💎Sygnity: European Software Compounder

The Constellation Software of Poland

Hi investor 👋

Most great investments don’t look like great investments at first glance.

They look boring, underfollowed, complicated, and regional.

Not on the radar of Wall Street. Too small for institutional screens. Too cheap for the “narrative chasers.”

Sygnity is a 30+ year-old Polish IT/software group that fits all of those criteria.

And yet, beneath the surface, something is happening.

Revenue is growing double-digits.

Margins are expanding dramatically.

Cash flow is exploding.

The balance sheet is strengthening.

The business mix is shifting toward sticky, recurring, high-value services.

And earnings are compounding at a pace that looks nothing like a “mature IT integrator.”

This is the kind of transformation you typically only see before the market wakes up.

TSS (Constellation Software) owns a controlling stake in Sygnity and operates by the same playbook:

“ Since you are all quite familiar with Constellation and TSS … we will have a very similar approach”

- Maciej Różycki, CEO Sygnity

When you run Sygnity through the 6 Pillars of Quality Growth, a picture starts forming:

A compounder, transitioning from a cyclical integrator to a cash-generating software & IT platform, trading at a fair valuation.

Let’s break it down 👇

1. Management: Executing on a High Level

One of the most important parts of any quality investment: who runs the business?

Sygnity’s recent acceleration is not an accident.

It’s the management’s execution.

The current leadership team, led by President Maciej Różycki, Vice Presidents Mariusz Jurak and Daniel Fryga, and CFO Monika Zientarska, has built:

A culture focused on profitability, not just revenue.

A disciplined approach to M&A integration.

A system for scaling software implementations efficiently.

This management team, together with TTS, has delivered:

