Tesla: Beyond Electric Cars 🔋

A Breakdown of Tesla's Business Model and Market Positioning

Hi there investor! 👋🏻

Build a high-quality stock portfolio of compounders in 2024💎

Tesla Inc (NYSE: TSLA 0.00%↑)

Introduction

Founded in 2003, Tesla is a multinational automotive and clean energy company based in Austin, Texas, in the U.S.

Most of you know it as a leading manufacturer of electric vehicles (EVs). However, the company also focuses on developing autonomous driving technology and renewable energy.

3 Interesting facts about Tesla:

The total return for shareholders has been approximately 42.7% CAGR since its IPO in 2010 (15.862% in total).

Tesla is the world’s leading manufacturer of electric cars. The company accounts for nearly 2 out of 3 electric vehicles sold in the United States alone.

In June 2024, Tesla’s share of the global EV (Electric Vehicle) market fell to 49.7%, the first time it’s ever been below 50%.

Let’s take a closer look at Tesla to see if it might prove an exciting investment opportunity 👇

The Business Model of Tesla 🏰

Tesla generates revenue primarily by selling electric vehicles (EVs) and renewable products.

The business can be divided into three main segments:

Automotive (EV sales, Full Self-Driving, Automotive Leasing)

Energy Generation and Storage (Solar Panels, Powerwall, Energy Storage Systems)

Services and Other (Vehicle Maintenance, Supercharging, Software Updates)

Tesla posted record quarterly revenues of 25.5 billion in the most recent quarter, primarily thanks to revenue increases in its energy storage and generation division.

Tesla dominates the electric vehicle market, holding a 66% market share in the U.S. in 2023. According to Statista, the estimated battery-electric vehicle sales in the United States in 2024 will be by brand (in units).

Tesla is expanding its international operations, especially in China and Europe, where demand for EVs is snowballing.

Already firmly positioned in the electric vehicles and renewable energy sectors, Tesla is expected to benefit further across the next decade as governments worldwide push harder for clean energy.

Grabbing early dominance in the EV market gives Tesla a big competitive advantage over other automakers that have pushed into the development of electric vehicles.

Electric Vehicles (EVs)

Tesla is well ahead in terms of EV sales in the U.S., and its Model Y and Model 3 models are the two best-selling electric vehicles in the country.

In 2023, Tesla sold over 650,000 EVs in the U.S.

While that’s just 6.9% of all new vehicle sales in the U.S., that just shows there is scope for significant improvement as the adoption of electric vehicles increases in the years ahead.

EVs Lead Sales

The Model Y is the best-selling Tesla model at the current time, selling double that of the Model 3. It was responsible for 51.38% of Tesla’s revenue in 2023.

The Model 3, which still outsells all other electric vehicles in the U.S., accounted for 26.61%%.

General Motors’ Chevrolet Bolt is the third best-selling EV, and that sold just a fraction of the numbers of the Model Y and Model 3.

Total automotive revenue accounts for 77.95% of Tesla’s revenue.

Tesla has a strong business model with high margins and significant returns on capital. The Model Y and Tesla’s energy storage systems have enjoyed considerable growth. The company expects further growth from those and other flagship products.

Growth Drivers

Here, we take a look at Tesla’s key growth drivers. These are focused on EV sales, international expansion, and the company’s development of energy expansion and autonomous driving technology.

Here are the main points:

Electric Vehicle (EV) Sales:

Model 3 and Model Y remain Tesla’s primary growth drivers. Both significantly contribute to the company’s total vehicle deliveries.

Tesla deliveries for model 3 and Y have compounded by 43.84% since 2019, but have stagnated in recent quarters (-2.6% YoY in the MRQ).

Tesla’s production capacity has expanded greatly, with new Gigafactories in Berlin and Texas helping scale global production.

Expansion in Energy Storage:

Tesla’s energy generation and storage business is growing rapidly. Energy storage deployments have increased by 54.4% year-over-year (2022 to 2023). In the MRQ the segment grew 99.7% YoY.

Tesla’s Powerwall and Megapack products are becoming increasingly popular as the world shifts towards renewable energy.

