Terry Smiths 2 Favorite Stocks for 2024 🏰

<5 min read 🧠

This article is sponsored by the Premium version of Invest In Quality.

Tomorrow, we will introduce a Top 10 Buys 2024 segment that will be updated monthly.

The objective is to give our premium subscribers a better idea of what businesses have the best combination of quality, growth, and valuation at any given time.

Fundsmiths 2 picks for 2024

In this article, we will break down the two favorite picks of Fundsmith for 2024. In their annual shareholders meeting, Terry and Julian were asked to name their favorite picks for 2024. In 2023, they picked Meta Platforms to do well - and it did, providing +190% for 2023. It was also their most hated position, they got a lot of flack for holding on to Meta Platforms.

I highly recommend watching the annual shareholders’ meeting from February this year:

Terry Smith’s top picks for 2024:

Mettler Toledo

Unilever

These are classic Terry Smith investments:

Quality businesses with a strong moat

High returns on capital

Decent per-share growth

Underlying secular trends

Intelligent management teams

Let’s take a closer look at these two potential investments:

Mettler-Toledo International

Mettler-Toledo supplies weighing and precision instruments to customers in the life sciences, industrial, and food retailing industries. MTD offers a wide portfolio of products, ranging from laboratory and retail scales, pipettes, pH meters, thermal analysis equipment, titrators, metal detectors, and X-ray analyzers.

Mettler-Toledo is the market leader in weighing instruments and controls more than 50% of the market for lab balances. The business sells its products worldwide with 30% of sales coming from the US, 30% from the EU, 20% from China, and 20% from the rest of the world.

Terry Smith has previously discussed the secular trend and the need for weighing and precision instruments in the next decades. MTD is well-positioned to capitalize on this trend.

