25 Quality Buys 2026 📈

💎 25 Quality Compounders to Buy in 2026

Hi Partner 👋

Today, we are providing a top 25 quality growth list for 2026.

The Top 25 List for 2026 🏆

Certain companies in our investable universe stand out due to their high quality, steady cash flows, competitive advantages, and attractive valuations.

From e-commerce giants and luxury brands to AI-winners and tech conglomerates, these 25 companies are shaping the way we live, shop, and interact with the world.

To get a better understanding of the different factors that go into scoring the business, we will use our Quality Growth system to score the different companies:

Let’s get into it 👇

#25: 🪪Visa: Quality Fintech Compounder V 0.00%↑

Visa is one of the highest-quality business models ever created. Visa is not a bank or a lender - it is a global payments network that earns a toll on economic activity, with extraordinary scalability, margins, and durability.

Investment thesis

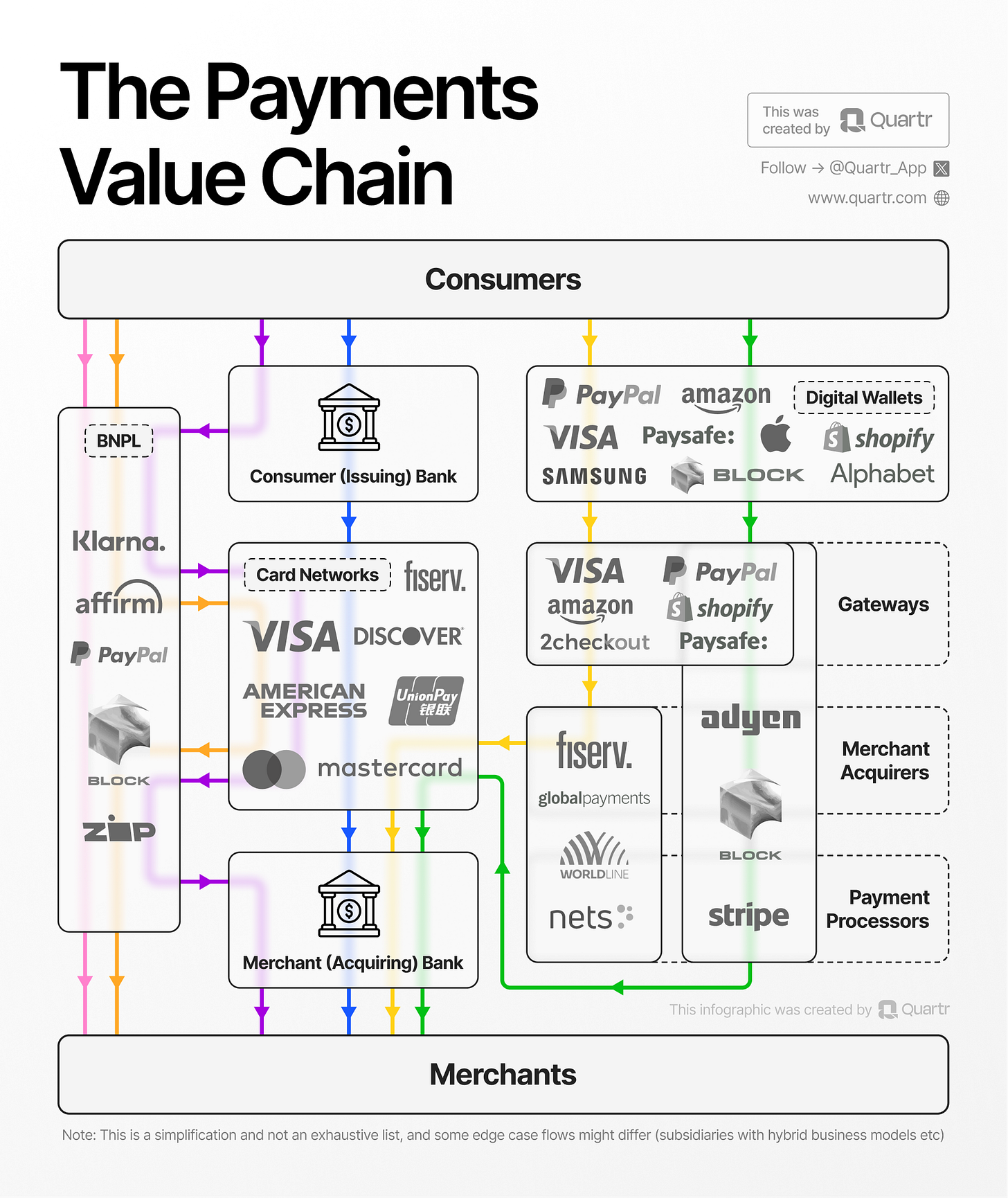

Visa sits at the center of global commerce. Every card swipe, tap, and online transaction routed over its network generates revenue with minimal incremental cost for Visa. The company benefits from powerful two-sided network effects connecting consumers, merchants, issuers, and acquirers. As cash continues to disappear and digital payments expand into new use cases (e-commerce, cross-border, subscriptions, B2B payments), Visa compounds relentlessly. Value-added services such as fraud prevention, tokenization, and data analytics further deepen customer lock-in and revenue growth potentail.

Fundamentals: Growth & ROIC

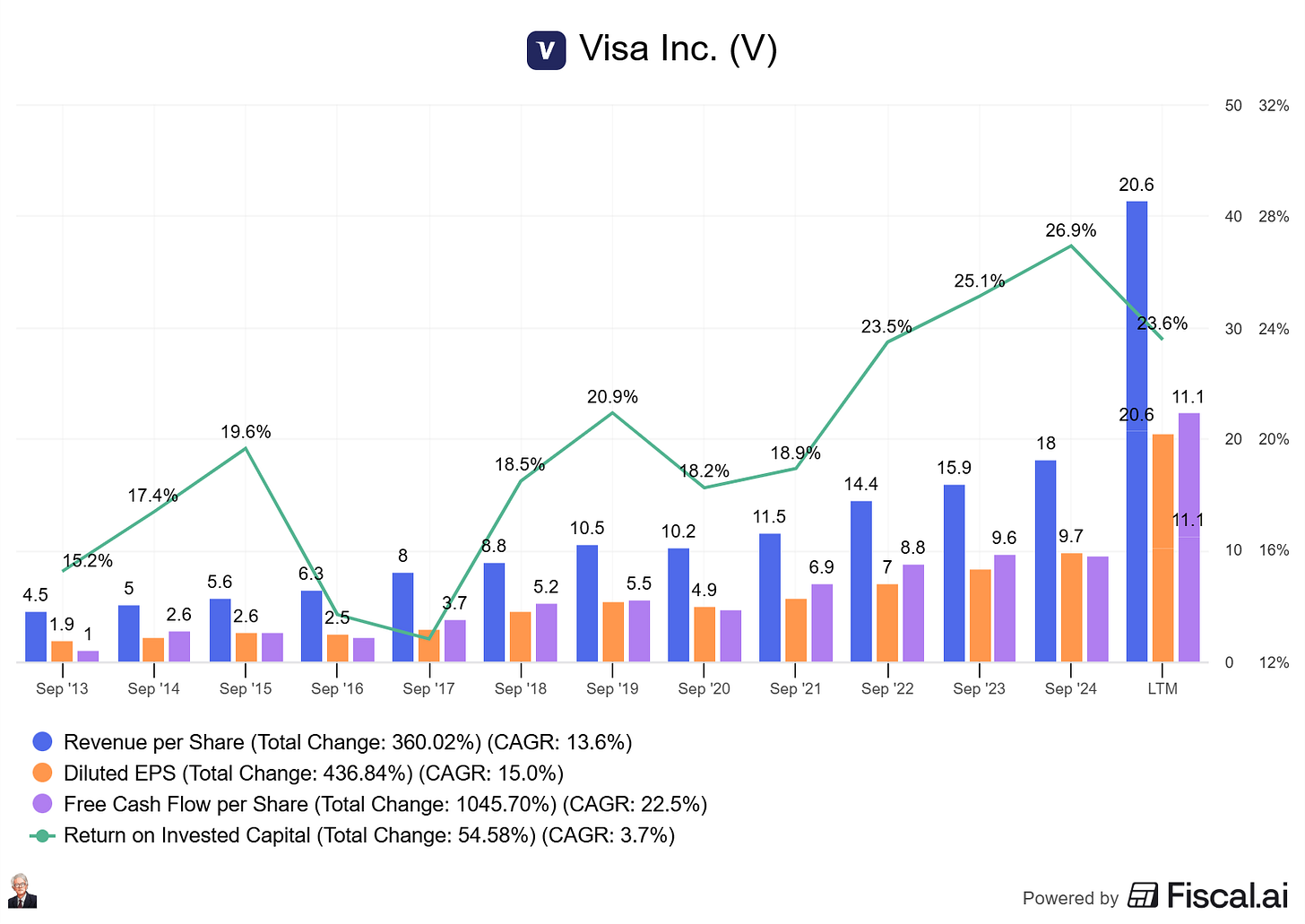

Visa has compounded revenue at a low-to-mid-teens rate over the long term, driven by global payment volume growth, cross-border transactions, and pricing discipline. Operating leverage is extreme: incremental transactions flow almost directly to the bottom line.

Returns on capital are exceptional. Visa generates very high ROIC, among the highest of any large public company, thanks to its capital-light model and minimal reinvestment needs. Free cash flow conversion is outstanding, enabling consistent share buybacks and dividend growth.

This is network-led compounding with near-perfect economics.

Valuation

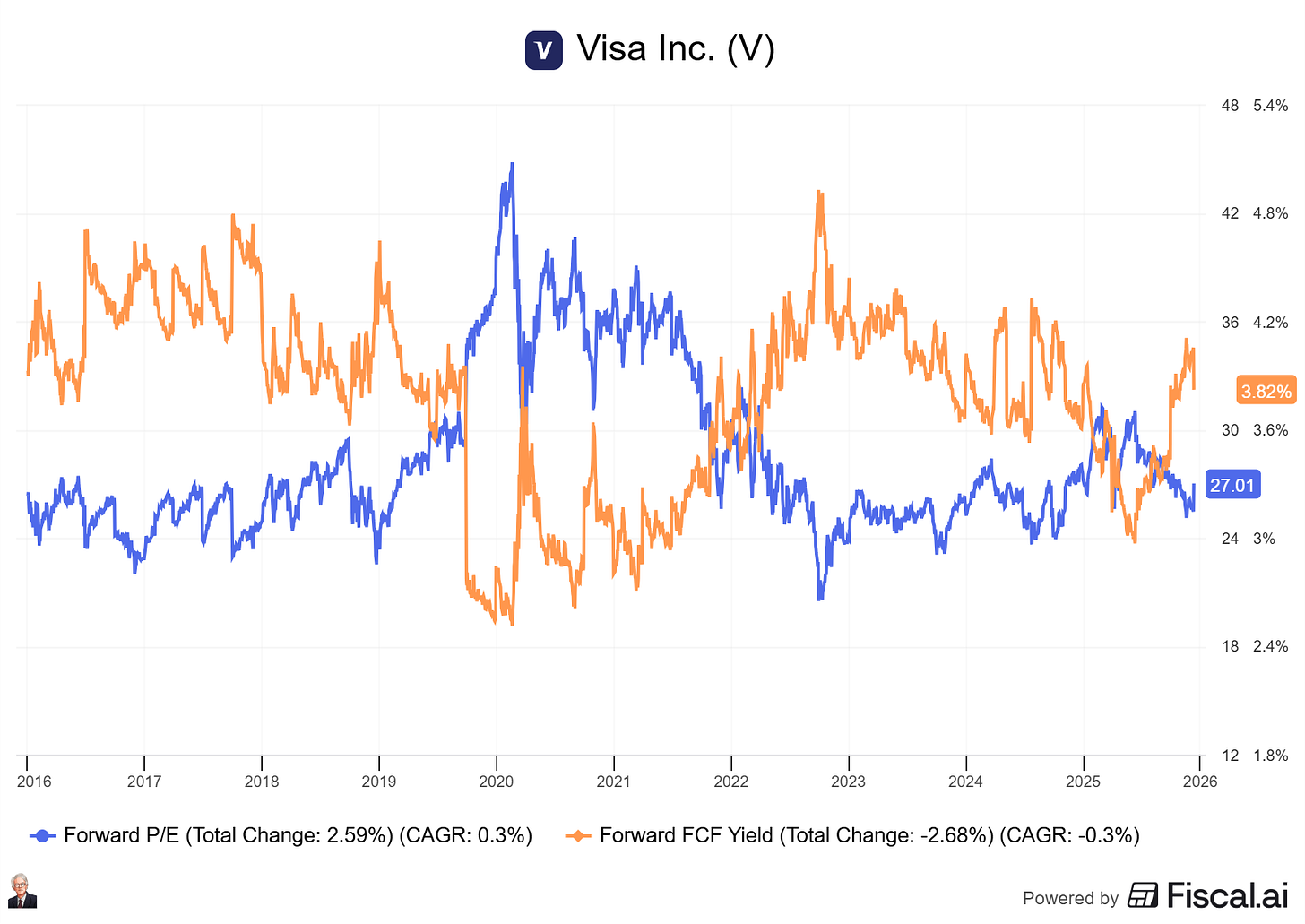

Visa typically trades at a premium multiple reflecting its stability, margins, and predictability. It rarely looks cheap, but valuation tends to be justified by long-term EPS compounding in the low-to-mid teens. Periods of market drawdowns or macro fear have historically been the best opportunities to add.

Currently, Visa is in line with historical averages with a forward PE of 27x and a FCF yield of 3.82%. Not off-putting for a stable compounder with an incredible moat.

6 Pillars of Quality Growth — Scorecard

Management: 9/10

Consistent execution, conservative risk exposure, and shareholder-friendly capital returns.

Business model: 10/10

Capital-light global toll road on payments with extreme operating leverage.

Competitive advantage: 10/10

Two-sided network effects, trust, scale, and regulatory entrenchment.

Growth: 8/10

Cash displacement and services expansion provide durable tailwinds.

Risk factors: 7/10

Regulation, pricing scrutiny, and alternative payment rails over time.

Valuation: 7/10

Usually expensive, best bought opportunistically.

Total score: 51 / 60

Conclusion

Visa is a sleep-well-at-night compounder. It doesn’t need innovation breakthroughs or heroic execution; it just needs the world to keep transacting digitally. For investors focused on durable growth, elite ROIC, and minimal business risk, Visa belongs in the very top tier of quality growth holdings.

#24:🚕Uber: The future of transportation UBER 0.00%↑

Uber Technologies is transitioning from a controversial disruptor into a global mobility and delivery platform with operating leverage. After years of subsidized growth, Uber is now proving it can compound free cash flows at scale.

