📈Nick Sleep’s 13-Year Masterclass: How He Beat the Market

Breaking down legendary investor, Nick Sleep's investing strategy 🚀

Hi there, friend,

Between 2001 and 2014, Nick Sleep, along with Qais Zakaria ran one of the most successful investment funds.

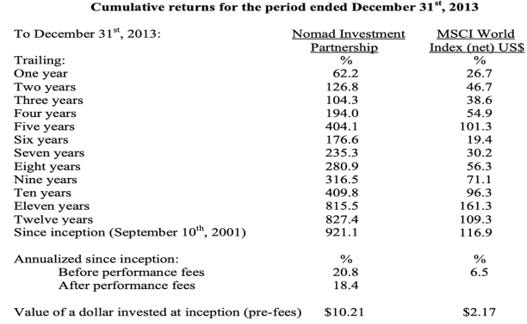

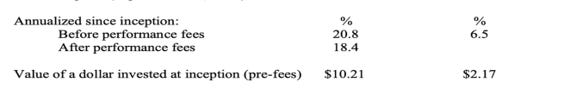

You’ve probably never even heard of it. They thrived for 13 years, giving finance enthusiasts much to learn. Their fund, the Nomad Investment Partnership, returned 921% before closing voluntarily. And this is compared to just 117% for the MSCI World Index over the same period.

And for this, they didn’t use leverage. They didn’t chase fads. In fact, they didn’t even try to impress investors. All they did was compound capital, quietly and methodically. That, too, just by doing the one thing most people in finance can’t seem to stomach:

Holding great businesses for a very long time.

So, if this has made you curious, then learn how Nick Sleep pulled it off. It’s one of the greatest long-term track records in modern investing.

Let’s break it down!

A Fund With No Flash, Just Substance

The Nomad Investment Partnership launched in 2001 under the umbrella of Marathon Asset Management. But by 2006, Sleep and Zakaria spun out to operate independently.

They built Nomad with a unique, focused, and near-monastic mindset:

Their letters were typed in Courier font.

They rarely communicated with investors.

Their pitch decks were non-existent, which is hard to imagine in the present scenario.

Instead, they quietly studied businesses like anthropologists. And it worked. Their annualized returns clocked in at approximately 20.8% gross (18.4% net). Thus, doubling the index while taking far less risk. But what truly made them special wasn’t just the performance; it was the philosophy behind it.

In a world where hedge funds often measure success by quarterly rankings or media coverage, Nomad was strangely silent. But refreshingly humble. Their office was small, and their team was lean. Instead of talking up positions, they spent their time rereading old shareholder letters and retail case studies. Simplicity wasn’t a tactic; it was a religion.