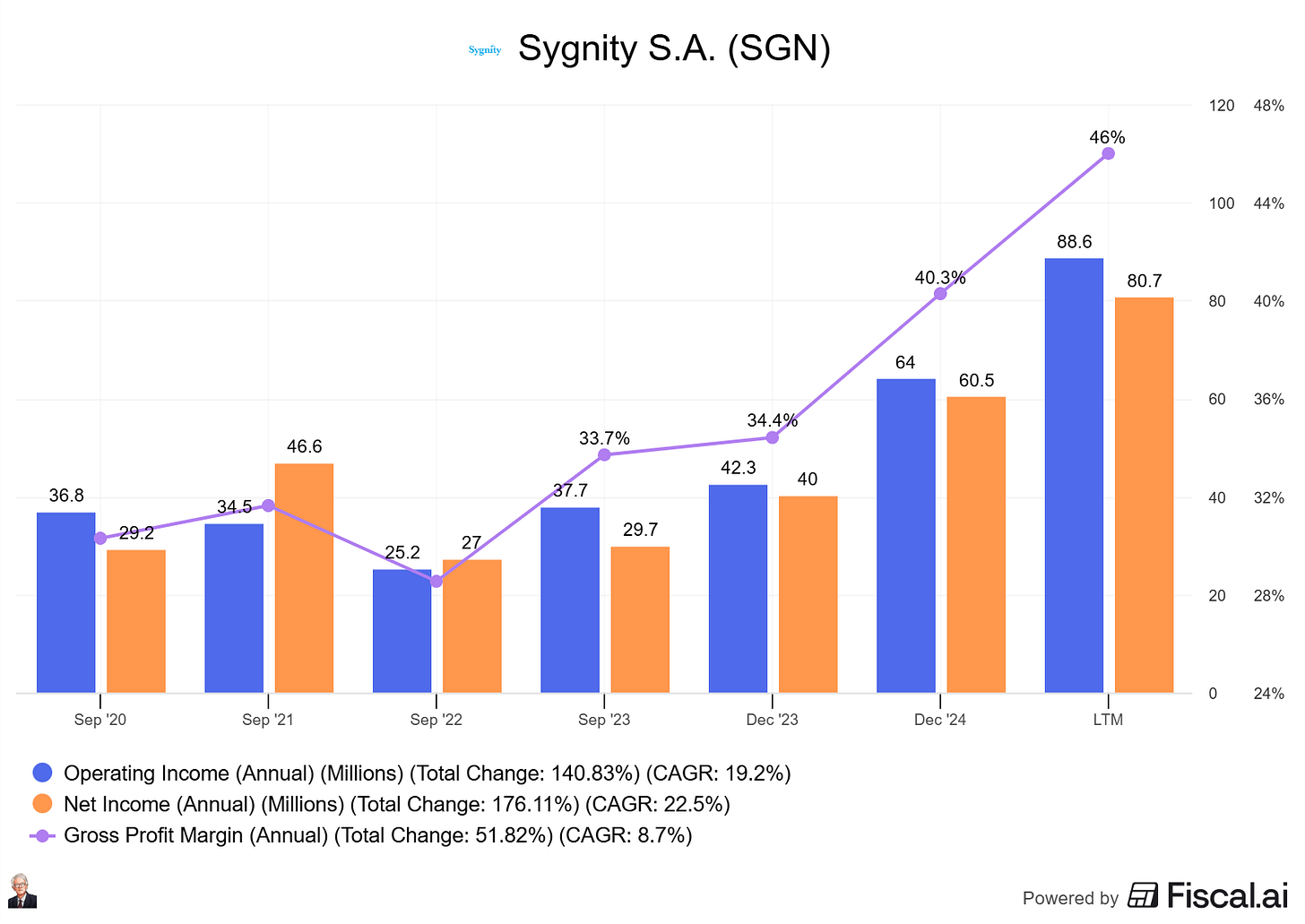

✅ Expanding gross margins in the last 5 years

✅ Improved ROIC sharply in the last decade

✅ Strengthened the balance sheet (net cash rising quarter by quarter)

✅ Shifted the revenue mix toward higher-value segments

✅ Executed cost controls without slowing growth

Across multiple quarterly reports, management repeatedly emphasizes one theme: Operational discipline.

You see it in the numbers:

EBIT has increased by more than 100% since 2023.

Net profit +171% since 2023.

Gross margin expansion from low-30% to mid-40%.

Nothing compounds harder than consistent, repeatable operational discipline.

The largest shareholder and controlling owner of Sygnity is TSS Europe, part of the Constellation Software ecosystem. TSS represents 72.68% of the total number of votes in Sygnity.

TSS has successfully helped Sygnity transform from a slow-growing, high-risk IT integrator to running the ‘Constellation’ compounding playbook of buying mission-critical vertical market software businesses at very cheap valuations.

2. Moat: Sticky Integrations & Recurring Revenue

Narrow Moat: A Specialist in Mission-Critical Polish Infrastructure

Sygnity fits the profile of a narrow-moat vertical software company: highly entrenched in critical public-sector and utility systems, but concentrated enough that the moat remains narrow rather than wide.

For decades, Sygnity has been one of the key vendors behind Poland’s digital infrastructure. Most notably, the e-Taxes platform for the Ministry of Finance and extensive IT systems used across public administration, utilities, and banking. These are large, multi-year systems that sit at the core of how state agencies and regional utilities operate. When a vendor becomes the “system of record” for national tax processes or for managing tens of thousands of kilometres of utility networks, the relationship becomes extremely sticky.

The moat here comes from depth and criticality, not scale: Sygnity owns specific verticals in Poland that matter, and those verticals are deeply embedded.

Switching Costs: Customer retention

The strongest part of Sygnity’s moat is its switching costs. Replacing Sygnity isn’t like swapping a CRM; it is a high-risk, multi-year re-platforming with political, operational, and regulatory consequences. Large projects like the national e-Taxes system involve custom integrations, bespoke workflows, and dependencies on other state registers. Utilities rely on Sygnity software for billing, forecasting, network planning, and regulatory reporting.

If a provincial water or gas operator wanted to switch vendors, they would essentially be rebuilding their operational backbone from scratch - risking outages, compliance failures, and massive migration costs. As a result, Sygnity’s customer relationships naturally extend across long renewal cycles, generating stable maintenance and recurring revenue. The switching cost moat is not theoretical - it is visible in the company’s contract lengths, recurring revenue mix, and the fact that many of its systems have been in place for a decade or more.

Intangible Assets: Domain Expertise

Sygnity also benefits from intangible assets accumulated over decades: regulatory expertise, proprietary frameworks, and deep institutional knowledge of Poland’s public sector.

