Novo Nordisk is Crashing after Earnings💊

Novo Nordisk enters a volume-led phase as pricing power resets

Hi partner 👋

Novo Nordisk just released its Q4 earnings report and was down as much as -17% on the news.

Let’s take a deeper look:

Novo Nordisk: Growth Is Intact, But 2026 Will Be a Reset Year

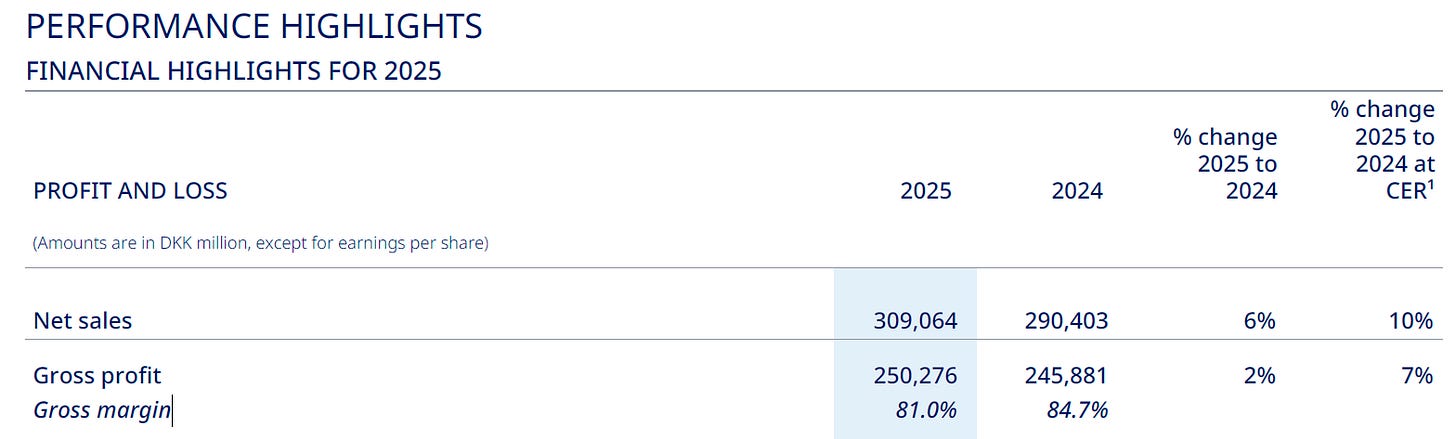

Novo Nordisk closed 2025 with 10% sales growth at constant exchange rates (CER) and industry-leading profitability, but the Q4 report made one thing clear: 2026 will be a year of digestion, not acceleration.

This is not a broken story, but expectations need to be recalibrated.

