💎Top 5 Quality Compounders

5 fairly priced quality compounders 🚀

Hi partner! 👋🏻

Welcome to the June edition of Top 5 Buys ✅

You can access our Top 15 Buys for 2025 list as a premium member here.

In this article, we will discuss our top stock picks for June 2025.

Let’s get into it 👇

The Market Sentiment: Greed

The market has recovered from “Extreme fear” in April, induced by the Trump administration’s foreign policy activities.

The market is back where it loves to be: Greed.

After the April dip, we’ve seen investor sentiment stabilize around greed levels. This indicates that investors are willing to take more risk than usual:

The S&P 500 and the overall market are breaking new all-time high levels.

The willingness to act when others were fearful in April has paid off in the short term, but will it sustain growth?

We don’t have a crystal ball, but what we do have, is 5 solid quality companies, trading at fair prices 👇

Disclaimer: This is not investment advice. Always conduct your due diligence and make your own investment decisions.

Now, let's get into it 👇🏻

Top 5 Quality Buys June 2025 🚀

Auto Partner SA — Scaled Distribution Platform in Auto Aftermarket 🚗

Thesis Summary

Auto Partner is a fast-growing Polish auto parts distributor benefiting from structural demand driven by Europe’s aging vehicle fleet. Its scalable, tech-enabled logistics network and strong B2B e-commerce platform support double-digit revenue growth, while private-label brands and a branded workshop network enhance margins and customer retention. Despite short-term margin pressure from wage inflation and deflation in parts pricing, Auto Partner maintains low leverage and is investing in automation to expand capacity and improve efficiency, positioning it as a resilient, high-quality player in the European aftermarket.

Business Overview

Auto Partner is a leading distributor of automotive spare parts across Central and Eastern Europe. Based in Poland, the company serves independent garages and resellers through a logistics network covering Poland, Czechia, Slovakia, Ukraine, and Belarus.

The company supplies both OEM and aftermarket components—spanning brakes, suspension, engine parts, electronics, oils, chemicals, and workshop tools—via 110+ branches and regional distribution centers. It operates an asset-light, high-volume model with rapid inventory turnover and just-in-time logistics.

Founded in 1993 and publicly listed in Warsaw, Auto Partner has developed proprietary IT systems and internal tooling to scale with efficiency.

Key Drivers of Value

1. Scaled Logistics & IT Infrastructure

3 national distribution centers and 110+ branches allow fast fulfillment across multiple markets

Proprietary software supports real-time inventory, ordering, and logistics—key to margin protection and customer retention

2. Private Label Margin Leverage (MaXgear)

Own brand MaXgear includes ~35,000 SKUs, lowering sourcing risk and improving pricing power