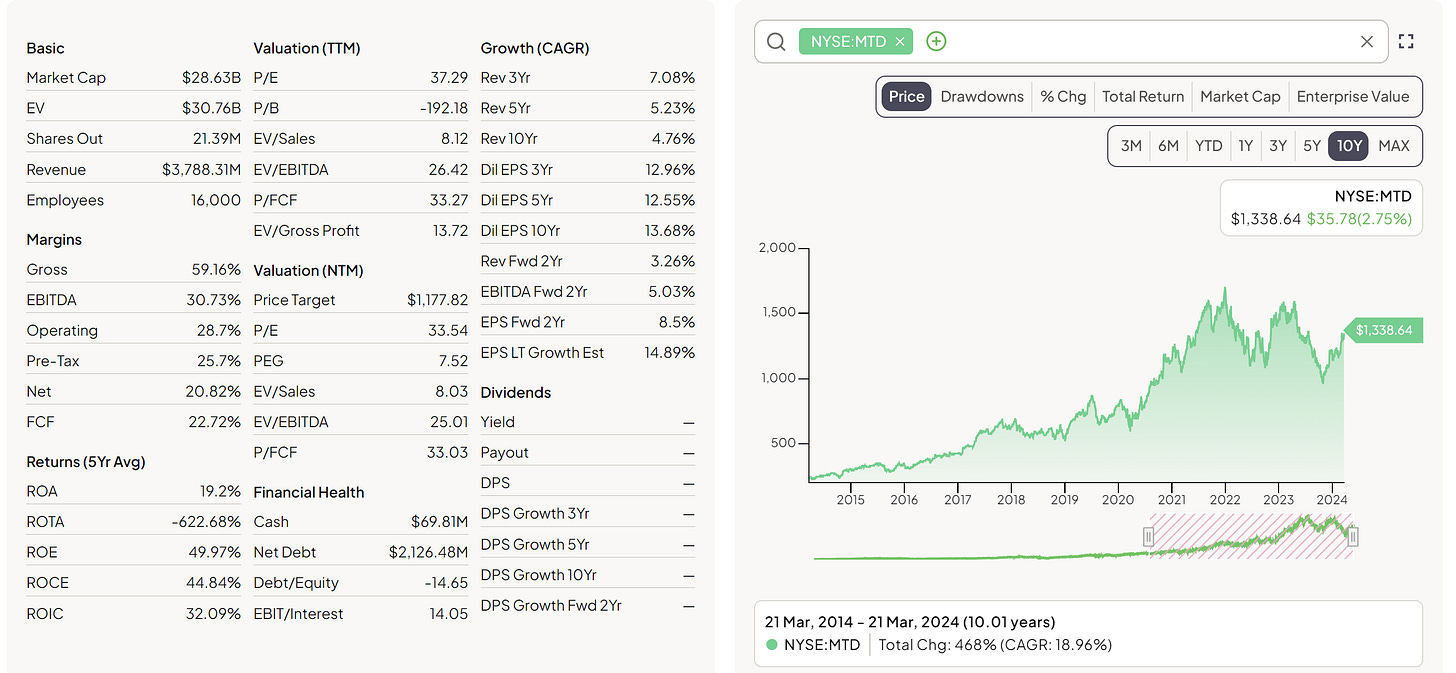

Mettler-Toledo International Fundamentals

10-Year Compounded Annual Growth Rates

Revenue +4.76%

Gross Profit +5.7%

Net Income +9.86%

Free Cash Flow +11.25%

The growth is not exactly spectacular, but it is predictable and growing with a larger growth in net income & free cash flow, indicating expanding margins (which in turn tells us that the business likely has a moat).

10-Year Per-Share Growth

EPS +13.3%

Operating cash flow per share +13.4%

Free cash flow per share +15%

In addition to stellar per-share growth (due to massive buybacks), Mettler-Toledo has increased its return on invested capital (ROIC) from 22% to +30% in the last decade.

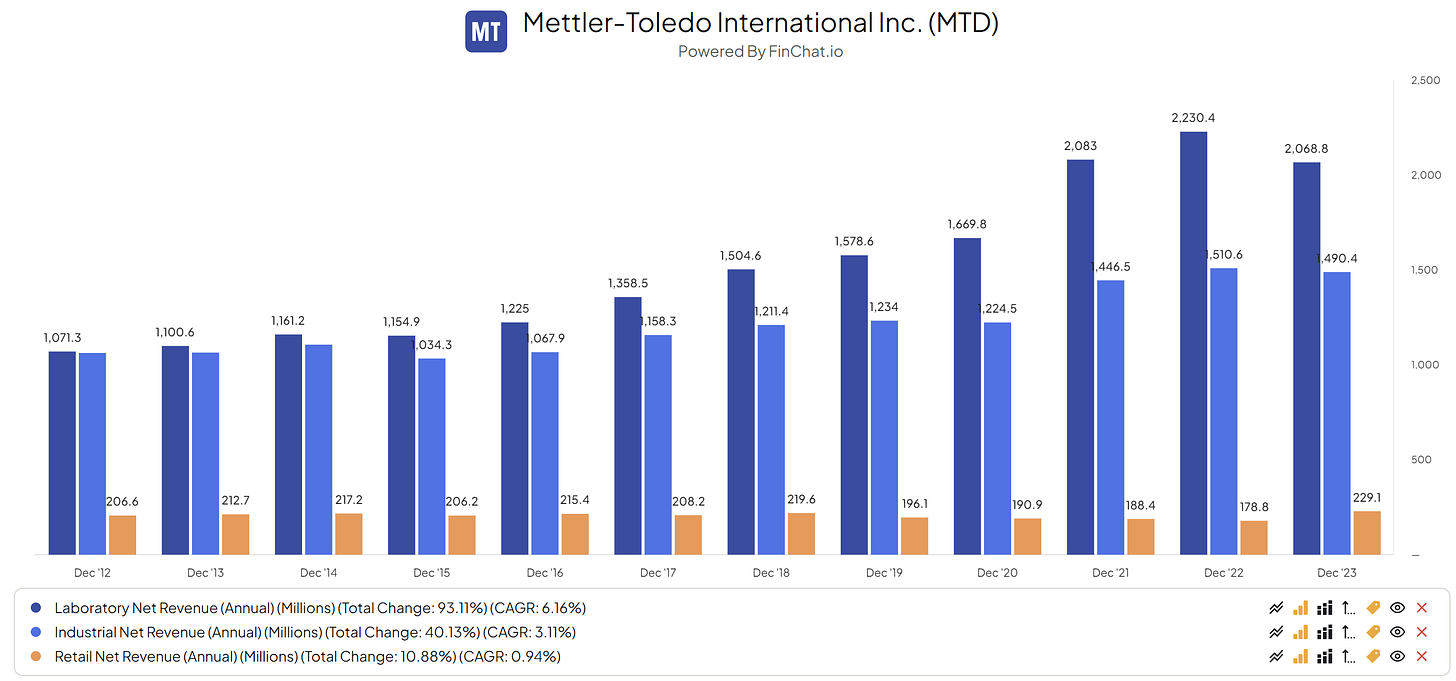

Product segmentation & Growth rates:

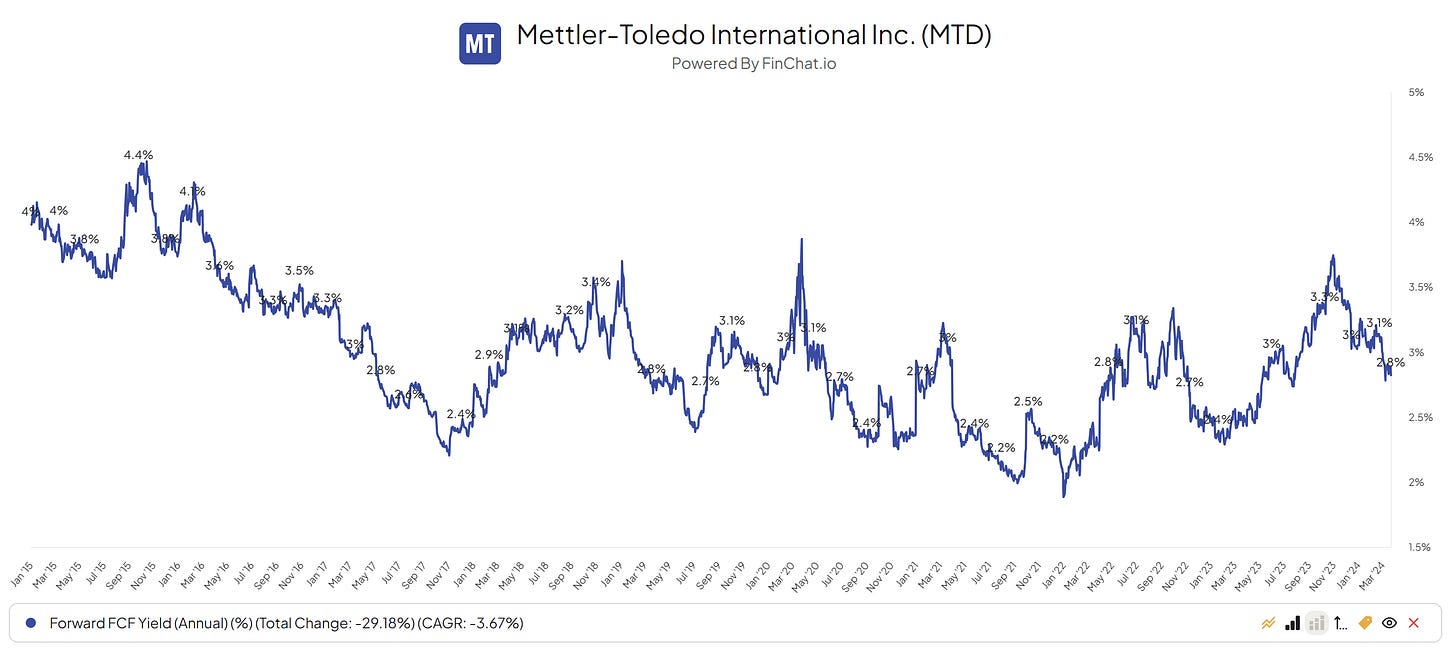

Historic Free Cash Flow Yield

With improved margins & capital efficiencies, we can assume that Mettler-Toledo is a slightly better business today than 10 years ago. But does it deserve a higher price? In the late parts of 2023, you could’ve picked up shares at ~4% FCF yield, which would be a good spot from a historical stand point. Now the shares trade around 2.8% FCF Yield.

Unilever PLC

Unilever is a diversified business that operates in the personal care, home care, and packaged foods sectors. They own several high-value brands, such as Knorr soups and sauces, Hellmann’s mayonnaise, Axe and Dove skin products, and the TRESemmé haircare brand.

Terry Smith has previously criticized the former executive management for making poor acquisitions. Or at least because they paid too much for them. He is now more positive about the new management team and believes they are aligned with what Fundsmith wants to see in a business (e.g. better capital allocation & focus on selling more products). Some of Unilever’s notable acquisitions include Paula’s Choice, Liquid I.V., Horlicks, Garancia, and The Vegetarian Butcher.

