Paycom: Shaping Modern Workplaces with Innovative Tech📊

Undervalued SaaS Business?

Hello, dear subscriber 👋

Today we will break down Paycom Software, a fast-growing HR and HCM solution technology firm that is on a -70% pullback from its all-time highs.

If you enjoy this article, make sure you ❤ and leave a comment✏ —It means the world!

Key Insights from the article:

Paycom guided for 10-12% revenue growth in 2024, significantly lower than its 3-year sales growth of ~25%.

Paycom’s NPS score is significantly higher than its peers, indicating that Paycom has a better product.

The founder is still the CEO (Co-CEO) of Paycom and owns 13.94% of the business. Other key executives also own a significant stake.

Paycom’s business model is highly attractive as it sells subscriptions and utilizes a software-as-a-service model to gain recurring revenue.

Their new product, BETI has investors concerned about the cannibalization of their existing products.

Let’s get to it!

Investment Thesis

Paycom Software is a founder-led business on a large pullback due to growth fears. The growth went from ~25% annually, to ~10% in the most recent quarters. This has scared investors. What is particularly scary, is their new software “BETI”. This software is very good and allows customers to have fewer transactions, hence Paycom is paid less. This product is cannibalizing their other products, and is giving Paycom a negative product mix hence the sales growth has dropped.

The BETI product is BETTER for the customer, but worse (in the short term) for Paycom, as it brings in less revenue. However, we want to argue that this is a long-term positive for the business and will allow Paycom to take more market share in the years ahead. It is better that Paycom is cannibalizing its own product, instead of a new challenger doing so. This shows us that management understands how dynamic and competitive the software space is.

Paycom offers a mix of high growth and profitability and will continue to take market share from the legacy incumbents.

This article is sponsored by Finchat.io — Get 15% off any paid plan.

For $24.65 per month, you get access to:

10 Years of financial data

5 years of Segments & KPI data

100 Copilot prompts

5 Dash boards and much more

Finchat is a grat tool tool for visualising data + getting the segment & KPI data is a game changer.

Paycom Software

Paycom Software is a leader in the online payroll and human resources technology sector and provides comprehensive cloud-based human capital management (HCM) software solutions.

Paycom was founded in 1998 and is headquartered in Oklahoma City. Paycom revolutionizes how organizations manage their workforce through its innovative software solutions.

In this article, we will delve into Paycom's business model, market position, financial performance, challenges, and future outlook to provide a clear picture of its strategic trajectory and market value.

Company Background

Paycom Software was founded by Chad Richison in 1998. The company has consistently expanded its offerings and market presence to become one of the leading providers of integrated HCM software.

This growth was marked by its IPO in 2014, which was a significant milestone, underscoring its financial stability and investor confidence. Over the years, Paycom has grown from a payroll services provider to a comprehensive HCM solution, servicing clients nationwide with a focus on all aspects of employee management including talent acquisition, payroll, and talent management.