Expands product range while building brand loyalty in a fragmented market

3. Geographic Expansion & Operating Leverage

Consistent entry into new Central and Eastern European markets

Centralized operations allow scale benefits as volumes grow

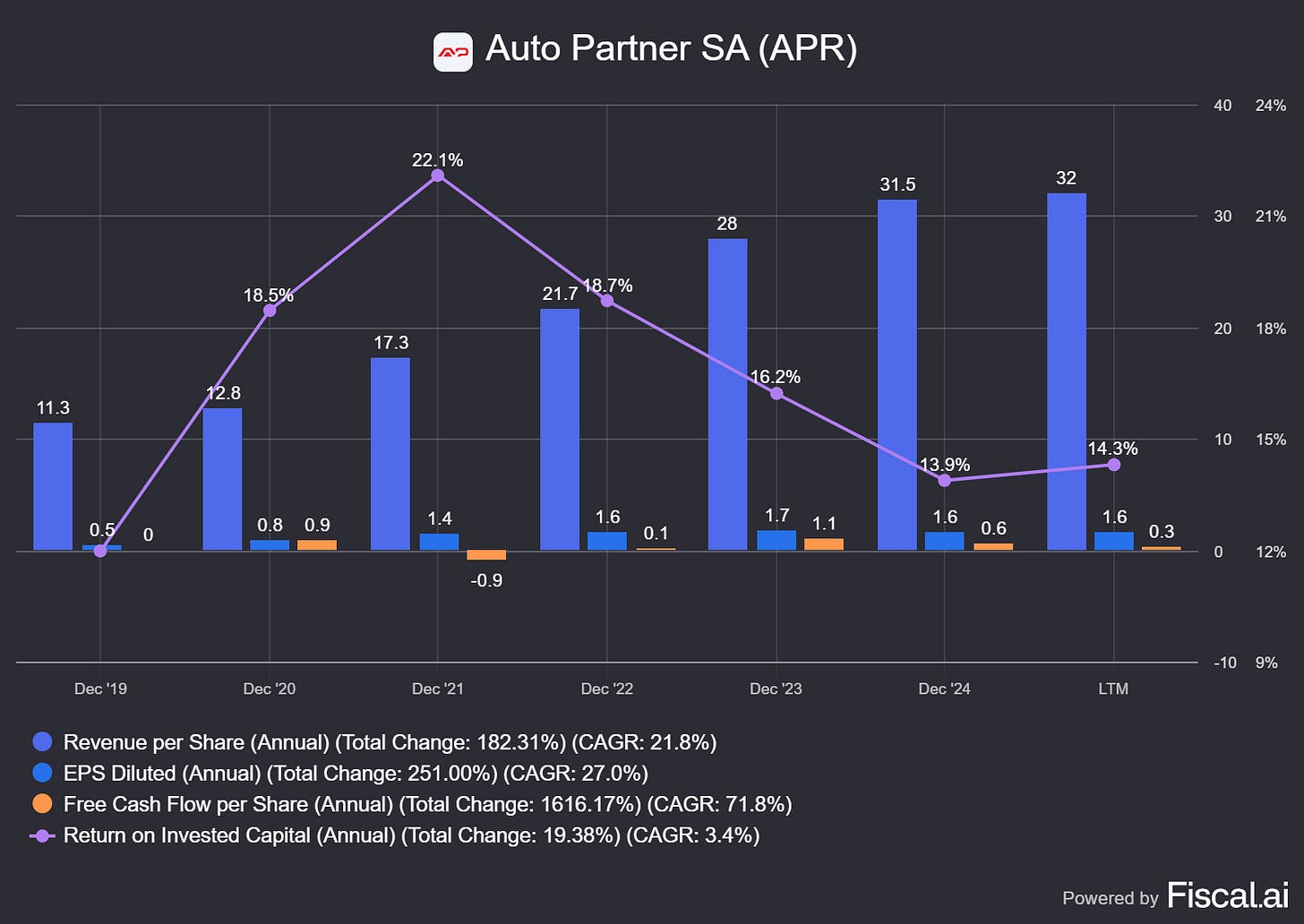

Financial Performance CAGR (2019–2024)

Revenue per share: +21.8% CAGR

EPS Diluted: +27%

Free cash flow per share: +71.8%

Return on Invested Capital: +13.9% since 2020

Auto Partner combines double-digit revenue growth with stable margins and disciplined capital deployment. It reinvests in automation and digital tooling while maintaining a strong equity base (~60% equity ratio).

Valuation & Outlook

At ~12–13× earnings, shares trade in line with industrial distributors, despite superior growth and margin scalability. Capex is moderate, allowing continued FCF growth without equity dilution or leverage risk.

The business remains structurally positioned to benefit from the trend toward longer vehicle lifespans, driving recurring demand for replacement parts. Risks include FX volatility, regional instability, and potential import tariffs, but Auto Partner's scale, IT backbone, and sourcing strategy provide meaningful downside protection.

Assa Abloy AB — Global Leader in Access Solutions 🔐

Thesis Summary

Assa Abloy is a global access control leader with a diversified portfolio, scalable M&A strategy, and growing exposure to digital security. Its combination of mission-critical products, high-margin electromechanical systems, and recurring revenue streams underpins long-term earnings durability. With a track record of disciplined capital allocation and consistent value creation, the company remains well-positioned for compounding growth at the intersection of industrial hardware and security technology.

Business Overview

Assa Abloy is the world’s largest provider of access solutions, offering mechanical and digital locks, identity verification, entrance automation, and smart security systems. Headquartered in Sweden, the company serves commercial, institutional, and residential customers globally, with operations spanning over 70 countries and a diversified portfolio of leading brands including Yale, HID, and Abloy. Its product offering ranges from simple door hardware to fully integrated biometric and cloud-based access systems.

Since its founding in 1994, Assa Abloy has completed over 300 acquisitions, building an unmatched global platform with deep local distribution. The company’s business is anchored in mission-critical, high-regulation verticals—such as healthcare, education, and infrastructure—where reliability, compliance, and lifecycle service drive recurring revenue and pricing power.

Key Drivers of Value

Global Scale & Brand Portfolio

Assa Abloy’s geographic reach and multi-brand strategy allow strong pricing, supply chain resilience, and customer diversification. Emerging markets (~25% of sales) provide long-term tailwinds.Technology-Driven Upselling & Recurring Revenue

The shift toward electromechanical locks and cloud-based access control (35% of sales and growing) enables higher-margin hardware/software bundles and service revenues. ID solutions (HID) benefit from secular trends in digital identity and security.M&A Flywheel & Operational Efficiency

A proven acquisition model adds scale and technology capabilities while enhancing local market share. Operational excellence programs and vertical integration support high and stable EBIT margins.

Financial Snapshot (2019–2024)

Revenue per share: +9.7%

Earnings per share: +7.5%

Free cash flow per share: +9.6%

ROE: consistently >14%

FCF conversion: ~85%+ of net income

Assa Abloy combines stable mid-single-digit organic growth with margin uplift from digital transition and acquisition synergies. The company maintains disciplined capital deployment and a strong investment-grade balance sheet, enabling both reinvestment and shareholder returns.

Valuation & Outlook

At ~20× forward earnings and a 5.08% free cash flow yield, Assa Abloy trades in line with high-quality industrial tech peers but benefits from superior durability, pricing power, and embedded growth via product innovation and M&A. As physical security converges with digital identity, Assa Abloy is structurally positioned to lead the global access control ecosystem.