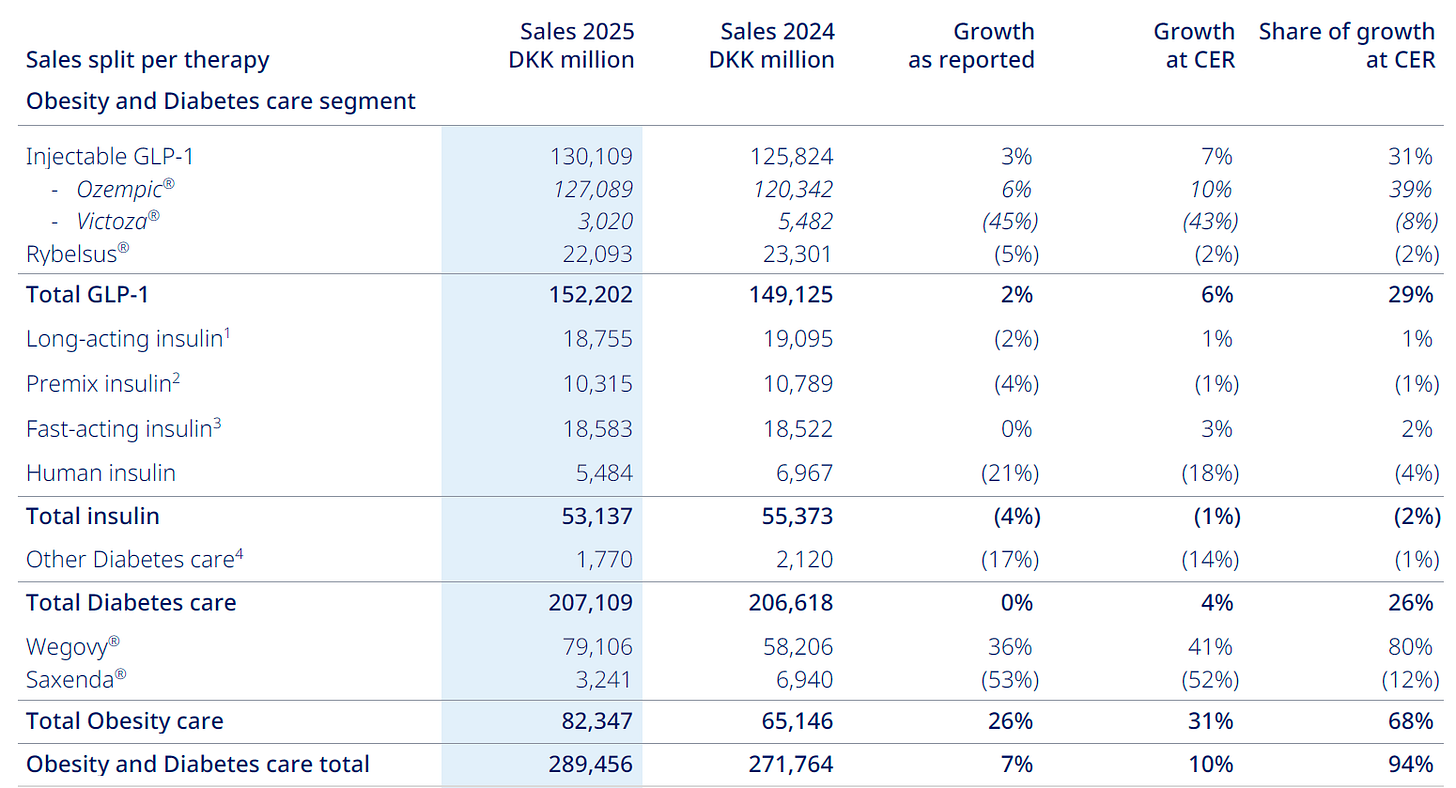

Key Numbers

FY 2025 sales: DKK 309bn (+10% CER) ✅

Operating profit: DKK 127.7bn (+6% CER, –1% reported)⛔

Operating margin: 41.3% (down from 44.2%)⛔

Free cash flow: DKK 28.3bn (vs. –14.7bn in 2024)✅

Dividend: DKK 11.70 per share (+3%)✅

Share buybacks: New DKK 15bn buyback authorized✅

Not the aggressive growth we’ve seen in previous years, but a solid year in general for Novo Nordisk.

Let’s dive into the good, the bad, and the ugly 👇

The Good

1. Obesity Is Still the Growth Engine ✅

Obesity care sales: +31% CER in 2025

Wegovy remains the core growth driver globally.

The oral Wegovy pill launched in January 2026 is showing early traction (~50,000 weekly prescriptions), mostly via self-pay channels.

This matters. Oral GLP-1 materially expands the addressable market.

2. Pipeline Depth Is Progressing ✅

CagriSema (obesity & diabetes): Phase 3 completed, FDA submission underway

Semaglutide 7.2 mg: Submitted to FDA

Rare disease pipeline (Mim8, concizumab): Strong late-stage progress

Novo is not a one-drug company, the next wave is already forming.