Investment thesis

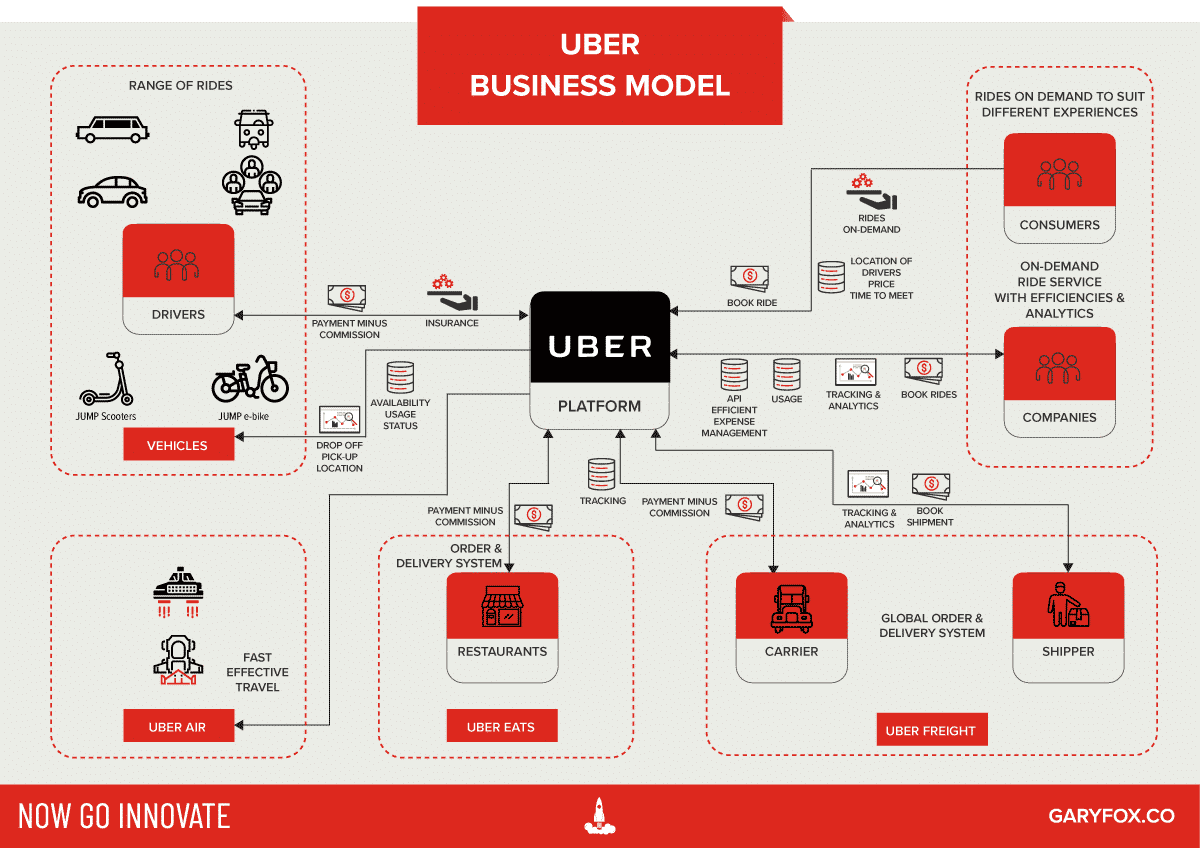

Uber’s moat is network density. More drivers reduce wait times, lower prices, and improve reliability, which attracts more riders and merchants, reinforcing the flywheel. This scale advantage is extremely hard to replicate in large cities. As the platform matures, Uber shifts from growth-at-all-costs to monetization through take rates, advertising, subscriptions, and logistics efficiency. The endgame is a capital-light marketplace extracting value from each transaction.

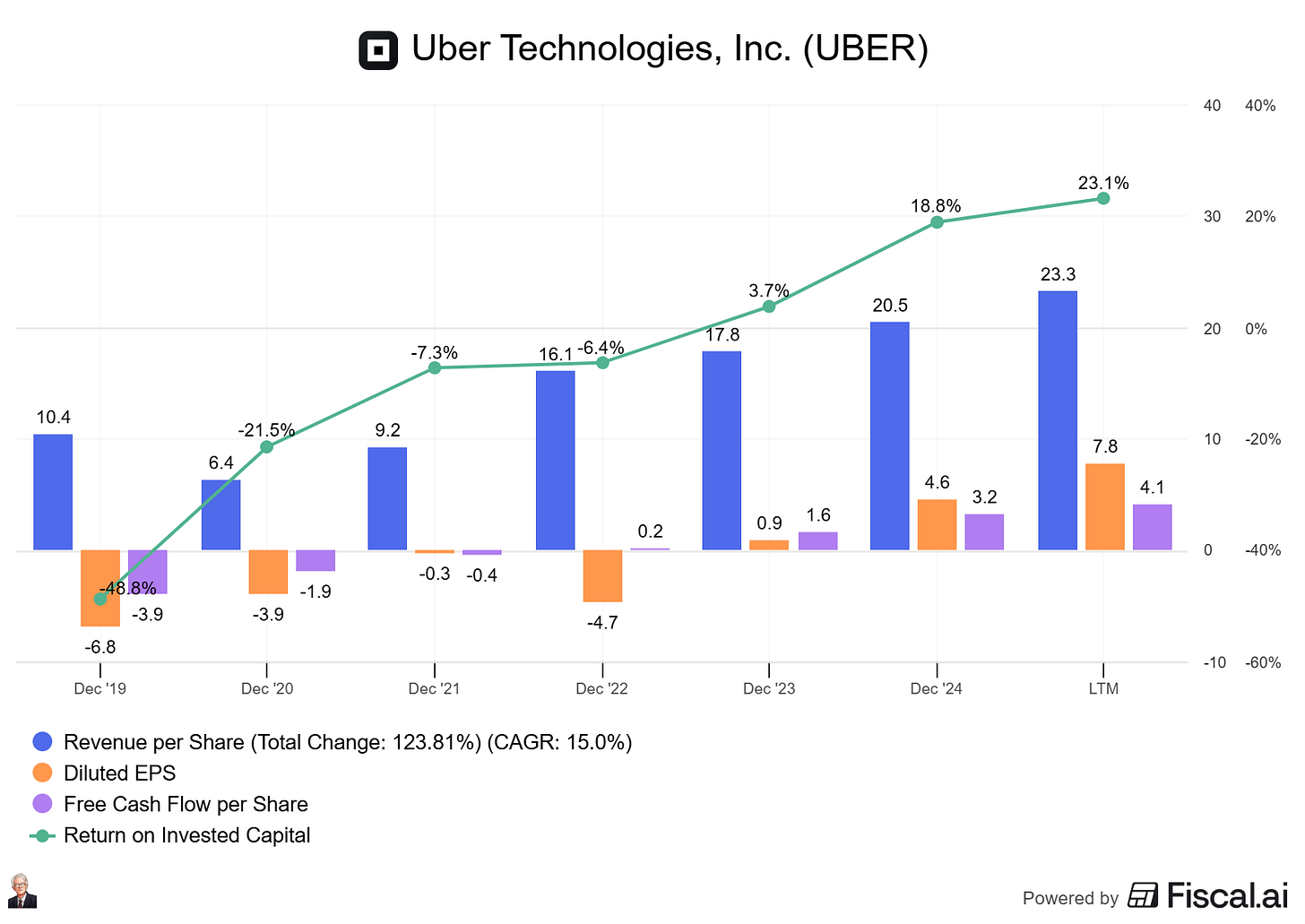

Fundamentals: Growth & ROIC

Uber has returned to high-teens revenue growth, driven by ride-hailing recovery, delivery profitability improvements, and rapid expansion of Uber Advertising. Gross bookings continue to scale while fixed costs grow more slowly, providing operating leverage.

While historical ROIC was poor due to subsidies and heavy investment, incremental ROIC is now meaningfully positive. Free cash flow has turned structurally positive, and margins continue to expand as the platform is being optimized.

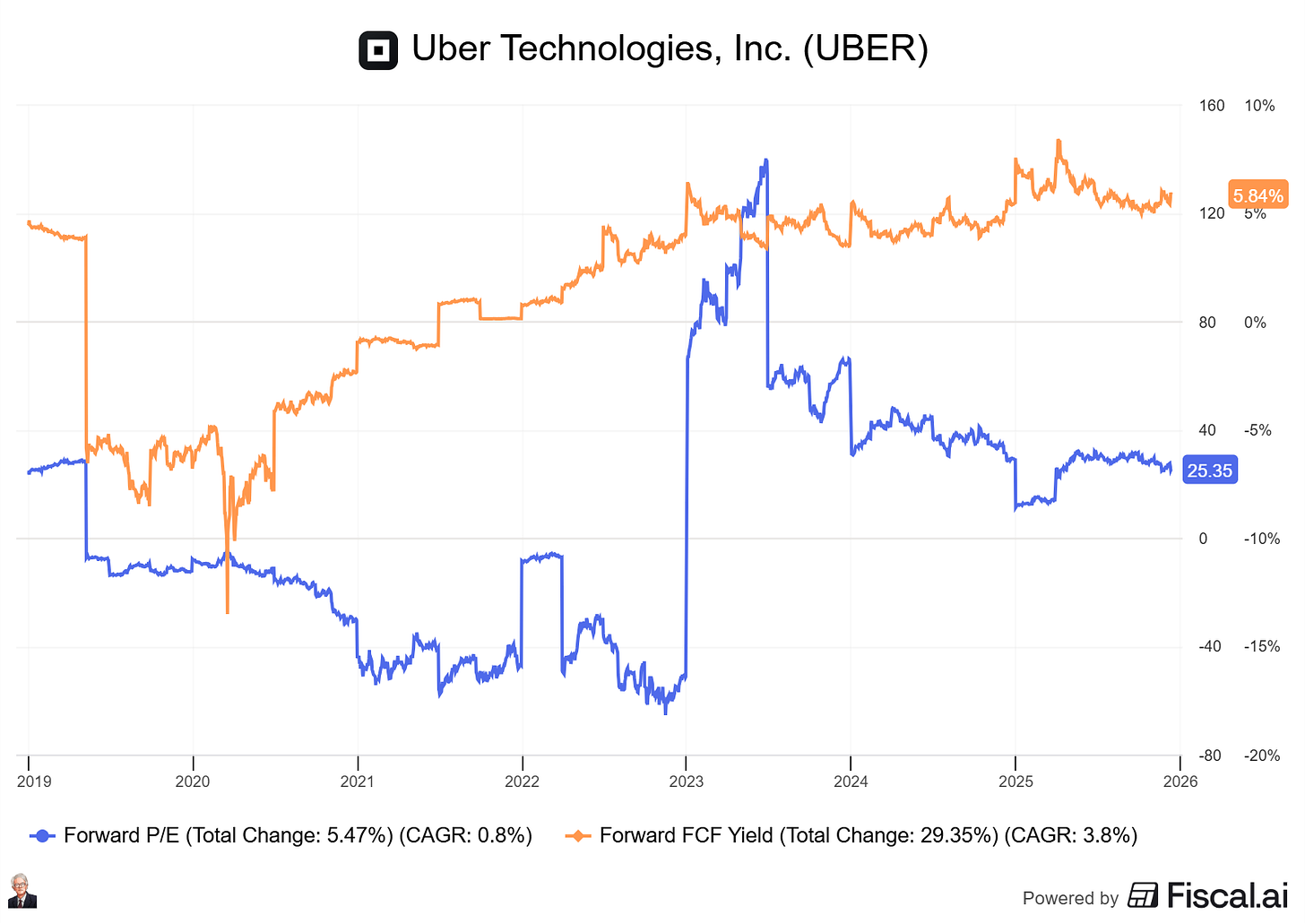

Valuation

Uber trades at a multiple that reflects improving profitability rather than peak growth. The market is still discounting execution risk and competitive pressure, but if Uber sustains mid-teens free cash flow growth, valuation remains attractive relative to platform quality and its optionality.

Forward earnings per share are currently 25x, and the FCF yield is 5.84%. A reasonable price for a platform business with multiple growth drivers (No wonder Bill Ackman likes the stock).

6 Pillars of Quality Growth — Scorecard

Management: 8/10

More disciplined, profitability-focused leadership with clearer capital allocation.

Business model: 9/10

Two-sided marketplace with capital-light economics and multiple monetization levers.

Competitive advantage: 8/10

Network density, brand, and scale, though competition remains intense.

Growth: 8/10

Urban mobility, delivery, and advertising provide multi-year runway.

Risk factors: 6/10

Regulation, labor classification, and competitive dynamics.

Valuation: 8/10

Still reasonable if the profitability trajectory continues.

Total score: 47 / 60

Conclusion

Uber is no longer a speculative story stock, it’s an emerging platform compounder. The hardest part is done: proving profitability. If management continues to execute and defend network advantages, Uber can deliver meaningful long-term compounding from a business once written off as structurally broken.

#23:🔴🟡 Mastercard: Quiet Compounder MA 0.00%↑

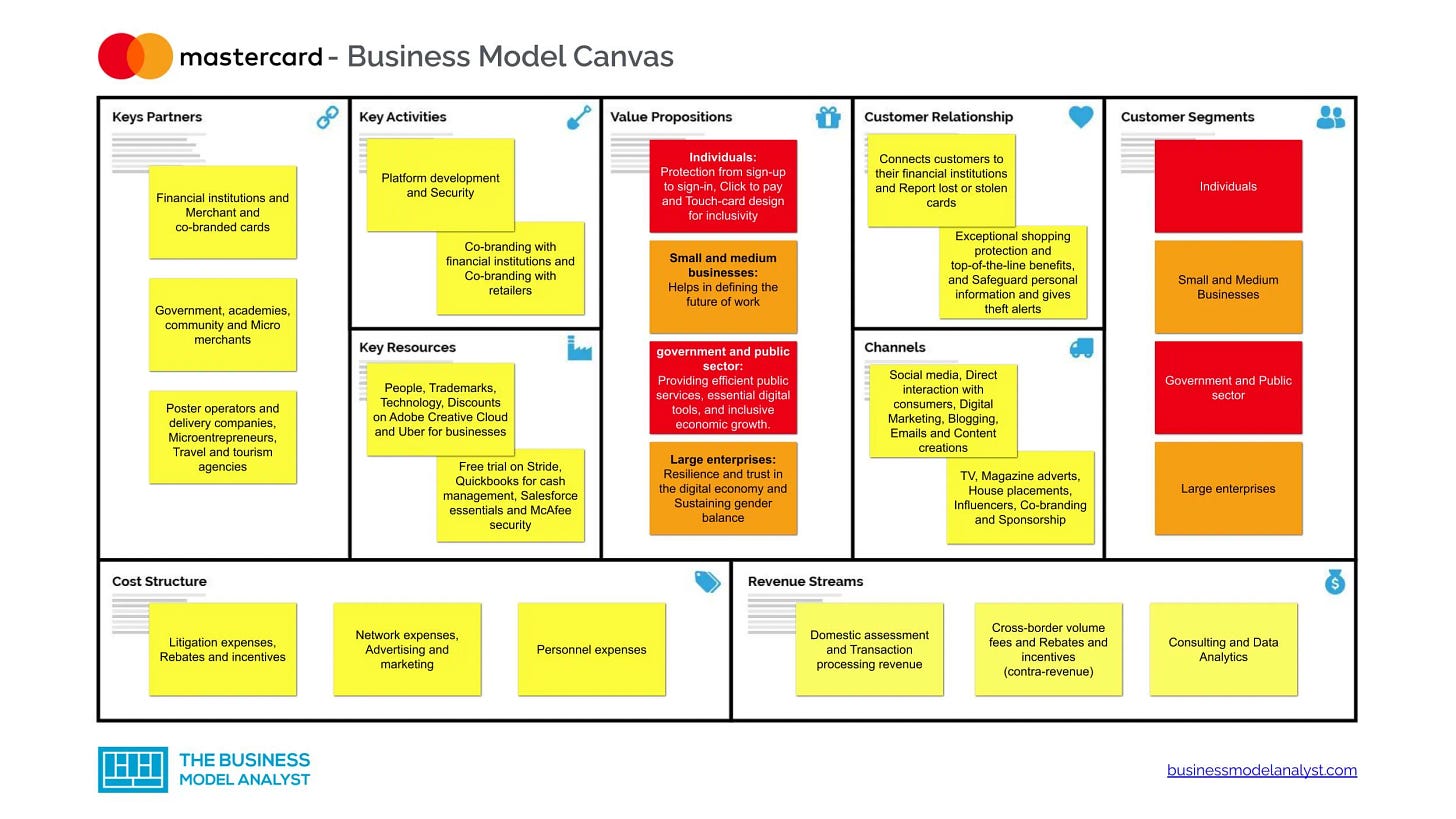

Mastercard (MA) is one of the cleanest quality compounders in global equities. It’s not a lender, it’s not taking credit risk; similar to Visa, it’s the toll road of digital commerce, earning a small fee on a growing stream of global payments.