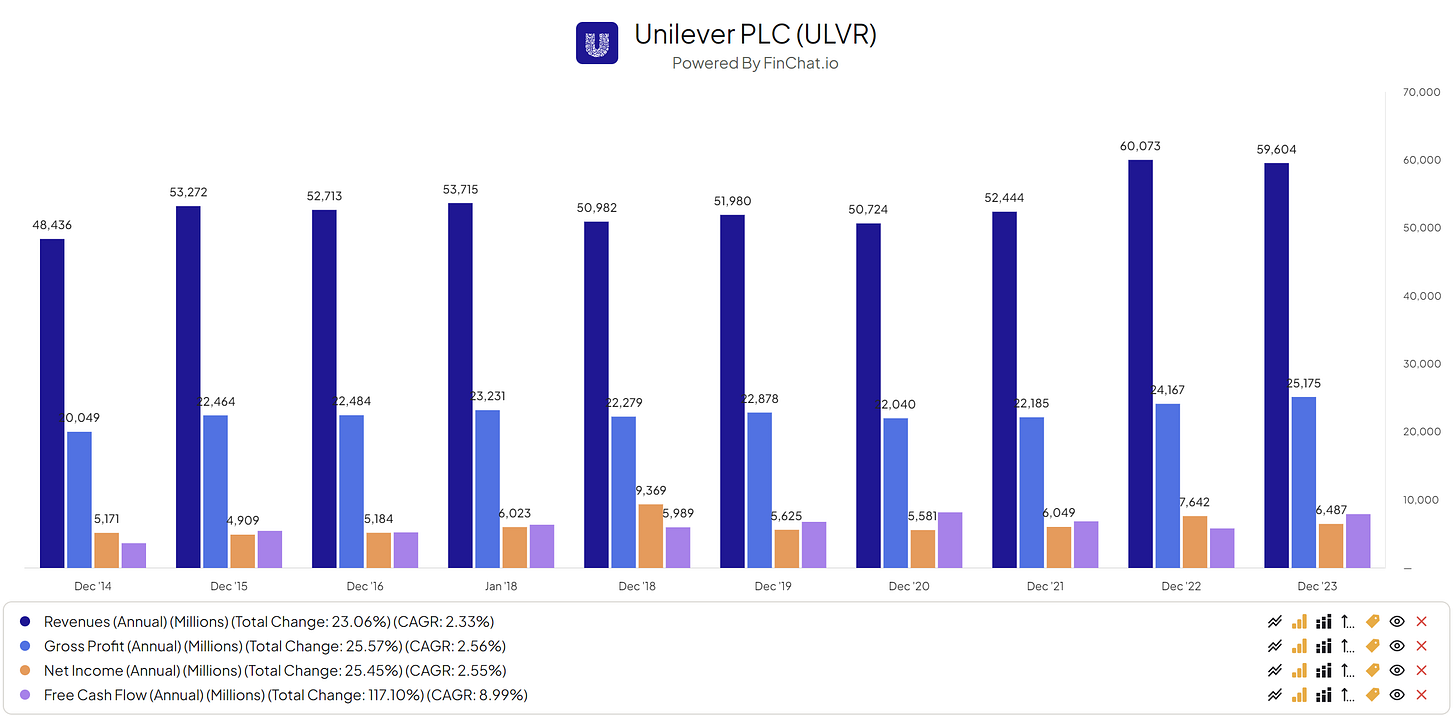

Unilever Fundamentals

10-Year Compounded Annual Growth Rates

Revenue +2.33%

Gross Profit +2.56%

Net Income +2.55%

Free Cash Flow +9%

The revenues, gross profits, and net income have been flat over the last decade, while cash flows grew at a satisfying rate of 9% annually. Unilever has not been great at growing organically over the last decade, the new management wants to reignite its growth. Let’s see how successful they are.

10-Year Per-Share Growth

EPS +4.05%

Operating cash flow per share +7.61%

Free cash flow per share +10.57%

The per-share growth is slightly better due to buybacks, but the return on invested capital has fallen from a high of 28% to the latest 19.3%. This is still a solid ROIC, but a falling ROIC might indicate intensified competition or loss of a competitive edge.

Historic Free Cash Flow Yield

Unilever is trading at its best valuation in a decade judging by its free cash flow yield. The FCF yield is currently above 5%, the business has gradually become cheaper (most likely due to mismanagement and a failed M&A strategy). If you (as Terry) believe that Unilever will turn things around and create significant shareholder value in the next +5 years, this might be a good entry.

That’s it for today — Thanks for reading! Leave a ❤ if you enjoyed it, and a comment ✏.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +6.500 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

Great read as always! Keep up the good work!