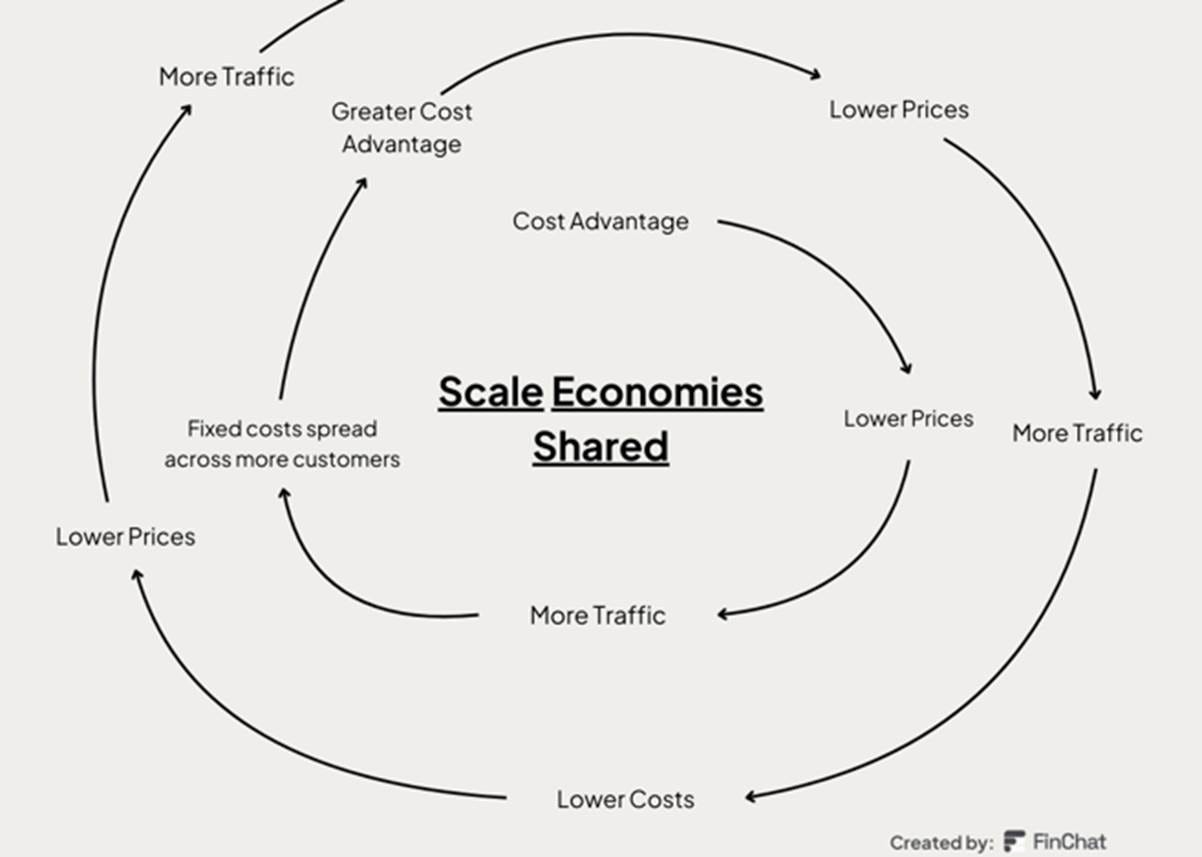

Scale Economies Shared: Nomad’s North Star

One of the best ideas in modern investing is “scale economies shared.” It is the evidence of Sleep’s defining insight. Most companies scale up and use their growing power to boost margins or pad executive compensation.

However, the companies that Sleep loved did the opposite. When they got more efficient, they shared the benefits with customers.

Take Costco, for instance. As the company grew, it didn’t raise prices to increase profits. Rather, it cuts prices to strengthen customer loyalty. This virtuous cycle did the following:

Kept customers coming back

Increased volumes

Deepened Costco’s competitive moat

“The longer we held Costco, the better the business got,” Sleep wrote. “And that wasn’t luck, but strategy.”

Amazon also operated similarly. Only by reinvesting every spare dollar into faster delivery, better prices, and infrastructure. It effectively sacrificed short-term earnings to build long-term dominance.

As a result, Nomad investors weren’t just betting on good companies. They were betting on flywheels powered by customer goodwill.

Long-Term Thinking in a Short-Term World

One reason Nomad thrived is that it didn’t care about what the market cared about. Where others obsessed over quarterly earnings, Nomad focused on multi-decade trajectories. In fact, Sleep once wrote that the most important data in investing often doesn’t come from Bloomberg terminals but from reading, thinking, and walking around stores.

Their letters read more like philosophy essays than Wall Street reports. They reference Plato, Zen, and retail operations with equal reverence.

Nomad deliberately took large positions. Often, 3 to 5 holdings made up most of the portfolio. At various times, Amazon, Costco, and Berkshire Hathaway dominated their allocations.

In fact, by 2013, Amazon and Costco together made up nearly 70% of Nomad’s portfolio. But even more importantly, Nomad rarely traded. They often held stocks for 10+ years, letting compounding do the heavy lifting. Brilliant, isn’t it?

That discipline, doing nothing, was perhaps their greatest edge. In one letter, Sleep mentioned that most of Nomad’s outperformance came not from buying at the perfect price but from holding long enough for the market to catch up to the business reality.

They Walked Away While Winning

In 2014, after 13 years of market-beating performance, Sleep and Zakaria did something almost unheard of in asset management. They gave the money back.

Not because of underperformance, redemptions, or activist pressure. Quite the opposite, actually, investors were thrilled. But Nomad’s founders had decided they had made enough. They wanted to dedicate their time and wealth to philanthropic causes instead.

And the final investor letter suggested holding on to their major positions: Amazon, Costco, Berkshire. That’s because the investment cases were still intact. As of 2023, a $1 million investment in Nomad at inception would have been worth over $10 million. By comparison, that same amount in the MSCI World Index would have grown to just $2.17 million.

And with that, Nomad closed its doors, with a 921% total return in the books.

Key Takeaways From Nick Sleep’s Playbook

#1 Understand the business better than Wall Street

Go deep, not wide: Focus intensely on a few businesses rather than many.

