Screen for High-Quality Ideas 💎

3 min read 🧠

We are building a video course on quality growth investing. 👨🏫

It will teach you:

How to find quality ideas 💡

How to analyze a business 🏰

How to value a business 📊

How to build your portfolio 🧠

Sign up for an early release offer when the course releases:

Finchat is a great tool for investors.

Using Finchat.io, we can screen for high-quality stock ideas easily and reliably. The most interesting stocks can be researched more deeply and become possible investments.

Step 1: Go to Finchat

Step 2: Go to the “Screener” section on the left side of the dashboard.

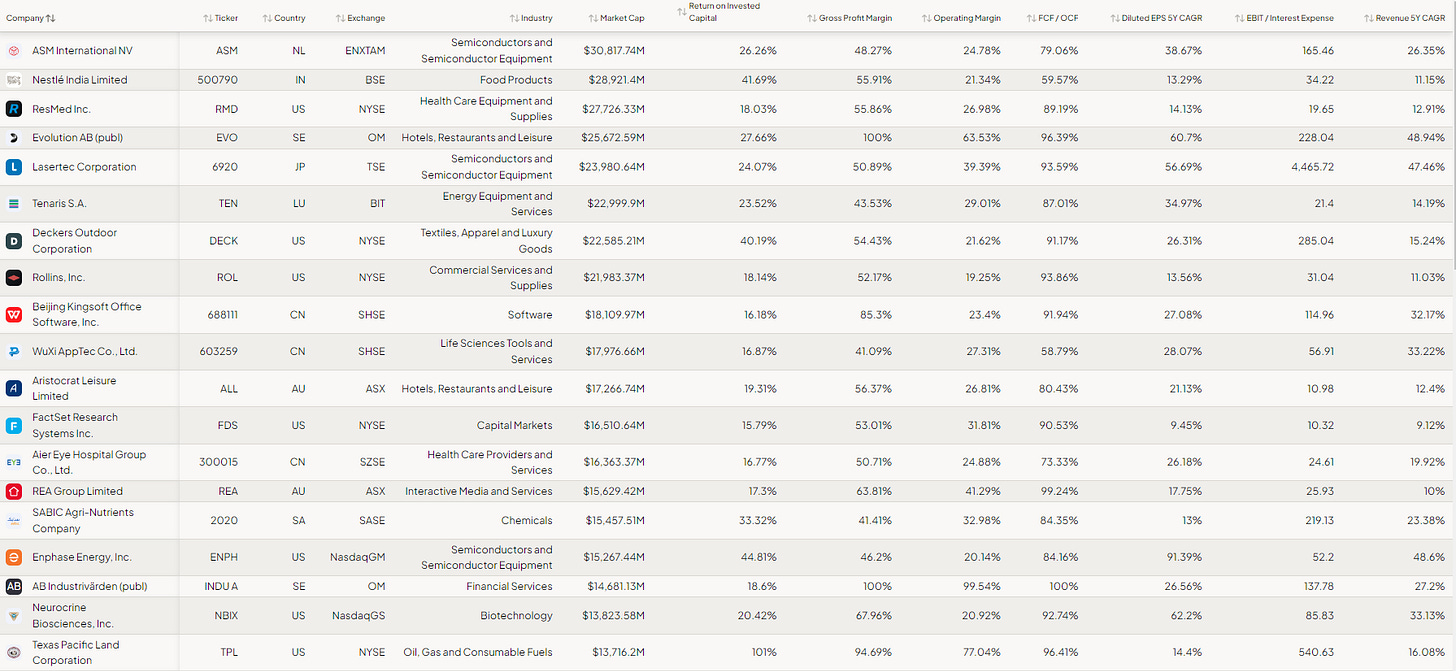

Step 3: Set your criteria:

ROIC 15% to infinity

Gross Profit Margin 40% to infinity

Operating Margin 10% to infinity

FCF / OFC 50% to infinity

Diluted EPS 5Y CAGR 8% to infinity

EBIT / Interest Expense 10% to infinity

Revenue 5Y CAGR 8% to infinity

Like this:

Step 4: Click “Run Screener”

The results will be sorted by market capitalization, you can always click the “Market Cap” section to sort it from lowest market cap instead of highest.

