Top 5 Quality Buys January 2025💎

5 Fairly Priced Quality Stocks for 2025 📈

Welcome to the January edition of Top 5 Buys ✅

You can access our Top 10 Buys 2024 list as a premium member here.

In this article, we will discuss our top stock picks for January 2025.

Let’s get into it 👇

The Market Sentiment: FEAR

The Fear to Greed index is (finally) pointing towards fear, indicating that investors are more fearful of taking excess stock market risk.

For long-term investors, fear in the market is synonymous with opportunities.

The last time the market was at similar levels, we saw a dip in the market (August 2024). This does not mean that the market can’t keep going down, but for long-term investors, we get better risk-reward opportunities from lower prices than higher prices in the stock market.

What is a Good Buy? 🧠

We emphasize understanding the fundamentals before investing. If you prefer an in-depth analysis, check out our guide, trusted by over 300 investors. We also offer a free valuation cheat sheet for a straightforward approach to determining a company’s intrinsic value.

We assess a company's quality based on its business model, revenue generation, margins, return on capital, management, and competitive advantages. We then analyze its historical valuation to identify attractive buying opportunities.

Invest in Quality is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Disclaimer: This is not investment advice. Always conduct your due diligence and make your own investment decisions.

Now, let's get into it 👇🏻

Nike (NYSE: NKE 0.00%↑ ) 👟

Nike is a global leader in athletic footwear and apparel. The business is known for its strong brand, wide distribution, and deep connection with athletes and consumers worldwide.

Nike's growth is fueled by strong demand across different geographies and segments, including sports, athleisure, and digital commerce. While the retail sector can be volatile, Nike's focus on innovation, direct-to-consumer channels, and expanding its global footprint positions it for future growth.

Bill Ackman recently made Nike a large position of his Pershing Square Capital fund, with 11.15% of the portfolio (an increase of 435.5% since last quarter). This can be viewed as a positive for the stock, as Ackman is particular about what stocks he puts into the fund.

Key fundamentals:

Gross Margin: 44.73%

Operating Margin: 12.08%

Return on Equity (ROE): 40.14%

Revenue growth (3Y): 1.89%

Earnings per share growth (3Y): -5.24%

Forward PE: 39.51x

Why we like Nike:

Strong Brand and Market Position: Despite recent issues, Nike maintains a dominant market position in the athletic footwear and apparel industry with a market share of 21.87% (CSImarket.com). Its strong brand value and extensive distribution network support Nike's market position.

Financial Resilience and Growth: Nike has a history of growing its revenues, earnings, and free cash flows. In addition, the margins and return on capital have been consistently high for decades, indicating a strong competitive position.

New Strategic Leadership and Innovation: The new CEO, Elliott Hill, is anticipated to create a new strategic direction for Nike. His focus will be on product innovation and re-engaging with retail partners. Analysts view this leadership change as a catalyst for renewed investor interest and potential stock appreciation.

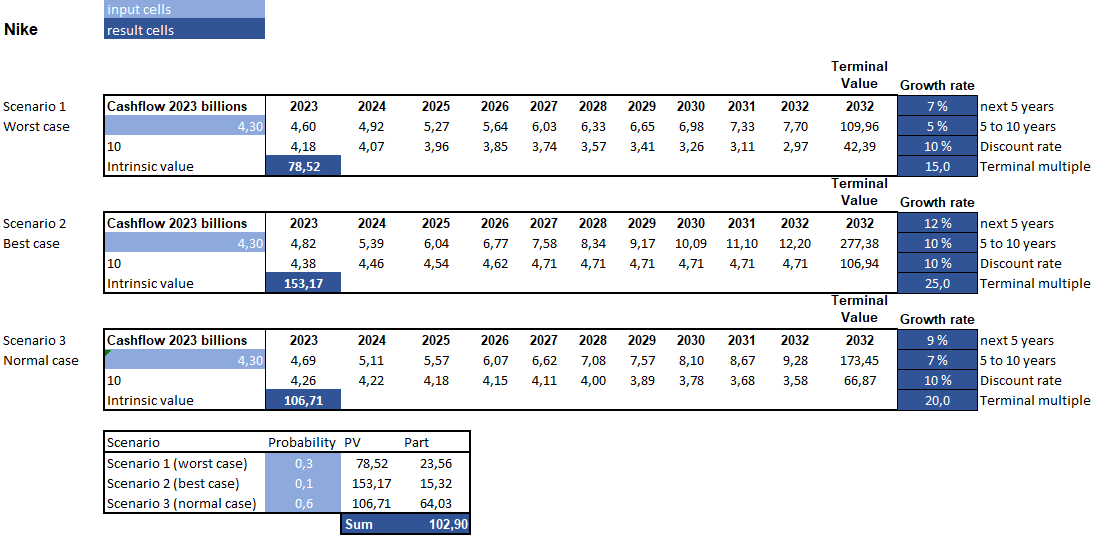

Simple Discounted Cash Flow Analysis

Fair value estimate: $102.90

Current price: $72.35

Upside: +42.2%

Expected CAGR: 14.5%

Alphabet (NYSE: GOOGL 0.00%↑ ) 🛜

Alphabet is a global technology leader known for its dominance in online search, digital advertising, cloud computing, AI, and countless digital assets with billions of users. Alphabet’s robust ecosystem includes platforms like YouTube, Google Workspace, and Android.

Alphabet investments heavily in emerging fields such as autonomous vehicles through Waymo, health technology via Verily, and AI under DeepMind.

Alphabet is well positioned to benefit from increased use of the internet as it owns the most valuable real estate online: www.Google.com.

Multiple super investors own significant stakes in Alphabet, ranging from Bill Ackman to value investor Li Lu, to Quality investor Terry Smith.

Key fundamentals:

Gross Margin: 58.13%

Operating Margin: 32.09%

Return on Equity (ROE): 27.25%

Revenue growth (3Y): 12.42%

Earnings per share growth (3Y): 13.23%

Forward PE: 22.28x

Why we like Alphabet:

Market leader in Digital Advertising: Alphabet is the global leader in digital advertising, with Google Search, YouTube, and Google Networks accounting for 81.95% of the share of online ad spend. Digital advertising remains a high-growth industry and is expected to grow 8-10% CAGR in the coming 10 years.

Diversified Revenue Streams: Beyond advertising, Alphabet is diversifying its revenue streams with Google Cloud, subscriptions & devices. Google Cloud alone generated over $40 billion in revenue in the last twelve months growing 22% YoY. Subscriptions and devices generated $39 billion in the last twelve months, growing 13.9% YoY.

AI potential and innovation: Alphabet invests heavily in cutting-edge technologies like artificial intelligence (AI), autonomous vehicles (via Waymo), and health tech (through Verily), positioning itself for future growth in emerging markets. This provides a long-tail bet that can provide high returns to investors if they hit.

Simple Discounted Cash Flow Analysis

Fair value estimate: $248.73

Current price: $193.95

Upside: +28.2%

Expected CAGR: 14%