This advantage strengthened further after its acquisition by Total Specific Solutions (TSS), part of the broader Constellation/Topicus ecosystem. Under TSS, Sygnity has added specialised vertical products through acquisitions like Sagra Technology (SaaS analytics/SFA for FMCG), DocLogix (document/workflow systems), and Edrana Baltic (ERP and public-sector software in Lithuania). These are not generic IT services - they are vertical, regulation-specific applications shaped by years of learning inside highly specialised domains.

That accumulated expertise is extremely hard for new entrants to replicate quickly. Combined with TSS’s “buy, optimise, and hold forever” model, Sygnity is converting decades of know-how into a growing portfolio of sticky, high-retention software assets. In other words, its moat is not scale, but specialization.

3. Business Model: Buy, Optimise, Hold Forever

From IT Integrator to Vertical-Software Operator

Sygnity is undergoing a profound shift in its business model.

Historically, it operated as a classic IT integrator: project-based revenues, custom implementations, dependence on public tenders, and lumpy profitability. That model creates cash-flow volatility and limited operating leverage.

Since being acquired by Total Specific Solutions (TSS) - the European arm of Constellation Software - the company has begun transitioning into a vertical-market software operator, where the economic engine is recurring revenue, not one-off projects.

This shift is already visible in the company’s mix: more proprietary software, more maintenance contracts, and a growing portfolio of owned applications across utilities, public-sector workflows, banking systems, and SaaS analytics. The direction of travel is unmistakable: fewer bespoke projects, more productised software with predictable renewals.

Buy: Adding Niche Vertical Software Assets

The first phase of the model is Buy: selectively acquiring specialised software businesses that serve narrow, defensible markets. Under TSS, Sygnity has added assets like Sagra Technology (SFA/analytics for FMCG sales teams), DocLogix (document/workflow automation), and Edrana Baltic (ERP and public-sector systems in Lithuania).

These businesses share the hallmarks of strong vertical software: mission-critical workflows, high switching costs, long customer relationships, and defensible niches that larger vendors overlook. Each acquisition brings not just revenue, but domain expertise, IP, and long-term maintenance streams, which layer naturally on top of Sygnity’s existing footprint in Polish public administration and utilities. This “acquire niches nobody else cares about” strategy mirrors exactly what Constellation did across North America and Europe for two decades.

Same playbook, different market.

Optimise & Hold Forever: The Compounding Engine

The second and third phases is “Optimise and Hold Forever”. This is where the compounding starts.

Instead of flipping assets or chasing hypergrowth, TSS runs a proven playbook: improve unit economics, standardise processes, raise customer retention, trim non-core development, and reinvest cash flows into the next niche acquisition.

The portfolio becomes a network of small, hyper-stable software companies, each throwing off predictable cash that funds more acquisitions. Sygnity is now being run with the same philosophy: focus on recurring revenue, productise services, deepen customer stickiness, widen margins, and redeploy capital into more vertical software.

Over time, this transforms Sygnity from an integrator tied to project cycles into a mini-Constellation: a decentralised compounding machine where dozens of small, resilient software businesses generate stable cash and long-term growth. This is the business model shift that turns a cyclical IT contractor into a structural compounder.