The list will be comprehensive and include many quality companies in our investable universe & watchlist:

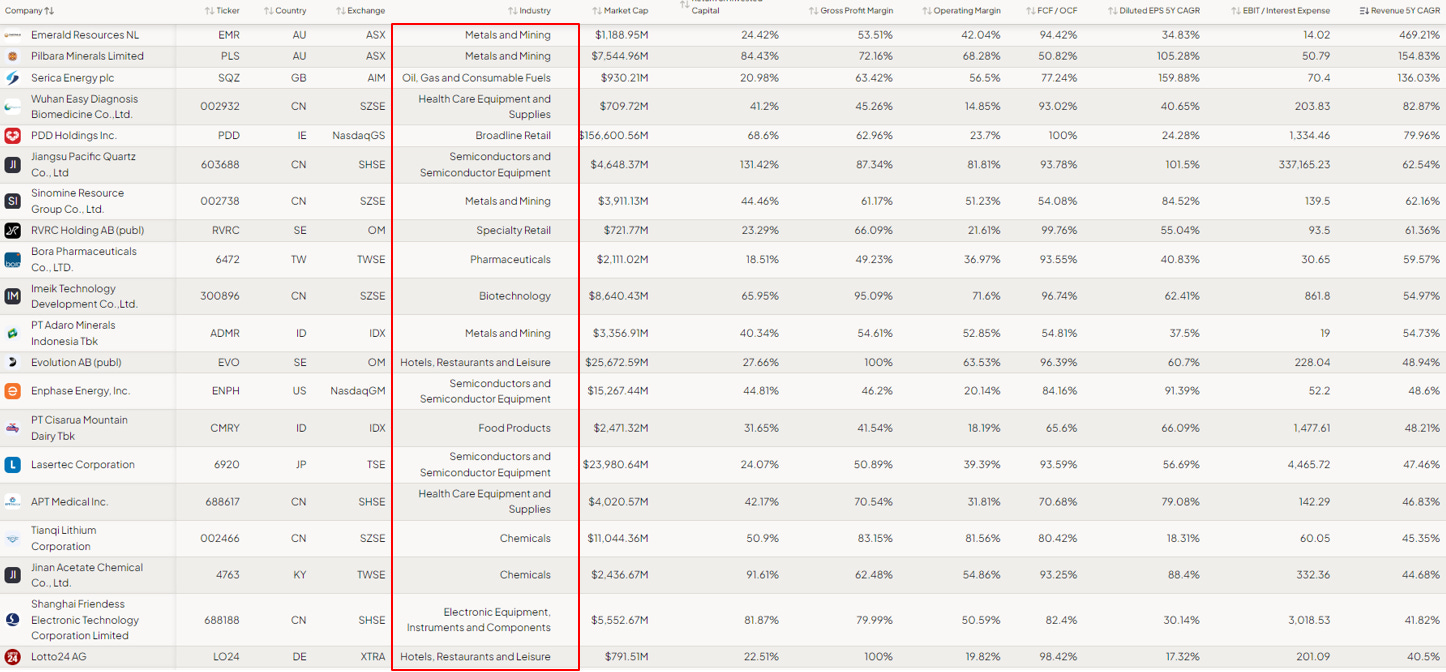

You can sort by growth by clicking the “EPS 5Y CAGR” or “Revenue 5Y CAGR” tab at the top.

Keep in mind, that this will often bring forward cyclical companies, as they are in their phase of growth due to cyclical factors.

I’m not investing in Mining companies, or Oil & gas companies for example, as these are generally destroying shareholder value over time, and only making solid returns in certain years.

