🏰 Topicus.com: Is the European Compounder Worth the Investment?

🧠 A niche-focused compounder for patient investors

Hello Investors! 👋

Topicus.com Inc. is not a household name, and it prefers it that way.

Spun off from Canadian tech legend Constellation Software in 2021, Topicus has been quietly building something remarkable in the Netherlands, Europe. It doesn’t chase unicorn valuations or Silicon Valley buzz. Instead, it buys small, deeply specialized software companies and lets them run.

These are the kinds of businesses that power:

School districts

Hospital systems

Municipal governments

Mortgage networks

And, often with software so embedded that switching becomes near impossible. Topicus is in the business of owning the infrastructure beneath the everyday.

If you’ve ever admired the capital discipline and decentralized brilliance of Constellation Software, Topicus might feel familiar. That’s not a coincidence! Topicus is CSI’s European cousin, using the same playbook of:

Recurring revenue

High switching costs

Relentless appetite for cash-generative acquisitions

And it's working. Topicus now operates across 26 European countries, serving 100,000 customers. They’re primarily concentrated in 40 sectors such as education, healthcare, and legal.

It’s also worth noting that it employs over 8,000 people.

But wait, it didn’t end there.

In an age where software companies burn cash for growth, Topicus does just the opposite. It earns profits, reinvests them, and keeps growing. Quietly, methodically, and please note, profitably!

Let’s break down how Topicus pulls it off, and whether it belongs in your watchlist.👇

The Topicus.com Business Model 💰

Topicus.com Inc. is a holding company for dozens of vertical market software (VMS) businesses spread across Europe. Rather than building from scratch, Topicus grows by acquiring small, niche software firms that serve specific industries. With education, healthcare, legal, financial, and government being the most common.

The business is split into three operating groups:

TSS Public: Software for municipalities, tax authorities, and public institutions

TSS Blue: Solutions for private verticals like real estate, legal, and financial services

Topicus Operating Group: The legacy Topicus B.V. platform focused on the Dutch health and education sectors

How they actually make money:

Recurring revenue: From licensing, support, maintenance, and SaaS subscriptions

One-time fees: From implementation and customization

Cross-selling: To existing customer bases after acquisitions

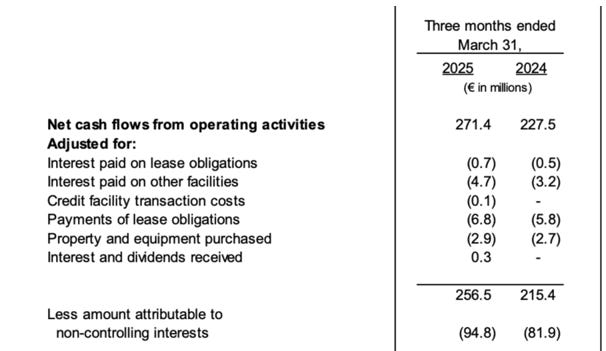

In fact, in Q1 2025, Topicus.com reported €355.6 million in revenue and €271.4 million in CFO. This was a 16% and 19% YoY increase from Q1 2024, respectively.

So, what makes Topicus.com unique? Well, it’s the structure…

Topicus is a clone of Constellation Software’s decentralized model. Each acquired business stays mostly autonomous. Thus, it retains its own leadership, decision-making power, and product roadmap.

There’s no bloated HQ or forced integration. Instead, Topicus adds value through capital, knowledge sharing, and long-term incentives.

The Main Growth Drivers 🚀

Topicus is not chasing explosive growth. Instead, it's compounding steadily through consistent execution. Its long-term playbook is built around three key growth drivers:

Acquisitions-focused:

The company keeps buying small, profitable & mission critical software firms across Europe. And in that particular category, there’s no shortage of enticing targets.

Regulatory complexity across Europe:

Every country has its own rules and software needs. That’s a nightmare for Big Tech! But heaven for Topicus, which thrives on localized solutions.

Locked-in customers:

The deeper the software goes into a client’s workflow, the harder it is to rip out. That means long-term contracts and consistent cash flow.

