📈 Forget ROIC, This Is What Actually Drives Compounding

ROIC gets all the attention, but reinvestment rate decides who actually compounds

Hi investor 👋

Investors love to talk about “high ROIC”, and for good reason. A company that earns a strong return on invested capital demonstrates an efficient business model, smart capital discipline, and often a sustainable competitive advantage.

But here’s the uncomfortable truth:

A high ROIC means very little if the business has nowhere to reinvest those proceeds.

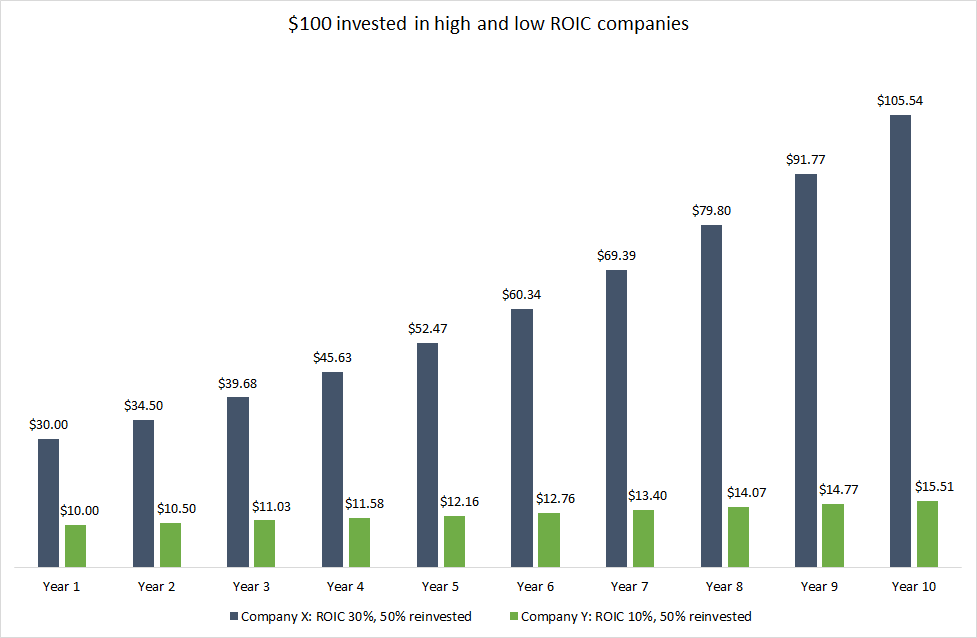

ROIC × Reinvestment = Compounding Growth Rate

Return on invested capital (ROIC) tells us how much value a company creates for each dollar it reinvests.

But it’s the reinvestment rate (the percentage of earnings that can be redeployed at those attractive returns) that determines how fast the business can actually compound over time.

Without reinvestment, even the most profitable company eventually plateaus.

You can’t earn “earnings on earnings” if there’s no fresh capital being put to work.

As Chuck Akre put it:

“The ability to earn earnings upon earnings is essentially the definition of compounding.”

What Compounding Really Requires

Sustainable compounding isn’t an accident, but the result of three ingredients:

An extraordinary business model – scalable, asset-light, and defensible.

Exceptional people and culture – disciplined operators and intelligent capital allocators.

Abundant reinvestment opportunities – the ability to deploy incremental dollars at high rates of return.

A business that masters all three becomes a self-reinforcing compounding machine.

But remove the reinvestment leg, and the stool collapses.

