🌍 Quality Compounders in Emerging Markets

How MercadoLibre and SEA prove moats can scale outside the US and Europe.

Hi investor👋

In this article, we’re breaking down two quality compounders from emerging markets.

Let’s get into it 👇

The Conventional View

When investors think of quality compounders, they default to the usual suspects:

US tech platforms,

European luxury houses,

Global payment rails.

Emerging markets, by contrast, are often seen as too risky—currency volatility, political instability, weaker governance.

But that conventional view is outdated. A new wave of businesses is proving that quality + growth is not just a story for developed markets.

Why Moats Matter More in EM

In emerging markets, structural advantages compound even faster:

Network effects are amplified in underpenetrated markets (e.g. digital payments, ecommerce).

Distribution moats are harder to replicate where infrastructure is weak.

Trust and brand carry extra weight in markets with less consumer protection and regulations.

When these businesses scale, they often become dominant platforms with little credible competition.

Case Study: MercadoLibre MELI 0.00%↑ 🛒

MercadoLibre is the Latin American giant often called “the Amazon + PayPal of the region.”

E-commerce: MELI built the largest online marketplace in LatAm, benefiting from both scale and logistics integration.

Payments (Mercado Pago): A fintech ecosystem riding the wave of cash-to-digital transition.

Moats: Trust, logistics, payments, and a brand synonymous with online commerce.

Founder-led: Marcos Galperin is the founder and still runs Mercadolibre, creating alignment with shareholders.

Over 20 years, MELI has grown from a small auction site into a multi-vertical powerhouse—with margins and ROIC that rival developed market peers.

