Top 5 Quality Buys May 🚀

5 Fairly priced Quality Businesses 💎

Hi partner! 👋🏻

Welcome to the May edition of Top 5 Buys ✅

You can access our Top 15 Buys for 2025 list as a premium member here.

In this article, we will discuss our top stock picks for May 2025.

Let’s get into it 👇

The Market Sentiment: Greed

The market has recovered from “Extreme fear” in April, induced by the Trump administration’s foreign policy activities.

The recovery has been incredibly fast due to 3 reasons:

Easing trade tensions between the US and China.

FED’s dovish stance with expectations of two rate cuts in 2025

Strong earnings from US businesses

The stock market is almost back at all-time high levels after a “V-shaped recovery”.

But, is the market volatility over? It’s impossible to say with the geopolitical unrest going on.

What is certain is that we will continue to buy great businesses when they trade at fair prices and hold them for the long term.

Disclaimer: This is not investment advice. Always conduct your due diligence and make your own investment decisions.

Now, let's get into it 👇🏻

Top 5 Quality Buys May 2025 🚀

Meta Platforms META 0.00%↑ 💎

Meta Platforms operates social media platforms like Facebook, Instagram, WhatsApp, and a digital advertising ecosystem.

The business primarily makes money from digital advertising, selling targeted ads based on user data across platforms. The appeal for ad-buyers is that Meta allows you to reach your niche with much more precision than any other channel.

Meta Platforms expects long-term growth from AI-driven ad optimization, short-form video (Reels), messaging monetization, and Metaverse/VR development (Reality Labs / Metaverse).

The founder still leads the business—Mark Zuckerberg, known for long-term vision but criticized for concentrated control (dual-share structure).

Meta has a strong competitive Advantage with unmatched scale of social platforms, rich user data, network effects, and integration of apps that provide high switching costs.

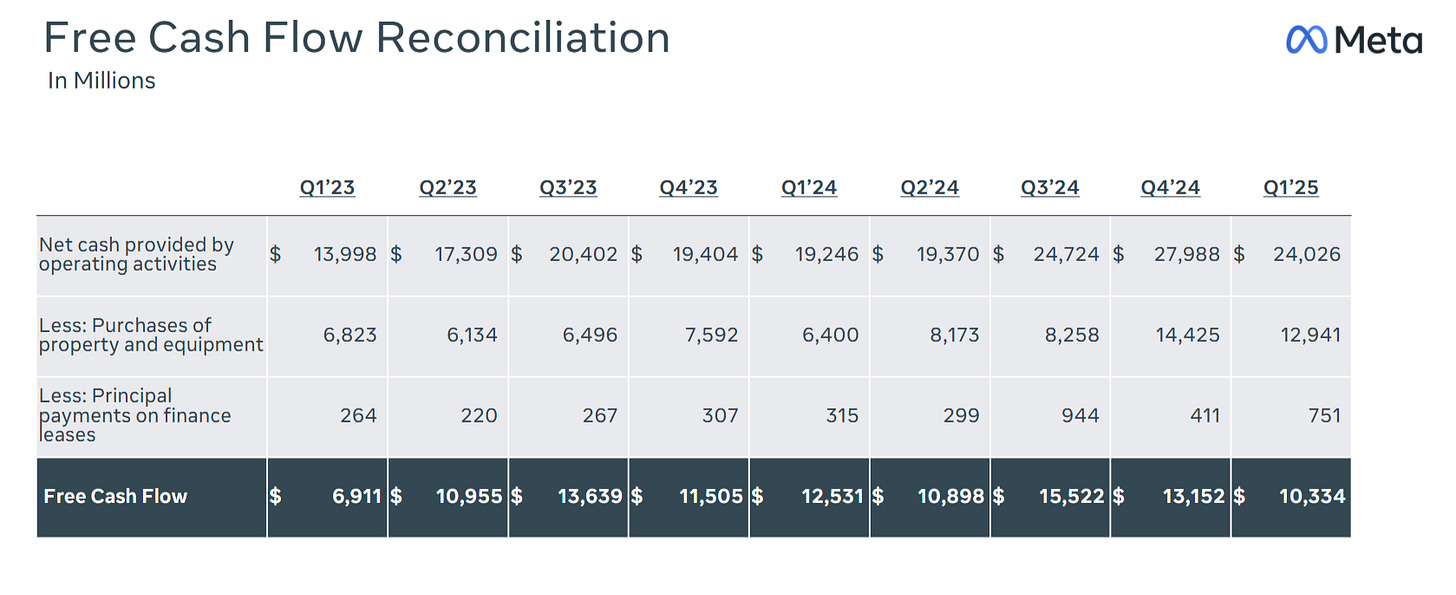

Meta is a free cash flow-generating machine and a high-quality business:

Despite a brief “depression” in the stock price in 2022, the fundamentals have been stellar over the last 5 years:

Revenue per share 5 year: 21% CAGR

EPS 5 year: 30.6% CAGR

Free cash flow 5 year: 21%

Return on Invested Capital of 35.5% in LTM

Meta Platforms is on a -20% dip

Meta’s current PE of 23.16x is undemanding for a high-quality business well positioned to take advantage of the future growth in digital advertising.