This graph illustrates the relationship between ROIC and Reinvestments. Give a similar reinvestment rate, ROIC is significant. But if you have 0% reinvestment rate, you can’t invest capital at that rate:

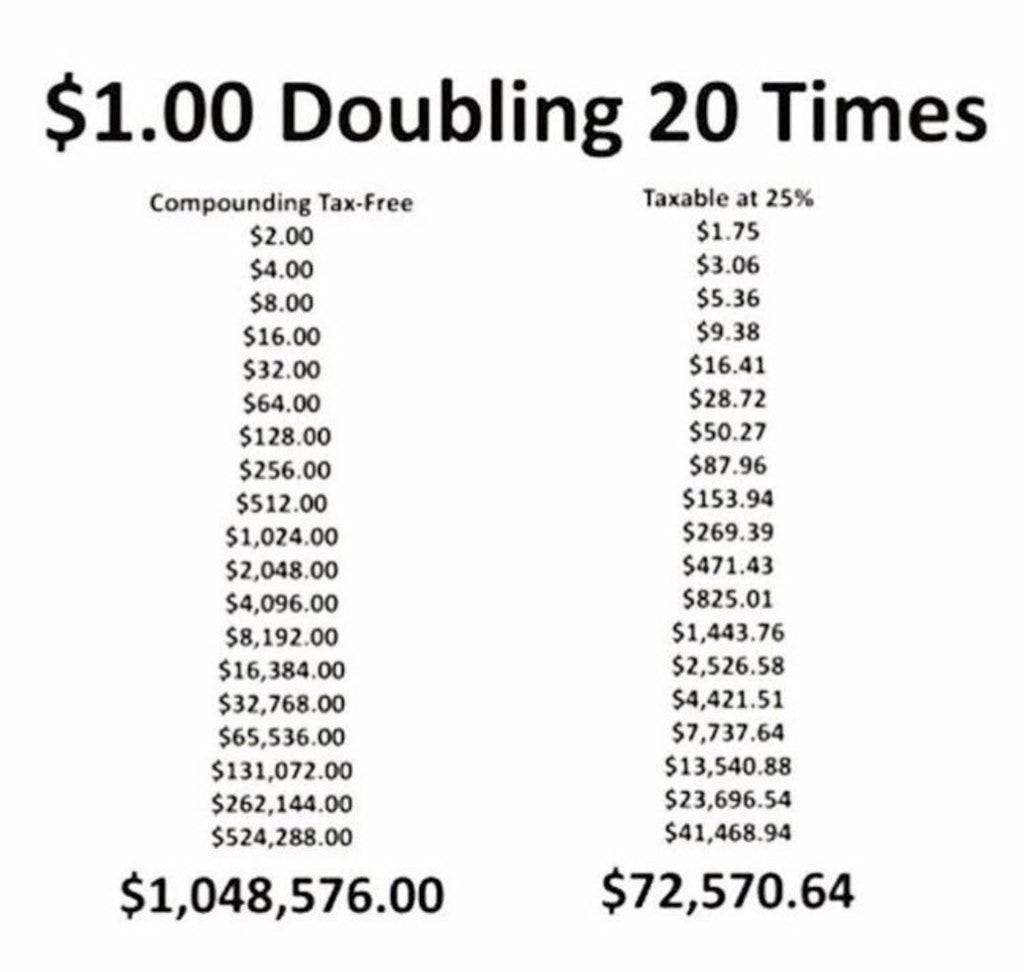

Dividends Are the Route to Average Returns

Dividends often signal a lack of reinvestment runway.

If management can’t find high-return opportunities internally, cash is returned to shareholders, who then need to find alternative investments elsewhere, often at lower returns.

There’s nothing inherently wrong with dividends, but investors seeking above-average returns should prefer businesses that can retain and reinvest capital at superior rates.

That’s where the true wealth creation happens.

A core reason for this is that we as investors are taxed on the dividends we received. Additionally, we have to find a new compounding vehicle for the capital we receive, high IRR opportunities does not grow on threes.