Investment thesis

Mastercard benefits from a simple, powerful tailwind: the world keeps moving from cash to electronic payments. Every tap, swipe, and online checkout expands Mastercard’s payment volume. The moat is structural: a two-sided network connecting consumers, merchants, banks, and fintechs. As the network scales, it becomes more valuable, harder to displace, and increasingly embedded in the global financial system. Beyond the core card rails, Mastercard is expanding into higher-value services like fraud prevention, cybersecurity, identity, and data analytics to drive the next phase of profitable growth.

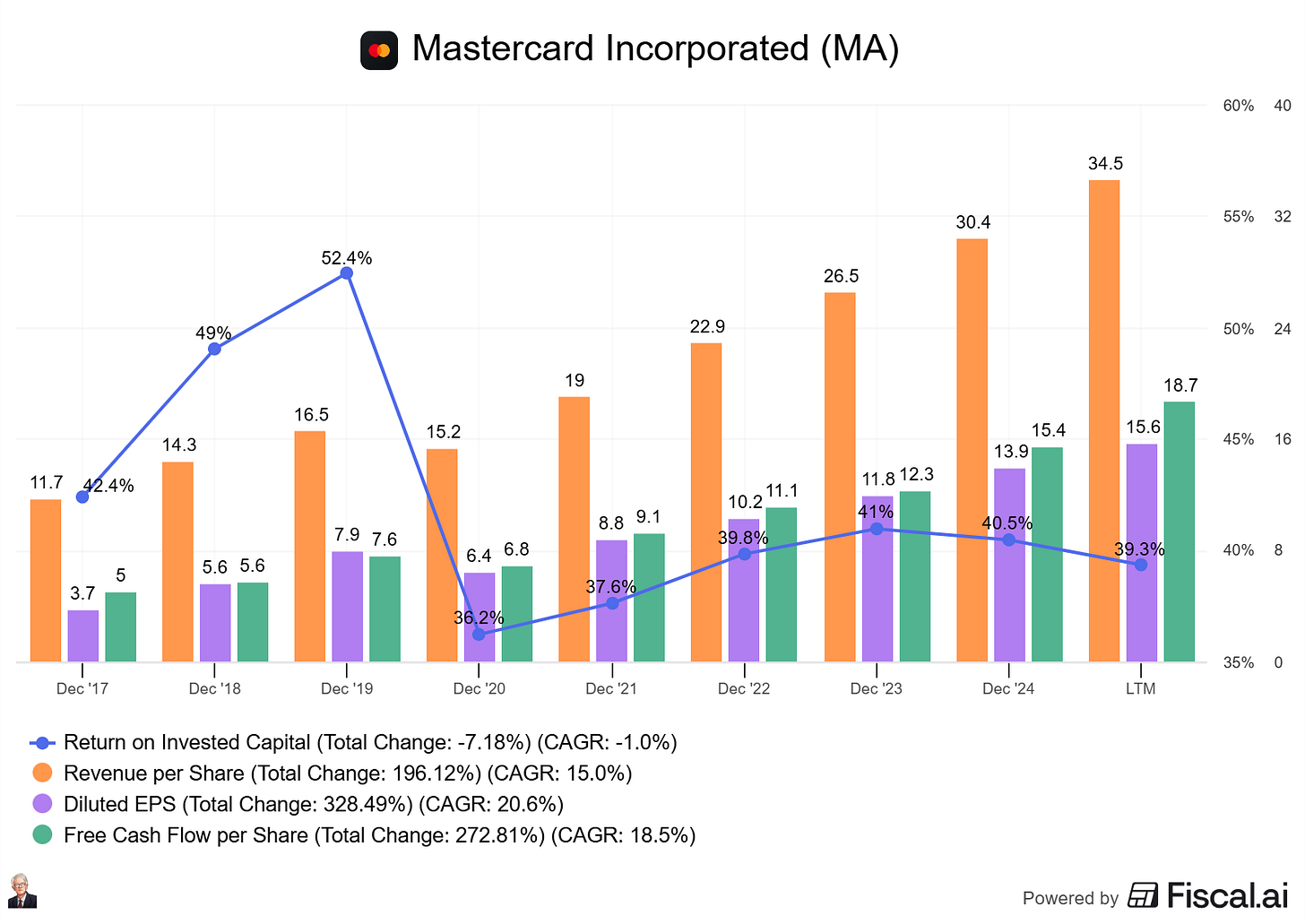

Fundamentals: Growth & ROIC

Mastercard has compounded revenue at a low-to-mid teens rate over the long term, driven by payment volume growth, cross-border recovery/expansion, and steady take-rates. The business is inherently scalable: incremental transactions require minimal incremental cost.

Returns on capital are elite. Mastercard generates very high ROIC due to capital-light economics, high operating margins, and strong free cash flow conversion. Capital returns are shareholder-friendly, with consistent buybacks and dividend growth supported by durable cash generation.

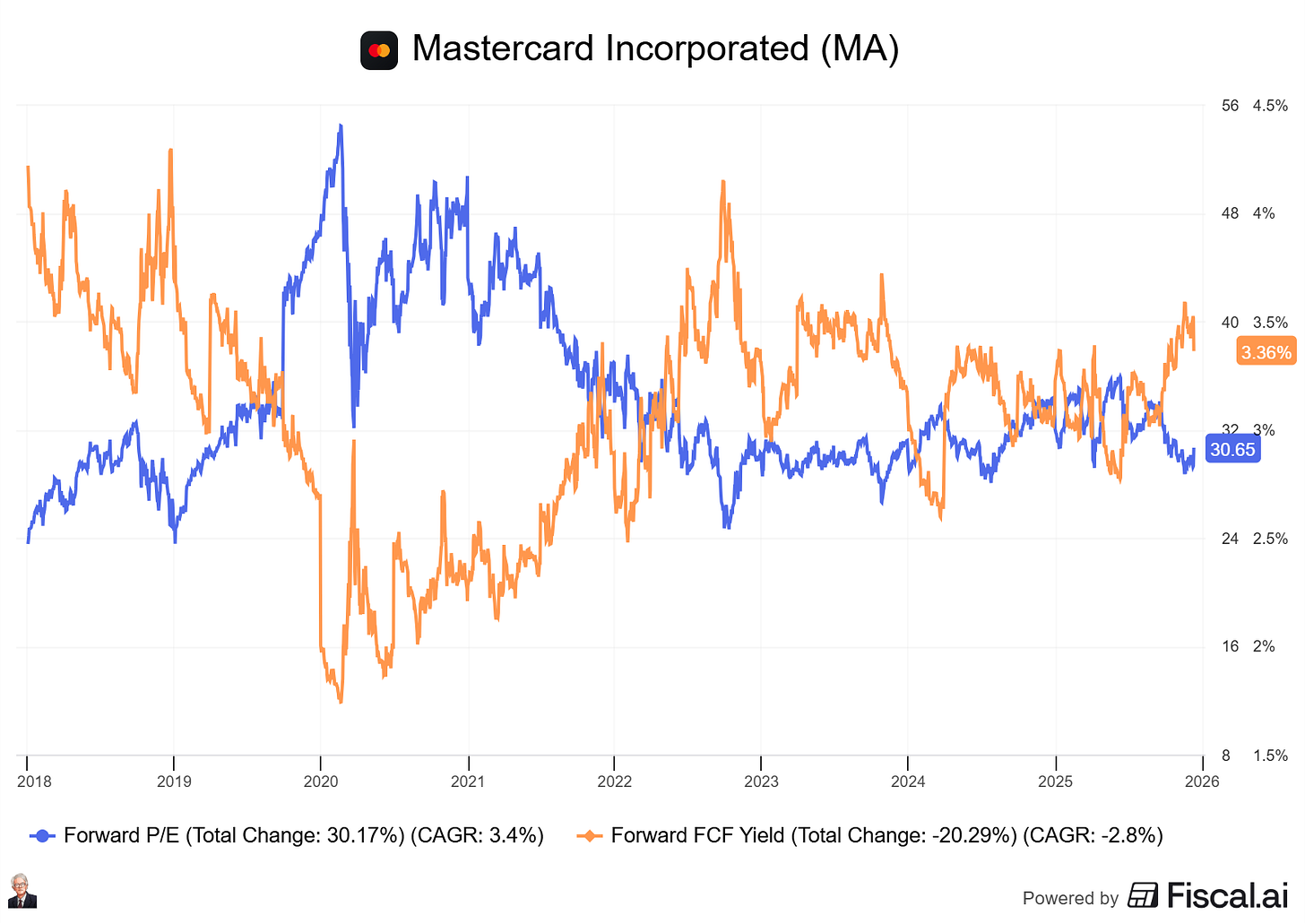

Valuation

Mastercard typically trades at a premium multiple because the business offers rare qualities: durable growth, high margins, high ROIC, and low operational risk. The key driver of long-term returns is whether Mastercard can sustain mid-teens EPS growth through volume, pricing discipline, operating leverage, and continued services expansion. At the right entry points, it’s the kind of business you can hold for a decade and let compounding do the work.

Similar to Visa, Mastercard is trading at a historically decent valuation of 30x forward PE and 3.36% FCF yield.

6 Pillars of Quality Growth — Scorecard

Management: 9/10

Consistent execution, smart adjacencies, and shareholder-friendly capital allocation.

Business model: 10/10

Toll-collector model on global payments, asset-light, highly scalable.

Competitive advantage: 10/10

Two-sided network effects, trust, and deep integration across the ecosystem.

Growth: 8/10

Secular tailwind from cash displacement plus services growth.

Risk factors: 7/10

Regulatory scrutiny, interchange/take-rate pressure, and fintech disruption attempts.

Valuation: 7/10

Often expensive; best bought during market drawdowns.

Total score: 51 / 60

Conclusion

Mastercard is a classic quality growth compounder: a dominant network with high ROIC and long-duration tailwinds. It rarely looks cheap, but it also rarely disappoints over long horizons. If you want a “sleep-well-at-night” platform business in global finance, Mastercard is as close as it gets.

#22:🖥️ Microsoft: The king of platform lock-in MSFT 0.00%↑

Microsoft (MSFT) is one of the most durable compounders in global equities. It combines a rare mix of platform lock-in, recurring revenue, and distribution power. Microsoft is now layering AI monetization on top of an already elite business.

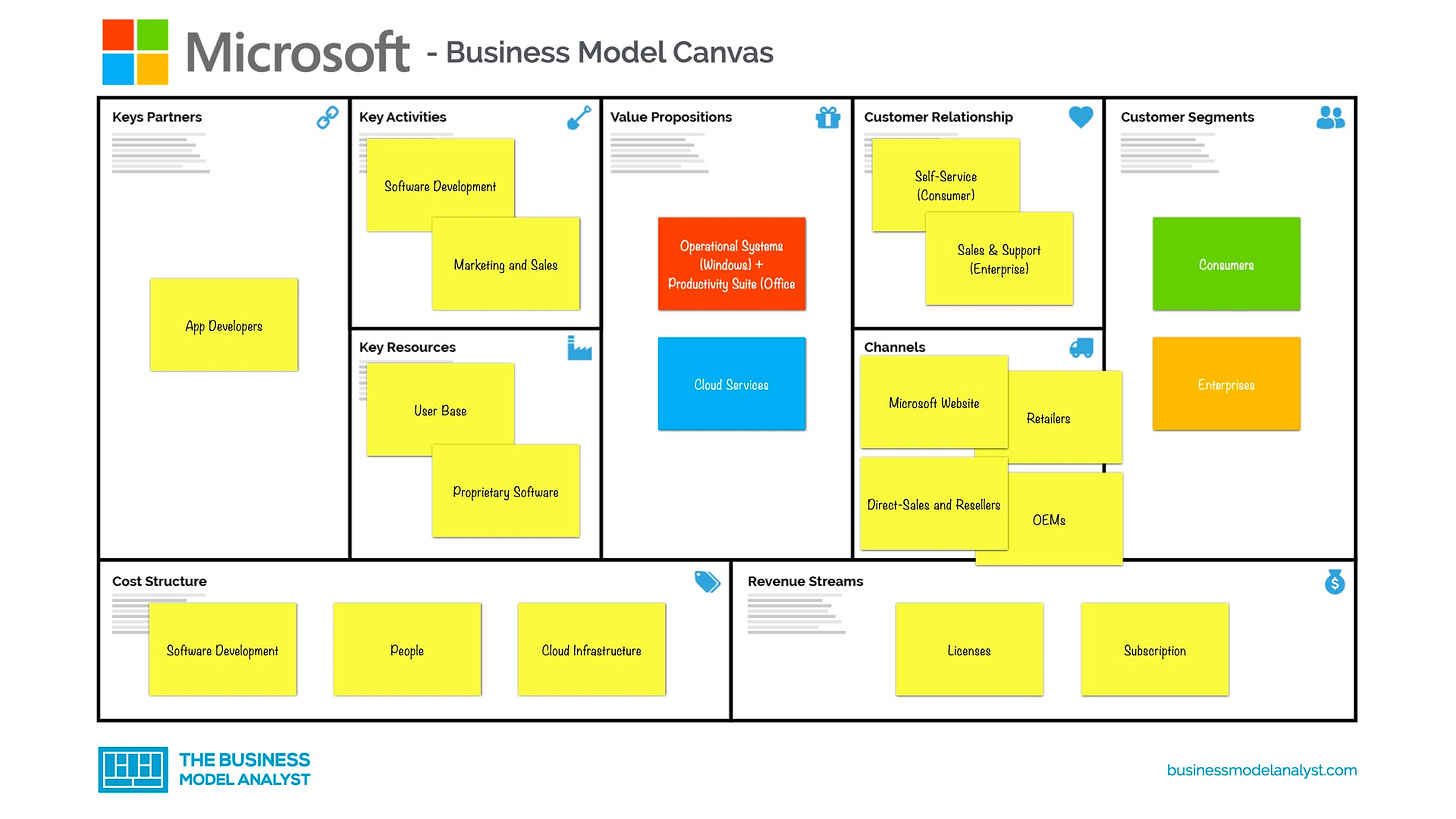

Investment thesis

Microsoft owns the modern enterprise stack: productivity (Microsoft 365), identity/security (Entra + Defender), infrastructure (Azure), developer tools (GitHub), and business applications (Dynamics). These products are deeply embedded in workflows, making switching costly and risky. The AI wave is additive: Microsoft can monetize through Copilot upsells, Azure AI consumption, and deeper platform dependence, while its distribution (hundreds of millions of users) gives it a structural advantage most AI-native challengers lack.