3. Capital Allocation Remains Shareholder-Friendly✅

DKK 306bn returned to shareholders since 2020

Balance sheet remains solid despite heavy capex and acquisitions

Equity ratio improved to 35.7%

The Bad

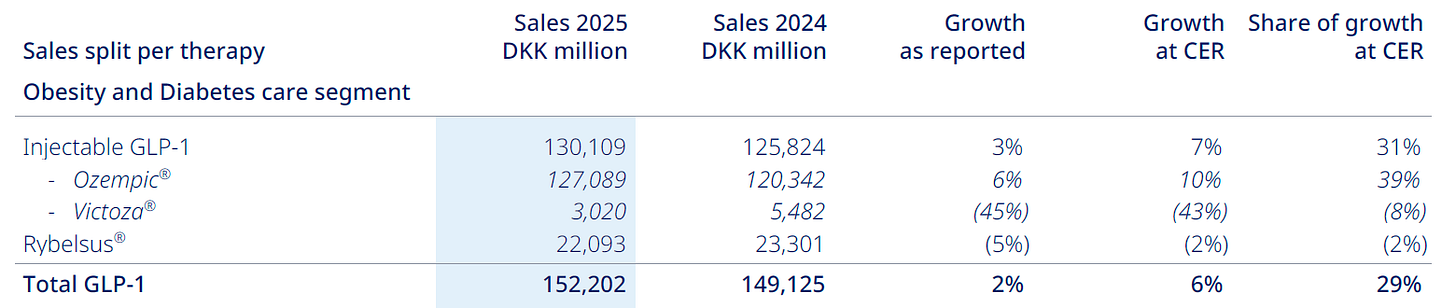

1. US Pricing Is Under Pressure⛔

US sales declined 7% CER in Q4

Lower realized prices across GLP-1, especially Ozempic and Rybelsus

Mix shift toward self-pay channels (≈30% of Wegovy prescriptions) compresses margins

Volume is growing. Pricing power is not.

The demand is still there in the US, but with pressure from the government and competitors, prices are compressed. The US market was “too good to be true” for companies making obesity and diabetes medicine; now things are normalizing.

2. Diabetes Franchise Is Slowing⛔

GLP-1 diabetes sales: –5% CER in Q4

Rybelsus volumes down due to reduced promotion

Ozempic losing share in competitive markets

This is the natural trade-off of prioritizing obesity, but it shows up in the numbers.

Despite being down in Q4, GLP-1 sales were up 6% CER YoY:

Not the strong growth we’ve seen before, but reflecting that Novo is coming off a hypergrowth phase into more normal market conditions.

The Ugly

1. 2026 Guidance Is a Shock 🚨

Novo guided for –5% to –13% adjusted sales and operating profit growth (CER) for 2026 .

Drivers:

US “Most Favoured Nation” pricing impact

Semaglutide patent expiries in select markets

Intensifying GLP-1 competition

Lower realized prices across the portfolio

This is not a cyclical dip. It is a structural pricing reset.

The Q4 report in and of itself was decent, but this is what got Wall Street worried.

So, is Novo management sandbagging this guidance?

I don’t think so, I think this is a conservative estimate (Not optimistic) to steer the market’s expectations moving into 2026. The management has obviously seen multiple factors that could reduce growth in the coming year, and wants to be transparent to gain the trust of the market.