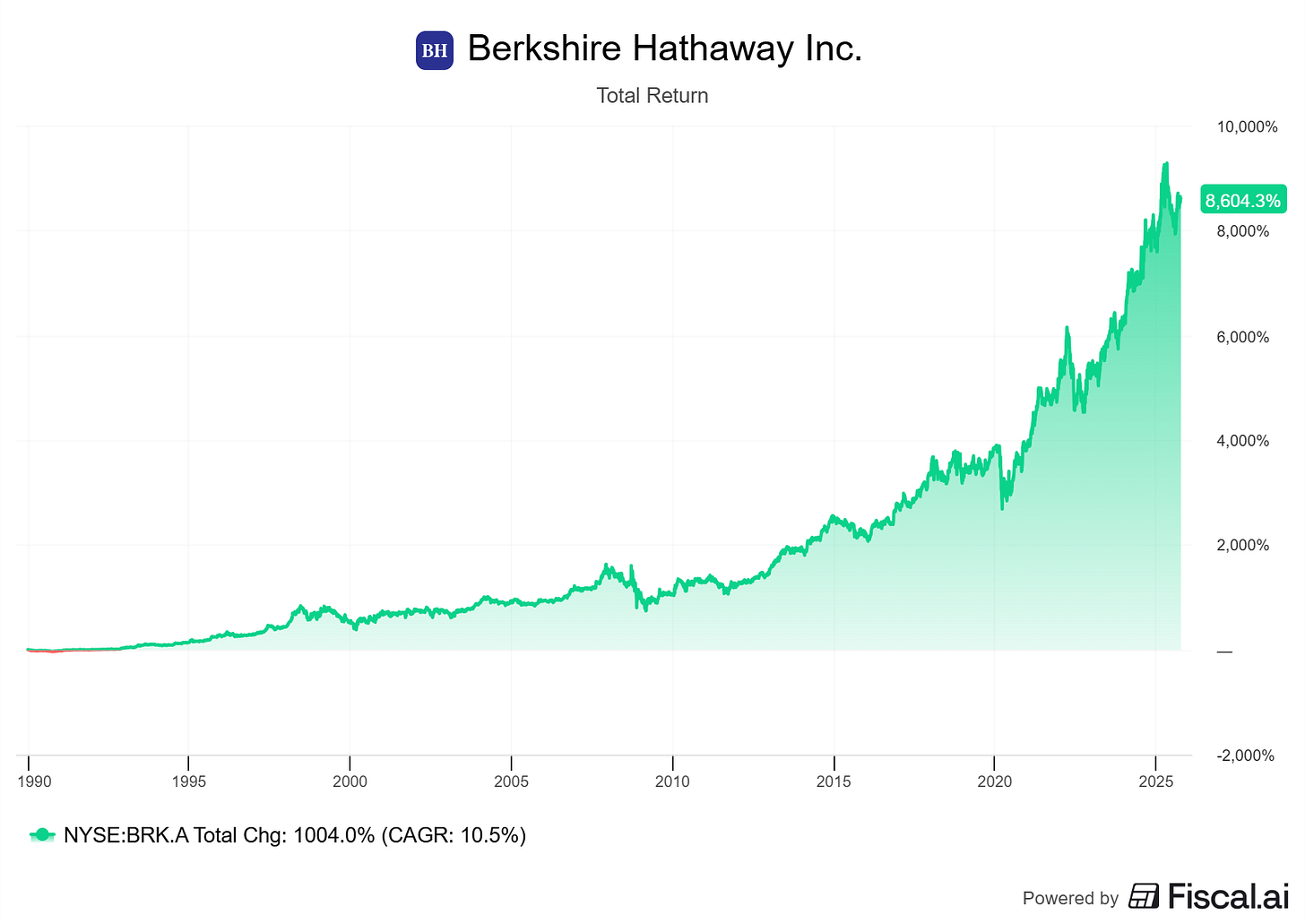

The Power of a Great Reinvestor

Even an average business, with an exceptional reinvestor at the helm, can become a remarkable compounding engine.

Just look at Berkshire Hathaway. It was once a struggling textile mill that evolved into one of the greatest capital allocation stories in history.

The magic wasn’t in its starting business model, but in its ability to continuously reinvest retained earnings into higher-return opportunities across decades.

Investor Takeaway

High ROIC alone doesn’t make a great investment.

The combination of high returns on capital and the ability to reinvest those returns is what drives exponential value creation.

“Dividends are the route to average returns. Excellence in reinvestment is the route to above-average returns.” — Akre Capital Management

So next time you evaluate a business, don’t just ask what the ROIC is, ask how the business can continue to reinvest its excess capital at these hight returns, and for how long.