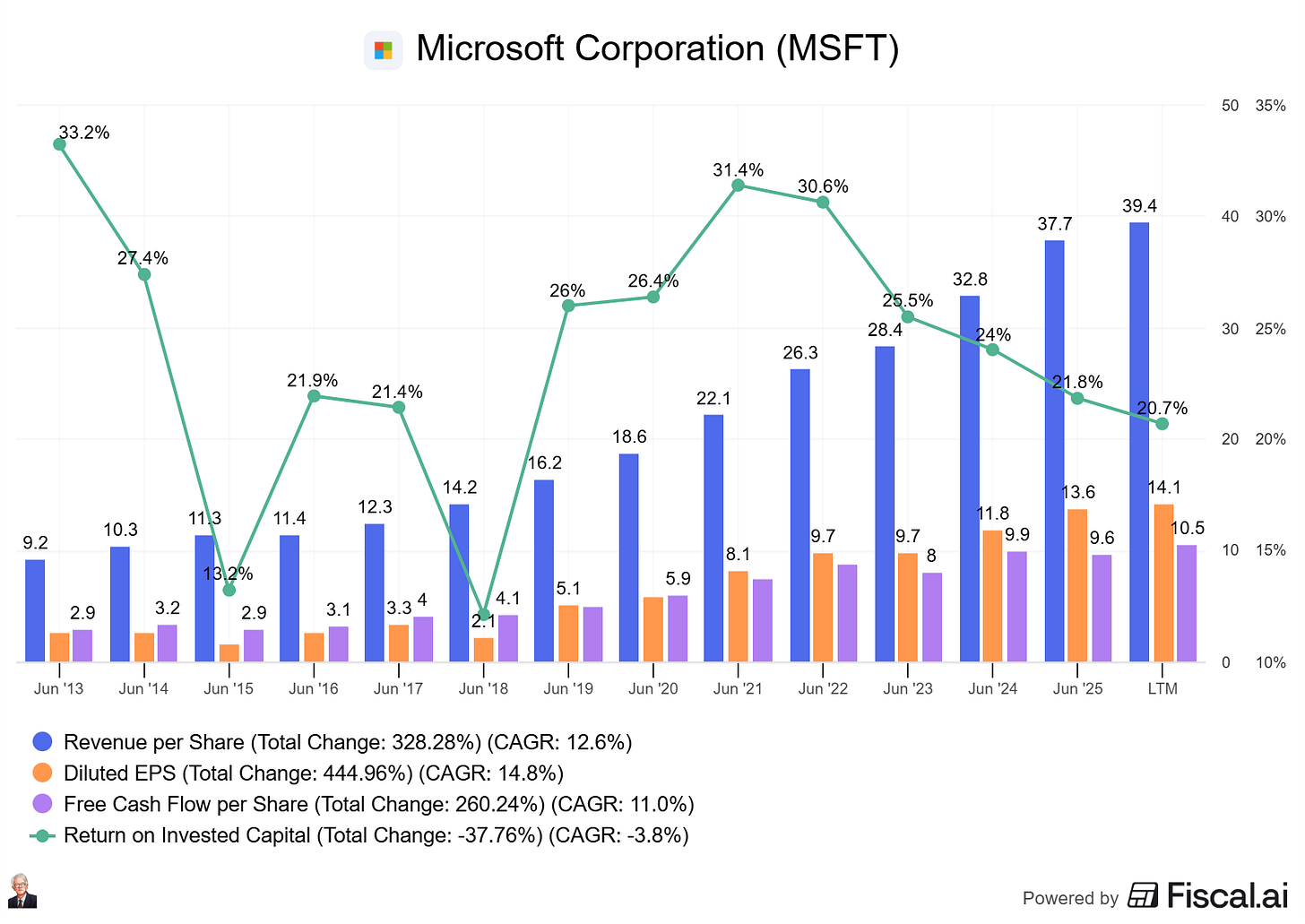

Fundamentals: Growth & ROIC

Microsoft compounds through a blend of steady top-line growth and expanding monetization per customer. Azure remains the primary growth engine, while Microsoft 365 and security continue to deliver highly predictable recurring revenue.

Returns on capital are consistently exceptional. Microsoft generates very high ROIC because the business is largely software and cloud services with massive operating leverage. Free cash flow is enormous, resilient, and increasingly flexible. This is funding buybacks, dividends, and ongoing AI/data center investment without compromising the balance sheet.

This is platform-led compounding with AI optionality.

Valuation

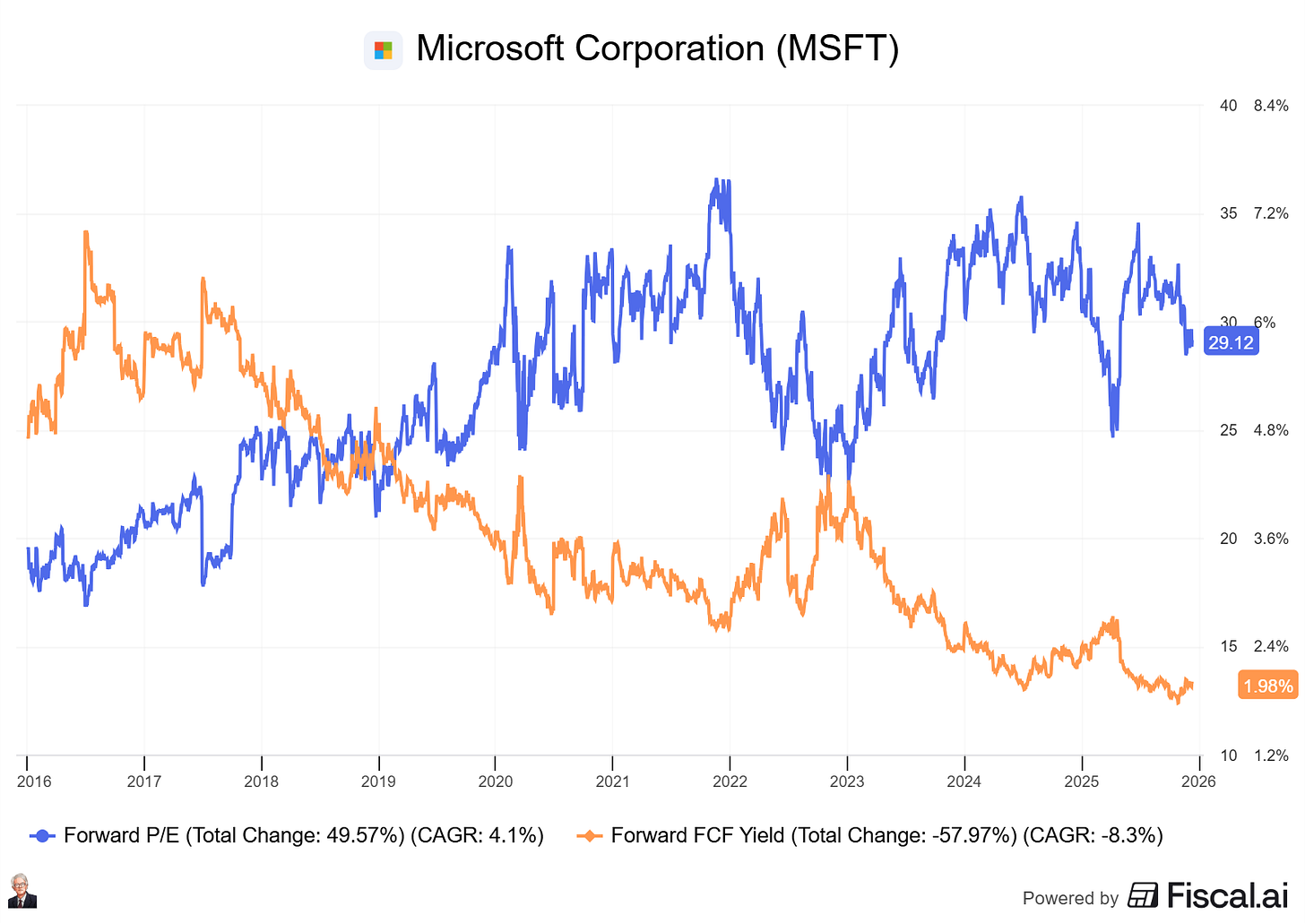

Microsoft typically trades at a premium multiple reflecting its quality, durability, and growth. The key question is not whether it is “cheap,” but whether earnings can compound at a mid-teens rate as AI monetization scales. If Copilot attach rates and Azure consumption expand over the next 3–5 years, today’s valuation can still deliver strong long-term returns.

That said, Microsoft cannot be considered cheap with a current Forward PE of 29x and a FCF yield of 1.98%. While not unreasonable, it is close to its top multiple levels.

6 Pillars of Quality Growth — Scorecard

Management: 9/10

Execution-focused culture, strong capital allocation, and clear strategic direction.

Business model: 10/10

Recurring revenue flywheel across productivity, cloud, and security with high operating leverage.

Competitive advantage: 10/10

Switching costs, distribution, ecosystem lock-in, and enterprise trust.

Growth: 8/10

Large base moderates growth, but Azure + security + AI provide a long runway.

Risk factors: 7/10

Regulatory scrutiny, cloud competition, and AI capex intensity.

Valuation: 7/10

Premium multiple; requires continued execution and AI monetization to justify.

Total score: 51 / 60

Conclusion

Microsoft is a high-quality platform compounder that keeps finding new ways to monetize its distribution. AI doesn’t need to “change everything” for MSFT; it only needs to increase revenue per user and consumption per workload. With elite fundamentals and multiple growth engines, Microsoft remains a cornerstone name in any long-term quality growth portfolio.

#21:🖥️ Vitec Software: Vertical market software compounder of Sweden $VIT.ST

Vitec Software Group (VIT B) is a Scandinavian vertical market software compounder built on a simple, proven playbook: own mission-critical niche software, keep customers for a long time, and compound through disciplined acquisitions + steady product reinvestment.

Investment thesis

Vitec wins by being boring and essential. It sells standardized software into narrow verticals where switching is painful, churn is low, and pricing is rational. The company then adds a Constellation-like layer: acquire high-quality niche vendors, decentralize operations, and reinvest for the long term.

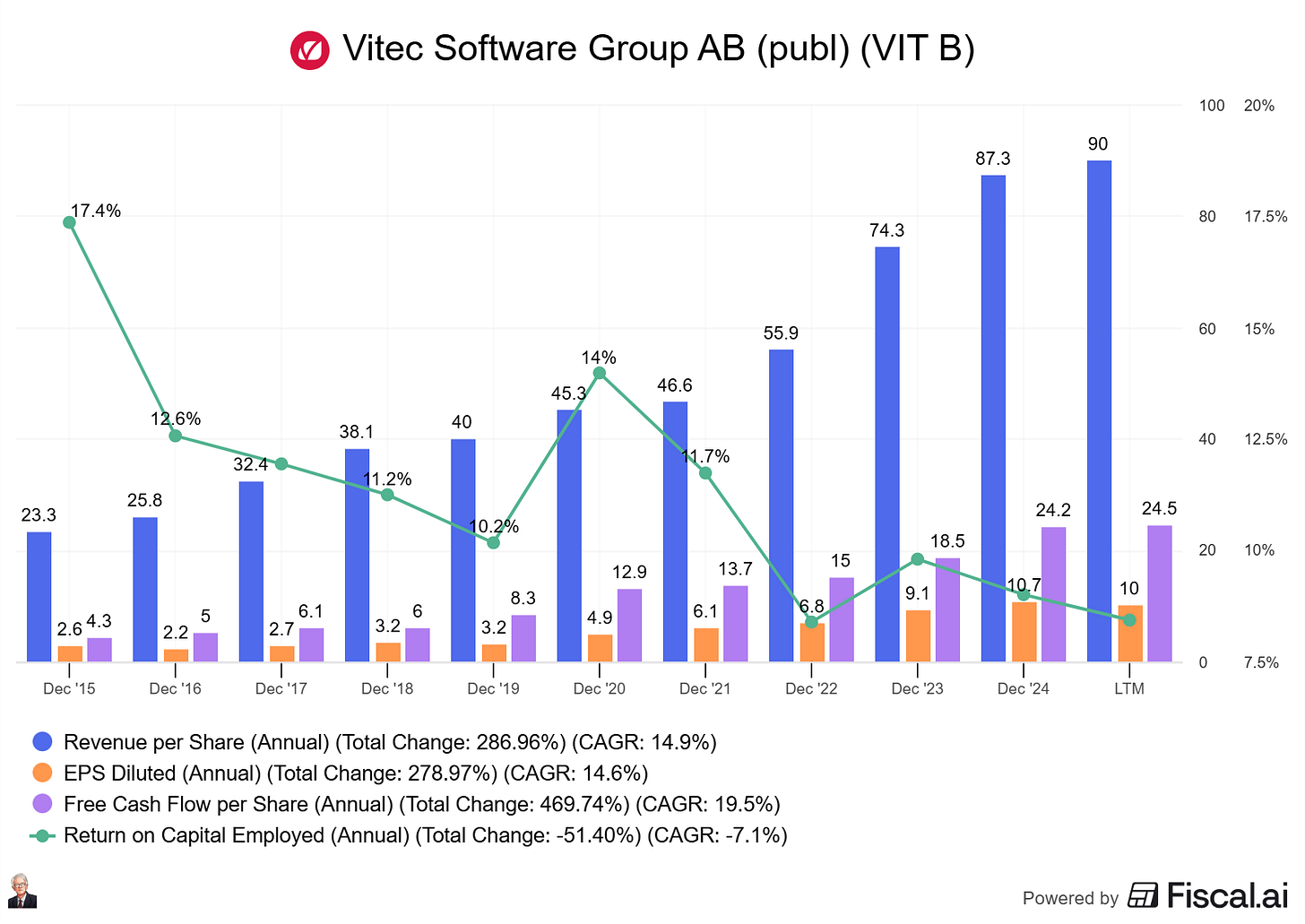

Fundamentals: Growth & ROIC

Vitec continues to compound with a high recurring revenue base and acquisition-driven scale. Recent results show strong revenue growth, a high recurring revenue mix, and healthy operating margins. On returns on capital, the business economics are strong, though reported ROIC can vary depending on how capitalized acquisitions are treated, the underlying cash returns from recurring revenue, and high margins are attractive.

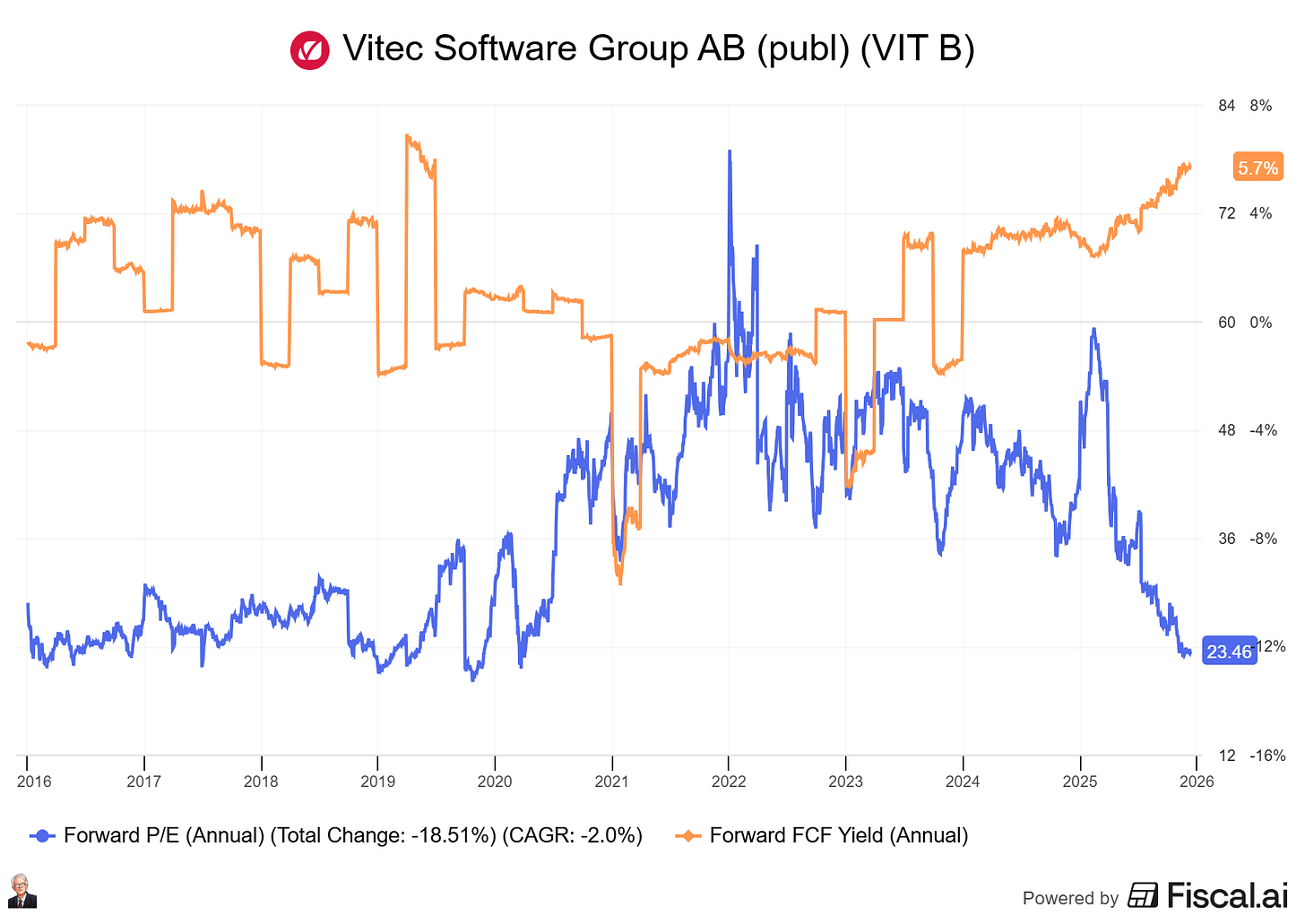

Valuation

Vitec trades at a multiple that reflects its recurring revenue quality, durable margins, and long acquisition runway. It’s not a deep value multiple, but levels typically paid for high-quality vertical software with predictable cash flows.