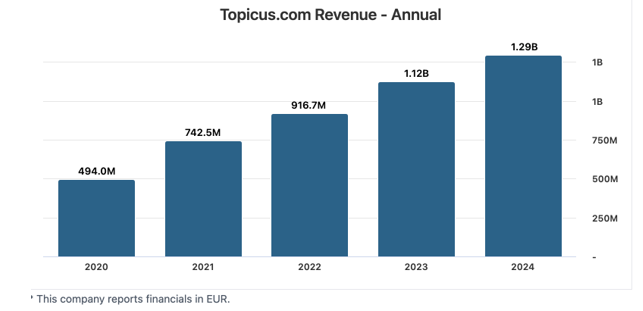

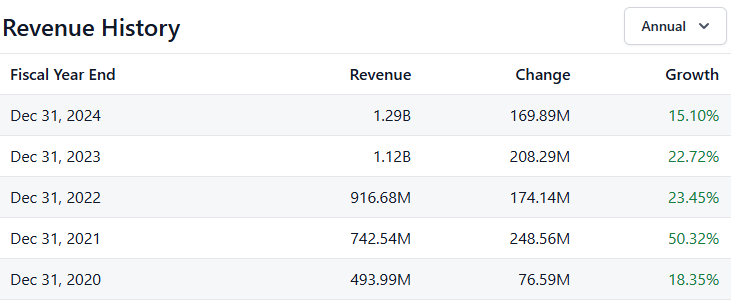

With these growth drivers behind it, from 2020 to 2024, Topicus nearly tripled its revenue. From around €494 million to nearly €1.3 billion. Not bad for a company that most investors haven’t even heard of.

In fact, the growth rate from 2023 to 2024 alone has been 15.10%. Whereas the 5-year price CAGR has been 24.18%.

Competitive Advantage 🏰

Topicus’s strength lies in its focus. It’s highly specific, vertical software that embeds itself deep inside essential workflows. This creates two powerful moats.

1. High Switching Costs

Public sector clients, from local governments to healthcare providers, rely on Topicus software for essential tasks. This includes:

Tax collection

Social benefits

Medical records, and more

These systems are mission-critical, often bound by multi-year service agreements and strict compliance requirements. And replacing them isn’t just expensive, it’s also risky. Retraining staff, migrating data, and passing audits make switching vendors a bureaucratic nightmare.

In 2024 alone, acquisitions amounted to a consideration worth €153.5 million.

2. Niche Market Scale

Rather than chasing massive tech markets, Topicus dominates dozens of narrow verticals, like:

Municipal tax systems

School administration

Notary registries, and more

Each acquisition brings localized knowledge and product fit.

For instance, a 2025 acquisition, Belgium’s Cipal Schaubroeck, brought in nearly €110 million in annual revenue and 590 employees. Thus, signifying integration into hundreds of long-term institutional contracts.

Topicus overlays shared metrics, compliance frameworks, and development platforms across its portfolio. As a result, enhancing margins and accelerating adoption deeper into each vertical.

Management 🏢

At the helm is Robin Van Poelje, founder of Total Specific Solutions (TSS) and a long-time executive. He led TSS from 2010 and became CEO and chair of Topicus.com, when the spin-off happened.

Whereas, the operational side is managed by Daan Dijkhuizen, Group CEO of Topicus Operating Group since 2017. Daan joined in 2013 from ING, bringing deep tech and financial expertise.

Here are some other noteworthy details:

Insider Ownership Status: Insiders own roughly 2.2% of Topicus shares.

Founder-led: Topicus is indeed founder-led. Robin built the business from scratch and still drives major strategy decisions.