Autonomous Driving Technology:

Tesla continues to push forward with its Full-Self Driving (FSD) technology. It is a crucial differentiator and potential future revenue stream for the company.

Tesla’s software-based approach to autonomous driving has consistently improved its Autopilot and FSD capabilities through over-the-air updates.

International Expansion:

Tesla’s market presence is expanding rapidly, particularly in China and Europe.

The Chinese market remains a significant growth lever for Tesla. Demand for EVs is growing due to government support and shifting consumer preferences.

Tesla’s Gigafactory Shanghai is critical in meeting domestic and global demand.

10 years of Compounding

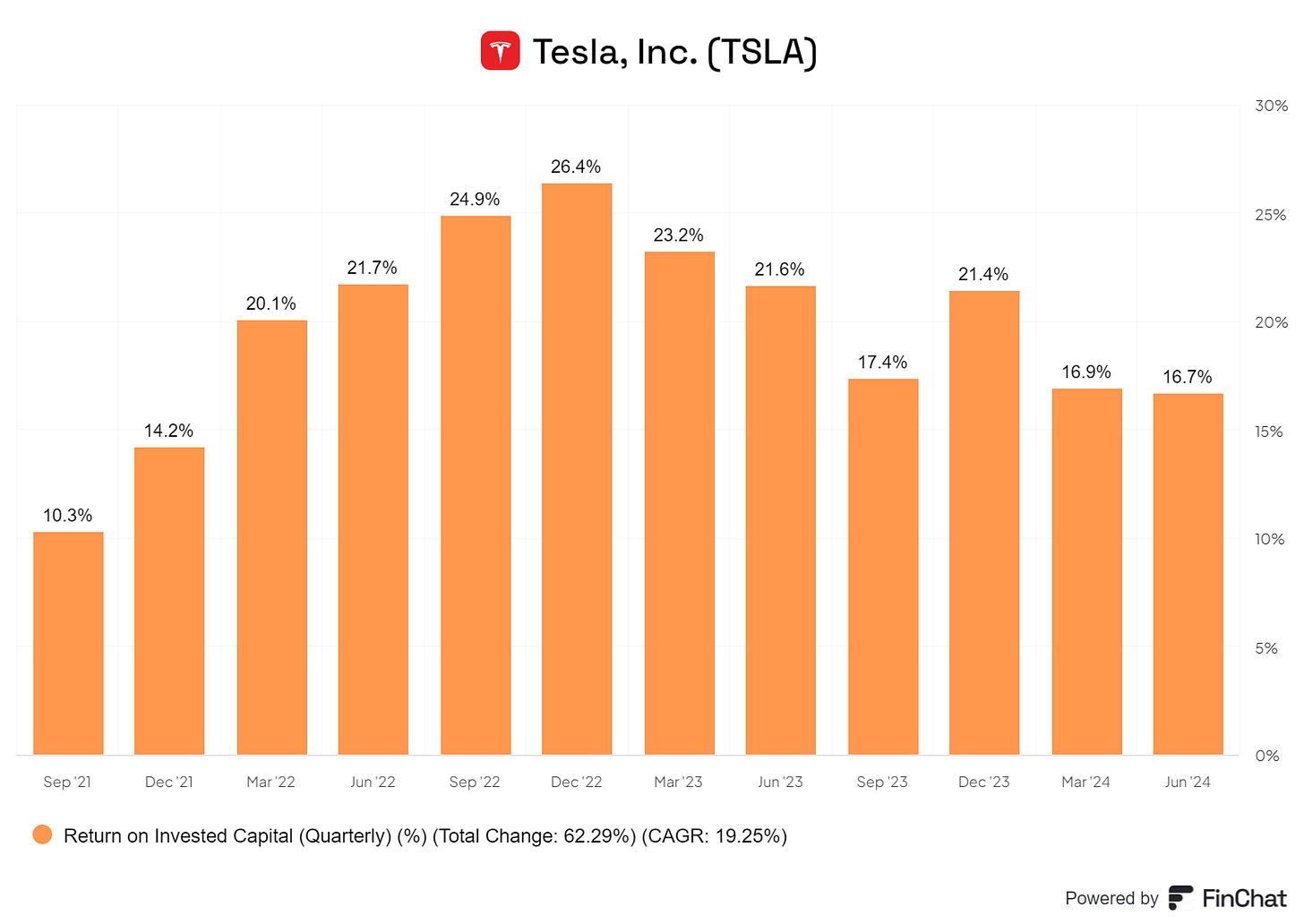

Tesla has compounded its revenue by 35.13% in the last decade. Earnings per share have grown from -$0.2 to $3.6, and free cash flow per share has grown from -$0.6 to $0.5. The ROIC has constantly been above 15%, showcasing that Tesla has an attractive and profitable business model.