5 Companies I found using this screener (That I haven’t looked much into yet):

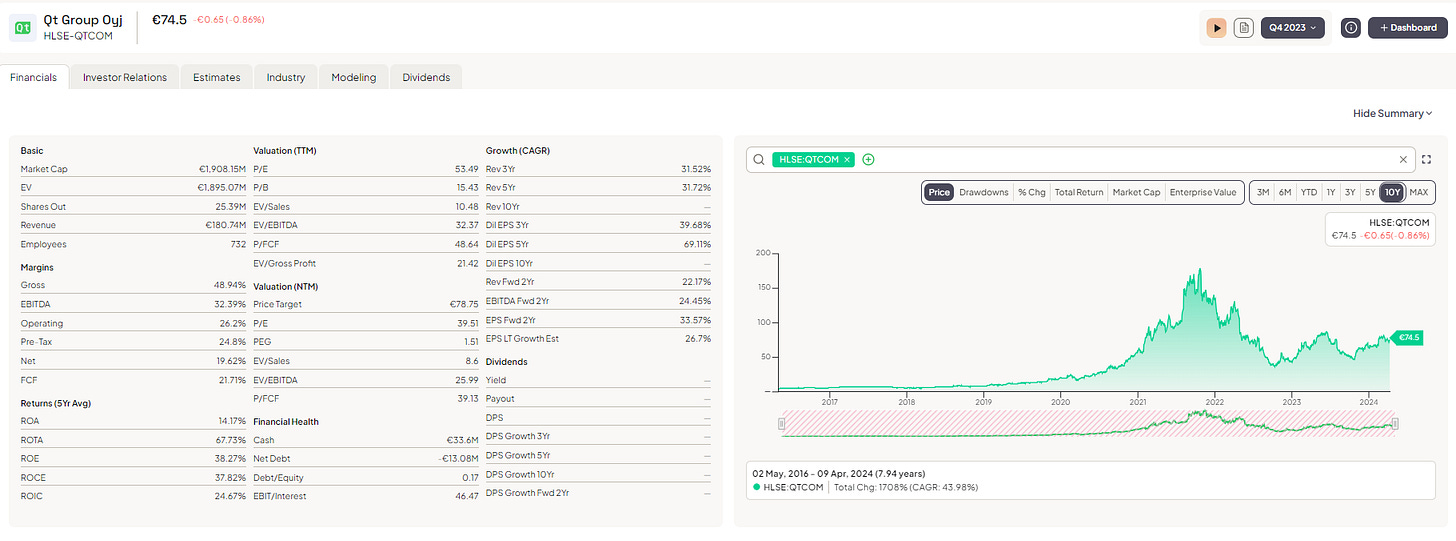

QT Group

QT provides its customers with software development tools. The technology is used in various devices and applications, including consumer electronics, vehicles, airplanes, and industrial automation applications.

10-Year share price CAGR: 43.98%

Airbnb

Airbnb is the world’s largest online alternative accommodation travel agency, also offering booking services for boutique hotels and experiences.

10-Year share price CAGR: 3.12%

Investor AB

Investor AB is an industrial holding company with a long-term, active investment portfolio strategy. The company focuses on investing in companies that emphasize innovation and product development. Investor AB's so-called "buy-to-build" strategy seeks not to divest holdings, but rather to develop them over time to close the gap between price and value.

10-Year share price CAGR: 19.5%

Technology One

Technology One is a technology company providing enterprise resource planning software, primarily to governments, education institutions, and healthcare organizations in Australia, New Zealand, and the United Kingdom.

10-Year share price CAGR: 23.2%

Inter Parfums

Inter Parfums operates in the fragrance business and manufactures, markets, and distributes fragrances and fragrance-related products. Its top brands include JIMMY CHOO, bebe, Paul Smith, Abercrombie and Fitch, COACH,

10-Year share price CAGR: 16.2%

Finchat has a fantastic free product, but if you want to try the paid version, you can get a 15% discount using our affiliate link: Finchat.io/investinassets

Let me know if you found this post helpful in the comments below and leave a ❤!

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +6.500 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

Easy to setup your criteria. Great resource. Copilot interesting. Anybody with a list of prompts?