Understand the DNA: Study culture, unit economics, competitive advantages, and business models.

Edge through depth: Most investors go an inch deep—go a mile.

Lesson: Your edge comes from understanding businesses better than anyone else.

#2 Find great founders & aligned management teams

Founder-led firms are preferred: Look for managers with skin in the game.

Avoid “hired guns”: Misaligned incentives can lead to shareholder value destruction.

Look for low/no salary leaders: E.g., Buffett, Bezos—true long-term builders.

Lesson: Invest with leaders who think and act like owners.

#3 Focus on the company’s destination

Ignore short-term noise: Sleep focused on 10–20-year outcomes.

In his “destination analysis”, he asked 3 essential questions:

Where will the business be in 10–20 years?

What must management do now to get there?

What could prevent that destination?

Lesson: Invest in companies with a clear, credible long-term trajectory.

#4 Have a Long-Term Orientation

Let compounding work: Avoid disrupting it with unnecessary trades.

Tune out media/news noise: Financial headlines are often irrelevant distractions.

Stick to the plan: Short-term volatility ≠ , long-term risk.

Lesson: The biggest threat to your wealth is interrupting compounding.

#5 Look for Scale Economics Shared

Customer-first economics: Businesses like Costco pass scale benefits to customers, building an extensive moat.

Loyalty builds moats: Shared value creates a stickier customer base.

Structural advantage: Built into the business model, not temporary.

Lesson: Superior companies grow by providing unmatched value to the customers (E.g. Amazon, Costco, McDonald’s).

#6 Look for Price Giveback Strategies

Give customers a “win”: 2–10% loyalty or savings returned to buyers.

Habit-forming and sticky: Reinforces repeat behavior and brand affinity.

No longer a unique edge: But was once a differentiator.

Lesson: Look for psychological moats created by recurring value to customers.

#7 The Lollapalooza Moats

Multi-dimensional moats: Culture, distribution, hiring, pricing, customer experience—all aligned.

Hard to replicate: Success comes from 1,000 small things done right (e.g., Costco, IKEA).

Not found in the 10-K: Requires qualitative insight and on-the-ground understanding.

Lesson: Invest in companies with layered, complex, and durable competitive advantages that are hard to replicate.

#8 The “Do Nothing” Strategy

Inactivity = edge: Most investors harm returns by overtrading.

Hold compounders: Sleep held Costco for 18 years, Amazon and Berkshire for 10+.

Stomach volatility: Even great businesses drop 50% sometimes.

Lesson: Patience is your biggest superpower. "Don’t pick the flowers and water the weeds."

Final Word: The Investor Who Didn't Play the Game—and Won

Nick Sleep never became a household name like Warren Buffett or Ray Dalio. He didn’t build an empire. He didn’t take victory laps.

Instead, he built a small, focused fund that crushed the market by ignoring it—by tuning out the noise, avoiding the hype, and doubling down on customer-first companies that would stand the test of time.

Then he walked away after a 921% return.

There’s a lesson here, not just for investors, but for anyone chasing long-term success: You don’t need to be loud. You just need to be right and give your ideas enough time to work.

Whenever you are ready, this is how I can help you:

Go Premium to access exclusive content & follow our market-beating Quality Growth portfolio. Read more here.

Essentials of Quality Growth — Join more than 300 investors who have bought the guide. Essentials of Quality Growth Investing is a multi-step guide for building a stock market portfolio of 10-20 high-performing quality compounders.

(Free) Valuation Cheat Sheet — Learn an easy and reliable method of valuing a business. Learn how to set a margin of safety for your investments.

(Free) How to identify a compounder — Learn how to effectively look for great companies that you can buy and hold for the long term.

(Free) How to analyze the financial statements — Learn how you read & analyze the balance sheet, income statement, and cash flow statement.

Promote yourself to +15.000 stock market investors (42% open rate) — Contact us via: investinassets20@gmail.com

Nice but I would add the following story:I hold Amazon since 2011 to 2013 when every,every value investor in the world was saying it was overvalued and it was loosing money and on dcf value was nothing for they thin margin.I sold it for a small profit.what is more difficult is to close the door and not listen to rational analysis,not easy in an industry built on opinion.Today I see the same on Palantir where every value investor says is overvalued.Same stories,different time..

https://open.substack.com/pub/constance710/p/the-cv-theyll-actually-read-executive?r=2pxtbo&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true