Chipotle Mexican Grill CMG 0.00%↑ 🌮

Chipotle Mexican Grill is a fast-casual restaurant chain offering customizable Mexican food with a focus on fresh, responsibly sourced ingredients.

The company makes money from in-store and digital food sales (high-margin digital channels growing rapidly).

CMG plans to grow by expanding its stores in North America, international opportunities, strong same-store sales growth, and increased digital ordering.

The CEO is Brian Niccol (ex-Taco Bell), who has led a successful digital and brand transformation for Chipotle Mexican Grill.

Chipotle’s moat is built around its brand reputation for quality, strong unit economics, vertically integrated supply chain, and digital ordering platform.

CMG is one of Bill Ackman’s top positions. Here’s a quote on CMG from the super investor:

“Chipotle is one of the best-positioned consumer companies for the current inflationary world.”

Chipotle Mexican Grill 5-year growth:

Revenue per share 5 year: 17.2%

EPS 5 year: 42.4%

Free cash flow per share 5 year: 48.1%

Return on Invested Capital expansion from 8.4% to 20.1% in LTM

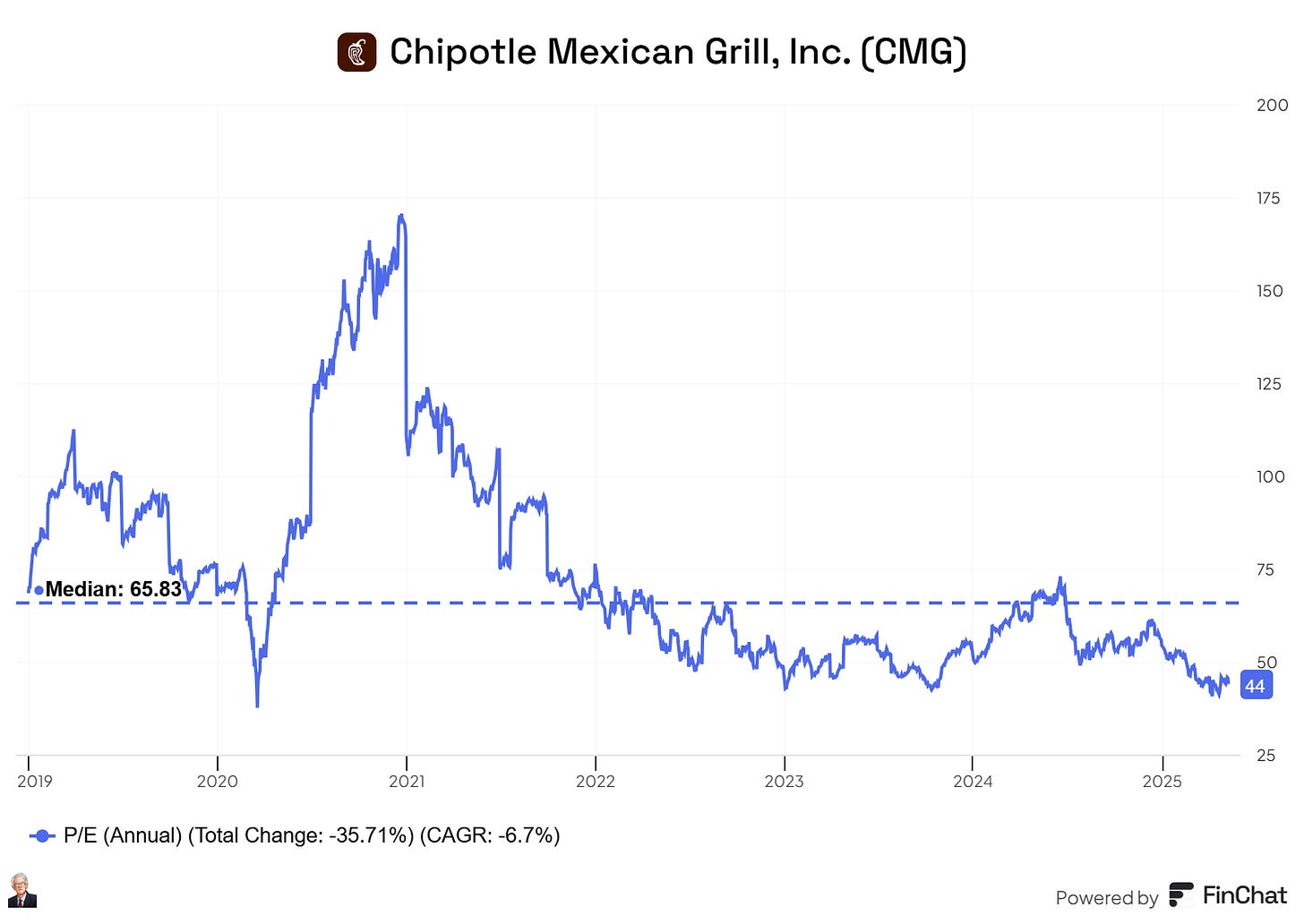

Chipotle is down -27.4% from its ATH

CMG is pulled down with the overall market as investors fear the implications of the geopolitical unrest. Chipotle trades at 44x LTM earnings, well below its median of 65.83x.

Now, let’s dive into the top 3 businesses for May: