🏰5 Quality Buys August

🧠 5 Quality Growth businesses with wide moats

Hi partner! 👋🏻

Welcome to the August edition of Top 5 Buys ✅

You can access our Top 15 Buys for 2025 list as a premium member here.

In this article, we will discuss our top stock picks for August 2025.

Let’s get into it 👇

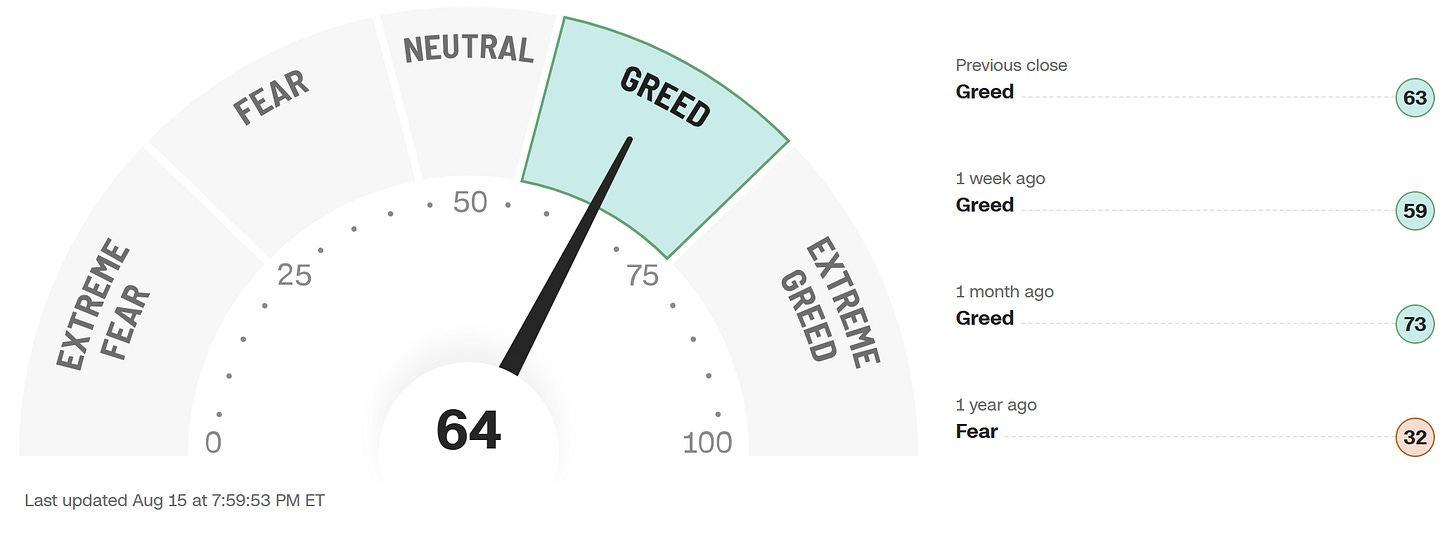

The Market Sentiment: Greed

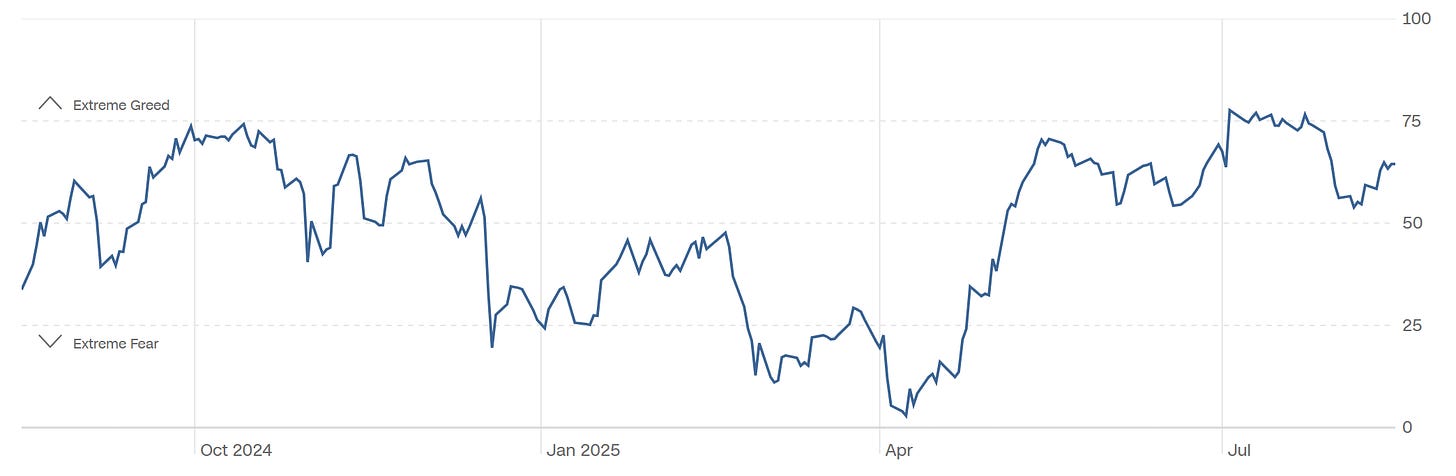

After a brief detour of Extreme fear in April, the market is back where it loves to be: Greed.

After the April dip, we’ve seen investor sentiment stabilize around greed levels. This indicates that investors are willing to take more risk than usual:

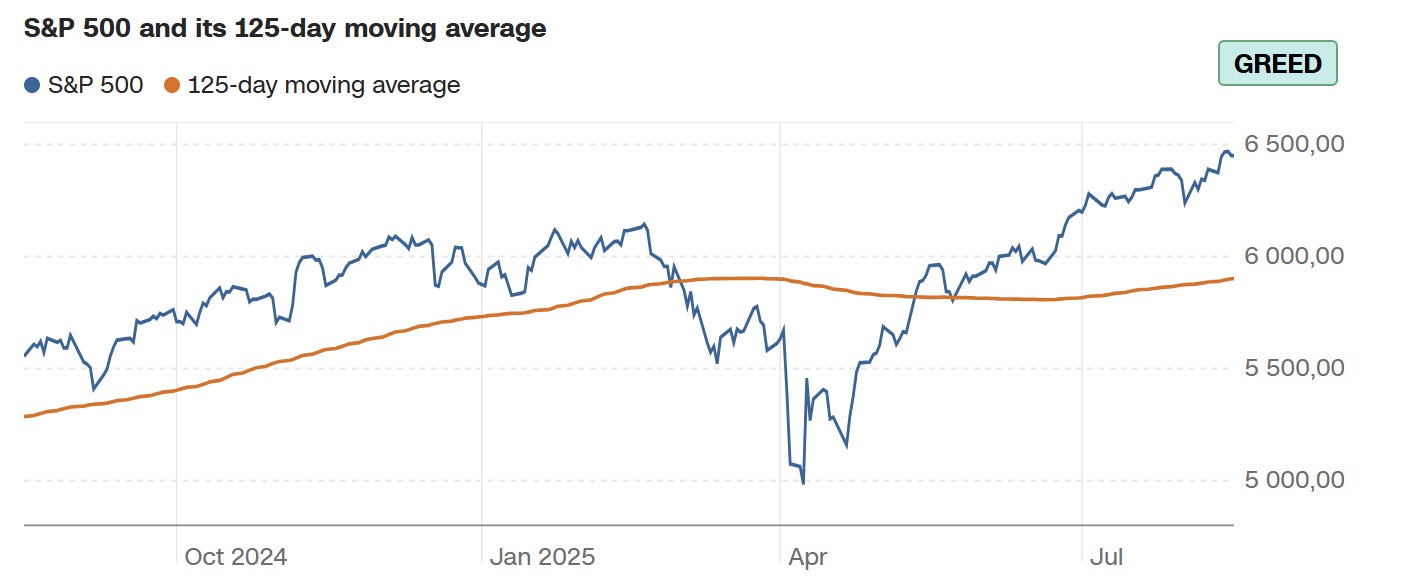

The S&P 500 and the overall market are breaking new all-time high levels and is trading well above the 125-day moving averge:

The willingness to act when others were fearful in April has paid off in the short term, but will it sustain?

I can’t predict the future, but we do have 5 solid quality growth businesses for this months top 5 buys, let’s get into it 👇

Disclaimer: This is not investment advice. Always conduct your due diligence and make your own investment decisions.

Growth edition: This months top 5 buys are tilted towards high growth businesses with strong margin profiles, great business models and strong product portfolios.

Now, let's get into it 👇🏻

Top 5 Quality Buys August 2025 🚀

#1🍿Netflix: The next phase: Ads, Sports, and the Race to $1 Trillion

Netflix is the world’s leading streaming platform, leveraging global scale, original content, and a growing advertising business.

Netflix has a scalable subscription business model and is the global market leader in streaming.

Growth drivers include:

Rapid adoption of ad-supported tier, boosting subs and margins.

Expansion into live sports and events to deepen engagement.

Pricing power and strong international growth.

Key initiatives

Netflix is making moves to sustain organic future growth. By building proprietary ad-tech for its ad tier, expanding sports rights, and launching in-person experiences, Netflix wants to expand and diversify their business, targeting a l $1 trillion market cap by 2030.

Expected growth for netflix

Rev Fwd 2 Yr 14.2%

EBITDA Fwd 2 Yr 24.7%

EPS Fwd 2 Yr 27.6%

EPS LT Growth Est 23.4%

Netflix has seen its Price to earnings ratio rise from sub 20x, to now 42.56x.

This valuation is by no means cheap, but the business has strong growth initiatives and a dominant position in streaming that can be levered to grow and hike prices over time, creating attractive economics.

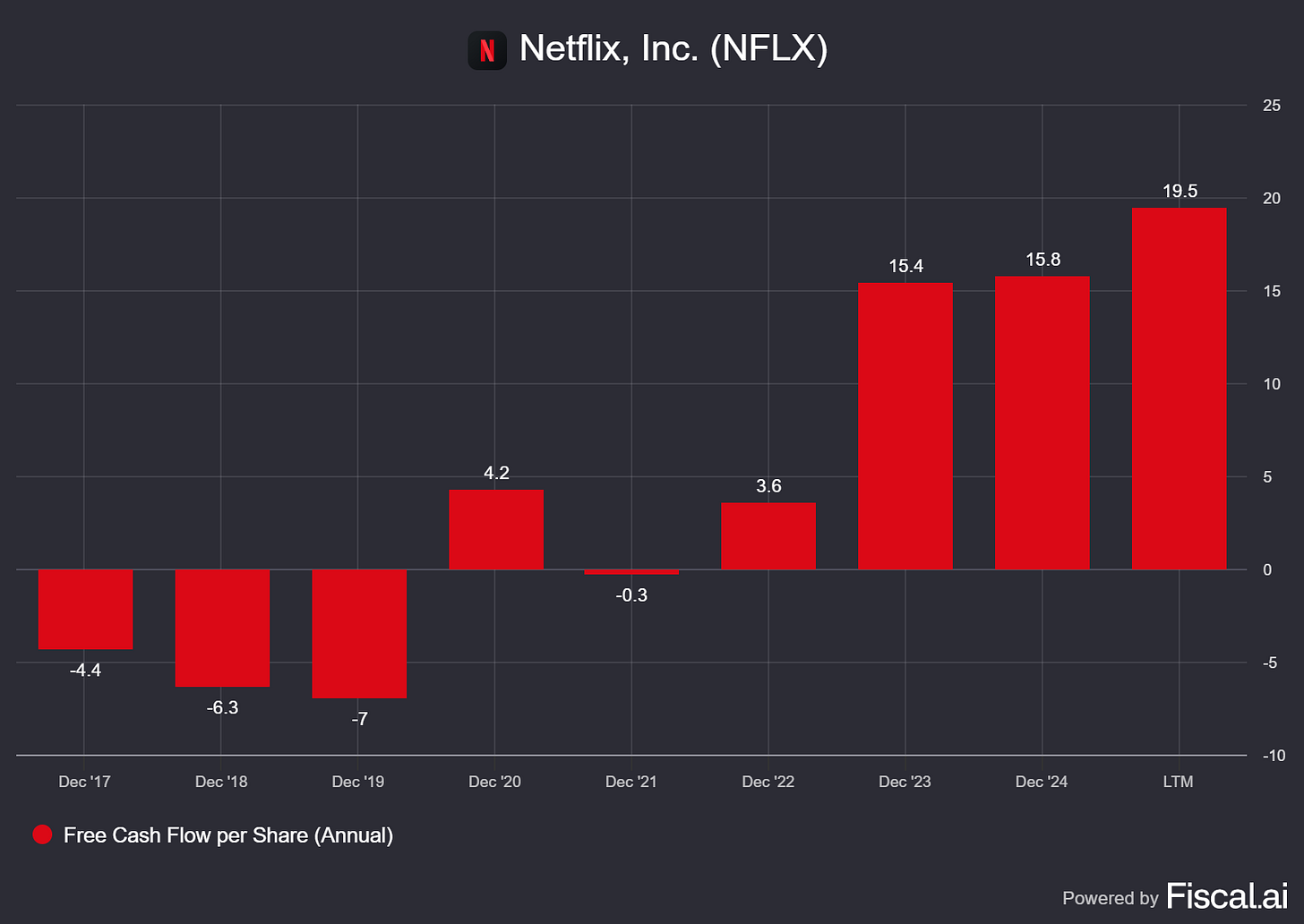

Netflix is turning into a Free Cash Flow generating machine—turning cash flow positive in 2022 and growing significantly since then:

#2 📱AppLovin – From Games to Global Ad-Tech Giant

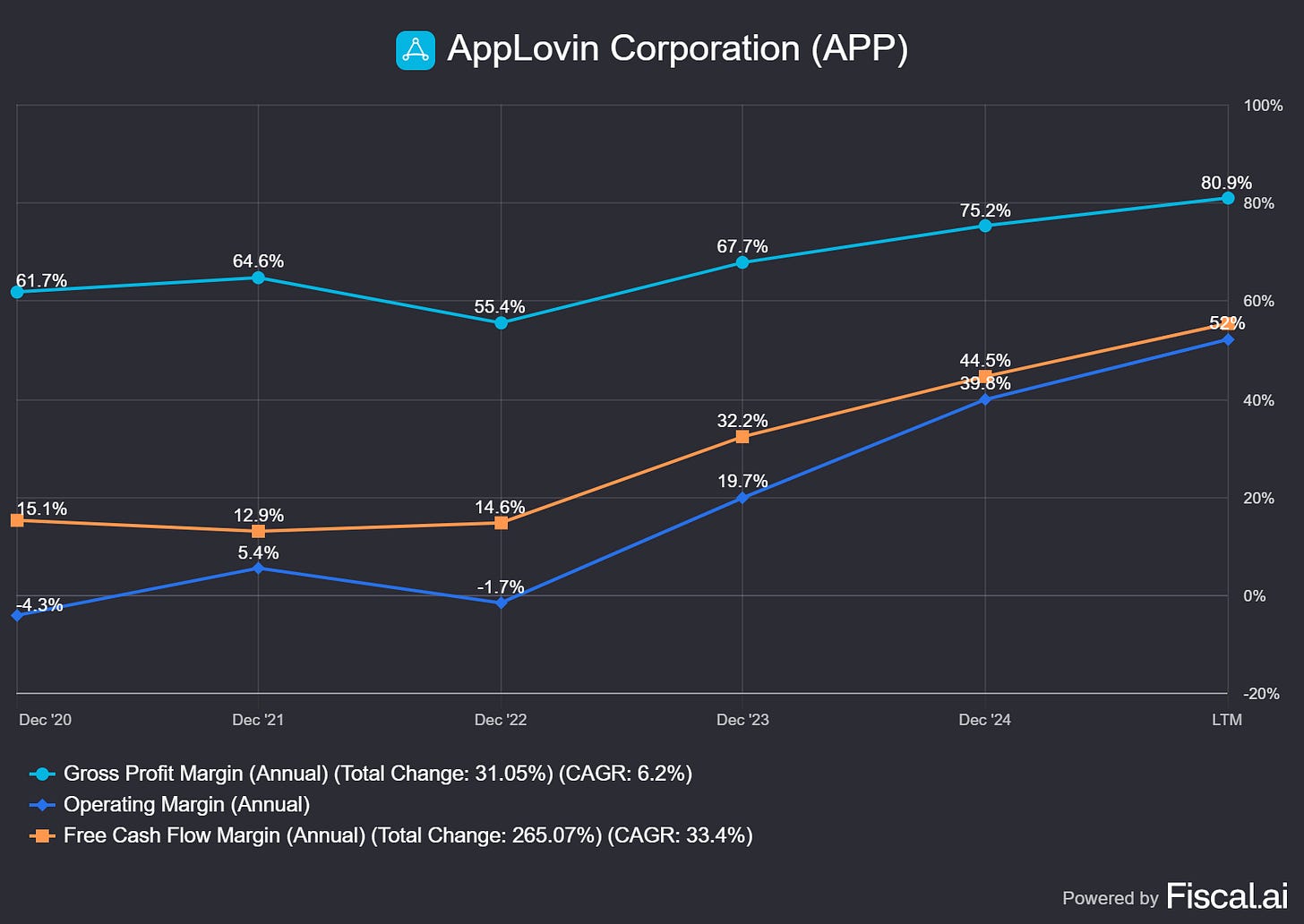

AppLovin is a leading ad-tech platform powered by its MAX bidding system and Axon AI engine. The business delivers margin expansion and premium growth across mobile and e-commerce advertising.

