Q3 2023 Portfolio Update

Sharing my performance, moves and thoughts about Q3 23

Sharing my 3 most popular write-ups from Q3 23:

Want to follow the portfolio in detail?

There have been several requests to be able to follow the portfolio in real-time from several subscribers. I’m working on a paid newsletter where I will disclose my portfolio in more detail, the processes and thesis’ behind my investments and moves.

Stay tuned to the newsletter if you are curious.

Q3 2023 Performance

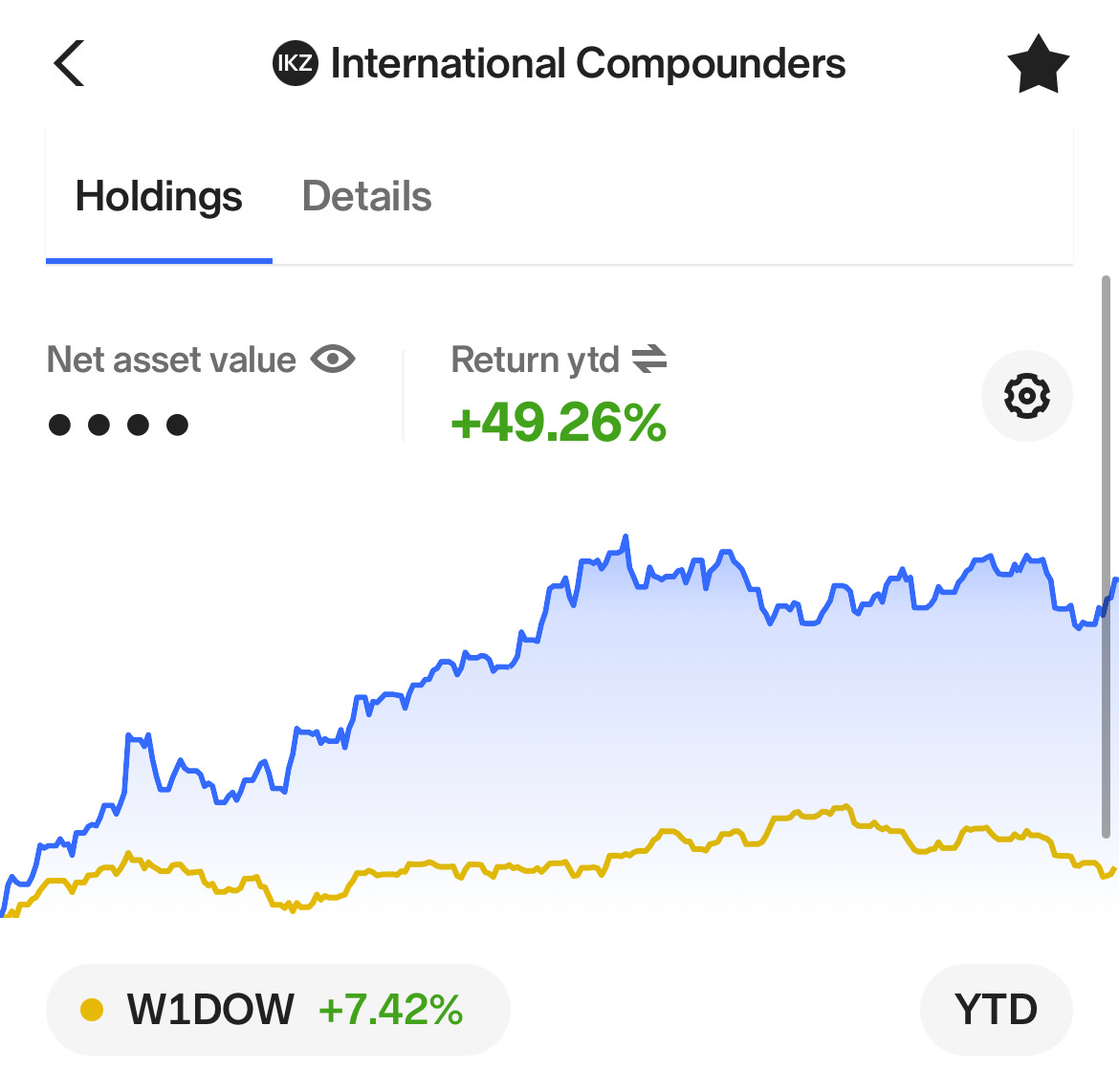

The portfolio had a small setback in Q3 along with the overall market. However, we are still doing very well with a YTD performance of +49.26% for my international portfolio (5/6 of the total capital), and +15.73% for my Nordic Portfolio (1/6 of the total capital).

SPY 0.00%↑ Q3 performance was -3.56% and YTD performance is +11.78%

The Global Index fund I would invest in that I measure my performance against had a Q3 performance of -2.43%, and YTD of +21.85%.

How did we do in Q3?

First off, I have 2 different portfolios for tax purposes:

“International Compounders” and “Nordic Compounders”

IC holds global stocks (US, Canada, Netherlands, and some Scandinavian stocks)

NC holds Scandinavian stocks only (Mostly Evolution AB)

International Compounders

My top holding is Amazon AMZN -1.05%↓ which contracted ~2.5% in Q3. My “Big Tech” holdings have performed well in 2023:

Amazon: +51.33%

Google: +48.32%

Microsoft: +31.66%

Additionally, we have had tailwinds from FX in 23, mainly due to a weakening NOK.

My International Compounders portfolio is concentrated on a few global compounders:

Amazon AMZN -1.05%↓ (-2.49% Q3)

Alphabet GOOGL -0.77%↓ (+9.32% Q3)

Constellation Software $CSU.TO (+2.16% Q3)

Microsoft MSFT 0.29%↑ (-7.28% Q3)

LVMH $LVMH (-16.83% Q3)

Qualys QLYS -0.73%↓ (+18.10% Q3)

Mastercard MA 0.32%↑ (+0.66% Q3)