Business Model and Core Products

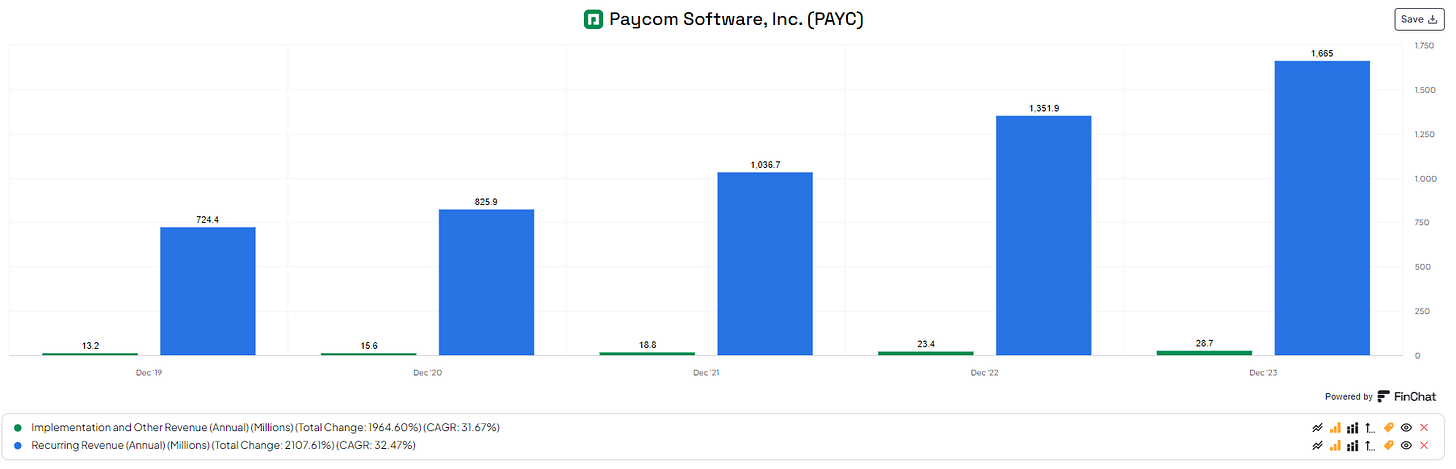

Paycom operates on a software-as-a-service (SaaS) model, which provides scalable solutions to businesses of all sizes. This model ensures a steady revenue stream through subscription fees, which are charged per employee per month. One of the key performance indicators (KPI) of Paycom is its ability to grow recurring revenue. Since 2019, their ARR has compounded by 32.5%. Paycom has also grown its client base by 13.3%, this indicates that Paycom has been successful in selling more products to existing customers.

The core products of Paycom include payroll services, talent acquisition, Talent management, HR management, and time and labor management. Each module is integrated within a single application, enabling real-time data processing and providing businesses with insights to make informed decisions quickly, enhancing overall operational efficiency for SMBs.

Paycom’s Suite of Products:

Paycom has award-winning software solutions and is recognized for its innovation:

Drivers for growth

Scalable business model & Product: Paycom’s suite of products is SaaS-based, and offers comprehensive HR solutions “from recruitment to retirement” for SMBs. The solution is highly scalable, and the suite of products allows for upselling & cross-selling to existing customers.

Product development: Paycom is not afraid to innovate, even if it affects the sales of its other products. Paycom wants to deliver the best HR solutions and HCM systems in the sector. They invest heavily in staying ahead of the game.

Strategic Marketing & Sales Initiatives: Paycom has a sound marketing strategy focused on targeted advertising, direct sales, and a strong online presence. This strategy has been successful in taking market share from the incumbent players.

Global expansion: In its most recent quarter, Paycom expanded globally with “Global HCM” and native payroll processing in Mexico and Canada. If Paycom gains traction internationally, it might be a future growth lever to pull.

This year, Paycom expanded the availability of its automated payroll solution, Beti, into the U.K.

Paycom has a high retention rate, however, it has fallen from a high of 94% in 2021, 91% in 2022, and down to 90% in 2023. This is something to keep an eye on, as new growth initiatives will fall short if retention is not high:

Diversification of sales

Product Segmentation

Paycom generates revenue from two segments. The primary segment is subscriptions from its various HCM SaaS products. Subscription fees include what Paycom charges its customers every month, as well as the number of employees and number of transactions processed for its clients.

In addition, Paycom generates revenue from helping its customers implement the HCM solution. This segment is small compared to the subscription.

Geographical Sales

Paycom primarily sells its HR and HCM solutions in the US, where it focuses on SMBs. The company specifically targets major metropolitan areas where the concentration of SMBs to larger businesses creates clusters.

Paycom holds sales offices in Dallas, Atlanta, and Los Angeles, among others. These offices play a vital role in their sales strategy as they allow for localized sales teams that understand the specific regulatory environment.

Paycom is starting its internationalization expansion with a move into Canada, Mexico, and the UK. Often, the smart move is to expand into neighboring countries where the business culture and practices is somewhat similar. If this strategy is successful, it can become a significant growth initiative for Paycom. However, it is too early to say.

The Stock

Since its inception, Paycom has returned 26.9% annually to shareholders. In the last 5 years, the stock price has been flat.

Paycom is on its largest drawdown since its IPO with a reduction in share price of -69.65% from its top levels.

We will explore in this article, is whether or not the sell-off is warranted, or if there is an opportunity here for investors.

Market and Competitive Landscape

The market for HR software is highly competitive and rapidly evolving, driven by the increasing demand for automation and streamlined human resources processes. Paycom operates in a crowded marketplace alongside major competitors like ADP, Workday, and Oracle. However, Paycom distinguishes itself with its single-application software solution, avoiding the complexities and integration issues faced by solutions that require multiple applications and interfaces. This unique selling proposition not only enhances user experience but also improves data integrity and reduces error rates in HR processes.

Main competitors:

SAP SuccessFactors HCM

Workday HCM

PeopleStrong

DayForce

ADP Workforce

Oracle Fusion Cloud

Paylocity

Paycom’s NPS score is 63 (Good score). It has been trending upward over the last few quarters. If you compare this NPS score to its main competitors, it is obvious that Paycom is able to create a lot more Promoters. This is a good indication of the quality of the products they sell.

Comparing the NPS score to a few competitors:

Workday has an NPS of 31:

SAP SuccessFactors have an NPS of 14:

Paylocity has an NPS score of -4:

Management: Founder-led & High insider ownership

Chad Richison has been the CEO since he founded Paycom in 1998. Mr Richison is, as of February 2024, the Co-CEO of Paycom, together with Chris Thomas, the former COO. Mr. Thomas has been with the company since 2018 and has held several senior positions within Paycom and other companies. Craig Boelte is the CFO at Paycom. Mr. Boelte has been with the company since 2006.