Vitec’s recent fall has put multiples into multi-year low levels, with a Forward PE of 23x and a FCF yield of 5.7%. The business is looking attractive.

6 Pillars of Quality Growth — Scorecard

Management: 8/10

Steady long-term culture and clear acquisition discipline.

Business model: 9/10

Vertical market software with high recurring revenue and sticky workflows.

Competitive advantage: 8/10

Switching costs + niche focus + portfolio resilience (not a single-product story).

Growth: 8/10

Proven M&A engine plus ongoing reinvestment in the product portfolio.

Risk factors: 7/10

Acquisition execution risk, integration/culture drift, and the classic “paying up” risk in vertical market software deals.

Valuation: 8/10

Fair for quality; can look rich if growth slows or deal economics deteriorate.

Total score: 48 / 60

Conclusion

Vitec is an unknown Nordic compounder: recurring revenue, strong margins, and a long runway for niche software consolidation. It rarely screens cheap, but if you want durable compounding driven by mission-critical software + disciplined capital allocation, Vitec fits the quality growth mold.

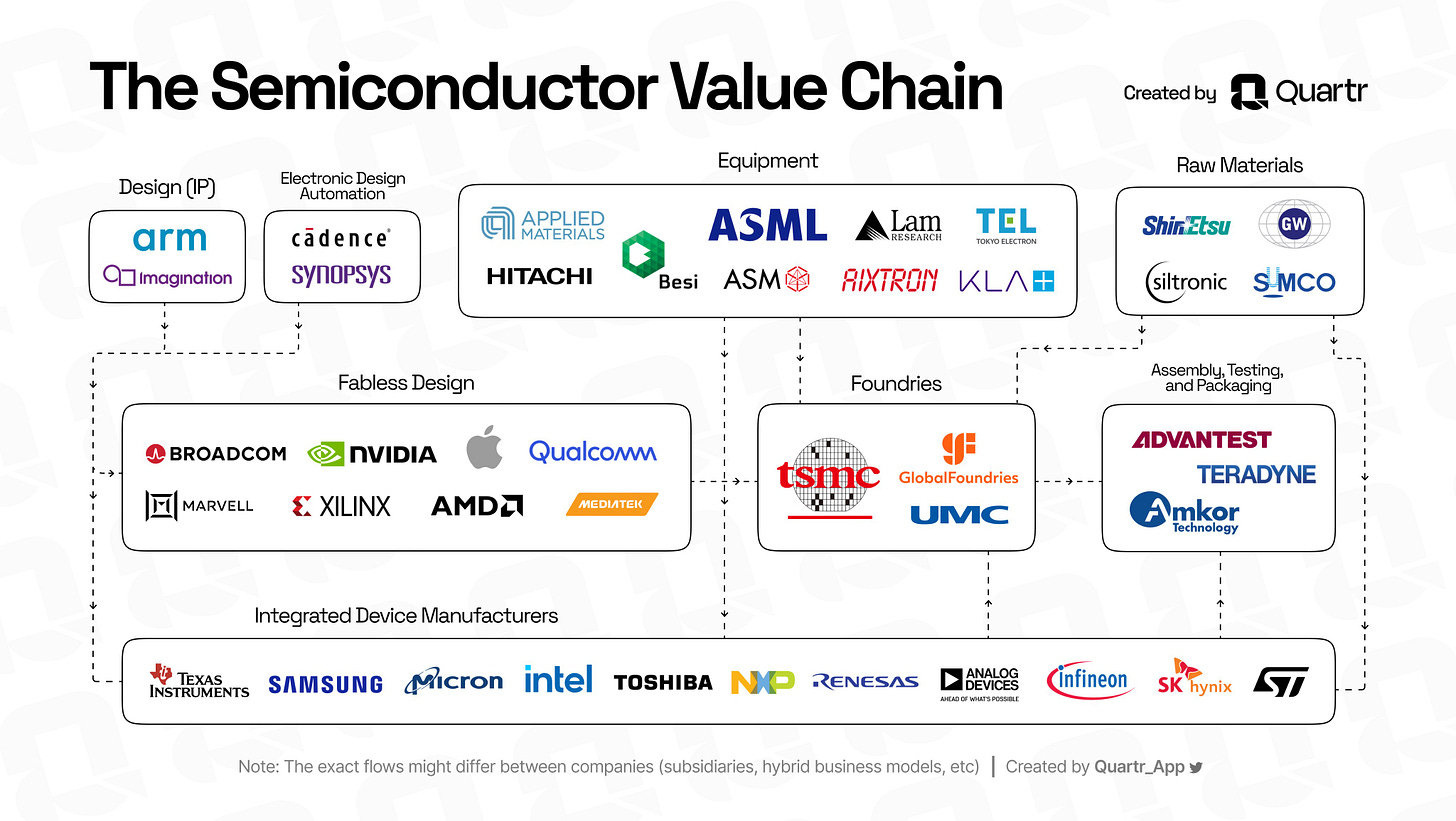

#20:💽 Broadcom: The hidden AI-winner AVGO 0.00%↑

Broadcom (AVGO) is one of the most misunderstood mega-cap compounders in technology. What looks like a diversified semiconductor company is, in reality, a cash-generative infrastructure platform spanning custom silicon, connectivity, and mission-critical enterprise software.

Investment thesis

Broadcom’s edge is focus and discipline. In semiconductors, it dominates high-value niches such as networking, custom accelerators, RF, and connectivity. These are areas where performance, reliability, and long design cycles create deep customer lock-in. In software, Broadcom owns deeply embedded enterprise assets with high switching costs and recurring revenue. The combination produces predictable cash flows that management aggressively reinvests into acquisitions, dividends, and buybacks.

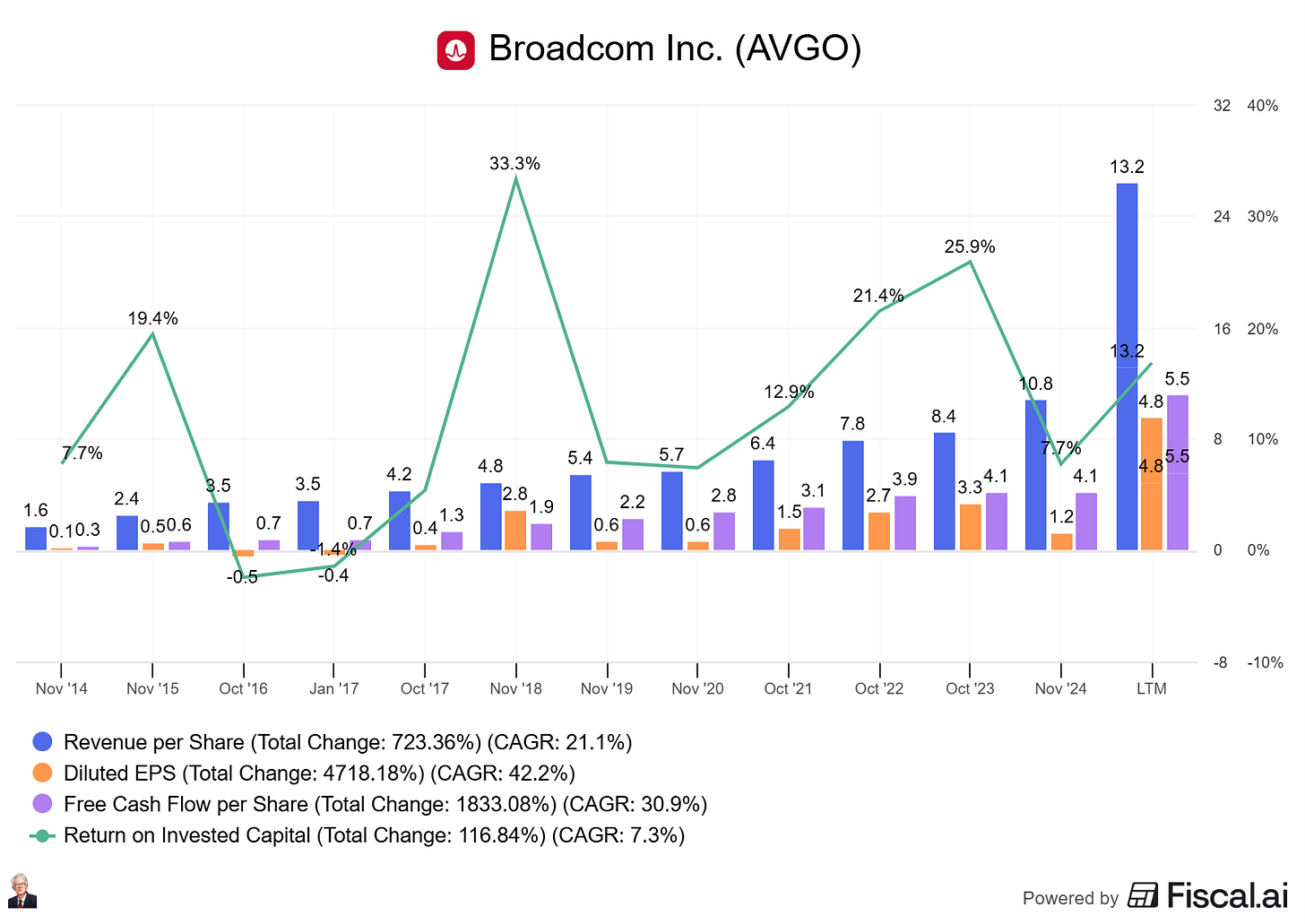

Fundamentals: Growth & returns

Broadcom has grown revenue at a mid-teens CAGR over the past decade, driven by strategic M&A and share gains in infrastructure silicon. AI networking and custom ASIC demand have become powerful growth drivers, particularly with hyperscale customers.

Despite operating in capital-intensive markets, Broadcom consistently generates ROIC in the 30%+ range. Operating margins exceed 50%, among the highest in semiconductors, reflecting pricing power, disciplined cost control, and a portfolio skewed toward high-value products. Free cash flow conversion is exceptional, supporting rapid shareholder returns.

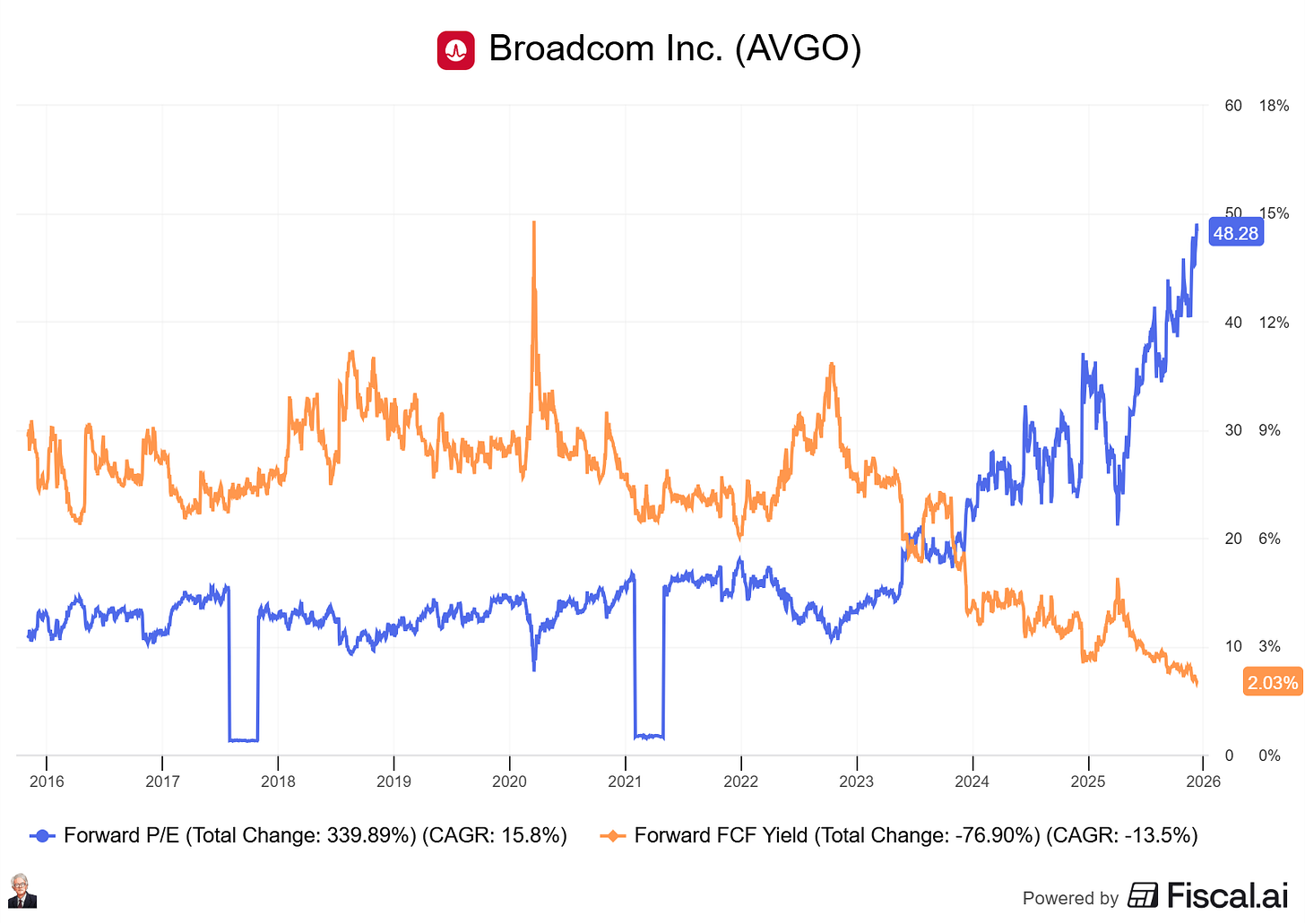

Valuation

Broadcom trades at approximately 48x forward earnings, a premium to many peers. The market justifies the price due to Broadcom’s earnings durability, AI exposure, and its sustained high capital returns. Free cash flow yield is currently 2.03%. A high price for a business that is well-positioned in the AI race.

6 Pillars of Quality Growth — Scorecard

Management: 9/10

Best-in-class capital allocation under a disciplined, shareholder-focused leadership team.

Business model: 9/10

High-value semiconductor franchises combined with recurring enterprise software revenue.

Competitive advantage: 9/10

Customer lock-in, long design cycles, and scale in critical infrastructure markets.

Growth: 8/10

AI and networking tailwinds offset maturity in some end markets.

Risk factors: 7/10

Customer concentration, cyclicality, and integration risk from acquisitions.

