnarounds require much more to go right to be successful. There is something wrong with the underlying business, the demand is not there, and now the business is struggling big time, this is what we want to avoid.

So, when do we sell Meta Platforms and Este Lauder in our scenarios?

When the story becomes consensus: Everyone knows that the turnaround has happened, Meta trades in line with its historical PE and fundamentals are improving. Typically, the stock price has increased a lot since the low point (Of course, if it truely is a great business, like Meta Platforms, you don’t have to sell it at all).

You were wrong, the business is stagnating: At some point (After 6-12 months) it will start to become obvious that you were mistaken, growth keeps stagnating, ROIC and gross margin is falling, and management decisions does not make sense (E.g., let’s say Zuckerberg kept doubling down on the Metaverse and neglected the core business). The management team is not executing effectively and there is no change in business fundamentals = sell.

The management team can say whatever they want, but if after 6-12 months we still don’t see any signs of business recovery, we should consider selling our position.

Example: Este Lauder’s deteriorating fundamentals since 2022:

4️⃣ When to sell a Slow Grower

Slow growers should compensate with capital returns and stability. They often deliver solid dividends and buybacks, providing a stable, bond-like return for investors (In theory).

Examples:

AT&T

Verizon

IBM

Kraft Heinz

British American Tobacco

Sell signals:

Unrelated Acquisitions

We often see Slow Growers make acquisitions that are not related to their core business. This does almost always fail. One example is when AT&T acquired Time Warner in 2018 for ~$85 billion dollars. It did not have a strategic fit (Telecom + Media), it provided AT&T with a massive debt problem, it made management disctracted (Now they had to focus on telecom and media, both incredibly complex industries), and it ultimately failed.

It’s time to sell a slow-grower when they start making “exciting acquisitions” to make up for stagnating growth.

In my opinion, it is far better for the business to double down and focus on how they can improve their core business, than to expand into new areas (But its not as sexy).

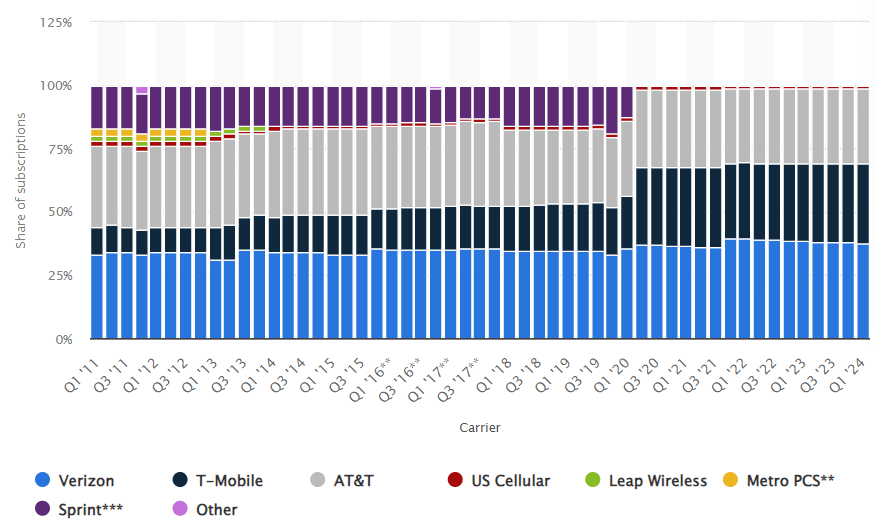

Market share decline

This is how a slow grower becomes a no-grower. If it happens in a quarter or two, it doesn’t mean as much, but when it starts to happen quarter over quarter for a year and more, it is a strong signal to sell the stock. At this point its heading towards no-growth and is losing market share to competitors. A business turnaround is often needed to get back on top, but this can take years (and a serious stock decline) before it happens.

A slow grower can keep growing by keeping the same market share, due to the growth of the market (Usually between 3-10% depending on the market).

Here is the marker share evolution in the telecom market in the US from 2011-2024:

No focus on R&D and product innovation

Nothing kills a slow-grower faster than zero innovation. Emerging business models with new products that are easier and cheaper slowly steal the slow grower’s lunch over time, and by being to slow to react, it can be devestating for the business.

This is the negative flywheel many slow growers get into:

No innovation → Loss of market share → price pressure → has to cut work force → less focus on innovation and more focus on cost cutting → slow and agonizing death

Lesson: Sell a slow-grower when its no longer willing to invest in innovation and its showing up as reduction in consumer preferences.

A short check list for selling quality stocks:

Before selling, ask:

Has quality deteriorated (Growth, Gross margins, ROIC)?

Has valuation outrun fundamentals (PE vs. growth)?

Has competitive advantage weakened (Losing market share)?

Has management capital allocation worsened (Exciting new acquisitions)?

If the answer is yes to one on this list, you should monitor it closely. But if we see two or more, it’s time to exit the position.

Final Thought

Great investors don’t sell because of volatility, they sell because the very reason they bought the business has broken.

The real risk isn’t selling too early.

It’s holding too long after the story has changed.

I’ve made countless mistakes holding stocks for too long, even when the fundamentals deteriorated. But by having a framework of when to sell stocks help me minimize the risk of holding onto a loser.

That’s it for today, let me know in the comments below what your rules are for when to sell a stock 👇

Ready to take the next step? Here’s how I can help you grow your investing journey:

Go Premium — Unlock exclusive content and follow our market-beating Quality Growth portfolio. Learn more here.

Essentials of Quality Growth — Join over 300 investors who have built winning portfolios with this step-by-step guide to identifying top-quality compounders. Get the guide.

Free Valuation Cheat Sheet — Discover a simple, reliable way to value businesses and set your margin of safety. Download now.

Free Guide: How to Identify a Compounder — Learn the key traits of companies worth holding for the long term. Access it here.

Free Guide: How to Analyze Financial Statements — Master reading balance sheets, income statements, and cash flows. Start learning.

Get Featured — Promote yourself to over 35,000 active stock market investors with a 35% open rate. Reach out: investinassets20@gmail.com

This framework is incredibly helpful - especially breaking down sell signals by stock type. The Meta example really drives home the difference between "the market is overreacting" versus "fundamentals are actually broken." That distinction alone is worth everything. The checklist at the end cuts through so much noise: has quality deteriorated, has valuation outrun fundamentals, has competitive advantage weakened, has management lost their way.

Question: When you're monitoring a position and see one yellow flag - like valuation getting stretched on a fast grower - how long do you typically give it before acting? Do you wait for a second signal to confirm, or is one enough? Curious how you balance being decisive versus giving a quality company the benefit of the doubt.

Good post mate