Applovin offers software tools for app developers that allow for targeted advertisement inside their existing applications.

Growth drivers include:

Rapid ad revenue expansion from AI-driven targeting.

Scaling e-commerce advertising and self-serve tools.

Strong cash flow and margin expansion.

Key initiatives:

Applovin is ramping up its growth by divesting gaming assets to focus on ad tech (The attractive business segment), launching a global self-serve platform, and exploring strategic acquisitions like TikTok’s international business.

Applovin has an attractive product portfolio in the ad-tech space, and is using AI to make it even better (Like everyone else)—They’ve shown great execution in positioning themselves as a long-term digital ads leader.

Expected growth for Applovin:

Rev Fwd 2 Yr 21.9%

EBITDA Fwd 2 Yr 44.3%

EPS Fwd 2 Yr 66.2%

EPS LT Growth Est 53.4%

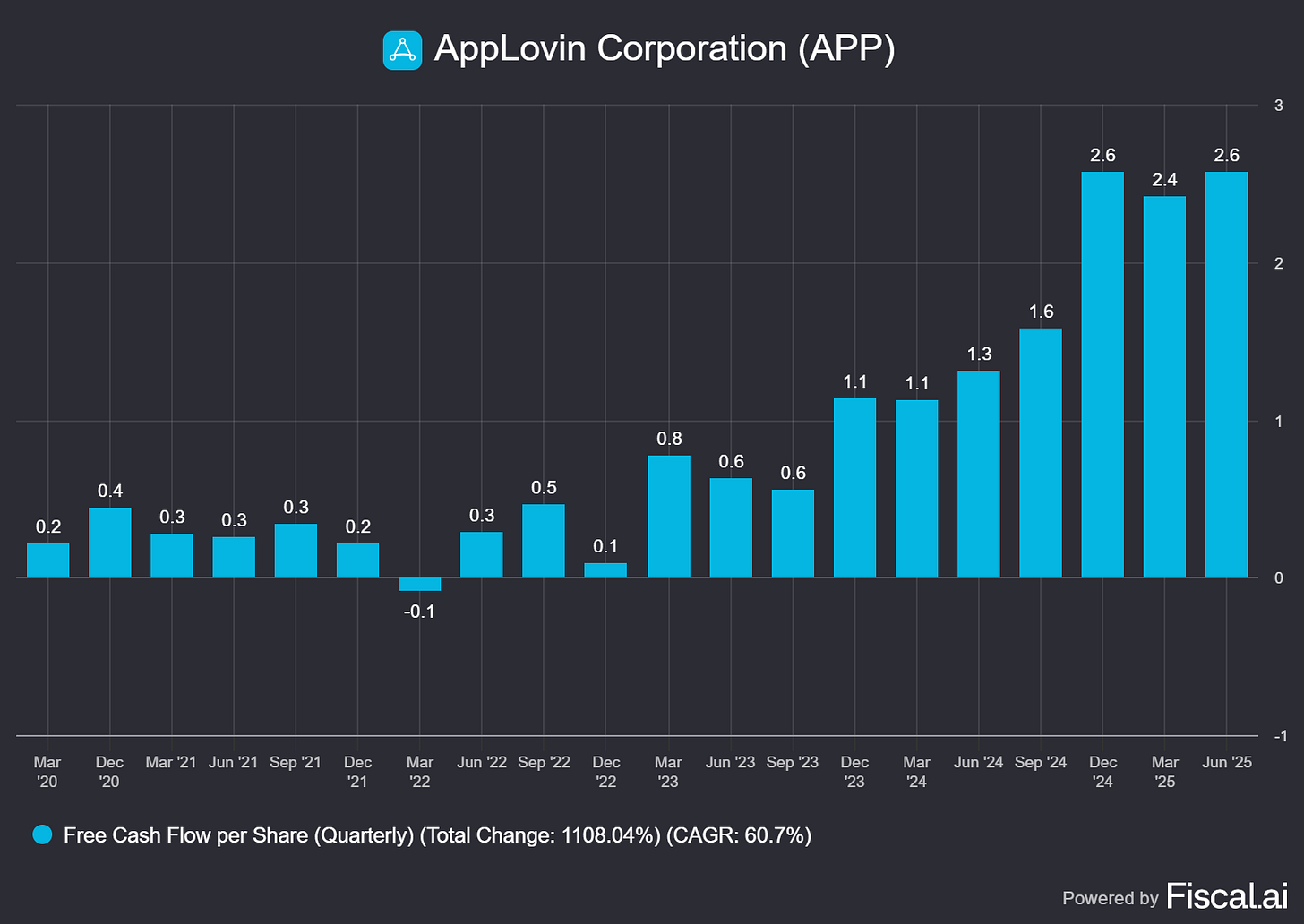

Applovin is turning into a free cash flow generating machine, growing its free cash flow per share by 60.7% CAGR since March 2020:

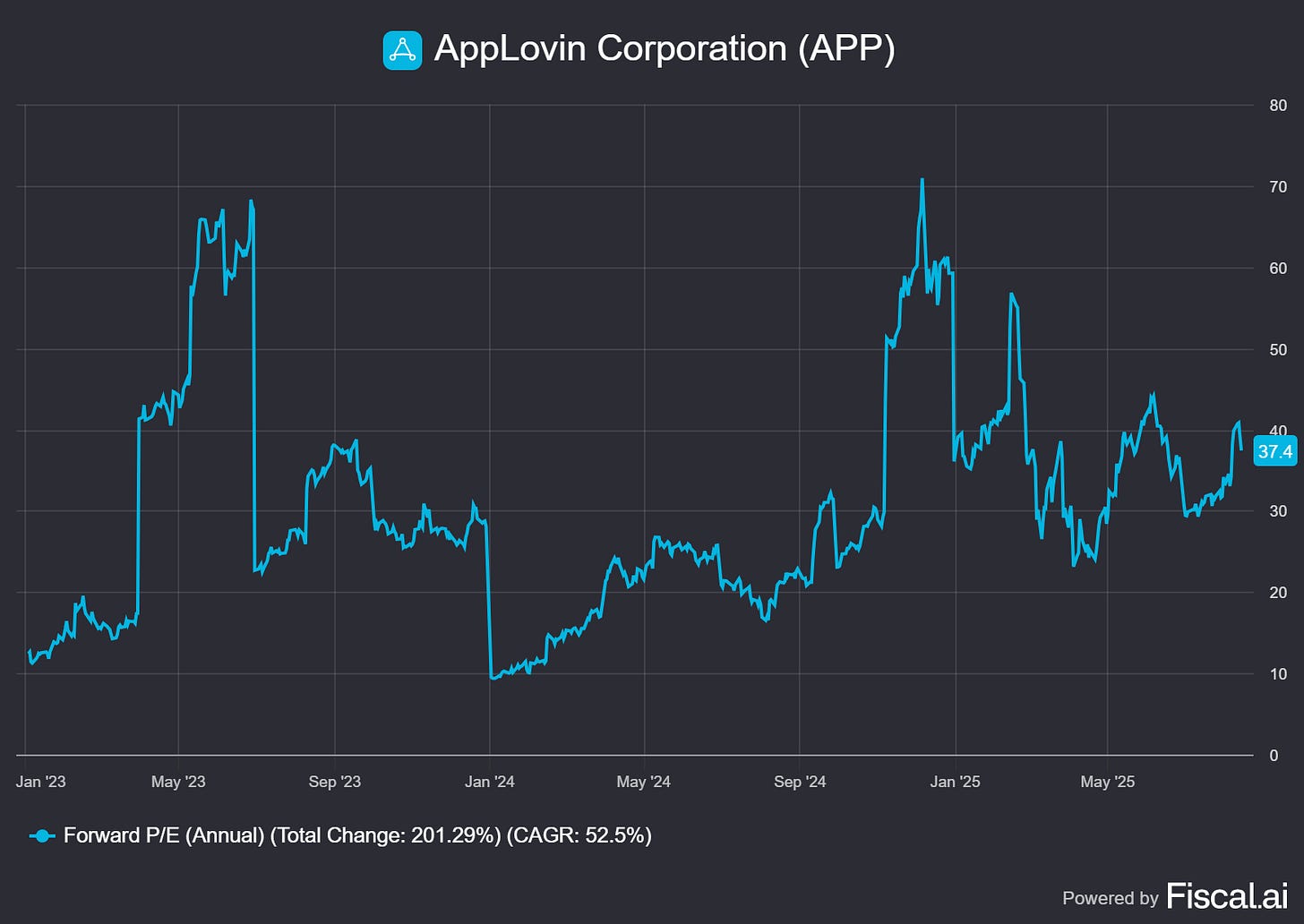

While not cheap, Applovin’s strong growth can easily justify its forward PE of 37.4x if it can continue to grow and expand margins.

The market loves a business with +20% sustainable growth and fat margins — the risk is of course if the growth targets are not met.