Valuation: 8/10

Fair relative to quality, cash generation, and long-term earnings power.

Total score: 50 / 60

Conclusion

Broadcom is a cash-flow compounding machine disguised as a semiconductor conglomerate. It won’t win innovation headlines, but it consistently wins on returns, discipline, and durability. For investors seeking high ROIC, cash flow growth, and infrastructure moats, Broadcom remains a strong quality growth holding.

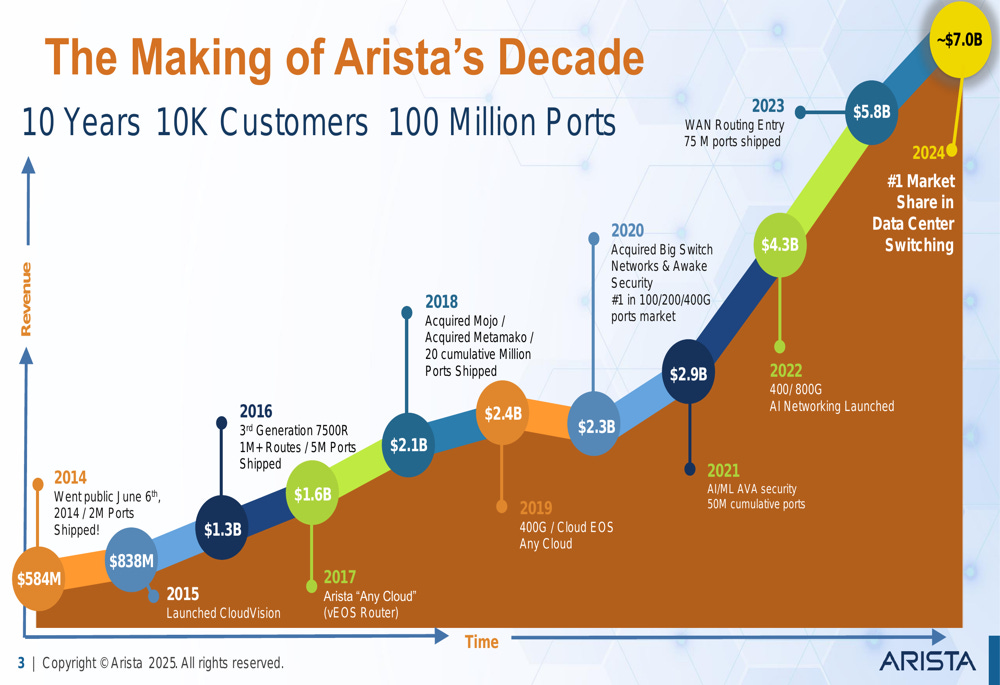

#19:🛜Arista Networks: Enterprise networking ANET 0.00%↑

Arista Networks (ANET) is one of the highest-quality compounders in enterprise networking. Often mistaken for a cyclical hardware vendor, Arista is in reality a software-driven infrastructure platform at the heart of cloud and AI data center buildouts.

Investment thesis

Arista’s edge is software-first networking. Its Extensible Operating System (EOS) runs across a common hardware platform, allowing customers to scale networks with reliability, automation, and low operational friction. Hyperscalers and large enterprises value Arista’s openness, speed of innovation, and stability, creating deep switching costs. As AI workloads explode, demand for high-speed, low-latency networking plays directly into Arista’s strengths.

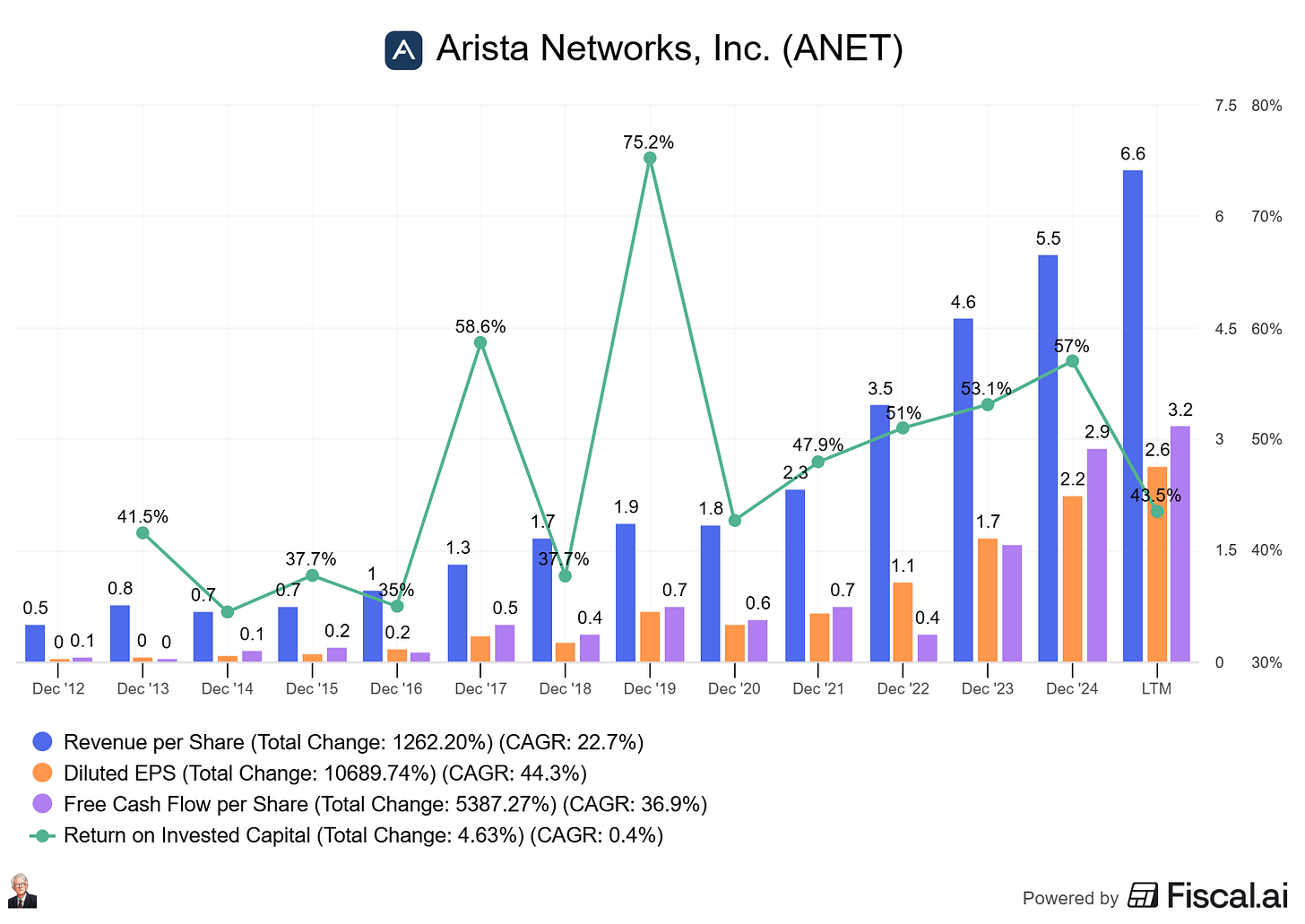

Fundamentals: growth & returns

Arista has compounded revenue at a 22%+ CAGR over the past decade, driven by cloud data center adoption and market share gains from legacy incumbents. More recently, AI-driven networking demand has become a major incremental growth driver.

The business consistently generates ROIC in the 35–45% range, supported by asset-light manufacturing, strong pricing discipline, and software leverage. Gross margins are structurally high, and free cash flow conversion is excellent.

This is infrastructure-led compounding with software economics.

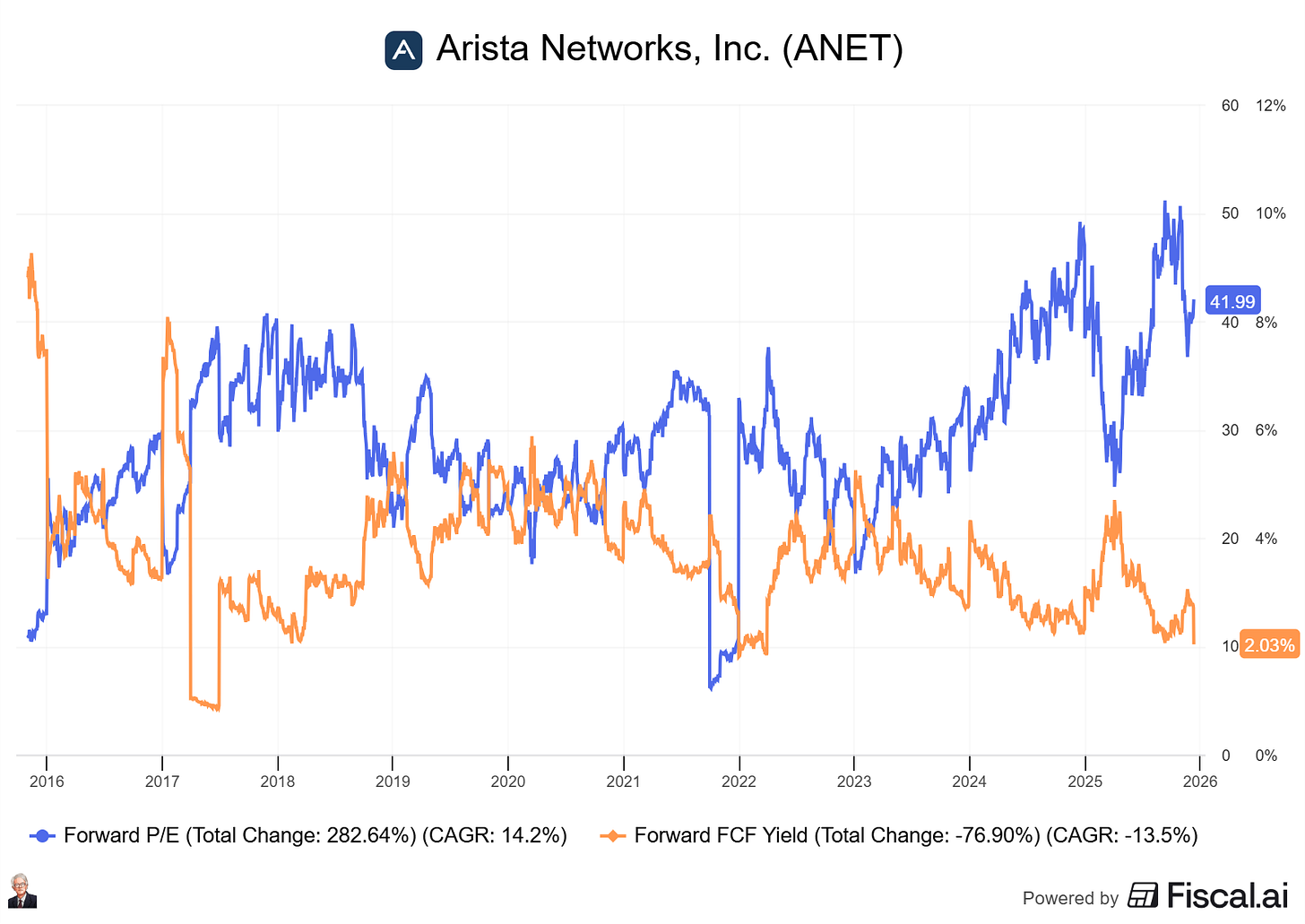

Valuation

Arista trades at approximately 42x forward earnings, reflecting strong growth expectations tied to AI infrastructure. While not cheap, valuation is justified by the market due to Arista’s balance sheet strength, margin profile, and long-term growth runway.

6 Pillars of Quality Growth — Scorecard

Management: 9/10

Founder-led, engineering-driven culture with disciplined execution.

Business model: 9/10

Software-centric networking platform with recurring customer expansion.

Competitive advantage: 9/10

Switching costs, performance leadership, and hyperscaler trust.

Growth: 9/10

AI, cloud, and enterprise networking provide multi-year tailwinds.

Risk factors: 7/10

Customer concentration and capex cyclicality at hyperscalers.

Valuation: 5/10

Premium multiple requires sustained execution.

Total score: 48 / 60

Conclusion

Arista Networks is a rare infrastructure compounder that combines hardware scale with software economics. Short-term demand can fluctuate, but long-term trends in cloud and AI networking remain firmly in its favor. For investors seeking high ROIC, balance sheet strength, and AI-driven growth, Arista sits at the top tier of quality growth names.

#18:🟢Adyen: Founder-led payment compounder $ADYEY

Adyen (ADYEN) is one of the highest-quality payments infrastructure businesses in the world. Beneath short-term growth volatility sits a mission-critical, enterprise-grade platform built for global merchants with extreme scale, reliability, and long-term operating leverage.

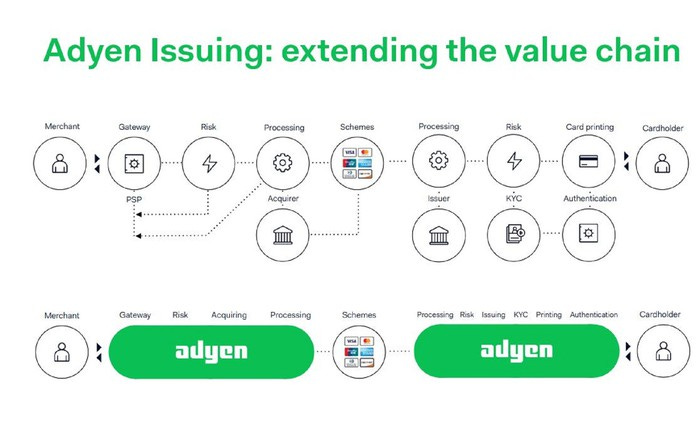

Investment thesis

Adyen’s advantage is a single-platform architecture. Unlike legacy payment processors stitched together through acquisitions, Adyen built one global stack for acquiring, issuing, and risk management. This enables better authorization rates, lower failure costs, and seamless global expansion for large merchants. As customers scale, Adyen scales with them — embedding itself deeply into payment workflows and making switching increasingly unattractive.