Competitive Advantage 🏰

Tesla has a wide economic moat, with technological leadership being one moat source and brand strength and market leadership being the other.

Technological Leadership

Tesla’s technological edge is a key driver of its competitive advantage:

Innovation in Battery Technology: Tesla remains the industry leader regarding battery research and development. The company continues to push advancements in energy density and production efficiency. Tesla’s new 4680 battery cells, for example, are expected to lower costs and improve the performance of future EVs.

Full-Self Driving (FSD): Tesla’s Autopilot and Full-Self Driving advanced driver assistance systems are proving key differentiators in the EV market. The company also boasts leading software capabilities that consistently improve its vehicles, specifically its over-the-air updates.

Energy Products: While Tesla is primarily known for its EVs, the company has a broader clean energy mission. For example, the company develops energy storage and solar energy solutions. Innovative products include the Powerwall and megapack.

Brand Strength and Market Leadership

Market Leadership: Tesla leads global EV sales with its Model Y and Model 3. The company also holds an EV market share of around 66% in the U.S.

Customer Loyalty: Tesla’s vehicles have a solid fan base and are well-received. The high satisfaction scores from customers ensure Tesla maintains leadership in the EV sector.

Tesla has a Net promoter score of 31, ranking as #32 in the Global Best Brands according to Comparably.

Tesla has generated a strong return on invested capital (ROIC)

The high ROIC reflects attractive reinvestment opportunities and Tesla’s efficient use of capital and reinvestment to grow. Tesla consistently invests in expanding production capacity while maintaining a low debt level.

Its ability to fund growth through internal cash flow gives it a strong position in capital markets.

To summarize, the competitive advantages of Tesla are driven by its brand power and technological leadership. The company is a leader in the EV and clean energy markets, a position it looks likely to hold for the foreseeable future. These factors contribute to Tesla’s wide economic moat and sustained market leadership.

Management 🕴🏻

Key executives and their insider holdings:

Elon R. Musk (CEO)

Title: CEO & Director

Ownership: 411.06M shares

Market Value of Shares: USD 72.03B

Tenure: 20 years (2004)

CEO Since: 2004

Track Record: Musk has overseen the growth of Tesla from the beginning, eventually leading the company to become the world’s leading electric vehicle manufacturer.

Vaibhav Taneja (CFO)

Title: Chief Financial Officer and Chief Accounting Officer

Ownership: 104.65K shares

Market Value of Shares: USD 18.33M

Tenure at Tesla: 5 years (since 2018)

Tenure as CFO: Since 2023

Track Record: Teneja has been an important factor in Tesla’s financial discipline while expanding internationally.

Tom Zhu (Senior Vice President, Automotive)

Title: Senior Vice President of Automotive

Ownership: 13.5K shares

Market Value of Shares: USD 2.37M

Tenure at Tesla: 10 years (since 2014)

Track Record: Tom Zhu has been key in scaling global operations, particularly through the success of Tesla’s Shanghai Gigafactory. Zhu was promoted to SVP in 2023 and is tasked to oversee the entire automotive division. Zhu has a track record of driving operational efficiency, production growth, and Tesla’s international expansion, making him an important part of the management team.

Tesla’s key executives have not been with the company for decades, but have a strong track record of performance and knowledge about the business and industry.

Elon Musk holds most of the company shares (411.06M).

He has been with Tesla since 2004, a year after its establishment. In the time since he has guided the company from a startup to being one of the world’s most valuable businesses in market capitalization.