Visa V 0.05%↑ (-3.15% Q3) Added in Q3

Adyen $ADYEY (-55.22% Q3) Added in Q3

ASML ASML 0.00%↑ (-18.78% Q3) New position in Q3

Evolution Gaming and Teqnion

International Coumpounders Q3 Performance -0.10%, YTD performance +49.26%:

Want to level up as an investor?

Check out Essentials of Quality Growth Investing

It will teach you how to identify, analyze, and value a compounder to achieve superior returns in the market.

Buy it here

Nordic Compounders

My top holding is Evolution Gaming $EVO.ST which contracted by 14.5% in the quarter. This holding has significantly affected the performance of the Nordic Portfolio, however, Evo is up 8% YTD and is currently trading at an attractive price.

There has also been a negative FX effect in Q3, subtracting the value of my Swedish investments by ~2%.

The Nordic Compounder portfolio is highly concentrated and the Scandinavian names we hold are:

Evolution Gaming $EVO.ST (-14.5% Q3) Added in Q3

Lifco AB $LIFCO.ST (-19% Q3) New position in Q3

Teqnion $TEQ.ST (-10.94% Q3)

Admicom $ADMCM.HE (-19.12% Q3) Added in Q3

AF Gruppen had to leave the portfolio in Q3 due to disappointing development in sales, and profitability, and due to better opportunities in the market.

Nordic Coumpounders Q3 Performance -9.07%, YTD performance +15.73%

Thoughts on Q3 2023

The third quarter of 2023 has been rather bumpy with some action to the downside. We saw Adyen plunge down more than 50% in a few days, following weaker-than-expected growth, and a growing concern around their moat.

Additionally, companies that are dependent on Asian sales have contracted due to the fears of economic slowdown in China as well as the political turbulence that has been going on between the East & the West. LVMH contracted by nearly 17% in the quarter as a result. We also saw Evolution AB get dragged down this quarter, most likely due to the same narrative.