Fundamentals: Growth & returns

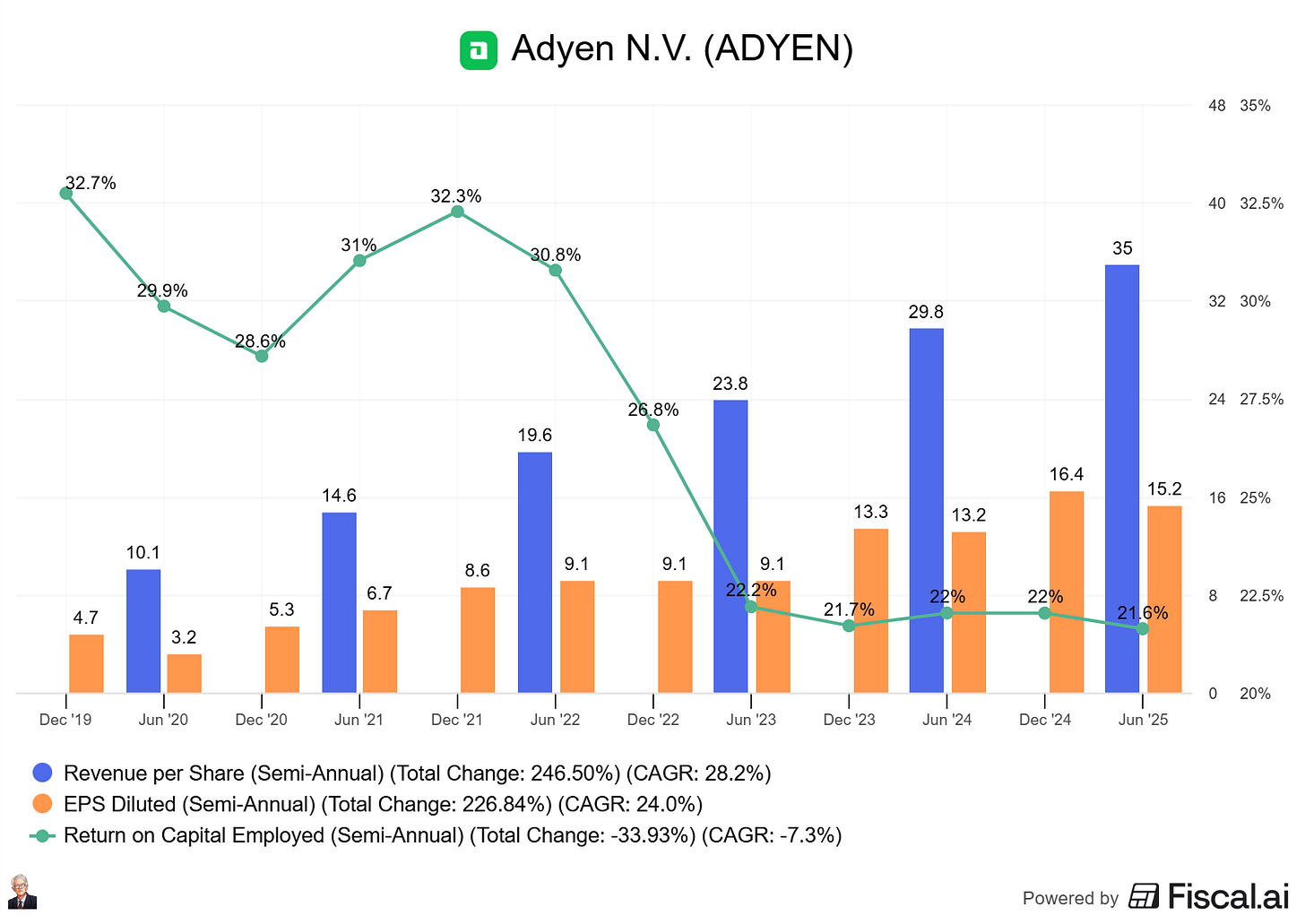

Adyen has compounded revenue at a mid-20%+ CAGR over the long term, driven by volume growth from existing merchants, new enterprise wins, and expanding use cases. Growth has recently normalized as e-commerce matured and comparisons became tougher.

Despite this, Adyen generates ROIC in the 25–35% range, exceptional for a payments infrastructure business. Operating margins remain structurally high due to platform economics and limited sales intensity. Free cash flow conversion is strong, with reinvestment focused primarily on engineering and global reach.

Valuation

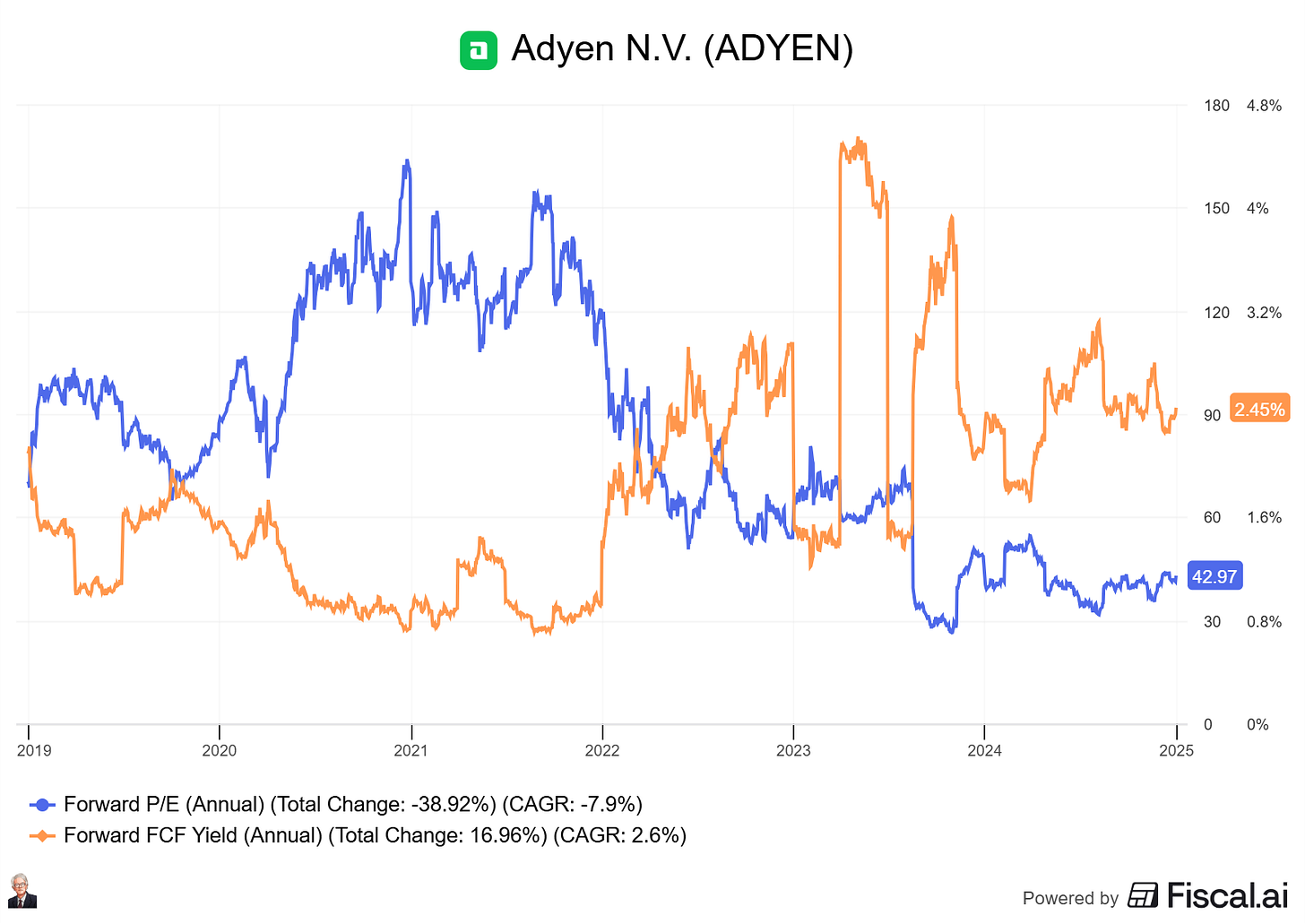

Adyen trades at approximately 43x forward earnings, well below its historical peak but still reflecting premium quality. While growth has slowed from peak levels, valuation is reasonable if Adyen returns to low-20s growth with sustained margin discipline.

Forward FCF yield is currently 2.45%, a premium that is only justified if Adyen can continue its fast-growth projectory.

6 Pillars of Quality Growth — Scorecard

Management: 9/10

Founder-led culture with long-term orientation, though recent cost signaling hurt confidence.

Business model: 9/10

Single-platform global payments infrastructure with recurring volume-based revenue.

Competitive advantage: 9/10

Superior tech stack, switching costs, and enterprise customer entrenchment.

Growth: 9/10

Large base and maturing e-commerce slow growth, but long runway remains.

Risk factors: 7/10

Pricing pressure, competition, and sensitivity to merchant volumes.

Valuation: 6/10

Fair for quality, but requires re-acceleration to justify premium.

Total score: 49 / 60

Conclusion

Adyen is a world-class infrastructure asset going through a normalization phase. The market punished the stock for decelerating growth, not deteriorating fundamentals. For investors focused on long-term payment volume growth, platform economics, and high ROIC, Adyen remains a compelling quality growth candidate: patience is required (Like for most great things).

#17:📸Adobe: The creative compounder ADBE 0.00%↑

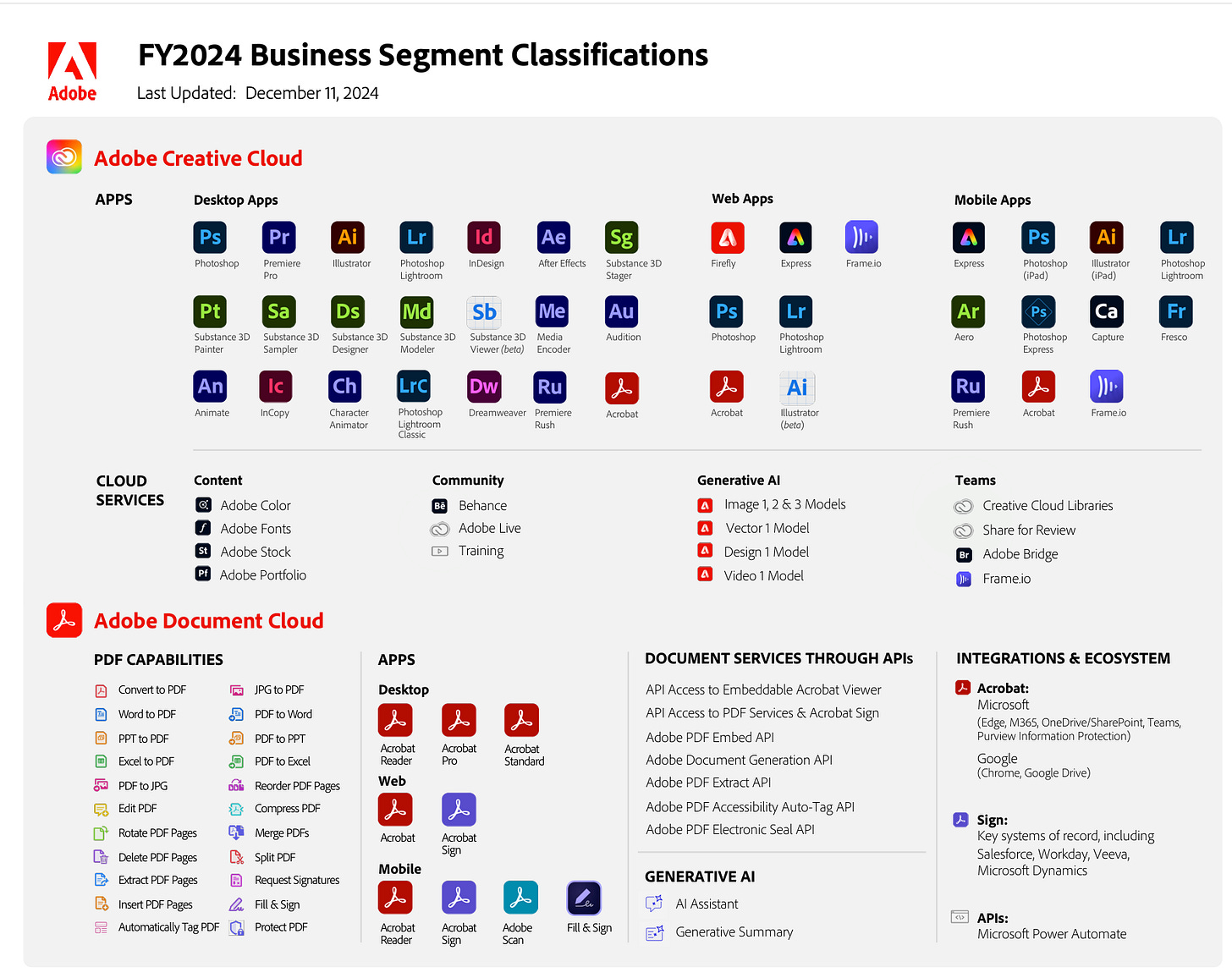

Adobe (ADBE) is one of the most durable software compounders of the past two decades. What started as a creative tools company has evolved into a mission-critical digital platform spanning content creation, document workflows, and digital experience management.

Investment thesis

Adobe’s strength lies in workflow lock-in. Creative Cloud, Document Cloud, and Experience Cloud are deeply embedded in professional and enterprise workflows, making switching costly and disruptive. The shift to subscriptions (SaaS) transformed Adobe into a high-margin, recurring-revenue business, while generative AI (Firefly) enhances product value rather than cannibalizing it. Over time, Adobe monetizes creativity and digital transformation across the global economy.

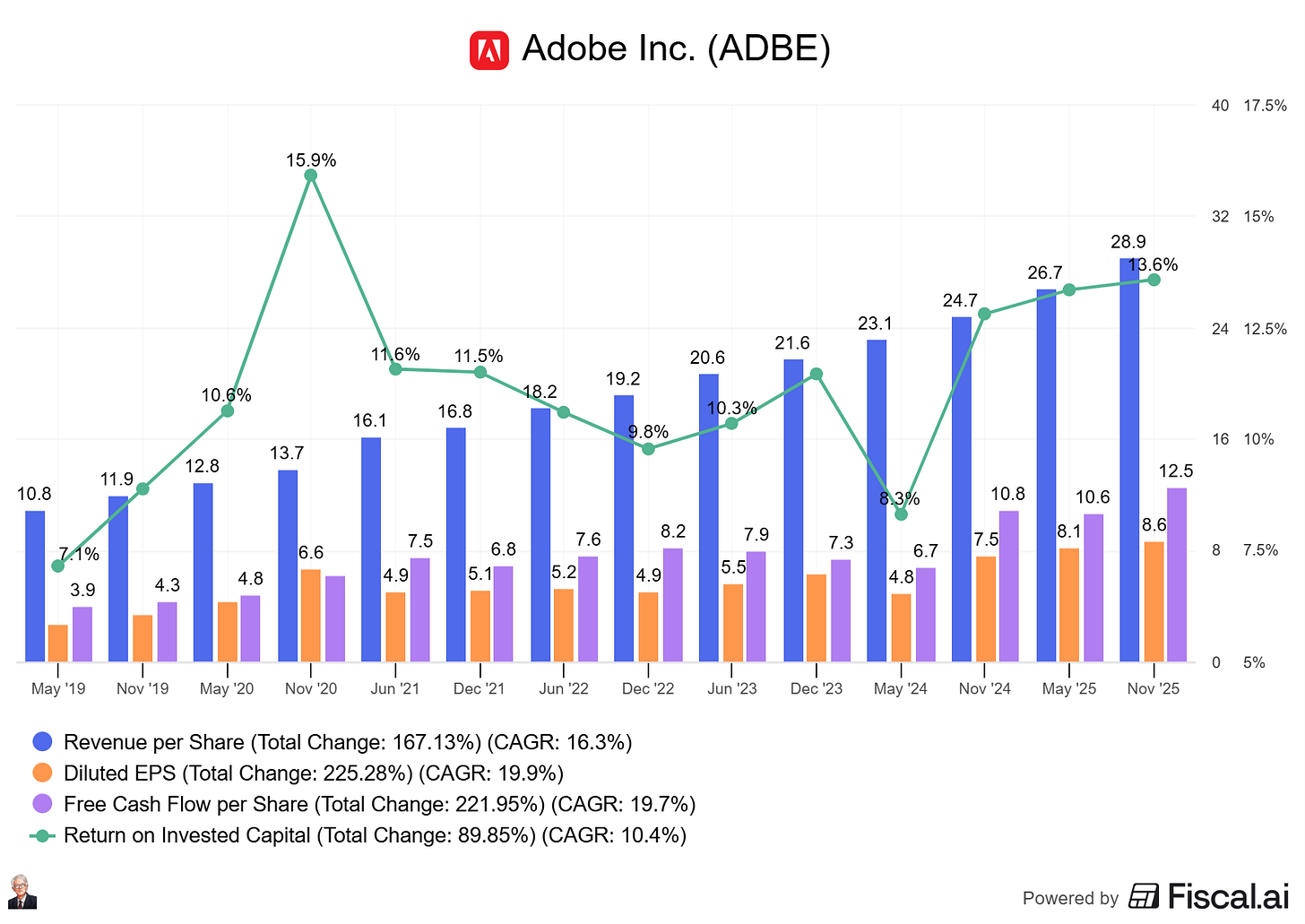

Fundamentals: growth & returns

Adobe has grown revenue at a ~16% CAGR over the past decade, driven by subscriber growth, pricing power, and expansion into enterprise workflows. Creative Cloud remains the core profit engine, while Document Cloud continues to scale rapidly.