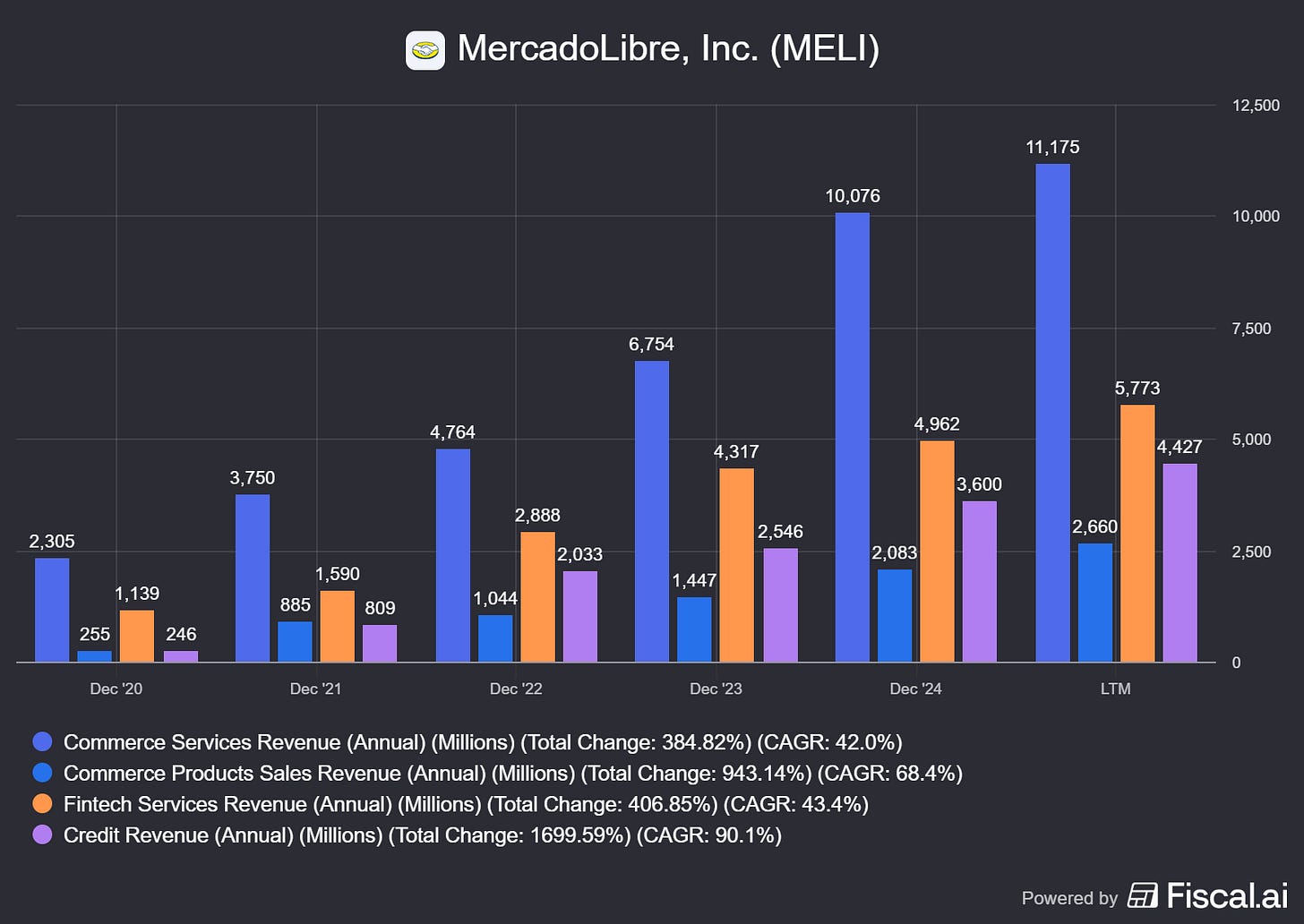

In the last 5 years, all business segments of MELI have grown +40% CAGR:

Case Study: Sea Limited SE 0.00%↑ 📱

Sea Limited, based in Singapore, operates three pillars of business:

Garena: Cash-generating gaming platform.

Shopee: E-commerce leader across Southeast Asia.

SeaMoney: Payments & lending ecosystem growing in parallel.

While still volatile and earlier in its lifecycle, SEA shows how ecosystems can scale in high-growth, underpenetrated markets.

The Quality Growth Flywheel in EM

The formula is the same as in developed markets—but often more powerful:

Early adoption curve → penetration rates still low.

Rapid scale → winner-take-most dynamics.

Widening moats → logistics, payments, and trust create high switching costs.

Reinvestment runway → large populations, rising middle class, digital adoption tailwinds.

Emerging market compounders combine growth + sustainability in ways that developed markets simply can’t match anymore.

