Top 5 Buys August 💎

5 Intersting Investment cases 🧠

Hi there investor 👋

Welcome to the August edition of Top 5 Buys.

In case you missed it:

As a premium member, you can access our Top 10 Buys 2024 here.

In this article, we will discuss our top stock picks for August 2024.

Let’s get into it 👇

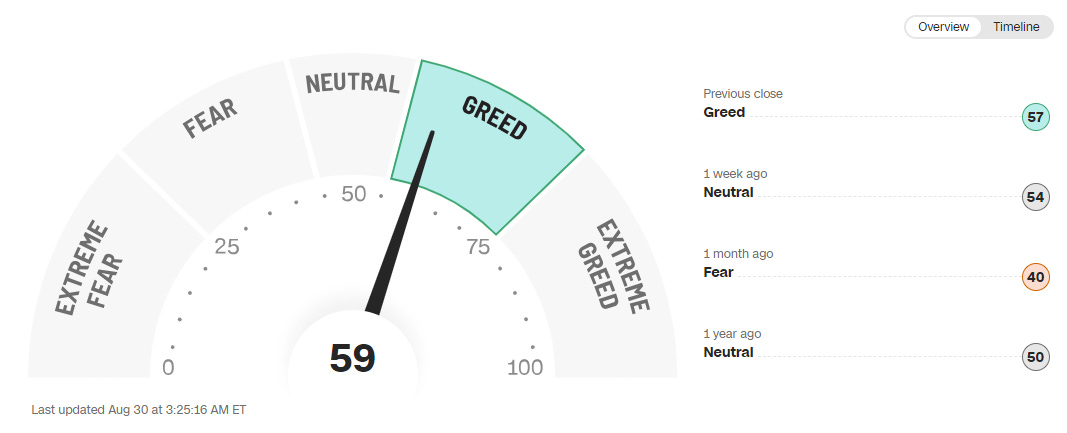

The Greed to Fear index is pointing towards Greed

After a brief tour of the fearful side, we're back to greedy market actors.

The market has recovered from its early-August sell-off - Everyone is anticipating rate cuts, which is positive for stocks.

We of course hoped for a longer drawdown so we could purchase quality assets at better prices.

The market is currently in a weird spot with S&P 500 PEs crossing 26x (Way above its historical average or median).

The S&P 500 is making new all-time highs

The S&P 500 is close to its all-time highs seen in July this year.

The recent sell-off scared investors, not because of the percent decline, but because of how quickly things escalated to the downside. The VIX (Volatility Index that measures the market’s volatility) went bonkers and large institutional investors almost lost their minds in a short few days.

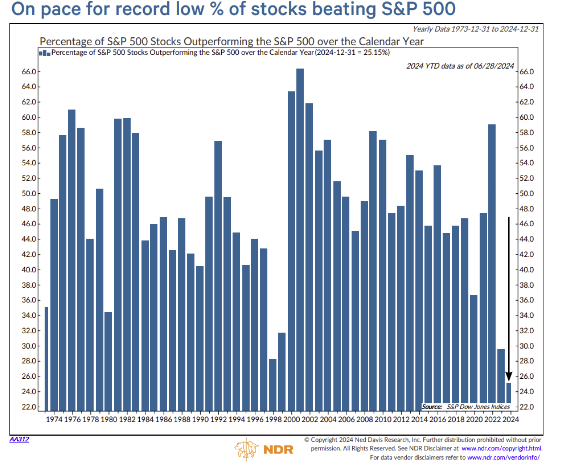

This year’s surge for the S&P 500 is funded by the AI and semiconductor-related hype. Few times in history have we seen this low amount of stocks outperforming the indexes:

For stockpickers, this means that it is hard to beat the market on a YTD basis. To beat it, you’d have to be overweight and invested in one of the large winners.

Of course, you see everyone who has had an oversized position in Nvidia on X (They can’t shut up about it).

What is a good buy?🧠

Our analysis process is outlined fully in our guide, read by more than 300 investors.

If you prefer video, we are creating a video course — sign up for the waitlist.

We have also outlined a simple valuation method in our free valuation cheat sheet. One can use several methods, but we like to keep it simple.

First, we want to determine business quality by understanding the business, how it makes money, the different business segments, the growth potential for each segment or product/service, the margins, return on capital, and competitive advantage.

Second, we want to understand the historical valuation and price to earnings/cash flows the company has traded at. Then we use a simple discounted cash flow analysis to determine what direction the company is heading.

High-quality businesses, bought at fair prices, yield great long-term returns.

Disclaimer: This is not investment advice, always do your due diligence and make your own investing decisions.

Now, let’s be real - the market is not cheap, but there are a few opportunities that might be trading at good levels.

Let’s get into it:

Top 5 Buys August 2024 💎

Airbnb ABNB 0.00%↑ 🌍

Airbnb is a global platform that connects travelers with hosts offering unique accommodations and experiences in destinations around the world.

This includes options ranging from entire homes and apartments to boutique hotels and local experiences.

Airbnb also provides a user-friendly platform accessible on various devices, allowing guests to easily book stays and explore activities tailored to their interests.