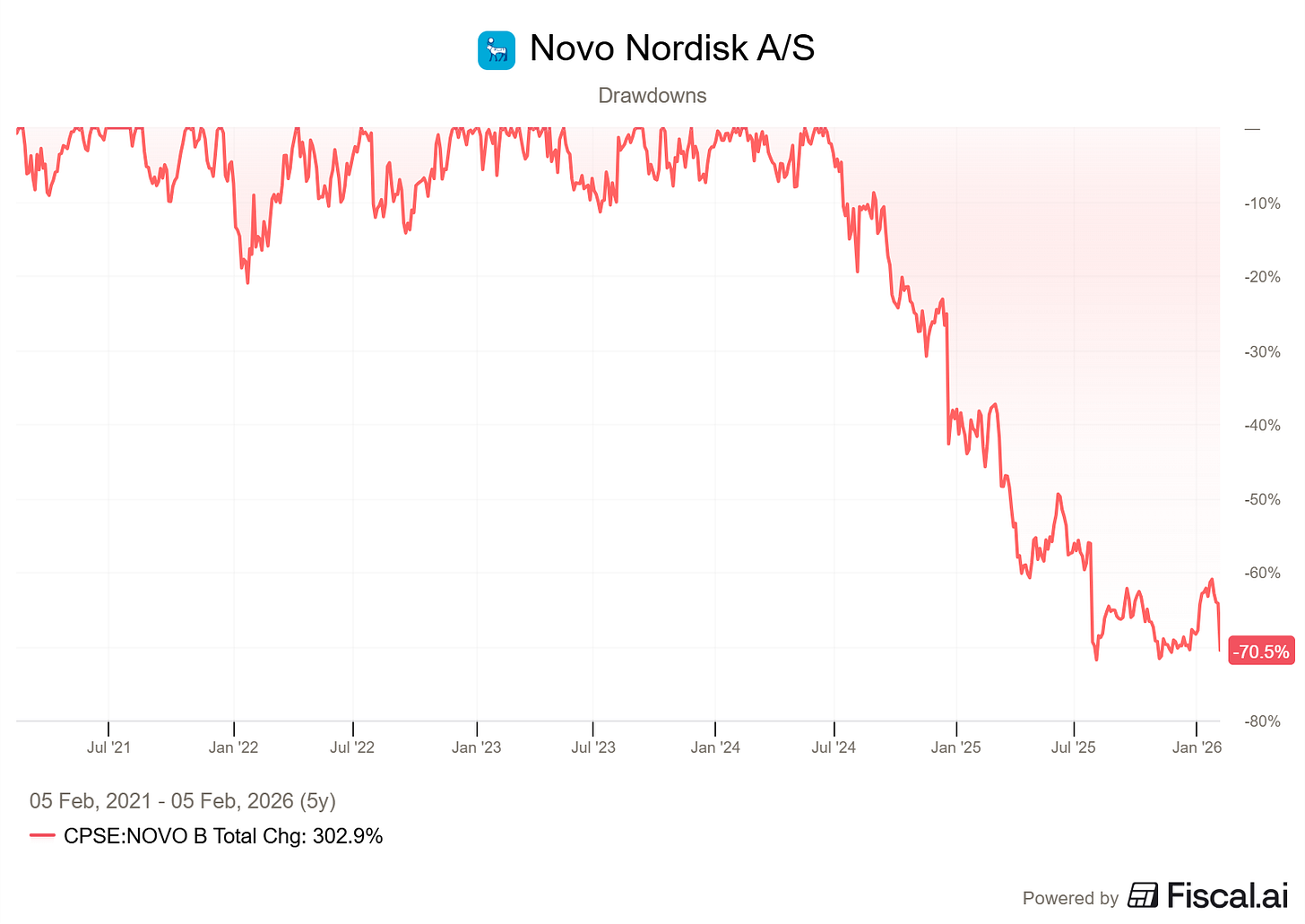

2025 has been a horrendous year for Novo, and it is looking to redeem itself by being honest about the outlook and getting a reset in 2026.

After a -70% drawdown, it needs to stabilize and get back on track:

2. Margins Are Compressing 🚨

Gross margin fell to 81.0% (from 84.7%)

Higher amortization from Catalent manufacturing acquisition

Sustained capex intensity (PP&E + intangibles ≈ DKK 90bn in 2025)

Novo is investing aggressively, but near-term profitability is the casualty.

If there are two things the market hates, it’s negative growth and contracting margins. Novo Nordisk is showing both in this earnings report, leading to a well-deserved sell-off.

Valuation is undemanding long term

I’m expecting short-term volatility and sideways trading for Novo Nordisk, but on a long-term horizon, given that Novo can continue to benefit from its GLP-1 and Obesity drugs (Which I strongly believe), the stock is trading very cheaply.