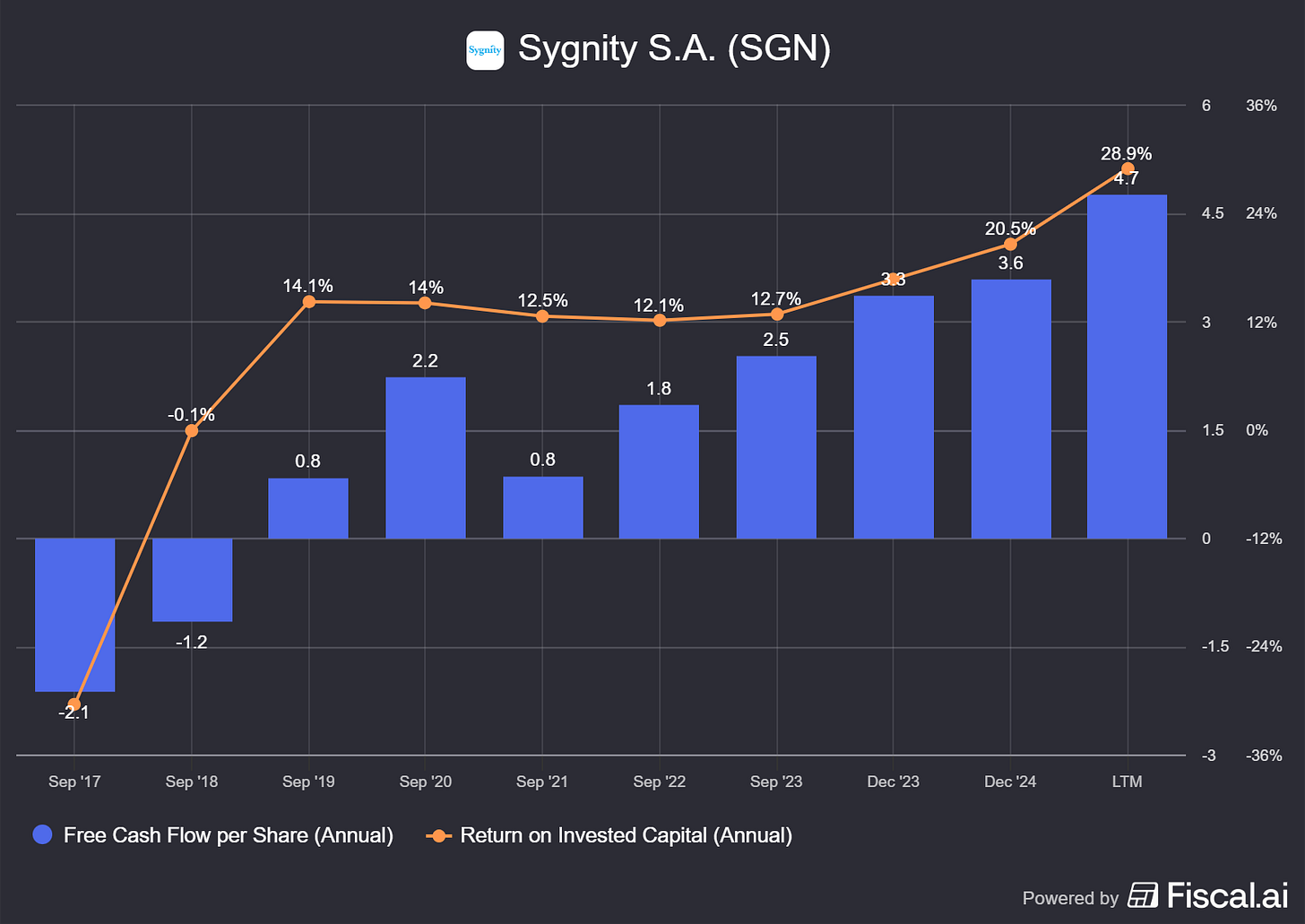

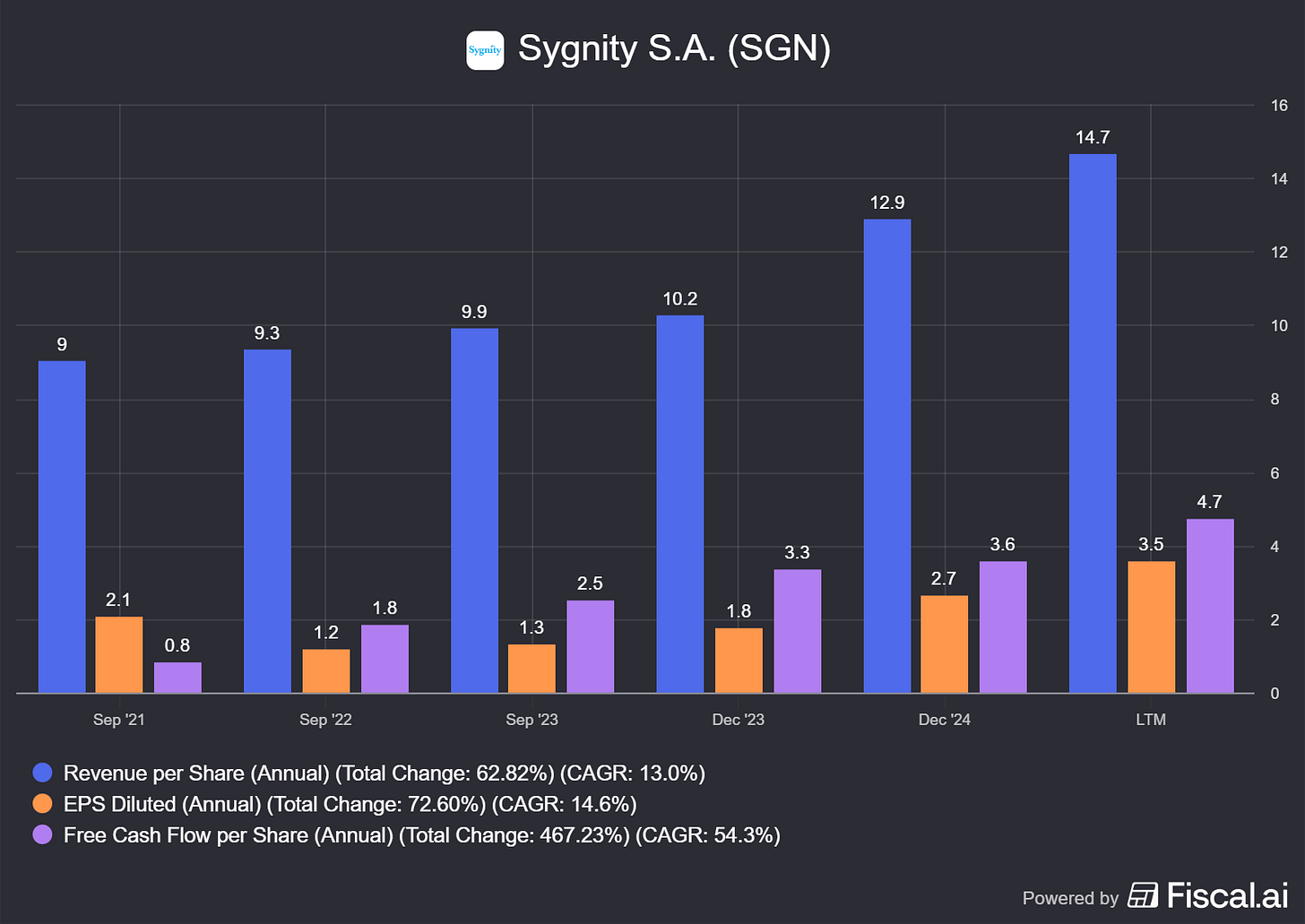

The transformation has yielded significant results, from negative free cash flow per share, to significant growth and increasing ROIC to +20%:

4. Growth: From Low Single Digits to Controlled Compounding

After years of grinding along at low single-digit growth, Sygnity has transformed into a higher gear.