Key fundamentals:

Gross Margin: 82.59%

Operating Margin: 15.21%

Return on Invested Capital (ROIC) 5Y: 7%

Revenue growth 3Y: 33.41%

Earnings per share growth 3Y: -11.71%

Forward PE: 27.67

Forward FCF yield: 5.37%

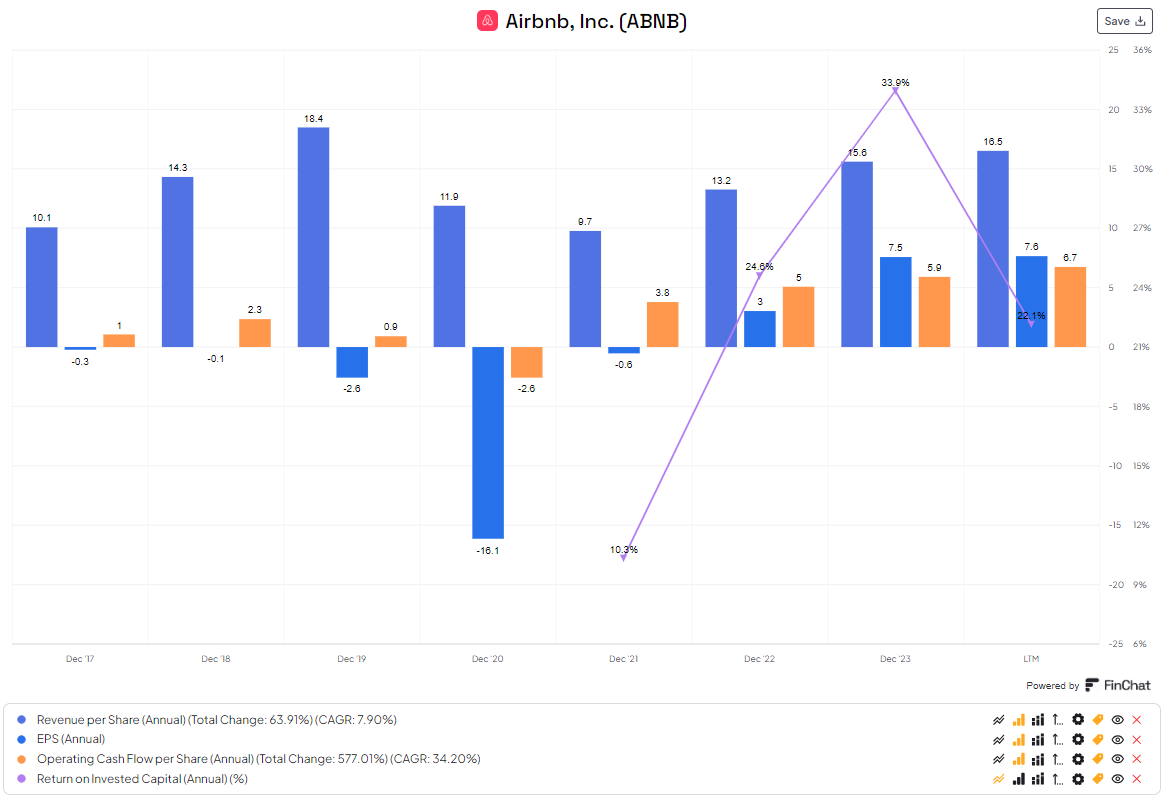

Airbnb has had a tough time since the pandemic, where they lost a lot of money due to restrictions and the global lockdown.

Since the pandemic, Airbnb has steadily grown with the most interesting part being the expanding margins and ROICs consistently above 20%.

Airbnb is currently on a 46.22% drawdown from its top due to slowing growth. Technology companies are notoriously sold off when they start to underperform. We do however suspect that the flat growth is temporary.

Airbnb is expected to grow its long-term EPS by 13.85%, we think this is on the low side.

3 reasons why Airbnb is an interesting investing case:

Historical low multiples for an attractive platform business (Forward FCF Yield of 5.37%) with strong growth drivers.

Short-term sell-off overshadows the long-term potential growth in under-penetrated markets such as lodging.

Nights booked are increasing and Airbnb is maintaining a 3% annual growth rate in booking value per night despite a tough economic backdrop.

Paycom PAYC 0.00%↑ 📊

Paycom is a leading provider of cloud-based payroll and human capital management (HCM) software, designed to streamline HR processes for businesses of all sizes.

This includes comprehensive solutions for payroll processing, talent acquisition, time and attendance, and employee self-service.

Paycom’s platform is accessible on various devices, enabling businesses to efficiently manage their workforce and ensure compliance with evolving regulations.

Key fundamentals:

Gross Margin: 86.1%

Operating Margin: 32.87%

Return on Invested Capital (ROIC): 8.46%

Revenue growth 3Y: 24.04%

Earnings per share growth 3Y: 41.7%

Forward PE: 19.91

Forward FCF yield: 3.52%

Why do we like Paycom?

The historical growth in revenue per share of 27.80%, EPS by 57.49%, and free cash flow per share of 45.35% is one thing - but the primary reason is the attractiveness of the SaaS model. The stability and predictability in cash flows make this business potentially wonderful.

The stock is in a massive drawdown of -70.44%. The main reason is due to slowing growth levels, and investors are questioning the stickiness or moat of Paycom. These are valid concerns, but the current price offers us a margin of safety.

3 reasons why Paycom is an interesting case:

Historical low forward PE of 19.91 while the business is expected to grow between 10-15% topline in the next few years and the business is gushing out cash with an FCF margin of 20%.

Paycom has a strong competitive position in the US, international expansion is a growth driver that can unlock many years’ worth of growth.

Paycom has a NPS score of 63 (Higher than its main competitors like Workday of 31, and Paylocity of -4) - this data point suggests that Paycom is providing a valuable service to its customers and has a higher loyalty than competitors.

Save Time: Let us be your personal research analysts. We will save you the time you can spend on your favorite hobby, or family or relax and read a book.

Valuable insight on Quality businesses: We focus on QUALITY, and we provide high-quality analysis and detailed reasoning for the portfolio changes we make. You can follow along, and get great quality ideas every month.

Personal follow-up: You can ask us any question you want about investing (Via Substack, X, or Email). We will be a sparring partner for you in your investing decisions