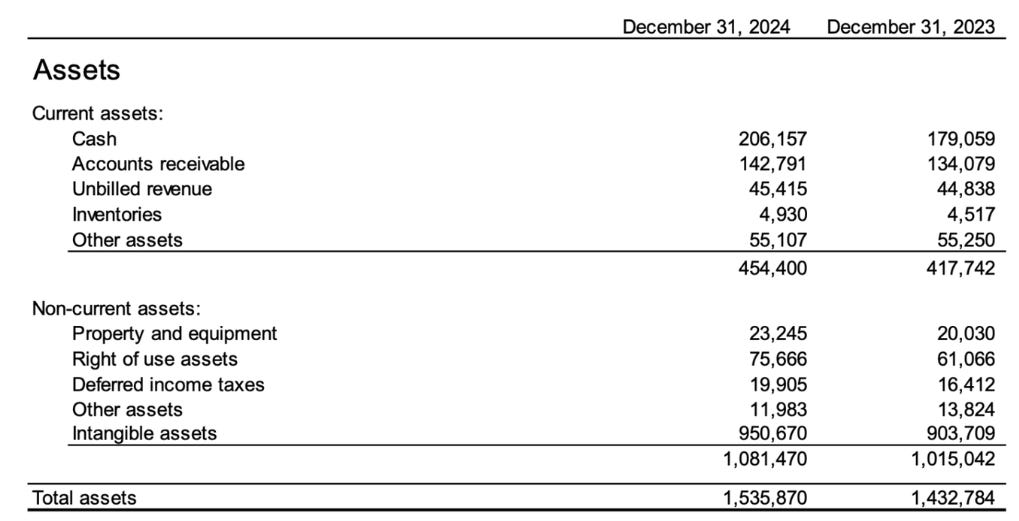

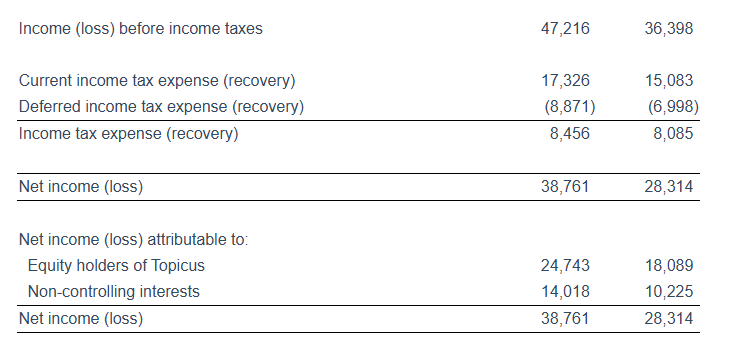

The Result: Net income for Q1 2025 rose to €38.8 million. That’s up from €28.3 million in Q1 2024, with a sharp increase in profitability.

Risk Factors ❌

Several risk factors affect Topicus.com. These aren’t deal-breakers. But they’re real, and they require discipline, which Topicus has undoubtedly shown so far.

Acquisition Pressure: The whole strategy is built on buying the right companies at the right price. If the deal flow dries up or if valuations get bloated, future growth could stall.

European Fragmentation: Yes, it’s an opportunity, but it’s also a headache. Navigating different tax regimes, data rules, and labor laws isn’t easy, even with local teams.

Currency Volatility: With operations across the Eurozone and beyond, FX swings and risks can hit hard.

Valuation

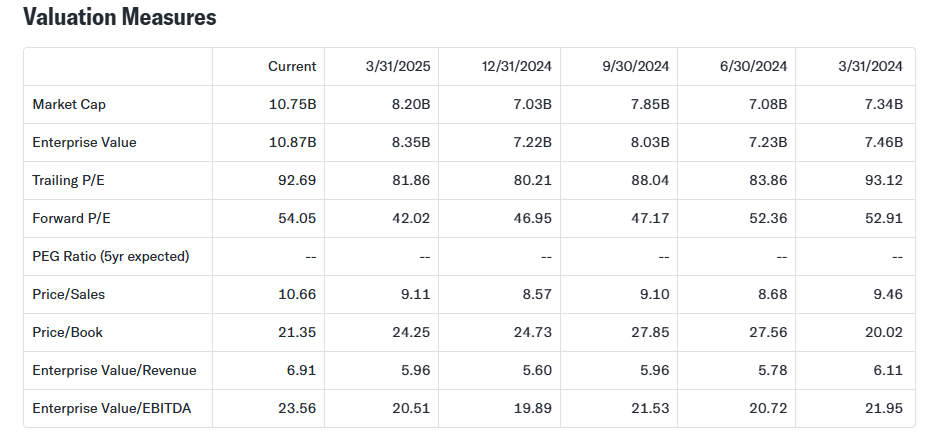

Topicus trades at a trailing P/E of 92.69x and a forward P/E of 54.05x, as of 15 July 2025. Moreover, its current stock price (TOITF) is USD129.

Its P/FCF stands at 38.72x, reflecting strong cash generation relative to price. This is about 15.53% more than the 5-year average.

Interpretation:

Topicus is expensive, but selectively so. The P/E suggests that the market is pricing in sustained 15%+ growth and reliable free-cash-flow conversion.

At the same time, its P/FCF is high but not extreme, reflecting solid cash returns. Hence, if Topicus continues to compound and maintain margins, this valuation may hold.

Conclusion

Topicus isn’t flashy, but it’s quietly building a European software empire. With sticky customers, steady cash flow, and disciplined acquisitions, it mirrors Constellation’s winning formula. The only difference is that it’s Euros this time.

While valuation looks rich, the fundamentals are sound. If execution stays sharp and deal flow continues, Topicus could keep compounding under the radar for years. For patient investors, it’s a story worth watching.

That’s it for today!

Ready to take the next step? Here’s how I can help you grow your investing journey:

Go Premium — Unlock exclusive content and follow our market-beating Quality Growth portfolio. Learn more here.

Essentials of Quality Growth — Join over 300 investors who have built winning portfolios with this step-by-step guide to identifying top-quality compounders. Get the guide.

Free Valuation Cheat Sheet — Discover a simple, reliable way to value businesses and set your margin of safety. Download now.

Free Guide: How to Identify a Compounder — Learn the key traits of companies worth holding for the long term. Access it here.

Free Guide: How to Analyze Financial Statements — Master reading balance sheets, income statements, and cash flows. Start learning.

Get Featured — Promote yourself to over 15,000 active stock market investors with a 42% open rate. Reach out: investinassets20@gmail.com

Disclaimer

This newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice.

The views expressed are solely the author’s opinions and may change without notice. Investing in securities involves risk, including the potential loss of capital.

Past performance is not indicative of future results. The author may hold positions in the securities mentioned.

Readers should do their own research and consult a licensed financial advisor before making investment decisions.