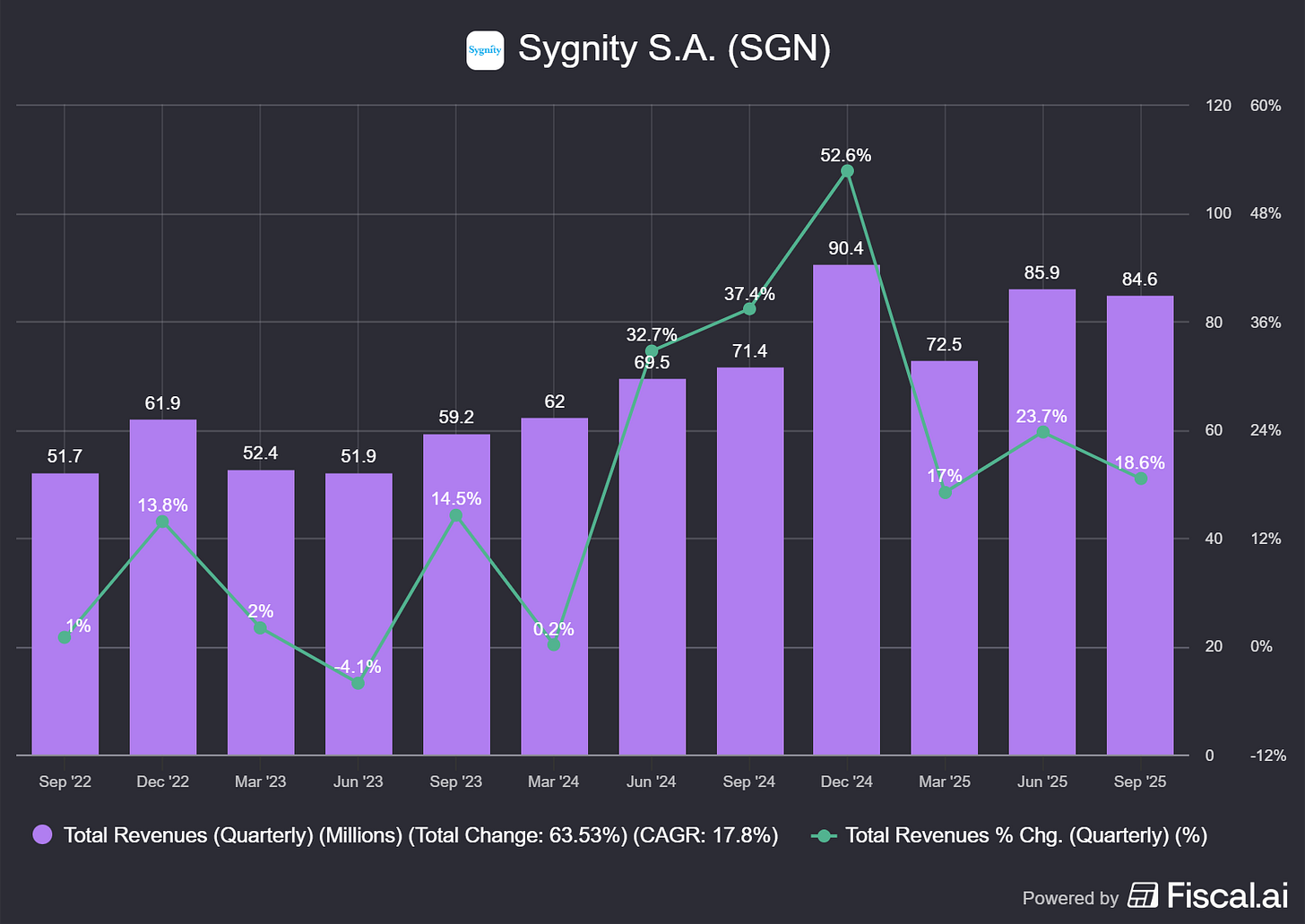

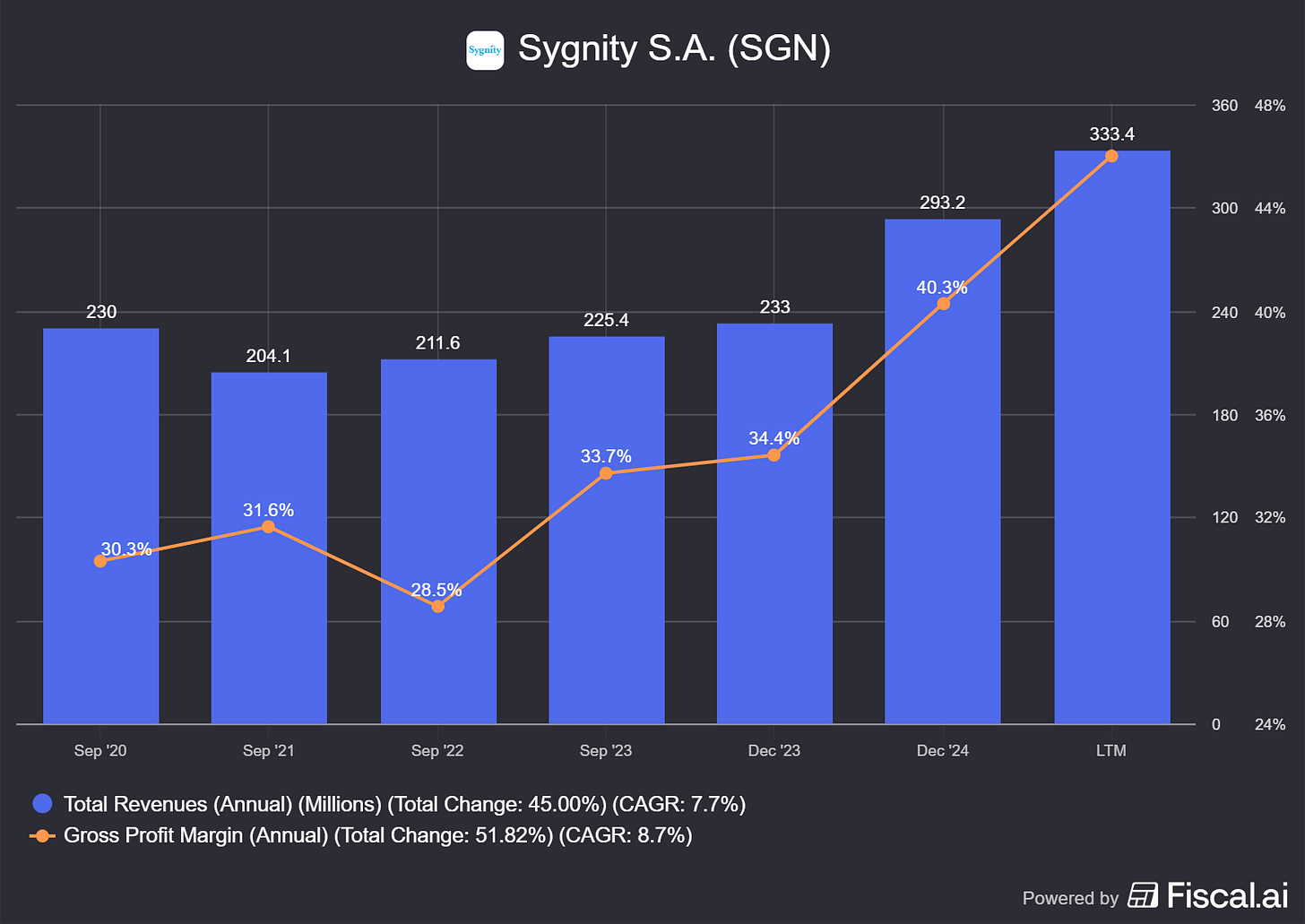

Reported revenue has climbed from roughly PLN 212m in 2022 to PLN 233m in 2023 and PLN 293m in 2024 (+26% YoY). On a trailing basis, revenue has now reached about PLN 333m (+43% YoY), with quarterly sales of PLN 84.6m in Q3 2025 (+18.6% YoY). Q1 2025 revenue alone grew 17% YoY (PLN 72.5m vs. 62.0m), while net profit was up ~43% as margins expanded.

In other words, this is no longer a stagnant IT contractor. It’s a vertical software group growing mid-teens to high-teens on the top line with structurally better profitability.

Growth Driver #1: Digital Transformation of Banks, Utilities, and the State

The first growth engine is organic demand for digital transformation in Sygnity’s core verticals: Polish banks, utilities/energy, and public administration.

Management (and external research) point out that banks are refreshing core systems, utilities are upgrading billing and network systems, and government agencies are modernising e-government, tax, and consular platforms.

This shows up directly in the numbers: Q1 2025 revenue +17% YoY to PLN 72.5m, driven by new contracts in banking and energy and a growing backlog.

Behind that demand is a policy-driven capex wave. Poland is deploying EUR 76bn of EU cohesion funds in 2021–2027, with “a more modern, greener and digital economy” explicitly flagged as a core objective. Gov.pl

Within that, the European Funds for Digital Development 2021–2027 programme alone provides about EUR 2bn earmarked for digital transformation and gigabit infrastructure, with subsidies directed at public administration and telecoms.

Poland’s Gross Domestic Product (GDP) is one of the fastest-growing economies in the world. This further backs the thesis that both government and private institutions will be investing more into digital platforms and services in the coming years to meet government digitalization goals.

In short: Sygnity’s public-sector and utility franchises are sitting in the slipstream of a multi-year EU-funded digitalisation cycle. That’s a structural growth driver, not a one-off project spike.

Growth Driver #2: Acquisitions in Fast-Growing Vertical Niches

The second engine is M&A, consistent with the Constellation/TSS playbook of buying niche vertical software and holding it forever. Since 2024, Sygnity has added Edrana Baltic (ERP + HR/payroll systems in Lithuania), Sagra Technology (SaaS SFA/analytics for FMCG sales teams), and DocLogix (document and workflow management used by enterprises and government agencies).

In 2024, these acquisitions contributed about PLN 13.6m (Edrana) and PLN 21.9m (Sagra) to revenue and PLN 2.2m and PLN 3.6m to net profit, respectively. So roughly 12 percentage points of the 26% revenue growth that year was acquisitive, with the rest coming organically.