Here are 10 companies I believe have substantial reinvestment opportunity at a high return on capital:

1. Amazon AMZN 0.00%↑

Still reinvesting across logistics, AWS, advertising, AI, and international expansion.

Every new business line feeds another flywheel. ROIC improving as AWS and Ads scale (High ROIC and margin business units).

2. Alphabet GOOGL 0.00%↑

Core Search throws off massive FCF, this is continually reinvested into Cloud, AI models, YouTube, and emerging “Other Bets” such as Waymo, DeepMind, and Verily.

Runway: long; incremental returns remain high in digital infrastructure and AI initiatives.

3. NVIDIA NVDA 0.00%↑

The ultimate reinvestment flywheel: each GPU cycle funds new architectures, software ecosystems (CUDA, AI stack), and data-center platforms.

High marginal returns on every reinvested R&D dollar.

4. ASML ASML 0.00%↑

Global monopoly on EUV lithography; reinvests billions into High-NA EUV, metrology, and service upgrades.

Still decades of reinvestment ahead as chip complexity rises.

5. Cadence Design Systems CDNS 0.00%↑

Capital-light software business model; reinvests in R&D and acquisitions across chip/system design and AI.

High returns, long reinvestment runway as chip complexity compounds.

6. Synopsys SNPS 0.00%↑

Peer to Cadence; high recurring revenue base funding reinvestment in AI-assisted design and IP licensing.

Still in early innings of AI-driven design transformation.

7. Constellation Software $CSU.TO

A masterclass in decentralized capital allocation.

Reinvests all free cash into small, mission-critical, VMS acquisitions with 20–40% IRRs, compounded for decades.

The gold standard for “earnings on earnings.”

8. Roper Technologies ROP 0.00%↑

Transitioned from industrial to software/analytics holding company.

Reinvests excess FCF into recurring, niche software verticals.

Incremental returns remain high due to disciplined capital deployment.

9. Brookfield Corporation BN 0.00%↑

Reinvests into real assets, infrastructure, renewables, insurance, and private credit, all with scalable platforms and internal compounding.

Brookfield’s structure lets it compound twice: once inside its investment funds and again at the parent company level. It never has to sell good assets, it just keeps reinvesting and growing.

10. MercadoLibre MELI 0.00%↑

Expanding its ecosystem (commerce, payments, credit, ads, logistics).

Still in early innings in LATAM, one of the longest growth runways globally.

Reinvestment optionality across multiple adjacent markets.

👉 Which business still has a long runway to reinvest its cash, and can keep earning high returns as it grows? Let us know in the comments!

Ready to take the next step? Here’s how I can help you grow your investing journey:

Go Premium — Unlock exclusive content and follow our market-beating Quality Growth portfolio. Learn more here.

Essentials of Quality Growth — Join over 300 investors who have built winning portfolios with this step-by-step guide to identifying top-quality compounders. Get the guide.

Free Valuation Cheat Sheet — Discover a simple, reliable way to value businesses and set your margin of safety. Download now.

Free Guide: How to Identify a Compounder — Learn the key traits of companies worth holding for the long term. Access it here.

Free Guide: How to Analyze Financial Statements — Master reading balance sheets, income statements, and cash flows. Start learning.

Get Featured — Promote yourself to over 24,000 active stock market investors with a 42% open rate. Reach out: investinassets20@gmail.com

Disclaimer:

This newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The views expressed are solely the author’s opinions and may change without notice.

Investing in securities involves risk, including the potential loss of capital. Past performance is not indicative of future results.

The author may hold positions in securities mentioned. Readers should do their own research and consult a licensed financial advisor before making investment decisions.

ROIC tells you how efficiently a company compounds, but reinvestment tells you how long it can.

Sounds like the real flywheel is when high returns meet long runways.

Read this,

Link :

https://open.substack.com/pub/absolutetoal/p/growth-and-roic-relationship?utm_source=share&utm_medium=android&r=5g11d4