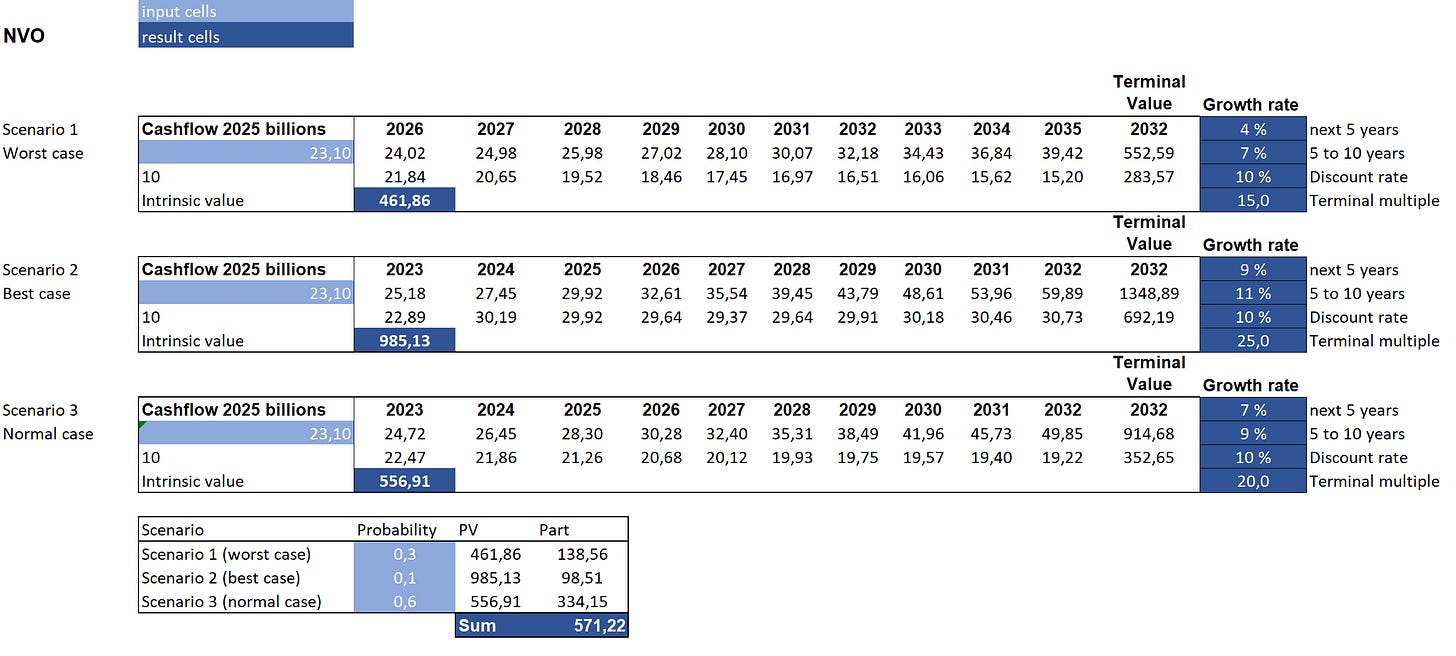

These are my 3 scenarios for Novo in the next 10 years. No hypergrowth, just consistent growth with multiple expansion (I assume multiple expansion, as Novo is a quality business that should not trade close to a single-digit PE).

Fair value estimate: DKK 571.22

Current price: DKK 302.85

Upside: +88%

CAGR expectations from normal scenario: ~20%

The Thesis Going Forward

Novo Nordisk is going from hypergrowth to normalized growth.

2026 will be a reset year, 2027 might show improvements, but the investment case is for 2028 and beyond.

This means that the Novo stock price might trade sideways for a while.

That said, the core thesis remains intact:

Obesity is a multi-decade demand wave

Novo has the deepest GLP-1 product offering

Oral + next-gen injectables expand reach and duration

But we must accept three realities:

Pricing power is normalizing

Growth will be volume-driven, not price-driven

2026 is about absorbing shocks, not compounding earnings

For long-term investors, this is not about next quarter’s margins. It is about whether Novo remains the best compounder in metabolic disease over the next 5+ years.

In my opinion, the answer is still that this is likely, but the path will be lumpier than previously expected.

Novo Nordisk is not broken, but it is no longer a frictionless growth story.

Ready to take the next step? Here’s how I can help you grow your investing journey:

Go Premium — Unlock exclusive content and follow our market-beating Quality Growth portfolio. Learn more here.

Essentials of Quality Growth — Join over 300 investors who have built winning portfolios with this step-by-step guide to identifying top-quality compounders. Get the guide.

Free Valuation Cheat Sheet — Discover a simple, reliable way to value businesses and set your margin of safety. Download now.

Free Guide: How to Identify a Compounder — Learn the key traits of companies worth holding for the long term. Access it here.

Free Guide: How to Analyze Financial Statements — Master reading balance sheets, income statements, and cash flows. Start learning.

Get Featured — Promote yourself to over 24,000 active stock market investors with a 42% open rate. Reach out: investinassets20@gmail.com

Can’t wait to read. One of my top three positions.

Outstanding breakdown of the Novo situation! Your framing of 2026 as a "reset year" really resonates—its a reminder that even quality compounders go through digestion periods. The contrast between volume-driven vs. price-driven growth is particulary insightful, and I think this distinction will seperate patient investors from reactionary ones. Long-term thesis intact, short-term pain absorbable.