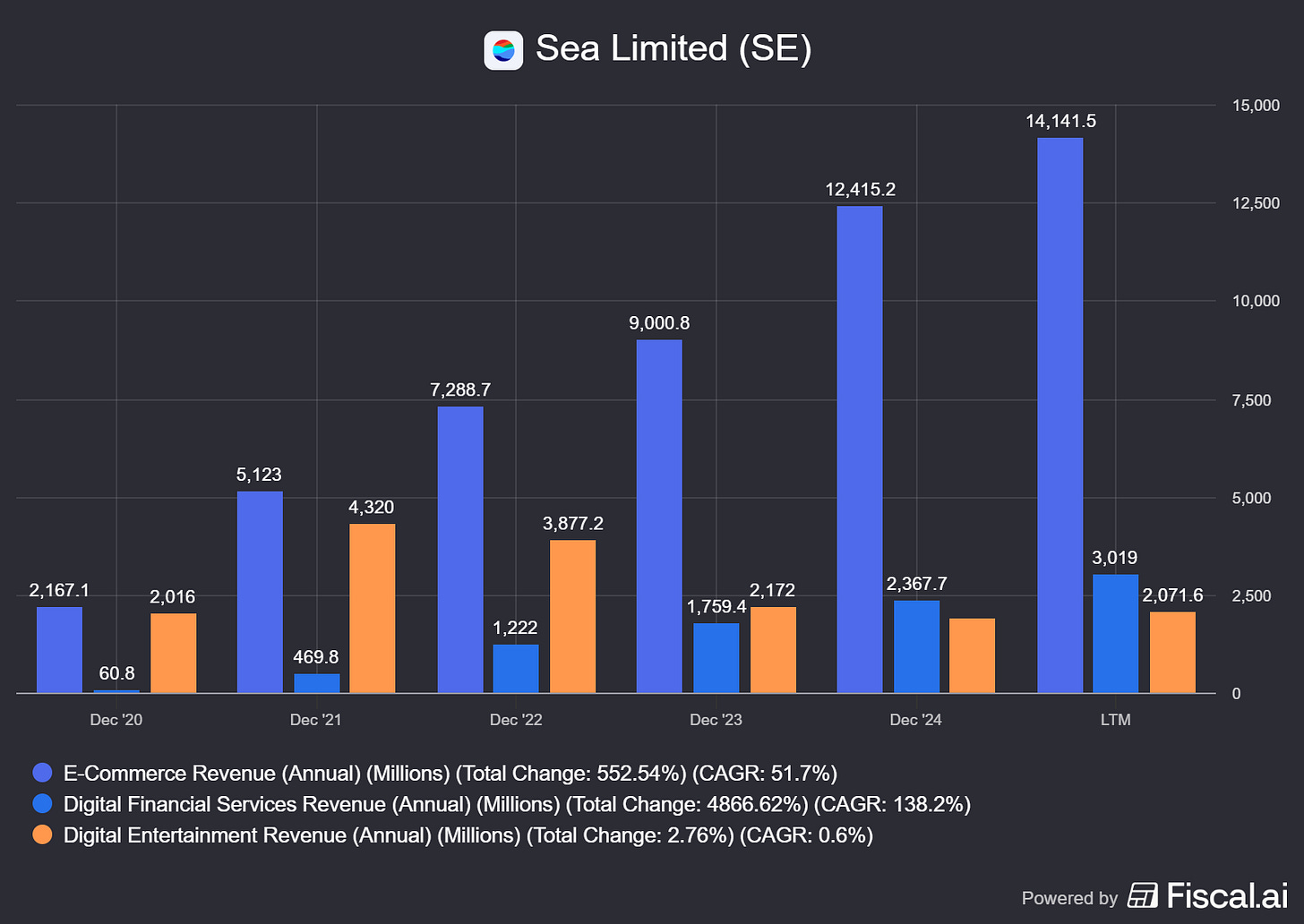

Similar to MELI, Sea is showcasing incredible growth from its e-commerce (+51.7% CAGR) and financial segment (+138.2% CAGR):

Why the Market Misprices Them

Macro noise (currency swings, politics) makes investors discount long-term fundamentals.

Many are still seen as “too risky” despite proven moats and cash flow.

Many funds don’t have a mandate to invest in emerging markets due to the perceived risk

This creates opportunity for patient investors—the same pattern we once saw with Amazon in 2001 or Tencent in 2010.

Investor Takeaway

Don’t ignore emerging markets when building a portfolio of quality compounders.

The risks are real, but so are the moats.

Platforms like MercadoLibre and Sea Limited prove that durable businesses can thrive outside the US and Europe.

Over the next decade, the next generation of 100x compounders may very well come from São Paulo or Jakarta, not Silicon Valley.

Ready to take the next step? Here’s how I can help you grow your investing journey:

Go Premium — Unlock exclusive content and follow our market-beating Quality Growth portfolio. Learn more here.

Essentials of Quality Growth — Join over 300 investors who have built winning portfolios with this step-by-step guide to identifying top-quality compounders. Get the guide.

Free Valuation Cheat Sheet — Discover a simple, reliable way to value businesses and set your margin of safety. Download now.

Free Guide: How to Identify a Compounder — Learn the key traits of companies worth holding for the long term. Access it here.

Free Guide: How to Analyze Financial Statements — Master reading balance sheets, income statements, and cash flows. Start learning.

Get Featured — Promote yourself to over 15,000 active stock market investors with a 42% open rate. Reach out: investinassets20@gmail.com