The key executive managers have a solid track record. The founder & CFO have been with the company for a long time and have been detrimental to the success of Paycom.

Insider Ownership

Mr. Richison (Co-CEO) owns 13.94% of the company, valued at $1.56Bn

Mr. Thomas (Co-CEO) owns 0.09% of the company, valued at $10Mn

Mr. Boelte (CFO) owns 0.53% of the company, valued at $59.54Mn

Key insiders own a significant stake in the business. Paycom is an owner-operator business.

CEO Approval is low at 59%, this might be a reason why they have moved Chris Thomas in as the Co-CEO in Paycom. Additionally, a 3.5/5 score on Glassdoor and a 60% “recommend”-rate is not very high. We can assume that the culture is not top-level at Paycom.

Competitive advantage

Paycom Software has a competitive advantage in the HR technology industry through its integrated, single-application approach to human capital management (HCM). Unlike competitors that often require multiple disjointed systems to manage various HR functions, Paycom's comprehensive platform eliminates the need for multiple interfaces, significantly reducing the complexity and potential for errors. This integration ensures a seamless user experience and higher data accuracy, which are critical for effective HR management.

Moreover, Paycom's focus on customer service and user-friendly design contributes to high client retention rates and new client acquisition through word-of-mouth and positive reviews. The company also invests heavily in security and compliance measures, essential in the HR sector where data sensitivity is paramount. These strategic investments in technology, customer service, and security establish Paycom as a leader in the HCM market, poised for long-term growth and client loyalty.

A few supporting facts that support the notion of Paycom having a CA:

High NPS score compared to peers

Expanding margins over time (+ Return on capital metrics)

Single app HCM system differentiates it from competitors

Financial Performance

Paycom has shown impressive financial performance over recent years. It consistently reports revenue growth, reflecting the increasing adoption of its solutions. Financially, the company has maintained a strong balance sheet with robust profitability margins, a testament to its efficient business model and operational execution.

Paycom Software is growing its topline revenues rapidly. Between ‘14 and ‘16, Paycom saw +40% annual growth rates. The growth rates since dipped to 30% and 25%, with an off year in 2020 with only 14% top-line growth. Paycom now guides for 10-12% revenue growth in 2024, which has spooked investors.

Paycom’s revenue has seen a CAGR of 30.8% over the last 10-year period. Gross Margins have increased by 31.34% annually, indicating a small gross margin expansion. Net Income has grown by 57.6% annually, and free cash flows by 52.8%.

Per share growth

Paycom has grown its per-share value by a significant amount over the last decade, with only a small dilution in shares outstanding. Revenue per share +28.6%, EPS +55.5%, OCF +39%, FCF +47%. Additionally, Paycom’s ROCE has been sustainably above 20%, even at its low point in 2020 (22.9%).

Paycom Software boats sustainably high and market-leading margins, which indicates that they offer something special in the marketplace. A high gross margin is also insurance against inflation (To the extent that is possible).

Returns on capital have been sustainably high and expanding. ROCE is currently at 26.2%, ROE is at 25%, and ROIC is at 9.33%.

Why own Paycom?

Great SaaS-based business model

Potential for international expansion

Innovative leadership

Single app strategy to simplify onboarding and user experience

High margins & capital efficiencies

Decent future growth prospects

Low debt levels

Founder-led

High insider ownership

Challenges and Risks

Regulatory Compliance Risks: As Paycom operates in the payroll and HR sectors, it must continuously adapt to changing labor laws and regulations. Non-compliance could result in fines, penalties, and damage to reputation.

Technological Advancements: The rapid pace of technological change poses a risk to Paycom. The company needs to continually invest in and update its software to maintain its competitive edge and meet evolving customer expectations.

Cybersecurity Threats: Handling sensitive employee data makes Paycom a prime target for cyberattacks. Data breaches could lead to significant financial liabilities and erode client trust.

Market Competition: The HR software market is highly competitive, with many players offering similar services. Increased competition could pressure pricing, margins, and market share.

Valuation

Forward multiples

Paycom is trading at its lowest forward PE recorded. This is warranted, as the growth has gone from 30-40% annually, not in the low tens. 20.9 times NTM earnings is however not a bad price for a high-quality SaaS business.