The market opportunity here is attractive. DocLogix operates in the DMS/ECM (document-management / enterprise-content-management) market, which is expected to grow at about 16% CAGR from ~USD 7bn in 2024 to >USD 18bn by 2030.

EU-wide moves toward mandatory e-invoicing and digital workflows from 2025 are likely to pull more enterprises and public bodies into structured document and workflow platforms - the exact niche DocLogix targets.

Edrana and Sagra, meanwhile, extend Sygnity into Baltic public-sector ERP and FMCG sales-force automation, both segments where software penetration and analytics intensity are rising. Net result: Sygnity is layering new potential markets on top of its Polish core instead of relying solely on domestic public-sector budgets.

Growth Driver #3: Margin Expansion and Mix Shift Toward High-Quality Revenue

The third driver is not just more revenue, but higher-quality revenue. Under TSS ownership, Sygnity has aggressively exited or renegotiated low-margin contracts and pushed its mix towards software, maintenance, and SaaS-like subscriptions.

Gross margins have significantly improved since their lows of 28.5% in 2021; in the TTM, gross margins have expanded to 46%. This showcases Sygnity’s successful pivot into higher-quality revenue sources by applying the CSI/TSS acquisition playbook.

Over 2021–2025, revenue grew from ~PLN 9 per share to ~PLN 14.7, but EPS and Free cash flow per share grew much faster as the company swapped commoditised integration work for higher-margin recurring software and support.

For a quality-growth investor, this matters more than pure top-line: Sygnity is not just growing. It is compounding free cash flow per zloty of revenue, which is exactly what you want to see in a Constellation-style business, as they will use the free cash to acquire more sticky vertical software businesses to continue to compound.

5. Risk

Key Risks Investors Should Watch

1. Concentrated in Poland and a few regulated sectors

Sygnity still generates ~95% of its revenue in Poland, with a heavy focus on banking/financials, public administration, and utilities.

This makes the company highly exposed to Polish macro conditions, public IT budgets, EU-funded projects, and local regulation. A slowdown in Polish IT spending, delayed tenders, or changes in sector regulation (especially in banking and public administration) would hit growth significantly.

2. Dependence on public tenders and project execution

A meaningful share of Sygnity’s business still comes from complex, tender-based projects for public institutions. These contracts are often fixed-price with strict performance and warranty clauses, which bring execution risk, potential cost overruns, and legal disputes if implementations slip.

Historically, the company has faced project-related claims and off-balance-sheet guarantees, illustrating how a single problematic contract can pressure margins and cash flow.

3. Buy–optimise–hold execution and integration risk

Under TSS/Topicus ownership, Sygnity is pivoting from classic IT integrator to vertical-market software consolidator, acquiring niche players like Edrana and DocLogix and healthcare specialist Comarch HIS. This model can be powerful, but it adds integration and capital allocation risk: overpaying for targets, misjudging product quality, or failing to integrate sales and development teams could dilute returns and stall margin expansion.

4. Minority shareholder and liquidity risk

Sygnity is now ~73% controlled by TSS Europe / Constellation Software (via Topicus), leaving a relatively small free float of ~27% and only a few million shares actually trading. For minority investors, this creates governance and exit risk: strategic decisions (M&A, leverage, dividends, potential delisting or squeeze-out) are effectively controlled by the majority owner, while daily trading volumes are thin, making larger positions harder to build or unwind without moving the price.

5. Competition and growth durability

Sygnity operates in a highly competitive Polish IT market, up against local leaders (e.g. Asseco, Comarch) and global vendors.

Recent years have shown that public-sector order intake can be lumpy - 2024 saw a weaker period before new contracts from institutions like Polish Post and ARMA replenished the backlog.

If the company cannot keep winning large renewals and cross-selling into its installed base, today’s high margins and growth rates may not be sustainable.

6. Valuation and multiple-compression risk

After a strong share-price run, Sygnity now trades at roughly ~25 trailing earnings and ~5.2% Free cash flow yield, materially above where traditional IT integrators have historically traded in Poland.

If organic growth slows, acquisitions disappoint, or the market starts to treat Sygnity more like a cyclical IT services name than a durable compounding software platform, multiple compression alone could drive meaningful downside even if the underlying business remains profitable.

The rest of the article is for Premium subscribers. Join us today 👇

6. Valuation: Is Sygnity a Buy?