Admicom keeps getting cheaper, which is expected for a business that is expected to contract. Hopefully, Admicom will manage to turn the downturn around in Q1/Q2 2024. For Admicom to continue its growth trajectory of 8-15% annual sales CAGR, they are repositioning the company with a focus on European expansion, supported by strategic acquisitions. If Admicom can manage to be successful in this endeavor, I believe this could turn out to be a great investment. Of course, the opposite is true if they fail.

Doubling down on a loser: Adyen

Adyen plunged down ~55% in Q3 of 2023. My take on the plunge is Adyen’s management’s refusal to play Wall Street’s short-term game. The CEO was asked on the earnings call why they would not lower prices to compete in North America (Where they saw increased competition and competitors lowering prices), his reply was that they did not want to compete on price. Long term, Adyen has a better product that not only decreases the total cost of ownership for their clients but also provides smart data solutions that help their clients increase sales and profitability.

Adyen was a small position in the portfolio before the fall (~1.5%), we have now added substantially to the position, as we like the management’s long-term mindset, we do believe Adyen still has a competitive advantage, and that the company will continue to grow profitably for the next 5-10 years. Additionally, the price we are getting for Adyen now vs. last quarter is appealing.

Adding to Evolution AB

I recently posted an article on Evolution, detailing my thesis and some of the strengths in the investment case. Evolution is an incredible business, but the business has substantial risks. It can’t be compared to something stable like S&P Global or Microsoft. But in return, it offers a solid upside, which is why we added to it in Q3. It is currently trading at a forward PE of 16, and a forward FCF yield of 5.2% - not bad for a business growing profitably at +25% rates.

New position: Lifco AB

I’ve followed Lifco for a few years, I like the organization as a whole. Competent and experienced management with a track record of profitable growth and successful acquisitions. Skin in the game, and continuous purchasing of their own stock from the CEO and other management members. The 3 main business segments are well-run and highly profitable, and we assume it will continue in the future.

The stock has been on a pullback as most other Swedish companies, and we found an OK entry in terms of valuation. We view this business as a compounder that we aim to own for a long time.

Generel Q3 and Q4 thoughts

I’m not viewing my investments on a quarterly basis but on a multi-year basis. So, for us, one, two, or three-quarters don’t mean as much. We will have periods of over performance, and periods of under performance, that is the name of the game.

Q3 has provided many more opportunities than we have seen in the market for a while, which is exciting. It may also mean that there might be changes made to the portfolio in Q423 / Q124 depending on what happens. We hope to see stocks become cheaper as the risk-free rate has increased substantially in Q3.

I have no forecasts for Q4 other than that I expect my businesses to do well, as they do (almost) every quarter, and continue to compound their revenues, earnings, and free cash flows. For Admicom, I am expecting to see better results in Q1 of 2024 as this is a “turnaround” play (However, I would argue that the business is not struggling with almost no debt and solid cash generation).

We deployed ~5% cash in Q3 to opportunities as we saw in the above-mentioned businesses. We added continuously to the investing account during the quarter, which leaves us at a cash position of ~7%. You can expect to see a few new businesses added to the portfolio in Q4 if our prices are hit.

Leaving you with this quote to consider as markets are declining:

"You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.”

- Peter Lynch

Whenever you are ready, here is how I can help you further:

Free resources:

Book, guide & investing tools:

Which broker do you use for buying/selling Teqnion shares?

Thank you for your update!

I have questions about the Nordic Portfolio. You also mentioned LVMH, do you hold LMVH also in this portfolio or do you have all stocks listed here?

You are basically going for quality. Why do you take such a risk with EVO? Moreover, you don't care about the ethical aspect? EVO will perform strongly especially in an environment of inflation, because there are enough victims who gamble away their last money and are even willing to put all their belongings at risk... I dont want to support such businesses. But of course it's your decision if you need/want to be invested in it.