The forward FCF yield at 3.25%, also a high historical yield for Paycom:

Discounted cash flow analysis

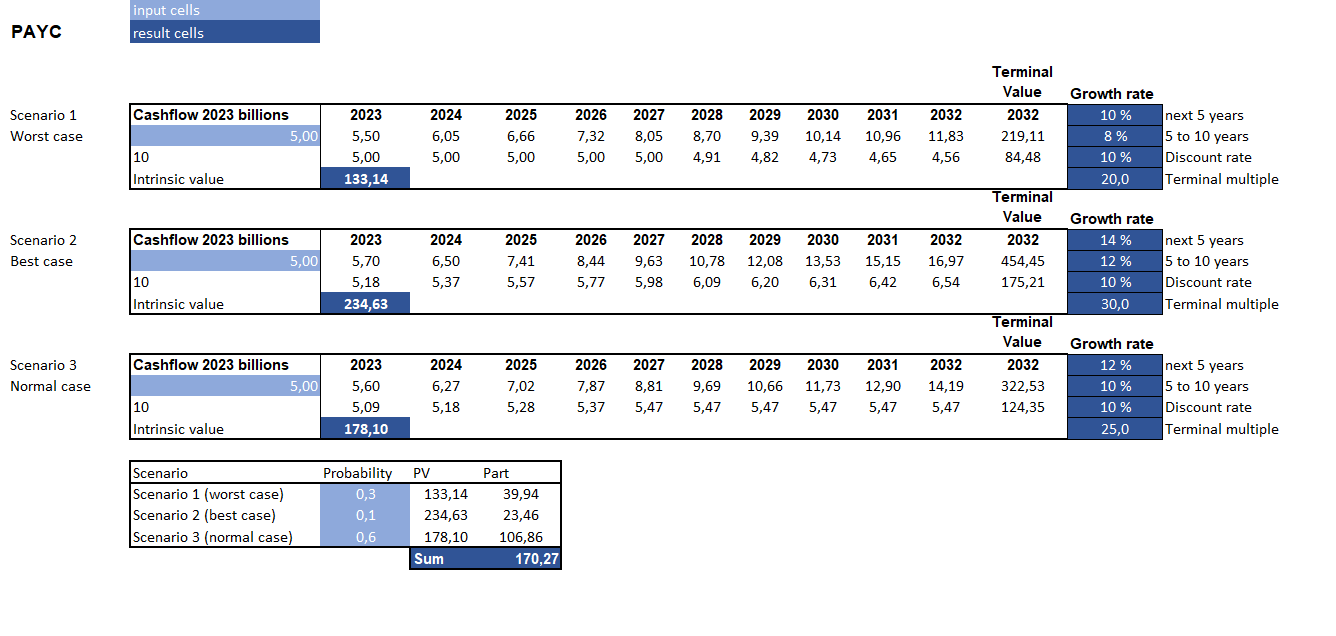

We use the input of free cash flow per share, which in 2023 was $5 per share (EPS is at $5.9).

We use 3 different scenarios based on the future growth estimates:

Worst case: 10% growth, followed by 8%, with an exit multiple of 20 x FCF (30% weighted).

Best case: 14% growth, followed by 12% growth, with an exit multiple of 30 x FCF (10% weighted).

Normal case: 12% growth, followed by 10% growth, with an exit multiple of 30 x FCF (60% weighted).

Our fair value estimate for Paycom is $170 per share.

Today’s stock price: $167

Paycom is currently in line with our value estimate.

Estimated annual return: 10%

Growth rates

It all comes down to how fast Paycom will grow in the future. If we set a higher growth estimate, let’s say 16% and 14%, the outcome can become good for investors. However, there is significant uncertainty in Paycom’s ability to grow. It will come down to the success of BETI and Paycom’s internationalization strategy.

Paycom is an interesting business we will continue to follow, but it is not of interest to invest in it right now. We want to see how growth develops in 2024, and if it can accelerate in 2025, and we want to see the valuation come down even more before contemplating a position in Paycom.

This article is sponsored by Finchat.io — Get 15% off any paid plan.

For $24.65 per month, you get access to:

10 Years of financial data

5 years of Segments & KPI data

100 Copilot prompts

5 Dash boards and much more

Finchat is a grat tool tool for visualising data + getting the segment & KPI data is a game changer.

Conclusion

Paycom stands out as a robust player in the competitive HCM SaaS market. It has a robust suite of products connected in a single app solution, with strong financial performance, strong growth, and strategic focus. The business is founder-led and key management executives have skin in the game with significant ownership stakes.

Paycom has a few levers to pull in terms of reigniting its growth, but right now the business seems to be in a negative business momentum cycle. Future growth will be detrimental to how well an investment in Paycom works out.

We believe that Paycom will produce ~10% annually for investors. We would like to see an acceleration of growth and a lower share price to be interested in taking a position.

I hope this analysis of Paycom Software was helpful to you. If it was—do us a favor and subscribe to the newsletter, like this post, and leave a comment. It helps us out.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 250 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +6.500 stock market investors (48% open rate) — Contact us via: investinassets20@gmail.com

Thanks! Where do you have NPS data from? Paylocity seems to eat shares.