Risk Factors

The main risks for Tesla are:

Production and Supply Chain Risks: Tesla heavily relies on a complex global supply chain to deliver essential materials, including lithium and cobalt. As you can imagine, disruptions such as shortages or geopolitical tensions can scupper abilities to meet production targets.

Autonomous Driving and Regulatory Risks: You’ve probably heard how Tesla’s Autopilot and FSD systems have come under scrutiny due to accidents involving the technology. The Federal Transportation Industry is currently investigating after discovering the technology has caused 13 fatal crashes (The Guardian).

Increased Competition in the EV market: Traditional automakers such as Ford and General Motors have upped their efforts in the EV industry. Adding to that, new EV startups such as Rivian and Lucid Motors represent increased competition.

Regulatory and Government Policy Risks: Tesla’s success, particularly in key markets like the U.S. and Europe, is often tied to government incentives for EVs. Any changes or reductions in these incentives could negatively impact demand for Tesla vehicles.

Valuation Risk

High Valuation: Tesla is trading at a high price-to-earnings ratio. If growth slows for whatever reason, it is vulnerable to market corrections. That could cause downside risks for investors if Tesla is unable to meet growth and production targets.

Market Fluctuations: Tesla’s stock is highly volatile. It is possible for considerable swings in market sentiment due to scrutiny or news of regulatory changes.

Valuation: Is Tesla a good investment?

Multiple Comparisons

Tesla is trading at 61.94x earnings. The median is 63.2 times earnings.

The Free Cash Flow Yield is 0.59% vs. its historical median of 0.24%.

There are high expectations built into the current stock price of Tesla. Here are leading analysts estimations for the next couple of years and the long term:

High valuation and low expectations for growth are not the best premises for a good investment.

Discounted Cash Flow Analysis

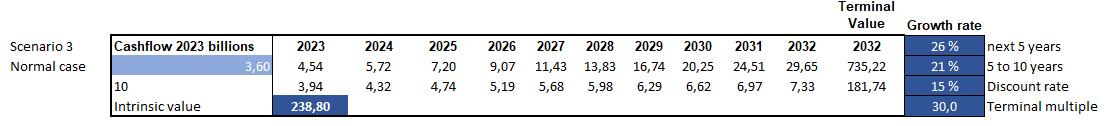

Using the diluted EPS of USD 3.6 as a proxy for earnings and 3 different scenarios for growth:

Fair Value Estimate: USD 129,37

Current Share Price: USD 239

Downside: -45.87%

Now, bulls will say we’re way too pessimistic on the growth side, what about self-driving cars and the battery business?

Even if these segments turn out to be large eventually, there are significant risks associated with it, and it is very unclear who will be the big winner of autonomous vehicles (if any).

Let’s flip the script and see what we would need Tesla to do in the following years to satisfy a 15% annual return:

Tesla would need to grow its earnings per share by 26% in the next 5 years, followed by 21% in the next 5 years, and be valued at 30x earnings at the end of the 10 years to justify its current valuation. We cannot justify that growth and find it unlikely to occur.

While the DCF (Discounted Cash Flow) analysis shows a potential downside of -45.87%, Tesla’s stock remains in a strong uptrend thanks to its dominant position in the EV market and its significant growth prospects. However, certain risks, if they materialize, could cause the stock to face considerable corrections.

Is now a good time to purchase Tesla on a fundamental basis? Not at the current valuation in our opinion.

Conclusion

The outlook of Tesla looks promising, mainly due to its leadership in the EV and cleaner energy sectors. The company stole a march on competitors, and alongside Tesla’s other competitive advantages, its strong growth drivers and solid business model make Tesla a great company.

We do recommend caution, however, as there are associated risks when investing in Tesla. The company faces increased competition and is often under scrutiny. In addition, we believe there is a major risk in its current valuation that is unlikely to yield good results for investors.

Despite those risks, the company is well-positioned for long-term growth and value creation. Tesla is a fantastic business trading at a poor valuation.

Build a high-quality stock portfolio of compounders in 2024💎

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +10.000 stock market investors (45% open rate) — Contact us via: investinassets20@gmail.com

There are quite some mistakes in the article, e.g., errors in numbers, reporting years, decreased/ increased,.. and Zack is not CFO anymore. Left the company quite some time ago