The business consistently generates ROIC in the 30–40% range, supported by software economics and modest capital requirements. Operating margins exceed 40%, and free cash flow conversion is strong, giving Adobe significant flexibility to reinvest and return capital.

The recent stock market crash is not reflected in the fundamentals:

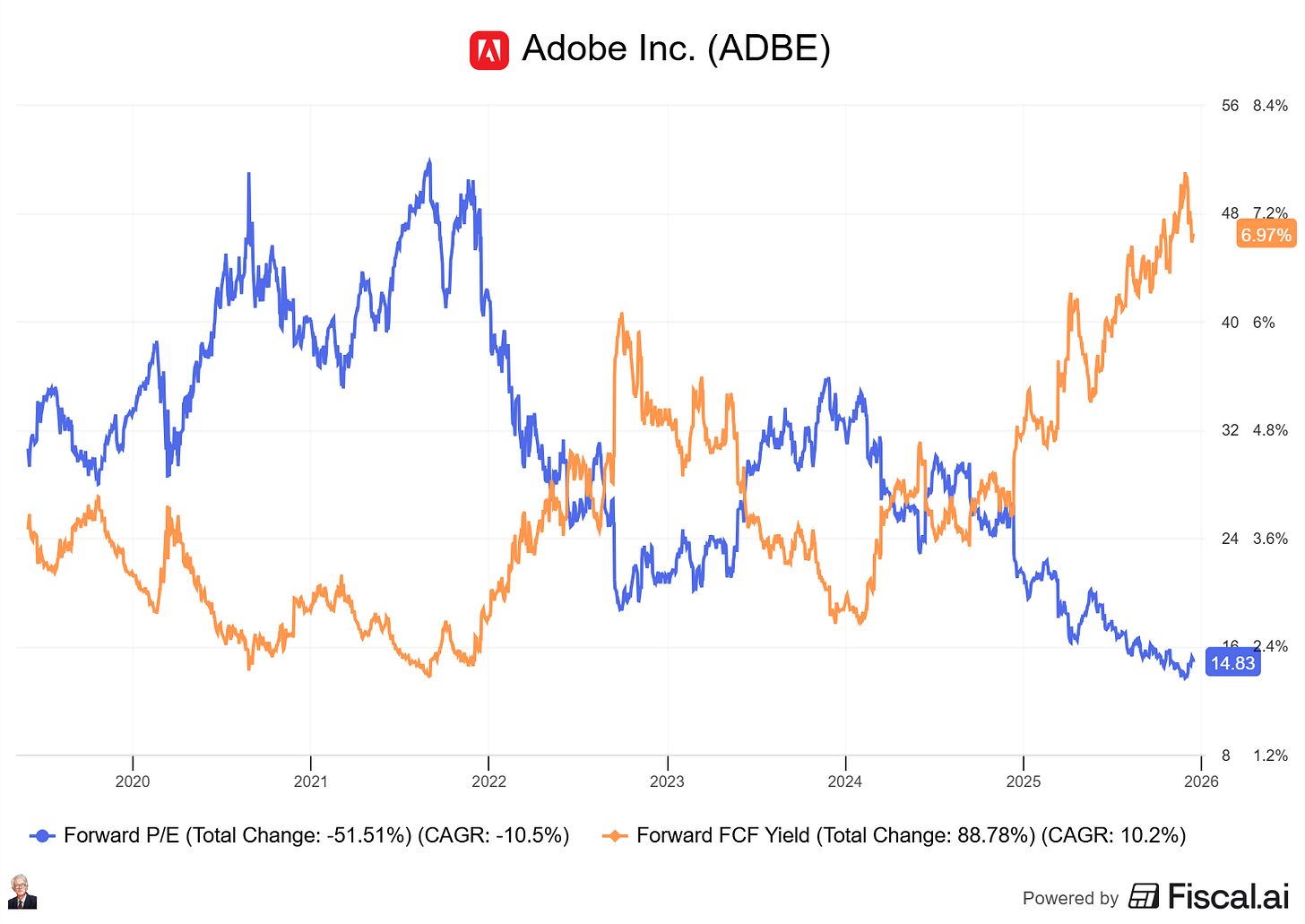

Valuation

Adobe trades at approximately 14.8x forward earnings, way below its historical premium as the market weighs competitive and AI-related concerns. Free cash flow yield is ~7%, and valuation appears reasonable for a dominant software platform with durable growth and strong margins.

6 Pillars of Quality Growth — Scorecard

Management: 8/10

Strong execution and product leadership, with improving capital discipline.

Business model: 9/10

High-margin subscription software with recurring revenue.

Competitive advantage: 7/10

Brand dominance, switching costs, and workflow integration.

Growth: 7/10

Steady demand from creators and enterprises, enhanced by AI.

Risk factors: 7/10

Competition, pricing sensitivity, and AI-driven disruption risk.

Valuation: 9/10

More attractive than history relative to quality and cash flow.

Total score: 47 / 60

#16:🚗Copart: The boring compounder CPRT 0.00%↑

Copart (CPRT) is a dominant marketplace business sitting at the intersection of autos, insurance, and logistics. What appears to be a salvage auction company is in reality a high-margin, capital-light global platform with powerful network effects and exceptional capital returns.

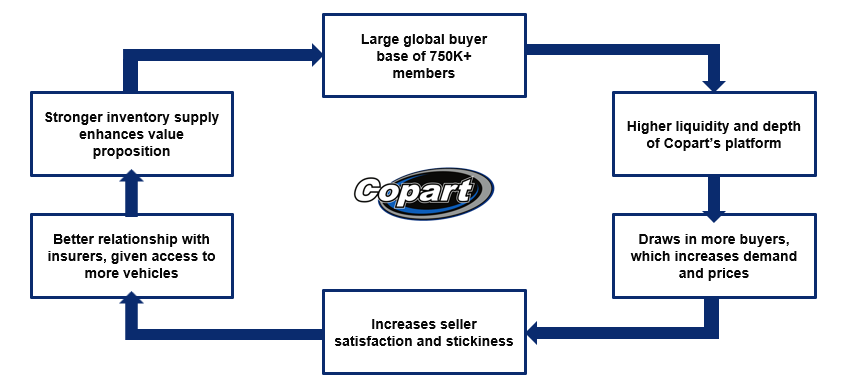

Investment thesis

Copart’s advantage lies in scale and two-sided network effects. Insurance companies supply vehicles, global buyers supply demand, and Copart’s auction platform matches the two with speed and transparency. As volume increases due to increasing automotive complexity, liquidity improves, prices rise, and switching costs deepen for insurers. Its global buyer base and logistics capabilities create a self-reinforcing moat that new entrants struggle to replicate.

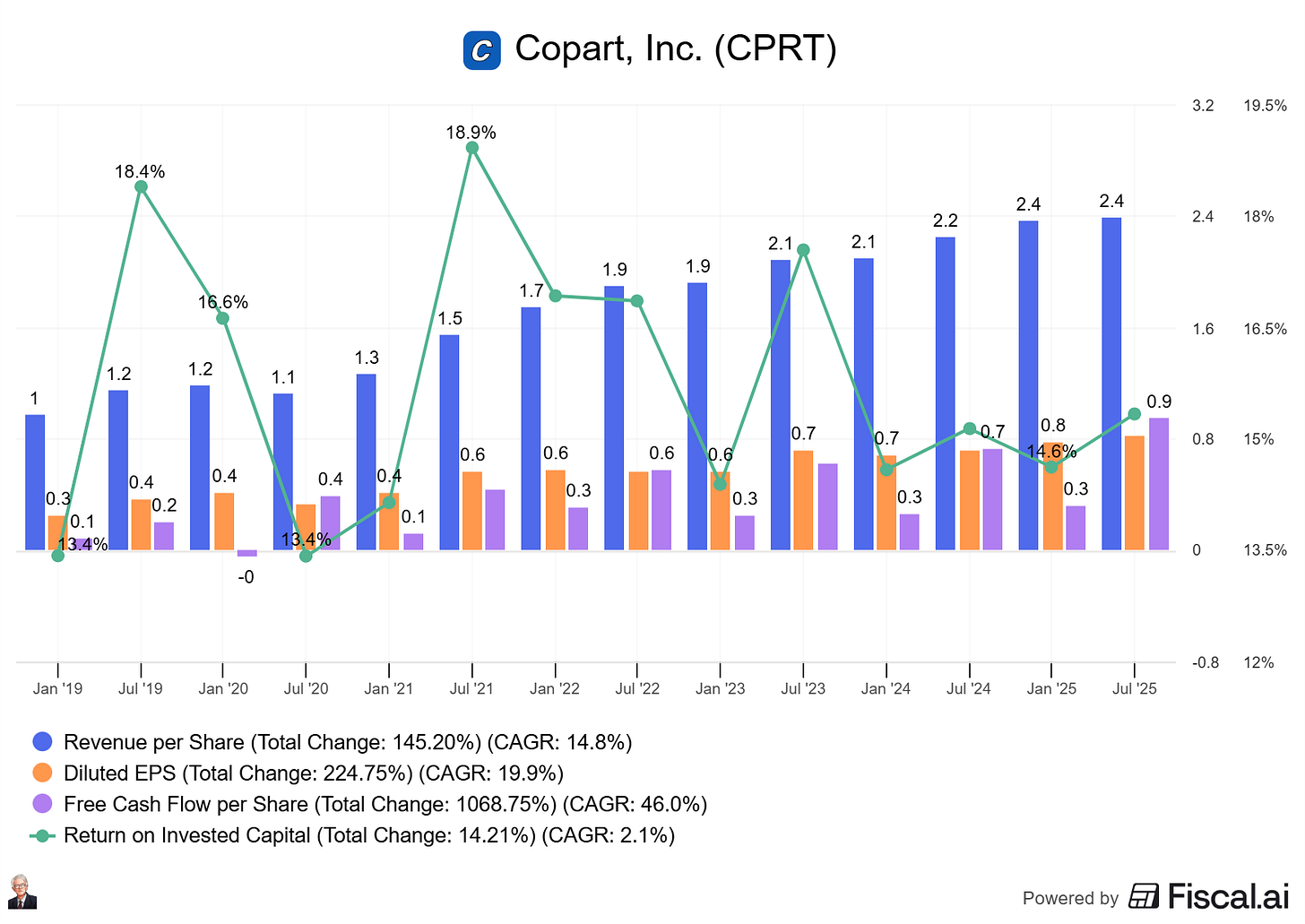

Fundamentals: Growth & returns

Copart has grown revenue at a ~15% CAGR over the past decade, driven by increasing total loss frequency, international expansion, and pricing power. Even in softer market cycles, Copart’s volumes remain resilient due to structural insurance trends.

The business consistently generates ROIC well above 12%, supported by negative working capital, asset-light auctions, and high operating leverage. Operating margins exceed 40%, and free cash flow conversion is exceptionally strong.

Valuation

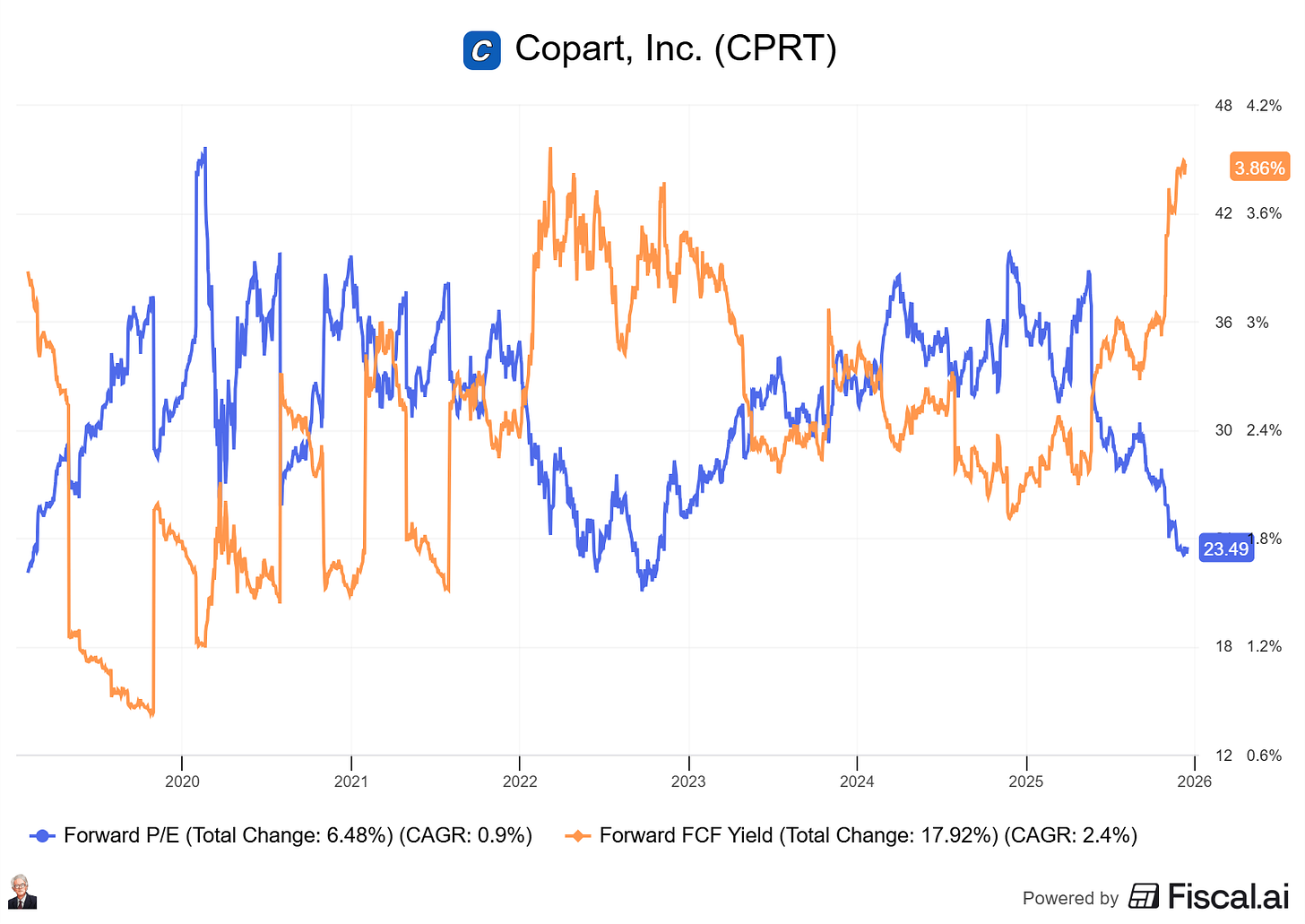

Copart trades at approximately 23.5x forward earnings and 3.86% Free Cash Flow yields, a premium to most industrial and auto-related businesses. However, the valuation reflects monopoly-like economics, high margins, and durable growth. Long-term returns are driven primarily by earnings growth rather than multiple expansion. That said, Copart is trading at a multi-year low from a multiples perspective.

6 Pillars of Quality Growth — Scorecard

Management: 10/10

Founder-influenced and family-led culture with disciplined, long-term execution.

Business model: 9/10

Two-sided auction platform with recurring, fee-based revenue.

Competitive advantage: 10/10

Network effects, scale, switching costs, and global reach.

Growth: 7/10

Steady structural growth with international runway.

Risk factors: 7/10

Exposure to used car prices, insurance cycles, and regulatory differences.

Valuation: 7/10

Premium multiple, justified by quality and durability.

Total score: 50 / 60

Top 15 Quality Growth picks for 2026 are for Premium subscribers. Read more here.